UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to

Section 13 or 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported) November

17, 2019

CAROLINA

FINANCIAL CORPORATION

(Exact name of

registrant as specified in its charter)

|

Delaware

(State

or other jurisdiction of incorporation)

|

001-10897

(Commission

File Number)

|

57-1039673

(IRS.

Employer Identification No.)

|

|

288

Meeting Street, Charleston, South Carolina

(Address

of principal executive offices)

|

29401

(Zip

Code)

|

(843) 723-7700

(Registrant’s

telephone number, including area code)

Not Applicable

(Former name

or former address, if changed since last report.)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

x Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered

pursuant to Section 12(b) of the Act:

|

Title

of each class

|

Trading

Symbol(s)

|

Name

of each exchange on which registered

|

|

Common

Stock

|

CARO

|

NASDAQ

Capital Market

|

Indicate by

check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth

company o

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 1.01

Entry into a Material Definitive Agreement

Agreement

and Plan of Merger

On

November 17, 2019, Carolina Financial Corporation (“Carolina Financial”) entered into an Agreement and Plan of Merger

(the “Agreement”) with United Bankshares, Inc. (“United”), a West Virginia corporation.

In

accordance with the Agreement, Carolina Financial shall merge with and into United (the “Merger”). Carolina Financial

will cease to exist and United shall survive and continue to exist as a West Virginia corporation. United may at any time prior

to the effective time of the Merger change the method of effecting the combination with Carolina Financial subject to certain

conditions contained in the Agreement.

The

Agreement provides that upon consummation of the Merger, each outstanding share of common stock of Carolina Financial will be

converted into the right to receive 1.13 shares of United common stock, par value $2.50 per share.

Pursuant

to the Agreement, as of the effective time of the Merger, each outstanding Carolina Financial stock option, whether vested or

unvested as of the date of the Agreement, shall, at such option holder’s election, (i) vest and convert into an option to

acquire United common stock adjusted based on the 1.13 exchange ratio, or (ii) be entitled to receive cash consideration equal

to the difference between (a) the option’s exercise price and (b) the volume weighted average trading price of the Carolina

Financial common stock on NASDAQ for the twenty full trading days ending on the second trading day immediately preceding the closing

date (the “CFC Closing Price”) multiplied by the number of shares of Carolina Financial common stock subject to such

stock option. Also, at the effective time of the Merger, each restricted stock grant, restricted stock unit grant or any other

award of a share of Carolina Financial common stock subject to vesting, repurchase or other lapse restriction under a Carolina

Financial stock plan (other than a stock option) (each, a “Stock Award”) that is outstanding immediately prior to

the effective time of the Merger, shall fully vest in accordance with the terms of the Carolina Financial stock plan and at the

election of the holder (i) convert into the right to receive shares of United common stock based on the 1.13 exchange ratio or

(ii) convert into cash in an amount equal to the CFC Closing Price multiplied by the shares of Carolina Financial common stock

subject to the Stock Award.

At

the effective time of the Merger, CresCom Bank, a wholly-owned subsidiary of Carolina Financial, will merge with and into United

Bank, a wholly-owned subsidiary of United (the “Bank Merger”). United Bank will survive the Bank Merger and continue

to exist as a Virginia banking corporation.

Consummation

of the Merger is subject to approval of the stockholders of United and Carolina Financial, the receipt of all required regulatory

approvals, as well as other customary conditions.

The

foregoing description of the Agreement does not purport to be complete and is qualified in its entirety by reference to the full

text of the Agreement, a copy of which is attached as Exhibit 2.1 to this Current Report on Form 8-K and is incorporated herein

by reference. The Agreement has been attached as an exhibit to provide investors and security holders with information

regarding its terms. It is not intended to provide any other financial information about Carolina Financial or its subsidiaries

or affiliates. The representations, warranties and covenants contained in the Agreement were made only for purposes of that agreement

and as of specific dates, are solely for the benefit of the parties to the Agreement, may be subject to limitations agreed upon

by the parties, including being qualified by confidential disclosures made for the purposes of allocating contractual risk between

the parties to the Agreement instead of establishing these matters as facts, and may be subject to standards of materiality applicable

to the parties that differ from those applicable to investors. Investors should not rely on the representations, warranties, or

covenants or any description thereof as characterizations of the actual state of facts or condition of Carolina Financial or any

of its subsidiaries or affiliates. Moreover, information concerning the subject matter of the representations, warranties, and

covenants may change after the date of the Agreement, which subsequent information may or may not be fully reflected in public

disclosures by Carolina Financial.

Support Agreements

In

connection with entering into the Agreement, each of the directors of Carolina Financial have entered into a Support

Agreement (collectively, the “Support Agreements”). The Support Agreements generally require that the stockholder

party thereto vote all of his or her shares of Carolina Financial common stock in favor of the Merger and, subject to

specified exceptions, prohibit such stockholder from transferring his or her shares of Carolina Financial common stock prior

to the consummation of the Merger. The Support Agreements will terminate upon the earlier of the consummation of the Merger

and the termination of the Agreement in accordance with its terms.

The

foregoing description of the Support Agreements does not purport to be complete and is qualified in its entirety by reference

to the Form of CFC Support Agreement, which is included as Exhibit A to the Agreement, which is filed as Exhibit 2.1 of

this Form 8-K, and incorporated by reference herein.

Item 8.01

Other Events

On

November 18, 2019, United and Carolina Financial issued a joint press release concerning the Merger.

A copy of the joint press release is attached hereto as Exhibit 99.1 and is being furnished to the Securities and Exchange Commission

and shall not be deemed “filed” for any purpose.

Item 9.01 Financial Statements and Exhibits

Forward

Looking Statements

This

Form 8-K and the press release contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933

and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are intended to be covered by the safe

harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. These forward-looking

statements include, but are not limited to, statements about (i) the benefits of the Merger between Carolina Financial and United,

including future financial and operating results, cost savings enhancements to revenue and accretion to reported earnings that

may be realized from the Merger; (ii) United’s and Carolina Financial’s plans, objectives, expectations and intentions

and other statements contained in this press release that are not historical facts; and (iii) other statements identified by words

such as “expects,” “anticipates,” “intends,” “plans,” “believes,”

“seeks,” “estimates,” “targets,” “projects,” or words of similar meaning generally

intended to identify forward-looking statements. These forward-looking statements are based upon the current beliefs and expectations

of the respective managements of United and Carolina Financial and are inherently subject to significant business, economic and

competitive uncertainties and contingencies, many of which are beyond the control of United and Carolina Financial. In addition,

these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are

subject to change. Actual results may differ materially from the anticipated results discussed in these forward-looking statements

because of possible uncertainties.

The

following factors, among others, could cause actual results to differ materially from the anticipated results or other expectations

expressed in the forward-looking statements: (1) the businesses of United and Carolina Financial may not be combined successfully,

or such combination may take longer, be more difficult, time-consuming or costly to accomplish than expected; (2) the expected

growth opportunities or cost savings from the Merger may not be fully realized or may take longer to realize than expected; (3)

deposit attrition, operating costs, customer losses and business disruption following the Merger, including adverse effects on

relationships with employees, may be greater than expected; (4) the regulatory approvals required for the Merger may not be obtained

on the proposed terms or on the anticipated schedule; (5) the stockholders of United and Carolina Financial may fail to approve

the Merger; (6) legislative or regulatory changes, including changes in accounting standards, may adversely affect the businesses

in which United and Carolina Financial are engaged; (7) the interest rate environment may further compress margins and adversely

affect net interest income; (8) results may be adversely affected by continued diversification of assets and adverse changes to

credit quality; (9) competition from other financial services companies in United’s and Carolina Financial’s markets

could adversely affect operations; and (10) an economic slowdown could adversely affect credit quality and loan originations.

Additional factors, that could cause actual results to differ materially from those expressed in the forward-looking statements

are discussed in Carolina Financial’s and United’s reports (such as Annual Reports on Form 10-K, Quarterly Reports

on Form 10-Q and Current Reports on Form 8-K) filed with the Securities and Exchange Commission and available on the SEC’s

Internet site (http://www.sec.gov).

United

and Carolina Financial caution that the foregoing list of factors is not exclusive. All subsequent written and oral forward-looking

statements concerning the proposed transaction or other matters attributable to United or Carolina Financial or any person acting

on their behalf are expressly qualified in their entirety by the cautionary statements above. United and Carolina Financial do

not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date

the forward-looking statements are made.

Additional

Information About the Merger and Where to Find It

Stockholders

of United and Carolina Financial and other investors are urged to read the joint proxy statement/prospectus that will be included

in the registration statement on Form S-4 that United will file with the Securities and Exchange Commission in connection with

the proposed Merger because it will contain important information about United, Carolina Financial, the Merger, the persons soliciting

proxies in the Merger and their interests in the Merger and related matters. Investors will be able to obtain all documents filed

with the SEC by Carolina Financial free of charge at the SEC’s Internet site (http://www.sec.gov). In addition, documents

filed with the SEC by Carolina Financial will be available free of charge from Carolina Financial

Corporation, 288 Meeting Street, Charleston, South Carolina 29401, Attention: William A. Gehman, III,

Executive Vice President and Chief Financial Officer. The joint proxy

statement/prospectus (when it is available) and the other documents may also be obtained for free by accessing United’s

website at www.ubsi-inc.com under the tab “Investor Relations” and then under the heading “SEC Filings”

or by accessing Carolina Financial’s website at www.haveanicebank.com under the tab “Investor Relations”

and then under the heading “SEC Filings”. You are urged to read the joint proxy statement/prospectus carefully before

making a decision concerning the Merger.

Participants

in the Transactions

United,

Carolina Financial and their respective directors, executive officers and certain other members of management and employees may

be deemed “participants” in the solicitation of proxies from United’s and Carolina Financial’s stockholders

in favor of the Merger. Information regarding the persons who may, under the rules of the SEC, be considered participants in the

solicitation of the United and Carolina Financial stockholders in connection with the proposed Merger will be set forth in the

joint proxy statement/prospectus when it is filed with the SEC.

You

can find information about Carolina Financial’s executive officers and directors in its Annual Report on Form 10-K for the

year ended December 31, 2018 and in its definitive proxy statement filed with the SEC on March 22, 2019. You can find information

about the executive officers and directors of United in its Annual Report on Form 10-K for the year ended December 31, 2018

and in its definitive proxy statement filed with the SEC on March 29, 2019. You can obtain free copies of these documents from

United, or Carolina Financial using the contact information above.

Additional Information About the Carolina Trust Acquisition and Where to Find It

Carolina Financial has filed a Registration Statement on Form S-4 (Registration No: 333-233640), which was declared effective

on October 21, 2019, which includes a proxy statement of Carolina Trust Bancshares, Inc. (“Carolina Trust”) and

a prospectus of Carolina Financial, as well as other relevant documents concerning the proposed Carolina Trust transaction.

The proposed Carolina Trust transaction will be submitted to Carolina Trust’s shareholders for their consideration.

This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall

there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of such jurisdiction.

SHAREHOLDERS OF CAROLINA TRUST ARE URGED TO READ THE REGISTRATION STATEMENT, THE PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT

DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION.

Shareholders of Carolina Trust will be able to obtain a free copy of the proxy statement/prospectus, as well as other filings

containing information about Carolina Financial and Carolina Trust, at the SEC’s internet site (http://www.sec.gov).

Copies of the proxy statement/prospectus and the filings with the SEC that will be incorporated by reference in the proxy

statement/prospectus can also be obtained, without charge, by directing a request to: Carolina Financial Corporation, 288

Meeting Street, Charleston, South Carolina 29401, Attention: William A. Gehman, III, Executive Vice President and Chief Financial

Officer or Carolina Trust BancShares, Inc., 901 East Main Street, Lincolnton, NC 28092, Attention: Edwin Laws, Chief Financial

Officer.

Participants in the Carolina Trust Solicitation

Carolina Trust and certain of its directors, executive officers and employees and other persons may be deemed to be participants

in the solicitation of proxies in respect of the proposed Carolina Trust transaction. Information regarding Carolina Trust’s

directors and executive officers is available in its definitive proxy statement (form type DEF 14A) which was filed with the

SEC on April 11, 2019 and certain of its Current Reports on Form 8-K. Other information regarding the participants in the

proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, is contained

in the proxy statement/prospectus and other relevant materials that may be filed with the SEC.

SIGNATURES

Pursuant to

the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

CAROLINA FINANCIAL CORPORATION,

|

|

|

Registrant

|

|

|

|

|

|

|

|

Date: November 18, 2019

|

By:

|

/s/ William A. Gehman, III

|

|

|

|

|

William A. Gehman, III

|

|

|

|

|

Executive Vice President and Chief Financial Officer

|

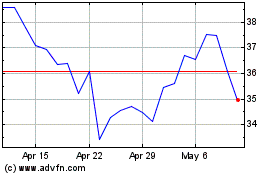

Maplebear (NASDAQ:CART)

Historical Stock Chart

From Mar 2024 to Apr 2024

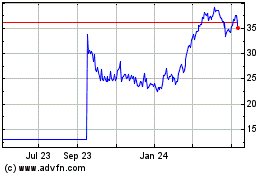

Maplebear (NASDAQ:CART)

Historical Stock Chart

From Apr 2023 to Apr 2024