Current Report Filing (8-k)

December 14 2020 - 6:01AM

Edgar (US Regulatory)

0001058290False00010582902020-12-102020-12-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): December 10, 2020

Cognizant Technology Solutions Corporation

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

0-24429

|

|

13-3728359

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

Glenpointe Centre West

|

|

|

|

500 Frank W. Burr Blvd.

|

|

|

|

Teaneck,

|

|

New Jersey

|

|

07666

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

(201) 801-0233

(Registrant’s telephone number, including area code)

Not applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425).

|

|

|

|

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12).

|

|

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)).

|

|

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)).

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Class A Common Stock,

$0.01 par value per share

|

CTSH

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

|

|

|

|

Emerging growth company

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

On December 10, 2020, the Board of Directors of Cognizant Technology Solutions Corporation (the “Company”) approved an increase of $2 billion to the amount authorized under the Company’s existing stock repurchase program, increasing the total amount authorized for repurchases from $7.5 billion to $9.5 billion, excluding fees and expenses, of the Company’s Class A common stock (the “Common Stock”). The repurchase program does not have an expiration date. Following the increase the Company had $2.9 billion available for repurchase under the authorization.

Repurchases under the program may be made in the open market, in privately negotiated transactions or otherwise, with the amount and timing of repurchases depending on market conditions and corporate needs. Open market repurchases will be structured to occur within the pricing and volume requirements of Rule 10b-18. The Company may also, from time to time, enter into Rule 10b5-1 plans to facilitate repurchases of its shares under this authorization.

This program does not obligate the Company to acquire any particular amount of Common Stock, and the program may be extended, modified, suspended or discontinued at any time at the Company’s discretion.

Forward-Looking Statements

This Current Report on Form 8-K includes statements which may constitute forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, the accuracy of which are necessarily subject to risks, uncertainties, and assumptions as to future events that may not prove to be accurate. These statements include, but are not limited to, express or implied forward-looking statements relating to our expectations regarding future stock repurchases. These statements are neither promises nor guarantees, but are subject to a variety of risks and uncertainties, many of which are beyond our control, which could cause actual results to differ materially from those contemplated in these forward-looking statements. Existing and prospective investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Factors that could cause actual results to differ materially from those expressed or implied include the recent ransomware attack, the impact of and effectiveness of business continuity plans during the COVID-19 pandemic, changes in the regulatory environment, including with respect to immigration and taxes, and the other factors discussed in our most recent Annual Report on Form 10-K, as updated by our most recent Quarterly Report on Form 10-Q and other filings with the Securities and Exchange Commission. Cognizant undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as may be required under applicable securities law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

COGNIZANT TECHNOLOGY SOLUTIONS CORPORATION

|

|

|

|

|

By:

|

/s/ Robert Telesmanic

|

|

Name:

|

Robert Telesmanic

|

|

Title:

|

SVP, Controller and Chief Accounting Officer

|

Date: December 11, 2020

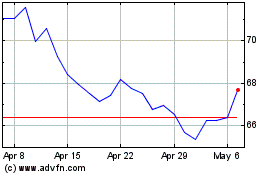

Cognizant Technology Sol... (NASDAQ:CTSH)

Historical Stock Chart

From Mar 2024 to Apr 2024

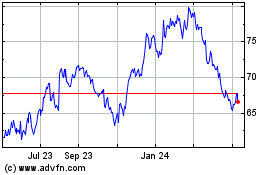

Cognizant Technology Sol... (NASDAQ:CTSH)

Historical Stock Chart

From Apr 2023 to Apr 2024