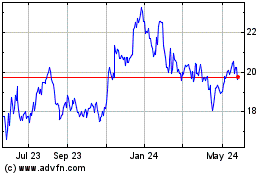

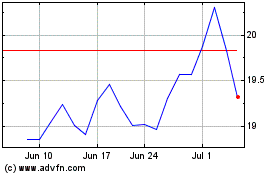

CNB Financial Corporation (“CNB” or the “Corporation”) (NASDAQ:

CCNE), the parent company of CNB Bank, today announced its earnings

for the fourth quarter ended December 31, 2020.

Joseph B. Bower, Jr., President and CEO, stated,

“The year of 2020 will go down in history as one for all to

remember. CNB had the daunting task, like all community banks, of

helping calm the concerns of local businesses and aiding them in

keeping their doors open and their employees engaged. And with the

entire world focused on maintaining health and safety, expansion of

the economy was not paramount. We took the opportunity to review

our balance sheet, delivery channels and processes to improve for

the future. Branch consolidations, an expansion of our

BankOnBuffalo franchise, capital raise, prepayment of long-term

debt, improved technology infrastructure both internally and in the

delivery channels, carbon footprint reduction initiatives, and

improved liquidity are a few of the major initiatives accomplished

by our team. We are excited for our communities’ 2021 prospects as

we successfully navigate through this pandemic and begin to move

forward again.”

CECL Adoption and FHLB Borrowing

Prepayment

- Section 4014 of the CARES Act was

issued in March 2020 that provided financial institutions with

optional temporary relief from having to comply with CECL on

January 1, 2020. On December 31, 2020 CNB adopted Accounting

Standard Update 2016-13, commonly referred to as CECL, effective

January 1, 2020. The CECL methodology replaces the former probable

incurred loss methodology, which requires entities to estimate

credit losses over the life of a financial asset measured at

amortized cost or off-balance sheet exposure. At adoption, CNB

recorded a $5.0 million increase to its allowance for credit

losses, of which $3.4 million was recorded as a reduction of

retained earnings. As a result of the adoption of CECL, coupled

with the impact of ongoing trends in CNB’s loan portfolio and the

COVID-19 pandemic, the allowance for credit losses increased from

$19.5 million, at December 31, 2019, to $34.3 million at December

31, 2020.

- During the fourth quarter of 2020

CNB prepaid the entire balance of its borrowings from the FHLB,

totaling approximately $160 million. The pre-payment penalty

associated with these prepayments totaled approximately $5.9

million after-tax or $0.35 per diluted common share. The weighted

average interest rate associated with these borrowings was

2.24%.

Earnings Performance

Highlights1

- Net income was $7.9 million, or

$0.40 per diluted common share, for the quarter ended December 31,

2020, and $32.7 million, or $1.97 per diluted common share, for the

year ended December 31, 2020. Pre-tax pre-provision ("PTPP") income

was $13.1 million and $55.4 million, for the three months and

twelve months ended December 31, 2020, respectively.1

- Excluding the after-tax FHLB

prepayment penalty, net income was $13.8 million, or $0.75 per

diluted common share, for the three months ended December 31, 2020,

compared to $10.6 million, or $0.70 per diluted share, for the same

period in 2019, reflecting increases of $3.2 million, or 29.5%, and

$0.05 per diluted common share, or 7.1%.1

- Excluding after-tax merger costs

related to CNB's acquisition of Bank of Akron, FHLB prepayment

penalties and branch closure costs totaling a combined $10.2

million, net income was $42.9 million, or $2.60 per diluted common

share, for the year ended December 31, 2020, compared to $40.2

million, or $2.64 per diluted share, for the year ended December

31, 2019, reflecting an increase of $2.7 million, or 6.7%, and a

decrease of $0.04 per diluted common share, or 1.5%.1

- Excluding merger costs and FHLB

prepayment penalties, PTPP income was $20.5 million for the quarter

ended December 31, 2020, representing an increase of approximately

$6.7 million, or 48.9%, from the same period in 2019. For the year

ended December 31, 2020, excluding the impact of merger, prepayment

penalties and branch closure costs PTPP income was $68.1 million,

representing an increase of approximately $13.3 million, or 24.2%,

from the same period in 2019.1

- At December 31, 2020, the

Corporation had $151.0 million of COVID-19 related deferred loan

payments for its commercial and consumer customers, or 4.5% of

total loans, down from $169.3 million, or 5.1% of total loans as of

October 31, 2020, and $626.0 million, or 20.7% of total loans, at

June 30, 2020.

1 This release contains references to financial

measures that are not defined in GAAP ("Generally Accepted

Accounting Principles"). Management believes that these non-GAAP

measures provide a greater understanding of ongoing operations,

enhance comparability of results of operations with prior periods

and show the effects of significant gains and charges in the

periods presented. A reconciliation of these non-GAAP financial

measures is provided below in the "Non-GAAP Reconciliations"

section.

Balance Sheet and Liquidity

Highlights

- Loans totaled $3.4 billion as of

December 31, 2020 and reflected an increase of $567.3 million, or

20.2%, from December 31, 2019, as a result of $319.1 million of

acquired loans from Bank of Akron, net of fair value adjustments,

$155.5 million in Paycheck Protection Program ("PPP") loans, net of

PPP deferred processing fees ("PPP-related loans") and $92.7

million, or 3.3%, of organic growth, primarily from our Cleveland

and Buffalo regions.

- Deposits totaled $4.2 billion as of

December 31, 2020, an increase of $1.1 billion, or 34.8%, from

December 31, 2019, as a result of $419.5 million of acquired

deposits from Bank of Akron, net of fair value adjustments, an

estimated $159.6 million in PPP deposits and $500.3 million, or

16.1%, of increases in deposits across all our regions, including

our Private Banking division.

- At December 31, 2020, the

Corporation’s cash position totaled approximately $532.7 million,

including additional excess liquidity of $483.2 million held at the

Federal Reserve, reflecting, in management's view, a strong

liquidity level. In addition to its cash position, the

Corporation’s borrowing capacity with the FHLB at December 31, 2020

was approximately $797.4 million.

- While book value per common share

was $21.29 and $20.00 as of December 31, 2020 and 2019,

respectively, tangible book value per common share was $18.66 as of

December 31, 2020, reflecting an increase of 6.9% from a tangible

book value per share of $17.45 as of December 31, 2019.

Customer Support Strategies and Loan

Portfolio Profile

- The Corporation participated in the

PPP provided under the auspices of the Small Business

Administration (“SBA”). Under this program, the Corporation lent

money primarily to its existing loan and/or deposit customers,

based on a predetermined SBA-developed formula, intended to

incentivize small business owners to retain their employees. These

loans carry a customer rate of 1.00% plus a processing fee that

varies depending on the balance of the loan at origination. As of

December 31, 2020, the Corporation had outstanding $159.6 million

in PPP loans, or 1,528 PPP loan relationships, at a rate of 1.00%

together with deferred PPP processing fees of approximately $4.1

million. For the three and twelve months ended December 31, 2020,

the Corporation recognized $4.5 million and $5.1 million,

respectively, in deferred PPP processing fees ("PPP-related

fees").

- In addition to participating in the

PPP, during the year ended December 31, 2020, the Corporation

deferred loan payments for several of its commercial and consumer

customers, as determined by the financial needs of each customer.

As of December 31, 2020, the COVID-19 related loans with deferred

loan payment arrangements, totaled $151.0 million, or 4.5% of total

loans outstanding, consisting of 112 loans, totaling $107.2

million, for which principal and interest were deferred, and 55

loans, totaling $43.8 million, for which principal only was

deferred. Loan payment deferrals by loan type were as follows:

- Commercial and industrial loans –

44 loans, totaling $39.1 million;

- Commercial real estate loans – 23

loans, totaling $101.8 million;

- Residential mortgage loans – 88

loans, totaling $9.9 million; and

- Consumer loans – 12 loans, totaling

$154 thousand.

- The Corporation tracks lending

exposure by industry classification to determine potential risk

associated with industry concentrations, if any, that could lead to

additional credit loss exposure. As a result of the COVID-19

pandemic, the Corporation has determined the Hotels/Motels and

Restaurants/Fast Foods industries represent a potentially higher

level of credit risk, as many of these customers have incurred a

significant negative impact to their businesses as a result of

governmental stay-at-home orders as well as travel limitations. At

December 31, 2020, the Corporation had loan concentrations for

these industries as follows, excluding PPP-related loans:

- Hotels/Motels – $206.6 million, or

6.42% of total loans outstanding, excluding PPP-related loans;

and

- Restaurants/Fast Foods – $30.1

million, or 0.94% of total loans outstanding, excluding PPP-related

loans.

Performance Ratios

- While annualized return on average

common equity was 7.45% for the three months ended December 31,

2020, annualized return on average tangible common equity was 8.53%

for the same period in 2020. Excluding after-tax merger costs,

prepayment penalties and branch closure costs, annualized adjusted

return on average tangible common equity was 15.94% for the three

months ended December 31, 2020, compared to 16.04% for the three

months ended December 31, 2019.1

- While return on average common

equity was 9.35% for the year ended December 31, 2020, return on

average tangible common equity was 10.67% for the year ended

December 31, 2020. Excluding after-tax merger costs, prepayment

penalties and branch closure costs, adjusted return on average

tangible common equity was 14.10% for the year ended December 31,

2020, compared to 16.34% for the year ended December 31,

2019.1

- Efficiency ratio was 72.16% and

65.10% for the three and twelve months ended December 31, 2020,

respectively. Excluding after-tax merger costs, prepayment

penalties and branch closure costs, the adjusted efficiency ratio

was 56.82% and 57.41% for the three and twelve months ended

December 31, 2020, respectively, compared to 61.12% and 60.07% for

the comparable periods in 2019. The improvement in efficiency ratio

resulted from the impact of PPP-related fees, as discussed below,

coupled with an overall lower level of business activity resulting

from the pandemic and the Corporation’s internal cost management

initiatives focusing on travel restrictions, a hiring freeze, lower

marketing expenditures and other expense management

initiatives.1

Revenue

- Total revenue (comprised of net

interest income plus non-interest income) was $48.1 million for the

three months ended December 31, 2020, an increase of $11.6 million,

or 31.7%, from the three months ended December 31, 2019 due to the

following:

- Net interest income of $40.1

million for the three months ended December 31, 2020, increased

$10.4 million or 34.9% from the three months ended December 31,

2019, primarily as a result of an organic growth of $704.2 million

and the impact of $413.7 million in PPP-related loans and estimated

average PPP-related deposits. In addition, the three months ended

December 31, 2020 included PPP-related fees totaling approximately

$4.5 million.

- Net interest margin on a fully

tax-equivalent basis was 3.58% and 3.54% for the three months ended

December 31, 2020 and 2019, respectively.

- The yield on earning assets of

4.16% for the three months ended December 31, 2020 decreased 65

basis points from 4.81% for the three months ended December 31,

2019, primarily as a result of the lower interest rate environment.

The cost of interest-bearing liabilities decreased 78 basis points

from 1.49% for the three months ended December 31, 2019 to 0.71%

for the three months ended December 31, 2020 primarily as a result

of the Corporation’s targeted deposit rate reductions.

- Total revenue (comprised of net

interest income plus non-interest income) was $162.8 million for

the twelve months ended December 31, 2020, an increase of $20.6

million, or 14.5%, from the twelve months ended December 31, 2019

due to the following:

- Net interest income for the twelve

months ended December 31, 2020 increased 15.9% to $134.7 million

from the twelve months ended December 31, 2019, driven by an

organic growth of $560.8 million and $336.3 million in PPP-related

loans, estimated PPP-related deposits and Paycheck Protection

Program Lending Facility ("PPPLF") related assets (collectively the

"PPP-related assets"). In addition, the twelve months ended

December 31, 2020 included PPP-related fees totaling approximately

$5.1 million.

- Net interest margin on a fully

tax-equivalent basis was 3.34% and 3.69% for the twelve months

ended December 31, 2020 and 2019, respectively, Excluding $336.3

million in PPP-related assets, the net interest margin on a

fully-tax equivalent basis was 3.50% for the twelve months ended

December 31, 2020.1

- The yield on earning assets of

4.15% for the twelve months ended December 31, 2020 included $336.3

million in PPP-related assets. Excluding PPP-related assets and

PPP-related fees, the yield on earning assets was 4.37% for the

twelve months ended December 31, 2020, a decrease of 56 basis

points from 4.93% for the twelve months ended December 31, 2019,

primarily as a result of the lower interest rate environment. The

cost of interest-bearing liabilities decreased 50 basis points to

0.95% for the twelve months ended December 31, 2020 from 1.45% for

the twelve months ended December 31, 2019 primarily as a result of

the Corporation’s targeted deposit rate reductions.1

- Total non-interest income was $8.0

million for the three months ended December 31, 2020, an increase

of $1.2 million, or 18.0%, from the same period in 2019. The

increase was primarily due to continued growth in Wealth and Asset

Management fees and increased mortgage banking and card processing

and interchange income, partially offset by a decrease in service

charges on deposits and other fees resulting from lower business

activity and CNB’s response to the pandemic.

- Total non-interest income was $28.1

million for the twelve months ended December 31, 2020, an increase

of $2.1 million, or 8.0%, from the twelve months ended December 31,

2019.

- Total non-interest income includes

net realized and unrealized losses on trading securities, which

combined totaled $2.5 million for the twelve months ended December

31, 2020 compared to $2.0 million for the twelve months ended

December 31, 2019.

- The remainder of the $2.1 million

increase was primarily due to continued growth in Wealth and Asset

Management fees, increased mortgage banking activity coupled with

higher card processing and interchange income, partially offset by

a decrease in service charges on deposits and other fees resulting

from lower business activity and CNB’s response to the

pandemic.

Non-Interest Expense

- For the three months ended December

31, 2020, total non-interest expense was $35.0 million. Excluding

merger costs, prepayment penalties and branch closure costs, total

non-interest expense was $27.6 million for the three months ended

December 31, 2020, an increase of $4.8 million, or 21.3%, from the

three months ended December 31, 2019, including an approximately

$929 thousand impact from the acquisition of Bank of Akron, $1.2

million related to an additional pay cycle in the fourth quarter of

2020 compared to 2019, as well as the Corporation’s ongoing

investments in technology and other general expenditures to support

long-term growth.1

- For the twelve months ended

December 31, 2020, total non-interest expense was $107.3 million.

Excluding merger costs, prepayment penalties and branch closure

costs, total non-interest expense was $94.7 million for the twelve

months ended December 31, 2020, an increase of $7.3 million, or

8.4%, from the twelve months ended December 31, 2019, including a

$1.6 million impact from the acquisition of Bank of Akron. The

remaining $5.7 million increase was the result of the Corporation’s

ongoing investments in technology and other general expenditures to

support long-term growth.1

Income Taxes

- Income tax expense of $1.9 million

for the three months ended December 31, 2020 decreased $420

thousand, or 18.3%, from the three months ended December 31, 2019.

Our effective tax rate was 19.2% for the three months ended

December 31, 2020 compared to 18.0% for the three months ended

December 31, 2019. The increase in the effective tax rate is

primarily attributable to a higher percentage of pre-tax net income

in the fourth quarter of 2020 that is not tax-exempt than was

recorded in the fourth quarter of 2019.

- Income tax expense of $7.3 million

for the twelve months ended December 31, 2020 decreased $1.2

million, or 14.2%, from the twelve months ended December 31, 2019.

Our effective tax rate was 18.3% for the twelve months ended

December 31, 2020 compared to 17.6% for the twelve months ended

December 31, 2019. The increase in the effective tax rate is

primarily attributable to a higher percentage of pre-tax net income

for the twelve months ended December 31, 2020, that is not

tax-exempt than was recorded in the twelve months ended December

31, 2019.

Asset Quality

- Total non-performing assets were

$31.5 million, or 0.67%, of total assets, as of December 31, 2020.

Total assets at December 31, 2020 include approximately $315.1

million in PPP-related assets. Excluding the PPP-related assets,

the ratio of total non-performing assets to total assets was 0.71%

as of December 31, 2020 compared to 0.62% as of December 31, 2019.1

The increase from December 31, 2019, was primarily due to one

commercial real estate loan relationship totaling approximately

$8.7 million. During the three months ended March 31, 2020, this

loan was downgraded to substandard and placed on non-accrual as a

result of a covenant violation. Management performed an evaluation

of the collateral supporting the loan and concluded to charge-off

$1.0 million in the fourth quarter of 2020.

- The allowance for credit losses

measured as a percentage of loans, net of unearned income, as of

December 31, 2020 was 1.01%. Total loans at December 31, 2020

include approximately $155.5 million in PPP-related loans.

Excluding PPP-related loans, the allowance for credit losses

measured as a percentage of loans, net of unearned income, was

1.07% as of December 31, 2020 compared to 0.69% as of December 31,

2019.1 The increase in the allowance for credit losses from

December 31, 2019 to December 31, 2020 resulted primarily from the

adoption of CECL, coupled with the impact of ongoing trends in

CNB’s loan portfolio and the COVID-19 pandemic. Included within the

trend in the allowance for credit losses, charge-offs totaling

approximately $6.4 million for the twelve months ended December 31,

2020, were comprised primarily of a $2.6 million charge-off in the

second quarter of 2020, related to a secured commercial and

industrial loan relationship with a borrower who is now deceased,

and a $1.0 million charge-off in the fourth quarter of 2020,

related to one commercial real estate loan.

- Management recognizes the degree of

uncertainty related to the pandemic and its potential impact on the

economy and, as a result, the allowance for credit losses at

December 31, 2020 also included a qualitative factor specifically

related to the COVID-19 pandemic deferred loans. As of December 31,

2020, the specific COVID-19 qualitative factor totaled

approximately $1.5 million, which was reflected in the

Corporation’s provision expense for the twelve months ended

December 31, 2020 and the related allowance for credit losses

during the same period. The Corporation will continue to evaluate

this factor and update its analysis, as necessary, as developments

related to the COVID-19 pandemic and its impact on the economy

evolve.

- For the three months ended December

31, 2020, net loan charge-offs were $1.8 million, or 0.21% of total

average loans, compared to $1.5 million, or 0.22%, of total average

loans during the comparable period in 2019. The fourth quarter of

2020 included a net charge-off totaling $1.0 million, related to

one commercial real estate loan, as discussed above.

- For the twelve months ended

December 31, 2020, net loan charge-offs were $6.4 million, or

0.21%, of total average loans, compared to $6.3 million, or 0.24%,

of total average loans during the twelve months ended December 31,

2019.

Capital

- As of December 31, 2020, CNB’s

total shareholders’ equity was $416.1 million, an increase of

$111.2 million, or 36.5%, from December 31, 2019 primarily as a

result of an increase in additional paid in capital related to the

Bank of Akron acquisition combined with the issuance of preferred

equity, an increase in accumulated other comprehensive income and

growth in organic earnings, partially offset by the adoption of

CECL and payment of common and preferred stock dividends to our

shareholders during the twelve months ended December 31, 2020.

- During the second quarter of 2020,

the Corporation announced the termination of its “at-the-market”

equity offering program (the “ATM Program”), pursuant to which the

Corporation could offer and sell up to $40 million of common stock.

The Corporation elected to terminate the ATM Program due to market

conditions and to limit uncertainty and unfavorable dilution for

its shareholders during this period of global economic volatility.

Prior to termination, the Corporation had sold 168,358 shares of

its common stock, raising approximately $5.1 million in gross

proceeds.

- On July 17, 2020, the Corporation

completed its acquisition of Bank of Akron, a state bank in Akron,

NY. Under the terms of the merger agreement, Bank of Akron merged

with and into CNB Bank, with CNB Bank as the surviving institution.

Banking offices of Bank of Akron operate under the trade name

BankOnBuffalo, a division of CNB Bank. Based on the elections and

proration procedures, the total consideration payable to Bank of

Akron shareholders was approximately $40.8 million, comprised of

approximately $16.1 million in cash and 1,501,402 shares of CNB

common stock, valued at $24.7 million based on the July 17, 2020

closing price of $16.43 per share of CNB common stock.

- During the three months ended

September 30, 2020, the Corporation raised $57.8 million, net of

issuance costs, from the issuance of depositary shares, each

representing a 1/40th ownership interest in a share of the

Corporation's 7.125% Series A fixed-to-floating rate non-cumulative

perpetual preferred stock, no par value, with a liquidation

preference of $1,000 per share of preferred stock.

- As of December 31, 2020 all of the

Corporation’s regulatory capital ratios reflected increases from

December 31, 2019. The Corporation’s Tier 1 Leverage ratio of 8.06%

at December 31, 2020, includes the impact of average PPP-related

loans, of $203.1 million.

- As of December 31, 2020, the

Corporation’s ratio of Tangible Common Equity to Tangible Assets

reflected the impact of approximately $155.5 million in PPP-related

loans. Excluding PPP-related loans, the Corporation’s ratio of

Tangible Common Equity to Tangible Assets of 6.93% decreased 21 bps

from December 31, 2019, primarily as a result of the impact of the

acquisition of Bank of Akron and the adoption of CECL, partially

offset by a net increase in earnings, net of common dividends and

an increase in accumulated other comprehensive income.1

About CNB Financial

Corporation

CNB Financial Corporation is a financial holding

company with consolidated assets of approximately $4.7 billion. CNB

Financial Corporation conducts business primarily through its

principal subsidiary, CNB Bank. CNB Bank is a full-service bank

engaging in a full range of banking activities and services,

including trust and wealth management services, for individual,

business, governmental, and institutional customers. CNB Bank

operations include a private banking division, one loan production

office, one drive-up office and 44 full-service offices in

Pennsylvania, Ohio, and New York. CNB Bank’s divisions include

ERIEBANK, based in Erie, Pennsylvania, with offices in northwest

Pennsylvania and northeast Ohio; FCBank, based in Worthington,

Ohio, with offices in central Ohio; and BankOnBuffalo, based in

Buffalo, New York, with offices in northern New York. CNB Bank is

headquartered in Clearfield, Pennsylvania, with offices in central

and north central Pennsylvania. Additional information about CNB

Financial Corporation may be found at www.CNBBank.bank.

Forward-Looking Statements

This press release includes forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended, with respect to CNB’s financial condition,

liquidity, results of operations, future performance and business.

These forward-looking statements are intended to be covered by the

safe harbor for “forward-looking statements” provided by the

Private Securities Litigation Reform Act of 1995. Forward-looking

statements are those that are not historical facts. Forward-looking

statements include statements with respect to beliefs, plans,

objectives, goals, expectations, anticipations, estimates and

intentions that are subject to significant risks and uncertainties

and are subject to change based on various factors (some of which

are beyond CNB’s control). Forward-looking statements often include

the words “believes,” “expects,” “anticipates,” “estimates,”

“forecasts,” “intends,” “plans,” “targets,” “potentially,”

“probably,” “projects,” “outlook” or similar expressions or future

conditional verbs such as “may,” “will,” “should,” “would” and

“could.” CNB’s actual results may differ materially from those

contemplated by the forward-looking statements, which are neither

statements of historical fact nor guarantees or assurances of

future performance. Such known and unknown risks, uncertainties and

other factors that could cause the actual results to differ

materially from the statements, include, but are not limited to,

(i) the duration and scope of the COVID-19 pandemic and the local,

national and global impact of COVID-19, (ii) actions governments,

businesses and individuals take in response to the pandemic, (iii)

the pace of recovery when the COVID-19 pandemic subsides, (iv)

changes in general business, industry or economic conditions or

competition; (v) changes in any applicable law, rule, regulation,

policy, guideline or practice governing or affecting financial

holding companies and their subsidiaries or with respect to tax or

accounting principles or otherwise; (vi) adverse changes or

conditions in capital and financial markets; (vii) changes in

interest rates; (viii) higher than expected costs or other

difficulties related to integration of combined or merged

businesses; (ix) the effects of business combinations and other

acquisition transactions, including the inability to realize our

loan and investment portfolios; (x) changes in the quality or

composition of our loan and investment portfolios; (xi) adequacy of

loan loss reserves; (xii) increased competition; (xiii) loss of

certain key officers; (xiv) deposit attrition; (xv) rapidly

changing technology; (xvi) unanticipated regulatory or judicial

proceedings and liabilities and other costs; (xvii) changes in the

cost of funds, demand for loan products or demand for financial

services; and (xviii) other economic, competitive, governmental or

technological factors affecting our operations, markets, products,

services and prices. Such developments could have an adverse impact

on CNB's financial position and results of operations. For more

information about factors that could cause actual results to differ

from those discussed in the forward-looking statements, please

refer to the “Risk Factors” and “Management’s Discussion and

Analysis of Financial Condition and Results of Operations” sections

of and the forward-looking statement disclaimers in CNB’s annual

and quarterly reports.

The forward-looking statements are based upon

management’s beliefs and assumptions and are made as of the date of

this press release. CNB undertakes no obligation to publicly update

or revise any forward-looking statements included in this press

release or to update the reasons why actual results could differ

from those contained in such statements, whether as a result of new

information, future events or otherwise, except to the extent

required by law. In light of these risks, uncertainties and

assumptions, the forward-looking events discussed in this press

release might not occur and you should not put undue reliance on

any forward-looking statements.

Financial Tables

The following tables supplement the financial

highlights described previously for CNB. All dollars are stated in

thousands, except share and per share data.

| |

(unaudited) |

|

|

| |

Three Months Ended |

|

Twelve Months Ended |

| |

December 31, |

|

December 31, |

| |

|

|

|

|

(unaudited) |

|

|

| |

|

|

% |

|

|

|

% |

| |

2020 |

2019 |

change |

|

2020 |

2019 |

change |

|

Income Statement |

|

|

|

|

|

|

|

|

Interest income |

$ |

46,648 |

|

$ |

40,608 |

|

14.9 |

|

% |

|

$ |

167,167 |

|

$ |

155,728 |

|

7.3 |

|

% |

|

Interest expense |

6,533 |

|

10,863 |

|

(39.9 |

) |

% |

|

32,456 |

|

39,530 |

|

(17.9 |

) |

% |

|

Net interest income |

40,115 |

|

29,745 |

|

34.9 |

|

% |

|

134,711 |

|

116,198 |

|

15.9 |

|

% |

|

Provision for credit losses (2) |

3,289 |

|

812 |

|

305.0 |

|

% |

|

15,354 |

|

6,024 |

|

154.9 |

|

% |

|

Net interest income after provision for credit losses |

36,826 |

|

28,933 |

|

27.3 |

|

% |

|

119,357 |

|

110,174 |

|

8.3 |

|

% |

| |

|

|

|

|

|

|

|

|

Non-interest income |

|

|

|

|

|

|

|

|

Service charges on deposit accounts |

1,443 |

|

1,676 |

|

(13.9 |

) |

% |

|

5,095 |

|

6,402 |

|

(20.4 |

) |

% |

|

Other service charges and fees |

700 |

|

775 |

|

(9.7 |

) |

% |

|

2,548 |

|

2,930 |

|

(13.0 |

) |

% |

|

Wealth and asset management fees |

1,416 |

|

1,145 |

|

23.7 |

|

% |

|

5,497 |

|

4,627 |

|

18.8 |

|

% |

|

Net realized gains on available-for-sale securities |

0 |

|

0 |

|

NA |

|

|

|

2,190 |

|

148 |

|

1,379.7 |

|

% |

|

Net realized and unrealized gains (losses) on trading

securities |

408 |

|

700 |

|

(41.7 |

) |

% |

|

328 |

|

1,888 |

|

(82.6 |

) |

% |

|

Realized gains on Visa Class B shares |

0 |

|

0 |

|

NA |

|

|

|

0 |

|

463 |

|

NA |

|

|

|

Mortgage banking |

1,264 |

|

395 |

|

220.0 |

|

% |

|

3,354 |

|

1,412 |

|

137.5 |

|

% |

|

Bank owned life insurance |

457 |

|

315 |

|

45.1 |

|

% |

|

1,747 |

|

1,317 |

|

32.6 |

|

% |

|

Card processing and interchange income |

1,668 |

|

1,196 |

|

39.5 |

|

% |

|

5,727 |

|

4,641 |

|

23.4 |

|

% |

|

Other |

612 |

|

552 |

|

10.9 |

|

% |

|

1,573 |

|

2,147 |

|

(26.7 |

) |

% |

|

Total non-interest income |

7,968 |

|

6,754 |

|

18.0 |

|

% |

|

28,059 |

|

25,975 |

|

8.0 |

|

% |

| Non-interest expenses |

|

|

|

|

|

|

|

|

Salaries and benefits |

14,145 |

|

12,365 |

|

14.4 |

|

% |

|

48,723 |

|

46,405 |

|

5.0 |

|

% |

|

Net occupancy expense of premises |

3,391 |

|

2,977 |

|

13.9 |

|

% |

|

12,333 |

|

11,221 |

|

9.9 |

|

% |

|

FDIC insurance premiums |

448 |

|

350 |

|

28.0 |

|

% |

|

2,414 |

|

1,252 |

|

92.8 |

|

% |

|

Core Deposit Intangible amortization |

28 |

|

97 |

|

(71.1 |

) |

% |

|

206 |

|

567 |

|

(63.7 |

) |

% |

|

Card processing and interchange expenses |

943 |

|

711 |

|

32.6 |

|

% |

|

3,135 |

|

2,891 |

|

8.4 |

|

% |

|

Merger costs, prepayment penalties and branch closure costs |

7,435 |

|

170 |

|

4,273.5 |

|

% |

|

12,642 |

|

170 |

|

7,336.5 |

|

% |

|

Other |

8,627 |

|

6,235 |

|

38.4 |

|

% |

|

27,873 |

|

25,002 |

|

11.5 |

|

% |

|

Total non-interest expenses |

35,017 |

|

22,905 |

|

52.9 |

|

% |

|

107,326 |

|

87,508 |

|

22.6 |

|

% |

| |

|

|

|

|

|

|

|

| Income before income

taxes |

9,777 |

|

12,782 |

|

(23.5 |

) |

% |

|

40,090 |

|

48,641 |

|

(17.6 |

) |

% |

| Income tax expense |

1,878 |

|

2,298 |

|

(18.3 |

) |

% |

|

7,347 |

|

8,560 |

|

(14.2 |

) |

% |

| Net income |

7,899 |

|

10,484 |

|

(24.7 |

) |

% |

|

32,743 |

|

40,081 |

|

(18.3 |

) |

% |

| Preferred stock dividends |

1,147 |

|

0 |

|

NA |

|

|

|

1,147 |

|

0 |

|

NA |

|

|

| Net income available to common

stockholders |

$ |

6,752 |

|

$ |

10,484 |

|

(35.6 |

) |

% |

|

$ |

31,596 |

|

$ |

40,081 |

|

(21.2 |

) |

% |

| |

|

|

|

|

|

|

|

| Average diluted common shares

outstanding |

16,792,676 |

|

15,178,128 |

|

|

|

16,000,749 |

|

15,164,280 |

|

|

| |

|

|

|

|

|

|

|

| Diluted earnings per common

share |

$ |

0.40 |

|

$ |

0.69 |

|

(42.0 |

) |

% |

|

$ |

1.97 |

|

$ |

2.63 |

|

(25.1 |

) |

% |

| Cash dividends per common

share |

$ |

0.17 |

|

$ |

0.17 |

|

0.0 |

|

% |

|

$ |

0.68 |

|

$ |

0.68 |

|

0.0 |

|

% |

| |

|

|

|

|

|

|

|

| Payout ratio |

43 |

% |

25 |

% |

|

|

35 |

% |

26 |

% |

|

| |

|

|

|

|

|

| |

(unaudited) |

|

|

|

|

| |

Three Months Ended |

|

|

Twelve Months Ended |

|

| |

December 31, |

|

|

December 31, |

|

| |

|

|

|

|

(unaudited) |

|

|

| |

2020 |

2019 |

|

|

2020 |

2019 |

|

|

Average Balances |

|

|

|

|

|

|

|

|

Loans, net of unearned income |

$ |

3,351,980 |

|

$ |

2,764,173 |

|

|

|

$ |

3,115,171 |

|

$ |

2,630,110 |

|

|

|

Loans, net of unearned income and PPP-related loans (1) |

3,148,921 |

|

2,764,173 |

|

|

|

2,965,096 |

|

2,630,110 |

|

|

|

Investment securities |

586,747 |

|

547,386 |

|

|

|

574,044 |

|

540,127 |

|

|

|

Total earning assets |

4,508,257 |

|

3,390,416 |

|

|

|

4,092,076 |

|

3,194,911 |

|

|

|

Total earning assets, net of PPP-related assets (1) |

4,094,577 |

|

3,390,416 |

|

|

|

3,755,758 |

|

3,194,911 |

|

|

|

Total assets |

4,779,624 |

|

3,616,347 |

|

|

|

4,347,142 |

|

3,413,737 |

|

|

|

Total assets, net of PPP-related assets (1) |

4,365,944 |

|

3,616,347 |

|

|

|

4,010,824 |

|

3,413,737 |

|

|

|

Non interest-bearing deposits |

627,843 |

|

373,289 |

|

|

|

516,723 |

|

360,208 |

|

|

|

Interest-bearing deposits |

3,469,102 |

|

2,588,202 |

|

|

|

3,123,823 |

|

2,402,361 |

|

|

|

Common shareholders' equity |

360,387 |

|

301,605 |

|

|

|

337,963 |

|

285,324 |

|

|

|

Tangible common shareholders' equity (1) |

315,039 |

|

262,656 |

|

|

|

296,142 |

|

246,161 |

|

|

| |

|

|

|

|

|

|

|

|

Average Yields |

|

|

|

|

|

|

|

|

Loans, net of unearned income |

5.20 |

% |

5.28 |

% |

|

|

4.93 |

% |

5.35 |

% |

|

|

Investment securities |

2.10 |

% |

2.88 |

% |

|

|

2.53 |

% |

2.99 |

% |

|

|

Total earning assets |

4.16 |

% |

4.81 |

% |

|

|

4.15 |

% |

4.93 |

% |

|

|

Total earning assets, net of PPP-related assets (1) |

4.15 |

% |

4.81 |

% |

|

|

4.37 |

% |

4.93 |

% |

|

|

Interest-bearing deposits |

0.54 |

% |

1.32 |

% |

|

|

0.77 |

% |

1.26 |

% |

|

|

Interest-bearing liabilities |

0.71 |

% |

1.49 |

% |

|

|

0.95 |

% |

1.45 |

% |

|

| |

|

|

|

|

|

|

|

|

Performance Ratios (annualized) |

|

|

|

|

|

|

|

|

Return on average assets |

0.66 |

% |

1.15 |

% |

|

|

0.75 |

% |

1.17 |

% |

|

|

Return on average assets, net of merger costs, prepayment penalties

and branch closure costs (1) |

1.15 |

% |

1.16 |

% |

|

|

0.99 |

% |

1.18 |

% |

|

|

Return on average common equity |

7.45 |

% |

13.79 |

% |

|

|

9.35 |

% |

14.05 |

% |

|

|

Return on average common equity, net of merger costs, prepayment

penalties and branch closure costs (1) |

13.94 |

% |

13.97 |

% |

|

|

12.36 |

% |

14.09 |

% |

|

|

Return on average tangible common equity (1) |

8.53 |

% |

15.84 |

% |

|

|

10.67 |

% |

16.28 |

% |

|

|

Return on average tangible common equity, net of merger costs,

prepayment penalties and branch closure costs (1) |

15.94 |

% |

16.04 |

% |

|

|

14.10 |

% |

16.34 |

% |

|

|

Net interest margin, fully tax equivalent basis (1) |

3.58 |

% |

3.54 |

% |

|

|

3.34 |

% |

3.69 |

% |

|

|

Net interest margin, fully tax equivalent basis and net of

PPP-related assets (1) |

3.51 |

% |

3.54 |

% |

|

|

3.50 |

% |

3.69 |

% |

|

|

Efficiency Ratio |

72.16 |

% |

61.58 |

% |

|

|

65.10 |

% |

60.19 |

% |

|

|

Efficiency Ratio, net of merger costs, prepayment penalties and

branch closure costs (1) |

56.82 |

% |

61.12 |

% |

|

|

57.41 |

% |

60.07 |

% |

|

| |

|

|

|

|

|

|

|

|

Net Loan Charge-Offs |

|

|

|

|

|

|

|

|

CNB Bank net loan charge-offs |

$ |

1,571 |

|

$ |

1,043 |

|

|

|

$ |

5,131 |

|

$ |

4,384 |

|

|

|

Holiday Financial net loan charge-offs |

208 |

|

503 |

|

|

|

1,299 |

|

1,871 |

|

|

|

Total net loan charge-offs |

$ |

1,779 |

|

$ |

1,546 |

|

|

|

$ |

6,430 |

|

$ |

6,255 |

|

|

| |

|

|

|

|

|

|

|

|

Net loan charge-offs / average loans |

0.21 |

% |

0.22 |

% |

|

|

0.21 |

% |

0.24 |

% |

|

| |

(unaudited)December 31, |

December 31, |

|

% change versus |

| |

2020 |

2019 |

|

12/31/19 |

| |

|

|

|

|

Ending Balance Sheet |

|

|

|

|

|

Loans, net of unearned income |

$ |

3,371,789 |

|

|

$ |

2,804,035 |

|

|

|

20.2 |

|

% |

|

Loans held for sale |

8,514 |

|

|

930 |

|

|

|

815.5 |

|

% |

|

Investment securities |

591,557 |

|

|

552,122 |

|

|

|

7.1 |

|

% |

|

FHLB and other equity interests |

2,899 |

|

|

11,354 |

|

|

|

(74.5 |

) |

% |

|

Other earning assets |

488,326 |

|

|

150,601 |

|

|

|

224.3 |

|

% |

|

Total earning assets |

4,463,085 |

|

|

3,519,042 |

|

|

|

26.8 |

|

% |

| |

|

|

|

|

|

Allowance for credit losses (2) |

(34,340 |

) |

|

(19,473 |

) |

|

|

76.3 |

|

% |

|

Goodwill |

43,749 |

|

|

38,730 |

|

|

|

13.0 |

|

% |

|

Core deposit intangible |

567 |

|

|

160 |

|

|

|

254.4 |

|

% |

|

Other assets |

256,338 |

|

|

225,200 |

|

|

|

13.8 |

|

% |

|

Total assets |

$ |

4,729,399 |

|

|

$ |

3,763,659 |

|

|

|

25.7 |

|

% |

| |

|

|

|

|

|

Non interest-bearing deposits |

$ |

627,114 |

|

|

$ |

382,259 |

|

|

|

64.1 |

|

% |

|

Interest-bearing deposits |

3,554,630 |

|

|

2,720,068 |

|

|

|

30.7 |

|

% |

|

Total deposits |

4,181,744 |

|

|

3,102,327 |

|

|

|

34.8 |

|

% |

| |

|

|

|

|

|

Borrowings |

0 |

|

|

227,907 |

|

|

|

(100.0 |

) |

% |

|

Subordinated debt |

70,620 |

|

|

70,620 |

|

|

|

0.0 |

|

% |

|

Other liabilities |

60,898 |

|

|

57,839 |

|

|

|

5.3 |

|

% |

| |

|

|

|

|

|

Common stock |

0 |

|

|

0 |

|

|

|

NA |

|

Preferred stock |

57,785 |

|

|

0 |

|

|

|

NA |

|

Additional paid in capital |

127,518 |

|

|

99,335 |

|

|

|

28.4 |

|

% |

|

Retained earnings |

218,727 |

|

|

201,503 |

|

|

|

8.5 |

|

% |

|

Treasury stock |

(2,967 |

) |

|

(2,811 |

) |

|

|

5.5 |

|

% |

|

Accumulated other comprehensive income (loss) |

15,074 |

|

|

6,939 |

|

|

|

NA |

|

Total shareholders' equity |

416,137 |

|

|

304,966 |

|

|

|

36.5 |

|

% |

| |

|

|

|

|

|

Total liabilities and shareholders' equity |

$ |

4,729,399 |

|

|

$ |

3,763,659 |

|

|

|

25.7 |

|

% |

| |

|

|

|

|

|

Ending shares outstanding |

16,833,008 |

|

|

15,247,985 |

|

|

|

|

| |

|

|

|

|

|

Book value per common share |

$ |

21.29 |

|

|

$ |

20.00 |

|

|

|

6.5 |

|

% |

|

Tangible book value per common share (1) |

$ |

18.66 |

|

|

$ |

17.45 |

|

|

|

6.9 |

|

% |

| |

|

|

|

|

|

Capital Ratios |

|

|

|

|

|

Tangible common equity / tangible assets (1) |

6.70 |

|

% |

7.14 |

|

% |

|

|

|

Tier 1 leverage ratio (4) |

8.06 |

|

% |

7.86 |

|

% |

|

|

|

Common equity tier 1 ratio (4) |

9.45 |

|

% |

9.32 |

|

% |

|

|

|

Tier 1 risk based ratio (4) |

11.86 |

|

% |

10.03 |

|

% |

|

|

|

Total risk based ratio (4) |

14.29 |

|

% |

12.51 |

|

% |

|

|

| |

|

|

|

|

|

Asset Quality |

|

|

|

|

|

Non-accrual loans |

$ |

30,359 |

|

|

$ |

21,736 |

|

|

|

|

|

Loans 90+ days past due and accruing |

325 |

|

|

61 |

|

|

|

|

|

Total non-performing loans |

30,684 |

|

|

21,797 |

|

|

|

|

|

Other real estate owned |

862 |

|

|

1,633 |

|

|

|

|

|

Total non-performing assets |

$ |

31,546 |

|

|

$ |

23,430 |

|

|

|

|

| |

|

|

|

|

|

Loans modified in a troubled debt restructuring (TDR): |

|

|

|

|

|

Performing TDR loans |

$ |

6,773 |

|

|

$ |

7,359 |

|

|

|

|

|

Non-performing TDR loans (3) |

3,536 |

|

|

2,443 |

|

|

|

|

|

Total TDR loans |

$ |

10,309 |

|

|

$ |

9,802 |

|

|

|

|

| |

|

|

|

|

|

Non-performing assets / Loans + OREO |

0.94 |

|

% |

0.84 |

|

% |

|

|

|

Non-performing assets / Total assets |

0.67 |

|

% |

0.62 |

|

% |

|

|

|

Non-performing assets / Total assets, net of PPP-related assets

(1) |

0.71 |

|

% |

0.62 |

|

% |

|

|

|

Allowance for credit losses / Loans (2) |

1.02 |

|

% |

0.69 |

|

% |

|

|

|

Allowance for credit losses / Loans, net of PPP-related loans (1)

(2) |

1.07 |

|

% |

0.69 |

|

% |

|

|

| |

|

|

|

|

|

(1) Management uses non-GAAP financial information in its analysis

of the Corporation’s performance. Management believes that these

non-GAAP measures provide a greater understanding of ongoing

operations, enhance comparability of results of operations with

prior periods and show the effects of significant gains and charges

in the periods presented. The Corporation’s management believes

that investors may use these non-GAAP measures to analyze the

Corporation’s financial performance without the impact of unusual

items or events that may obscure trends in the Corporation’s

underlying performance. This non-GAAP data should be considered in

addition to results prepared in accordance with GAAP, and is not a

substitute for, or superior to, GAAP results. Limitations

associated with non-GAAP financial measures include the risks that

persons might disagree as to the appropriateness of items included

in these measures and that different companies might calculate

these measures differently.. A reconciliation of these non-GAAP

financial measures is provided below (dollars in thousands, except

per share data). |

|

|

(2) Beginning January 1, 2020, calculation is based upon current

expected credit loss methodology. Prior to January 1, 2020,

calculation was based on probable incurred loss methodology. |

|

|

(3) Nonperforming TDR loans are also included in the balance of

non-accrual loans in the previous table. |

|

|

(4) Capital ratios as of December 31, 2020 are estimated. |

|

| |

|

|

|

|

| Non-GAAP

Reconciliations

(1): |

|

| |

(unaudited) |

|

|

|

| |

December 31, |

December 31, |

|

|

| |

2020 |

2019 |

|

|

|

Calculation of tangible book value per share and tangible

common equity/tangible assets: |

|

|

|

|

|

Shareholders' equity |

$ |

416,137 |

|

|

$ |

304,966 |

|

|

|

|

|

Less: preferred equity |

57,785 |

|

|

0 |

|

|

|

|

|

Less: goodwill |

43,749 |

|

|

38,730 |

|

|

|

|

|

Less: core deposit intangible |

567 |

|

|

160 |

|

|

|

|

|

Tangible common equity |

$ |

314,036 |

|

|

$ |

266,076 |

|

|

|

|

| |

|

|

|

|

|

Total assets |

$ |

4,729,399 |

|

|

$ |

3,763,659 |

|

|

|

|

|

Less: goodwill |

43,749 |

|

|

38,730 |

|

|

|

|

|

Less: core deposit intangible |

567 |

|

|

160 |

|

|

|

|

|

Tangible assets |

$ |

4,685,083 |

|

|

$ |

3,724,769 |

|

|

|

|

| |

|

|

|

|

|

Ending shares outstanding |

16,833,008 |

|

|

15,247,985 |

|

|

|

|

| |

|

|

|

|

|

Tangible book value per common share |

$ |

18.66 |

|

|

$ |

17.45 |

|

|

|

|

|

Tangible common equity/Tangible assets |

6.70 |

|

% |

7.14 |

|

% |

|

|

| |

|

|

|

|

|

Calculation of tangible common equity/tangible assets, net

of PPP-related loans: |

|

|

|

|

|

Tangible common equity |

$ |

314,036 |

|

|

$ |

266,076 |

|

|

|

|

| |

|

|

|

|

|

Tangible assets |

$ |

4,685,083 |

|

|

$ |

3,724,769 |

|

|

|

|

|

Less: PPP-related loans |

155,529 |

|

|

0 |

|

|

|

|

|

Adjusted tangible assets |

$ |

4,529,554 |

|

|

$ |

3,724,769 |

|

|

|

|

| |

|

|

|

|

|

Adjusted tangible common equity/tangible assets |

6.93 |

|

% |

7.14 |

|

% |

|

|

| Non-GAAP

Reconciliations

(1): |

| |

(unaudited) |

|

|

|

| |

Three Months Ended |

|

Twelve Months Ended |

| |

December 31, |

|

December 31, |

| |

|

|

|

(unaudited) |

|

| |

2020 |

2019 |

|

2020 |

2019 |

|

Calculation of average loans, net of unearned income and

PPP-related loans: |

|

|

|

|

|

|

Average loans, net of unearned |

$ |

3,351,980 |

|

$ |

2,764,173 |

|

|

$ |

3,115,171 |

|

$ |

2,630,110 |

|

|

Less: average PPP loans |

203,059 |

|

0 |

|

|

150,075 |

|

0 |

|

|

Adjusted average loans, net of unearned income and PPP-related

loans (non-GAAP) |

$ |

3,148,921 |

|

$ |

2,764,173 |

|

|

$ |

2,965,096 |

|

$ |

2,630,110 |

|

| |

|

|

|

|

|

|

Calculation of average total earning assets, net of

PPP-related assets: |

|

|

|

|

|

|

Average total earning assets |

$ |

4,508,257 |

|

$ |

3,390,416 |

|

|

$ |

4,092,076 |

|

$ |

3,194,911 |

|

|

Less: average PPP-related loans |

203,059 |

|

0 |

|

|

150,075 |

|

0 |

|

|

Less: estimated average PPP deposits held at the Federal

Reserve |

210,621 |

|

0 |

|

|

154,124 |

|

0 |

|

|

Less: average PPPLF deposits held at the Federal Reserve |

0 |

|

0 |

|

|

32,119 |

|

0 |

|

|

Adjusted average total earning assets, net of PPP-related assets

(non-GAAP) |

$ |

4,094,577 |

|

$ |

3,390,416 |

|

|

$ |

3,755,758 |

|

$ |

3,194,911 |

|

| |

|

|

|

|

|

|

Calculation of average total assets, net of PPP-related

assets: |

|

|

|

|

|

|

Average total assets |

$ |

4,779,624 |

|

$ |

3,616,347 |

|

|

$ |

4,347,142 |

|

$ |

3,413,737 |

|

|

Less: average PPP-related loans |

203,059 |

|

0 |

|

|

150,075 |

|

0 |

|

|

Less: estimated average PPP deposits held at the Federal

Reserve |

210,621 |

|

0 |

|

|

154,124 |

|

0 |

|

|

Less: average PPPLF deposits held at the Federal Reserve |

0 |

|

0 |

|

|

32,119 |

|

0 |

|

|

Adjusted average total assets, net of PPP-related assets

(non-GAAP) |

$ |

4,365,944 |

|

$ |

3,616,347 |

|

|

$ |

4,010,824 |

|

$ |

3,413,737 |

|

| |

|

|

|

|

|

|

Calculation of average yield on earning assets, net of

unearned income, PPP-related assets and PPP-related

fees: |

|

|

|

|

|

|

Investment income (tax equivalent) |

$ |

2,999 |

|

$ |

3,889 |

|

|

$ |

14,037 |

|

$ |

15,963 |

|

|

Add: loan income (tax equivalent) |

43,823 |

|

36,806 |

|

|

153,639 |

|

140,742 |

|

|

Add: other earning asset income (tax equivalent) |

155 |

|

275 |

|

|

852 |

|

499 |

|

|

Less: PPP-related fees |

4,457 |

|

0 |

|

|

5,140 |

|

0 |

|

|

Total income related to earning assets (tax equivalent)

(non-GAAP) |

$ |

42,520 |

|

40,970 |

|

|

$ |

163,388 |

|

$ |

157,204 |

|

| |

|

|

|

|

|

|

Adjusted average total earning assets, net of PPP-related assets

(non-GAAP) |

$ |

4,094,577 |

|

$ |

3,390,416 |

|

|

$ |

3,755,758 |

|

$ |

3,194,911 |

|

|

Less: average mark to market adjustment on investments

(non-GAAP) |

19,765 |

|

12,116 |

|

|

18,884 |

|

5,631 |

|

|

Adjusted average total earning assets, net of market to market,

PPP-related assets (non-GAAP) |

$ |

4,074,812 |

|

$ |

3,378,300 |

|

|

$ |

3,736,874 |

|

3,189,280 |

|

|

Adjusted average yield on earning assets, net of unearned income,

PPP-related assets and PPP-related fees (non-GAAP)

(annualized) |

4.15 |

% |

4.81 |

% |

|

4.37 |

% |

4.93 |

% |

| Non-GAAP

Reconciliations

(1): |

| |

(unaudited) |

|

| |

December 31, |

December 31, |

| |

2020 |

2019 |

| |

|

|

|

Calculation of non-performing assets / Total assets, net of

PPP-related assets: |

|

|

|

Non-performing assets |

$ |

31,546 |

|

$ |

23,430 |

|

| |

|

|

|

Total assets |

$ |

4,729,399 |

|

$ |

3,763,659 |

|

|

Less: PPP-related loans |

155,529 |

|

0 |

|

|

Less: estimated PPP deposits held at the Federal Reserve |

159,584 |

|

0 |

|

|

Adjusted total assets, net of PPP-related assets (non-GAAP) |

$ |

4,414,286 |

|

$ |

3,763,659 |

|

| |

|

|

|

Adjusted non-performing assets / total assets, net of PPP-related

assets (non-GAAP) |

0.71 |

% |

0.62 |

% |

| |

|

|

|

Calculation of allowance / loans, net of PPP-related

loans: |

|

|

|

Total allowance for credit losses (2) |

$ |

34,340 |

|

$ |

19,473 |

|

| |

|

|

|

Total loans net of unearned income |

$ |

3,371,789 |

|

$ |

2,804,035 |

|

|

Less: PPP-related loans |

155,529 |

|

0 |

|

|

Adjusted total loans, net of unearned income, PPP-related loans

(non-GAAP) |

$ |

3,216,260 |

|

$ |

2,804,035 |

|

| |

|

|

|

Adjusted allowance / loans, net of PPP-related loans (non-GAAP)

(2) |

1.07 |

% |

0.69 |

% |

| |

|

|

|

|

| |

(unaudited) |

|

|

|

| |

Three Months Ended |

|

Twelve Months Ended |

| |

December 31, |

|

December 31, |

| |

|

|

|

(unaudited) |

|

| |

2020 |

2019 |

|

2020 |

2019 |

|

Calculation of net interest margin (fully tax equivalent

basis): |

|

|

|

|

|

|

Interest income (fully tax equivalent basis) (non-GAAP) |

$ |

46,977 |

|

$ |

40,970 |

|

|

$ |

168,528 |

|

$ |

157,204 |

|

|

Interest expense (fully tax equivalent basis) (non-GAAP) |

6,533 |

|

10,863 |

|

|

32,456 |

|

39,530 |

|

|

Net interest income (fully tax equivalent basis) (non-GAAP) |

$ |

40,444 |

|

$ |

30,107 |

|

|

$ |

136,072 |

|

$ |

117,674 |

|

| |

|

|

|

|

|

|

Average total earning assets |

$ |

4,508,257 |

|

$ |

3,390,416 |

|

|

$ |

4,092,076 |

|

$ |

3,194,911 |

|

|

Less: average mark to market adjustment on investments |

19,765 |

|

12,116 |

|

|

18,884 |

|

5,631 |

|

|

Adjusted average total earning assets, net of mark to market

(non-GAAP) |

$ |

4,488,492 |

|

$ |

3,378,300 |

|

|

$ |

4,073,192 |

|

$ |

3,189,280 |

|

| |

|

|

|

|

|

|

Net interest margin, fully tax equivalent basis (non-GAAP)

(annualized) |

3.58 |

% |

3.54 |

% |

|

3.34 |

% |

3.69 |

% |

| |

|

|

|

|

|

|

Calculation of net interest margin (fully tax equivalent

basis), net of PPP-related assets and PPP-related

fees: |

|

|

|

|

|

|

Net interest income (fully tax equivalent basis) (non-GAAP) |

$ |

40,444 |

|

$ |

30,107 |

|

|

$ |

136,072 |

|

$ |

117,674 |

|

|

Less: Recognized PPP-related fees |

4,457 |

|

0 |

|

|

5,140 |

|

0 |

|

|

Adjusted interest income (fully tax equivalent basis), net of

PPP-related fees (non-GAAP) |

$ |

35,987 |

|

$ |

30,107 |

|

|

$ |

130,932 |

|

$ |

117,674 |

|

|

Adjusted average total earning assets, net of market to market,

PPP-related assets (non-GAAP) |

$ |

4,074,812 |

|

$ |

3,378,300 |

|

|

$ |

3,736,874 |

|

$ |

3,189,280 |

|

| |

|

|

|

|

|

|

Net interest margin, fully tax equivalent basis, net of PPP-related

assets and PPP-related fees (non-GAAP) (annualized) |

3.51 |

% |

3.54 |

% |

|

3.50 |

% |

3.69 |

% |

| Non-GAAP

Reconciliations

(1): |

| |

|

|

|

|

|

| |

(unaudited) |

|

|

|

| |

Three Months Ended |

|

Twelve Months Ended |

| |

December 31, |

|

December 31, |

| |

|

|

|

(unaudited) |

|

| |

2020 |

2019 |

|

2020 |

2019 |

|

Calculation of adjusted efficiency ratio, net of merger

costs, prepayment penalties and branch closure costs: |

|

|

|

|

|

|

Non-interest expense |

$ |

35,017 |

|

$ |

22,905 |

|

|

$ |

107,326 |

|

$ |

87,508 |

|

|

Less: core deposit intangible amortization |

28 |

|

97 |

|

|

206 |

|

567 |

|

|

Less: merger costs, prepayment penalties and branch closure

costs |

7,435 |

|

170 |

|

|

12,642 |

|

170 |

|

|

Adjusted non-interest expense (non-GAAP) |

$ |

27,554 |

|

$ |

22,638 |

|

|

$ |

94,478 |

|

$ |

86,771 |

|

| |

|

|

|

|

|

|

Non-interest income |

$ |

7,968 |

|

$ |

6,754 |

|

|

$ |

28,059 |

|

$ |

25,975 |

|

| |

|

|

|

|

|

|

Net interest income |

$ |

40,115 |

|

$ |

29,745 |

|

|

$ |

134,711 |

|

$ |

116,198 |

|

|

Less: tax exempt investment and loan income, net of TEFRA

(non-GAAP) |

1,352 |

|

1,606 |

|

|

5,703 |

|

6,664 |

|

|

Add: tax exempt investment and loan income (non-GAAP)

(tax-equivalent) |

1,759 |

|

2,148 |

|

|

7,490 |

|

8,946 |

|

|

Adjusted net interest income (non-GAAP) |

40,522 |

|

30,287 |

|

|

136,498 |

|

118,480 |

|

|

Adjusted net revenue (non-GAAP) (tax-equivalent) |

$ |

48,490 |

|

$ |

37,041 |

|

|

$ |

164,557 |

|

$ |

144,455 |

|

|

Adjusted efficiency ratio, net of merger costs, prepayment

penalties and branch closure costs |

56.82 |

% |

61.12 |

% |

|

57.41 |

% |

60.07 |

% |

| |

|

|

|

|

|

|

Calculation of adjusted return on average total assets, net

of merger costs, prepayment penalties, branch closure costs

and PPP-related assets: |

|

|

|

|

|

|

Net income |

$ |

7,899 |

|

$ |

10,484 |

|

|

$ |

32,743 |

|

$ |

40,081 |

|

|

Add: merger costs, prepayment penalties and branch closure costs

(net of tax) |

5,874 |

|

134 |

|

|

10,168 |

|

134 |

|

|

Adjusted net income (non-GAAP)(net of tax) |

$ |

13,773 |

|

$ |

10,618 |

|

|

$ |

42,911 |

|

$ |

40,215 |

|

|

Average total assets |

$ |

4,779,624 |

|

$ |

3,616,347 |

|

|

$ |

4,347,142 |

|

$ |

3,413,737 |

|

|

Adjusted return on average total assets, net of merger costs,

prepayment penalties, branch closure costs and PPP-related

assets (non-GAAP)(annualized) |

1.15 |

% |

1.16 |

% |

|

0.99 |

% |

1.18 |

% |

| |

|

|

|

|

|

|

Calculation of adjusted return on average common equity,

net of merger costs, prepayment penalties and branch closure

costs: |

|

|

|

|

|

|

Net income available to common stockholders |

$ |

6,752 |

|

$ |

10,484 |

|

|

$ |

31,596 |

|

$ |

40,081 |

|

|

Add: merger costs, prepayment penalties and branch closure costs

(net of tax) |

5,874 |

|

134 |

|

|

10,168 |

|

134 |

|

|

Adjusted net income (non-GAAP)(net of tax) |

$ |

12,626 |

|

$ |

10,618 |

|

|

$ |

41,764 |

|

$ |

40,215 |

|

|

Average shareholders' common equity |

$ |

360,387 |

|

$ |

301,605 |

|

|

$ |

337,963 |

|

$ |

285,324 |

|

|

Adjusted return on average common equity, net of merger costs,

prepayment penalties and branch closure

costs (non-GAAP)(annualized) |

13.94 |

% |

13.97 |

% |

|

12.36 |

% |

14.09 |

% |

| |

|

|

|

|

|

|

Calculation of adjusted return on average tangible common

equity, net of merger costs, prepayment penalties and branch

closure costs: |

|

|

|

|

|

|

Net income available to common stockholders |

$ |

6,752 |

|

$ |

10,484 |

|

|

$ |

31,596 |

|

$ |

40,081 |

|

|

Add: merger costs, prepayment penalties and branch closure costs

(net of tax) |

5,874 |

|

134 |

|

|

10,168 |

|

134 |

|

|

Adjusted net income (non-GAAP)(net of tax) |

$ |

12,626 |

|

$ |

10,618 |

|

|

$ |

41,764 |

|

$ |

40,215 |

|

|

Average tangible shareholders' common equity |

$ |

315,039 |

|

$ |

262,656 |

|

|

$ |

296,142 |

|

$ |

246,161 |

|

|

Adjusted return on average tangible common equity, net of merger

costs, prepayment penalties and branch closure

costs (non-GAAP)(annualized) |

15.94 |

% |

16.04 |

% |

|

14.10 |

% |

16.34 |

% |

| Non-GAAP

Reconciliations

(1): |

| |

|

|

|

|

|

| |

(unaudited) |

|

|

|

| |

Three Months Ended |

|

Twelve Months Ended |

| |

December 31, |

|

December 31, |

| |

|

|

|

(unaudited) |

|

| |

2020 |

2019 |

|

2020 |

2019 |

|

Calculation of adjusted earnings per common share, net of

merger costs, prepayment penalties and branch closure

costs: |

|

|

|

|

|

|

Net earnings allocated to common stock |

$ |

6,733 |

|

$ |

10,451 |

|

|

$ |

31,496 |

|

$ |

39,934 |

|

|

Add: Merger costs, prepayment penalties and branch closure costs,

after-tax allocated to common stock |

5,860 |

|

133 |

|

|

10,138 |

|

134 |