Total sales of $179.7 million, in line with

previously stated guidance

Strong financial position with liquidity of

approximately $164 million and no debt

Company updates fiscal year 2023

guidance

Citi Trends, Inc. (NASDAQ: CTRN), a leading specialty value

retailer of apparel, accessories and home trends for way less spend

primarily for African American and multicultural families in the

United States, today reported results for the first quarter ended

April 29, 2023.

Financial Highlights – First Quarter

2023

- Total sales decreased 13.7% vs. Q1 2022 in line with guidance;

Comparable store sales decreased 14.1% compared to Q1 2022

- Gross margin of 36.7%, or 37.0% as adjusted* vs. 39.0% in Q1

2022

- Operating loss was $9.5 million, or a loss of $7.9 million as

adjusted*, compared to operating income of $39.7 million, or $4.7

million as adjusted* in Q1 2022

- Net loss per share was ($0.81), or adjusted net loss per share*

of ($0.66), vs. diluted earnings per share of $3.59, or adjusted

diluted earnings per share* of $0.42 in Q1 2022

- Quarter-end total dollar inventory decreased 11.9% compared to

Q1 2022; average in-store inventory increased 8.1% compared to Q1

2022 reflecting work to rebuild inventory levels in targeted

departments

- Total liquidity of approximately $164 million at the end of the

quarter, made up of $88.7 million of cash, no borrowings under a

$75 million credit facility, and no debt

Chief Executive Officer

Comments

David Makuen, Chief Executive Officer, commented, “Against what

remained a challenging macro backdrop for the low-income families

that we serve, our first quarter results were in line with our

previously stated guidance. During the quarter, we made progress

rebuilding inventory in key areas of the business, which we believe

will position us to recoup market share. Although we are seeing

good response to our spring and early summer merchandise, our

customers are being selective about what they put in their basket.

That said, we continue to see strong shopper conversion, a clear

signal that our assortments are resonating and the Citi Trends

brand position remains healthy.”

Mr. Makuen continued, “With a macro environment that remains

uncertain, we are prudently adjusting our outlook for the fiscal

year, incorporating the impact of continued headwinds on our

customers’ spending through the first half with modest improvement

in the second half. Importantly, we remain laser focused on

controlling what we can control, including tight expense and

capital management. Looking forward, we’ll leverage our strong

financial position to procure a fresh assortment of exciting

products at amazing values that will set us up for successful

back-to-school and holiday selling seasons.”

Capital Return Program

Update

In the first quarter of 2023, the Company did not repurchase any

shares of its common stock. At the end of the first quarter of

2023, $50.0 million remained available under the Company’s share

repurchase program.

Guidance

Given the uncertain macro-economic environment, the Company is

updating its outlook for fiscal 2023 as follows:

- Full year total sales are expected to be in the range of

negative mid single-digits to negative low single-digits as

compared to fiscal 2022, assuming a challenging first half with

modest improvement in the second half of the year

- Full year EBITDA now expected to be in the range of $5 million

to $20 million

- The Company now plans to open 5 new stores and remodel 10 to 20

stores in the year

- Full year capital expenditures are now expected to be in the

range of $15 million to $20 million

- Year end cash balance is expected to be in the range of $85

million to $105 million

- The remaining aspects of the prior guidance are unchanged with

full year gross margin expected to be in the high thirties and the

closure of 10 to 15 underperforming stores

Investor Conference Call and

Webcast

Citi Trends will host a conference call today at 9:00 a.m. ET.

The number to call for the live interactive teleconference is (415)

226-5357. A replay of the conference call will be available until

May 30, 2023, by dialing (800) 633-8284 and entering the passcode,

22026757.

The live broadcast of Citi Trends' conference call will be

available online at the Company's website, cititrends.com, under

the Investor Relations section, beginning today at 9:00 a.m. ET.

The online replay will follow shortly after the call and will be

available for replay for one year.

During the conference call, the Company may discuss and answer

questions concerning business and financial developments and trends

that have occurred after quarter-end. The Company’s responses to

questions, as well as other matters discussed during the call, may

contain or constitute information that has not been disclosed

previously.

About Citi Trends

Citi Trends, Inc. is a leading specialty value retailer of

apparel, accessories and home trends for way less spend primarily

for African American and multicultural families in the United

States. The Company operates 608 stores located in 33 states. For

more information, visit cititrends.com or your local store.

*Non-GAAP Financial

Measures

The historical non-GAAP financial measures discussed herein are

reconciled to their corresponding GAAP measures at the end of this

press release.

Forward-Looking

Statements

All statements other than historical facts contained in this

news release, including statements regarding the Company’s future

financial results and position, business policy and plans,

objectives and expectations of management for future operations and

capital allocation expectations, are forward-looking statements

that are subject to material risks and uncertainties. The words

"believe," "may," "could," "plans," "estimate," “expects,”

"continue," "anticipate," "intend," "expect," “upcoming,” “trend”

and similar expressions, as they relate to the Company, are

intended to identify forward-looking statements, although not all

forward-looking statements contain such language. Statements with

respect to earnings, sales or new store guidance are

forward-looking statements. Investors are cautioned that any such

forward-looking statements are subject to the finalization of the

Company’s quarter-end financial and accounting procedures, are not

guarantees of future performance or results, and are inherently

subject to risks and uncertainties, some of which cannot be

predicted or quantified. Actual results or developments may differ

materially from those included in the forward-looking statements as

a result of various factors which are discussed in our Annual

Reports and Quarterly Reports on Forms 10-K and 10-Q, respectively,

and any amendments thereto, filed with the Securities and Exchange

Commission. These risks and uncertainties include, but are not

limited to, uncertainties relating to general economic conditions,

including inflation, energy and fuel costs, unemployment levels,

and any deterioration whether caused by acts of war, terrorism,

political or social unrest (including any resulting store closures,

damage or loss of inventory) or other factors; changes in market

interest rates and market levels of wages; natural disasters such

as hurricanes; uncertainty and economic impact of pandemics,

epidemics or other public health emergencies such as the ongoing

COVID-19 pandemic; transportation and distribution delays or

interruptions; changes in freight rates; the Company’s ability to

attract and retain workers; the Company’s ability to negotiate

effectively the cost and purchase of merchandise inventory risks

due to shifts in market demand; the Company’s ability to gauge

fashion trends and changing consumer preferences; consumer

confidence and changes in consumer spending patterns; competition

within the industry; competition in our markets; the duration and

extent of any economic stimulus programs; changes in product mix;

interruptions in suppliers’ businesses; the ongoing assessment and

impact of the cyber disruption we identified on January 14, 2023,

including legal, reputational, financial and contractual risks

resulting from the disruption, and other risks related to

cybersecurity, data privacy and intellectual property; temporary

changes in demand due to weather patterns; seasonality of the

Company’s business; the results of pending or threatened

litigation; delays associated with building, remodeling, opening

and operating new stores; and delays associated with building and

opening or expanding new or existing distribution centers. Any

forward-looking statements by the Company, with respect to

guidance, the repurchase of shares pursuant to a share repurchase

program, or otherwise, are intended to speak only as of the date

such statements are made. Except as required by applicable law,

including the securities laws of the United States and the rules

and regulations of the Securities and Exchange Commission, the

Company does not undertake to publicly update any forward-looking

statements in this news release or with respect to matters

described herein, whether as a result of any new information,

future events or otherwise.

CITI TRENDS, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (unaudited)

(in thousands, except per

share data)

First Quarter

2023

2022

2021

Net sales

$

179,688

$

208,215

$

285,381

Cost of sales (exclusive of depreciation shown separately

below)

(113,659

)

(127,011

)

(163,791

)

Selling, general and administrative expenses

(70,807

)

(71,026

)

(77,892

)

Depreciation

(4,681

)

(5,445

)

(4,697

)

Gain on sale-leaseback

—

34,920

—

(Loss) income from operations

(9,459

)

39,653

39,001

Interest income

1,023

—

4

Interest expense

(75

)

(76

)

(47

)

(Loss) income before income taxes

(8,511

)

39,577

38,958

Income tax expense

1,876

(9,374

)

(8,061

)

Net (loss) income

$

(6,635

)

$

30,203

$

30,897

Basic net (loss) income per common share

$

(0.81

)

$

3.59

$

3.27

Diluted net (loss) income per common share

$

(0.81

)

$

3.59

$

3.23

Weighted average number of shares outstanding Basic

8,182

8,407

9,450

Diluted

8,182

8,407

9,571

CITI TRENDS, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS (unaudited)

(in thousands)

April 29, 2023

April 30, 2022

Assets: Cash and cash equivalents

$

88,707

$

61,657

Inventory

114,322

129,715

Prepaid and other current assets

16,054

16,354

Property and equipment, net

57,383

68,213

Operating lease right of use assets

252,435

241,686

Other noncurrent assets

5,529

5,603

Total assets

$

534,430

$

523,228

Liabilities and Stockholders' Equity: Accounts payable

$

90,029

$

87,857

Accrued liabilities

23,473

33,614

Current operating lease liabilities

47,780

46,910

Other current liabilities

912

7,657

Noncurrent operating lease liabilities

209,594

203,856

Other noncurrent liabilities

2,680

2,155

Total liabilities

374,468

382,049

Total stockholders' equity

159,962

141,179

Total liabilities and stockholders' equity

$

534,430

$

523,228

RECONCILIATION OF NON-GAAP FINANCIAL

MEASURES (unaudited) (in thousands, except per share

data)

The Company makes reference in this release to adjusted gross

margin, adjusted operating income and adjusted earnings per diluted

share. The Company believes these supplemental measures reflect

operating results that are more indicative of the Company's ongoing

operating performance while improving comparability to prior and

future periods, and as such, may provide investors with an enhanced

understanding of the Company's past financial performance and

prospects for the future. This information is not intended to be

considered in isolation or as a substitute for net income or

earnings per diluted share prepared in accordance with generally

accepted accounting principles (GAAP).

First Quarter

2023

Reconciliation of Adjusted Gross Margin Net sales

$

179,688

Cost of sales

(113,659

)

Gross profit

$

66,029

Gross margin

36.7

%

Cyber incident expenses

$

513

Adjusted gross profit

$

66,542

Adjusted gross margin

37.0

%

First Quarter

2023

2022

Reconciliation of Adjusted Operating Income Operating (loss)

income

$

(9,459

)

$

39,653

Cyber incident expenses

1,560

—

Gain on sale-leasebacks

—

(34,920

)

Adjusted operating (loss) income

$

(7,899

)

$

4,733

First Quarter

2023

2022

Reconciliation of Adjusted Diluted EPS Diluted (loss)

earnings per share

$

(0.81

)

$

3.59

Cyber incident expenses

0.19

—

Gain on sale-leasebacks

—

(4.15

)

Tax effect

(0.04

)

0.98

Adjusted diluted (loss) earnings per share

$

(0.66

)

$

0.42

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230523005328/en/

Tom Filandro/Rachel Schacter ICR, Inc.

CitiTrendsIR@icrinc.com

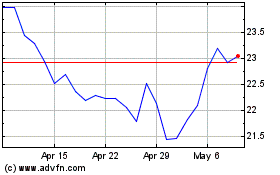

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Apr 2023 to Apr 2024