CEA Industries Inc. (NASDAQ: CEAD, CEADW) today announced operating

and financial results for the three months ended March 31, 2022.

Financial

Highlights

- Q1 2022 revenue of $1.7 million

represents a 26% decrease compared to Q1 2021 revenue due to

supply-chain driven delays in revenue recognition.

- Q1 2022 operating expenses of

$1,702,000 represents a 65% increase from Q1 2021, largely due to

labor related costs.

- For Q1 2022, our operating loss and

net loss was approximately $1,611,000 and $1,423,000, respectively.

This compares to a Q1 2021 operating loss and net loss of

approximately $686,000 and $793,000, respectively.

- Our Q1 2022 gross profit margin was

5.2% compared to 14.6% for Q1 2021, a decrease of 9.4 percentage

points.

- As of March 31, 2022, our cash

balance was approximately $22,034,000, compared to approximately

$2,160,000 as of December 31, 2021. Q1 2022 cash from operations

was approximately $193,000, compared to approximately $484,000 in

Q1 2021.

- Working capital was approximately

$17,948,000 as of March 31, 2022, compared to a working capital

deficit of approximately $2,349,000 as of March 31, 2021.

Supply Chain

Disruptions Affect Recognized

Revenues

During the first quarter of 2022 we had net

bookings totaling approximately $2.1 million. Our quarter-ended

backlog grew by approximately 3.3% to approximately $11.2 million

for the quarter ended March 31, 2022, compared to approximately

$10.8 million for the quarter ended December 31, 2021. However, our

recognized revenue during the first quarter was hampered by

supplier-related production and shipping delays, from a reduction

in cargo shipped by air, a shortage of containers, and a shortage

of domestic truck delivery availability. We continue to coordinate

solutions with our customers, suppliers, and shipping partners.

These logistical issues delayed our ability to translate some of

our backlog to revenues in accordance with the original timeframe

of the contracts. As a result, contract performance was delayed

with a corresponding delay in revenues recognized from various

large contracts in Q1 2022. The reduction in revenue partially

contributed to a lower gross margin as compared to Q1 2021, due to

the lack of absorption of our fixed costs.

Higher than Expected Labor

Costs and One-time Expenses

In addition to supply chain related disruptions,

the Company experienced cost increases driven by several factors.

First, the Company recognized higher labor and employment costs, as

it adjusted salaries to reflect current inflationary pressure on

labor costs. As stated above, our employees continue to manage our

business amidst supply disruptions and longer wait-times that

require diligent coordination amongst our customers, suppliers,

transporters, and other partners. Offering market-level competitive

salaries that keep pace with inflation is necessary to keep our

employees focused on the existing challenges of our business. In

addition, we have invested in future growth through hiring certain

skilled new employees.

The Company also recognized certain

non-recurring expenses in Q1 2022, associated with identifying and

hiring certain members of the executive team. Together these costs

were necessary to retain existing employees and build out the

executive skillset necessary to support our organic growth and

strategic acquisition strategies.

Product Development

Initiatives

We continue to accelerate the expansion of our

product and service offering, as originally announced in May 2021.

These efforts have diversified and expanded our revenue base to

include new products, new customers, and revenues that are more

recurring in nature.

We believe this expansion beyond traditional

HVAC technical solutions is a testament to our reputation as a

knowledgeable partner to our customers. We continue to invest in

product development, marketing and sales efforts to assist our

existing and future customers and we look forward to scaling this

base of expertise and knowledge as we expand our partnership

efforts to new addressable markets.

Tony McDonald, Chairman & CEO, commented:

“Like countless other industries, we continue to work through

supply chain and inflationary issues with our customers and our

shippers. These efforts require a coordinated effort and continued

evaluation of how these issues affect our ability to perform on our

contacts and recognize revenues. However, we remain confident about

our efforts to expand our product and service offerings and

increase our customer base, and we are optimistic that we will

continue to grow revenues through the year.”

About CEA

Industries Inc.

CEA Industries Inc. (www.ceaindustries.com),

through its subsidiary Surna Cultivation Technologies, is an

industry leader in CEA facility design and technologies. We provide

full-service licensed architectural and mechanical, electrical, and

plumbing (MEP) engineering services, carefully curated HVACD

equipment, proprietary controls systems, air sanitization,

lighting, and benching and racking products. Our team of project

managers, licensed professional architects and engineers,

technology and horticulture specialists and systems integrations

experts help our customers by precisely designing for their unique

applications. Through our partnership with a certified service

contractor network, we provide installation and maintenance

services to assist in a smooth build-out and optimal facility

performance. We have been providing solutions to indoor growers for

over 15 years and have served over 800 cultivators with over 200 of

them being large, commercial projects.

Headquartered in Louisville, Colorado, we

leverage our experience in the industry to bring value-added

solutions to our customers that help improve their overall crop

quality and yield, optimize energy and water efficiency, and

satisfy evolving state and local codes, permitting and regulatory

requirements.

Forward Looking Statements

This press release may contain statements of a

forward-looking nature relating to future events. These

forward-looking statements are subject to the inherent

uncertainties in predicting future results and conditions. These

statements reflect our current beliefs, and a number of important

factors could cause actual results to differ materially from those

expressed in this press release, including the factors set forth in

“Risk Factors” set forth in our annual and quarterly reports filed

with the Securities and Exchange Commission (“SEC”), and subsequent

filings with the SEC. Please refer to our SEC filings for a more

detailed discussion of the risks and uncertainties associated with

our business, including but not limited to the risks and

uncertainties associated with our business prospects and the

prospects of our existing and prospective customers; the inherent

uncertainty of product development; regulatory, legislative and

judicial developments, especially those related to changes in, and

the enforcement of, cannabis laws; increasing competitive pressures

in our industry; and relationships with our customers and

suppliers. Except as required by the federal securities laws, we

undertake no obligation to revise or update any forward-looking

statements, whether as a result of new information, future events

or otherwise. The reference to CEA’s website has been provided as a

convenience, and the information contained on such website is not

incorporated by reference into this press release.

Non-GAAP Financial Measures

To supplement our financial results on U.S.

generally accepted accounting principles (“GAAP”) basis, we use

non-GAAP measures including net bookings and backlog. We believe

these non-GAAP measures are helpful in understanding our past

performance and are intended to aid in evaluating our potential

future results. The presentation of these non-GAAP measures should

be considered in addition to our GAAP results and are not intended

to be considered in isolation or as a substitute for financial

information prepared or presented in accordance with GAAP. We

believe these non-GAAP financial measures reflect an additional way

to view aspects of our operations that, when viewed with our GAAP

results, provide a more complete understanding of factors and

trends affecting our business.

| |

CEA Industries

Inc. Marketing |

| |

Jamie English |

| |

Vice President, Marketing

Communications |

| |

jamie.english@ceaindustries.com |

| |

(303) 993-5271 |

CEA Industries

Inc.Consolidated Balance Sheets

|

|

|

March 31, |

|

|

December 31, |

|

|

|

|

2022 |

|

|

2021 |

|

|

|

|

|

(Unaudited) |

|

|

|

|

|

| ASSETS |

|

|

|

|

|

|

|

|

| Current Assets |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

22,033,664 |

|

|

$ |

2,159,608 |

|

|

Accounts receivable (net of allowance for doubtful accounts of

$159,744 and $181,942, respectively) |

|

|

191,002 |

|

|

|

179,444 |

|

|

Other receivables |

|

|

50,762 |

|

|

|

- |

|

|

Inventory, net |

|

|

1,005,918 |

|

|

|

378,326 |

|

|

Prepaid expenses and other |

|

|

1,774,219 |

|

|

|

1,273,720 |

|

| Total Current Assets |

|

|

25,055,565 |

|

|

|

3,991,098 |

|

| Noncurrent Assets |

|

|

|

|

|

|

|

|

|

Property and equipment, net |

|

|

77,239 |

|

|

|

77,346 |

|

|

Goodwill |

|

|

631,064 |

|

|

|

631,064 |

|

|

Intangible assets, net |

|

|

1,830 |

|

|

|

1,830 |

|

|

Deposits |

|

|

14,747 |

|

|

|

14,747 |

|

|

Operating lease right-of-use asset |

|

|

540,444 |

|

|

|

565,877 |

|

| Total Noncurrent Assets |

|

|

1,265,324 |

|

|

|

1,290,864 |

|

| |

|

|

|

|

|

|

|

|

| TOTAL ASSETS |

|

$ |

26,320,889 |

|

|

$ |

5,281,962 |

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES AND SHAREHOLDERS’ EQUITY (DEFICIT) |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| CURRENT LIABILITIES |

|

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities |

|

$ |

1,389,028 |

|

|

$ |

1,345,589 |

|

|

Deferred revenue |

|

|

5,485,416 |

|

|

|

2,839,838 |

|

|

Accrued equity compensation |

|

|

83,625 |

|

|

|

83,625 |

|

|

Other liabilities |

|

|

37,078 |

|

|

|

37,078 |

|

|

Current portion of operating lease liability |

|

|

112,072 |

|

|

|

100,139 |

|

| Total Current Liabilities |

|

|

7,107,219 |

|

|

|

4,406,269 |

|

| |

|

|

|

|

|

|

|

|

| NONCURRENT LIABILITIES |

|

|

|

|

|

|

|

|

|

Operating lease liability, net of current portion |

|

|

459,482 |

|

|

|

486,226 |

|

| Total Noncurrent Liabilities |

|

|

459,482 |

|

|

|

486,226 |

|

| |

|

|

|

|

|

|

|

|

| TOTAL LIABILITIES |

|

|

7,566,701 |

|

|

|

4,892,495 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and Contingencies (Note 7) |

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

| TEMPORARY EQUITY |

|

|

|

|

|

|

|

|

|

Series B Redeemable Convertible Preferred Stock, $0.00001 par

value; 0 and 3,300 issued and outstanding, respectively |

|

|

- |

|

|

|

3,960,000 |

|

| Total Temporary Equity |

|

|

- |

|

|

|

3,960,000 |

|

| |

|

|

|

|

|

|

|

|

| SHAREHOLDERS’ EQUITY (DEFICIT) |

|

|

|

|

|

|

|

|

|

Preferred stock; 25,000,000 and 150,000,000 shares authorized,

respectively |

|

|

- |

|

|

|

- |

|

|

Common stock, $0.00001 par value; 200,000,000 and 850,000,000

shares authorized, respectively; 7,784,444 and 1,600,835 shares

issued and outstanding, respectively |

|

|

78 |

|

|

|

16 |

|

|

Additional paid in capital |

|

|

48,958,618 |

|

|

|

25,211,017 |

|

|

Accumulated deficit |

|

|

(30,204,508 |

) |

|

|

(28,781,566 |

) |

| Total Shareholders’ Equity (Deficit) |

|

|

18,754,188 |

|

|

|

(3,570,533 |

) |

| |

|

|

|

|

|

|

|

|

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY

(DEFICIT) |

|

$ |

26,320,889 |

|

|

$ |

5,281,962 |

|

CEA Industries

Inc.Consolidated Statements of

Operations(Unaudited)

| |

|

For the Three Months Ended March 31, |

|

|

|

|

2022 |

|

|

2021 |

|

| Revenue, net |

|

$ |

1,744,427 |

|

|

$ |

2,366,529 |

|

| |

|

|

|

|

|

|

|

|

| Cost of revenue |

|

|

1,653,919 |

|

|

|

2,021,923 |

|

| |

|

|

|

|

|

|

|

|

| Gross profit |

|

|

90,508 |

|

|

|

344,606 |

|

| |

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

Advertising and marketing expenses |

|

|

251,015 |

|

|

|

177,145 |

|

|

Product development costs |

|

|

138,918 |

|

|

|

112,638 |

|

|

Selling, general and administrative expenses |

|

|

1,311,777 |

|

|

|

740,473 |

|

| Total operating expenses |

|

|

1,701,710 |

|

|

|

1,030,256 |

|

| |

|

|

|

|

|

|

|

|

| Operating loss |

|

|

(1,611,202 |

) |

|

|

(685,650 |

) |

| |

|

|

|

|

|

|

|

|

| Other income (expense): |

|

|

|

|

|

|

|

|

|

Other income (expense), net |

|

|

185,000 |

|

|

|

(107,000 |

) |

|

Interest income (expense),net |

|

|

3,260 |

|

|

|

(718 |

) |

| Total other income (expense) |

|

|

188,260 |

|

|

|

(107,718 |

) |

| |

|

|

|

|

|

|

|

|

| Loss before provision for income taxes |

|

|

(1,422,942 |

) |

|

|

(793,368 |

) |

| |

|

|

|

|

|

|

|

|

| Income taxes |

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(1,422,942 |

) |

|

$ |

(793,368 |

) |

| |

|

|

|

|

|

|

|

|

|

Convertible preferred series B stock dividends |

|

|

(35,984 |

) |

|

|

- |

|

|

Deemed dividend on convertible preferred series B stock on down

round |

|

|

(439,999 |

) |

|

|

- |

|

| |

|

|

|

|

|

|

|

|

| Net Loss Available to Common Shareholders |

|

$ |

(1,898,925 |

) |

|

$ |

(793,368 |

) |

| |

|

|

|

|

|

|

|

|

| Loss per common share – basic and dilutive |

|

$ |

(0.41 |

) |

|

$ |

(0.50 |

) |

| |

|

|

|

|

|

|

|

|

| Weighted average number of common shares outstanding, basic and

dilutive |

|

|

4,622,427 |

|

|

|

1,576,844 |

|

CEA Industries

Inc.Consolidated Statements of Cash Flows

(Unaudited)

| |

|

For the Three Months Ended March 31, |

|

|

|

|

2022 |

|

|

2021 |

|

| Cash Flows From Operating Activities: |

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(1,422,942 |

) |

|

$ |

(793,368 |

) |

| Adjustments to reconcile net loss to net cash provided by (used

in) operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation and intangible asset amortization expense |

|

|

8,556 |

|

|

|

18,377 |

|

|

Share-based compensation |

|

|

92,517 |

|

|

|

6,342 |

|

|

Common stock issued for other expense |

|

|

- |

|

|

|

67,000 |

|

|

Provision for doubtful accounts |

|

|

(22,168 |

) |

|

|

- |

|

|

Provision for excess and obsolete inventory |

|

|

3,676 |

|

|

|

(4,371 |

) |

|

Loss on disposal of assets |

|

|

5,499 |

|

|

|

- |

|

|

Amortization of ROU asset |

|

|

25,433 |

|

|

|

49,051 |

|

| |

|

|

|

|

|

|

|

|

| Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

10,610 |

|

|

|

6,748 |

|

|

Inventory |

|

|

(631,269 |

) |

|

|

(187,679 |

) |

|

Prepaid expenses and other |

|

|

(551,261 |

) |

|

|

(1,026,765 |

) |

|

Accounts payable and accrued liabilities |

|

|

43,438 |

|

|

|

5,354 |

|

|

Deferred revenue |

|

|

2,645,579 |

|

|

|

2,362,905 |

|

|

Accrued interest |

|

|

- |

|

|

|

718 |

|

|

Lease deposit |

|

|

- |

|

|

|

(8,061 |

) |

|

Operating lease liability, net |

|

|

(14,811 |

) |

|

|

(64,672 |

) |

|

Accrued equity compensation |

|

|

- |

|

|

|

52,794 |

|

| Net cash (used in)/provided by operating activities |

|

|

192,857 |

|

|

|

484,373 |

|

| |

|

|

|

|

|

|

|

|

| Cash Flows From Investing Activities |

|

|

|

|

|

|

|

|

|

Purchases of property and equipment |

|

|

(13,948 |

) |

|

|

(12,326 |

) |

| Net cash used in investing activities |

|

|

(13,948 |

) |

|

|

(12,326 |

) |

| |

|

|

|

|

|

|

|

|

| Cash Flows From Financing Activities |

|

|

|

|

|

|

|

|

|

Payment of dividends on series B preferred stock |

|

|

(35,984 |

) |

|

|

- |

|

|

Redemption of series B preferred stock |

|

|

(1,980,000 |

) |

|

|

- |

|

|

Cash proceeds on sale of common stock and warrants, net of

expenses |

|

|

21,711,131 |

|

|

|

- |

|

|

Proceeds from issuance of note payable |

|

|

- |

|

|

|

514,200 |

|

| Net cash provided by financing activities |

|

|

19,695,147 |

|

|

|

514,200 |

|

| |

|

|

|

|

|

|

|

|

| Net change in cash and cash equivalents |

|

|

19,874,056 |

|

|

|

986,247 |

|

| Cash and cash equivalents, beginning of period |

|

|

2,159,608 |

|

|

|

2,284,881 |

|

| Cash and cash equivalents, end of period |

|

$ |

22,033,664 |

|

|

$ |

3,271,128 |

|

| |

|

|

|

|

|

|

|

|

| Supplemental cash flow information: |

|

|

|

|

|

|

|

|

|

Interest paid |

|

$ |

- |

|

|

$ |

- |

|

|

Income taxes paid |

|

$ |

- |

|

|

$ |

- |

|

|

|

|

|

|

|

|

|

|

|

| Non-cash investing and financing activities: |

|

|

|

|

|

|

|

|

|

Conversion of series B preferred stock |

|

$ |

1,980,000 |

|

|

$ |

- |

|

|

Deemed dividend on series B preferred stock arising on down

round |

|

$ |

439,999 |

|

|

$ |

- |

|

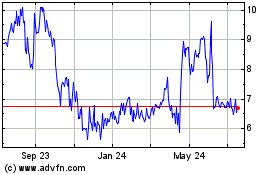

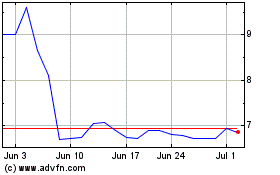

CEA Industries (NASDAQ:CEAD)

Historical Stock Chart

From Mar 2024 to Apr 2024

CEA Industries (NASDAQ:CEAD)

Historical Stock Chart

From Apr 2023 to Apr 2024