Coinbase Stock Price: Will the FTX Fiasco Drag Shares of the Crypto Exchange Lower?

November 18 2022 - 6:16AM

Finscreener.org

Earlier this month, Coindesk

accessed a leaked balance sheet of Alameda Research which showed

$3.66 billion in unlocked FTT. Alameda Research is a trading firm

owned by Sam Bankman-Fried, who is also the CEO of FTX

- the second-largest crypto exchange

globally.

Alameda’s total assets on its

balance sheet stand at $14.6 billion, which includes the unlocked

FTT. Alameda also has $8 billion in liabilities, a majority of

which are loans, and $2.16 billion of these loans are

collateralized by FTT.

FTT is the token issued by the

FTX exchange, which allows users to benefit from a discount on

trading fees on the crypto platform. CoinDesk explains that Alameda has high exposure

to a token invented by a sister company and not an independent

asset such as a stablecoin or even a market-leading

cryptocurrency.

FTX files for bankruptcy

Once the details were made public

several investors, including Binance,

liquidated their FTT holdings due to the unusually close

association between FTX and Alameda Research.

In a Cointelegraph report, Mike

Burgersburg, an independent market analyst for the Dirty Bubble

Media Substack, states, “Alameda will never be able to cash in a

significant portion of FTT to pay back its debts.”

However, Alameda CEO Caroline

Ellison emphasized, “The balance sheet breaks out a few of our

biggest long positions we obviously have hedges that aren’t listed.

Given the tightening in the crypto credit space this year, we’ve

returned most of our loans by now.”

But, these statements did not

hold true, and FTX soon filed for bankruptcy. Additionally, over

$600 million has been hacked from FTX, wiping off billions of

dollars in wealth in less than ten days.

The lack of regulation

surrounding the crypto market continues to haunt investors and will

have a domino effect on other participants of this highly

disruptive space too. For example, shares of

Coinbase (NASDAQ:

COIN), now the

second-largest crypto exchange globally, have slumped by close to

25% in the past month. Will COIN stock price move lower by the end

of 2022?

What next for COIN stock price and

investors?

Coinbase went public in April

2021, and the

stock touched a record

high of $355 last

November. Currently, COIN stock is priced at $57, valuing the

company at a market cap of $15 billion.

Yes, selling pressure on Bitcoin

and other cryptos has intensified in the last two weeks. However,

the collapse of FTX will increase investor confidence in Coinbase,

which is regulated under the SEC.

Coinbase is the largest crypto

exchange in the United States and would be under pressure if the

previously announced merger between Binance and FTX had gone

through. As Binance and FTX have a large presence in international

markets, the expansion plans of Coinbase would also be dampened, at

least in the near term.

The stock price of Coinbase will

still be tied to the performance of Bitcoin and Ethereum, the two

largest cryptocurrencies in the world. It will crush the broader

markets in a bull run and grossly underperform when investor

sentiment turns bearish.

But Coinbase has successfully

diversified its revenue stream in 2022. Last year, 88% of total

sales originated from transaction fees. As trading volumes are

higher in bull runs, Coinbase managed to increase sales to $7.83

billion in 2021 from just $1.27 billion in 2020.

However, Coinbase also generated

$101.8 million from interest income in Q3, an increase of 1,100%

year over year. In the year-ago period, the company’s interest

income stood at $8.4 million. So, interest income accounted for 18%

of Coinbase sales in Q3 and is fast gaining momentum.

CoinbaseU+02019s leadership

position and its widening ecosystem make COIN stock a top long-term

bet, especially if you are bullish on crypto.

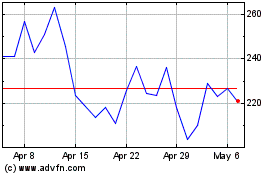

Coinbase Global (NASDAQ:COIN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Coinbase Global (NASDAQ:COIN)

Historical Stock Chart

From Apr 2023 to Apr 2024