Total second quarter sales of $185.0 million

with gross margin of 38.1%

Comparable sales decreased 24.9% vs. 25.6%

increase in Q2 2021 vs. Q2 2019; 3 year stack of 0.7%

First half 2022 net income of $27.7 million;

adjusted EBITDA* of $12.1 million

Expects to close second sale-leaseback

transaction for $36 million in September

Company is aggressively lowering expenses to

align with the current demand environment

Expects second half operating income to be

approximately in line with second half of 2019

Citi Trends, Inc. (NASDAQ: CTRN), a leading specialty value

retailer of apparel, accessories and home trends for way less spend

primarily for African American and Latinx families in the United

States, today reported results for the second quarter ended July

30, 2022.

The Company is reporting select operating results for the second

quarter and first half of 2022 relative to the same periods of 2019

due to the unique operating environment resulting from the COVID-19

pandemic and related government stimulus in 2020 and 2021.

Financial Highlights – Second Quarter

2022

- Total sales of $185.0 million decreased 22.0% vs. Q2 2021 and

increased 1.2% vs. Q2 2019; comparable sales decreased 24.9%

compared to Q2 2021 lapping a 25.6% increase in Q2 2021 vs Q2 2019;

3 year stack of 0.7%

- Comparable store transactions vs. prior year sequentially

improved 510 bps from Q1 to Q2; conversion remained strong and

year-to-date average basket size contracted only 5.4% compared to

the same period in the prior year, a period with unprecedented

government stimulus assistance

- Gross margin of 38.1% vs. 40.8% in Q2 2021 and 37.3% in Q2

2019

- SG&A expense dollars declined 9.2% vs. Q2 2021; SG&A

expenses deleveraged 520 bps vs. Q2 2021 to 37.0% of total sales on

lower sales base and deleveraged 250 bps vs. Q2 2019

- Operating loss of $3.3 million compared to operating income of

$16.4 million in Q2 2021 and $0.2 million in Q2 2019; EBITDA of

$1.9 million compared to $21.4 million in Q2 2021 and $4.8 million

in Q2 2019

- Diluted loss per share of $0.31 vs. diluted earnings per share

of $1.36 in Q2 2021 and $0.03 in Q2 2019

- Quarter-end total dollar inventory increased 25.5% vs Q2 2021

and 7.6% vs Q2 2019. Excluding packaway goods, inventory increased

8.0% compared to Q2 2021 and decreased 4.3% vs. Q2 2019; average

in-store inventory decreased 12.7% vs Q2 2019

- Cash of $27.9 million at the end of the quarter, with no debt

and no borrowings under a $75 million credit facility

Financial Highlights – 26 week first

half ended July 30, 2022

- Total sales of $393.2 million decreased 24.8% vs. 2021,

increased 1.4% vs. 2019; comparable sales decreased 27.2% compared

to 2021 on top of a 30.4% increase in 2021 vs 2019; 3 year stack of

3.2%

- Gross margin of 38.6% vs. 41.8% in 2021 and 37.4% in 2019

- Operating income of $36.3 million, or $1.4 million as adjusted*

for the gain on the sale of a distribution center, vs. $55.4

million in 2021 and $8.9 million in 2019, or $9.9 million as

adjusted*

- Net income of $27.7 million, or $1.0 million as adjusted*, vs.

$43.4 million in 2021 and $8.2 million in 2019, or $9.1 million as

adjusted*

- Adjusted EBITDA* of $12.1 million, vs. $65.1 million in 2021

and vs. $19.6 million in 2019, as adjusted*

- Diluted EPS of $3.34; adjusted diluted EPS* of $0.12, vs. $4.63

in 2021 and $0.68 in 2019, or $0.76 as adjusted*

Chief Executive Officer

Comments

David Makuen, Chief Executive Officer, said, “The first half of

2022 was a challenging period as our customers, particularly those

in the lowest income bracket, were under extraordinary pressure

from widespread inflation, reducing their visits to stores for

discretionary apparel and accessory purchases. It’s difficult to

predict when this slower demand cycle will abate, therefore, we

have revised our outlook for fiscal 2022 and have made it our

number one priority to lower our SG&A expenses to align with a

lower sales expectation. In fact, we are taking swift action on

approximately $10 million in expense savings for the back half of

2022, or about 7% of total second half SG&A expenses, including

a 10% staff reduction. We wish the very best to the associates

impacted by this difficult decision and truly appreciate their

contributions.”

Mr. Makuen continued, “During the quarter, we continued

optimizing our Buy, Move, Sell and Support teams as we remain

hyper-focused on driving healthy sales, managing inventories and

maximizing margin to improve our operating profit. We are also

prudently reducing capital expenditures by approximately $10

million to ensure we have additional liquidity to chase

opportunities as they arise. We continue to believe there is

significant white space opportunity to grow the Citi Trends brand

and have confidence that our neighborhood customers, whom we know

to be resilient and loyal, will allow us to return to a position of

growth in time.”

Capital Return Program

Update

In the second quarter, the Company repurchased approximately

160,000 shares of its common stock at an aggregate cost of $4.7

million. In the first half of fiscal 2022, the Company repurchased

approximately 331,000 shares of its common stock at an aggregate

cost of $10.0 million. At the end of the second quarter of 2022,

$50.0 million remained available under the Company’s share

repurchase program.

Sale-Leaseback Update

As previously announced, the Company underwent a comprehensive

review of its owned real estate. As a result, the Company has

elected to proceed with a sale-leaseback agreement with an

affiliate of Oak Street Real Estate Capital, LLC, a division of

Blue Owl, for its distribution center located in Roland, Oklahoma.

The Company anticipates closing the transaction in September for an

expected purchase price of $36 million.

Guidance

The Company is providing the following updated guidance for

2022, which includes the impact of the sale-leaseback of the Roland

distribution center:

- Expects low single digit increase in second half total sales

compared to first half total sales; for the full year this

represents an 8% to 10% decline from the mid-point of previous

guidance of $870 million

- Expects gross margin to remain in the high 30s to low 40s range

for the second half

- Expects significantly less SG&A expense deleverage in the

second half vs. the same period in the prior year as a result of

swift expense reduction actions net of incremental lease expense

from the sale-leaseback transactions

- Expects second half operating income to be approximately in

line with the second half of 2019

- Expects year-end cash balance of approximately $85 million to

$100 million

Investor Conference Call and

Webcast

Citi Trends will host a conference call today at 9:00 a.m. ET.

The number to call for the live interactive teleconference is (212)

231-2900. A replay of the conference call will be available until

August 30, 2022, by dialing (402) 977-9140 and entering the

passcode, 22019378.

The live broadcast of Citi Trends' conference call will be

available online at the Company's website, cititrends.com, under

the Investor Relations section, beginning today at 9:00 a.m. ET.

The online replay will follow shortly after the call and will be

available for replay for one year.

During the conference call, the Company may discuss and answer

questions concerning business and financial developments and trends

that have occurred after quarter-end. The Company’s responses to

questions, as well as other matters discussed during the call, may

contain or constitute information that has not been disclosed

previously.

About Citi Trends

Citi Trends, Inc. is a leading specialty value retailer of

apparel, accessories and home trends for way less spend primarily

for African American and Latinx families in the United States. The

Company operates 617 stores located in 33 states. For more

information, visit cititrends.com or your local store.

*Non-GAAP Financial

Measures

The historical non-GAAP financial measures discussed herein are

reconciled to their corresponding GAAP measures at the end of this

press release.

Forward-Looking

Statements

All statements other than historical facts contained in this

news release, including statements regarding the Company’s future

financial results and position, business policy and plans,

objectives and expectations of management for future operations and

capital allocation expectations, are forward-looking statements

that are subject to material risks and uncertainties. The words

"believe," "may," "could," "plans," "estimate," “expects,”

"continue," "anticipate," "intend," "expect," “upcoming,” “trend”

and similar expressions, as they relate to the Company, are

intended to identify forward-looking statements, although not all

forward-looking statements contain such language. Statements with

respect to earnings, sales or new store guidance are

forward-looking statements. Investors are cautioned that any such

forward-looking statements are subject to the finalization of the

Company’s quarter-end financial and accounting procedures, are not

guarantees of future performance or results, and are inherently

subject to risks and uncertainties, some of which cannot be

predicted or quantified. Actual results or developments may differ

materially from those included in the forward-looking statements as

a result of various factors which are discussed in our Annual

Reports and Quarterly Reports on Forms 10-K and 10-Q, respectively,

and any amendments thereto, filed with the Securities and Exchange

Commission. These risks and uncertainties include, but are not

limited to, uncertainties relating to general economic conditions,

including inflation, energy and fuel costs, unemployment levels,

and any deterioration whether caused by acts of war, terrorism,

political or social unrest (including any resulting store closures,

damage or loss of inventory) or other factors; changes in market

interest rates and market levels of wages; natural disasters such

as hurricanes; public health emergencies such as the ongoing

COVID-19 pandemic and associated containment and remediation

efforts, the potential negative impacts of COVID-19 on the global

economy and foreign sourcing; the impacts of COVID-19 on the

Company's financial condition, business operations and liquidity,

including the re-closure of any or all of the Company’s retail

stores and distribution centers; transportation and distribution

delays or interruptions; changes in freight rates; the Company’s

ability to attract and retain workers; the Company’s ability to

negotiate effectively the cost and purchase of merchandise

inventory risks due to shifts in market demand; the Company’s

ability to gauge fashion trends and changing consumer preferences;

consumer confidence and changes in consumer spending patterns;

competition within the industry; competition in our markets; the

duration and extent of any economic stimulus programs; changes in

product mix; interruptions in suppliers’ businesses; temporary

changes in demand due to weather patterns; seasonality of the

Company’s business; changes in market interest rates and market

levels of wages; the results of pending or threatened litigation;

delays associated with building, remodeling, opening and operating

new stores; and delays associated with building and opening or

expanding new or existing distribution centers. Any forward-looking

statements by the Company, with respect to guidance, the repurchase

of shares pursuant to a share repurchase program, or otherwise, are

intended to speak only as of the date such statements are made.

Except as required by applicable law, including the securities laws

of the United States and the rules and regulations of the

Securities and Exchange Commission, the Company does not undertake

to publicly update any forward-looking statements in this news

release or with respect to matters described herein, whether as a

result of any new information, future events or otherwise.

CITI TRENDS, INC. CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (unaudited) (in thousands, except

per share data) Thirteen Weeks Ended

July 30, 2022 July 31, 2021 August 3, 2019 Net

sales

$

185,012

$

237,281

$

182,830

Cost of sales (exclusive of depreciation shown separately

below)

(114,589

)

(140,542

)

(114,612

)

Selling, general and administrative expenses

(68,481

)

(75,383

)

(62,989

)

Depreciation

(5,272

)

(4,994

)

(4,607

)

Asset impairment

—

—

(472

)

(Loss) income from operations

(3,330

)

16,362

150

Interest income

2

2

414

Interest expense

(78

)

(77

)

(40

)

(Loss) income before income taxes

(3,406

)

16,287

524

Income tax benefit (expense)

870

(3,797

)

(147

)

Net (loss) income

$

(2,536

)

$

12,490

$

377

Basic net (loss) income per common share

$

(0.31

)

$

1.37

$

0.03

Diluted net (loss) income per common share

$

(0.31

)

$

1.36

$

0.03

Weighted average number of shares outstanding Basic

8,165

9,088

11,882

Diluted

8,165

9,178

11,882

Twenty-Six Weeks Ended July 30,

2022 July 31, 2021 August 3, 2019 (unaudited)

(unaudited) (unaudited) Net sales

$

393,227

$

522,662

$

387,862

Cost of sales (exclusive of depreciation shown separately

below)

(241,600

)

(304,333

)

(242,850

)

Selling, general and administrative expenses

(139,507

)

(153,275

)

(126,436

)

Depreciation

(10,717

)

(9,691

)

(9,221

)

Asset impairment

—

—

(472

)

Gain on sale of building

34,920

—

—

Income from operations

36,323

55,363

8,883

Interest income

2

6

793

Interest expense

(154

)

(124

)

(78

)

Income before income taxes

36,171

55,245

9,598

Income tax expense

(8,504

)

(11,858

)

(1,433

)

Net income

$

27,667

$

43,387

$

8,165

Basic net income per common share

$

3.34

$

4.68

$

0.68

Diluted net income per common share

$

3.34

$

4.63

$

0.68

Weighted average number of shares outstanding Basic

8,284

9,269

11,929

Diluted

8,284

9,374

11,944

CITI TRENDS, INC. CONDENSED CONSOLIDATED

BALANCE SHEETS (unaudited) (in thousands) July

30, 2022 July 31, 2021 (unaudited) (unaudited) Assets:

Cash and cash equivalents

$

27,914

$

76,751

Short-term investment securities

—

24,603

Inventory

142,101

113,186

Prepaid and other current assets

17,728

19,144

Property and equipment, net

72,450

66,524

Operating lease right of use assets

237,556

190,503

Deferred tax assets

2,538

4,086

Other noncurrent assets

1,252

1,414

Total assets

$

501,539

$

496,211

Liabilities and Stockholders' Equity: Accounts payable

$

82,956

$

99,177

Accrued liabilities

33,797

43,799

Current operating lease liabilities

47,547

47,145

Income tax payable

—

3,642

Other current liabilities

1,205

1,133

Noncurrent operating lease liabilities

200,220

156,592

Other noncurrent liabilities

2,204

2,349

Total liabilities

367,929

353,837

Total stockholders' equity

133,610

142,374

Total liabilities and stockholders' equity

$

501,539

$

496,211

CITI TRENDS, INC. RECONCILIATION OF GAAP BASIS

OPERATING RESULTS TO ADJUSTED NON-GAAP OPERATING RESULTS

(unaudited) (in thousands, except per share data)

The Company makes reference in this release to adjusted net

income, adjusted earnings per diluted share, adjusted operating

income, EBITDA and Adjusted EBITDA. The Company believes these

supplemental measures reflect operating results that are more

indicative of the Company's ongoing operating performance while

improving comparability to prior and future periods, and as such,

may provide investors with an enhanced understanding of the

Company's past financial performance and prospects for the future.

This information is not intended to be considered in isolation or

as a substitute for net income or earnings per diluted share

prepared in accordance with generally accepted accounting

principles (GAAP).

Twenty-Six Weeks Ended July 30, 2022 As

Reported Adjustment (1) As Adjusted Net sales

$

393,227

$

—

$

393,227

Cost of sales (exclusive of depreciation shown

separately below)

(241,600

)

—

(241,600

)

Selling, general and administrative expenses

(139,507

)

—

(139,507

)

Depreciation

(10,717

)

—

(10,717

)

Gain on sale of building

34,920

(34,920

)

—

Income from operations

36,323

(34,920

)

1,403

Interest income

2

—

2

Interest expense

(154

)

—

(154

)

Income before income taxes

36,171

(34,920

)

1,251

Income tax expense

(8,504

)

8,210

(294

)

Net income

$

27,667

$

(26,710

)

$

957

Basic net income per common share

$

3.34

$

0.12

Diluted net income per common share

$

3.34

$

0.12

Weighted average number of shares outstanding

Basic

8,284

8,284

Diluted

8,284

8,284

Twenty-Six Weeks Ended August

3, 2019 As Reported Adjustment (2) As

Adjusted Net sales

$

387,862

$

—

$

387,862

Cost of sales (exclusive of depreciation shown

separately below)

(242,850

)

—

(242,850

)

Selling, general and administrative expenses

(126,436

)

1,042

(125,394

)

Depreciation

(9,221

)

—

(9,221

)

Asset impairment

(472

)

—

(472

)

Income from operations

8,883

1,042

9,925

Interest income

793

—

793

Interest expense

(78

)

—

(78

)

Income before income taxes

9,598

1,042

10,640

Income tax expense

(1,433

)

(156

)

(1,589

)

Net income

$

8,165

$

886

$

9,051

Basic net income per common share

$

0.68

$

0.76

Diluted net income per common share

$

0.68

$

0.76

Weighted average number of shares outstanding

Basic

11,929

11,929

Diluted

11,944

11,944

(1) Gain on sale of distribution center

in Darlington, South Carolina and related tax effects (2) Proxy

contest expenses and related tax effects

CITI TRENDS, INC. RECONCILIATION OF GAAP BASIS

OPERATING RESULTS TO ADJUSTED NON-GAAP OPERATING RESULTS

(unaudited) (in thousands, except per share data)

Thirteen Weeks Ended July 30,

2022 July 31, 2021 August 3, 2019 Net (loss)

income

$

(2,536

)

$

12,490

$

377

Interest income

(2

)

(2

)

(414

)

Interest expense

78

77

40

Income tax benefit (expense)

(870

)

3,797

147

Depreciation

5,272

4,994

4,607

EBITDA

$

1,942

$

21,356

$

4,757

Asset impairment

—

—

472

Adjusted EBITDA

$

1,942

$

21,356

$

5,229

Twenty-Six Weeks Ended

July 30, 2022 July 31, 2021 August 3,

2019 Net income

$

27,667

$

43,387

$

8,165

Interest income

(2

)

(6

)

(793

)

Interest expense

154

124

78

Income tax expense

8,504

11,858

1,433

Depreciation

10,717

9,691

9,221

EBITDA

$

47,040

$

65,054

$

18,104

Gain on sale of building

(34,920

)

—

—

Asset impairment

—

—

472

Proxy contest expenses

—

—

1,042

Adjusted EBITDA

$

12,120

$

65,054

$

19,618

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220824005241/en/

Tom Filandro/Rachel Schacter ICR, Inc.

CitiTrendsIR@icrinc.com

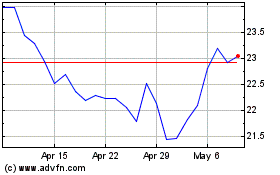

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Apr 2023 to Apr 2024