Buy for Co-Diagnostics (NASDAQ:CODX) Reiterated by H.C. Wainwright with $20 Price Target

March 11 2020 - 9:30AM

Analyst Yi Chen released additional coverage on Co-Diagnostics

(NASDAQ:CODX), a Utah-based molecular diagnostics company, raising

the firm’s price target to $20 and keeping a Buy rating on the

shares after news that the company continues to execute on product

shipments domestically and internationally. Co-Diagnostics

[Ticker:CODX] was the first U.S. company to receive CE Marking

designation for a COVID-19 test, Chen tells investors in a research

note. The analyst believes a recent FDA policy change to help

expedite the availability of COVID-19 coronavirus diagnostics could

be a significant boost to the company's potential sales of its

COVID-19 test domestically.

Co-Diagnostics is now shipping its proprietary COVID-19 test to

countries across four continents, including America, Europe, Asia

and Australia, said the analysts, adding “the domestic and

international demand for COVID-19 tests has been surging in the

past weeks.”

The company has been seeing an increase in product shipments of

its Logix Smart COVID-19 screening test following the US Food and

Drug Administration’s decision late last month to allow labs that

meet a set of standards known as the Clinical Laboratory

Improvement Amendments (CLIA) to use coronavirus detection tests

that have been validated by the laboratories, even before the FDA

has completed the review of the labs’ Emergency Use Authorization

(EUA) submission.

Previously, labs seeking to use coronavirus tests had to wait

for specific clearance from the FDA.

This recent activity coincides with the company completing a

registered direct offering of 470K shares at $9 per share for gross

proceeds of $4.2M, which leads the analyst to estimate that the

company’s pro forma cash position post offering could approximate

$24M, which should fund operations for the next three years.

According to the Wainwright analyst:

“In view of the continuing—and rapidly accelerating—COVID-19

infection spread worldwide and initialization of shipments to U.S.

labs, we have increased the enterprise value-to-sales (EV/Sales)

multiple to 12x from 10x and projected 2020 total sales to $1.66

from $0.40 per share, which leads to a value of $20 per share.

Therefore, we reiterate our Buy rating while raising the 12-month

target to $20 from $4 per share.”

The full research report can be accessed here.

Disclosure: Co-Diagnostics Inc is a client of BDA

International.

About BDA International,

Inc.:

BDA International is an independent global

Investor Relations firm offering a wide range of IR-related

analysis, research and advisory services. In particular, we provide

and are compensated for service packages that include strategic

action plans and investor/market perception studies to help

entities improve communication with customers and investors, and to

increase their visibility. BDA International has received no direct

compensation related to this release but its principles hold shares

of client companies in our personal portfolios, including CODX. BDA

International accepts sole responsibility for the content and

distribution of the foregoing release, which does not contain any

previously unpublished or non-public information. Parties

interested in learning more about the relationship between BDA and

CODX may do so via the contact information at the bottom of this

release.

Disclaimer

The information, opinions and analysis

contained herein are based on sources believed to be reliable, but

no representation, expressed or implied, is made as to its

accuracy, completeness or correctness. The opinions contained in

this analysis reflect our current judgment and are subject to

change without notice. We do not accept any responsibility or

liability for any losses, damages or costs arising from an

investor’s or other person’s reliance on or use of this analysis.

This analysis is for information purposes only, and is neither a

solicitation to buy nor an offer to sell securities, nor a

recommendation of any security, although members of the BDA may at

times hold a position in the company covered within the article.

Co-Diagnostics is a client of BDA International. Past gains are not

a representative of future gains. The opinions herein contain

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995, including, but not

limited to, statements concerning manufacturing, marketing, growth,

and expansion. When used herein, the words “anticipate,” “intend,”

“estimate,” “believe,” “expect,” “plans,” “should,” “potential,”

“forecast,” and variations of such words and similar expressions

are intended to identify forward-looking statements. Such

forward-looking information involves important risks and

uncertainties that could affect actual results and cause them to

differ materially from expectations expressed herein. A company’s

actual results could differ materially from those described in any

forward-looking statements contained herein. BDA is not a licensed

broker, broker dealer, market maker, investment advisor, analyst or

underwriter. We recommend that you use the information found herein

as an initial starting point for conducting your own research in

order to determine your own personal opinion of the companies

discussed herein before deciding whether or not to invest. You

should seek such investment, tax, financial, accounting or legal

advice appropriate for your particular circumstances. Information

about many publicly traded companies and other investor resources

can be found at www.sec.gov. Investing in securities is speculative

and carries risk.

Investor Relations Contact:

Mushtaq

Dost

BDA International

www.bda-ir.com

dost@bda-ir.com

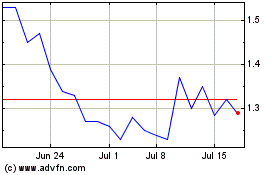

Co Diagnostics (NASDAQ:CODX)

Historical Stock Chart

From Mar 2024 to Apr 2024

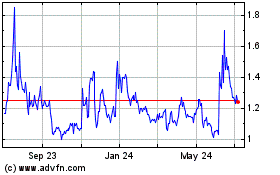

Co Diagnostics (NASDAQ:CODX)

Historical Stock Chart

From Apr 2023 to Apr 2024