Current Report Filing (8-k)

January 23 2023 - 8:52AM

Edgar (US Regulatory)

0001819615FALSE00018196152023-01-232023-01-230001819615us-gaap:CommonStockMember2023-01-232023-01-230001819615us-gaap:WarrantMember2023-01-232023-01-2300018196152023-01-172023-01-170001819615country:PT2023-01-172023-01-17xbrli:pure00018196152023-01-170001819615srt:MinimumMember2023-01-172023-01-17iso4217:USD0001819615srt:MaximumMember2023-01-172023-01-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): January 23, 2023

Clever Leaves Holdings Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| British Columbia, Canada | | 001-39820 | | Not Applicable |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | | | | | |

Bodega 19-B Parque Industrial Tibitoc P.H, Tocancipá - Cundinamarca, Colombia | | N/A |

| (Address of principal executive offices) | | (Zip Code) |

(561) 634-7430

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol (s) | | Name of each exchange on which registered |

| Common shares without par value | | CLVR | | The Nasdaq Stock Market LLC |

| Warrants, each warrant exercisable for one common share at an exercise price of $11.50 | | CLVRW | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.05. Costs Associated with Exit or Disposal Activities.

On January 17, 2023, Clever Leaves Holdings Inc.’s (the “Company”) board of directors authorized a restructuring plan that is designed to improve operating margin and support the Company’s growth, scale and profitability objectives. As part of that restructuring plan, the Company has begun to wind-down its operations in Portugal which has historically been comprised of cultivation, post-harvesting and manufacturing activities which will result in approximately 96% reduction to the Company’s workforce in Portugal and 21% reduction to the Company’s total workforce. Potential position eliminations in Portugal are subject to local law and consultation requirements. The Company expects to complete these actions in the first half of fiscal 2023.

The Company currently estimates that it will incur charges of approximately $19 million to $21 million in connection with the restructuring plan. The total expected range includes approximately $0.7 million to $0.9 million related to severance and employee benefits, and approximately $12 million to $13 million related to real estate and equipment exit costs, consisting of lease impairment and property and equipment abandonment charges. The total expected range also includes approximately $6 million to $7 million related to the write-off of inventories that will not be sold.

The Company expects approximately $7 million in gross annualized run rate savings to be realized from these actions by 2023. These savings will partially mitigate the impact of higher labor costs and headwinds from the macroeconomic environment, as well as fund additional investments to continue to drive a more efficient cost structure long term.

The Company expects to provide its full year 2023 outlook during its fourth quarter 2022 earnings call in March 2023. The charges that the Company expects to incur are subject to a number of assumptions and actual expenses may differ from the estimates disclosed above.

Item 2.06 Material Impairments.

The information contained in Item 2.05 relating to impairment charges is hereby incorporated by reference.

Forward-Looking Statements

This Current Report on Form 8-K includes certain statements that are not historical facts but are forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such as “aim,” “anticipate,” “believe,” “can,” “continue,” “could,” “estimate,” “evolve,” “expect,” “forecast,” “future,” “guidance,” “intend,” “may,” “opportunity,” “outlook,” “pipeline,” “plan,” “predict,” “potential,” “projected,” “seek,” “seem,” “should,” “will,” “would” and similar expressions (or the negative versions of such words or expressions) that predict or indicate future events or trends or that are not statements of historical matters. Such forward-looking statements, including statements relating to the Company’s wind-down of its operations in Portugal and the expected costs and cost savings of such wind-down, are subject to risks and uncertainties, which could cause actual results to differ from the forward-looking statements. Important factors that may affect actual results or the achievability of the Company’s expectations include, but are not limited to: (i) expectations with respect to future operating and financial performance and growth, including if or when Clever Leaves will become profitable; (ii) Clever Leaves’ ability to execute its business plans and strategy and to receive regulatory approvals (including its goals in its key markets); (iii) Clever Leaves’ ability to capitalize on expected market opportunities, including the timing and extent to which cannabis is legalized in various jurisdictions; (iv) expectations with respect to restructuring costs and savings, including in connection with the wind-down of the Company’s Portugal operations (v) global economic and business conditions, including economic sanctions against Russia and their effects on the global economy; (vi) geopolitical events (including the ongoing military conflict between Russia and Ukraine), natural disasters, acts of God and pandemics, including the economic and operational disruptions and other effects of COVID-19 such as the global supply chain crisis, travel restrictions, delays or disruptions to physical shipments (including outright bans on imported products), delays in issuing licenses and permits, delays in hiring necessary personnel to carry out sales, cultivation and other tasks, and financial pressures upon Clever Leaves and its customers; (vii) regulatory developments in key markets for the Company's products, including international regulatory agency coordination and increased quality standards imposed by certain health regulatory agencies, and failure to otherwise comply with laws and regulations; (viii) uncertainty with respect to the requirements applicable to certain cannabis products as well as the permissibility of sample shipments, and other risks and uncertainties; (ix) consumer, legislative, and regulatory sentiment or perception regarding Clever Leaves’ products; (x) lack of regulatory approval and market acceptance of Clever Leaves’ new products which may impede its ability to successfully commercialize its CBD brand in the United States; (xi) the extent to which Clever Leaves’ is able to monetize its existing THC market quota within Colombia; (xii) demand for Clever Leaves’ products and Clever Leaves’ ability to meet demand for its products and negotiate agreements with existing and new customers, including the sales agreements identified as a part of the Company’s 2022 strategic growth objectives; (xiii) developing product enhancements and formulations with commercial value and appeal; (xiv) product liability claims exposure; (xv) lack of a history and experience operating a business on a large scale and across multiple jurisdictions; (xvi) limited experience operating as a public company; (xvii) changes in currency exchange rates and interest rates; (xviii) weather and agricultural conditions and their impact on the Company’s cultivation and construction plans; (xix) Clever Leaves’ ability to hire and retain skilled personnel in the jurisdictions where it operates; (xx) Clever Leaves’ rapid growth, including growth in personnel; (xxi) Clever Leaves’ ability to remediate a material weakness in its internal control cover financial reporting and to develop and

maintain effective internal and disclosure controls; (xxii) potential litigation; and (xxiii) access to additional financing. The foregoing list of factors is not exclusive. Additional information concerning certain of these and other risk factors is contained in Clever Leaves’ most recent filings with the SEC. All subsequent written and oral forward-looking statements concerning Clever Leaves and attributable to Clever Leaves or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Clever Leaves expressly disclaims any obligations or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in its expectations with respect thereto or any change in events, conditions or circumstances on which any statement is based.

Item 7.01. Regulation FD Disclosure.

Attached as Exhibit 99.1 and incorporated herein by reference is a copy of the Company’s press release dated January 23, 2023 announcing its decision to wind-down its operations in Portugal.

Item 9.01. Financial Statements and Exhibits.

| | | | | |

| Exhibit No. | Description |

| 99.1 | |

| 104 | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Clever Leaves Holdings Inc. |

| |

| | By: | /s/ David M. Kastin |

| | Name: | David M. Kastin |

| | Title: | General Counsel and Corporate Secretary |

Date: January 23, 2023

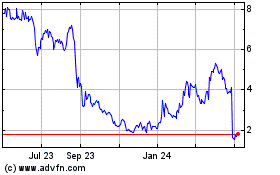

Clever Leaves (NASDAQ:CLVR)

Historical Stock Chart

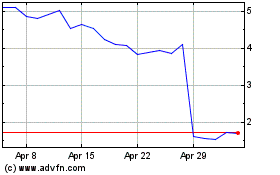

From Mar 2024 to Apr 2024

Clever Leaves (NASDAQ:CLVR)

Historical Stock Chart

From Apr 2023 to Apr 2024