- Sales of $147.8 million on higher

than anticipated recurring revenue

- Gross margin of 36.8%; non-GAAP gross

margin of 41.5%

- Business model to benefit from

accelerated integration synergies

Cohu, Inc. (NASDAQ: COHU), a global leader in back-end

semiconductor equipment and services, today reported fiscal 2019

first quarter net sales of $147.8 million and GAAP loss of

$22.9 million or $0.56 per share. Cohu also reported

first quarter 2019 non-GAAP loss of $1.4 million or

$0.03 per share. (1)

GAAP Results (1)

(in millions, except per share amounts)

Q1 FY 2019 Q4 FY

2018 Q1 FY 2018 Net sales $147.8 $170.6

$95.2 Income (loss) $(22.9) $(57.1) $8.1 Income (loss) per

share $(0.56) $(1.40) $0.28

Non-GAAP

Results (1) (in millions, except per share amounts)

Q1 FY 2019 Q4 FY 2018 Q1 FY 2018 Income

(loss) $(1.4) $10.0 $10.5 Income (loss) per share $(0.03) $0.24

$0.36

(1) All amounts presented are from continuing

operations.

Total cash and investments at the end of first quarter 2019 were

$160.1 million.

“First quarter sales and gross margin were above guidance due to

a ramp in recurring business,” said Cohu President and CEO Luis

Müller. “Market conditions appear to have stabilized and we are

forecasting some segments to start improving in the second quarter

and continuing into the second half of the year. We are

accelerating the integration of Xcerra, have begun to implement the

restructuring of our German operation, and now project annual

run-rate cost synergies of $40 million by the end of 2019,

significantly advancing the timeframe for when the full synergy

savings will positively impact the business.”

Cohu expects second quarter 2019 sales to be between

$150 million and $160 million. Cohu's Board of Directors

approved a quarterly cash dividend of $0.06 per share payable on

July 26, 2019 to shareholders of record on June 14, 2019.

Conference Call Information:

The company will host a live conference call and webcast with

slides to discuss first quarter 2019 results at 1:30 p.m. Pacific

Time/4:30 p.m. Eastern Time on May 6, 2019. Interested investors

and analysts are invited to dial into the conference call by using

1-866-434-5330 (domestic) or +1-213-660-0873 (international) and

entering the pass code 6874566. Webcast access will be available on

the Investor Information section of the company’s website at

www.cohu.com.

The teleconference replay will be available through June 5,

2019. The replay dial-in number is 1-855-859-2056 (domestic) or

+1-404-537-3406 (international) using pass code 6874566. The

webcast replay will be available on the Company’s website through

May 6, 2020 at www.cohu.com.

About Cohu:

Cohu (NASDAQ: COHU) is a global leader in back-end semiconductor

equipment and services, delivering leading-edge solutions for the

manufacturing of semiconductors and printed circuit boards.

Additional information can be found at www.cohu.com.

Use of Non-GAAP Financial Information:

Included within this press release and accompanying materials

are non-GAAP financial measures, including non-GAAP Gross Margin,

Income and Income (adjusted earnings) per share, Adjusted EBITDA,

and Operating Expense that supplement the Company’s Condensed

Consolidated Statements of Operations prepared under generally

accepted accounting principles (GAAP). These non-GAAP financial

measures adjust the Company’s actual results prepared under GAAP to

exclude charges and the related income tax effect for: share-based

compensation, the amortization of acquired intangible assets

including favorable/unfavorable lease adjustments, restructuring

costs, manufacturing transition and severance costs,

acquisition-related costs and associated professional fees, fair

value adjustment to contingent consideration, reduction of

indemnification receivable, depreciation of purchase accounting

adjustments to property, plant and equipment and purchase

accounting inventory step-up included in cost of sales.

Reconciliations of GAAP to non-GAAP amounts for the periods

presented herein are provided in schedules accompanying this

release and should be considered together with the Condensed

Consolidated Statements of Operations.

These non-GAAP measures are not meant as a substitute for GAAP,

but are included solely for informational and comparative purposes.

The Company’s management believes that this information can assist

investors in evaluating the Company’s operational trends, financial

performance, and cash generating capacity. Management believes

these non-GAAP measures allow investors to evaluate Cohu’s

financial performance using some of the same measures as

management. However, the non-GAAP financial measures should not be

regarded as a replacement for (or superior to) corresponding,

similarly captioned, GAAP measures.

Forward Looking Statements:

Certain statements contained in this release and accompanying

materials may be considered forward-looking statements within the

meaning of the U.S. Private Securities Litigation Reform Act of

1995, including statements regarding integration and cost synergy

savings, timing and targets; design-wins; contactor sales growth;

5G opportunities; incremental sales opportunities; semiconductor

market conditions in 2019, expected improvements and mid-term

growth; Cohu’s second quarter 2019 sales forecast, guidance,

non-GAAP operating expenses, gross margin, adjusted EBITDA and

effective tax rate, and cash and shares outstanding; and any other

statements that are predictive in nature and depend upon or refer

to future events or conditions, and include words such as “may,”

“will,” “should,” “would,” “expect,” “anticipate,” “plan,”

“likely,” “believe,” “estimate,” “project,” “intend,” and other

similar expressions among others. Statements that are not

historical facts are forward-looking statements. Forward-looking

statements are based on current beliefs and assumptions that are

subject to risks and uncertainties and are not guarantees of future

performance. Actual results could differ materially from those

contained in any forward-looking statement as a result of various

factors, including, without limitation: risks associated with

acquisitions; inventory, goodwill and other asset write-downs; our

ability to convert new products into production on a timely basis

and to support product development and meet customer delivery and

acceptance requirements for new products; our reliance on

third-party contract manufacturers and suppliers; failure to obtain

customer acceptance resulting in the inability to recognize revenue

and accounts receivable collection problems; revenue recognition

impacts due to ASC 606; market demand and adoption of our new

products; customer orders may be canceled or delayed; the

concentration of our revenues from a limited number of customers;

intense competition in the semiconductor equipment industry; our

reliance on patents and intellectual property; compliance with U.S.

export regulations; impacts from the Tax Cuts and Jobs Act of 2017

and ongoing tax examinations; geopolitical issues and trade wars;

ERP system implementation issues; the seasonal, volatile and

unpredictable nature of capital expenditures by semiconductor

manufacturers and the late 2018 and early 2019 weakened demand in

this market; ongoing weakness in Greater China market; rapid

technological change; and significant risks associated with the

Xcerra acquisition including but not limited to (i) the ability of

Cohu and Xcerra to integrate their businesses successfully and to

achieve anticipated synergies and cost savings, (ii) the

possibility that other anticipated benefits of the acquisition will

not be realized, (iii) litigation relating to the acquisition that

still could be instituted against Cohu and/or Xcerra, (iv) the

possibility that restructuring charges will significantly exceed

estimates, (v) the ability of Cohu or Xcerra to retain, attract and

hire key personnel, (vi) potential adverse reactions or changes to

relationships with customers, employees, suppliers or other parties

resulting from the acquisition, (vii) potential disruptions,

expenses and lost revenue associated with the transition to direct

sales in China and Taiwan; (viii) the discovery of liabilities or

deficiencies associated with Xcerra that were not identified in

advance, (ix) potential failures to maintain adequate internal

controls over financial reporting given the significant increase in

size, number of employees, global operations and complexity of

Cohu’s business, (x) mandatory ongoing impairment evaluation of

goodwill and other intangibles whereby Cohu could be required to

write off some or all of this goodwill and other intangibles, (xi)

the adverse impact to Cohu’s operating results from interest

expense on the financing debt, rising interest rates, and any

restrictions on operations related to such debt, and (xii)

continued availability of capital and financing and rating agency

actions, and limited market access given our high debt levels.

These and other risks and uncertainties are discussed more fully in

Cohu’s filings with the Securities and Exchange Commission,

including the most recently filed Form 10-K and Form 10-Q, and the

other filings made by Cohu with the SEC from time to time, which

are available via the SEC’s website at www.sec.gov. Except as

required by applicable law, Cohu does not undertake any obligation

to revise or update any forward-looking statement, or to make any

other forward-looking statements, whether as a result of new

information, future events or otherwise.

For press releases and other information of interest to

investors, please visit Cohu’s website at www.cohu.com.

COHU, INC. CONSOLIDATED STATEMENTS OF

OPERATIONS (Unaudited) (in thousands, except per share amounts)

Three Months Ended

March 30, March 31,

2019 1

2018 Net sales

$ 147,809 $

95,150 Cost and expenses: Cost of sales (excludes amortization

shown below) (2)

93,394 54,923 Research and development

22,733 11,775 Selling, general and administrative (3)

38,286 15,786 Amortization of purchased intangible assets

10,019 1,074 Restructuring charges

1,361

-

165,793 83,558

Income (loss) from operations

(17,984 ) 11,592

Other (expense) income: Interest expense

(5,507 ) (11

) Interest income

222 247 Foreign transaction gain (loss)

and other

218 (1,579 ) Income (loss)

from continuing operations before taxes

(23,051 )

10,249 Income tax provision (benefit)

(200 )

2,127 Income (loss) from continuing operations

(22,851 ) 8,122 Discontinued

operations: (4) Income from discontinued operations before taxes

189 - Income tax provision

25 -

Income from discontinued operations

164 - Net income

(loss)

(22,687 ) 8,122 Net

income (loss) attributable to noncontrolling interest

(44 ) - Net income (loss) attributable

to Cohu

$ (22,643 ) $

8,122

Income (loss) per share: Basic: Income (loss) from

continuing operations before non-controlling interest

$

(0.56 ) $ 0.28 Income from discontinued operations

0.01 - Net income (loss) attributable to noncontrolling

interest

0.00 - Net income

(loss) attributable to Cohu

$ (0.55 ) $ 0.28

Diluted: Income (loss) from continuing operations

before non-controlling interest

$ (0.56 ) $

0.28 Income from discontinued operations

0.01 - Net income

(loss) attributable to noncontrolling interest

0.00

- Net income (loss) attributable to Cohu

$ (0.55 ) $ 0.28 Weighted

average shares used in computing income (loss) per share: (5) Basic

40,872 28,602 Diluted

40,872 29,531 (1)

The three- month periods ended March 30, 2019 and March 31, 2018

were both comprised of 13 weeks. The Company’s results for the

three months ended March 30, 2019, include the results of Xcerra

which was acquired on October 1, 2018. (2) In conjunction with the

acquisition of Xcerra the Company assessed the need to realign its

historical financial statement presentation and certain statement

of operations classifications were reclassified to conform to

current period presentation. The changes made were as follows:

-- Prior to the fourth quarter of 2018,

amortization of intangibles previously were presented in cost of

sales and SG&A. These amounts are now presented as a separate

line item “Amortization of purchased intangible assets” within

operating expenses. Amounts associated with purchased intangible

assets that previously would have been included in cost of sales

are $7.6 million for three-month period ended March 30, 2019.

Amounts previously presented in cost of sales that have been

reclassified to conform with the Company’s revised presentation for

the three-month period ended March 31, 2018 are $0.7 million.

-- Historically, gains and losses associated with foreign currency

translation and remeasurement were included within SG&A which

resulted in fluctuations in expenses as foreign exchange rates

change. These amounts are now being presented within foreign

transaction gain (loss) and other as it will provide investors more

insight into the Company’s operating expenses. (3) SG&A expense

for the three-month periods ended March 30, 2019 and March 31, 2018

include Xcerra transaction costs totaling $0.2 million and $0.3

million, respectively. (4) On October 1, 2018, the Company made the

decision to sell the fixtures business acquired from Xcerra, and,

as a result, the operating results of the fixtures business have

been presented as discontinued operations. (5) For the three-month

period ended March 30, 2019, potentially dilutive securities were

excluded from the per share computations due to their antidilutive

effect. The Company has utilized the "control number" concept in

the computation of diluted earnings per share to determine whether

a potential common stock instrument is dilutive. The control number

used is income from continuing operations. The control number

concept requires that the same number of potentially dilutive

securities applied in computing diluted earnings per share from

continuing operations be applied to all other categories of income

or loss, regardless of their anti-dilutive effect on such

categories.

COHU, INC. CONDENSED

CONSOLIDATED BALANCE SHEETS (in thousands) (Unaudited)

March 30, December 29,

2019 2018

Assets: Current assets: Cash and investments

$

160,086 $ 165,020 Accounts receivable

131,133 149,276

Inventories

130,744 139,314 Other current assets

18,761 27,888 Current assets of discontinued operations

4,122 3,741 Total current assets

444,846 485,239 Property, plant & equipment, net

71,792 74,332 Goodwill

239,270 242,127 Intangible

assets, net

305,306 318,961 Other assets

(1)

44,889 13,264 Noncurrent assets of discontinued operations

94 79 Total assets

$

1,106,197 $ 1,134,002

Liabilities

& Stockholders’ Equity: Current liabilities: Short-term

borrowings

$ 3,160 $ 3,115 Current installments of

long-term debt

3,422 3,672 Deferred profit

8,268

6,896 Other current liabilities

122,643 146,388 Current

liabilities of discontinued operations

596

518 Other current liabilities

138,089 160,589

Long-term debt

342,632 346,041

Other noncurrent liabilities (1)

97,162 81,428 Cohu stockholders’ equity

528,670

546,243 Noncontrolling Interest

(356 )

(299 ) Total liabilities & stockholders’ equity

$

1,106,197 $ 1,134,002 (1)

Cohu adopted ASU 2016-02, Leases (Topic

842), as of December 30, 2018. Adoption of the new standard

resulted in the recording of additional net lease assets and lease

liabilities of approximately $30.7 million and $29.9 million,

respectively, as of December 30, 2018. We had previously recorded a

sale and operating leaseback transaction in accordance with Topic

840 and as a result of the adoption of the new standard, recognized

$10.2 million of deferred gain as an adjustment to retained

earnings. In addition, we had previously recognized assets and

liabilities related to a build-to-suit designation under Topic 840

and as a result of the adoption of the new standard, derecognized

assets and liabilities of $0.5 million and $0.6 million,

respectively, with the difference recorded as an adjustment to

retained earnings. The difference between the additional lease

assets and lease liabilities, net of the deferred tax impact, was

recorded as an adjustment to retained earnings.

COHU, INC. Supplemental

Reconciliation of GAAP Results to Non-GAAP Financial Measures

(Unaudited) (in thousands, except per share amounts)

Three Months Ended March 30, December 29, March 31,

2019 (1)

2018 (1)

2018 Income (loss) from operations - GAAP basis (a) $

(17,984 ) $ (59,151 ) $ 11,592 Non-GAAP adjustments: Share-based

compensation included in (b): Cost of sales (COS) 125 138 121

Research and development (R&D) 638 619 349 Selling, general and

administrative (SG&A) 2,930 3,799

1,199 3,693 4,556 1,669 Amortization of purchased

intangible assets (c) 10,019 14,080 1,074 Restructuring charges

related to inventory adjustments in COS (d) 466 19,053 -

Restructuring charges (d): 1,361 18,704 - Manufacturing and

sales transition costs included in (e): Cost of sales (COS) 235 - -

Research and development - 280 - Selling, general and

administrative 526 205 (13 ) 761

485 (13 ) Adjustment to contingent consideration included in

SG&A (f) - - (147 ) Acquisition costs included in SG&A (g)

224 4,633 296 Inventory step-up included in COS (h) 6,038 14,782 -

PP&E step-up included in SG&A (i) 1,257 1,257 - Reduction

of indemnification receivable included in SG&A (j) -

879 - Income from operations -

non-GAAP basis (k) $ 5,835 $ 19,278 $ 14,471

Income (loss) from continuing operations - GAAP basis $

(22,851 ) $ (57,116 ) $ 8,122 Non-GAAP adjustments (as scheduled

above) 23,819 78,429 2,879 Tax effect of non-GAAP adjustments (l)

(2,358 ) (11,302 ) (501 ) Income (loss) from

continuing operations - non-GAAP basis $ (1,390 ) $ 10,011 $

10,500 GAAP income (loss) from continuing operations

per share - diluted $ (0.56 ) $ (1.40 ) $ 0.28 Non-GAAP

income (loss) from continuing operations per share - diluted (m) $

(0.03 ) $ 0.24 $ 0.36

(1) Includes

operating results from Xcerra acquired on October 1, 2018

Management believes the presentation of these non-GAAP financial

measures, when taken together with the corresponding GAAP financial

measures, provides meaningful supplemental information regarding

the Company's operating performance. Our management uses these

non-GAAP financial measures in assessing the Company's operating

results, as well as when planning, forecasting and analyzing future

periods and these non-GAAP measures allow investors to evaluate the

Company’s financial performance using some of the same measures as

management. Management views share-based compensation as an expense

that is unrelated to the Company’s operational performance as it

does not require cash payments and can vary in amount from period

to period and the elimination of amortization charges provides

better comparability of pre and post-acquisition operating results

and to results of businesses utilizing internally developed

intangible assets. Management initiated certain restructuring

activities including employee headcount reductions and other

organizational changes to align our business strategies in light of

the merger with Xcerra. Restructuring costs have been excluded

because such expense is not used by Management to assess the core

profitability of Cohu’s business operations. Manufacturing and

sales transition costs relate principally to expenses incurred as a

result of moving certain manufacturing activities to Asia and

incremental costs incurred related to the buildup of a direct sales

force for certain equipment sales in Asia. Employee severance are

costs incurred in conjunction with the termination of certain

employees to streamline our operations and reduce costs. Management

has excluded these costs primarily because they are not reflective

of the ongoing operating results and they are not used to assess

ongoing operational performance. Acquisition costs, fair value

adjustment to contingent consideration, adjustments for inventory

step-up costs have been excluded by management as they are

unrelated to the core operating activities of the Company and the

frequency and variability in the nature of the charges can vary

significantly from period to period. Management believes the

reduction of an uncertain tax position liability and related

indemnification receivable is better reflected within income tax

expense rather than a charge to SG&A and credit to the income

tax provision. Excluding this data provides investors with a basis

to compare Cohu’s performance against the performance of other

companies without this variability. However, the non-GAAP financial

measures should not be regarded as a replacement for (or superior

to) corresponding, similarly captioned, GAAP measures. The

presentation of non-GAAP financial measures above may not be

comparable to similarly titled measures reported by other companies

and investors should be careful when comparing our non-GAAP

financial measures to those of other companies. (a) (12.2)%,

(34.7)% and 12.2% of net sales, respectively. (b) To eliminate

compensation expense for employee stock options, stock units and

our employee stock purchase plan. (c) To eliminate the amortization

of acquired intangible assets. (d) To eliminate restructuring costs

incurred related to the integration of Xcerra. (e) To eliminate

manufacturing and sales transition and severance costs. (f) To

eliminate fair value adjustment to contingent consideration related

to the acquisition of Kita. (g) To eliminate professional fees and

other direct incremental expenses incurred related to acquisitions.

(h) To eliminate the inventory step-up costs incurred related to

the acquisition of Xcerra. (i) To eliminate the accelerated

depreciation from the property, plant & equipment step-up

related to the acquisition of Xcerra. (j) To eliminate the impact

of the reduction of an uncertain tax position liability and related

indemnification receivable. (k) 3.9%, 11.3% and 15.2% of net sales,

respectively. (l) To adjust the provision for income taxes related

to the adjustments described above based on applicable tax rates.

(m) The three months ended December 29, 2018 was computed using

41,241 shares outstanding as the effect of dilutive securities was

excluded from GAAP diluted common shares due to the reported net

loss under GAAP, but are included for non-GAAP diluted common

shares since the Company has non-GAAP net income. All other periods

presented were computed using number of GAAP diluted shares

outstanding for each period.

COHU, INC.

Supplemental Reconciliation of GAAP Results to Non-GAAP

Financial Measures (Unaudited) (in thousands)

Three Months Ended March 30, December 29, March 31,

2019 (1)

2018 (1)

2018

Gross Profit Reconciliation Gross profit - GAAP

basis (excluding amortization)(2) $ 54,415 $ 41,919 $ 40,227

Non-GAAP adjustments to cost of sales (as scheduled above)

6,864 33,973 121 Gross profit -

Non-GAAP basis $ 61,279 $ 75,892 $ 40,348

Non-GAAP gross profit as a percentage of net sales 41.5 % 44.5 %

42.4 %

Adjusted EBITDA Reconciliation Net income

(loss) attributable to Cohu - GAAP Basis $ (22,643 ) $ (56,754 ) $

8,122 Income from discontinued operations (164 ) (119 ) - Income

tax provision (200 ) (6,266 ) 2,127 Interest expense 5,507 4,944 11

Interest income (222 ) (274 ) (247 ) Amortization 10,019 14,080

1,074 Depreciation 5,020 4,691 1,383 Other non-GAAP adjustments (as

scheduled above) 12,406 63,092

1,805 Adjusted EBITDA $ 9,723 $ 23,394 $

14,275 Adjusted EBITDA as a percentage of net sales 6.6 %

13.7 % 15.0 %

Operating Expense Reconciliation

Operating Expense - GAAP basis $ 72,399 $ 101,070 $ 28,635 Non-GAAP

adjustments to operating expenses (as scheduled above)

(16,955 ) (44,456 ) (2,758 ) Operating Expenses -

Non-GAAP basis $ 55,444 $ 56,614 $ 25,877

(1)

Includes operating results from Xcerra acquired on October 1, 2018

(2)

Excludes amortization of $7,641 for the three months ending March

30, 2019, $11,626 for the three months ending December 29, 2018 and

$676 for the three months ended March 31, 2018.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190506005734/en/

Cohu, Inc.Richard Yerganian, 781-467-5063Vice President,

Investor Relationsrich.yerganian@cohu.com

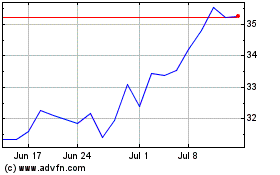

Cohu (NASDAQ:COHU)

Historical Stock Chart

From Mar 2024 to Apr 2024

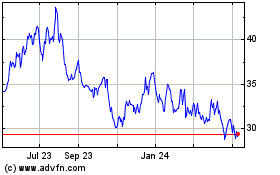

Cohu (NASDAQ:COHU)

Historical Stock Chart

From Apr 2023 to Apr 2024