Current Report Filing (8-k)

November 18 2021 - 5:27PM

Edgar (US Regulatory)

0001223389

false

0001223389

2021-11-17

2021-11-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event

reported): November 17, 2021

Conn's,

Inc.

(Exact name of registrant as specified in

its charter)

|

Delaware

|

001-34956

|

06-1672840

|

|

(State or other jurisdiction of

incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

2445 Technology Forest Blvd., Suite 800

The

Woodlands, Texas

|

77381

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant's telephone number, including

area code: (936) 230-5899

Not Applicable

(Former name, former address and former

fiscal year, if changed since last report)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section

12(b) of the Act:

|

Title of Each Class

|

Trading Symbol

|

Name of Each Exchange on Which Registered

|

|

Common Stock, par value $0.01 per share

|

CONN

|

NASDAQ Global Select Market

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

¨

Emerging growth company

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01 Entry into a Material Definitive

Agreement

On

November 17, 2021, Conn’s, Inc. (the “Company”), Conn’s Receivables Funding 2021-A, LLC, a newly

formed special purpose entity that is indirectly owned by the Company (the “Issuer”), Conn Appliances Receivables

Funding, LLC, an indirect wholly owned subsidiary of the Company (the “Depositor”), and Conn Appliances, Inc.,

a direct and wholly owned subsidiary of the Company (“Conn Appliances”), entered into a Note Purchase Agreement

(the “Note Purchase Agreement”) with MUFG Securities Americas Inc., Deutsche Bank Securities Inc. and J.P. Morgan

Securities LLC (collectively, the “Initial Purchasers”), for the sale of the Issuer’s 1.05% $247,830,000

Asset Backed Fixed Rate Notes, Class A, Series 2021-A (the “Class A Notes”), 2.87% $66,090,000 Asset Backed

Fixed Rate Notes, Class B, Series 2021-A (the “Class B Notes”) and 4.59% $63,890,000 Asset Backed Fixed Rate

Notes, Class C, Series 2021-A (the “Class C Notes” and, together with the Class A Notes and the Class B Notes,

the “Purchased Notes”). The Issuer will also issue the Asset Backed Notes, Class R, Series 2021-A (the “Class

R Notes” and, collectively with the Purchased Notes, the “Series 2021-A Notes”), which will not

have a principal amount or interest rate and which will be transferred to the Depositor on the Closing Date to satisfy the risk retention

obligations of Conn Appliances. It is anticipated that the Series 2021-A Notes will be issued on or about November 23, 2021 (the “Closing

Date”). The Series 2021-A Notes have not been and will not be registered under the Securities Act of 1933, as amended (the

“Securities Act”) or the securities laws of any jurisdiction. The Purchased Series 2021-A Notes are being sold

initially to the Initial Purchasers and then reoffered and resold only (i) to “Qualified Institutional Buyers” as defined

in Rule 144A under the Securities Act (“Rule 144A”) in transactions meeting the requirements of Rule 144A or

(2) solely with respect to the Class A Notes, outside the United States to non-U.S. Persons in transactions in compliance with Regulation

S under the Securities Act.

Attached as Exhibit 1.1 is the Note Purchase Agreement.

Item 9.01 Financial Statements and Exhibits

|

(a)

|

Not applicable.

|

|

(b)

|

Not applicable.

|

|

(c)

|

Not applicable.

|

|

(d)

|

Exhibits

|

The exhibit number corresponds

with Item 601(a) of Regulation S-K.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

CONN'S, INC.

|

|

|

|

|

|

Date:

|

November 18, 2021

|

By:

|

/s/ Mark L. Prior

|

|

|

|

Name:

|

Mark L. Prior

|

|

|

|

Title:

|

Vice President, General Counsel & Secretary

|

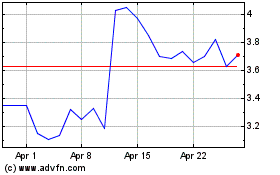

Conns (NASDAQ:CONN)

Historical Stock Chart

From Mar 2024 to Apr 2024

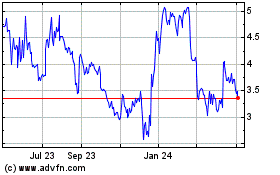

Conns (NASDAQ:CONN)

Historical Stock Chart

From Apr 2023 to Apr 2024