Clover Health Investments, Corp. (Nasdaq: CLOV) ("Clover" or the

"Company"), a physician enablement company focused on improving

health outcomes for America's seniors, today reported financial

results for the first quarter of 2022. Management will host a

conference call today at 5:00 p.m. ET to discuss its operating

results and other business highlights.

"2022 is off to a strong start, led by

significant year-over-year revenue growth and quarter-over-quarter

margin improvements in Insurance (Medicare Advantage) and

Non-Insurance (Direct Contracting)," said Clover Health CEO Vivek

Garipalli. "We believe our focus on balancing this strong growth

with ongoing action to further reduce MCRs and increase operational

efficiencies is powering our progress towards profitability."

Andrew Toy, President of Clover Health, added,

"This year we’ll continue investing in the Clover Assistant to

deliver data driven value based care and are rounding out our

leadership team with top level talent. Further, we believe our

focus on building a sustainable, intelligent, and efficient growth

engine will benefit our results by driving incremental scale,

improvements across our Insurance MCR, positive Non-Insurance

results, and more efficient operating expenses."

We have updated the names of our Medicare

Advantage (MA) and Direct Contracting segments to our Insurance and

Non-Insurance segments, respectively. We believe that this approach

better reflects each segment’s current role and contribution to our

business. There has been no change to the existing composition of

these segments, and previously reported consolidated and

segment-level financial results of the Company were not impacted by

these changes.

Key Company highlights are as follows:

|

Dollars in Millions |

|

Q1’22 |

|

Q1’21 |

|

Total Revenue |

|

$ |

874.4 |

|

|

$ |

200.3 |

|

| Insurance MCR |

|

|

96.4 |

% |

|

|

107.9 |

% |

| Non-Insurance MCR |

|

|

99.8 |

|

|

|

— |

|

| Salaries and Benefits Plus

General and Administrative Expenses |

|

$ |

126.8 |

|

|

$ |

104.6 |

|

| Adjusted Operating Expenses

(Non-GAAP) (1)(2) |

|

|

84.4 |

|

|

|

58.2 |

|

| Net Loss |

|

|

(75.3 |

) |

|

|

(48.4 |

) |

| Adjusted EBITDA (Non-GAAP)

(1)(2) |

|

|

(71.8 |

) |

|

|

(72.5 |

) |

|

(1) |

Adjusted Operating Expenses (Non-GAAP) and Adjusted EBITDA

(Non-GAAP) are non-GAAP financial measures. Reconciliations of

Adjusted Operating Expenses (Non-GAAP) to the sum of Salaries and

Benefits Plus General and Administrative Expenses and Adjusted

EBITDA (Non-GAAP) to Net Loss, respectively, the most directly

comparable GAAP measures, are provided in the tables immediately

following the consolidated financial statements below. Additional

information about the Company's non-GAAP financial measures can be

found under the caption "About Non-GAAP Financial Measures" below

and in Appendix A. |

|

(2) |

Beginning in first quarter 2022, we are no longer reporting

Normalized MA MCR (Non-GAAP) and Normalized Adjusted EBITDA

(Non-GAAP), reflecting the expected reduction in the impact of the

COVID-19 pandemic on our financial results. We have also updated

our definition and presentation of Adjusted EBITDA (Non-GAAP) to

exclude premium deficiency reserve expense or benefit (PDR), gain

on investment, and expenses attributable to Seek Insurance

Services, Inc., and Clover Therapeutics Company. PDR is now being

excluded because management believes that PDR does not reflect the

Company’s underlying fundamentals due to the significant

variability in PDR from period to period and because it is a

non-cash item, gain on investment is being excluded because it is a

non-cash item and does not reflect the Company’s underlying

operations, and expenses attributable to Seek Insurance Services,

Inc., and Clover Therapeutics Company are being excluded because

management believes they are not reflective of the Company’s

operating expenses relating to its core businesses or its actual

recurring cash expense. The prior period figure has been revised to

conform to the updated definition and presentation. For additional

information, see the definition of "Adjusted EBITDA (Non-GAAP)" in

Appendix A. |

Lives under Clover

Management

|

|

March 31, 2022 |

|

March 31, 2021 |

| Insurance Members |

85,026 |

|

66,348 |

| Non-Insurance

Beneficiaries |

172,416 |

|

— |

| Total Lives under Clover

Management |

257,442 |

|

66,348 |

Clover Assistant (CA)

Highlights

- Lives under Clover

Assistant Management grew ~550% year-over-year to 211,386.

- Approximately 3,600

unique users (NPIs) were live on Clover Assistant in the first

quarter, up ~43% year-over-year.

- During 2021, our

Insurance members whose primary care providers (PCPs) used the

Clover Assistant had an MCR that was more than 1,000 basis points

lower than members whose PCPs didn't. Further, our returning 2021

Insurance members with PCPs who were live on CA in 2018 had a 4.2%

lower incurred Insurance MCR (non-GAAP)(1) than members with PCPs

who went live on CA in 2019, and members with PCPs who went live on

CA in 2019 had a 5.5% lower incurred Insurance MCR (non-GAAP) than

members with PCPs who went live on CA in 2020.(1) Incurred

Insurance MCR (Non-GAAP) is a non-GAAP financial measure. A

reconciliation of Incurred Insurance MCR (Non-GAAP) to Insurance

MCR, the most directly comparable GAAP measure, is provided in the

tables immediately following the consolidated financial statements

below. Additional information about the Company's non-GAAP

financial measures can be found under the caption "About Non-GAAP

Financial Measures" below and in Appendix A.

Financial Outlook

"The first quarter was a solid start to the

year. We are cautiously optimistic about the remainder of 2022, and

are maintaining our expectations for a meaningful improvement over

last year," said Mark Herbers, interim Chief Financial Officer of

Clover Health. "We continue to focus on sustainable and intelligent

growth, including a deeper analysis of our specific markets, to

drive our go-to-market strategy. Importantly, we believe there are

multiple levers that we can utilize in order to drive another

step-wise improvement in our Insurance MCR, better Non-Insurance

results and lower operating expenses."

For full-year 2022, Clover Health is reaffirming

its previously provided guidance and commentary:

- Total revenues are

expected to be in the range of $3.0 billion to $3.4 billion. This

includes projected Insurance revenue of $1.0 billion to $1.1

billion and Non-Insurance revenue of $2.0 billion to $2.3

billion.

- Insurance

membership is expected to average 84,000 - 85,000, a growth rate of

26% - 27% as compared to the 2021 average. For the Non-Insurance

program, the Company expects the average number of aligned

beneficiaries to be 160,000 - 165,000, compared to an average of

62,125 in 2021.

- Insurance MCR is

expected to be in the range of 95% - 99%. This improvement versus

2021 is expected to be driven by a combination of expected

operational efficiencies, increased risk scores, and slightly lower

COVID-19 costs. Non-Insurance MCR is also expected to improve

versus 2021 levels. Any significant developments related to

COVID-19 and/or historical utilization trends could impact these

expectations.

- Adjusted Operating

Expenses (Non-GAAP)(1) are expected to be between $330 million and

$345 million.

- Adjusted Operating

Expenses as a Percentage of Revenue (Non-GAAP)(1) is expected to be

10% - 12% compared to 18% in 2021.(1) Reconciliations of projected

Adjusted Operating Expenses (Non-GAAP) to projected Salaries and

Benefits Plus General and Administrative Expenses and of projected

Adjusted Operating Expenses as a Percentage of Revenue (Non-GAAP)

to projected Salaries and Benefits Plus General and Administrative

Expenses as a Percentage of Revenue, the most directly comparable

GAAP measures, are not provided because stock-based compensation

expense, which is excluded from Adjusted Operating Expenses

(Non-GAAP), cannot be reasonably calculated or predicted at this

time without unreasonable efforts. Additional information about the

Company's non-GAAP financial measures can be found under the

caption "About Non-GAAP Financial Measures" below and in Appendix

A.

Insurance MCR Cohorts by

RegionThis quarter we are providing information regarding

the Company's Insurance MCR by region in fiscal year 2021, which is

our most recent comprehensive data available, to demonstrate the

variations across our footprint.

|

Insurance MCR (GAAP) for Year Ended December 31,

2021 |

| All Members |

106.0 |

% |

|

|

| |

|

|

|

|

Incurred Insurance MCR

(Non-GAAP)(1) by Region for Year

Ended December 31, 2021 |

| |

Incurred Insurance MCR

(Non-GAAP)(1) |

|

Member Weight(5) |

|

Northern New Jersey(2) |

99.3 |

% |

|

67.7 |

% |

|

Southern New Jersey(3) |

120.4 |

|

|

22.9 |

|

|

Georgia(4) |

99.9 |

|

|

6.2 |

|

|

Other |

103.8 |

|

|

3.2 |

|

|

All Members |

103.5 |

|

|

100.0 |

% |

|

(1) |

Incurred Insurance MCR (Non-GAAP) is a non-GAAP financial measure.

A reconciliation of Incurred Insurance MCR (Non-GAAP) to Insurance

MCR, the most directly comparable GAAP measure, is provided in the

tables immediately following the consolidated financial statements

below. Additional information about the Company's non-GAAP

financial measures can be found under the caption "About Non-GAAP

Financial Measures" below and in Appendix A. |

|

(2) |

The Incurred Insurance MCR (non-GAAP) presented reflects a weighted

average of premiums and claims associated with our members enrolled

in MA plans that we offer in what we describe internally as our

Northern New Jersey region. Our Northern New Jersey region includes

the following counties in New Jersey: Atlantic, Bergen, Essex,

Hudson, Mercer, Monmouth, Morris, Passaic, Somerset, Sussex, and

Union. We consider these to be our Northern New Jersey counties

based on the consistency of our plan design and maturity for the MA

plans we offer in these markets, which generally fall within the

geography of Northern New Jersey. |

|

(3) |

The Incurred Insurance MCR (non-GAAP) presented reflects a weighted

average of premiums and claims associated with our members enrolled

in MA plans that we offer in what we describe internally as our

Southern New Jersey region. Our Southern New Jersey region includes

the following counties in New Jersey: Burlington, Camden, Cape May,

Cumberland, Gloucester, Hunterdon, Middlesex, Ocean, and Salem. We

consider these to be our Southern New Jersey counties based on the

consistency of our plan design and maturity for the MA plans we

offer in these markets, which generally fall within the geography

of Southern New Jersey. |

|

(4) |

The Incurred Insurance MCR (non-GAAP) presented reflects a weighted

average of premiums and claims associated with our members enrolled

in MA plans that we offer in Georgia. |

|

(5) |

Determined by dividing the number of Clover's Insurance members in

the applicable region by Clover's total number of Insurance

members. |

Leadership Update

Year to date, the Company has significantly

bolstered its management team, making several key hires. During the

first quarter of 2022, Clover Health appointed Conrad Wai as Chief

Technology Officer and Joseph Martin as General Counsel.

Additionally, today Aric Sharp joined the Company as CEO of Value

Based Care.

Earnings Conference Call Details

Clover Health’s management will host a

conference call to discuss its financial results on Monday, May 9,

at 5:00 PM Eastern Time. A live webcast of the call can be accessed

from Clover Health’s Investor Relations website at

investors.cloverhealth.com, and an on-demand replay will be

available on the same website following the call.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. Forward-looking statements include statements

regarding future events and Clover Health’s future results of

operations, financial position, market size and opportunity,

business strategy and plans, and the factors affecting our

performance and our objectives for future operations.

Forward-looking statements are not guarantees of future performance

and you are cautioned not to place undue reliance on such

statements. In some cases, you can identify forward looking

statements because they contain words such as "may," "will,"

"should," "expects," "plans," "anticipates," "going to," "can,"

"could," "should," "would," "intends," "target," "projects,"

"contemplates," "believes," "estimates," "predicts," "potential,"

"outlook," "forecast," "guidance," "objective," "plan," "seek,"

"grow," "target," "if," "continue," or the negative of these words

or other similar terms or expressions that concern Clover Health’s

expectations, strategy, priorities, plans or intentions.

Forward-looking statements in this release include, but are not

limited to, statements under "Financial Outlook," including

expectations relating to potential improvements in Insurance MCR,

Non-Insurance MCR, and operating expenses, and the statements

contained in the quotations of our executive officers, including

expectations related to Clover Health’s "progress towards

profitability" and potential improvements in our 2023 results,

including our Insurance MCR, Non-Insurance MCR, and operating

expenses. These statements are subject to known and unknown risks,

uncertainties and other factors that may cause our actual results,

levels of activity, performance or achievements to differ

materially from results expressed or implied in this press release.

Such risk factors include, but are not limited to, those related

to: Clover Health’s ability to increase the lifetime value of

enrollments and manage medical expenses; changes in CMS' risk

adjustment payment system; challenges in expanding our member and

beneficiary base or into new markets; Clover Health's exposure to

unfavorable changes in local benefit costs, reimbursement rates,

competition and economic conditions; the impact of litigation or

investigations; changes or developments in Medicare or the health

insurance system and laws and regulations governing the health

insurance markets; the current and future impact of the COVID-19

pandemic and its variants on Clover Health’s business and industry;

the adoption and usage of the Clover Assistant; the timing and

market acceptance of new releases and upgrades to the Clover

Assistant; and the successful development of our Non-Insurance

operations and the degree to which our offerings gain market

acceptance by physicians. Additional information concerning these

and other risk factors is contained in our latest Annual Report on

Form 10-K filed with the Securities and Exchange Commission (the

"SEC") on February 28, 2022, including the Risk Factors section

therein, and in our other filings with the SEC. The forward-looking

statements included in this release are made as of the date hereof.

Except as required by law, Clover Health undertakes no obligation

to update any of these forward-looking statements after the date of

this press release or to conform these statements to actual results

or revised expectations.

About Non-GAAP Financial Measures

We use non-GAAP measures including Adjusted

EBITDA, Adjusted Operating Expenses, Adjusted Operating Expenses as

a Percentage of Revenue, and Incurred Insurance MCR. These non-GAAP

financial measures are provided to enhance the reader's

understanding of Clover Health's past financial performance and our

prospects for the future. Clover Health's management team uses

these non-GAAP financial measures in assessing Clover Health's

performance, as well as in planning and forecasting future periods.

These non-GAAP financial measures are not computed according to

GAAP, and the methods we use to compute them may differ from the

methods used by other companies. Non-GAAP financial measures are

supplemental to and should not be considered a substitute for

financial information presented in accordance with GAAP and should

be read only in conjunction with our consolidated financial

statements prepared in accordance with GAAP. Readers are encouraged

to review the reconciliations of these non-GAAP financial measures

to the comparable GAAP measures, which are attached to this

release, together with other important financial information,

including our filings with the SEC, on the Investor Relations page

of our website at investors.cloverhealth.com.

For a description of these non-GAAP financial

measures, including the reasons management uses each measure,

please see Appendix A: "Explanation of Non-GAAP Financial Measures

and Other Items."

The statements contained in this document are

solely those of the authors and do not necessarily reflect the

views or policies of CMS. The authors assume responsibility for the

accuracy and completeness of the information contained in this

document.

About Clover Health:

Clover Health (Nasdaq: CLOV) is a physician

enablement company focused on seniors who have historically lacked

access to affordable, high-quality healthcare. Our strategy is

underpinned by our proprietary software platform, the Clover

Assistant, which is designed to aggregate patient data from across

the health ecosystem to support clinical decision-making and

improve health outcomes. We operate two distinct lines of business:

Insurance and Non-Insurance. Through its Insurance segment, the

Company provides PPO and HMO plans to Medicare Advantage members in

several states. The Company's Non-Insurance segment consists of its

operations in connection with its participation in CMS' Direct

Contracting model, which will transition to the ACO Reach model

beginning in 2023. Clover's corporate headquarters are in Franklin,

Tenn.

Visit: www.cloverhealth.com

Contacts:

Investor Relations:

Derrick Nueman & Ryan Schmidt

investors@cloverhealth.com

Press Contact:

Andy Robinson & Andrew Still-Baxter

press@cloverhealth.com

CLOVER HEALTH INVESTMENTS, CORP. AND

SUBSIDIARIESCONSOLIDATED BALANCE SHEETS: SELECTED METRICS(in

thousands)

| |

March 31,

2022(Unaudited) |

|

December 31, 2021 |

| Selected Balance Sheet

Data: |

|

|

|

|

Cash, cash equivalents and investments |

$ |

722,844 |

|

$ |

791,194 |

|

Total assets |

|

2,679,894 |

|

|

950,804 |

|

Unpaid claims |

|

164,240 |

|

|

138,604 |

|

Notes and securities payable, net of discount and deferred issuance

costs |

|

19,947 |

|

|

19,938 |

|

Total liabilities |

|

2,190,081 |

|

|

411,487 |

|

Total stockholders' equity |

|

489,813 |

|

|

539,317 |

|

|

|

CLOVER HEALTH INVESTMENTS, CORP. AND SUBSIDIARIES |

|

CONSOLIDATED STATEMENTS OF OPERATIONS |

|

(in thousands) (Unaudited) |

| |

|

|

|

|

| |

|

Three Months EndedMarch 31, |

|

|

|

|

2022 |

|

|

|

2021 |

|

|

Revenues: |

|

|

|

|

|

Premiums earned, net (Net of ceded premiums of $119 and $124, for

the three months ended March 31, 2022 and 2021, respectively) |

|

$ |

278,169 |

|

|

$ |

199,376 |

|

|

Direct Contracting revenue |

|

|

594,898 |

|

|

|

— |

|

|

Other income |

|

|

1,312 |

|

|

|

949 |

|

|

Total revenues |

|

|

874,379 |

|

|

|

200,325 |

|

| |

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

Net medical claims incurred |

|

|

861,722 |

|

|

|

214,420 |

|

|

Salaries and benefits |

|

|

69,091 |

|

|

|

66,024 |

|

|

General and administrative expenses |

|

|

57,697 |

|

|

|

38,618 |

|

|

Premium deficiency reserve benefit |

|

|

(27,657 |

) |

|

|

— |

|

|

Depreciation and amortization |

|

|

826 |

|

|

|

160 |

|

|

Other expense |

|

|

— |

|

|

|

191 |

|

|

Total operating expenses |

|

|

961,679 |

|

|

|

319,413 |

|

|

Loss from operations |

|

|

(87,300 |

) |

|

|

(119,088 |

) |

| |

|

|

|

|

| Change

in fair value of warrants payable |

|

|

— |

|

|

|

(85,506 |

) |

| Interest

expense |

|

|

403 |

|

|

|

1,175 |

|

|

Amortization of notes and securities discounts |

|

|

— |

|

|

|

13,660 |

|

| Gain on

investment |

|

|

(12,394 |

) |

|

|

— |

|

|

Net loss |

|

$ |

(75,309 |

) |

|

$ |

(48,417 |

) |

Operating Segments

| |

|

Insurance |

|

Non-Insurance |

|

Corporate/Other |

|

Eliminations |

|

Consolidated Total |

| Three months ended

March 31, 2022 |

|

(in thousands) |

|

Premiums earned, net (Net of ceded premiums of $119) |

|

$ |

278,169 |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

|

$ |

278,169 |

| Non-Insurance revenue |

|

|

— |

|

|

594,898 |

|

|

— |

|

|

— |

|

|

|

594,898 |

| Other income |

|

|

271 |

|

|

— |

|

|

27,399 |

|

|

(26,358 |

) |

|

|

1,312 |

| Intersegment revenues |

|

|

— |

|

|

— |

|

|

19,136 |

|

|

(19,136 |

) |

|

|

— |

| Net medical claims incurred

and other medical costs |

|

|

268,126 |

|

|

593,999 |

|

|

2,628 |

|

|

(3,031 |

) |

|

|

861,722 |

| Gross profit |

|

$ |

10,314 |

|

$ |

899 |

|

$ |

43,907 |

|

$ |

(42,463 |

) |

|

$ |

12,657 |

|

|

|

CLOVER HEALTH INVESTMENTS, CORP. AND SUBSIDIARIES |

|

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES |

|

ADJUSTED EBITDA RECONCILIATION |

|

(in thousands) (Unaudited)(1)(2) |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended March 31, |

|

Three Months Ended |

| |

|

|

2022 |

|

|

|

2021 |

|

|

December 31, 2021 |

|

September 30, 2021 |

|

June 30, 2021 |

|

Net loss: |

|

$ |

(75,309 |

) |

|

$ |

(48,417 |

) |

|

$ |

(187,202 |

) |

|

$ |

(34,527 |

) |

|

$ |

(317,611 |

) |

|

Adjustments |

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

403 |

|

|

|

1,175 |

|

|

|

412 |

|

|

|

413 |

|

|

|

1,229 |

|

|

Amortization of notes and securities discount |

|

|

— |

|

|

|

13,660 |

|

|

|

— |

|

|

|

13 |

|

|

|

8 |

|

|

Depreciation and amortization |

|

|

826 |

|

|

|

160 |

|

|

|

848 |

|

|

|

120 |

|

|

|

118 |

|

|

Change in fair value of warrants payable |

|

|

— |

|

|

|

(85,506 |

) |

|

|

— |

|

|

|

(115,152 |

) |

|

|

134,512 |

|

|

Gain on investment |

|

|

(12,394 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Stock-based compensation expense |

|

|

40,640 |

|

|

|

42,713 |

|

|

|

31,181 |

|

|

|

46,803 |

|

|

|

43,026 |

|

|

Premium deficiency reserve (benefit) expense |

|

|

(27,657 |

) |

|

|

— |

|

|

|

61,967 |

|

|

|

20,761 |

|

|

|

27,900 |

|

|

Expenses attributable to Seek Insurance Services, Inc. |

|

|

1,374 |

|

|

|

3,020 |

|

|

|

4,542 |

|

|

|

3,735 |

|

|

|

2,739 |

|

|

Expenses attributable to Clover Therapeutics Company |

|

|

357 |

|

|

|

703 |

|

|

|

826 |

|

|

|

1,106 |

|

|

|

988 |

|

|

Adjusted EBITDA (Non-GAAP) |

|

$ |

(71,760 |

) |

|

$ |

(72,492 |

) |

|

$ |

(87,426 |

) |

|

$ |

(76,728 |

) |

|

$ |

(107,091 |

) |

|

(1) |

The table above includes non-GAAP measures. Non-GAAP financial

measures are supplemental and should not be considered a substitute

for financial information presented in accordance with GAAP. For a

detailed explanation of these non-GAAP measures, see Appendix

A. |

|

(2) |

In first quarter 2022, we updated our definition and presentation

of Adjusted EBITDA (Non-GAAP) to exclude premium deficiency reserve

expense or benefit (PDR), gain on investment, and expenses

attributable to Seek Insurance Services, Inc. and Clover

Therapeutics Company from the calculation of this measure. PDR is

now being excluded because management believes PDR does not reflect

the Company's underlying fundamentals due to the significant

variability in PDR from period to period and because it is a

non-cash item, gain on investment is being excluded because it is a

non-cash item and management believes it does not reflect the

Company's underlying operations, and expenses attributable to Seek

Insurance Services, Inc., and Clover Therapeutics Company are being

excluded because management believes they are not reflective of the

Company’s operating expenses relating to its core businesses or its

actual recurring cash expense. Previously reported Adjusted EBITDA

(Non-GAAP) figures have been revised in the table above to conform

to the updated presentation. |

CLOVER HEALTH INVESTMENTS, CORP. AND

SUBSIDIARIESRECONCILIATION OF NON-GAAP FINANCIAL MEASURESINCURRED

INSURANCE MEDICAL CARE RATIO (NON-GAAP)

RECONCILIATION(Unaudited)(1)

| |

Year Ended December 31, 2021 |

|

GAAP Insurance MCR (All Members) |

106.0 |

% |

| Adjustments |

|

|

Prior Period Development(2)(3) |

(2.5 |

) |

| Incurred Insurance MCR

(Non-GAAP)(3) |

103.5 |

|

| |

|

| Incurred Insurance MCR

(Non-GAAP) By Region |

|

|

Northern New Jersey |

99.3 |

|

|

Southern New Jersey |

120.4 |

|

|

Georgia |

99.9 |

|

|

Other |

103.8 |

|

|

All Members Total |

103.5 |

|

| |

|

| Incurred Insurance MCR

(Non-GAAP) By Clover Assistant (CA)

Cohort(3)(4) |

|

|

2018 CA Cohort |

89.2 |

|

|

2019 CA Cohort |

93.4 |

|

|

2020 CA Cohort |

98.9 |

|

|

Aggregate CA PCP Cohort |

93.5 |

|

|

Non-CA PCP Cohort |

112.5 |

|

|

(1) |

The table above includes non-GAAP measures. Non-GAAP financial

measures are supplemental to and should not be considered a

substitute for financial information presented in accordance with

GAAP. For a detailed explanation of these non-GAAP measures, see

Appendix A. |

|

(2) |

Prior period development cannot be reasonably attributed to

specific Insurance members and, therefore, the reconciliation of

Incurred Insurance MCR to GAAP Insurance MCR is provided at the

total Insurance-member level only. We do not expect the impact of

prior period development would be material to the calculation of

Insurance MCR for any regional or Clover Assistant cohort over the

applicable period. |

|

(3) |

Figures presented differ from those included in our fourth quarter

2021 earnings release, reflecting our actual claims experience as

compared to the Company's estimates as of December 31, 2021. |

|

(4) |

Includes only returning members with primary care providers. |

CLOVER HEALTH INVESTMENTS, CORP. AND

SUBSIDIARIESRECONCILIATION OF NON-GAAP FINANCIAL MEASURESADJUSTED

OPERATING EXPENSES (NON-GAAP) RECONCILIATION(in thousands)

(Unaudited)(1)

| |

Three Months Ended March 31, |

|

|

|

2022 |

|

|

|

2021 |

|

| Salaries and benefits |

$ |

69,091 |

|

|

$ |

66,024 |

|

| General and administrative

expenses |

|

57,697 |

|

|

|

38,618 |

|

|

Total Salaries and benefits plus General and administrative

expenses |

|

126,788 |

|

|

|

104,642 |

|

| Adjustments |

|

|

|

|

Stock-based compensation expense |

|

(40,640 |

) |

|

|

(42,713 |

) |

|

Expenses attributable to Seek Insurance Services, Inc. |

|

(1,374 |

) |

|

|

(3,020 |

) |

|

Expenses attributable to Clover Therapeutics Company |

|

(357 |

) |

|

|

(703 |

) |

|

Adjusted Operating Expenses (Non-GAAP) |

$ |

84,417 |

|

|

$ |

58,206 |

|

| |

|

|

|

| Total revenues |

$ |

874,379 |

|

|

$ |

200,325 |

|

| Adjusted Operating Expenses

(Non-GAAP) as a Percentage of Revenue |

|

10 |

% |

|

|

29 |

% |

|

(1) |

The table above includes non-GAAP measures. Non-GAAP financial

measures are supplemental and should not be considered a substitute

for financial information presented in accordance with GAAP. For a

detailed explanation of these non-GAAP measures, see Appendix

A. |

CLOVER HEALTH INVESTMENTS, CORP. AND

SUBSIDIARIESAppendix AExplanation of Non-GAAP Financial Measures

and Other Items

Non-GAAP Adjustments

We believe it is useful to investors for our

presentation within this document of financial measures on a

non-GAAP basis to exclude the below items. In particular, we

believe that the exclusion of these amounts provides useful

measures for period-to-period comparisons of our business. These

key measures are used by our management and the board of directors

to understand and evaluate our operating performance and trends, to

prepare and approve our annual budget and to develop short and

long-term operating plans. In addition, we believe that the

presentation of these non-GAAP measures enhances an investor's

understanding of our financial performance.

Amortization of notes and securities discount -

We report non-convertible notes and convertible securities at

carrying value, net of discount. We account for convertible

securities in accordance with accounting guidance for debt with

conversion and other options, after determining whether embedded

conversion options should be bifurcated from their host

instruments.

Change in fair value of warrants payable - The

fair value of warrant liabilities is estimated using a valuation

method based on the level of instrument, where the values of

various instruments are estimated based on an analysis of future

values, assuming various future outcomes.

Depreciation and Amortization - Depreciation and

amortization consists of all depreciation and amortization expenses

associated with our property and equipment. Depreciation includes

expenses associated with property and equipment. Amortization

includes expenses associated with leasehold improvements.

Expenses Attributable to Seek Insurance

Services, Inc. and Clover Therapeutics Company - This consists of

expenses incurred by the Company in the current period attributable

to Seek Insurance Services, Inc. and Clover Therapeutics Company.

These expenses are excluded from Adjusted Operating Expenses

(Non-GAAP) and Adjusted EBITDA (Non-GAAP) because management

believes they are not reflective of the Company's core businesses

or its actual recurring cash expense and therefore do not

appropriately reflect the Company's underlying fundamentals.

Gain on Investment - Gain on investment consists

of the gain recorded by the Company upon the completion by one of

its subsidiaries, Clover Therapeutics Company, of a private capital

transaction during the first quarter of 2022.

Interest Expense - Interest expense consists

mostly of interest expense associated with previously outstanding

non-convertible notes under our term loan facility that was

terminated in the second quarter of 2021.

Premium deficiency reserve expense (benefit) –

This consists of a reserve established to the extent that the sum

of expected future costs, claim adjustment expenses, and

maintenance costs exceeds related future premiums under contracts

without consideration of investment income. We assess the

profitability of our contracts with CMS to identify those contracts

where current operating results or forecasts indicate probable

future losses. Premium deficiency reserve expense (benefit) is

recognized in the period in which the losses are identified.

Prior Period Development – This consists of our

estimate of adjustments in the current period which relate to prior

period dates of service. We exclude these amounts from Incurred

Insurance MCR (Non-GAAP) to isolate our estimate of current period

performance.

Stock-Based Compensation Expense – This consists

of expenses for stock-based payment awards granted to employees and

non-employees.

Non-GAAP Definitions

Adjusted EBITDA - A non-GAAP financial measure

defined by us as net loss before interest expense, amortization of

notes and securities discount, depreciation and amortization,

change in fair value of warrants payable, gain on investment,

stock-based compensation expense, premium deficiency reserve

expense (benefit), and expenses attributable to Seek Insurance

Services, Inc., and Clover Therapeutics Company. Adjusted EBITDA is

a key measure used by our management team and the board of

directors to understand and evaluate our operating performance and

trends, to prepare and approve our annual budget and to develop

short and long-term operating plans. In particular, we believe that

the exclusion of the amounts eliminated in calculating Adjusted

EBITDA provide useful measures for period-to-period comparisons of

our business. Accordingly, we believe that Adjusted EBITDA provides

investors and others useful information to understand and evaluate

our operating results in the same manner as our management and our

board of directors.

Adjusted Operating Expenses - A non-GAAP

financial measure defined by us as Salaries and benefits plus

General and administrative expenses, less Stock-based compensation

expense, and expenses attributable to Seek Insurance Services, Inc.

and Clover Therapeutics Company. We believe that Adjusted Operating

Expenses provides management, investors, and others a useful view

of our operating spend as it excludes non-cash, stock-based

compensation, and expenses related to investments that management

believes do not reflect the Company's core operating expenses. We

believe that Adjusted Operating Expenses as a Percentage of Revenue

is useful to management, investors, and others because it allows us

to measure our operational leverage as revenue scales.

Incurred Insurance MCR - A non-GAAP financial

measure that excludes from Insurance Medical Care Ratio (as defined

below) the impact of prior period development. We believe that this

metric, which is used by our management team in the operation of

the business, is helpful to investors and others in assessing the

medical care ratios of various cohorts of our members, excluding

the impact associated with adjustments made in the current period

relating to prior period dates of service.

Definitions of Other Items

Non-Insurance Medical Care Ratio - We calculate

our Non-Insurance medical care ratio (MCR) by dividing net medical

claims incurred in connection with our Non-Insurance operations by

Non-Insurance revenue in a given period. We believe our

Non-Insurance MCR is an indicator of our gross profitability and

our ability to capture and analyze data over time to generate

actionable insights for returning beneficiaries to improve care and

reduce medical expenses.

Lives under Clover Assistant Management -

Insurance members and Original Medicare beneficiaries whose

providers or practices were live on the Clover Assistant on or

before March 31, 2022. We believe that Lives under Clover Assistant

Management is a useful measure of the size of the beneficiary

population for whom we believe we have the potential to enhance

healthcare delivery, reduce expenditures, and improve care.

Lives under Clover Management - Consists of our

(i) Insurance members and (ii) Original Medicare beneficiaries

aligned to the Company's Direct Contracting Entity (DCE) via

attribution to a DCE-participating provider through alignment based

on claims data or by beneficiary election through voluntarily

alignment, in connection with the Centers for Medicare &

Medicaid Services' Global and Professional Direct Contracting

Model, which will transition to the ACO Reach model in 2023. We

believe that Lives under Clover Management is a useful measure of

the size of the beneficiary population managed by the Company.

Insurance Medical Care Ratio, Gross and Net - We

calculate our Insurance medical care ratio (MCR) by dividing total

net medical claims incurred by premiums earned, in each case on a

gross or net basis, as the case may be, in a given period. We

believe our MCR is an indicator of our gross profit for our

Medicare Advantage plans and the ability of our Clover Assistant

platform to capture and analyze data over time to generate

actionable insights for returning members to improve care and

reduce medical expenses.

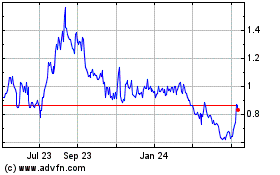

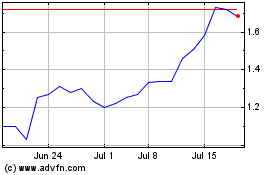

Clover Health Investments (NASDAQ:CLOV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Clover Health Investments (NASDAQ:CLOV)

Historical Stock Chart

From Apr 2023 to Apr 2024