Citi Trends Draws Down on Credit Facility

March 23 2020 - 7:00AM

Business Wire

Citi Trends, Inc. (NASDAQ: CTRN) announced today that it has

drawn down $43.7 million in principal amount under its committed

$50 million revolving credit facility.

The Company’s borrowing under its revolving credit facility was

a proactive measure taken by the Company to increase its cash

position and preserve financial flexibility in light of current

uncertainties resulting from the coronavirus (COVID-19) outbreak.

In accordance with the terms of the revolving credit facility, the

proceeds from this borrowing may in the future be used for working

capital, general corporate purposes or other purposes permitted by

the revolving credit facility.

The draw down on the facility is in addition to the actions

previously announced that are being taken by the Company to

strengthen its financial position and balance sheet and preserve

liquidity during these uncertain times. These additional actions

include reviewing all operating expenses, reducing capital

expenditures, reducing inventory as appropriate and for the time

being, the Company is not intending to repurchase any shares under

the previously announced share repurchase program.

About Citi Trends

Citi Trends, Inc. is a value-priced retailer of fashion apparel,

accessories and home goods for the entire family. The Company

operates 574 stores located in 33 states. Citi Trends’ website

address is www.cititrends.com. CTRN-G

Forward-Looking

Statements

All statements other than historical facts contained in this

news release are forward-looking statements that are subject to

material risks and uncertainties. The words "believe," "may,"

"could," "plans," "estimate," "continue," "anticipate," "intend,"

"expect," “upcoming,” “trend” and similar expressions, as they

relate to the Company, are intended to identify forward-looking

statements, although not all forward-looking statements contain

such language. Investors are cautioned that any such

forward-looking statements are not guarantees of future performance

or results and are inherently subject to risks and uncertainties,

some of which cannot be predicted or quantified. Actual results or

developments may differ materially from those included in the

forward-looking statements as a result of various factors which are

discussed in the Company’s filings with the Securities and Exchange

Commission, including those set forth under the heading “Item 1A.

Risk Factors” in the Company’s Form 10-K for the fiscal year ended

February 2, 2019. These risks and uncertainties include, but are

not limited to, potential risks and uncertainties relating to the

ultimate geographic spread of the coronavirus (COVID-19), the

severity of the disease, the duration of the COVID-19 outbreak,

actions that may be taken by governmental authorities to contain

the COVID-19 outbreak or to treat its impact, the potential

negative impacts of COVID-19 on the global economy and foreign

sourcing and the impacts of COVID-19 on the Company's financial

condition and business operation. Any forward-looking statements by

the Company are intended to speak only as of the date such

statements are made. Except as required by applicable law,

including the securities laws of the United States and the rules

and regulations of the Securities and Exchange Commission, the

Company does not undertake to publicly update any forward-looking

statements in this news release or with respect to matters

described herein, whether as a result of any new information,

future events or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200323005088/en/

Investor Relations Contact: Tom Filandro ICR, Inc. (646)

277-1235

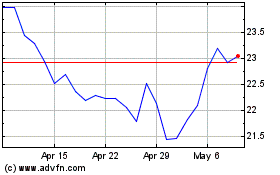

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Apr 2023 to Apr 2024