UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the date of February 1, 2022

Commission File Number 001-39124

Centogene N.V.

(Translation of registrant’s name into English)

Am Strande

7

18055 Rostock

Germany

(Address of principal executive offices)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F..X.. Form 40-F ___

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ___

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

Centogene N.V.

Entry into a Material Definitive Agreement

Private Placement of Common Shares and Warrants

On January 31, 2022,

Centogene N.V. (the “Company”) entered into a Securities Purchase Agreement (the “Securities Purchase Agreement”)

with the purchasers named therein (the “Investors”) and a Warrant Agreement (the “Warrant Agreement”)

with the Investors. Pursuant to the Securities Purchase Agreement and the Warrant Agreement, the Company agreed to sell to the Investors

(i) an aggregate of 4,479,088 common shares, nominal value €0.12 per share (the “Common Shares”) at a price of

$3.73 per Common Share, and (ii) warrants initially exercisable for the purchase of up to an aggregate of 1,343,727 Common Shares at an

initial exercise price of $7.72 per Common Share (the “Warrants”), for aggregate gross proceeds of €15.0 million

(the “Private Placement”). The Warrants are exercisable immediately as of the date of issuance and will expire on December

31, 2026.

The Securities Purchase

Agreement and the Warrant Agreement contain customary representations and warranties from the Company and the Investors and customary

closing conditions. The closing of the Private Placement occurred on January 31, 2022 (the “Closing Date”).

The Company has also

agreed pursuant to the Securities Purchase Agreement and the Warrant Agreement, among other things, to indemnify the Investors from certain

liabilities arising out of or based in whole or in part on the inaccuracy of the representations and warranties of the Company contained

in those respective agreements or the failure of the Company to perform its obligations thereunder.

Each of the Investors

is a party to the Company’s existing Registration Rights Agreement, dated November 12, 2019 (as amended, the “Registration

Rights Agreement”) (one Investor having executed a joinder thereto prior to the Closing Date). Pursuant to the Registration

Rights Agreement, the Company has agreed under certain circumstances to file a registration statement to register the resale of the securities

held by such Investors, subject to certain exceptions, as well as to cooperate in certain public offerings of such securities.

The Private Placement

is exempt from registration pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended, as a transaction by the issuer not

involving a public offering. The Investors have acquired the securities for investment only and not with a view to or for sale in connection

with any distribution thereof, and appropriate legends have been affixed to the Common Shares and the Warrants.

The foregoing summary

does not purport to be complete and is qualified in its entirety by reference to the complete text of the Securities Purchase Agreement

and the Warrant Agreement, which are filed as Exhibits 99.4 and 99.5, respectively, to this Report on Form 6-K, and the Registration

Rights Agreement, the form of which is attached as Exhibit 4.1 to the Company’s Registration Statement on Form F-1 (File No. 333-234177),

filed with the SEC on October 11, 2019 (as amended by the Amendment No. 1 thereto, the form of which is attached as Exhibit 4.2 to the

Company’s Registration Statement on Form F-1 (File No. 333-239735), filed with the SEC on July 7, 2020).

Loan and Security

Agreement

On January 31, 2022 (the “Closing

Date”), Centogene N.V. (the “Company”) entered into a Loan and Security Agreement (the “Loan Agreement”)

with Centogene GmbH, CentoSafe B.V. and Centogene US, LLC (together, with the Company, “Borrowers”), Oxford Finance

LLC (“Oxford”) and the other financial institutions or entities from time to time parties to the Loan Agreement (collectively,

referred to as “Lenders”) and Oxford, in its capacity as collateral agent for itself and Lenders (in such capacity,

“Agent”). Under the Loan Agreement, Lenders agreed to make available to Borrowers certain term loans in an aggregate

principal amount of up to $45.0 million, subject to funding in two tranches as follows: (a) on the Closing Date, a loan in the aggregate

principal amount of $25.0 million (the “Term A Loan”) and (b) on and after the Term B Milestone (as defined below)

until the earlier of 60 days thereafter and July 31, 2023, a loan in the aggregate principal amount of $20.0 million (the “Term

B Loan” and collectively with the Term A Loan, the “Term Loans”). The obligations of Lenders to fund the

Term Loans are subject to certain conditions precedent, including with respect to the Term A Loan, the receipt by the Company on the Closing

Date of €15.0 million net cash proceeds from the issuance and sale of the Company’s equity securities (including from the Private

Placement) and, with respect to the Term B Loan, the achievement by the Company of at least $50.0 million in gross product revenue from

the diagnostics and pharma services segments of the Company and its subsidiaries, calculated on a consolidated and trailing twelve (12)

month basis as of the last day of any fiscal month (such achievement, the “Term B Milestone”). As security for Borrowers’

obligations under the Loan Agreement, Borrowers granted Lenders a first priority security interest on Borrowers’ assets. In connection

with the foregoing, Borrowers have agreed to pay certain fees to Oxford that are customary for facilities of this type.

The maturity date of the Term Loans is January

29, 2027, with amortized payments commencing March 1, 2025 in 24 equal monthly payments. The Term Loans bear an interest rate of 7.93%

per annum plus the 1-month CME Term SOFR reference rate as published by the CME Group Benchmark Administration Limited (subject

to a floor of 0.07%), based on a year consisting of 360 days.

At any time following the Closing Date, Borrowers

may prepay an amount of not less than all of the then outstanding principal balance and all accrued and unpaid interest on the Term

Loans, subject to at least fifteen (15) days prior written notice to Agent and the payment of a prepayment fee equal to (x) if made

on or prior to the first anniversary of the Closing Date, 3.0% of the principal amount being prepaid, (y) if made after the first anniversary

of the Closing Date but on or prior to the second anniversary of the Closing Date, 2.0% of the principal amount being prepaid and (z)

otherwise, 1.0%.

The Loan Agreement contains customary affirmative

covenants, negative covenants and events of default, as defined in the Loan Agreement, including covenants and restrictions that, among

other things, require the Borrowers to satisfy a financial covenant, restrict Borrowers’ ability to transfer cash to their subsidiaries,

and in certain circumstances restrict the ability of the Borrowers to incur liens, incur additional indebtedness, engage in mergers and

acquisitions, make distributions or make asset sales without the prior written consent of Lenders. A failure to comply with these covenants

could permit Lenders to declare Borrowers’ obligations under the Loan Agreement, together with accrued interest and fees, to be

immediately due and payable, plus any applicable additional amounts relating to a prepayment or termination, as described above.

The foregoing description of the Loan Agreement

does not purport to be complete and is qualified in its entirety by reference to the Loan Agreement, attached hereto as Exhibit 99.6,

and incorporated herein by reference.

Press Release

On February 1, 2022,

the Company issued the following press releases:

|

|

·

|

a

press release regarding the Private Placement and the Loan and Security Agreement titled

“Centogene Announces USD 62 Million Aggregate Equity and Debt Financings to Support

Growth Plan”;

|

|

|

·

|

a press release

titled “Centogene Announces Nomination of Andreas Busch to Supervisory Board”;

and

|

|

|

·

|

a

press release titled “Centogene Announces Nomination of Kim Stratton as Chief Executive

Officer”.

|

A copy of each of the press releases is attached hereto as Exhibit

99.1, Exhibit 99.2 and Exhibit 99.3, respectively.

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

CENTOGENE N.V.

Date: February 1, 2022

|

|

|

|

|

|

By:

|

|

/s/ Rene Just

|

|

|

|

Name:

|

Rene Just

|

|

|

|

Title:

|

Chief

Financial Officer

|

|

|

|

|

|

Exhibit Index

|

Exhibits

|

Description of Exhibit

|

|

|

|

|

99.1

|

Press release dated February 1, 2022 regarding Private Placement and Loan and Security Agreement.

|

|

99.2

|

Press release dated February 1, 2022 regarding Nomination to Supervisory Board.

|

|

99.3

|

Press release dated February 1, 2022 regarding Chief Executive Officer.

|

|

99.4*

|

Securities Purchase Agreement, dated January 31, 2022, by and among Centogene N.V. and the Investors

identified on Schedule 1 attached thereto.

|

|

99.5

|

Warrant Agreement, dated January 31, 2022, by and among Centogene N.V. and the Investors identified

on Schedule 1 attached thereto.

|

|

99.6**

|

Loan and Security Agreement dated as of January 31, 2022 between Centogene N.V., Oxford Finance

LLC, as Collateral Agent, and the Lenders named in Schedule 1.1 attached thereto.

|

* Portions of this exhibit have

been omitted pursuant to Item 601(b)(10)(iv) of Regulation S-K on the basis that the Company customarily and actually treats that

information as private or confidential and the omitted information is not material. The Company hereby undertakes to furnish

supplemental copies of any of the omitted exhibits upon request by the SEC.

** The exhibits to this agreement have been

omitted pursuant to Item 601(a)(5) of Regulation S-K. The Company hereby undertakes to furnish supplemental copies of any of the

omitted exhibits upon request by the SEC.

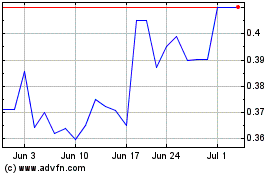

Centogene NV (NASDAQ:CNTG)

Historical Stock Chart

From Mar 2024 to Apr 2024

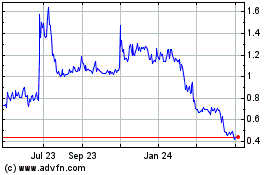

Centogene NV (NASDAQ:CNTG)

Historical Stock Chart

From Apr 2023 to Apr 2024