Carolina Trust BancShares, Inc. (the “Company”) (NASDAQ

- CART) reports its financial results today for

the most recently completed quarter. In the quarter

that ended June 30, 2019 (“2Q19”), the Company’s net income was

$1,818,000 or $0.19 per diluted share as compared to $510,000 or

$0.08 per diluted share in the quarter ended June 30, 2018

(“2Q18”), an increase of $1,308,000 or $0.11 per diluted

share. The diluted average common shares outstanding

increased to 9.4 million shares in 2Q19 from 6.7 million shares in

2Q18, following the acquisition of Clover Community Bankshares,

Inc., (“Clover”) and its subsidiary bank, Clover Community Bank on

January 1, 2019 that was described in more detail in the Company’s

first quarter 2019 earnings release.

The Company recognized expenses and income in each period that

were related to its acquisition. These items, net of tax,

reduced income by $43,000 in 2Q19 and by $287,000 in 2Q18 when the

Company began incurring investment banking, legal, and due

diligence fees for the Clover acquisition. Adjusted net

income, which excludes these merger-related items and is a non-GAAP

(Generally Accepted Accounting Principles) measure, was $1,861,000

in 2Q19 and $797,000 in 2Q18. On a diluted per share basis,

adjusted net income was $0.20 in 2Q19 and $0.12 in 2Q18. See

the non-GAAP reconciliation table that accompanies this

release.

For the linked quarter ended March 31, 2019, net income was

$337,000 or $0.04 per diluted share and adjusted net income was

$1,710,000 or $0.18, per diluted share.

Jerry Ocheltree, President and CEO, stated, “We are pleased with

the results of the second quarter including higher net income and

improved ROA, ROE, and efficiency ratios following a successful

integration of the Clover franchise during the first quarter.

We have a stronger team that serves a larger portion of the

Charlotte MSA and have generated profits for capital support of our

planned asset growth. In the second half of 2019 we will work

each day to serve our customers well and to be responsive to their

financial needs, while at the same time working toward the planned

merger and successful integration into Carolina Financial

Corporation and its subsidiary, CresCom Bank. As part of this

larger community bank, we are excited about continuing the highest

level of service with an anticipated wider array of products as

part of the Carolina Financial team led by Jerry Rexroad and his

experienced and dedicated executives.”

The table below summarizes the key components of net income for

2Q19 and 2Q18.

|

$ in thousands |

For the three months ended |

|

|

|

|

June 30, 2019 |

June 30, 2018 |

Increase(Decrease) |

% Change |

|

Interest income |

$ |

7,403 |

|

$ |

5,198 |

|

$ |

2,205 |

|

42 |

% |

|

Interest expense |

|

1,548 |

|

|

1,155 |

|

|

393 |

|

34 |

% |

|

Net interest income |

|

5,855 |

|

|

4,043 |

|

|

1,812 |

|

45 |

% |

|

Provision for loan loss |

|

76 |

|

|

88 |

|

|

(12 |

) |

(14 |

%) |

|

Noninterest income |

|

664 |

|

|

366 |

|

|

298 |

|

81 |

% |

|

Noninterest expense, excluding merger expenses |

|

4,059 |

|

|

3,297 |

|

|

762 |

|

23 |

% |

|

Merger expenses |

|

49 |

|

|

323 |

|

|

(274 |

) |

(85 |

%) |

|

Pre-tax income |

|

2,335 |

|

|

701 |

|

|

1,634 |

|

233 |

% |

|

Income tax expense |

|

517 |

|

|

191 |

|

|

326 |

|

171 |

% |

|

Net income |

$ |

1,818 |

|

$ |

510 |

|

|

1,308 |

|

256 |

% |

|

|

|

|

|

|

|

Non-GAAP measurements: |

|

|

|

|

|

Net income |

$ |

1,818 |

|

$ |

510 |

|

|

|

|

Adjustments: |

|

|

|

|

|

+ Merger expenses |

|

49 |

|

|

323 |

|

|

|

|

- Accretion of purchased loan discounts |

|

(132 |

) |

|

(2 |

) |

|

|

|

- Accretion of purchased time deposit discounts |

|

10 |

|

|

- |

|

|

|

|

+ Amortization of core deposit intangible |

|

125 |

|

|

9 |

|

|

|

|

- Net tax effect of adjustments |

|

(9 |

) |

|

(43 |

) |

|

|

|

= Adjusted net income |

$ |

1,861 |

|

$ |

797 |

|

$ |

1,064 |

|

134 |

% |

|

|

|

|

|

|

|

Return on assets |

|

1.18 |

% |

|

0.44 |

% |

|

0.74 |

% |

|

|

Return on equity |

|

10.64 |

% |

|

4.69 |

% |

|

5.95 |

% |

|

|

Net interest margin |

|

4.10 |

% |

|

3.76 |

% |

|

0.34 |

% |

|

|

Efficiency ratio 1 |

|

63 |

% |

|

82 |

% |

|

(19 |

%) |

|

|

Adjusted return on assets 2 |

|

1.21 |

% |

|

0.69 |

% |

|

0.52 |

% |

|

|

Adjusted return on equity 2 |

|

10.89 |

% |

|

7.34 |

% |

|

3.55 |

% |

|

|

Adjusted net interest margin 2 |

|

4.02 |

% |

|

3.76 |

% |

|

0.26 |

% |

|

|

Adjusted efficiency ratio 2 |

|

62 |

% |

|

75 |

% |

|

(13 |

%) |

|

|

Average assets |

$ |

615,546 |

|

$ |

460,556 |

|

$ |

154,990 |

|

34 |

% |

|

Average loans |

|

480,821 |

|

|

370,875 |

|

|

109,946 |

|

30 |

% |

|

Average deposits |

|

518,293 |

|

|

381,125 |

|

|

137,168 |

|

36 |

% |

|

Average equity 3 |

|

68,538 |

|

|

43,576 |

|

|

24,962 |

|

57 |

% |

|

Book value per share as of the end of the period |

$ |

7.51 |

|

$ |

6.73 |

|

|

|

|

Tangible book value per share as of the end of the period |

$ |

6.63 |

|

$ |

6.73 |

|

|

|

| |

|

|

|

|

|

|

|

|

| 1 Efficiency

ratio = Noninterest expense / (Net interest income + Noninterest

income) |

| 2 Adjusted

returns on assets and equity, adjusted net interest margin and

adjusted efficiency ratios are non-GAAP measures. A

reconciliation to GAAP is included at the end of this release. |

| 3 Note: The

common stock offering completed in April 2018 added $18.4 million

to common equity. The acquisition of Clover in January 2019

added $16.1 million to common equity |

| |

As shown in the table, expenses related to acquisitions in 2Q19

included $125,000 in amortization of core deposit intangibles

(“CDI”), $49,000 in merger-related expenses, and $10,000 in expense

from accretion of discounts on acquired deposits. These

expenses were partially offset by $132,000 in income from accretion

of discounts recorded on acquired loans. The tax benefit was

$9,000 for an overall $43,000 decrease to 2Q19 net income related

to acquisitions. In 2Q18, the CDI amortization, merger

related expenses, income from accretion on loans and tax benefit

were $9,000, $323,000, $2,000 and $43,000 respectively, which

resulted in an overall decrease to net income of $287,000.

Comparing 2Q19 with 2Q18, the $1,634,000 (+233%) increase in

pre-tax income was due to the $1,812,000 (+45%) increase in net

interest income, as interest income grew by $2,205,000 (+42%) while

interest expenses grew by only $393,000 (+34%). Noninterest

income grew by $298,000 (+81%) as compared to a $488,000 (+13%)

increase in noninterest expenses. Income taxes increased by

$326,000 (+171%), which was less than the growth of pre-tax income

due to more tax-exempt income in 2Q19 and to non-deductible merger

expenses incurred in 2Q18.

Tangible book value per share at June 30, 2019 was $6.63, a

$0.10 decrease from $6.73 at June 30, 2018. The decrease was

due to dilution from merger consideration paid to Clover

shareholders for the net assets acquired. Tangible book value

per share increased by $0.29 from $6.34 at March 31, 2019 with the

increase attributed to earnings and higher accumulated other

comprehensive income, an equity component that reflects a higher

valuation of the securities portfolio.

Net interest income increased from $4,043,000 in 2Q18 to

$5,855,000 in 2Q19, primarily due to the loan and deposit growth

from the acquisition of Clover and, secondarily, to organic loan

growth from existing operations of Carolina Trust Bank (the

“Bank”). Average loans increased by $110 million, or 30%,

from 2Q18 to 2Q19 and included $64 million acquired from

Clover. The remaining $46 million in year-over-year average

loan growth was concentrated in the Mooresville and Hickory offices

and the Salisbury loan production office, which combined for $34

million of the growth, followed by the Denver and Gastonia offices

with average loan growth totaling $14 million. The offices

with the highest average loans in 2Q19 were Gastonia ($87 million),

Mooresville ($86 million), Hickory ($75 million), and Lincolnton

Main ($69 million).

The net interest margin increased by 34 basis points from 3.76%

in 2Q18 to 4.10% in 2Q19. The yield on earning assets

increased by 35 basis points from 4.84% in 2Q18 to 5.19% in

2Q19. Comparatively, the cost of funds, including deposits,

borrowings and holding company debt, increased by only 2 basis

points from 1.12% in 2Q18 to 1.14% in 2Q19. The improvement

in the yield on earning assets and the net interest margin was

softened slightly by the shift in the earning asset mix, as the

ratio of average loans to average earning assets declined from 86%

in 2Q18 to 84% in 2Q19. The additional liquidity maintained

in interest earning cash and securities resulted in those

categories increasing from 14% to 16% as a percentage of earning

assets for the same periods.

The margin and asset yield increases were attributed primarily

to the 42 basis points increase in loan yield from 5.24% in 2Q18 to

5.66% in 2Q19. Loan yields were positively impacted by prime

rate increases of 25 basis points each in June 2018, September

2018, and December 2018. The loan yields also benefited from

accretion of the discounts on purchased loans and were partially

offset by accretion of the discounts on acquired time deposits. The

net impact of loan and deposit accretion added 8 basis points to

the net interest margin.

In a linked quarter comparison, the net interest margin improved

by 1 basis point from 4.09% in 1Q19 to 4.10% in 2Q19. The

earning asset yield grew by 7 basis points and was slightly better

than the 6 basis points increase in cost of funds. As

compared to the linked quarter, average loans grew by $16 million

at an annualized growth rate of 14%, and average deposits grew by

$9 million at an annualized growth rate of 7%.

Noninterest income increased by $298,000 from $366,000 in 2Q18

to $664,000 in 2Q19. The increase was due mostly to mortgage

fee income increasing by $97,000 or 359%, to unrealized gains in

equity securities increasing by $78,000 or 156%, and to an increase

in interchange fees of $64,000 or 123%. The growth in

mortgage fee income result was partially attributed to experienced

mortgage specialists who were previously with Clover and to a

renewed emphasis to meeting the demand for mortgages in the Bank’s

markets. The unrealized gains in equity securities was driven

by an increase in the market value of the Bank’s investment

security holdings that trade in public markets. The interchange

fees increased as a result of an increase in the Bank’s checking

account customer base for which the average total balance grew by

64% from 2Q18 to 2Q19, primarily due to the acquisition of Clover,

and as a result of an overall increase in debit card usage.

Noninterest expense increased by $488,000 (+13%), from

$3,620,000 in 2Q18 to $4,108,000 in 2Q19. Salaries and

benefits grew by $467,000 or 25% and data processing expenses grew

by $90,000 or 48% due to the additional employees and customer

accounts following the acquisition of Clover on January 1,

2019. Amortization of core deposit intangibles increased by

$116,000 due to the core deposit intangible recognized on January

1, 2019 from the valuation of Clover’s non-maturing deposits.

Stockholder expenses increased by $54,000 due to the additional

legal, transfer agent, printing and SEC filing expenses in 2019

with a larger shareholder base.

Lessening the impact of increases in other noninterest expenses

that were mostly attributed to the growth from Clover acquisition

were decreases in merger related expenses of $274,000, or 85%, and

in foreclosed asset expenses of $221,000 or 74% in 2Q19 as compared

to 2Q18. Merger expenses, higher in 2Q18, were attributed to

due diligence and negotiating the merger agreement with Clover in

2018. The Bank’s foreclosed asset expenses have declined, as

foreclosed assets have decreased over the past 12 months by

$621,000 or 31%.

Comparison of Financial Condition at June 30, 2019 with March

31, 2019

Loans grew by $11.2 million (+2.4%) while deposits declined by

$7.2 million (+1.4%), from March 31, 2019 to June 30, 2019, even

though average deposits increased from 1Q19 to 2Q19 as discussed

above in the net interest income section. The additional

funding for loan growth was drawn from interest-earning deposits

with other banks. Loan growth was mostly in commercial real

estate loans, both owner-occupied, up $3.4 million, and non-owner

occupied, up $2.8 million. Commercial-other loans which

includes municipal loans increased by $3.0 million, and residential

mortgage loans grew by $2.3 million. The decrease in deposits

was mostly in the categories of business noninterest checking, down

$4.7 million, and consumer interest checking, down $1.7

million. Shareholders’ equity grew by $2.5 million (+3.7%),

primarily from $1.8 million in earnings during the quarter.

Equity also increased by $700,000 due to accumulated other

comprehensive income from the appreciation of the Bank’s debt

securities as markets began anticipating a decrease in the

short-term interest rates in the last half of 2019.

Over the past twelve months, loans grew by $111 million

including $64 million acquired from Clover on January 1, 2019 and

$47 million from the Bank’s existing customer relationships.

Deposits grew by $123 million, including $112 million acquired from

Clover, and $16 million from existing customer relationships that

were partially offset by a $5 million decrease in wholesale

deposits.

Asset quality measurements remained strong during the second

quarter of 2019. The ratio of non-performing assets to total

assets was 0.43% on June 30, 2019 as compared to 0.52% on March 31,

2019 and as compared to 0.65% on June 30, 2018. Nonperforming

loans to total loans increased by 2 basis points during the second

quarter to 0.24% at June 30, 2019 but decreased by 6 basis points

from a year ago.

Net charge offs (recoveries) to average loans on an annualized

basis were 0.00%, (0.01%), and 0.03%, respectively, for the

quarters ended June 30, 2019, March 31, 2019, and June 30,

2018.

Regulatory capital ratios for the Company’s wholly owned

subsidiary, Carolina Trust Bank, increased from March 31, 2019 to

June 30, 2019. The growth in risk-based capital from second

quarter earnings exceeded the second quarter growth in

risk-weighted assets. The Bank’s total risk-based capital

ratio at June 30, 2019 was 13.47%, a 22 basis point increase from

13.25% at March 31, 2019. Additional detail regarding the

Bank’s regulatory capital ratios are included in the financial

tables that accompany this release.

About Carolina Trust BancShares, Inc. Carolina

Trust BancShares, Inc. is a bank holding company and the parent

company of Carolina Trust Bank. Carolina Trust Bank is a full

service, state-chartered bank headquartered in Lincolnton,

N.C. The bank operates in eleven full-service offices and one

loan production office in the Piedmont and Mountain Regions of the

Carolinas to the north and west of Charlotte, NC.

Caution Regarding Forward-Looking Statements: This news release

contains forward-looking statements. Words such as “anticipates,” “

believes,” “estimates,” “expects,” “intends,” “should,” “will,”

variations of such words and similar expressions are intended to

identify forward-looking statements. These statements reflect

management’s current beliefs as to the expected outcomes of future

events and are not guarantees of future performance. These

statements involve certain risks, uncertainties and assumptions

that are difficult to predict with regard to timing, extent,

likelihood and degree of occurrence. Therefore, actual results and

outcomes may materially differ from what may be expressed or

forecasted in such forward-looking statements. Factors that could

cause a difference in actual results and outcomes include, among

others: the impact of changes in tax law and regulations, including

the Tax Cuts and Jobs Act of 2017; changes in the national and

local economies or market conditions; changes in interest rates,

deposit flows, loan demand and asset quality, including real estate

and other collateral values; changes in banking regulations and

accounting principles, policies or guidelines; the impact of

competition from traditional or new sources; and the impact of our

merger activity, including the risks that (1) the business related

to such merger activity may not be integrated successfully or such

integration may take longer to accomplish than expected (or may not

occur at all); (2) the expected cost savings and any revenue

synergies from our merger activity may not be fully realized within

expected timeframes or at all; and (3) disruption from merger

activity may make it more difficult to maintain relationships with

clients, associates, or suppliers. These and other factors that may

emerge could cause decisions and actual results to differ

materially from current expectations. The Company undertakes no

obligation to revise, update, or clarify forward-looking statements

to reflect events or conditions after the date of this release.

Note Regarding Use of Non-GAAP Financial Measures: This

news release presents certain non-GAAP financial measures

including, without limitation, adjusted net income, adjusted net

income per share, and tangible book value per share. Non-GAAP

financial measures include numerical measures of a company’s

historical financial performance, financial position, or cash flows

that exclude (or include) amounts, or that are subject to

adjustments that have the effect of excluding (or including)

amounts, that are included (or, as applicable, excluded) in the

most directly comparable measures calculated and presented in

accordance with GAAP. The Company has presented the

adjustments to reconcile from the applicable GAAP financial

measures to the non-GAAP financial measures where applicable.

The Company considers these adjustments to the GAAP financial

measures to be relevant to ongoing operating results. The

Company believes that excluding the amounts associated with these

adjustments to present the non-GAAP financial measures provides a

meaningful base for the period-to-period comparisons, which will

assist investors and analysts in analyzing the operating results or

financial position of the Company. The non-GAAP financial

measures are used by management to assess the performance of the

Company’s business, including for presentations of Company

performance to investors. The Company further believes that

presenting the non-GAAP financial measures will permit investors

and analysts to assess the performance of the Company on the same

basis as that applied by management. Non-GAAP financial

measures have inherent limitations, are not required to be

uniformly applied, and are not audited. Although non-GAAP

financial measures are frequently used by investors to evaluate a

company, they have limitations as an analytical tool and should not

be considered in isolation or as a substitute for analysis of

results reported under GAAP. Reconciliations of non-GAAP

financial measures to the most directly comparable GAAP measures

are included in the tables that accompany this release.

|

Carolina Trust BancShares,

Inc. |

|

Selected Financial Highlights |

|

Dollars in thousands |

|

|

|

|

Unaudited |

Unaudited |

(a) |

Unaudited |

Unaudited |

|

|

6/30/19 |

3/31/19 |

12/31/18 |

9/30/18 |

6/30/18 |

| Balance Sheet

Data: |

|

|

|

|

|

| Total Assets |

$ |

617,423 |

$ |

621,279 |

$ |

475,104 |

$ |

465,171 |

$ |

470,854 |

| Total Loans |

|

485,435 |

|

474,239 |

|

393,282 |

|

380,746 |

|

374,026 |

| Allowance for Loan Loss |

|

4,146 |

|

4,069 |

|

3,978 |

|

3,925 |

|

3,844 |

| Total Deposits |

|

516,153 |

|

523,390 |

|

395,149 |

|

386,497 |

|

393,279 |

| Total Shareholders’ Equity |

|

69,897 |

|

67,378 |

|

50,261 |

|

48,954 |

|

48,201 |

| |

|

|

|

|

|

|

|

|

|

|

| (a) Unless

otherwise noted, all financial information presented in the

accompanying tables as of and for the year ending December 31,

2018, is derived from audited financial statements |

|

Carolina Trust BancShares, Inc. |

|

Comparative Income Statements |

|

For the Three Months Ended |

|

Dollars in thousands, except share and per share data |

|

|

| |

Unaudited6/30/19 |

Unaudited6/30/18 |

Variance$ |

Variance% |

| Income and Per Share

Data: |

|

|

|

|

|

Interest Income |

$ |

7,403 |

$ |

5,198 |

$ |

2,205 |

|

42 |

% |

| Interest Expense |

|

1,548 |

|

1,155 |

|

393 |

|

34 |

% |

| Net Interest Income |

|

5,855 |

|

4,043 |

|

1,812 |

|

45 |

% |

| Provision for Loan Loss |

|

76 |

|

88 |

|

(12 |

) |

(14 |

%) |

| Net Interest Income After

Provision |

|

5,779 |

|

3,955 |

|

1,824 |

|

46 |

% |

| Non-interest Income |

|

664 |

|

366 |

|

298 |

|

81 |

% |

| Non-interest Expense, Excluding

Merger Expenses |

|

4,059 |

|

3,297 |

|

762 |

|

23 |

% |

| Merger Expenses |

|

49 |

|

323 |

|

(274 |

) |

(85 |

%) |

| Income Before Taxes |

|

2,335 |

|

701 |

|

1,634 |

|

233 |

% |

| Income Tax Expense |

|

517 |

|

191 |

|

326 |

|

171 |

% |

| Net Income |

$ |

1,818 |

$ |

510 |

$ |

1,308 |

|

256 |

% |

|

|

|

|

|

|

| Net Income Per Common

Share: |

|

|

|

|

| Basic |

$ |

0.20 |

$ |

0.08 |

|

|

| Diluted |

$ |

0.19 |

$ |

0.08 |

|

|

| Average Common Shares

Outstanding: |

|

|

|

|

| Basic |

|

9,297,142 |

|

6,583,719 |

|

|

| Diluted |

|

9,366,814 |

|

6,671,626 |

|

|

|

|

|

Carolina Trust BancShares, Inc. |

|

Comparative Income Statements |

|

For the Six Months Ended |

|

Dollars in thousands, except share and per share data |

| |

| |

|

|

|

|

| |

Unaudited |

Unaudited |

Variance |

Variance |

| |

6/30/2019 |

6/30/2018 |

$ |

% |

| Income and Per Share

Data: |

|

|

|

|

|

Interest Income |

$ |

14,483 |

$ |

10,025 |

$ |

4,458 |

|

44 |

% |

| Interest Expense |

|

2,970 |

|

2,215 |

|

755 |

|

34 |

% |

| Net Interest Income |

|

11,513 |

|

7,810 |

|

3,703 |

|

47 |

% |

| Provision for Loan Loss |

|

153 |

|

340 |

|

(187 |

) |

(55 |

%) |

| Net Interest Income After

Provision |

|

11,360 |

|

7,470 |

|

3,890 |

|

52 |

% |

| Non-interest Income |

|

1,284 |

|

696 |

|

588 |

|

84 |

% |

| Non-interest Expense,

Excluding Merger Expenses |

|

8,128 |

|

6,393 |

|

1,735 |

|

27 |

% |

| Merger Expenses |

|

1,771 |

|

323 |

|

1,448 |

|

448 |

% |

| Income Before Taxes |

|

2,745 |

|

1,450 |

|

1,295 |

|

89 |

% |

| Income Tax Expense |

|

590 |

|

359 |

|

231 |

|

64 |

% |

| Net

Income |

$ |

2,155 |

$ |

1,091 |

$ |

1,064 |

|

98 |

% |

| |

|

|

|

|

| Net Income Per Common

Share: |

|

|

|

|

| Basic |

$ |

0.23 |

$ |

0.19 |

|

|

| Diluted |

$ |

0.23 |

$ |

0.19 |

|

|

| Average Common Shares

Outstanding: |

|

|

|

|

| Basic |

|

9,293,994 |

|

5,667,619 |

|

|

| Diluted |

|

9,366,779 |

|

5,763,824 |

|

|

| |

|

|

|

|

|

Carolina Trust BancShares, Inc. |

|

Quarterly Income Statement |

|

Dollars in thousands, except share and per share

data |

| |

|

| |

For the three months ended: |

| Income and Per Share

Data: |

Unaudited6/30/19 |

Unaudited3/31/19 |

Unaudited12/31/18 |

Unaudited9/30/18 |

Unaudited6/30/18 |

|

Interest Income |

$ |

7,403 |

$ |

7,080 |

$ |

5,645 |

|

$ |

5,419 |

$ |

5,198 |

| Interest Expense |

|

1,548 |

|

1,422 |

|

1,233 |

|

|

1,176 |

|

1,155 |

| Net Interest Income |

|

5,855 |

|

5,658 |

|

4,412 |

|

|

4,243 |

|

4,043 |

| Provision for Loan Loss |

|

76 |

|

77 |

|

(9 |

) |

|

75 |

|

88 |

| Net Interest Income After

Provision |

|

5,779 |

|

5,581 |

|

4,421 |

|

|

4,168 |

|

3,955 |

| Non-interest Income |

|

664 |

|

620 |

|

186 |

|

|

374 |

|

366 |

| Non-interest Expense,

Excluding Merger Expenses |

|

4,059 |

|

4,069 |

|

3,093 |

|

|

3,170 |

|

3,297 |

| Merger Expenses |

|

49 |

|

1,722 |

|

264 |

|

|

157 |

|

323 |

| Income Before Taxes |

|

2,335 |

|

410 |

|

1,250 |

|

|

1,215 |

|

701 |

| Income Tax Expense |

|

517 |

|

73 |

|

304 |

|

|

300 |

|

191 |

| Net

Income |

$ |

1,818 |

$ |

337 |

$ |

946 |

|

$ |

915 |

$ |

510 |

| |

|

|

|

|

|

| Net Income Per Common

Share: |

|

|

|

|

|

| Basic |

$ |

0.20 |

$ |

0.04 |

$ |

0.13 |

|

$ |

0.13 |

$ |

0.08 |

| Diluted |

$ |

0.19 |

$ |

0.04 |

$ |

0.13 |

|

$ |

0.13 |

$ |

0.08 |

| Average Common Shares

Outstanding: |

|

|

|

|

|

| Basic |

|

9,297,142 |

|

9,290,811 |

|

7,156,987 |

|

|

7,156,987 |

|

6,583,719 |

| Diluted |

|

9,366,814 |

|

9,361,612 |

|

7,239,698 |

|

|

7,243,875 |

|

6,598,542 |

| |

|

|

|

|

|

Non-GAAP MeasureAdjusted Net Income

(excludes accretion of purchased loan discounts and purchased time

deposit discounts, amortization of core deposit intangibles, and

merger expenses, adjusted for the effect of income

taxes):

|

Income Before Taxes |

$ |

2,335 |

|

$ |

410 |

|

$ |

1,250 |

|

$ |

1,215 |

|

$ |

701 |

|

| Less:

Accretion of purchased loan Discount |

|

(132 |

) |

|

(117 |

) |

|

(1 |

) |

|

(2 |

) |

|

(2 |

) |

|

Add: Accretion of purchased time deposit discounts |

|

10 |

|

|

12 |

|

|

- |

|

|

- |

|

|

- |

|

|

Add: Amortization of core deposit Intangibles |

|

125 |

|

|

161 |

|

|

7 |

|

|

9 |

|

|

9 |

|

|

Add: Merger Expenses |

|

49 |

|

|

1,722 |

|

|

264 |

|

|

157 |

|

|

323 |

|

| Adjusted

Income Before Taxes |

|

2,387 |

|

|

2,188 |

|

|

1,520 |

|

|

1,379 |

|

|

1,031 |

|

|

Less: Income Tax Expense |

|

517 |

|

|

73 |

|

|

304 |

|

|

300 |

|

|

191 |

|

| Less:

Income Tax Effect of Adjustments |

|

9 |

|

|

405 |

|

|

43 |

|

|

17 |

|

|

43 |

|

|

Adjusted Net Income |

$ |

1,861 |

|

$ |

1,710 |

|

$ |

1,173 |

|

$ |

1,062 |

|

$ |

797 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted Net Income Per Common Share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

0.20 |

|

$ |

0.18 |

|

$ |

0.16 |

|

$ |

0.15 |

|

$ |

0.12 |

|

|

Diluted |

$ |

0.20 |

|

$ |

0.18 |

|

$ |

0.16 |

|

$ |

0.15 |

|

$ |

0.12 |

|

|

Average Common Shares Outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

9,297,142 |

|

|

9,290,811 |

|

|

7,156,987 |

|

|

7,156,987 |

|

|

6,583,719 |

|

|

Diluted |

|

9,366,814 |

|

|

9,361,612 |

|

|

7,239,698 |

|

|

7,243,875 |

|

|

6,671,626 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Carolina Trust BancShares, Inc. |

|

Selected Financial Highlights |

|

Dollars in thousands, except share and per share data |

|

|

| |

6/30/19 |

3/31/19 |

12/31/18 |

9/30/18 |

6/30/18 |

| Capital

Ratios: |

|

|

|

|

|

| Common equity tier 1 capital

ratio 1 |

|

12.67 |

% |

|

12.45 |

% |

|

12.36 |

% |

|

12.21 |

% |

|

12.16 |

% |

| Tier 1 capital ratio 1 |

|

12.67 |

% |

|

12.45 |

% |

|

12.36 |

% |

|

12.21 |

% |

|

12.16 |

% |

| Total capital ratio 1 |

|

13.47 |

% |

|

13.25 |

% |

|

13.34 |

% |

|

13.19 |

% |

|

13.14 |

% |

| Tier 1 leverage ratio 1 |

|

10.88 |

% |

|

10.64 |

% |

|

10.85 |

% |

|

10.56 |

% |

|

10.45 |

% |

| |

|

|

|

|

|

| Tangible Common Equity

(*) |

$ |

61,648 |

|

$ |

58,983 |

|

$ |

50,221 |

|

$ |

48,907 |

|

$ |

48,145 |

|

| Common Shares Outstanding |

|

9,301,575 |

|

|

9,296,977 |

|

|

7,156,987 |

|

|

7,156,987 |

|

|

7,156,987 |

|

| Book Value per Common

Share |

$ |

7.51 |

|

$ |

7.25 |

|

$ |

7.02 |

|

$ |

6.84 |

|

$ |

6.73 |

|

| Tangible Book Value per Common

Share (*) |

$ |

6.63 |

|

$ |

6.34 |

|

$ |

7.02 |

|

$ |

6.83 |

|

$ |

6.73 |

|

| |

|

|

|

|

|

| Performance Ratios for

the Three Months Ended (annualized): |

|

|

|

|

|

| Return on Average Assets |

|

1.18 |

% 2 |

|

0.23 |

% 3 |

|

0.80 |

% 4 |

|

0.78 |

% 5 |

|

0.44 |

% 6 |

| Return on Average Common

Equity |

|

10.64 |

% 2 |

|

2.05 |

% 3 |

|

7.54 |

% 4 |

|

7.42 |

% 5 |

|

4.69 |

% 6 |

| Net Interest Margin |

|

4.10 |

% |

|

4.09 |

% |

|

3.94 |

% |

|

3.82 |

% |

|

3.76 |

% |

| |

|

|

|

|

|

| Asset

Quality: |

|

|

|

|

|

| Delinquent Loans (30-89 days

accruing interest) |

$ |

741 |

|

$ |

819 |

|

$ |

459 |

|

$ |

754 |

|

$ |

957 |

|

| |

|

|

|

|

|

| Delinquent Loans (90 days or

more and accruing) |

$ |

120 |

|

$ |

1 |

|

$ |

5 |

|

|

-0- |

|

$ |

25 |

|

| Non-accrual Loans |

|

1,166 |

|

|

1,034 |

|

|

1,046 |

|

$ |

1,057 |

|

|

1,080 |

|

| OREO and Repossessed

property |

|

1,351 |

|

|

2,190 |

|

|

1,157 |

|

|

1,782 |

|

|

1,971 |

|

| Total Nonperforming

Assets |

$ |

2,637 |

|

$ |

3,225 |

|

$ |

2,208 |

|

$ |

2,839 |

|

$ |

3,076 |

|

| |

|

|

|

|

|

| Restructured Loans |

$ |

3,229 |

|

$ |

3,755 |

|

$ |

3,856 |

|

$ |

3,925 |

|

$ |

4,006 |

|

| Nonperforming Assets / Total

Assets |

|

0.43 |

% |

|

0.52 |

% |

|

0.46 |

% |

|

0.61 |

% |

|

0.65 |

% |

| Nonperforming Assets / Equity

& Allowance for Loan Loss |

|

3.56 |

% |

|

4.51 |

% |

|

4.07 |

% |

|

5.37 |

% |

|

5.91 |

% |

| Allowance for Loan Loss /

Nonperforming Assets |

|

157 |

% |

|

126 |

% |

|

180 |

% |

|

138 |

% |

|

125 |

% |

| Allowance for Loan Loss /

Total Loans |

|

0.85 |

% |

|

0.86 |

% |

|

1.01 |

% |

|

1.03 |

% |

|

1.03 |

% |

| Net Loan Charge-offs

(Recoveries) |

|

($2 |

) |

|

($14 |

) |

|

($62 |

) |

|

($6 |

) |

$ |

23 |

|

| Net Loan Charge-offs

(Recoveries) / Average Loans (annualized) |

|

0.00 |

% |

|

(0.01 |

%) |

|

(0.06 |

%) |

|

(0.01 |

%) |

|

0.03 |

% |

| |

|

|

|

|

|

| Purchased Credit Impaired

Loans (gross) |

$ |

3,920 |

|

$ |

4,000 |

|

$ |

-0- |

|

$ |

-0- |

|

$ |

-0- |

|

| Discount on Purchased Credit

Impaired Loans |

|

665 |

|

|

673 |

|

|

-0- |

|

|

-0- |

|

|

-0- |

|

| Purchased Credit Impaired Loan

(carrying value) |

|

3,255 |

|

|

3,327 |

|

|

-0- |

|

|

-0- |

|

|

-0- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Purchased Non-Credit Impaired

Loans (gross) |

$ |

50,650 |

|

$ |

55,798 |

|

$ |

-0- |

|

$ |

-0- |

|

$ |

-0- |

|

| Discount on Purchased

Non-Credit Impaired Loans |

|

754 |

|

|

857 |

|

|

-0- |

|

|

-0- |

|

|

-0- |

|

| Purchased Non-Credit Impaired

Loans (carrying value) |

|

49,896 |

|

|

54,941 |

|

|

-0- |

|

|

-0- |

|

|

-0- |

|

| Note: Financial

information is unaudited. |

|

|

|

|

|

| |

| 1 Capital

ratios are presented for Carolina Trust Bank which reports these

ratios to the Federal Financial Institutions Examination Council on

form FFIEC 051. |

| 2 For the

three months ended June 30, 2019, excluding merger expenses,

accretion of discounts on purchased loans and time deposits, and

amortization of core deposit intangibles, all net of tax, would

result in an annualized ROA of 1.21% and an annualized ROE of

10.89%. |

| 3 For the

three months ended March 31, 2019, excluding merger expenses,

accretion of discounts on purchased loans and time deposits, and

amortization of core deposit intangibles, all net of tax, would

result in an annualized ROA of 1.14% and an annualized ROE of

10.41%. |

| 4 For the

three months ended December 31, 2018, excluding merger expenses,

accretion of purchased loan discounts and amortization of core

deposit intangibles, net of tax, would result in an annualized ROA

of 0.99% and an annualized ROE of 9.35%. |

| 5 For the

three months ended September 30, 2018, excluding merger expenses,

accretion of purchased loan discounts and amortization of core

deposit intangibles, net of tax, would result in an annualized ROA

of 0.90% and an annualized ROE of 8.61%. |

| 6 For the

three months ended June 30, 2018, excluding merger expenses,

accretion of purchased loan discounts and amortization of core

deposit intangibles, net of tax, would result in an annualized ROA

of 0.69% and an annualized ROE of 7.34%. |

| (*) |

|

Reconciliation of GAAP to non-GAAP (Dollars in

Thousands, |

|

|

|

|

|

|

|

except share and per share data): |

|

6/30/19 |

3/31/19 |

12/31/18 |

9/30/18 |

6/30/18 |

|

Shareholders’ equity (GAAP) |

$ |

69,897 |

$ |

67,378 |

$ |

50,261 |

$ |

48,954 |

$ |

48,201 |

|

Less: Goodwill |

|

5,665 |

|

5,355 |

|

- |

|

- |

|

- |

|

Less: Core deposit intangible |

|

2,584 |

|

3,039 |

|

40 |

|

47 |

|

56 |

|

Tangible Common Equity (non-GAAP) |

|

61,648 |

|

58,984 |

|

50,221 |

|

48,907 |

|

48,145 |

|

Common Shares Outstanding |

|

9,301,575 |

|

9,296,977 |

|

7,156,987 |

|

7,156,987 |

|

7,156,987 |

|

Tangible Book Value per Common Share (non-GAAP) |

$ |

6.63 |

$ |

6.34 |

$ |

7.02 |

$ |

6.83 |

$ |

6.73 |

| 1 Note from Page 2 |

|

|

|

|

|

|

| Dollars in Thousands |

|

|

|

|

|

|

|

Reconciliation of GAAP to non-GAAP: |

|

2Q19 |

|

|

|

|

2Q18 |

|

| Net income |

$ |

1818 |

|

|

|

$ |

510 |

|

| Less: Accretion of

purchased loan discounts |

|

(132 |

) |

|

|

|

(2 |

) |

| Add: Accretion of

purchased time deposit discounts |

|

10 |

|

|

|

|

- |

|

| Add: Amortization of

core deposit intangibles |

|

125 |

|

|

|

|

9 |

|

| Add: Merger

expenses |

|

49 |

|

|

|

|

323 |

|

| Tax effect of adjustments |

|

(9 |

) |

|

|

|

(43 |

) |

| Adjusted net income |

$ |

1,861 |

|

|

|

$ |

797 |

|

| |

|

|

|

|

|

|

| Average diluted shares |

|

9,366,814 |

|

|

|

|

6,671,626 |

|

| Adjusted diluted earnings per

share |

$ |

0.20 |

|

|

|

$ |

0.12 |

|

| |

|

|

|

|

|

|

| Average assets |

$ |

615,546 |

|

|

|

$ |

460,556 |

|

| Adjusted return on assets

(annualized) |

|

1.21 |

% |

|

|

|

0.69 |

% |

| |

|

|

|

|

|

|

| Average equity |

$ |

68,538 |

|

|

|

$ |

43,576 |

|

| Adjusted return on equity

(annualized) |

|

10.89 |

% |

|

|

|

7.34 |

% |

| |

|

|

|

|

|

|

| Net interest income |

$ |

5,855 |

|

|

|

$ |

4,043 |

|

| Less: Accretion of

purchased loan discounts |

|

(132 |

) |

|

|

|

(2 |

) |

| Add: Accretion of

purchased time deposit discounts |

|

10 |

|

|

|

|

_ |

|

| Adjusted net interest

income |

$ |

5,733 |

|

|

|

$ |

4,041 |

|

| Average earning assets |

|

572,463 |

|

|

|

|

431,168 |

|

| Adjusted net interest margin

(annualized) |

|

4.02 |

% |

|

|

|

3.76 |

% |

| |

|

|

|

|

|

|

| Noninterest expenses |

$ |

4,108 |

|

|

|

$ |

3,620 |

|

| Less: Amortization of core

deposit intangibles |

|

(125 |

) |

|

|

|

(9 |

) |

| Less: Merger

expenses |

|

(49 |

) |

|

|

|

(323 |

) |

| Adjusted noninterest expenses

(a) |

$ |

3,934 |

|

|

|

$ |

3,288 |

|

| |

|

|

|

|

|

|

| Adjusted net interest income

(see above) |

$ |

5,733 |

|

|

|

$ |

4,041 |

|

| Noninterest income |

|

664 |

|

|

|

|

366 |

|

| Adjusted net revenues (b) |

$ |

6,397 |

|

|

|

$ |

4,407 |

|

| Adjusted efficiency ratio (a)

/ (b) |

|

62 |

% |

|

|

|

75 |

% |

Contact:Jerry L. OcheltreePresident and CEOCarolina Trust

BancShares, Inc.(704) 735-1104

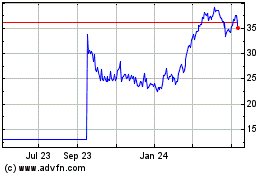

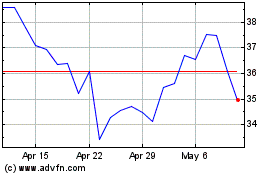

Maplebear (NASDAQ:CART)

Historical Stock Chart

From Mar 2024 to Apr 2024

Maplebear (NASDAQ:CART)

Historical Stock Chart

From Apr 2023 to Apr 2024