Fourth quarter comparable store sales up

3.1%

Fourth quarter earnings per diluted share up

42% to $0.84, or up 49% to $0.88 on an adjusted basis*

Fourth quarter gross profit expands 235

basis points to 39.7%

Continued capital return program, returning

$32 million to shareholders in fiscal 2019 and authorizing a new

$30 million share repurchase program

Fiscal 2019 earnings per diluted share were

$1.41, or $1.56 on an adjusted basis* exceeding prior

guidance

Initial guidance for fiscal 2020 earnings

per diluted share of $1.75 to $1.85 on an adjusted basis*

Citi Trends, Inc. (NASDAQ:

CTRN) today reported results for the fourth quarter and fiscal year

ended February 1, 2020.

Financial Highlights – 13-week fourth

quarter ended February 1, 2020

- Total sales increased 4.9% to $211.0 million compared with

$201.2 million in the fourth quarter of fiscal 2018

- Comparable store sales increased 3.1%

- Gross profit expands 235 basis points to 39.7% reflecting

strong full price selling and lower markdown rates

- Selling, general and administrative expenses de-leveraged 151

basis points to 32.1% primarily due to higher distribution center

labor costs and the reversal of an accrual for incentive

compensation in the prior year

- Operating profit increased 27.7% to $11.3 million, or an

operating profit margin of 5.3%, up 116 basis points as compared to

the fourth quarter of fiscal 2018

- Net income was $9.4 million compared with $7.3 million in the

fourth quarter of fiscal 2018 on a GAAP basis, or $9.9 million* in

the fourth quarter of fiscal 2019 when adjusted for interim CEO

related expenses

- Earnings per diluted share were $0.84 compared with $0.59 in

the fourth quarter of fiscal 2018 on a GAAP basis, or $0.88* in the

fourth quarter of fiscal 2019 when adjusted for interim CEO related

expenses

- Quarter-end inventory was down 1.1% comparing favorably to the

4.9% total sales increase for the fourth quarter, which led to a

high quality inventory position entering the spring season

Financial Highlights – 52-week fiscal

year ended February 1, 2020

- Total sales increased 1.6% to $781.9 million compared with

$769.6 in fiscal 2018

- Comparable store sales decreased 0.1%

- Net income was $16.5 million compared with $21.4 million in

fiscal 2018 on a GAAP basis, or $18.2 million* in fiscal 2019 when

adjusted for interim CEO related expenses, proxy contest-related

expenses and asset impairment expenses

- Earnings per diluted share were $1.41 compared with $1.64 in

fiscal 2018 on a GAAP basis, or $1.56* in fiscal 2019 when adjusted

for interim CEO related expenses, proxy contest-related expenses

and asset impairment expenses, compared to $1.71* in fiscal 2018 on

an adjusted basis

- In fiscal 2019, Citi Trends opened 16 new stores; remodeled,

relocated or expanded 25 stores; and closed 7 stores to end the

year at a total of 571 open stores.

Executive Chairman

Comments:

Peter Sachse, Executive

Chairman, commented, “We ended 2019 on a high note with strong top

and bottom line results that reflect continued progress on a number

of our strategic initiatives. We successfully continued to shift

our offering towards more non-apparel merchandise, while fueling

our growth with lower inventory levels and faster turns, resulting

in significantly higher gross profit. We are entering the spring

season with current merchandise at lower inventory levels than in

recent years, which will enable us to deliver a higher level of

fresh fashion and drive our sales in the first half of the year. I

am confident we are well positioned to achieve our three year

objectives, including a net sales CAGR of approximately 8.5%

reaching $1.0 billion in sales and delivering an EPS CAGR of

20-25%.”

Mr. Sachse continued, “Like

many others, we are paying close attention to developments relating

to the outbreak of the coronavirus (COVID-19). First and foremost,

we are focused on the health and safety of our employees and

customers, as well as planning for business continuity. We are

closely monitoring local, state and federal government agencies to

ensure we follow best practices surrounding the coronavirus. The

extent and duration of the impacts that the coronavirus may have on

our business are not known at this time, but we are monitoring

developments in order to be in a position to take appropriate

action.”

Guidance

- For the first five plus weeks of fiscal 2020, the Company is

+3.6% in comparable stores sales, despite a delay in income tax

refunds that materially affected the third week of February.

- The Company’s guidance for first quarter earnings per diluted

share is in a range of $0.87 to $0.91* on an adjusted basis, which

excludes an expected $0.04 per share impact of management

transition costs and compares with last year’s first quarter of

$0.72* on an adjusted basis.

- The Company’s guidance for the first quarter is based on a

comparable store sales increase of approximately 2.5% to 3.0%.

- For fiscal 2020, the Company expects diluted earnings per share

to be in a range of $1.75 to $1.85* on an adjusted basis, assuming

a comparable store sales increase in a range of 2.5% to 3.5%,

compared with adjusted diluted earnings per share of $1.56* in

fiscal 2019.

The Company’s 2020 guidance

does not include any potential impact related to the

coronavirus.

Long-Term Strategic Plan

Update

The Company is continuing to

make meaningful progress on its long-term strategic plan,

including:

- Approving 22 of the planned 30 store openings for fiscal

2020

- Completing 20 of the 50 planned remodels for fiscal 2020 with

the remaining 30 targeted for completion by the end of May

2020

- Hiring Deloitte to identify and execute our strategic systems

road map

- Making significant improvements to the Company’s supply chain,

including reducing freight costs and efficiencies within the

distribution centers

Capital Return Program

As previously announced on

November 26, 2019, the Company’s Board of Directors authorized a

$25 million share repurchase program. Since that announcement, the

Company has completed that repurchase program. Since the beginning

of 2019, the Company has returned approximately $32 million to its

shareholders in the form of share repurchases and

dividends.

The Company’s Board of

Directors today announced the authorization of another $30 million

share repurchase program. The Company expects to fund the share

repurchase program from cash on hand.

Investor Conference Call and

Webcast

Citi Trends will host a

conference call today at 9:00 a.m. ET. The number to call for the

live interactive teleconference is (212) 231-2931. A replay of the

conference call will be available until March 20, 2020, by dialing

(402) 977-9140 and entering the passcode, 21951761.

The live broadcast of Citi

Trends' conference call will be available online at the Company's

website, www.cititrends.com, under the Investor Relations section,

beginning today at 9:00 a.m. ET. The online replay will follow

shortly after the call and will be available for replay for one

year.

During the conference call,

the Company may discuss and answer questions concerning business

and financial developments and trends that have occurred after

quarter-end. The Company’s responses to questions, as well as other

matters discussed during the conference call, may contain or

constitute information that has not been disclosed

previously.

About Citi Trends

Citi Trends, Inc. is a

value-priced retailer of urban fashion apparel, accessories and

home goods for the entire family. The Company operates 574 stores

located in 33 states. Citi Trends’ website address is

www.cititrends.com. CTRN-G

*Non-GAAP Financial

Measures

The historical non-GAAP

financial measures discussed herein are reconciled to their

corresponding GAAP measures at the end of this press release. The

Company is unable to provide a full reconciliation of the GAAP and

non-GAAP measures used in 2020 guidance without unreasonable effort

because it is not possible to predict certain of its adjustment

items with a reasonable degree of certainty. This information is

dependent upon future events and may be outside of the Company’s

control and its unavailability could have a significant impact on

its financial results.

Forward-Looking Statements

All statements other than

historical facts contained in this news release, including

statements regarding the Company’s future financial results and

position, business policy and plans, objectives of management for

future operations and our intentions and ability to pay dividends

and complete any share repurchase authorizations, are

forward-looking statements that are subject to material risks and

uncertainties. The words "believe," "may," "could," "plans,"

"estimate," "continue," "anticipate," "intend," "expect,"

“upcoming,” “trend” and similar expressions, as they relate to the

Company, are intended to identify forward-looking statements,

although not all forward-looking statements contain such language.

Statements with respect to earnings, sales or new store guidance

are forward-looking statements. Investors are cautioned that any

such forward-looking statements are subject to the finalization of

the Company’s quarter-end financial and accounting procedures, are

not guarantees of future performance or results and are inherently

subject to risks and uncertainties, some of which cannot be

predicted or quantified. Actual results or developments may differ

materially from those included in the forward-looking statements as

a result of various factors which are discussed in the Company’s

filings with the Securities and Exchange Commission, including

those set forth under the heading “Item 1A. Risk Factors” in the

Company’s Form 10-K for the fiscal year ended February 2, 2019.

These risks and uncertainties include, but are not limited to,

uncertainties relating to economic conditions, the impact of

potential global health emergencies such as COVID-19 (coronavirus),

including potential negative impacts on the global economy and

foreign sourcing, growth risks, consumer spending patterns,

competition within the industry, competition in our markets and the

ability to anticipate and respond to fashion trends. Any

forward-looking statements by the Company, with respect to

guidance, the Company’s intention to declare and pay dividends, the

repurchase of shares pursuant to a share repurchase program, or

otherwise, are intended to speak only as of the date such

statements are made. Except as required by applicable law,

including the securities laws of the United States and the rules

and regulations of the Securities and Exchange Commission, the

Company does not undertake to publicly update any forward-looking

statements in this news release or with respect to matters

described herein, whether as a result of any new information,

future events or otherwise.

CITI TRENDS, INC. CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS (unaudited) (in thousands, except per share

data) Thirteen Weeks Ended Thirteen

Weeks Ended February 1, 2020 February 2, 2019

(unaudited) (unaudited) Net sales

$

211,013

$

201,158

Cost of sales (exclusive of depreciation shown separately

below)

(127,311

)

(126,095

)

Selling, general and administrative expenses

(67,654

)

(61,460

)

Depreciation

(4,794

)

(4,636

)

Asset impairment

-

(152

)

Income from operations

11,254

8,815

Interest income

363

374

Interest expense

(41

)

(40

)

Income before income taxes

11,576

9,149

Income tax expense

(2,154

)

(1,802

)

Net income

$

9,422

$

7,347

Basic net income per common share

$

0.84

$

0.59

Diluted net income per common share

$

0.84

$

0.59

Weighted average number of shares outstanding Basic

11,202

12,447

Diluted

11,271

12,471

Fifty-Two Weeks Ended

Fifty-Two Weeks Ended February 1, 2020 February 2,

2019 (unaudited) (unaudited) Net sales

$

781,925

$

769,553

Cost of sales (exclusive of depreciation shown separately

below)

(484,740

)

(476,326

)

Selling, general and administrative expenses

(259,629

)

(247,938

)

Depreciation

(18,535

)

(18,886

)

Asset impairment

(472

)

(1,274

)

Income from operations

18,549

25,129

Interest income

1,577

1,353

Interest expense

(158

)

(154

)

Income before income taxes

19,968

26,328

Income tax expense

(3,465

)

(4,954

)

Net income

$

16,503

$

21,374

Basic net income per common share

$

1.41

$

1.64

Diluted net income per common share

$

1.41

$

1.64

Weighted average number of shares outstanding Basic

11,674

13,030

Diluted

11,699

13,070

CITI TRENDS, INC. CONDENSED CONSOLIDATED BALANCE

SHEETS (unaudited) (in thousands) February 1,

2020 February 2, 2019 (unaudited) (unaudited) Assets:

Cash and cash equivalents

$

19,923

$

17,863

Short-term investment securities

27,562

50,350

Inventory

138,258

139,841

Prepaid and other current assets

15,464

17,544

Property and equipment, net

64,985

56,224

Operating lease right of use assets (1)

169,854

-

Long-term investment securities

15,675

8,883

Other noncurrent assets

7,424

7,284

Total assets

$

459,145

$

297,989

Liabilities and Stockholders' Equity: Accounts payable

$

79,596

$

73,391

Accrued liabilities

27,768

28,057

Current operating lease liabilities (1)

42,944

-

Other current liabilities

554

921

Noncurrent operating lease liabilities (1)

135,316

-

Noncurrent liabilities

1,923

8,195

Total liabilities

288,101

110,564

Total stockholders' equity

171,044

187,425

Total liabilities and stockholders' equity

$

459,145

$

297,989

(1) Lease assets and liabilities recorded in

connection with the adoption of ASU No. 2016-02, Leases (Topic 842)

CITI TRENDS, INC. RECONCILIATION OF GAAP BASIS

OPERATING RESULTS TO ADJUSTED NON-GAAP OPERATING RESULTS

(unaudited) (in thousands, except per share data)

The Company makes reference in this release to net income

adjusted for proxy contest and interim CEO related expenses and

earnings per diluted share adjusted for proxy contest expenses,

interim CEO related expenses and asset impairment expenses for the

thirteen and fifty-two weeks ended February 1, 2020, as well as the

fifty-two weeks ended February 2, 2019 and the thirteen weeks ended

May 4, 2019. The Company believes that excluding proxy contest

expenses, interim CEO related expenses and asset impairment

expenses together with their related tax effects from its financial

results reflects operating results that are more indicative of the

Company's ongoing operating performance while improving

comparability to prior and future periods, and as such, may provide

investors with an enhanced understanding of the Company's past

financial performance and prospects for the future. This

information is not intended to be considered in isolation or as a

substitute for net income or earnings per diluted share prepared in

accordance with generally accepted accounting principles (GAAP).

Fifty-Two Weeks Ended February 1, 2020 As Reported

Adjustment (1) Adjustment (2) Adjustment (3)

As Adjusted (unaudited) (unaudited) (unaudited) Net

sales

$

781,925

$

-

$

-

$

-

$

781,925

Cost of sales (exclusive of depreciation shown separately

below)

(484,740

)

-

-

-

(484,740

)

Selling, general and administrative expenses

(259,629

)

571

1,042

-

(258,016

)

Depreciation

(18,535

)

-

-

-

(18,535

)

Asset impairment

(472

)

-

-

472

-

Income from operations

18,549

571

1,042

472

20,634

Interest income

1,577

-

-

-

1,577

Interest expense

(158

)

-

-

-

(158

)

Income before income taxes

19,968

571

1,042

472

22,053

Income tax expense

(3,465

)

(99

)

(181

)

(82

)

(3,827

)

Net income

$

16,503

$

472

$

861

$

390

$

18,226

Basic net income per common share

$

1.41

$

1.56

Diluted net income per common share

$

1.41

$

1.56

Weighted average number of shares outstanding Basic

11,674

11,674

Diluted

11,699

11,699

(1) Interim CEO related expenses and related tax effects (2)

Proxy contest expenses and related tax effects (3) Asset impairment

expenses and related tax effects

Thirteen Weeks Ended February

1, 2020 As Reported Adjustment (1) As

Adjusted (unaudited) (unaudited) (unaudited) Net sales

$

211,013

$

-

$

211,013

Cost of sales (exclusive of depreciation shown separately

below)

(127,311

)

-

(127,311

)

Selling, general and administrative expenses

(67,654

)

571

(67,083

)

Depreciation

(4,794

)

-

(4,794

)

Asset impairment

-

-

-

Income from operations

11,254

571

11,825

Interest income

363

-

363

Interest expense

(41

)

-

(41

)

Income before income taxes

11,576

571

12,147

Income tax expense

(2,154

)

(106

)

(2,260

)

Net income

$

9,422

$

465

$

9,887

Basic net income per common share

$

0.84

$

0.88

Diluted net income per common share

$

0.84

$

0.88

Weighted average number of shares outstanding Basic

11,202

11,202

Diluted

11,271

11,271

Thirteen Weeks Ended May 4, 2019 As

Reported Adjustment (2) As Adjusted (unaudited)

(unaudited) (unaudited) Net sales

$

205,032

$

-

$

205,032

Cost of sales (exclusive of depreciation shown separately

below)

(128,238

)

-

(128,238

)

Selling, general and administrative expenses

(63,447

)

1,042

(62,405

)

Depreciation

(4,614

)

-

(4,614

)

Income from operations

8,733

1,042

9,775

Interest income

379

-

379

Interest expense

(38

)

-

(38

)

Income before income taxes

9,074

1,042

10,116

Income tax expense

(1,286

)

(148

)

(1,434

)

Net income

$

7,788

$

894

$

8,682

Basic net income per common share

$

0.65

$

0.72

Diluted net income per common share

$

0.65

$

0.72

Weighted average number of shares outstanding Basic

11,976

11,976

Diluted

12,006

12,006

(1) Interim CEO related expenses and related tax

effects (2) Proxy contest expenses and related tax effects

Fifty-Two Weeks Ended February 2, 2019 As Reported

Adjustment (1) As Adjusted (unaudited) (unaudited)

(unaudited) Net sales

$

769,553

$

-

$

769,553

Cost of sales (exclusive of depreciation shown separately

below)

(476,326

)

-

(476,326

)

Selling, general and administrative expenses

(247,938

)

-

(247,938

)

Depreciation

(18,886

)

-

(18,886

)

Asset impairment

(1,274

)

1,274

-

Income from operations

25,129

1,274

26,403

Interest income

1,353

-

1,353

Interest expense

(154

)

-

(154

)

Income before income taxes

26,328

1,274

27,602

Income tax expense

(4,954

)

(240

)

(5,194

)

Net income

$

21,374

$

1,034

$

22,408

Basic net income per common share

$

1.64

$

1.72

Diluted net income per common share

$

1.64

$

1.71

Weighted average number of shares outstanding Basic

13,030

13,030

Diluted

13,070

13,070

(1) Asset impairment expenses and related tax effects

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200313005058/en/

Investor Contact: ICR, Inc. Tom Filandro, 646-277-1235

Tom.Filandro@icrinc.com

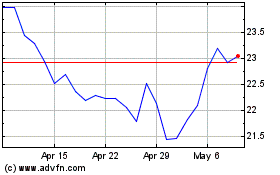

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Apr 2023 to Apr 2024