As

filed with the Securities and Exchange Commission on September 13, 2019

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-1

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

|

CITIUS

PHARMACEUTICALS, INC.

|

|

(Exact

name of registrant as specified in its charter)

|

|

|

|

Nevada

|

|

8731

|

|

27-3425913

|

|

(State

or other jurisdiction of

|

|

(Primary

Standard Industrial

|

|

(I.R.S.

Employer

|

|

incorporation

or organization)

|

|

Classification

Code Number)

|

|

Identification

Number)

|

11

Commerce Drive, First Floor

Cranford,

New Jersey 07016

(908)

967-6677

(Address,

including zip code and telephone number, including area code, of registrant’s principal executive offices)

Myron

Holubiak

President

and Chief Executive Officer

11

Commerce Drive, First Floor

Cranford,

New Jersey 07016

(908)

967-6677

(Name,

address, including zip code and telephone number, including area code, of agent for service)

Copies

to:

|

Alexander

M. Donaldson

Lorna

A. Knick

Wyrick

Robbins Yates & Ponton LLP

4101

Lake Boone Trail, Suite 300

Raleigh,

North Carolina 27607

(919)

781-4000

|

|

Oded

Har-Even

Ron

Ben-Bassat

Zysman,

Aharoni, Gayer and Sullivan & Worcester LLP

1633

Broadway

New

York, NY 10019

(212)

660-5000

|

Approximate

date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If

any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under

the Securities Act of 1933, as amended (the “Securities Act”), check the following box. ☒

If

this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the

same offering. ☐

If

this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

Large

accelerated filer ☐

|

Accelerated

filer ☐

|

|

|

Non-accelerated

filer ☒

|

Smaller

reporting company ☒

Emerging

growth company ☐

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

☐

CALCULATION

OF REGISTRATION FEE

|

Title of Each Class of Securities To Be Registered

|

|

Proposed Maximum Aggregate Offering Price (1)(2)

|

|

|

Amount of Registration Fee (2)

|

|

|

Units, each unit consisting of one share of common stock, par value $0.001 per share, and one common warrant to purchase one share of common stock (3)

|

|

$

|

9,2000,000

|

|

|

$

|

1,115.04

|

|

|

(i) Common stock included in the units (4)

|

|

|

--

|

|

|

|

--

|

|

|

(ii) Common warrants included in the units (4)

|

|

|

--

|

|

|

|

--

|

|

|

Pre-funded units, each pre-funded unit consisting of one pre-funded warrant to purchase one share of common stock and one common warrant to purchase one share of common stock (3)

|

|

$

|

9,108,000

|

|

|

$

|

1,103.89

|

|

|

(i) Pre-funded warrants included in the pre-funded units (4)

|

|

|

--

|

|

|

|

--

|

|

|

(ii) Common warrants included in the pre-funded units (4)

|

|

|

--

|

|

|

|

--

|

|

|

Shares of common stock underlying common warrants included in the units and the pre-funded units (3)

|

|

$

|

18,400,000

|

|

|

$

|

2,230.08

|

|

|

Shares of common stock underlying pre-funded warrants included in the pre-funded units (3)

|

|

$

|

92,000

|

|

|

$

|

11.15

|

|

|

Underwriter’s warrants to purchase common stock (5)

|

|

|

--

|

|

|

|

--

|

|

|

Common stock issuable upon exercise of the underwriter’s warrants (6)

|

|

$

|

805,000

|

|

|

$

|

97.57

|

|

|

Total

|

|

$

|

37,605,000

|

|

|

$

|

4,557.73

|

|

|

|

(1)

|

Estimated

solely for purposes of computing the amount of the registration fee pursuant to Rule 457(o)

under the Securities Act of 1933, as amended (the “Securities Act”). Includes

securities subject to the underwriter’s option to purchase additional securities.

|

|

|

(2)

|

Pursuant

to Rule 416 under the Securities Act, the shares of common stock registered hereby

also include an indeterminate number of additional shares of common stock as may, from

time to time, become issuable by reason of stock splits, stock dividends, recapitalizations

or other similar transactions.

|

|

|

(3)

|

The

proposed maximum aggregate offering price of the units proposed to be sold in the offering

will be reduced on a dollar-for-dollar basis based on the offering price of any pre-funded

units offered and sold in the offering, and as such the proposed maximum aggregate offering

price of the units and pre-funded units (including the common stock issuable upon exercise

of the pre-funded warrants included in the pre-funded units), if any, is $8,000,000 (or $9,200,000 if the underwriter’s

option to purchase additional securities is exercised in full).

|

|

|

(4)

|

No

additional registration fee is payable pursuant to Rule 457(i) under the Securities

Act.

|

|

|

(5)

|

No

additional registration fee is payable pursuant to Rule 457(g) under the Securities

Act.

|

|

|

(6)

|

Represents

warrants to purchase a number of shares of common stock equal to 7.0% of the number of

shares of common stock (i) included within the units and (ii) issuable upon the

exercise of the pre-funded warrants included within the pre-funded units placed in this

offering at an exercise price equal to 125% of the offering price per unit (excluding

any shares of common stock underlying the common warrants included in the units and the

pre-funded units sold in this offering).

|

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until

the registrant shall file a further amendment that specifically states that this registration statement shall thereafter become

effective in accordance with Section 8(a) of the Securities Act, or until the registration statement shall become effective on

such date as the Commission, acting pursuant to said Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is

not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject

to Completion, Dated September 13, 2019

PRELIMINARY

PROSPECTUS

Up

to Units (each Unit contains one Share of Common Stock and one Common Warrant to

purchase

one Share of Common Stock)

Up

to Pre-funded Units (each Pre-funded Unit contains one Pre-funded Warrant to

Purchase

one Share of Common Stock and one Common Warrant to purchase one Share of Common Stock)

Shares

of Common Stock Underlying the Pre-funded Warrants and

Shares

of Common Stock Underlying the Common Warrants

We

are offering up to units (each unit consisting of one share of our common stock and one common warrant to purchase one share of

our common stock). Each common warrant contained in a unit has an exercise price of $ per

share. The common warrants contained in the units will be exercisable immediately and will expire five years from the date of

issuance. We are also offering the shares of our common stock that are issuable from time to time upon exercise of the common

warrants contained in the units.

We

are also offering to each purchaser whose purchase of units in this offering would otherwise result in the purchaser, together

with its affiliates and certain related parties, beneficially owning more than 4.99% of our outstanding common stock immediately

following the consummation of this offering, the opportunity to purchase, if the purchaser so chooses, pre-funded units (each

pre-funded unit consisting of one pre-funded warrant to purchase one share of our common stock and one common warrant to purchase

one share of our common stock) in lieu of units that would otherwise result in the purchaser’s beneficial ownership exceeding

4.99% of our outstanding common stock (or at the election of the purchaser, 9.99%). Each pre-funded warrant contained in a pre-funded

unit will be exercisable for one share of our common stock. The purchase price of each pre-funded unit will equal the price per

unit being sold to the public in this offering minus $0.01, and the exercise price of each pre-funded warrant included in the

pre-funded unit will be $0.01 per share. The pre-funded warrants contained in the pre-funded units will be exercisable immediately

and may be exercised at any time until the pre-funded warrants are exercised in full. This offering also relates to the shares

of common stock issuable upon exercise of any pre-funded warrants contained in the pre-funded units sold in this offering. Each

common warrant contained in a pre-funded unit has an exercise price of $ per

share. The common warrants contained in the pre-funded units will be exercisable immediately and will expire five years from the

date of issuance. We are also offering the shares of our common stock that are issuable from time to time upon exercise of the

common warrants contained in the pre-funded units.

For

each pre-funded unit we sell, the number of units we are offering will be decreased on a one-for-one basis. Units and the pre-funded

units will not be issued or certificated. The shares of common stock or pre-funded warrants, as the case may be, and the common

warrants can only be purchased together in this offering, but the securities contained in the units or pre-funded units will be

issued separately.

At

least one of our directors has indicated an interest in purchasing up to approximately $ worth of units in this offering at the

public offering price and other directors may do so as well. However, because indications of interest are not binding agreements

or commitments to purchase, the underwriter may sell more, less or no units in this offering to any of these persons, or any of

these persons may determine to purchase more, less or no units in this offering. The underwriter will receive the same underwriting

discounts and commissions and other compensation on any units purchased by these persons as they will on any other units sold

to the public in this offering.

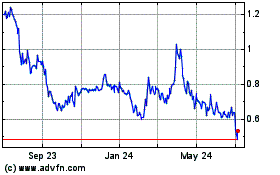

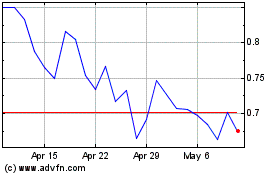

Our

common stock is listed on the Nasdaq Capital Market under the ticker symbol “CTXR”. On September 12, 2019, the

closing price of our common stock on the Nasdaq Capital Market was $0.9688. We do not intend to apply for listing of the

common warrants or pre-funded warrants on any securities exchange or other nationally recognized trading system. There is no

established public trading market for the common warrants or pre-funded warrants, and we do not expect a market to develop.

Without an active trading market, the liquidity of the common warrants and pre-funded warrants will be limited. We have

assumed a public offering price of $ per unit, the closing price for our

common stock as reported on the Nasdaq Capital Market on September , 2019, and

$ per pre-funded unit. The actual offering price per unit or pre-funded unit,

as the case may be, will be negotiated between us and the underwriter based on the trading of our common stock prior to the

offering, among other things, and may be at a discount to the current market price. Therefore, the assumed public offering

price used throughout this prospectus may not be indicative of the final offering price.

You

should read this prospectus, together with additional information described under the headings “Incorporation of Certain

Information by Reference” and “Where You Can Find More Information,” carefully before you invest in our securities.

|

|

|

Per Unit

|

|

|

Per Pre-Funded Unit

|

|

|

Total

|

|

|

Public offering price

|

|

$

|

|

|

|

$

|

|

|

|

$

|

|

|

|

Underwriting discounts and commissions (1)

|

|

$

|

|

|

|

$

|

|

|

|

$

|

|

|

|

Proceeds to us, before expenses

|

|

$

|

|

|

|

$

|

|

|

|

$

|

|

|

|

|

(1)

|

We

have agreed to reimburse the underwriter for certain of its expenses and to issue the

underwriter warrants to purchase our common stock. See “Underwriting” on

page 23 of this prospectus for a description of the additional compensation to be

received by the underwriter.

|

We

have granted the underwriter the option to purchase up to additional shares of common stock at a purchase price of $ per

share and/or common warrants to purchase up to an aggregate of shares of common stock at a purchase price of $0.01 per common

warrant with an exercise price of $ per

share, less the underwriting discounts and commissions. The underwriter may exercise its option at any time within 30 days

from the date of this prospectus. If the underwriter exercises the option in full, the total underwriting discounts and commissions

payable by us will be $ , and the total

proceeds to us, before expenses, will be $ .

The

underwriter expects to deliver the securities to purchasers on or about , 2019.

Investing

in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described under the

heading “Risk Factors” beginning on page 8 of this prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Sole

Book-Running Manager

H.C.

Wainwright & Co.

The

date of this prospectus is ,

2019.

TABLE

OF CONTENTS

You

should read this prospectus, including the information incorporated by reference herein, and any related free writing prospectus

that we have authorized for use in connection with this offering.

You

should rely only on the information that we have included or incorporated by reference in this prospectus and any related free

writing prospectus that we may authorize to be provided to you. We have not authorized any underwriter, dealer or other person

to give any information or to make any representation other than those contained or incorporated by reference in this prospectus

or any related free writing prospectus that we may authorize to be provided to you. You must not rely upon any information or

representation not contained or incorporated by reference in this prospectus or any related free writing prospectus. This prospectus

and any related free writing prospectus do not constitute an offer to sell or the solicitation of an offer to buy any securities

other than the registered securities to which they relate, nor do this prospectus or any related free writing prospectus constitute

an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to

make such offer or solicitation in such jurisdiction.

You

should not assume that the information contained in this prospectus or any related free writing prospectus is accurate on any

date subsequent to the date set forth on the front of the document or that any information we have incorporated by reference herein

or therein is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus

or any related free writing prospectus is delivered, or securities are sold, on a later date.

This

prospectus contains or incorporates by reference summaries of certain provisions contained in some of the documents described

herein, but reference is made to the actual documents for complete information. Copies of some of the documents referred to herein

have been filed or have been incorporated by reference as exhibits to the registration statement of which this prospectus forms a

part, and you may obtain copies of those documents as described in this prospectus under the headings “Incorporation of

Certain Documents by Reference” and “Where You Can Find More Information.”

Unless

the context indicates otherwise, as used in this prospectus, the terms “Citius,” “we,” “us,”

“our,” “the Company,” “our company” and “our business” refer to Citius Pharmaceuticals,

Inc.

We

own or have rights to various U.S. federal trademark registrations and applications, and unregistered trademarks and servicemarks,

including Mino-Lok®. All other trade names, trademarks and service marks appearing in this prospectus are the property of

their respective owners. We have assumed that the reader understands that all such terms are source-indicating. Accordingly, such

terms, when first mentioned in this prospectus, appear with the trade name, trademark or service mark notice and then throughout

the remainder of this prospectus without trade name, trademark or service mark notices for convenience only and should not be

construed as being used in a descriptive or generic sense.

PROSPECTUS

SUMMARY

This

summary highlights certain information about us and this offering contained elsewhere in this prospectus or incorporated herein

by reference. Because it is only a summary, it does not contain all of the information that you should consider before investing

in our securities and should be read in conjunction with, the more detailed information appearing elsewhere in this prospectus

or incorporated herein by reference. Before you decide to invest in our securities, you should read the entire prospectus carefully,

including “Risk Factors” beginning on page 8, and the consolidated financial statements and related notes incorporated

by reference into this prospectus.

Company

Overview

Citius

Pharmaceuticals, Inc., headquartered in Cranford, New Jersey, is a specialty pharmaceutical company dedicated to the development

and commercialization of critical care products addressing important medical needs with a focus on anti-infective products in

adjunct cancer care and unique prescription products. Our goal is to achieve leading market positions by providing therapeutic

products that address unmet medical needs, yet have a lower development risk than new chemical entities usually have. New formulations

of previously approved drugs targeting new indications with substantial safety and efficacy data are a core focus. We seek to

reduce development and clinical risks associated with drug development, yet still focus on innovative applications. Our strategy

centers on products that have intellectual property and regulatory exclusivity protection, while providing competitive advantages

over other existing therapeutic approaches.

Since

its inception, the Company has devoted substantially all of its efforts to business planning, research and development, recruiting

management and technical staff, and raising capital. We are developing three proprietary products: Mino-Lok®, an antibiotic

lock solution used to treat patients with catheter related bloodstream infections (“CRBSIs”) by salvaging the infected

catheter and avoiding costly and discomforting catheter exchange; Mino-Wrap, a liquifying gel-based wrap for reducing tissue expander

infections following breast reconstructive surgeries; and Hydro-Lido, a corticosteroid-lidocaine topical formulation that is intended

to provide anti-inflammatory and anesthetic relief to persons suffering from hemorrhoids. We believe these unique markets for

our products are large, growing, and underserved by the current prescription products or procedures.

Mino-Lok®

Mino-Lok

is a patented solution containing minocycline, disodium ethylenediaminetetraacetic acid (edetate), and ethyl alcohol, all of which

act synergistically to treat biofilm encrusted pathogens and salvage infected central venous catheters (“CVCs”) in

patients with CRBSIs. Mino-Lok breaks down biofilm barriers formed by bacterial colonies, eradicates the bacteria, and provides

anti-clotting properties to maintain patency in CVCs.

The

administration of Mino-Lok consists of filling the lumen of the catheter with 0.8 ml to 2.0 ml of Mino-Lok solution. The catheter

is then “locked”, meaning that the solution remains in the catheter without flowing into the vein; the lock is maintained

for a dwell-time of two hours while the catheter is not in use. If the catheter has multiple lumens, all lumens may be locked

with the Mino-Lok solution either simultaneously or sequentially. If patients are receiving continuous infusion therapy, the catheters

alternate between being locked with the Mino-Lok solution and delivering therapy. The Mino-Lok therapy is designed to be administered

for two hours per day for at least five days, usually with two additional locks in the subsequent two weeks. After locking the

catheter for two hours, the Mino-Lok solution is aspirated, and the catheter is flushed with normal saline. At that time, either

the infusion will be continued, or will be locked with the standard-of-care lock solution until further use of the catheter is

required. In a clinical study conducted by MD Anderson Cancer Center (“MDACC”), there were no serum levels of either

minocycline or edetate detected in the sera of several patients who underwent daily catheter lock solution with minocycline and

edetate (“M-EDTA”) at the concentration level proposed in Mino-Lok treatment. Thus, it has been demonstrated that

the amount of either minocycline or edetate that leaks into the serum is very low or none at all.

Phase

2b Results

From

April 2013 to July 2014, 30 patients with CVC-related bloodstream infection were enrolled at MDACC in a prospective Phase 2b study.

Patients received Mino-Lok therapy for two hours once daily for a minimum of five days within the first week followed by two additional

locks within the next two weeks. Patients were followed for one month post lock therapy. Demographic information, clinical characteristics,

laboratory data, therapy, as well as adverse events and outcome were collected for each patient. Median age at diagnosis was 56

years (range: 21-73 years). In all patients, prior to the use of lock therapy, systemic treatment with a culture-directed, first-line

intravenous antibiotic was started. Microbiological eradication was achieved at the end of therapy in all cases. None of the patients

experienced any serious adverse event related to the lock therapy.

The

active arm, which is the Mino-Lok treated group of patients, was then compared to 60 patients in a matched cohort that experienced

removal and replacement of their CVCs within the same contemporaneous timeframe. The patients were matched for cancer type, infecting

organism, and level of neutropenia. All patients were cancer patients and treated at the MDACC. The efficacy of Mino-Lok therapy

was 100% in salvaging CVCs, demonstrating equal effectiveness of a salvaged CVC to removing the infected CVC and replacing with

a new catheter.

The

main purpose of the study was to show that Mino-Lok therapy was at least as effective as the removal and replacement of CVCs when

CRBSIs are present, and that the safety was better, that is, the complications of removing an infected catheter and replacing

with a new one could be avoided. In addition to having a 100% efficacy rate with all CVCs being salvaged, Mino-Lok therapy had

no significant adverse events (“SAEs”), compared to an 18% SAE rate in the matched cohort where patients had the infected

CVCs removed and replaced (“R&R”) with a fresh catheter. There were no overall complication rates in the Mino-Lok

arm group compared to 11 patients with events (18%) in the control group. These events included bacterial relapse (5%) at four

(4) weeks post-intervention, and a number of complications associated with mechanical manipulation in the removal or replacement

procedure for the catheter (10%) or development of deep seated infections such as septic thrombophlebitis and osteomyelitis (8%).

As footnoted, six (6) patients had more than one (1) complication in the control arm group.

|

Parameter

|

|

Mino-Lok Arm

|

|

|

Control Arm

|

|

|

|

|

N

|

|

|

(%)

|

|

|

N

|

|

|

(%)

|

|

|

Patients

|

|

|

30

|

|

|

|

(100

|

%)

|

|

|

60

|

|

|

|

(100

|

%)

|

|

Cancer type

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Hematologic

|

|

|

20

|

|

|

|

(67

|

)

|

|

|

48

|

|

|

|

(80

|

)

|

|

- Solid tumor

|

|

|

10

|

|

|

|

(33

|

)

|

|

|

12

|

|

|

|

(20

|

)

|

|

ICU Admission

|

|

|

4

|

|

|

|

(13

|

)

|

|

|

4

|

|

|

|

(7

|

)

|

|

Mech.Ventilator

|

|

|

3

|

|

|

|

(10

|

)

|

|

|

0

|

|

|

|

(0

|

)

|

|

Bacteremia

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Gram+

|

|

|

17

|

|

|

|

(57

|

)*

|

|

|

32

|

|

|

|

(53

|

)

|

|

- Gram-

|

|

|

14

|

|

|

|

(47

|

)*

|

|

|

28

|

|

|

|

(47

|

)

|

|

Neutropenia (<500)

|

|

|

19

|

|

|

|

(63

|

)

|

|

|

36

|

|

|

|

(60

|

)

|

|

Microbiologic Eradication

|

|

|

30

|

|

|

|

(100

|

)

|

|

|

60

|

|

|

|

(100

|

)

|

|

- Relapse

|

|

|

0

|

|

|

|

(0

|

)

|

|

|

3

|

|

|

|

(5

|

)

|

|

Complications

|

|

|

0

|

|

|

|

(0

|

)

|

|

|

8

|

|

|

|

(13

|

)

|

|

SAEs related R&R

|

|

|

0

|

|

|

|

(0

|

)

|

|

|

6

|

|

|

|

(10

|

)

|

|

Overall Complication Rate

|

|

|

0

|

|

|

|

(0

|

%)

|

|

|

11

|

**

|

|

|

(18

|

%)

|

|

|

*

|

1

Polymicrobial patient had a Gram+ and a Gram- organism cultured

|

|

|

**

|

6

Patients had > 1 complication

|

Source:

Dr. Issam Raad, Antimicrobial Agents and Chemotherapy, June 2016, Vol. 60 No. 6, Page 3429

Phase

3 Initiation

In

November 2016, the Company initiated site recruitment for Phase 3 clinical trials. From initiation through first quarter 2017,

the Company received input from several sites related to the control arm as being less than standard of care for some of the respective

institutions. The Company worked closely with the United States Food and Drug Administration (“FDA”) with respect

to the design of the Phase 3 trial, and received feedback on August 17, 2017. The FDA stated that they recognized that there is

an unmet medical need in salvaging infected catheters and agreed that an open label, superiority design would address the Company’s

concerns and would be acceptable to meet the requirements of a new drug application (“NDA”). The Company amended the

Phase 3 study design to remove the saline and heparin placebo control arm and to use an active control arm that conforms with

today’s current standard of care. Patient enrollment commenced in February 2018.

The

Mino-Lok Phase 3 Trial is planned to enroll 700 patients in 50 participating institutions, all located in the U.S. There will

be interim analyses at the 50% and 75% point of the trial as measured by the number of patients treated. As of August 31, 2019,

there are 27 active sites currently enrolling patients including such academic centers as MDACC, Henry Ford Health Center, Georgetown

University Medical Center, University of Chicago, and others. There are 9 additional well renowned medical centers in startup

mode. There are no remaining sites in feasibility.

In

September 2019, the Company announced that the FDA agreed to a new primary efficacy endpoint of “time to catheter failure”

in comparing Mino Lok to the antibiotic lock control arm. Additionally, the Company submitted a response to the FDA that it will

implement this change in the primary endpoint and expected it to result in less than 150 subjects needed in its Phase 3 trial,

which the FDA is reviewing.

Fast

Track Designation

In

October 2017, the Company received official notice from FDA that the investigational program for Mino-Lok was granted “Fast

Track” status. Fast Track is a designation that expedites FDA review to facilitate development of drugs which treat a serious

or life-threatening condition and fill an unmet medical need. A drug that receives Fast Track designation is eligible for the

following:

|

|

●

|

More

frequent meetings with FDA to discuss the drug’s development plan and ensure collection

of appropriate data needed to support drug approval;

|

|

|

●

|

More

frequent written correspondence from FDA about the design of the clinical trials;

|

|

|

●

|

Priority

review to shorten the FDA review process for a new drug from ten months to six months;

and,

|

|

|

●

|

Rolling

review, which means Citius can submit completed sections of its NDA for review by FDA,

rather than waiting until every section of the application is completed before the entire

application can be reviewed.

|

Mino-Lok

International Study

In

October 2017, data from an international study on Mino-Lok was presented at the Infectious Disease Conference, in San Diego, California.

The 44 patient study was conducted in Brazil, Lebanon, and Japan and showed Mino-Lok therapy was an effective intervention to

salvage long term, infected CVCs in CRBSI in patients who had cancer with limited vascular access. This study showed 95% effectiveness

for Mino-Lok therapy in achieving microbiological eradication of the CVCs as compared to 83% for the control. The single failure

in the Mino-Lok arm was due to a patient with Burkholderia cepacia that was resistant to all antibiotics tested.

Stability

Patent Application for Mino-Lok

In

July 2018, the Company received notice from the MDACC that the US Patent and Trademark Office (“USPTO”) has reviewed

and examined the patent application US 2017/051373 A1 and that it is allowed for issuance as a patent. The new invention overcomes

limitations in mixing antimicrobial solutions in which components have precipitated because of physical and/or chemical factors,

thus limiting the stability of the post-mix solutions.

In

September 2018, the Company reported that the European Patent Application (No. 16806326.1) for Mino-Lok with Enhanced Stability

was published (September 12, 2018) under serial number 3370794. This patent, which already received a Notice of Allowance from

the USPTO in July of 2018, and which patent was issued by the USPTO in September 2018, will provide and strengthen intellectual

property protection for Mino-Lok through November of 2036. The new invention overcomes limitations in mixing antimicrobial solutions,

in which components have precipitated because of physical and/or chemical factors, thus limiting the stability of the post-mix

solutions. The scientists and technologists at MDACC have been able to improve the stability of the post-mixed solutions through

adjustments of the post-mixed pH of the solution. This may allow for longer storage time of the ready-to-use solution.

In

October 2018, the USPTO issued U.S. patent 10/086,114, entitled “Antimicrobial Solutions with Enhanced Stability.”

The new invention overcomes limitations in mixing antimicrobial solutions in which components have precipitated because of physical

and/or chemical factors, thus limiting the stability of the post-mix solutions. The scientists and technologists at MDACC have

been able to improve the stability of the post-mixed solutions through adjustments of the post-mixed pH of the solution. This

may allow for longer storage time of the ready-to-use solution. Citius holds the exclusive worldwide license which provides access

to this patented technology for development and commercialization of Mino-Lok.

Mino-Wrap

On

January 2, 2019, we entered into a patent and technology license agreement with the Board of Regents of the University of Texas

System on behalf of the MDACC, whereby we in-licensed exclusive worldwide rights to the patented technology for any and all uses

relating to breast implants. We intend to develop a liquefying, gel-based wrap containing minocycline and rifampin for the

reduction of infections associated with breast implants following breast reconstructive surgeries (“Mino-Wrap”).

We are required to use commercially reasonable efforts to commercialize Mino-Wrap under several regulatory scenarios and achieve

milestones associated with these regulatory options leading to an approval from the FDA. Mino-Wrap will require pre-clinical development

prior to any regulatory pathway. In July 2019, we announced that we intend to pursue the FDA’s Investigational New Drug

(“IND”) regulatory pathway for the development of Mino-Wrap.

Hydro-Lido

Overview

Hydro-Lido

(“CITI-001”) is a topical formulation of hydrocortisone and lidocaine that is intended for the treatment of hemorrhoids.

To our knowledge, there are currently no FDA-approved prescription drug products for the treatment of hemorrhoids. Some physicians

are known to prescribe topical steroids for the treatment of hemorrhoids. In addition, there are various strengths of topical

combination prescription products containing hydrocortisone along with lidocaine or pramoxine, each a topical anesthetic, that

are prescribed by physicians for the treatment of hemorrhoids. These products contain drugs that were in use prior to the start

of the Drug Efficacy Study Implementation (“DESI”) program and are commonly referred to as DESI drugs. However, none

of these single-agent or combination prescription products have been clinically evaluated for safety and efficacy and approved

by the FDA for the treatment of hemorrhoids. Further, many hemorrhoid patients use over the counter (“OTC”) products

as their first line therapy. OTC products contain any one of several active ingredients including glycerin, phenylephrine, pramoxine,

white petrolatum, shark liver oil and/or witch hazel, for symptomatic relief.

Development

of Hemorrhoids Drugs

Hemorrhoids

are a common gastrointestinal disorder, characterized by anal itching, pain, swelling, tenderness, bleeding and difficulty defecating.

In the U.S., hemorrhoids affect nearly 5% of the population, with approximately 10 million persons annually admitting to having

symptoms of hemorrhoidal disease. Of these persons, approximately one third visit a physician for evaluation and treatment of

their hemorrhoids. The data also indicate that for both sexes a peak of prevalence occurs from age 45 to 65 years with a subsequent

decrease after age 65 years. Caucasian populations are affected significantly more frequently than African Americans, and increased

prevalence rates are associated with higher socioeconomic status in men but not women. Development of hemorrhoids before age 20

is unusual. In addition, between 50% and 90% of the general U.S., Canadian and European population will experience hemorrhoidal

disease at least once in life. Although hemorrhoids and other anorectal diseases are not life-threatening, individual patients

can suffer from agonizing symptoms which can limit social activities and have a negative impact on the quality of life.

Hemorrhoids

are defined as internal or external according to their position relative to the dentate line. Classification is important for

selecting the optimal treatment for an individual patient. Accordingly, physicians use the following grading system referred to

as the Goligher’s classification of internal hemorrhoids:

|

|

Grade

I

|

Hemorrhoids

not prolapsed but bleeding.

|

|

|

Grade

II

|

Hemorrhoids

prolapse and reduce spontaneously with or without bleeding.

|

|

|

Grade

III

|

Prolapsed

hemorrhoids that require reduction manually.

|

|

|

Grade

IV

|

Prolapsed

and cannot be reduced including both internal and external hemorrhoids that are confluent from skin tag to inner anal canal.

|

Development

Activities to Date

In

the fall of 2015, we completed dosing patients in a double-blind dose ranging placebo controlled Phase 2 study where six different

formulations containing hydrocortisone and lidocaine in various strengths were tested against the vehicle control. The objectives

of this study were to: 1) demonstrate the safety and efficacy of the formulations when applied twice daily for two weeks in subjects

with Grade I or II hemorrhoids and 2) assess the potential contribution of lidocaine hydrochloride and hydrocortisone acetate,

alone or in combination for the treatment of symptoms of Goligher’s Classification Grade I or II hemorrhoids.

In

March 2018, we announced that we are selecting a higher potency corticosteroid in our steroid/anesthetic topical formulation program

for the treatment of hemorrhoids. The original topical preparation, CITI-001, was a combination of hydrocortisone acetate and

lidocaine hydrochloride. The new formulation, CITI-002, which we refer to as Halo-Lido, will combine lidocaine with the higher

potency corticosteroid for symptomatic relief of the pain and discomfort of hemorrhoids.

We

held a Type C meeting with the FDA in December 2017 to discuss the results of the Phase 2a study and to obtain the FDA’s

view on development plans to support the potential formulation change for the planned Phase 2b study. We also requested the FDA’s

feedback on our Phase 2b study design, including target patient population, inclusion/exclusion criteria, and efficacy endpoints.

The pre-clinical and clinical development programs for CITI-002 are planned to be similar to those conducted for the development

of CITI-001 to support the design for a planned Phase 3 clinical trial.

Corporate

Information

The

Company was founded as Citius Pharmaceuticals, LLC, a Massachusetts limited liability company, on January 23, 2007. On September

12, 2014, Citius Pharmaceuticals, LLC entered into a Share Exchange and Reorganization Agreement, with Citius Pharmaceuticals,

Inc. (formerly Trail One, Inc.), a publicly traded company incorporated under the laws of the State of Nevada (the “Reverse

Acquisition”). Citius Pharmaceuticals, LLC became a wholly-owned subsidiary of Citius. On March 30, 2016, Citius acquired

Leonard-Meron Biosciences, Inc. (“LMB”) as a wholly-owned subsidiary. LMB was a pharmaceutical company focused on

the development and commercialization of critical care products with a concentration on anti-infectives.

The

Company’s principal executive offices are located at 11 Commerce Drive, First Floor, Cranford, New Jersey 07016 and its

telephone number is (908) 976-6677.

THE

OFFERING

|

Units

offered by us

|

Up

to units, each consisting of one

share of our common stock and one common warrant to purchase one share of our common stock.

|

|

|

|

|

Pre-funded

units offered by us

|

We

are also offering to each purchaser whose purchase of units in this offering would otherwise result in the purchaser, together

with its affiliates and certain related parties, beneficially owning more than 4.99% of our outstanding common stock immediately

following the consummation of this offering, the opportunity to purchase, if the purchaser so chooses, pre-funded units (each

pre-funded unit consisting of one pre-funded warrant to purchase one share of our common stock and one common warrant to purchase

one share of our common stock) in lieu of units that would otherwise result in the purchaser’s beneficial ownership

exceeding 4.99% of our outstanding common stock (or, at the election of the purchaser, 9.99%). The purchase price of each

pre-funded unit will equal the price at which the units are being sold to the public in this offering, minus $0.01, and the

exercise price of each pre-funded warrant included in each pre-funded unit will be $0.01 per share. The pre-funded warrants

will be immediately exercisable and may be exercised at any time until the pre-funded warrants are exercised in full. This

offering also relates to the shares of common stock issuable upon exercise of any pre-funded warrants sold in this offering.

For each pre-funded unit we sell, the number of units we are offering will be decreased on a one-for-one basis. Because we

will issue a common warrant as part of each unit or pre-funded unit, the number of common warrants sold in this offering will

not change as a result of a change in the mix of the units and pre-funded units sold.

|

|

|

|

|

Common

warrants offered by us

|

Common

warrants to purchase an aggregate of shares

of our common stock. Each unit and each pre-funded unit includes a common warrant to purchase one share of our common stock.

Each common warrant will have an exercise price of $ per

share, will be immediately separable from the common stock or pre-funded warrant, as the case may be, will be immediately

exercisable and will expire on the fifth anniversary of the original issuance date, at which point it will automatically be

exercised on a cashless basis. This prospectus also relates to the offering of the shares of common stock issuable upon exercise

of the common warrants.

|

|

|

|

|

Option

to purchase additional securities

|

The

underwriter has the option to purchase up to additional

shares of common stock at a purchase price of $ per

share and/or common warrants to purchase up to an aggregate of shares

of common stock at a purchase price of $0.01 per common warrant with an exercise price of $ per

share, less underwriting discounts and commissions. The underwriter can exercise this option at any time within 30 days

from the date of this prospectus.

|

|

|

|

|

Common

stock to be outstanding immediately after this offering (1)

|

shares

(assuming no exercise of the underwriter’s option to purchase additional securities, assuming no sale of any pre-funded

units and assuming none of the common warrants issued in this offering are exercised).

|

|

|

|

|

Public

offering price

|

The

assumed public offering price is $ per

unit and $ per pre-funded unit,

which is based on the closing price for our common stock as reported on the Nasdaq Capital Market on September ,

2019. The actual offering price per each unit and pre-funded unit will be negotiated between us and the underwriter based

on the trading of our common stock prior to the offering, among other things, and may be at a discount to the current market

price.

|

|

|

|

|

Use

of proceeds

|

We

estimate that the net proceeds from this offering will be approximately $ ,

after deducting the underwriter discounts and commissions and estimated offering expenses payable by us. We intend to use

substantially all of the net proceeds from this offering primarily towards the research and development of our product candidates

and the remainder for capital expenditures, working capital and other general corporate purposes. See “Use of Proceeds”

for a more complete description of the intended use of proceeds from this offering.

|

|

|

|

|

Underwriter

warrants

|

The

registration statement of which this prospectus is a part also registers for sale warrants to purchase up to shares

of our common stock to the underwriter as a portion of its compensation payable in connection with this offering. The warrants

will be exercisable during a period commencing at six months from the effective date of the offering and ending five years

from the effective date of the offering at an exercise price equal to 125% of the public offering price of the common stock.

Please see “Underwriting – Underwriter Warrants” for a description of these warrants.

|

|

Risk

Factors

|

An

investment in our securities involves a high degree of risk. See “Risk Factors” beginning on page 8 of

this prospectus and the similarly titled sections in the documents incorporated by reference into this prospectus.

|

|

|

|

|

NASDAQ

Capital Market trading symbol

|

Our

common stock is listed on the Nasdaq Capital Market under the symbol “CTXR.” We do not intend to apply for listing

of the common warrants or pre-funded warrants on any securities exchange or other nationally recognized trading system. There

is no established public trading market for the common warrants or pre-funded warrants, and we do not expect a market to develop.

Without an active trading market, the liquidity of the common warrants and pre-funded warrants will be limited.

|

|

|

(1)

|

The

number of shares of our common stock that will be outstanding immediately after this

offering is based on 22,075,781 shares of our common stock outstanding as of August 31,

2019 and excludes:

|

|

|

●

|

16,490,794

shares of common stock issuable upon the exercise of warrants outstanding, with a weighted

average price of $2.337 per share;

|

|

|

●

|

1,771,039

shares of our common stock issuable upon the exercise of options outstanding under our

2014 Stock Incentive Plan (“2014 Plan”) and 2018 Omnibus Stock Incentive

Plan (“2018 Plan”) with a weighted average price of $4.029 per share;

|

|

|

●

|

5,799

shares of our common stock reserved for future issuance under our 2014 Plan and 1,085,000

shares of our common stock reserved for future issuance under our 2018 Plan;

|

|

|

●

|

100,667

shares of common stock and warrants to purchase 100,667 shares of common stock, at an

exercise price of $9.00 per share, each issued or issuable pursuant to certain units,

in the form of a unit purchase option agreement, with a price of $9.00 per unit;

|

|

|

●

|

shares

of common stock issuable upon the exercise of common warrants to be issued to investors

in this offering at an exercise price of $

per share; and

|

|

|

●

|

shares

(or shares if the underwriter’s option to purchase additional securities is exercised

in full) of our common stock issuable upon exercise of the warrants being issued to the

underwriter in connection with this offering.

|

Except

as otherwise indicated herein, all information in this prospectus, including the number of shares that will be outstanding after

this offering, does not assume or give effect to the exercise of options or warrants outstanding as of June 30, 2019 and assumes

no sale of any pre-funded units in this offering.

Unless

otherwise indicated, all information contained in this prospectus assumes no exercise by the underwriter of its option to purchase

additional securities.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus contains forward-looking statements that involve substantial risks and uncertainties. All statements, other than statements

of historical facts, included in this prospectus or the documents incorporated herein by reference regarding our strategy, future

operations, future product research or development, future financial position, future revenues, projected costs, prospects, plans

and objectives of management, are forward-looking statements. The words “anticipate,” “believe,” “goals,”

“estimate,” “expect,” “intend,” “may,” “might,” “plan,”

“predict,” “project,” “target,” “potential,” “will,” “would,”

“could,” “should,” “continue” and similar expressions are intended to identify forward-looking

statements, although not all forward-looking statements contain these identifying words. Forward-looking statements in this prospectus

include, but are not limited to, statements about:

|

|

●

|

our

need for, and ability to raise, additional capital;

|

|

|

●

|

the

number, designs, results and timing of our clinical trials;

|

|

|

●

|

the

regulatory review process and any regulatory approvals that may be issued or denied by

the FDA or other regulatory agencies;

|

|

|

●

|

the

commercial success and market acceptance of any of our products and product candidates

that are approved for marketing in the United States or other countries;

|

|

|

●

|

the

accuracy of our estimates of the size and characteristics of the markets that may be

addressed by our products and product candidates;

|

|

|

●

|

our

ability to manufacture sufficient amounts of our product candidates for clinical trials

and our products for commercialization activities;

|

|

|

●

|

our

need to secure collaborators to license, manufacture, market and sell any products for

which we receive regulatory approval;

|

|

|

●

|

our

ability to protect our intellectual property and operate our business without infringing

upon the intellectual property rights of others;

|

|

|

●

|

the

medical benefits, effectiveness and safety of our products and product candidates;

|

|

|

●

|

the

safety and efficacy of medicines or treatments introduced by competitors that are targeted

to indications which our products and product candidates have been developed to treat;

|

|

|

●

|

our

current or prospective collaborators’ compliance or non-compliance with their obligations

under our agreements with them; and

|

|

|

●

|

other

factors discussed elsewhere in this prospectus.

|

We

may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not

place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions

and expectations disclosed in the forward-looking statements we make. We have included important factors in the cautionary statements

included in this prospectus, particularly under “Risk Factors” on page 8 of this prospectus and the documents

incorporated herein that we believe could cause actual results or events to differ materially from the forward-looking statements

that we make.

You

should read this prospectus, the documents incorporated herein by reference and the documents that we have filed as exhibits to

this prospectus completely and with the understanding that our actual future results may be materially different from what we

expect.

Except

as required by law, we undertake no obligation to update or revise any forward-looking statements to reflect new information or

future events or developments. You should therefore not rely on these forward-looking statements as representing our views as

of any date subsequent to the date of this prospectus. You also should not assume that our silence over time means that actual

events are bearing out as expressed or implied in such forward-looking statements. Before deciding to purchase our securities,

you should carefully consider the risk factors discussed and incorporated by reference in this prospectus and the documents incorporated

herein.

RISK

FACTORS

An

investment in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should carefully

consider the risks described below and those discussed under the section captioned “Risk Factors” contained in our

Annual Report on Form 10-K for the fiscal year ended September 30, 2018, filed with the Securities and Exchange Commission

(the “SEC”) on December 11, 2018, which is incorporated by reference in this prospectus, together with the information

included in this prospectus and documents incorporated by reference herein, and in any free writing prospectus that we have authorized

for use in connection with this offering. If any of these risks actually occurs, our business, financial condition, results of

operations or cash flow could be harmed. This could cause the trading price of our common stock to decline, resulting in a loss

of all or part of your investment.

Risk

Related to this Offering

We

may be required to raise additional financing by issuing new securities with terms or rights superior to those of our existing

securityholders, which could adversely affect the market price of shares of our common stock and our business.

We

will require additional financing to fund future operations, including our research, development, sales and marketing activities.

We may not be able to obtain financing on favorable terms, if at all. If we raise additional funds by issuing equity securities,

the percentage ownership of our current stockholders will be reduced, and the holders of the new equity securities may have rights

superior to those of our existing securityholders, which could adversely affect the market price of our common stock and the voting

power of shares of our common stock. If we raise additional funds by issuing debt securities, the holders of these debt securities

would similarly have some rights senior to those of our existing securityholders, and the terms of these debt securities could

impose restrictions on operations and create a significant interest expense for us which could have a materially adverse effect

on our business.

Issuances

of shares of our common stock or securities convertible into or exercisable for shares of our common stock following this offering,

as well as the exercise of outstanding options and warrants, will dilute your ownership interests and may adversely affect the

future market price of our common stock.

The

issuance of additional shares of our common stock or securities convertible into or exchangeable for our common stock could be

dilutive to stockholders if they do not invest in future offerings. We intend to use the net proceeds from this offering for the

continued clinical development of our product candidates, Mino-Lok, Mino-Wrap and Hydro-Lido, and for other general corporate

purposes, which may include working capital, research and development expenditures, the funding of in-licensing agreements for

product candidates, additional technologies or other forms of intellectual property, expenditures relating to manufacturing infrastructure

and other capital expenditures, and general and administrative expenses. We may seek additional capital through a combination

of private and public equity offerings, debt financings, strategic partnerships and alliances and licensing arrangements, which

may cause your ownership interest to be diluted.

In

addition, we have a substantial number of options and warrants to purchase shares of our common stock outstanding, which will

be significantly increased by the number of pre-funded warrants and common warrants issued in the offering. If these securities

are converted or exercised, you may incur further dilution. Moreover, to the extent that we issue additional convertible notes,

convertible preferred stock, options or warrants to purchase, or securities convertible into or exchangeable for, shares of our

common stock in the future and those options, warrants or other securities are exercised, converted or exchanged, stockholders

may experience further dilution.

There

is no public market for the common warrants or the pre-funded warrants in this offering.

There

is no established public trading market for the common warrants or the pre-funded warrants in this offering, and we do not expect

a market to develop. In addition, we do not intend to apply to list the common warrants or the pre-funded warrants on any national

securities exchange or other nationally recognized trading system, including The Nasdaq Capital Market. Without an active market,

the liquidity of the common warrants and the pre-funded warrants will be limited.

The

common warrants and the pre-funded warrants in this offering are speculative in nature.

Neither

the common warrants nor the pre-funded warrants in this offering confer any rights of common stock ownership on its holders, such

as voting rights or the right to receive dividends, but rather merely represent the right to acquire shares of common stock at

a fixed price and, with respect to the common warrants, during a fixed period of time. Specifically, commencing on the date of

issuance, holders of the common warrants may exercise their right to acquire the common stock and pay an exercise price of $ per

share, subject to certain adjustments, prior to the expiration of the common warrants on the fifth anniversary of the original

issuance date, at which time the common warrants would be automatically exercised on a cashless basis. Commencing on the date

of issuance, holders of the pre-funded warrants may exercise their right to acquire the common stock and pay an exercise price

of $0.01 per share, subject to certain adjustments, at any time until the pre-funded warrants are exercised in full. Moreover,

following this offering, the market value of the common warrants and the pre-funded warrants, if any, is uncertain and there can

be no assurance that the market value of the common warrants or the pre-funded warrants will equal or exceed their imputed offering

price. Neither the common warrants nor the pre-funded warrants will be listed or quoted for trading on any market or exchange.

There can also be no assurance that the market price of the common stock will ever equal or exceed the exercise price of the common

warrants, and consequently, whether it will ever be profitable for holders of the common warrants to exercise the common warrants.

You

will experience immediate and substantial dilution in the net tangible book value per share of the common stock included in the

units or issuable upon exercise of the common warrants or pre-funded warrants in this offering.

Since

the effective price per share of common stock included in the units or issuable upon exercise of the common warrants or the pre-funded

warrants being offered is substantially higher than the net tangible book deficit per share of our common stock outstanding prior

to this offering, you will suffer immediate and substantial dilution in the net tangible book value of the common stock included

in the units or issuable upon the exercise of the common warrants or the pre-funded warrants issued in this offering. See the

section titled “Dilution” on page 16 for a more detailed discussion of the dilution you will incur if you purchase

units in this offering.

A

significant portion of our total outstanding shares are eligible to be sold into the market, which could cause the market price

of our common stock to drop significantly, even if our business is doing well.

Sales

of a substantial number of shares of our common stock in the public market, either by us or by our current stockholders, or the

perception that these sales could occur, could cause a decline in the market price of our securities. Such sales, along with any

other market transactions, could adversely affect the market price of our common stock.

Upon

completion of this offering, based on our shares outstanding as of June 30, 2019, we will have shares of common stock outstanding

based on the issuance and sale of units in this offering, assuming no sale of any pre-funded units. Of these shares , are subject

to a contractual lock-up with the underwriter for this offering for a period of 90 days following this offering. These shares

can be sold, subject to any applicable volume limitations under federal securities laws, after the earlier of the expiration of,

or release from, the 90-day lock-up period. The balance of our outstanding shares of common stock, including any shares of common

stock included in units or issuable upon the exercise of the common warrants and pre-funded warrants purchased in this offering

other than shares acquired by our current stockholders who are also subject to the contractual lock-up, may be resold into the

public market immediately without restriction, unless owned or purchased by our affiliates.

As

of June 30, 2019, there were an aggregate of 16,490,794 shares subject to outstanding warrants, many of which shares we have registered

under the Securities Act of 1933, as amended (the “Securities Act”). These shares can be freely sold in the public

market upon issuance, subject to volume limitations applicable to affiliates to the extent applicable.

As

of June 30, 2019, there were 856,039 shares subject to outstanding options that are issuable under our 2014 Plan, all of which

shares we have registered under the Securities Act on a registration statement on Form S-8. These shares can be freely sold

in the public market upon issuance, subject to volume limitations applicable to affiliates, to the extent applicable. As of June

30, 2019, there were 915,000 shares subject to outstanding options that are issuable under our 2018 Plan, which shares have not

yet been registered under the Securities Act and therefore may not be freely sold in the public market upon issuance.

Our

management will have broad discretion in the use of the net proceeds from this offering and may not use them effectively.

Our

management will have broad discretion in the application of the net proceeds from this offering, and our stockholders will not

have the opportunity as part of their investment decision to assess whether the net proceeds are being used appropriately. Because

of the number and variability of factors that will determine our use of the net proceeds from this offering, their ultimate use

may vary substantially from their currently intended use. The failure by our management to apply these funds effectively could

harm our business. See “Use of Proceeds” on page 10 of this prospectus for a description of our proposed use of

proceeds from this offering.

USE

OF PROCEEDS

We

estimate that the net proceeds from this offering will be approximately $ , based on an assumed offering price of $

per unit, which was the closing price of our common stock on the Nasdaq Capital Market on September , 2019, and assuming the sale

of units and no sale of any pre-funded units in this offering, after deducting the underwriting discounts and commissions and

estimated offering expenses payable by us, and excluding the proceeds, if any, from the exercise of the common warrants issued

pursuant to this offering. If the underwriter exercises its option to purchase additional securities in full, we estimate that

the net proceeds will be approximately $ , assuming an offering price of $ per unit, and assuming no sale of any pre-funded units

in this offering, after deducting the underwriting discounts and commissions and estimated offering expenses payable by us, and

excluding the proceeds, if any, from the exercise of the common warrants issued pursuant to this offering.

The

actual offering price per unit and pre-funded unit, as applicable, will be as determined between us and the underwriter at the

time of pricing, and may be at a discount to the current market price of our common stock. These estimates exclude the proceeds,

if any, from the exercise of common warrants in this offering. If all of the common warrants sold in this offering were to be

exercised in cash at an assumed exercise price of $

per unit, we would receive additional net proceeds of approximately $ million.

However, the common warrants contain a cashless exercise provision that permit exercise of the common warrants on a cashless basis

(i) at any time where there is no effective registration statement under the Securities Act covering the issuance of the underlying

shares or (ii) on the expiration date of the common warrant. We cannot predict when or if these common warrants will be exercised

or whether they will be exercised for cash. It is possible that these common warrants may be exercised solely on a cashless basis.

A

$0.25 increase or decrease in the assumed public offering price of per unit, which was the closing price of our common stock on

the Nasdaq Capital Market on September , 2019, would increase or decrease the net proceeds to us from this offering by $ ,

assuming that the number of units offered by us, as set forth on the cover page of this prospectus, remains the same, after deducting

the estimated underwriter discounts and commissions and estimated offering expenses payable by us, assuming no sale of any pre-funded

units and excluding the proceeds, if any, from the exercise of the common warrants issued pursuant to this offering.

Similarly,

each increase or decrease of 500,000 units offered by us would increase or decrease the net proceeds to us by approximately $

, assuming the assumed public offering price of $ per unit remains the same, after deducting the underwriting discounts and commissions

and estimated offering expenses payable by us, assuming no sale of any pre-funded units and excluding the proceeds, if any, from

the exercise of the common warrants issued pursuant to this offering.

We

intend to use the net proceeds from the sale of our common stock by us under this prospectus for general corporate purposes, including

our Phase 3 clinical Mino-Lok trial for the treatment of catheter related bloodstream infections, the IND development pathway

for Mino-Wrap and our Phase 2b clinical trial of Hydro-Lido cream for the treatment of hemorrhoids, and working capital and capital

expenditures.

MARKET

FOR COMMON STOCK

Prior

to August 3, 2017, our common stock traded under the ticker symbol “CTXR.QB” on the OTCQB Venture Market operated

by OTC Markets Group, Inc. (the “OTCQB”). On August 3, 2017, our common stock began trading on the Nasdaq Capital

Market, under the symbol “CTXR”.

On

September 12, 2019, the closing price as reported on the Nasdaq Capital Market of our common stock was $0.9688. As of

August 31, 2019, there were 98 holders of record of our common stock.

DIVIDEND

POLICY

We

have not paid any cash dividends on our common stock and our Board of Directors presently intends to continue a policy of retaining

earnings, if any, for use in our operations.

CAPITALIZATION

The

following table sets forth our cash and cash equivalents and capitalization as of June 30, 2019:

|

|

●

|

on

an actual basis; and

|

|

|

●

|

on

an as adjusted basis to give effect to our sale of units in this offering at an assumed

public offering price of $ per unit, the closing price for our common stock on the Nasdaq

Capital Market on September , 2019, assuming no sale of any pre-funded units in this

offering, after deducting the underwriting discounts and commissions and estimated offering

expenses payable by us, and excluding the proceeds, if any, from the exercise of the

common warrants issued pursuant to this offering.

|

Our

capitalization following the closing of this offering will be adjusted based on the actual public offering price and other terms

of this offering determined at pricing. You should read this table together with our consolidated financial statements and the

related notes and the “Management’s Discussion and Analysis of Financial Condition and Results of Operations”

section of our Quarterly Report on Form 10-Q for the quarter ended June 30, 2019, filed with the SEC on August 14, 2019,

which is incorporated by reference into this prospectus.

|

|

|

As of June 30, 2019

|

|

|

|

|

Actual

|

|

|

As

|

|

|

|

|

(Unaudited)

|

|

|

Adjusted

|

|

|

|

|

|

|

|

|

|

|

Cash

|

|

$

|

4,510,751

|

|

|

$

|

|

|

|

Preferred stock – $0.001 par value; 10,000,000 shares authorized; no shares issued and outstanding

|

|

|

--

|

|

|

|

|

|

|

Common stock - $0.001 par value; 200,000,000 shares authorized; 22,075,781 shares issued and outstanding at June 30, 2019; with _________ shares issued and outstanding as adjusted

|

|

|

22,076

|

|

|

|

|

|

|

Additional paid-in capital

|

|

|

73,655,109

|

|

|

|

|

|

|

Accumulated deficit

|

|

|

(52,170,180

|

)

|

|

(

|

|

)

|

|

Total Stockholders’ Equity

|

|

|

21,507,105

|

|

|

|

|

|

|

Total Capitalization

|

|

$

|

21,680,075

|

|

|

$

|

|

|

|

|

(1)

|

Each

$0.25 increase or decrease in the assumed public offering price per unit would increase

or decrease the amount of cash and cash equivalents, working capital, total assets, and

total stockholders’ equity by approximately $ , assuming the number of units offered

by us, as set forth on the cover page of this prospectus, remains the same and after

deducting underwriting discounts and commissions and estimated offering expenses payable

by us of $400,000. We may also increase or decrease the number of units offered in this

offering. Each increase or decrease of 500,000 units offered by us would increase or

decrease the as adjusted amount of cash and cash equivalents, working capital, total

assets and total stockholders’ equity by approximately $ assuming that the assumed