By Emily Glazer, Theo Francis and Chip Cutter

Two of the biggest U.S. banks and other corporations said they

are pausing or reviewing their political action committee donations

in the wake of last week's riot at the Capitol.

JPMorgan Chase & Co. and Citigroup Inc. said they are

pausing all PAC donations to Republicans and Democrats in the

coming months. Other companies, including the Blue Cross Blue

Shield insurance group and Marriott International Inc., said they

would pause donations to Republican lawmakers who objected to

President-elect Joe Biden's Electoral College win after supporters

of President Trump stormed the Capitol on Wednesday.

The actions follow a week in which businesses and their chief

executives have sought ways to ensure a peaceful transition of

power, with some calling for Mr. Trump's removal from office by

invoking the 25th amendment or impeachment. Others say they are

holding back on such action as they await Mr. Biden's inauguration

on Jan. 20.

The announcements could reflect an acceleration of recent trends

among large companies to limit or better disclose political

spending.

JPMorgan, the largest bank in the country, made the decision to

pause political giving for the next six months because of the

growing political crisis following the violence at the Capitol

alongside health and economic crises, said Peter Scher, JPMorgan's

head of corporate responsibility, in an interview.

"The focus of business leaders, political leaders, civic leaders

right now should be on governing and getting help to those who

desperately need it most right now," said Mr. Scher, who is also

chairman of the bank's Mid-Atlantic region. "There will be plenty

of time for campaigning later."

JPMorgan's PAC raised about $900,000 for federal candidates in

the 2019-2020 cycle, according to data analyzed through Nov. 23 by

the Center for Responsive Politics.

Citigroup's PAC will pause all its political donations through

March 30, according to an internal memo reviewed by The Wall Street

Journal. "We want you to be assured that we will not support

candidates who do not respect the rule of law," according to the

memo, which was sent Sunday.

Citigroup's PAC raised about $740,000 for federal candidates in

the 2019-2020 cycle, according to the Center for Responsive

Politics. Bloomberg News earlier reported on Citigroup's decision

to halt its PAC donations.

The JPMorgan and Citigroup PACs both gave more money to federal

candidates who are Republicans compared to Democrats, according to

the Center for Responsive Politics.

While the PACs' donations are a fraction of overall political

giving, JPMorgan and Citigroup employees also donate directly to

politicians and other political groups that may not disclose their

donors. The Wall Street Journal reported last week that some CEOs,

both Republicans and Democrats, were considering withholding

political contributions from lawmakers seen as trying to impede a

peaceful transition of power.

JPMorgan's PAC contributed $2,000 since 2017 to a committee led

by Missouri Sen. Josh Hawley, according to data from the Center for

Responsive Politics. Citigroup told employees in the memo it gave

$1,000 in 2019 to Mr. Hawley's campaign. Mr. Hawley has come under

fire from members of his own party, as well as Democrats, for what

critics see as his role instigating Wednesday's Capitol riot.

JPMorgan began discussing potential changes to its PAC giving

several days ago, a person familiar with the discussions said. The

decision to pause all political donations gives the bank time to

think through future giving, the person said.

A spokeswoman for medical-device maker Boston Scientific Corp.

said it is temporarily suspending its PAC activity for an unknown

period of time given the recent violence and polarized political

environment and will review its approach to future contributions.

The company has given $3,000 to Mr. Hawley's campaign committee

since 2017.

The newsletter Popular Information earlier reported the Boston

Scientific announcement and that three companies -- health insurer

Blue Cross Blue Shield Association, Commerce Bancshares Inc. and

hotel giant Marriott -- would halt political spending to lawmakers

who impeded the transition following the violence at the

Capitol.

Marriott's PAC has given $1,000 to Mr. Hawley's campaign, as

well as another $1,000 to a PAC he heads. A Marriott spokeswoman

said the company would pause giving from its PAC to those who voted

against certification of the election. "We have taken the

destructive events at the Capitol to undermine a legitimate and

fair election into consideration," she said.

A spokeswoman for Commerce Bancshares said its employee-funded

PAC suspended donations for "officials who have impeded the

peaceful transfer of power." The spokeswoman added: "Commerce Bank

condemns violence in any form and believes the actions witnessed

this week are abhorrent, anti-democratic and entirely contrary to

supporting goodwill for Americans and businesses."

Commerce Bancshares has given $5,000 to Mr. Hawley's campaign

since 2017, according to Center for Responsive Politics data.

Blue Cross Blue Shield Association Chief Executive Kim Keck said

it is suspending contributions to Republican lawmakers who "voted

to undermine our democracy."

"While a contrast of ideas, ideological differences and

partisanship are all part of our politics, weakening our political

system and eroding public confidence in it must never be," Ms. Keck

said in a statement.

The association has given $500 to Mr. Hawley's campaign since

2017, while Anthem Inc., a Blue Cross Blue Shield licensee with

health plans in more than a dozen states, has given $5,000 to

committees supporting the Missouri senator, Center for Responsive

Politics data show.

CEOs and business groups have condemned the riots and taken

other steps in recent days. The National Association of

Manufacturers on Wednesday called on Vice President Mike Pence to

consider invoking the 25th amendment, which allows for a transfer

of power when a president is unable to fulfill his duties. Twitter

Inc. banned President Trump's personal account from its platform,

citing a risk of further incitement of violence, while the Canadian

e-commerce company Shopify Inc. took stores run by Mr. Trump's

business and campaign offline and Stripe Inc. will no longer

process payments for Mr. Trump's campaign website.

Some CEOs, though, said they didn't plan to adjust their

political funding for now. "I'm not thinking about that at this

point," said Paul Sarvadi, CEO of Insperity Inc., a publicly traded

provider of human-resources and other business services, who has

donated to Republicans. "I think it pays for companies to be more

deliberate, less reactive."

Companies face growing pressure from investors and shareholders

over political spending. Since 2004, 200 of the S&P 500

companies have faced shareholder proposals seeking to limit

political spending or to improve disclosure, according to the

Center for Political Responsibility, a nonpartisan group in

Washington that works with investors to push companies to limit or

better disclose political spending.

Nearly half of companies in the index fully disclose or prohibit

contributions to candidates, parties and political committees, up

from 183 in 2015, according to the group. Most of those prohibit at

least one kind of contribution altogether, often independent

expenditures or contributions to candidates and political

committees.

A key factor is the backlash -- from consumers, employees and

investors -- that companies can face for funding candidates who

later take stands conflicting with popular sentiment or the

company's own public positions, said Bruce Freed, the group's

president. He expects companies to come under increasing scrutiny

in coming weeks and months.

"All of their statements become hollow if their political money

is going to members who voted to overturn this election," Mr. Freed

said. "The risk of political giving has gone up exponentially."

Write to Emily Glazer at emily.glazer@wsj.com, Theo Francis at

theo.francis@wsj.com and Chip Cutter at chip.cutter@wsj.com

(END) Dow Jones Newswires

January 10, 2021 21:05 ET (02:05 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

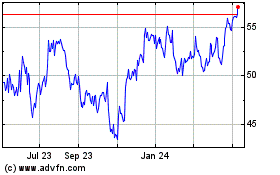

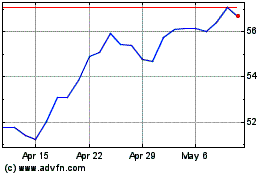

Commerce Bancshares (NASDAQ:CBSH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Commerce Bancshares (NASDAQ:CBSH)

Historical Stock Chart

From Apr 2023 to Apr 2024