Company provides 2020 product revenue guidance

range of $89 million to $93 million representing growth of

approximately 20% to 25% over preliminary 2019 full year

results

Cerus Corporation (Nasdaq:CERS) announced today preliminary

product revenue for the fourth quarter and full year 2019 and

provided 2020 product revenue guidance.

Cerus’ unaudited preliminary product revenue for the fourth

quarter of 2019 totaled $20.9 million, an increase of 27%, compared

to the $16.5 million recognized during the same period in the prior

year. Based on its fourth quarter unaudited preliminary product

revenue, the Company expects full year 2019 product revenue of

$74.6 million, at the top end of the Company’s most recent 2019

product guidance range of $72 million to $75 million. The

preliminary product revenue results have not been audited and are

subject to change.

Preliminary fourth quarter product revenue would represent the

highest quarterly product revenue ever reported by Cerus.

“We finished 2019 with momentum with preliminary fourth quarter

product revenue up 27% driven by strong INTERCEPT platelet kit

demand in North America and platelet and plasma kit demand in EMEA.

We expect the robust sales growth experienced during the past year

to continue into 2020 driven in part by the need for U.S. blood

centers and hospitals to comply with the final FDA guidance

document on bacterial safety,” said William ‘Obi’ Greenman, Cerus’

president and chief executive officer.

“We are looking forward to an exciting year as we continue to

help our blood center partners safeguard their blood component

production against known and unknown infectious disease. With the

planned increase in product revenue and margins, and continued

leverage we expect from our SG&A investments, we anticipate

lower cash use from operations during 2020 compared to 2019. In

addition, we are looking forward to the anticipated expansion of

our product portfolio with our first biologic therapeutic product,

pathogen-reduced cryoprecipitate, which has been granted FDA

breakthrough device designation for the treatment of critically

bleeding patients. An anticipated U.S. regulatory submission is

planned for the first half of 2020, with a potential approval

decision in the second half of the year,” continued Greenman.

Given the 2019 strength and anticipated increase in platelet kit

demand as U.S. blood centers become compliant with the FDA guidance

document, the Company expects full year 2020 product revenue will

be in the range of $89 million to $93 million, representing growth

of approximately 20% to 25% compared to preliminary unaudited 2019

full year results.

Cerus will provide complete fourth quarter and full year 2019

financial results and host a call to discuss both 2019 results and

2020 expectations in late February.

ABOUT CERUS

Cerus Corporation is dedicated solely to safeguarding the

world’s blood supply and aims to become the preeminent global blood

products company. Based in Concord, California, our employees are

dedicated to deploying and supplying vital technologies and

pathogen-protected blood components for blood centers, hospitals

and ultimately patients who rely on safe blood. With the INTERCEPT

Blood System, we are focused on protecting patients by delivering

the full complement of reliable products and expertise for

transfusion medicine. Cerus develops and markets the INTERCEPT

Blood System, and remains the only company in the blood transfusion

space to earn both CE Mark and FDA approval for pathogen reduction

of both platelet and plasma components. Cerus currently markets and

sells the INTERCEPT Blood System in the United States, Europe, the

Commonwealth of Independent States, the Middle East and selected

countries in other regions around the world. The INTERCEPT Red

Blood Cell system is in clinical development. For more information

about Cerus, visit www.cerus.com.

INTERCEPT and the INTERCEPT Blood System are trademarks of Cerus

Corporation.

Forward Looking Statements and Preliminary Product Revenue

Results

Except for the historical statements contained herein, this

press release contains forward-looking statements concerning Cerus’

products, prospects and expected results, including statements

relating to Cerus’ 2020 annual product revenue guidance; Cerus’

expectation that sales growth will continue into 2020 that Cerus

believes will be underpinned by the need for U.S. blood centers and

hospitals to comply with the final FDA guidance document on

bacterial safety; Cerus continuing to help its blood center

partners safeguard their blood component production against known

and unknown infectious disease; Cerus’ expectation that cash use

from operations during 2020 will lessen compared to 2019 and the

reasons therefor; the potential for pathogen-reduced

cryoprecipitate to be Cerus’ first biologic product; the planned

U.S. regulatory submission for pathogen-reduced cryoprecipitate,

the timing therefor and the timing of an anticipated approval

decision; and other statements that are not historical fact. Actual

results could differ materially from these forward-looking

statements as a result of certain factors, including, without

limitation: risks associated with the commercialization and market

acceptance of, and customer demand for, the INTERCEPT Blood System,

including the risks that Cerus may not (a) meet its 2020 annual

product revenue guidance, (b) grow sales in its U.S. and European

markets and/or realize expected revenue contribution resulting from

its U.S. and European market agreements, (c) realize meaningful

and/or increasing revenue contributions from U.S. customers in the

near term or at all, particularly since Cerus cannot guarantee the

volume or timing of commercial purchases, if any, that its U.S.

customers may make under Cerus’ commercial agreements with these

customers, and/or (d) realize any revenue contribution from its

pipeline product candidates, whether due to Cerus’ inability to

obtain regulatory approval of its pipeline product candidates, or

otherwise; risks associated with Cerus’ lack of commercialization

experience in the United States and its ability to develop and

maintain an effective and qualified U.S.-based commercial

organization, as well as the resulting uncertainty of its ability

to achieve market acceptance of and otherwise successfully

commercialize the INTERCEPT Blood System for platelets and plasma

in the United States, including as a result of licensure

requirements that must be satisfied by U.S. customers prior to

their engaging in interstate transport of blood components

processed using the INTERCEPT Blood System; risks related to

Fresenius Kabi’s efforts to assure an uninterrupted supply of

platelet additive solution (PAS); risks related to how any future

PAS supply disruption could affect INTERCEPT’s acceptance in the

marketplace; risks related to how any future PAS supply disruption

might affect current commercial contracts; risks related to Cerus’

ability to demonstrate to the transfusion medicine community and

other health care constituencies that pathogen reduction and the

INTERCEPT Blood System is safe, effective and economical; the

uncertain and time-consuming development and regulatory process,

including the risks (a) that Cerus may be unable to comply with the

FDA’s post-approval requirements for the INTERCEPT platelet and

plasma systems, including by successfully completing required

post-approval studies, which could result in a loss of U.S.

marketing approval for the INTERCEPT platelet and/or plasma

systems, (b) related to Cerus’ ability to expand the label claims

and product configurations for the INTERCEPT platelet and plasma

systems in the United States, including for pathogen-reduced

cryoprecipitate, which will require additional regulatory

approvals, (c) that Cerus may be unable to submit its planned

regulatory submission to the FDA for pathogen-reduced

cryoprecipitate on the anticipated timeframe or at all, and even if

submitted, Cerus may be unable to obtain FDA approval, or any other

regulatory approvals, of pathogen-reduced cryoprecipitate in a

timely manner or at all, (d) that applicable regulatory authorities

may disagree with Cerus‘ interpretations of the data from its

clinical studies and/or may otherwise determine not to approve

Cerus’ regulatory submissions, including Cerus’ anticipated

submission for pathogen-reduced cryoprecipitate, in a timely manner

or at all, and (e) even if Cerus’ regulatory submissions are

approved, Cerus may not receive label claims for all requested

indications or for indications with the highest unmet need or

market acceptance; risks associated with Cerus’ lack of experience

in marketing products directly to hospitals and expertise complying

with regulations governing finished biologics; risks associated

with the uncertain nature of BARDA’s funding over which Cerus has

no control as well as actions of Congress and governmental agencies

which may adversely affect the availability of funding under Cerus’

BARDA agreement and/or BARDA’s exercise of any potential subsequent

option periods, such that the anticipated activities that Cerus

expects to conduct with the funds available from BARDA may be

delayed or halted and that Cerus may not otherwise realize the

total potential value under its agreement with BARDA; risks related

to product safety, including the risk that the septic platelet

transfusions may not be avoidable with the INTERCEPT Blood System;

risks related to adverse market and economic conditions, including

continued or more severe adverse fluctuations in foreign exchange

rates and/or weakening economic conditions in the markets where

Cerus currently sells and is anticipated to sell its products;

Cerus’ reliance on third parties to market, sell, distribute and

maintain its products; Cerus’ ability to maintain an effective,

secure manufacturing supply chain, including the ability of its

manufacturers to comply with extensive FDA and foreign regulatory

agency requirements, and Cerus’ ability to maintain its primary kit

manufacturing agreement and its other supply agreements with its

third party suppliers; Cerus’ ability to identify and obtain

additional partners to manufacture pathogen-reduced

cryoprecipitate; risks associated with Cerus’ ability to meet its

debt service obligations and its need for additional funding; the

impact of legislative or regulatory healthcare reforms that may

make it more difficult and costly for Cerus to produce, market and

distribute its products; risks related to future opportunities and

plans, including the uncertainty of Cerus’ future capital

requirements and its future revenues and other financial

performance and results, as well as other risks detailed in Cerus’

filings with the Securities and Exchange Commission, including

Cerus’ Quarterly Report on Form 10-Q for the quarter ended

September 30, 2019, filed with the SEC on October 30, 2019. Cerus

disclaims any obligation or undertaking to update or revise any

forward-looking statements contained in this press release.

This press release includes Cerus’ preliminary product revenue

results for the quarter and year ended December 31, 2019. Cerus is

currently in the process of finalizing its full financial results

for the quarter and year ended December 31, 2019, and the

preliminary product revenue results presented in this press release

are based only upon preliminary information available to Cerus as

of January 13, 2020. Cerus’ preliminary product revenue results

should not be viewed as a substitute for full audited financial

statements prepared in accordance with U.S. GAAP, and undue

reliance should not be placed on Cerus’ preliminary product revenue

results. In addition, Cerus’ independent registered public

accounting firm has not audited or reviewed the preliminary product

revenue results included in this press release or expressed any

opinion or other form of assurance on such preliminary product

revenue results. In addition, items or events may be identified or

occur after the date hereof due to the completion of operational

and financial closing procedures, final audit adjustments and other

developments may arise that would require Cerus to make material

adjustments to the preliminary product revenue results included in

this press release. Therefore, the preliminary product revenue

results included in this press release may differ, perhaps

materially, from the product revenue results that will be reflected

in Cerus’ audited consolidated financial statements for the year

ended December 31, 2019.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200113005228/en/

Tim Lee – Investor Relations Director Cerus Corporation

925-288-6137

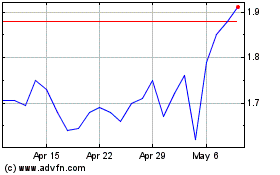

Cerus (NASDAQ:CERS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cerus (NASDAQ:CERS)

Historical Stock Chart

From Apr 2023 to Apr 2024