The Chefs’ Warehouse, Inc. Increases Full Year 2022 Guidance

June 22 2022 - 8:30AM

The Chefs’ Warehouse, Inc. (NASDAQ:CHEF) (the “Company”), a premier

distributor of specialty food products in North America, today

announced that based on current trends in the business and the

outlook for the remainder of 2022, the Company is raising full year

2022 guidance as follows:

- Net sales to be in the range of $2.325 billion to $2.425

billion, compared to a range of $2.13 billion to $2.23 billion

previously

- Gross profit to be in the range of $542.0 million to $565.0

million, compared to a range of $500.0 million to $524.0 million

previously

- Adjusted EBITDA to be in the range of $130.0 million to $140.0

million, compared to a range of $103.0 million to $112.0 million

previously

“Strength in customer demand along with our team’s ability to

merchandise the world’s finest ingredients with just in time

service continues to drive solid financial performance, despite a

challenging supply chain and food inflationary environment,” said

Christopher Pappas, Chairman and Chief Executive Officer of the

Company. “We look forward to leveraging the investments we are

making in talent, capacity expansion, technology and operational

process improvements to continue driving growth and increased

efficiencies.”

Forward-Looking Statements

Statements in this press release regarding the Company’s

business that are not historical facts are “forward-looking

statements” that involve risks and uncertainties and are based on

current expectations and management estimates; actual results may

differ materially. Words such as “estimates”, “anticipates”,

“expects”, “intends”, “plans”, “believes”, “seeks” and variations

of these words and similar expressions are intended to identify

forward-looking statements. These statements are not guarantees of

future performance and are subject to risks, uncertainties and

other factors, some of which are beyond our control, are difficult

to predict and/or could cause actual results to differ materially

from those expressed or forecasted in the forward-looking

statements. Any projections of future results of operations are

based on a number of assumptions, many of which are outside the

Company’s control and should not be construed in any manner as a

guarantee that such results will in fact occur. These projections

are subject to change and could differ materially from reported

results. The Company may, from time-to-time, update these publicly

announced projections, but it is not obligated to do so. The risks

and uncertainties which could impact these statements include, but

are not limited to the following: our sensitivity to general

economic conditions, including disposable income levels and changes

in consumer discretionary spending; our ability to expand our

operations in our existing markets and to penetrate new markets

through acquisitions; we may not achieve the benefits expected from

our acquisitions, which could adversely impact our business and

operating results; we may have difficulty managing and facilitating

our future growth; conditions beyond our control could materially

affect the cost and/or availability of our specialty food products

or center-of-the-plate products and/or interrupt our distribution

network; our distribution of center-of-the-plate products, like

meat, poultry and seafood, involves exposure to price volatility

experienced by those products; our business is a low-margin

business and our profit margins may be sensitive to inflationary

and deflationary pressures; because our foodservice distribution

operations are concentrated in certain culinary markets, we are

susceptible to economic and other developments, including adverse

weather conditions, in these areas; fuel cost volatility may have a

material adverse effect on our business, financial condition or

results of operations; our ability to raise capital in the future

may be limited; we may be unable to obtain debt or other financing,

including financing necessary to execute on our acquisition

strategy, on favorable terms or at all; interest charged on our

outstanding debt may be adversely affected by changes in the method

of determining London Interbank Offered Rate (LIBOR), or the

replacement of LIBOR with an alternative rate; our business

operations and future development could be significantly disrupted

if we lose key members of our management team; and significant

public health epidemics or pandemics, including COVID-19, may

adversely affect our business, results of operations and financial

condition. Any forward-looking statements are made pursuant to the

Private Securities Litigation Reform Act of 1995, Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, and, as such, speak

only as of the date made. A more detailed description of these and

other risk factors is contained in the Company’s most recent Annual

Report on Form 10-K filed with the Securities and Exchange

Commission (“SEC”) on February 22, 2022 and other reports filed by

the Company with the SEC since that date. The Company is not

undertaking to update any information unless required by applicable

laws.

About The Chefs’ Warehouse

The Chefs’ Warehouse, Inc. (http://www.chefswarehouse.com) is a

premier distributor of specialty food products in the United States

and Canada focused on serving the specific needs of chefs who own

and/or operate some of the nation’s leading menu-driven independent

restaurants, fine dining establishments, country clubs, hotels,

caterers, culinary schools, bakeries, patisseries, chocolateries,

cruise lines, casinos and specialty food stores. The Chefs’

Warehouse, Inc. carries and distributes more than 50,000 products

to more than 35,000 customer locations throughout the United States

and Canada.

Contact:Investor Relations Jim Leddy, CFO,

(718) 684-8415

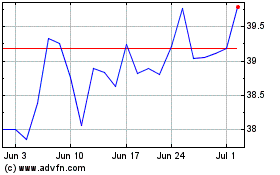

Chefs Warehouse (NASDAQ:CHEF)

Historical Stock Chart

From Mar 2024 to Apr 2024

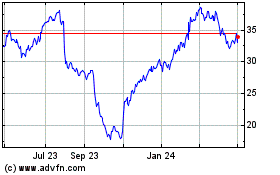

Chefs Warehouse (NASDAQ:CHEF)

Historical Stock Chart

From Apr 2023 to Apr 2024