UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

DEFINITIVE SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

|

☐

|

Preliminary Proxy Statement

|

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

☒

|

Definitive Proxy Statement

|

|

|

☐

|

Definitive Additional Materials

|

|

|

☐

|

Soliciting Material Pursuant to §240.14a-12

|

|

CHINA JO-JO DRUGSTORES, INC.

|

|

(Name of Registrant as Specified in Its Charter)

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

|

☒

|

No fee required.

|

|

|

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

|

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

|

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

|

CHINA JO-JO DRUGSTORES, INC.

Hai Wai Hai Tongxin Mansion Floor 6

Gong Shu District, Hangzhou City

People’s Republic of China 310008

June 2, 2021

Dear Stockholder:

You are cordially invited

to the special meeting of stockholders (the “Special Meeting”) of China Jo-Jo Drugstores, Inc., a Nevada corporation (the

“Company”), to be held on Tuesday, July 20, 2021, at 9:00 a.m., Beijing time (July 19, 2021 at 9:00 p.m. E.T.), at the principal

office of the Company located at Hai Wai Hai Tongxin Mansion Floor 6, Gong Shu District, Hangzhou City, People’s Republic of China

310008. Only stockholders of record at the close of business on June 2, 2021 are entitled to notice of and to vote at the Special Meeting.

At the Special Meeting, you

will be asked to vote on the important matters described in the notice of Special Meeting of stockholders and proxy statement/prospectus

accompanying this letter. You will also have an opportunity to ask questions and receive information about the Company’s business.

At the Special Meeting, you

will be asked to vote on the adoption of an agreement and plan of merger, dated as of May 14, 2021 (the “Merger Agreement”),

which included a plan of merger required to be filed with the Register of Companies of the Cayman Islands, substantially in the form as

attached as Annex A to the Merger Agreement (the “Plan of Merger”) which provides for a redomicile of the Company to the Cayman

Islands through a merger (the “Redomicile Merger”) that would result in each share of the Company’s common stock being

converted into the right to receive one ordinary share in the capital of China Jo-Jo Drugstores Holdings, Inc., an exempted company incorporated

under the laws of the Cayman Islands with registration number of 373821 (“CJJD Cayman”), and CJJD Cayman shall issue to each

holder of such right that number of ordinary shares in CJJD Cayman to which such holder is entitled. Upon the completion of the Redomicile

Merger, the former stockholders of the Company will become the legal owners of the shares of CJJD Cayman, and CJJD Cayman, together with

its subsidiaries, will own and continue to conduct our business in substantially the same manner as is currently being conducted by the

Company and its subsidiaries. CJJD Cayman will also be managed by the same board of directors and executive officers that manage the Company

today.

As further explained in the

accompanying proxy statement/prospectus, our Board of Directors expects that the reorganization of the Company’s corporate structure,

which will be facilitated by the approval of the Redomicile Merger, will result in the following benefits:

|

|

●

|

reduction of our operational, administrative, legal and accounting costs over the long term through the reduction of our reporting obligations and related expenses because CJJD Cayman is expected to qualify as a “foreign private issuer” under the rules and regulations of the Securities and Exchange Commission (“SEC”) and be exempt from certain rules under the Securities Exchange Act of 1934, as amended (“Exchange Act”), that would otherwise apply if CJJD Cayman were a company incorporated in the United States or did not meet the other conditions to qualify as a foreign private issuer, which is in line with the Company’s current business and operations which are almost all conducted outside of the United States;

|

|

|

●

|

alignment of our structure with our international corporate strategy, which structure would more closely align with those of other companies operating in the same industry in China; and

|

|

|

●

|

potential regulatory benefits in China, which has a strictly regulated pharmaceutical industry that officially or unofficially may favor companies that are incorporated in jurisdictions that are not politically and economically perceived to be in competition with China.

|

We have chosen to redomicile

under the laws of the Cayman Islands because of its political and economic stability, effective judicial system, absence of exchange control

or currency restrictions and availability of professional and support services.

The Redomicile Merger cannot

be completed unless proposal to adopt the Merger Agreement and the Plan of Merger is approved by the holders of a majority of the Company’s

outstanding shares of common stock. There are a number of risks which you should be aware of in considering whether to vote in favor of

the proposal to approve the Merger Agreement and the Plan of Merger. The accompanying proxy statement/prospectus contains important information

about the Merger Agreement and the Plan of Merger and related Redomicile Merger and the risks associated thereto and we encourage you

to read it. In particular, you should carefully consider the discussion in the section of the proxy statement/prospectus entitled “Risk

Factors and Caution Regarding Forward-Looking Statements” beginning on page 21.

We intend the Redomicile

Merger to qualify as a reorganization for U.S. federal income tax purposes, and it is a condition to our obligation to complete the Redomicile

Merger that we receive an opinion (the “Tax Opinion”) from our tax counsel substantially to this effect. The Tax Opinion does

not bind the IRS or prevent the IRS from adopting a contrary position. Based on the Tax Opinion, after the Redomicile Merger, CJJD Cayman,

as successor to the Company, will be treated as a U.S. domestic corporation for U.S. federal income tax purposes. If the Redomicile Merger

qualifies as a reorganization, stockholders of the Company will not recognize any gain or loss for U.S. federal income tax purposes solely

due to the receipt of CJJD Cayman ordinary shares in the Redomicile Merger. For a more detailed discussion of U.S. federal income tax

considerations for stockholders, please see the section entitled “Tax Opinion” beginning on page 77. We urge you to consult

your own tax advisor regarding the particular tax consequences of the Redomicile Merger for you.

Our Board of Directors has

determined that the Redomicile Merger is advisable and in the best interests of the Company and our stockholders and, as such, has unanimously

approved the Redomicile Merger, the Merger Agreement and the Plan of Merger. Our Board of Directors recommends that you vote “FOR”

the proposal to adopt the Merger Agreement.

Your vote is important.

Whether or not you plan to attend the Special Meeting, we hope that you will vote as soon as possible. You may vote your shares by either

completing, signing and returning the accompanying proxy card or casting your vote via a toll-free telephone number or over the Internet.

|

|

Sincerely,

|

|

|

|

|

|

/s/ Lei Liu

|

|

|

Lei Liu

|

|

|

Chief Executive Officer

|

NEITHER THE SECURITIES

AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THE SECURITIES TO BE ISSUED UNDER THIS PROXY

STATEMENT/PROSPECTUS OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROXY STATEMENT/PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS

A CRIMINAL OFFENSE.

This proxy statement/prospectus is dated June

2, 2021 and is being first mailed to

China Jo-Jo Drugstores, Inc. stockholders on

or about June 8, 2021

CHINA JO-JO DRUGSTORES, INC.

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

to be held on July 19, 2021

NOTICE IS HEREBY GIVEN that

the Special Meeting of stockholders (the “Special Meeting”) of China Jo-Jo Drugstores, Inc., a Nevada corporation (the “Company”),

will be held on Tuesday, July 20, 2021, at 9:00 a.m., Beijing time (July 19, 2021 at 9:00 p.m. E.T.), at the principal office of the Company

located at Hai Wai Hai Tongxin Mansion Floor 6, Gong Shu District, Hangzhou City, People’s Republic of China 310008, for the following

purposes:

|

|

1.

|

to approve and adopt the agreement and plan of merger (the “Merger Agreement”) by and between the Company and China Jo-Jo Drugstores Holdings, Inc., an exempted company incorporated under the laws of the Cayman Islands and a wholly owned subsidiary of the Company (“CJJD Cayman”), which included a plan of merger required to be filed with the Register of Companies of the Cayman Islands, substantially in the form as attached as Annex A to the Merger Agreement (the “Plan of Merger”), pursuant to which the Company will merge with and into CJJD Cayman, with CJJD Cayman as the surviving company upon the merger becoming effective, and whereby each issued and outstanding share of the common stock of the Company will be converted into the right to receive one ordinary share of CJJD Cayman (the “Redomicile Merger”); and

|

|

|

2.

|

to transact such other business as may properly come before the Special Meeting or any adjournment or postponement thereof.

|

If you owned our common stock

at the close of business on June 2, 2021, you may attend and vote at the Special Meeting.

A proxy statement/prospectus

describing the matters to be considered at the Special Meeting is attached to this Notice.

Your vote is important.

Whether or not you plan to attend the Special Meeting, we hope that you will vote as soon as possible. You may vote your shares by either

completing, signing and returning the accompanying proxy card or casting your vote via a toll-free telephone number or over the Internet.

|

|

By Order of the Board of Directors

|

|

|

|

|

|

/s/ Lei Liu

|

|

|

Lei Liu

|

|

|

Chief Executive Officer

|

|

|

June 2, 2021

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY

OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON July 19, 2021

This Notice and proxy statement/prospectus are

available online at https://www.iproxydirect.com/CJJD.

TABLE OF CONTENTS

CAUTIONARY STATEMENT REGARDING FORWARD LOOKING

STATEMENTS

This proxy statement/prospectus

contains or incorporates by reference forward looking statements within the meaning of the private securities litigation reform act of

1995 with respect to the restructuring and our financial condition, results of operations and business. This act protects public companies

from liability for forward looking statements in private securities litigation if the forward looking statement is identified and is accompanied

by meaningful cautionary statements identifying important factors that could cause actual results to differ materially from the forward

looking statements. Forward looking statements by their nature involve a degree of risk and uncertainty, including, but not limited to,

the risks and uncertainties referred to under “Risk Factors” and elsewhere herein or in the documents incorporated by reference.

All statements regarding the expected benefits of the restructuring are forward looking statements. The forward looking statements may

include statements for the period following completion of the Redomicile Merger. You can find many of these statements by looking for

words such as “believes,” “expects,” “anticipates,” “estimates,” “continues,”

“may,” “can,” “continue,” “potential,” “should,” “will,” “could,”

“intends,” “plans” or similar expressions in this proxy statement/prospectus or in the documents incorporated

by reference. You should be aware that any forward looking statements in this proxy statement/prospectus reflect only current expectations

and are not guarantees of performance. Many possible events or factors could affect our future financial results and performance. This

could cause our results or performance to differ materially from those we express in our forward looking statements. You should consider

these risks when deciding how to vote. Also, as you make your decision how to vote, please take into account that forward looking statements

speak only as of the date of this proxy statement/prospectus or, in the case of documents incorporated by reference, the date of any such

document, or in certain cases, as of a specified date.

We have identified factors

that could cause actual plans or results to differ materially from those included in any forward looking statements. These factors include,

but are not limited to, the following:

|

|

●

|

an inability to realize expected benefits of the restructuring within the anticipated time frame, or at all;

|

|

|

●

|

changes in tax law, tax treaties or tax regulations or the interpretation or enforcement thereof, including taxing authorities not agreeing with our assessment of the effects of such laws, treaties and regulations;

|

|

|

●

|

an inability to execute any of our business strategies;

|

|

|

●

|

costs or difficulties related to the Redomicile Merger and related restructuring transactions, which could be greater than expected; and

|

|

|

●

|

such other risk factors as may be discussed in our reports filed with the SEC.

|

We disclaim any obligation

or undertaking to disseminate any updates or revisions to our statements, forward looking or otherwise, to reflect changes in our expectations

or any change in events, conditions or circumstances on which any such statements are based.

Except as otherwise indicated

by the context and for the purposes of this prospectus only, references in this prospectus to:

|

|

●

|

“China Jo-Jo Drugstores,” “CJJD”, “we,” “us,” “our company,” or “our” are to China Jo-Jo Drugstores, Inc., a Nevada corporation, and, unless the context requires otherwise, its direct and indirect subsidiaries;

|

|

|

●

|

“China” or “PRC” are to the People’s Republic of China, excluding, for the purposes of this prospectus only, Taiwan and the special administrative regions of Hong Kong and Macau;

|

|

|

●

|

“Exchange Act” are to the Securities Exchange Act of 1934, as amended;

|

|

|

●

|

“RMB” are to the legal currency of China;

|

|

|

●

|

“SEC” are to the Securities and Exchange Commission;

|

|

|

●

|

“Securities Act” are to the Securities Act of 1933, as amended;

|

|

|

●

|

“U.S. dollars” or “$” are to the legal currency of the United States.

|

INFORMATION ABOUT THE SPECIAL MEETING AND THE

PROPOSED REDOMICILE MERGER

The Board of Directors (the

“Board”) of China Jo-Jo Drugstores, Inc., a Nevada corporation (the “Company,” “we,” “us,”

“our” or “CJJD”), is furnishing this proxy statement/prospectus and the accompanying proxy to you to solicit your

proxy for the Special Meeting of Stockholders (the “Special Meeting”). The Special Meeting will be heldon Tuesday, July 20,

2021, at 9:00 a.m., Beijing time (July 19, 2021 at 9:00 p.m. E.T.), at the principal office of the Company located at Hai Wai Hai Tongxin

Mansion Floor 6, Gong Shu District, Hangzhou City, People’s Republic of China 310008.

It is anticipated that the

proxy materials will be mailed to stockholders on or about June 8, 2021.

The following questions and

answers are intended to address briefly some commonly asked questions regarding the Special Meeting and, in particular, the proposed Redomicile

Merger. These questions and answers may not address all issues that may be important to you. Please refer to the more detailed information

contained elsewhere in this proxy statement/prospectus, its annexes and the documents referred to.

QUESTIONS AND ANSWERS ABOUT THE SPECIAL MEETING

What is this proxy statement/prospectus?

You have received this proxy

statement/prospectus because our Board is soliciting your proxy to vote your shares at the Special Meeting. This proxy statement/prospectus

includes information that we are required to provide to you under the rules of the Securities and Exchange Commission (“SEC”)

and that is designed to assist you in voting your shares.

What is the purpose of the Special Meeting?

At the Special Meeting, our

stockholders will act upon the matters described in this proxy statement/prospectus. These actions include the adoption of the Merger

Agreement and approval of the Redomicile Merger. An additional purpose of the Special Meeting is to transact any other business that may

properly come before the Special Meeting and any and all adjournments or postponements of the Special Meeting.

Who can attend the Special Meeting?

All stockholders of record

at the close of business on June 2, 2021 (the “Record Date”), or their duly appointed proxies, may attend the Special Meeting.

What proposals will be voted on at the Special Meeting?

Stockholders will vote on

one proposal at the Special Meeting:

|

|

●

|

the approval and adoption of the agreement and plan of merger (the “Merger Agreement”) by and between the Company and China Jo-Jo Drugstores Holdings, Inc., an exempted company incorporated under the laws of the Cayman Islands and a wholly owned subsidiary of the Company (“CJJD Cayman”), which included a plan of merger required to be filed with the Register of Companies of the Cayman Islands, substantially in the form as attached as Annex A to the Merger Agreement (the “Plan of Merger”), pursuant to which the Company will merge with and into CJJD Cayman, with CJJD Cayman as the surviving company upon the merger becoming effective, and whereby each issued and outstanding share of the common stock of the Company will be converted into the right to receive one ordinary share of CJJD Cayman (the “Redomicile Merger”).

|

What are the Board’s recommendations?

Our Board recommends that you vote:

|

|

●

|

FOR adoption of the Merger Agreement and approval of the Redomicile Merger.

|

Will there be any other business on the agenda?

The Board knows of no other

matters that are likely to be brought before the Special Meeting. If any other matters properly come before the Special Meeting, however,

the persons named in the enclosed proxy, or their duly appointed substitute acting at the Special Meeting, will be authorized to vote

or otherwise act on those matters in accordance with their judgment.

Who is entitled to vote?

Only stockholders of record

at the close of business on June 2, 2021, which we refer to as the Record Date, are entitled to notice of, and to vote at, the Special

Meeting. Holders of common stock as of the Record Date are entitled to one vote for each share held for the proposal. No other

class of voting securities is outstanding on the date of mailing of this proxy statement/prospectus.

What is the difference between holding shares as a stockholder

of record and as a beneficial owner?

Stockholder of Record.

If your shares are registered directly in your name with our transfer agent, you are considered, with respect to those shares, the

“stockholder of record.” This proxy statement/prospectus has been sent directly to you by us.

Beneficial Owner.

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the “beneficial owner”

of shares held in street name. This proxy statement/prospectus has been forwarded to you by your broker, bank or nominee who is considered,

with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker, bank or nominee

how to vote your shares by using the voting instructions included in with your proxy materials.

How do I vote my shares?

Whether you hold shares directly

as a registered stockholder of record or beneficially in street name, you may vote without attending the Special Meeting. You may vote

by granting a proxy or, for shares held beneficially in street name, by submitting voting instructions to your stockbroker, trustee or

nominee. In most cases, you will be able to do this by using the Internet or telephone or by mail, if you received a printed set of the

proxy materials.

By Internet — If you

have Internet access, you may submit your proxy via the Internet by following the instructions provided in the Notice of Special Meeting

of Stockholders accompanying this proxy statement/prospectus (the “Notice”), or if you received a printed version of the proxy

materials by mail, by following the instructions provided with your proxy materials and on your proxy card or voting instruction card.

By Telephone or Mail —

If you received printed proxy materials, you may submit your proxy by telephone by following the instructions provided on your proxy card

or voting instruction card. If you received a Notice, you may submit your proxy by telephone after accessing the proxy materials via the

Internet. You may also submit your proxy by mail by signing your proxy card if your shares are registered or, for shares held beneficially

in street name, by following the voting instructions included by your stockbroker, trustee or nominee, and mailing it in the envelope

provided. If you provide specific voting instructions, your shares will be voted as you have instructed. Voting by telephone is not available

to persons outside of the United States.

Telephone and Internet voting

facilities for stockholders of record will be available 24 hours a day and will close at 6:00 p.m. E.T. on July 19, 2021.

If you vote by proxy, the

individuals named on the proxy card (your “proxies”) will vote your shares in the manner you indicate. You may specify how

your shares should be voted for the proposal. If you grant a proxy without indicating your instructions, your shares will be

voted as follows:

|

|

●

|

FOR adoption of the Merger Agreement and approval of the Redomicile Merger.

|

Each share of common stock is entitled to one

vote.

What constitutes a quorum?

A quorum is the presence,

in person or by proxy, of the holders of a majority of the shares of the common stock entitled to vote. Under Nevada law, an abstaining

vote and a broker “non-vote” are counted as present and are, therefore, included for purposes of determining whether a quorum

of shares is present at the Special Meeting.

What is a broker “non-vote” and what is its effect

on voting?

If you are a beneficial owner

of shares held in street name and do not provide the organization that holds your shares with specific voting instructions, under the

rules of various national and regional securities exchanges, the organization that holds your shares may generally vote on routine matters

but cannot vote on non-routine matters. If the organization that holds your shares does not receive instructions from you on how to vote

your shares on a non-routine matter, the organization that holds your shares does not have the authority to vote on the matter with respect

to those shares. This is generally referred to as a “broker non-vote.”

What is required to approve each item?

For Proposal No. 1 (adoption

of the Merger Agreement), the majority of the outstanding shares of our common stock must vote “For” the proposal.

For the purpose of determining

whether the stockholders have approved matters, abstentions are treated as shares present or represented and voting, so abstaining has

the same effect as a negative vote. If stockholders hold their shares through a broker, bank or other nominee and do not instruct them

how to vote, the broker has authority to vote the shares for routine matters.

How will shares of common stock represented by properly executed

proxies be voted?

All shares of common stock

represented by proper proxies will, unless such proxies have previously been revoked, be voted in accordance with the instructions indicated

in such proxies. If you do not provide voting instructions, your shares will be voted in accordance with the Board’s recommendations

as set forth herein. In addition, if any other matters properly come before the Special Meeting, the persons named in the enclosed proxy,

or their duly appointed substitute acting at the Special Meeting, will be authorized to vote or otherwise act on those matters in accordance

with their judgment.

Can I change my vote or revoke my proxy?

Any stockholder

executing a proxy has the power to revoke such proxy at any time prior to your shares being voted. You may revoke your proxy prior

to your shares being voted by calling 1-866-752-VOTE (8683), or by accessing the Internet website https://www.iproxydirect.com/CJJD,

or in writing by execution of a subsequently dated proxy, or by a written notice of revocation, sent to the attention of the Chief

Financial Officer at China Jo-Jo Drugstores, Inc., Hai Wai Hai Tongxin Mansion Floor 6, Gong Shu District, Hangzhou City,

People’s Republic of China 310008, or by attending and voting in person at the Special Meeting. Unless revoked, the shares

represented by timely received proxies will be voted in accordance with the directions given therein. Your most current proxy card

or telephone or Internet proxy is the one that is counted.

If the Special Meeting is

postponed or adjourned for any reason, at any subsequent reconvening of the Special Meeting, all proxies granted according to the instructions

set forth herein will be voted in the same manner as the proxies would have been voted at the previously convened Special Meeting (except

for any proxies that have at that time effectively been revoked or withdrawn), even if the proxies had been effectively voted on the same

or any other matter at a previous Special Meeting.

How are proxies solicited?

In addition to the mail solicitation

of proxies, our officers, directors, employees and agents may solicit proxies by written communication, telephone or personal call. These

persons will receive no special compensation for any solicitation activities. We will reimburse banks, brokers and other persons holding

common stock for their expenses in forwarding proxy solicitation materials to beneficial owners of our common stock.

Who paid for this proxy solicitation?

The cost of preparing, printing,

assembling and mailing this proxy statement/prospectus and other material furnished to stockholders in connection with the solicitation

of proxies is borne by us.

What is “householding”?

The SEC has adopted rules

that allow a company to deliver a single proxy statement to an address shared by two or more of its stockholders. This method of delivery,

known as “householding”, permits us to realize significant cost savings, reduces the amount of duplicate information stockholders

receive, and reduces the environmental impact of printing and mailing documents to you. Under this process, certain stockholders of record

who do not participate in electronic delivery of proxy materials will receive only one copy of our proxy materials and any additional

proxy materials that are delivered until such time as one or more of these stockholders notify us that they want to receive separate copies.

Any stockholders who wish

to opt out of, or wish to begin, householding may contact our Chief Financial Officer through one of the following methods:

|

|

●

|

by sending a written request by mail to:

|

China Jo-Jo Drugstores, Inc.

Hai Wai Hai Tongxin Mansion Floor 6

Gong Shu District, Hangzhou City

People’s Republic of China 310008

Attention: Chief Financial Officer

|

|

●

|

by calling our Chief Financial Officer, at (+86) 571-88219579.

|

Are there any rules regarding admission to the Special Meeting?

Yes. You are entitled to

attend the Special Meeting only if you were, or you hold a valid legal proxy naming you to act for, one of our stockholders on the Record

Date. Before we admit you to the Special Meeting, we must be able to confirm:

|

|

●

|

Your identity by reviewing a valid form of photo identification, such as your passport; and

|

|

|

●

|

You were, or are validly acting for, a stockholder of record on the Record Date by:

|

|

|

●

|

verifying your name and stock ownership against our list of registered stockholders, if you are the record holder of your shares;

|

|

|

●

|

reviewing other evidence of your stock ownership, such as your most recent brokerage or bank statement, if you hold your shares in street name; or

|

|

|

●

|

reviewing a written proxy that shows your name and is signed by the stockholder you are representing, in which case either the stockholder must be a registered stockholder of record or you must have a brokerage or bank statement for that stockholder as described above.

|

If you do not have a valid

form of photo identification and proof that you owned, or are legally authorized to act as proxy for someone who owned shares of our common

stock on June 2, 2021, you will not be admitted to the Special Meeting.

At the entrance to the Special

Meeting, we will verify that your name appears in our stock records or will inspect your brokerage or bank statement, as your proof of

ownership, and any written proxy you present as the representative of a stockholder. We will decide in our sole discretion whether the

documentation you present for admission to the Special Meeting meets the requirements described above.

How do I learn the results of the voting at the Special Meeting?

The preliminary voting results

will be announced at the Special Meeting. The final results will be published in our current report on Form 8-K to be filed with the SEC

within four business days after the date of the Special Meeting, provided that the final results are available at such time. In the event

the final results are not available within such time period, the preliminary voting results will be published in our current report on

Form 8-K to be filed within such time period, and the final results will be published in an amended current report on Form 8-K/A to be

filed within four business days after the final results are available.

Can I receive future stockholder communications

electronically through the Internet?

Yes. You may elect to receive

future notices of meetings and proxy materials electronically through the Internet. To consent to electronic delivery, vote your shares

using the Internet. At the end of the Internet voting procedure, the on-screen Internet voting instructions will tell you how to request

future stockholder communications be sent to you electronically.

Once you consent to electronic

delivery, you must vote your shares using the Internet and your consent will remain in effect until withdrawn. You may withdraw this consent

at any time during the voting process and resume receiving stockholder communications in print form.

Whom may I contact for further assistance?

If you have any questions about giving your proxy

or require any assistance, please contact our Chief Financial Officer:

China Jo-Jo Drugstores, Inc.

Hai Wai Hai Tongxin Mansion Floor 6

Gong Shu District, Hangzhou City

People’s Republic of China 310008

Attention: Chief Financial Officer

|

|

●

|

by telephone at (+86) 571-88219579

|

QUESTIONS AND ANSWERS ABOUT THE REDOMICILE MERGER

What is the Redomicile Merger?

Under the Merger Agreement

and Plan of Merger, the Company will merge with and into CJJD Cayman, with CJJD Cayman as the surviving company and changing its name

to China Jo-Jo Drugstores, Inc. upon the Redomicile Merger becoming effective. Upon consummation of the Redomicile Merger, each share

of the Company’s common stock will be converted into the right to receive one ordinary share of CJJD Cayman, which ordinary shares

will be issued by CJJD Cayman in connection with the Redomicile Merger. Following the Redomicile Merger, CJJD Cayman, together with its

subsidiaries, will own and continue to conduct our business in substantially the same manner as it is currently being conducted by the

Company and its subsidiaries. CJJD Cayman will also be managed by substantially the same board of directors and executive officers that

manage the Company today.

Why does the Company want to engage in the Redomicile Merger?

We expect that the Redomicile

Merger will, among other things, result in a reduction in operational, administrative, legal and accounting costs over the long term,

more closely align our structure with our international corporate strategy and potentially provide regulatory benefits. However, there

can be no assurance that following the Redomicile Merger we will be able to realize these expected benefits for the reasons discussed

in the section entitled “Risk Factors and Caution Regarding Forward-Looking Statements-Risks Relating to the Redomicile Merger —

The expected benefits of the Redomicile Merger may not be realized.”

Will the Redomicile Merger affect current

or future operations?

We expect that the Redomicile

Merger will not have a material impact on how we conduct day-to-day operations and the new corporate structure will not change our future

operational plans to grow our business. We expect that the Redomicile Merger, by aligning our structure with our international corporate

strategy and moving our jurisdiction of incorporation outside the U.S., may improve our ability to grow both internationally and as well

as in China which has a strictly regulated pharmaceutical industry that may officially or unofficially may favor companies that are incorporated

in jurisdictions that are not politically and economically perceived to be in competition with China. The location of future operations

will depend on the needs of the business, which will be determined without regard to our jurisdiction of incorporation.

Will CJJD Cayman be treated differently

from the Company for U.S. federal income tax purposes?

Based on the Tax Opinion,

after the Redomicile Merger, CJJD Cayman, as successor to the Company, will be treated as a U.S. domestic corporation for U.S. federal

income tax purposes, will be subject to U.S. federal income taxes, and dividends paid by CJJD Cayman to its non-U.S. stockholders will

be subject to U.S. withholding taxes. The Tax Opinion does not bind the IRS or prevent the IRS from adopting a contrary position. For

a more detailed discussion of U.S. federal income tax considerations of the Redomicile Merger, please see the section entitled “Tax

Opinion” beginning on page 77.

Is the Redomicile Merger taxable to me?

We intend the Redomicile

Merger to qualify as a reorganization for U.S. federal income tax purposes, and it is a condition to our obligation to complete the Redomicile

Merger that the Tax Opinion is substantially to this effect. The Tax Opinion does not bind the IRS or prevent the IRS from adopting a

contrary position. If the Redomicile Merger qualifies as a reorganization: (i) a U.S. Holder (as defined in the section titled “Taxation

— United States Taxation”) will not recognize any gain or loss for U.S. federal income tax purposes solely due to the receipt

of CJJD Cayman ordinary shares in the Redomicile Merger, (ii) a U.S. Holder’s adjusted tax basis in the CJJD Cayman ordinary shares

received in the Redomicile Merger will be the same as such U.S. Holder’s adjusted tax basis in the Company common stock surrendered

in the Redomicile Merger, and (iii) such U.S. Holder’s holding period in the CJJD Cayman ordinary shares received in the Redomicile

Merger will include such U.S. Holder’s holding period in the Company common stock surrendered in the Redomicile Merger; provided

that, if a U.S. Holder acquired different blocks of Company common stock at different times or at different prices, the CJJD Cayman ordinary

shares received in the Redomicile Merger will be allocated pro rata to each block of Company common stock, and the basis and holding period

of each block of CJJD Cayman ordinary shares received will be determined on a block-for-block basis depending on the basis and holding

period of the blocks of Company common stock exchanged for such block of CJJD Cayman ordinary shares. For a more detailed discussion of

U.S. federal income tax considerations for stockholders, please see the section entitled “Tax Opinion” beginning on page 77.

We urge you to consult your own tax advisor regarding the particular tax consequences of the Redomicile Merger for you.

THE TAX TREATMENT OF THE

REDOMICILE MERGER UNDER STATE OR LOCAL LAW WILL DEPEND ON THE JURISDICTION. WE URGE YOU TO CONSULT YOUR OWN TAX ADVISOR PRIOR TO CONSENTING

REGARDING THE PARTICULAR TAX CONSEQUENCES OF THE REDOMICILE MERGER TO YOU.

Has the U.S. Internal Revenue Service rendered a ruling on any

aspects of the Redomicile Merger?

No ruling has been requested

from the U.S. Internal Revenue Service (the “IRS”), in connection with the Redomicile Merger.

When do you expect to complete the Redomicile Merger?

If the adoption of the Merger

Agreement is approved by our stockholders, we anticipate that the Redomicile Merger will become effective promptly following such approval,

although the Redomicile Merger may be abandoned by our board of directors prior to its completion. Please see the section entitled “Risk

Factors and Caution Regarding Forward-Looking Statements-Risks Relating to the Redomicile Merger — Our Board of Directors may choose

to defer or abandon the Redomicile Merger.”

What types of information and reports will

CJJD Cayman make available to shareholders following the Redomicile Merger?

Following completion of the

Redomicile Merger, CJJD Cayman is expected to qualify as a “foreign private issuer” under the rules and regulations of the

SEC. CJJD Cayman will remain subject to the provisions of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act. However, as a foreign

private issuer, CJJD Cayman will be exempt from certain rules under the Securities Exchange Act of 1934, as amended (“Exchange Act”),

that would otherwise apply if CJJD Cayman were a company incorporated in the United States or did not meet the other conditions to qualify

as a foreign private issuer. For example:

|

|

●

|

CJJD Cayman may include in its SEC filings financial statements prepared in accordance with generally accepted accounting principles in the United States, or U.S. GAAP, or with the International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or IASB, without reconciliation to U.S. GAAP;

|

|

|

●

|

CJJD Cayman will not be required to provide as many Exchange Act reports, or as frequently or as promptly, as U.S. companies with securities registered under the Exchange Act. For example, CJJD Cayman will not be required to file current reports on Form 8-K within four business days from the occurrence of specific material events. Instead, CJJD Cayman will need to promptly furnish reports on Form 6-K any information that CJJD Cayman (a) makes or is required to make public under the laws of the Cayman Islands, (b) files or is required to file under the rules of any stock exchange, or (c) otherwise distributes or is required to distribute to its shareholders. Unlike Form 8-K, there is no precise deadline by which Form 6-K must be furnished. In addition, CJJD Cayman will not be required to file its annual report on Form 10-K, which may be due as soon as 60 days after its fiscal year end. As a foreign private issuer, CJJD Cayman will be required to file an annual report on Form 20-F within four months after its fiscal year end;

|

|

|

●

|

CJJD Cayman will not be required to provide the same level of disclosure on certain issues, such as executive compensation;

|

|

|

●

|

CJJD Cayman will be exempt from filing quarterly reports under the Exchange Act with the SEC; however, as a Nasdaq listed foreign private issuer, CJJD Cayman will be required to publish on a Form 6-K an interim balance sheet and income statement as of the end of its second quarter no later than six months following the end of such quarter;

|

|

|

●

|

CJJD Cayman will not be subject to the requirement to comply with Regulation FD, which imposes certain restrictions on the selected disclosure of material information;

|

|

|

●

|

CJJD Cayman will not be required to comply with the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; and

|

|

|

●

|

CJJD Cayman will not be required to comply with Section 16 of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and establishing insider liability for profits realized from any “short-swing” trading transaction.

|

Accordingly, after the completion

of the Redomicile Merger, if you hold CJJD Cayman shares, you may receive less information about CJJD Cayman and its business than you

currently receive with respect to the Company and be afforded less protection under the U.S. federal securities laws than you are entitled

to currently.

If CJJD Cayman loses its

status as a foreign private issuer at some future time, then it will no longer be exempt from such rules and, among other things, will

be required to file periodic reports and financial statements as if it were a company incorporated in the U.S. The costs (including operational,

administrative, legal and accounting costs) incurred in fulfilling these additional regulatory requirements could be substantial. Please

see the sections entitled “Risk Factors and Caution Regarding Forward-Looking Statements-Risks Relating to the Redomicile Merger

— The expected benefits of the redomicile merger may not be realized” and “Risk Factors and Caution Regarding Forward-Looking

Statements — Risks Relating to the Redomicile Merger.”

Do I have to take any action to exchange my common stock in the

Company to receive ordinary shares of CJJD Cayman?

Each share of the Company’s

common stock registered in your name or which you beneficially own through your broker will be converted into the right to receive one

CJJD Cayman ordinary shares and such ordinary shares will be registered in your name (or your broker’s name, as applicable) in CJJD

Cayman’s register of members upon completion of the Redomicile Merger. Upon completion of the Redomicile Merger, only registered

shareholders reflected in CJJD Cayman’s register of members will have and be entitled to exercise any voting and other rights with

respect to and to receive any dividend and other distributions upon CJJD Cayman ordinary shares registered in their respective names.

Any attempted transfer of the Company’s common stock prior to the Redomicile Merger that is not properly documented and reflected

in the stock records maintained by the Company’s transfer agent as of immediately prior to the Effective Time will not be reflected

in holdings of CJJD Cayman’s ordinary shares upon completion of the Redomicile Merger. If you hold your shares of the Company’s

common stock in an account with a broker or other securities intermediary, you will receive delivery of ordinary shares in your account

with that same broker or other securities intermediary. Under Cayman Islands law, a Cayman Islands company such as CJJD Cayman may pay

a dividend on its shares out of either profit or share premium amount, provided that in no circumstances may a dividend be paid if this

would result in the company being unable to pay its debts due in the ordinary course of business.

If you hold the Company’s

common stock in certificated form, you may exchange your common stock certificates of the Company for CJJD Cayman ordinary shares in certificated

form following the Redomicile Merger. We will request that all of the Company’s stock certificates be returned to CJJD Cayman’s

transfer agent following the Redomicile Merger. Soon after the closing of the Redomicile Merger, you will be sent a letter of transmittal

from our exchange agent. It is expected that, prior to the Effective Time, Securities Transfer Corporation will be appointed as our exchange

agent for the Redomicile Merger. The letter of transmittal will contain instructions explaining the procedure for surrendering your stock

certificates in the Company to receive CJJD Cayman ordinary shares in certificated form. YOU SHOULD NOT RETURN STOCK CERTIFICATES WITH

THE ENCLOSED PROXY CARD. CJJD Cayman’s current transfer agent is American Stock Transfer & Trust Company, which will continue

to serve as the transfer agent for CJJD Cayman ordinary shares after the Effective Time.

What happens to the Company’s stock options and other equity

awards at the effective time of the Redomicile Merger?

At the Effective Time, all

outstanding options to purchase shares of the Company’s common stock granted or issued prior to the Effective Time and all other

outstanding equity awards granted under our equity compensation plans to directors, employees and consultants, as applicable, will entitle

the holder to purchase or receive, or receive payment based on, as applicable, an equal number of CJJD Cayman ordinary shares. Immediately

prior to the Effective Time, all existing equity compensation plans of the Company, as may be amended, will be adopted and assumed by

CJJD Cayman. We do not anticipate an increase to the total number of shares underlying options and awards outstanding under our assumed

equity compensation plans or shares otherwise issuable thereunder. Future awards would be subject to and governed by the terms of our

assumed equity compensation plans and any agreements entered into pursuant thereto.

Can I trade my common stock in the Company before the Redomicile

Merger is completed?

Yes. Common stock in the

Company will continue to be listed on the NASDAQ Capital Market through the last trading day prior to the date of completion of the Redomicile

Merger, which is anticipated to take place promptly following the approval of the Redomicile Merger.

After the Redomicile Merger, where can I trade my CJJD Cayman

ordinary shares?

The Company and CJJD Cayman

are in the process of applying for listing of the ordinary shares of CJJD Cayman with the NASDAQ Capital Market and hope to complete that

process concurrent with or shortly after the consummation of the Redomicile Merger.

How will my rights as a shareholder of CJJD

Cayman change after the Redomicile Merger relative to my rights as a stockholder of the Company prior to the Redomicile Merger?

Because of differences between

Nevada law and Cayman Islands law and differences between the governing documents of the Company and the constitutional documents of CJJD

Cayman, we are unable to adopt governing documents for CJJD Cayman that are identical to the governing documents for the Company. CJJD

Cayman’s amended and restated memorandum and articles of association differ from the Company’s bylaws and articles of incorporation,

both in form and substance, and the rights of shareholders of CJJD Cayman will change relative to your rights as a stockholder of the

Company as a result of the Redomicile Merger and you may not be afforded as many rights as a shareholder of CJJD Cayman under applicable

laws and CJJD Cayman’s amended and restated memorandum and articles of association as you had as a stockholder of the Company under

applicable laws and the Company’s articles of incorporation and bylaws. Please see the sections entitled “Risk Factors and

Caution Regarding Forward-Looking Statements-Risks Relating to the Redomicile Merger — Your rights as a stockholder of the Company

will change as a result of the Redomicile Merger and you may not be afforded as many rights as a shareholder of CJJD Cayman under applicable

laws and CJJD Cayman’s amended and restated memorandum and articles of association as you were as a stockholder of the Company under

applicable laws and the Company’s articles of incorporation and bylaws,” “Description of Share Capital of CJJD Cayman”,

and “Comparison of Rights under Nevada and Cayman Islands Laws.” Additionally, as a foreign private issuer, CJJD Cayman will

be permitted to follow corporate governance practices in accordance with Cayman Islands laws. However, we do not intend to initially rely

on any NASDAQ exemptions or accommodations for foreign private issuers following the merger.

Do I have Dissenters’ Rights?

In connection with the Redomicile

Merger, our stockholders will not have dissenters’ rights under the Nevada Revised Statutes (“NRS”). Please see the

section entitled “Comparison of Rights under Nevada and Cayman Islands Laws.”

SUMMARY

The following summary

highlights selected information from this proxy statement/prospectus and may not contain all of the information that is important to you.

To better understand the Merger Agreement, including the Redomicile Merger and other transactions contemplated thereby, you should carefully

read this entire proxy statement/prospectus, including the Merger Agreement attached as Annex A to this proxy statement/prospectus and

the Plan of Merger attached as Annex A to the Merger Agreement. For purposes of this proxy statement/prospectus, the term “Merger

Agreement” will refer to the Merger Agreement, as the same may be amended.

The Redomicile Merger

The Parties to the Merger Agreement and the Plan of Merger

China Jo-Jo Drugstores,

Inc., a Nevada incorporated corporation, the Company or CJJD Nevada. The Company is a retailer and distributor of pharmaceutical and

other healthcare products typically found in retail pharmacies in the PRC. The Company currently has one hundred and eighteen (118) store

locations under the store brand “Jiuzhou Grand Pharmacy” in Hangzhou city and its adjacent town Lin’an. The Company

currently operates in four business segments in China: (1) retail drugstores, (2) online pharmacy, (3) wholesale business selling products

similar to those we carry in our pharmacies, and (4) farming and selling herbs used for traditional Chinese medicine (“TCM”).

All of the above business are performed in China with no other international sales.

China Jo-Jo Drugstores

Holdings, Inc. a Cayman incorporated company, or CJJD Cayman. CJJD Cayman is a newly formed exempted company incorporated under the

laws of the Cayman Islands and currently a wholly-owned subsidiary of the Company. An “exempted” company under the laws of

the Cayman Islands is one which receives such registration as a result of satisfying the Registrar of Companies in the Cayman Islands

that it conducts its operations mainly outside of the Cayman Islands and is as a result exempted from complying with certain provisions

of the Companies Act (2021 Revision) (the “Companies Act”) of the Cayman Islands, such as the general requirement to file

an annual return of its shareholders with the Registrar of Companies, and is permitted flexibility in certain matters, such as the ability

to register by way of continuation in another jurisdiction and be deregistered in the Cayman Islands upon satisfying certain requirements

of the Companies Act as it pertains to continuation and/or deregistration. CJJD Cayman does not have a significant amount of assets or

liabilities and has not engaged in any business since its incorporation other than activities associated with its anticipated participation

in the Redomicile Merger.

The principal executive offices

of each of the Company and CJJD Cayman are located at Hai Wai Hai Tongxin Mansion Floor 6, Gong Shu District, Hangzhou City, People’s

Republic of China 310008; Telephone: +86 571-88219579. The registered office for CJJD Cayman is in the Cayman Islands located at Cricket

Square, Hutchins Drive, PO Box 2681, Grand Cayman, KY1-1111, Cayman Islands, and the phone number of the registered office is +1 345 945

3901.

Background and Reasons for the Redomicile Merger

We believe that the Redomicile

Merger, which would change our place of incorporation from Nevada to the Cayman Islands, (i) would allow us to reduce operational, administrative,

legal and accounting costs over the long term because CJJD is expected to qualify as a foreign private issuer and be exempt from certain

rules under the Exchange Act, which is in line with the Company’s current business and operations which are almost all conducted

outside of the United States, (ii) will more closely align our structure with our international corporate strategy and (iii) may improve

our ability to grow both internationally and as well as in China which has a strictly regulated biopharmaceutical industry that may officially

or unofficially may favor companies that are incorporated in jurisdictions that are not politically and economically perceived to be in

competition with China. With our headquarters in Hangzhou City, China and substantially all of our executive team and members of our board

of directors residing outside the United States, we believe that it is advisable to move our place of incorporation outside the United

States. In reaching its decision to approve the Merger Agreement, our Board of Directors identified several potential benefits to our

stockholders, which are described under “The Merger Agreement — Background and Reasons for the Redomicile Merger.” Please

also see the section entitled “Risk Factors and Caution Regarding Forward-Looking Statements — Risks Relating to the Redomicile

Merger” for a description of certain risks associated with the merger.

The Merger Agreement

A copy of the Merger Agreement

and Plan of Merger is attached as Annex A to this proxy statement/prospectus. The Company encourages you to read the entire Merger Agreement

and Plan of Merger carefully they are the principal documents governing the Redomicile Merger.

CJJD Cayman Ordinary Shares

If the Redomicile Merger

is completed, each share of the Company’s common stock shall convert into the right to receive one ordinary share in the capital

of CJJD Cayman, which ordinary shares will be issued by CJJD Cayman in connection with the Redomicile Merger. Following the Redomicile

Merger, the former stockholders of the Company will become holders of CJJD Cayman ordinary shares, and CJJD Cayman, together with its

subsidiaries, will own and continue to conduct our business in substantially the same manner as is currently being conducted by the Company

and its subsidiaries.

Treatment of the Company’s Options, Warrants and Convertible

Securities

In connection with the Redomicile

Merger, each outstanding option, warrant or convertible security exercisable or convertible into common stock of the Company will be assumed

by CJJD Cayman and will become an option, warrant or convertible security exercisable or convertible into an equal number of ordinary

shares in the capital of CJJD Cayman under the same terms and conditions.

Overview of the Merger Agreement

The Company and CJJD Cayman

are required to complete the Redomicile Merger only if certain customary conditions are satisfied or waived, including, among others,

the registration statement on Form F-4, of which this proxy statement/prospectus is a part, being declared effective by the SEC, and the

Merger Agreement and Plan of Merger being approved by the Company’s stockholders.

Board of Directors; Management of the CJJD Cayman Following the

Redomicile Merger

Following the Redomicile

Merger, CJJD Cayman will be managed by substantially the same board of directors and executive officers that manage the Company. Under

Cayman Islands law, all directors owe three types of duties: (i) statutory duties, (ii) fiduciary duties, and (iii) common law duties.

The Companies Act (2021 Revision), as amended, of the Cayman Islands imposes a number of statutory duties on a director. A Cayman Islands

director’s fiduciary duties are not codified, however the courts of the Cayman Islands have held that a director owes the following

fiduciary duties: (a) a duty to act in what the director bona fide considers to be in the best interests of the company, (b) a duty to

exercise their powers for the purposes they were conferred, (c) a duty to avoid fettering his or her discretion in the future and (d)

a duty to avoid conflicts of interest and of duty. The common law duties owed by a director are those to act with skill, care and diligence

that may reasonably be expected of a person carrying out the same functions as are carried out by that director in relation to the company

and, also, to act with the skill, care and diligence in keeping with a standard of care commensurate with any particular skill they have

which enables them to meet a higher standard than a director without those skills. In fulfilling their duty of care, the directors must

ensure compliance with the amended articles of association, as amended and restated from time to time. There is a right to seek damages

if a duty owed by any of director is breached.

Accounting Treatment

The Redomicile Merger will

be accounted for as a legal reorganization with no change in ultimate ownership interest immediately before and after the transaction.

Accordingly, all assets and liabilities will be recorded at historical cost as an exchange between entities under common control.

Material U.S. Federal Income Tax Consequences

We intend the Redomicile

Merger to qualify as a reorganization within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”),

and it is a condition to our obligation to complete the Redomicile Merger that the Tax Opinion is substantially to this effect. The Tax

Opinion does not bind the IRS or prevent the IRS from adopting a contrary position. Based on the Tax Opinion, after the Redomicile Merger,

CJJD Cayman, as successor to the Company, will be treated as a U.S. domestic corporation for U.S. federal income tax purposes. If the

Redomicile Merger qualifies as a reorganization: (i) a U.S. Holder (as defined in the section titled “Taxation — United States

Taxation”) will not recognize any gain or loss for U.S. federal income tax purposes solely due to the receipt of CJJD Cayman ordinary

shares in the Redomicile Merger, (ii) a U.S. Holder’s adjusted tax basis in the CJJD Cayman ordinary shares received in the Redomicile

Merger will be the same as such U.S. Holder’s adjusted tax basis in the Company common stock surrendered in the Redomicile Merger,

and (iii) such U.S. Holder’s holding period in the CJJD Cayman ordinary shares received in the Redomicile Merger will include such

U.S. Holder’s holding period in the Company common stock surrendered in the Redomicile Merger; provided that, if a U.S. Holder acquired

different blocks of Company common stock at different times or at different prices, the CJJD Cayman ordinary shares received in the Redomicile

Merger will be allocated pro rata to each block of Company common stock, and the basis and holding period of each block of CJJD Cayman

ordinary shares received will be determined on a block-for-block basis depending on the basis and holding period of the blocks of Company

common stock exchanged for such block of CJJD Cayman ordinary shares. For a more detailed discussion of U.S. federal income tax considerations

for stockholders, please see the section entitled “Tax Opinion” beginning on page 77. We urge you to consult your own tax

advisor regarding the particular tax consequences of the Redomicile Merger for you.

Comparison of Stockholder/Shareholder Rights

Upon consummation of the

Redomicile Merger, the holders of issued and outstanding common stock of the Company will be entitled to receive CJJD Cayman ordinary

shares. The rights of the holders of the Company’s common stock are governed by the Company’s articles of incorporation and

bylaws and by the Nevada Revised Statutes, while the rights of holders of CJJD Cayman’s ordinary shares are generally governed by

CJJD Cayman’s amended and restated memorandum and articles of association and the Companies Act of the Cayman Islands and the common

law of the Cayman Islands. There are differences in rights afforded by under Nevada law and Cayman Islands law. Please see the section

entitled “Comparison of Rights under Nevada and Cayman Islands Laws.”

Risks Associated with the Redomicile Merger

Holders of the Company’s

common stock and, assuming consummation of the Redomicile Merger, CJJD Cayman’s ordinary shares, will be subject to various risks

associated with CJJD Cayman’s business and industries. These risks are discussed in greater detail under the section entitled “Risk

Factors and Caution Regarding Forward-Looking Statements” in this proxy statement/prospectus. The Company encourages you to read

and consider all of these risks carefully.

MARKET FOR THE COMPANY’S COMMON STOCK

Market Information

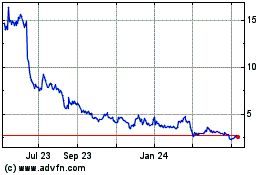

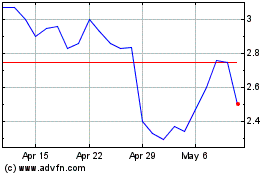

Our common stock trades on

the NASDAQ Capital Market under the symbol “CJJD”.

Based on the records of our

transfer agent, we had 41,751,790 shares of common stock issued and outstanding as of the Record Date for the Special Meeting.

We and CJJD Cayman are in

the process of applying for listing of CJJD Cayman’s ordinary shares with the Nasdaq Capital Market and hope to complete that process

concurrent with or shortly after the consummation of the Redomicile Merger.

Holders

Based on the records of our

transfer agent, there were 34 stockholders of record of our common stock as of the Record Date for the Special Meeting (not including

beneficial owners who hold shares at broker/dealers in “street name”).

Transfer Agent

Our transfer agent is American

Stock Transfer & Trust Company, LLC, whose address is 6201, 15th Avenue, Brooklyn, New York 11219, and whose telephone number is (718)

921-8206.

Dividends

While there are no restrictions

that limit our ability to pay dividends, we have not paid, and following the approval and completion of the Redomicile Merger do not currently

intend to pay, cash dividends on our common stock in the foreseeable future. Our policy is to retain all earnings, if any, to provide

funds for the operation and expansion of our business. The declaration of dividends, if any, will be subject to the discretion of our

Board of Directors, who may consider such factors as our results of operations, financial condition, capital needs and acquisition strategy,

among others, in making its determination.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion

and analysis of our results of operations and financial condition for the fiscal years ended March 31, 2020 and 2019, and for the three

and nine months ended December 31, 2020, should be read in conjunction with our financial statements and the notes to those financial

statements that are included elsewhere in this prospectus. Our discussion includes forward-looking statements based upon current expectations

that involve risks and uncertainties, such as our plans, objectives, expectations and intentions. Actual results and the timing of events

could differ materially from those anticipated in these forward-looking statements as a result of a number of factors, including those

set forth under the “Risk Factors” and “Business” sections and elsewhere in this prospectus. We use words such

as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,”

“expect,” “believe,” “intend,” “may,” “will,” “should,” “could,”

“predict” and similar expressions to identify forward-looking statements. Although we believe the expectations expressed in

these forward-looking statements are based on reasonable assumptions within the bound of our knowledge of our business, our actual results

could differ materially from those discussed in these statements. Factors that could contribute to such differences include, but are not

limited to, those discussed in the “Risk Factors” section of this prospectus. We undertake no obligation to update publicly

any forward-looking statements for any reason even if new information becomes available or other events occur in the future other than

in compliance with the SEC rules and regulations.

Our financial statements

are prepared in U.S. Dollars and in accordance with accounting principles generally accepted in the United States. See “Exchange

Rates” at the end of this section for information concerning the exchanges rates at which Renminbi (“RMB”) were translated

into U.S. Dollars (“USD” or “$”) at various pertinent dates and for pertinent periods.

Overview

We currently operate in four

business segments in China: (1) retail drugstores, (2) online pharmacy, (3) wholesale of products similar to those that we carry in our

pharmacies, and (4) farming and selling herbs used for traditional Chinese medicine (“TCM”).

Our drugstores offer customers

a wide variety of pharmaceutical products, including prescription and over-the-counter (“OTC”) drugs, nutritional supplements,

TCM, personal and family care products, medical devices, and convenience products, including consumable, seasonal, and promotional items.

Additionally, we have licensed doctors of both western medicine and TCM on site for consultation, examination and treatment of common

ailments at scheduled hours. As of December 31, 2020, we had 115 pharmacies in Hangzhou city and its adjacent town Lin’an under

the store brand of “Jiuzhou Grand Pharmacy” and 4 independent pharmacies controlled by Jiuzhou Pharmacy. During the nine months

ended December 31, 2020, we dissolved four pharmacies.

Since May 2010, we have also

been selling certain OTC drugs, medical devices, nutritional supplements and other sundry products online. Our online pharmacy sells through

several third-party platforms such as Alibaba’s Tmall, JD.com, Amazon.com and the Company’s own platform all over China. Our

sales through our own platform are primarily generated by customers who use their private commercial medical insurances packages.

We operate a wholesale business

through Jiuxin Medicine distributing third-party pharmaceutical products (similar to those carried by our pharmacies) primarily to trading

companies throughout China. We also planted gingko trees but have not incurred sales in the nine months ended December 31, 2020.

Amidst the COVID-19 outbreak,

we experienced a decline in the number of customer visits. To avoid face-to-face contact, customers tend to shop online. In order to keep

pace with customers’ change in their ways of shopping, we strengthened our O2O service team, which takes orders online, i.e. via

mobile phone app, and delivers products to local community from our stores. The spread of the disease has been effectively controlled

in China in the past few months. The number of the new infected daily has become limited. People tend to work and live as usual. As a

result, we believe the negative impacts on our operations are temporary. However, the extent to which the COVID-19 impacts our operations

will depend on its future developments, which are highly uncertain and cannot be predicted with confidence, including the duration of

the outbreak, new information which may emerge concerning the severity of the coronavirus and the actions to contain the coronavirus or

minimize its harm, among others.

Critical Accounting Policies and Estimates

In preparing our audited

consolidated financial statements in accordance with accounting principles generally accepted in the United States of America, we are

required to make judgments, estimates and assumptions that affect: (i) the reported amounts of our assets and liabilities; (ii) the disclosure

of our contingent assets and liabilities at the end of each reporting period; and (iii) the reported amounts of revenue and expenses during

each reporting period. We continually evaluate these estimates based on our own historical experience, knowledge and assessment of current

business and other conditions, our expectations regarding the future based on available information and reasonable assumptions, which

together form our basis for making judgments about matters that are not readily apparent from other sources. Since the use of estimates

is an integral component of the financial reporting process, our actual results could differ materially from those estimates.

We believe that any reasonable

deviation from those judgments and estimates would not have a material impact on our financial condition or results of operations. To

the extent that the estimates used differ from actual results, however, adjustments to the statement of operations and corresponding balance

sheet accounts would be necessary. These adjustments would be made in future financial statements.

When reading our financial

statements, you should consider: (i) our critical accounting policies; (ii) the judgment and other uncertainties affecting the application

of such policies; and (iii) the sensitivity of reported results to changes in conditions and assumptions. The critical accounting policies

and related judgments and estimates used to prepare our financial statements are identified in Note 2 to our audited consolidated financial

statements accompanying in this prospectus.

Revenue recognition

In May 2014, the FASB issued

ASU No. 2014-09, which creates Topic 606, Revenue from Contracts with Customers. The new guidance outlines a single comprehensive model

for entities to use in accounting for revenue arising from contracts with customers. The core principle of the guidance is that an entity

should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration

to which the entity expects to be entitled in exchange for those goods and services. Additionally, the guidance requires improved disclosure

to help users of financial statements better understand the nature, amount, timing, and uncertainty of revenue that is recognized. The

new guidance supersedes most current revenue recognition guidance, including industry-specific guidance. The standard is effective for

annual reporting periods beginning after December 15, 2017, including interim periods within that reporting period, and permits early

adoption on a limited basis. The update permits the use of either the retrospective or cumulative effect transition method. On April 1,

2018, we adopted the guidance in ASC 606 and all the related amendments and applied the new revenue standard to all contracts using the

modified retrospective method. Based on the new standard our revenue recognition policies related to membership rewards programs has changed.

Membership rewards, usually membership points, are accumulated by customers based on their historical spending levels. The Company has

determined that there is an additional performance obligation to those customers at the time of the initial transaction. The customers

can then redeem these points against the prices of merchandises they purchase in the future. At the end of each period, unredeemed membership

rewards are reflected as a contract liability. The adoption of the new revenue standard was not material and is not expected to be material

to our net income on an ongoing basis.

Impairment of definite-lived intangible assets

The Company evaluates the

recoverability of definite-lived intangible assets whenever events or changes in circumstances indicate that the carrying value of an

asset may not be recoverable. These long-lived assets are grouped and evaluated for impairment at the lowest level at which individual

cash flows can be identified. When evaluating these long-lived assets for potential impairment, the Company first compares the carrying

amount of the asset group to the asset group’s estimated future cash flows (undiscounted and without interest charges). If the estimated

future cash flows are less than that carrying amount of the asset group, an impairment loss calculation is prepared. The impairment loss

calculation compares the carrying amount of the asset group to the asset group’s estimated future cash flows (discounted and with

interest charges). If required, an impairment loss is recorded for the portion of the asset group’s carrying value that exceeds

the asset group’s estimated future cash flows (discounted and with interest charges).

The long-lived asset impairment

loss calculation contains uncertainty since management must use judgment to estimate each asset group’s future sales, profitability

and cash flows. When preparing these estimates, the Company considers historical results and current operating trends and consolidated

sales, profitability and cash flow results and forecasts. These estimates can be affected by a number of factors including, but not limited