Current Report Filing (8-k)

December 07 2022 - 4:22PM

Edgar (US Regulatory)

Chefs' Warehouse, Inc. false 0001517175 0001517175 2022-12-07 2022-12-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 7, 2022

THE CHEFS’ WAREHOUSE, INC.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

| Delaware |

|

001-35249 |

|

20-3031526 |

| (State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

100 East Ridge Road,

Ridgefield, Connecticut 06877

(Address of Principal Executive Offices, and Zip Code)

(203) 894-1345

Registrant’s Telephone Number, Including Area Code

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

☐ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ |

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.01 par value |

|

CHEF |

|

NASDAQ |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 |

Entry into a Material Definitive Agreement |

On December 7, 2022, The Chefs’ Warehouse, Inc. (the “Company”) entered into a ninth amendment (the “Ninth Amendment”) to its senior secured term loan credit agreement, originally dated as of June 22, 2016, by and among the Company, Chefs’ Warehouse Parent, LLC, as borrower, Dairyland USA Corporation, as borrower, certain other subsidiaries of the Company, as guarantors, the lenders party thereto and Jefferies Finance LLC, as administrative agent and collateral agent to, among other things, allow for the ability by the Company and its subsidiaries to incur, subject to specified terms and conditions, unsecured indebtedness in an aggregate principal amount not exceeding on any date, an amount equal to (i) $350.0 million minus (ii) the aggregate principal amount of the Company’s 1.875% convertible senior notes due 2024 outstanding on such date, with a maturity date that occurs prior to the date that is 91 days after the latest maturity date of the term loans. The Ninth Amendment further implements technical changes to allow for the conversion or exchange of the Company’s 1.875% convertible senior notes due 2024 and future convertible notes.

On December 7, 2022, the Company entered into a fifth amendment (the “Fifth Amendment”) to its asset-based loan facility (the “ABL Facility”), originally dated as of June 29, 2018, by and among the Company, Chefs’ Warehouse Parent, LLC, as borrower, Dairyland USA Corporation, as borrower, and a group of lenders for which BMO Harris Bank, N.A. acts as administrative agent to, among other things, allow for the ability by the Company and its subsidiaries to incur, subject to specified terms and conditions, unsecured indebtedness with a maturity date that occurs prior to the scheduled maturity date of the ABL Facility. The Fifth Amendment further implements technical changes to allow for the conversion or exchange of the Company’s 1.875% convertible senior notes due 2024 and future convertible notes.

On December 7, 2022, the Company issued a press release announcing its intention to offer Convertible Senior Notes due 2028 (the “Notes”) in an aggregate principal amount of $250.0 million in a private offering that is exempt from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”). The Notes will be offered and sold only to qualified institutional buyers pursuant to Rule 144A under the Securities Act. The Company also expects to grant the initial purchasers of the Notes the option to purchase additional Notes in an aggregate principal amount of up to $37.5 million. In connection with the pricing of the Notes, the Company expects to enter into exchange agreements with a limited number of holders of its 1.875% convertible senior notes due 2024. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference into this Item 8.01.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

| THE CHEFS’ WAREHOUSE, INC. |

|

|

| By: |

|

/s/ Alexandros Aldous |

| Name: |

|

Alexandros Aldous |

| Title: |

|

General Counsel, Corporate Secretary and Chief Government Relations Officer |

Date: December 7, 2022

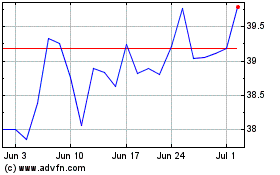

Chefs Warehouse (NASDAQ:CHEF)

Historical Stock Chart

From Mar 2024 to Apr 2024

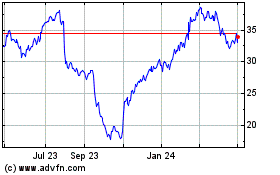

Chefs Warehouse (NASDAQ:CHEF)

Historical Stock Chart

From Apr 2023 to Apr 2024