UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT REPORT

Pursuant to

Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report

(Date of earliest event reported)

July 15, 2019

CAROLINA

FINANCIAL CORPORATION

(Exact

name of registrant as specified in its charter)

|

Delaware

(State

or other jurisdiction of incorporation)

|

001-10897

(Commission

File Number)

|

57-1039673

(I.R.S.

Employer Identification No.)

|

|

288

Meeting Street, Charleston, South Carolina

(Address

of principal executive offices)

|

29401

(Zip

Code)

|

(843)

723-7700

(Registrant’s

telephone number, including area code)

Not

Applicable

(Former

name or former address, if changed since last report.)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

x

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered

pursuant to 12(b) of the Act:

|

Title

of each class

|

Trading

Symbol(s)

|

Name

of each exchange on which registered

|

|

Common

Stock

|

CARO

|

Nasdaq

Capital Market

|

Indicate by

check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company

o

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Item 1.01 Entry

into a Material Definitive Agreement

Agreement and Plan of Merger

and Reorganization

On July 15, 2019,

Carolina Financial Corporation (“Carolina Financial”), the parent holding company for CresCom Bank, Charleston, South

Carolina, and Carolina Trust BancShares, Inc. (“Carolina Trust”), the parent holding company for Carolina Trust Bank,

Lincolnton, North Carolina, entered into an agreement and plan of merger and reorganization (the “Agreement”), which

provides that, subject to the terms and conditions set forth in the Agreement, Carolina Trust will merge with and into Carolina

Financial, with Carolina Financial being the surviving corporation in the merger. In addition, as soon as practicable following

the merger of Carolina Trust with and into Carolina Financial, Carolina Trust Bank will be merged with and into CresCom Bank.

Subject to the

terms and conditions of the Agreement, each share of Carolina Trust common stock will be converted into the right to receive 0.3000

shares of the Carolina Financial’s common stock or $10.57 in cash for each share of Carolina Trust common stock outstanding,

subject to election and proration such that the aggregate consideration will consist of 90% Carolina Financial stock and 10% cash.

Cash also will be paid in lieu of fractional shares. The aggregate merger consideration equals $100.1 million as of July 12, 2019,

based on the closing price of a share of Carolina Financial common stock as of such date. The parties anticipate closing the merger

during the first quarter of 2020.

The boards of

directors of Carolina Financial and Carolina Trust have unanimously approved the Agreement. The Agreement and the transactions

contemplated thereby are subject to the approval of the shareholders of Carolina Trust, regulatory approvals, the effectiveness

of the registration statement to be filed by Carolina Financial with respect to the Carolina Financial common stock to be issued

in the merger, and other customary closing conditions.

The Agreement

contains customary representations and warranties from Carolina Financial and Carolina Trust, and Carolina Financial and Carolina

Trust have agreed to customary covenants and agreements, including, among others, covenants and agreements relating to: (1) the

conduct of their respective businesses during the interim period between the execution of the Agreement and the closing of the

merger, (2) Carolina Trust’s obligation to facilitate its shareholders’ consideration of, and voting upon, approval

of the Agreement, (3) the recommendations by the board of directors of Carolina Trust in favor of the necessary approvals by its

shareholders, (4) Carolina Trust’s non-solicitation obligations relating to alternative business combination transactions,

and (5) Carolina Financial’s appointment of Johnathan L. Rhyne, Jr., Carolina Trust’s current chairman of the board,

to the boards of directors of Carolina Financial and CresCom Bank, CresCom Bank’s appointment of Jerry L. Ocheltree, the

current president and chief executive officer of Carolina Trust, as president of CresCom Bank’s North Carolina commercial

banking operations, and CresCom Bank’s establishment of a Charlotte, North Carolina area advisory board comprised of the

other directors of Carolina Trust and Carolina Trust Bank, all effective immediately following the closing of the mergers.

The Agreement

may be terminated in certain circumstances, including: (i) by mutual written agreement of the parties; (ii) by either party in

the event of a breach by the other party of any representation or warranty contained in the Agreement that has not been cured

within 30 days and where such breach is reasonably likely to permit such party to refuse to consummate the merger; (iii) by either

party in the event that any consent of any required regulatory authority is denied by final action or any law or order prohibiting

the merger shall become final and nonappealable; (iv) by either party if the requisite approval of the Carolina Trust shareholders

is not obtained; (v) by either party in the event that the merger shall not have been consummated by February 28, 2020; (vi) by

Carolina Financial in the event that Carolina Trust’s board of directors has not recommended for approval the merger Agreement

to its shareholders except as permitted by the Agreement; (vii) by Carolina Financial in the event that Carolina Trust’s

board of directors fails to duly convene and hold a meeting of the Carolina Trust shareholders for the purpose of voting on the

Agreement; (vii) by Carolina Trust, if after a shareholders’ meeting where the requisite approval of its shareholders is

not obtained and Carolina Trust received a superior proposal and determined to enter into an agreement for a superior proposal

and actually enters into such agreement. Upon termination of the Agreement in certain circumstances, including by (i) Carolina

Financial if Carolina Trust’s board of directors has not recommended for approval the Agreement to its shareholders due

to an alternate superior proposal, or (ii) by Carolina Financial to enter into a superior proposal, Carolina Trust may be required

to pay to Carolina Financial a termination fee of $4,712,000.

All unexercised

Carolina Trust stock options outstanding immediately prior to the effective time of the merger will either be (i) assumed by Carolina

Financial or (ii) replaced with substantially identical awards under Carolina Financial’s existing equity plans, such that

after the merger Carolina Trust’s stock options will be converted into and become rights with respect to Carolina Financial

common stock.

The

foregoing description of the Agreement does not purport to be complete and is qualified in its entirety by reference to the complete

text of the Agreement, which is set forth below as

Exhibit 2.1

hereto and is incorporated herein by reference. Capitalized

terms used but not defined herein shall have such meanings as set forth in the Agreement. The Agreement has been attached as an

exhibit to this report in order to provide investors and security holders with information regarding its terms. It is not intended

to provide any other financial information about Carolina Financial, Carolina Trust, or their respective subsidiaries and affiliates.

The representations, warranties, and covenants contained in the Agreement were made only for purposes of that agreement and as

of specific dates, are solely for the benefit of the parties to the Agreement, may be subject to limitations agreed upon by the

parties, including being qualified by confidential disclosures made for the purposes of allocating contractual risk between the

parties to the Agreement instead of establishing these matters as facts, and may be subject to standards of materiality applicable

to the parties that differ from those applicable to investors. Investors should not rely on the representations, warranties, or

covenants or any description thereof as characterizations of the actual state of facts or condition of Carolina Financial, Carolina

Trust, or any of their respective subsidiaries or affiliates. Moreover, information concerning the subject matter of the representations,

warranties, and covenants may change after the date of the Agreement, which subsequent information may or may not be fully reflected

in public disclosures by Carolina Financial.

Support Agreements

In connection

with entering into the Agreement, each of the directors and executive officers of Carolina Trust have entered into a Shareholder

Support Agreement (collectively, the “Support Agreements”). The Support Agreements generally require that the shareholder

party thereto vote all of his or her shares of Carolina Trust common stock in favor of the merger and against alternative transactions

and generally prohibit such shareholder from transferring his or her shares of Carolina Trust common stock prior to the consummation

of the merger. The Support Agreements will terminate upon the earlier of the consummation of the merger and the termination of

the Agreement in accordance with its terms.

Employment Agreement with Jerry

L. Ocheltree

Simultaneously

with the execution of the Agreement, Jerry L. Ocheltree entered into an Employment Agreement with Carolina Financial and CresCom

Bank, which provides that Mr. Ocheltree will serve as president of CresCom Bank’s North Carolina commercial banking operations

effective only upon consummation of the merger.

Director Non-Competition and

Non-Solicitation Agreements

Simultaneously

with the execution of the Agreement, each of Carolina Trust’s non-employee directors (with the exception of Mr. Rhyne, who

will be appointed to the boards of directors of Carolina Financial and CresCom Bank) entered into a Non-Employee Director Non-Competition

Agreement or a Non-Employee Director Non-Solicitation Agreement with Carolina Financial. The agreements contain provisions related

to non-disclosure of confidential information, non-recruitment of employees, non-solicitation of customers, and, as applicable,

non-competition.

Item 9.01. Financial Statements

and Exhibits

(d) Exhibits

Forward-Looking

Statements

Certain

statements in this report contain “forward-looking statements” within the meaning of the Private Securities Litigation

Reform Act of 1995, such as statements relating to future plans and expectations, and are thus prospective. Such forward-looking

statements include but are not limited to statements with respect to plans, objectives, expectations and intentions and other

statements that are not historical facts, and other statements identified by words such as “believes,” “expects,”

“anticipates,” “estimates,” “intends,” “plans,” “targets,” and “projects,”

as well as similar expressions. Such statements are subject to risks, uncertainties, and other factors which could

cause actual results to differ materially from future results expressed or implied by such forward-looking statements. Although

the parties making such statements believe that the assumptions underlying the forward-looking statements are reasonable, any

of the assumptions could prove to be inaccurate. Therefore, neither Carolina Financial nor Carolina Trust provides any assurance

that the results contemplated in the forward-looking statements will be realized. The inclusion of this forward-looking

information should not be construed as a representation by Carolina Financial, Carolina Trust or any other person that

the future events, plans, or expectations contemplated will be achieved.

The

following factors, among others, could cause actual results to differ materially from the anticipated results or other expectations

expressed in the forward-looking statements: the occurrence of any event, change or other circumstances that could give

rise to the right of one or both of the parties to terminate the definitive merger agreement between Carolina Financial and Carolina

Trust; the outcome of any legal proceedings that may be instituted against Carolina Financial or Carolina Trust; the failure to

obtain necessary regulatory approvals (and the risk that such approvals may result in the imposition of conditions that could

adversely affect the combined company or the expected benefits of the transaction); the failure to obtain the necessary approval

by the shareholders of Carolina Trust, or to satisfy any of the other conditions to the transaction on a timely basis or at all;

the possibility that the anticipated benefits of the transaction are not realized when expected or at all, including as a result

of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy

and competitive factors in the areas where Carolina Financial and Carolina Trust do business; the possibility that the transaction

may be more expensive to complete than anticipated, including as a result of unexpected factors or events; diversion of management’s

attention from ongoing business operations and opportunities; potential adverse reactions or changes to business or employee relationships,

including those resulting from the announcement or completion of the transaction; Carolina Financial’s ability to complete

the acquisition and integration of Carolina Trust successfully; credit risk associated with commercial real estate, commercial

business and construction lending; interest risk involving the effect of a change in interest rates on both of Carolina Financial’s

and Carolina Trust’s earnings and the market value of the portfolio equity; liquidity risk affecting each bank’s ability

to meet its obligations when they come due; price risk focusing on changes in market factors that may affect the value of traded

instruments; transaction risk arising from problems with service or product delivery; compliance risk involving risk to earnings

or capital resulting from violations of or nonconformance with laws, rules, regulations, prescribed practices, or ethical standards;

strategic risk resulting from adverse business decisions or improper implementation of business decisions; reputation risk that

adversely affects earnings or capital arising from negative public opinion; and cybersecurity risk related to the dependence of

Carolina Financial and Carolina Trust on internal computer systems and the technology of outside service providers, as well as

the potential impacts of third-party security breaches, which subjects each company to potential business disruptions or financial

losses resulting from deliberate attacks or unintentional events. For a discussion of some of the other risks and factors

that could cause actual results to differ materially from those described in the forward-looking statements, please refer to the

filings made by Carolina Financial and Carolina Trust in their respective reports filed with the Securities and

Exchange Commission (the “SEC”), including each company’s Annual Report on Form 10-K, Quarterly Reports on Form

10-Q and Current Reports on Form 8-K available at the SEC’s Internet site (http://www.sec.gov). All

subsequent written and oral forward-looking statements concerning Carolina Financial, Carolina Trust or any person acting

on either company’s behalf are expressly qualified in their entirety by the cautionary statements above. Neither

Carolina Financial nor Carolina Trust undertakes any obligation to update any forward-looking statement to reflect circumstances

or events that occur after the date the forward-looking statements are made.

Additional

Information About the Acquisition and Where to Find It

Carolina

Financial and Carolina Trust will file relevant documents concerning the transaction with the SEC, including a Registration Statement

on Form S-4 which will include a proxy statement of Carolina Trust and a prospectus of Carolina Financial, as well as other

relevant documents concerning the proposed transaction. The proposed transaction will be submitted to Carolina Trust’s

shareholders for their consideration. This communication shall not constitute an offer to sell or the solicitation of an offer

to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale

would be unlawful prior to registration or qualification under the securities laws of such jurisdiction.

SHAREHOLDERS

OF CAROLINA TRUST ARE URGED TO READ THE REGISTRATION STATEMENT, THE PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS WHEN

THEY ARE FILED WITH THE SEC,

as well as any amendments or supplements to those documents

WHEN THEY BECOME AVAILABLE, AS THEY WILL CONTAIN IMPORTANT INFORMATION.

Shareholders

of Carolina Trust will be able to obtain a free copy of the proxy statement/prospectus, as well as other filings containing

information about Carolina Financial and Carolina Trust, at the SEC’s internet site (http://www.sec.gov). Copies

of the proxy statement/prospectus and the filings with the SEC that will be incorporated by reference in the proxy statement/prospectus

can also be obtained, without charge, by directing a request to: Carolina Financial Corporation, 288 Meeting Street, Charleston,

South Carolina 29401, Attention: William A. Gehman, III, Executive Vice President and Chief Financial Officer

or Carolina Trust BancShares, Inc., 901 East Main Street, Lincolnton, NC 28092, Attention: Edwin Laws, Chief Financial

Officer.

Participants

in the Solicitation

Carolina

Trust and certain of its directors, executive officers and employees and other persons may be deemed to be participants in the

solicitation of proxies in respect of the proposed transaction. Information regarding Carolina Trust’s directors

and executive officers is available in its definitive proxy statement (form type DEF 14A) which was filed with the SEC on April

11, 2019 and certain of its Current Reports on Form 8-K. Other information regarding the participants in the proxy solicitation

and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus

and other relevant materials to be filed with the SEC when they become available.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

CAROLINA FINANCIAL CORPORATION,

|

|

|

Registrant

|

|

|

|

|

|

|

|

By:

|

|

/s/ William A. Gehman, III

|

|

|

|

|

|

William A. Gehman, III

|

|

|

|

|

Executive Vice President and Chief Financial Officer

|

Dated: July 18, 2019

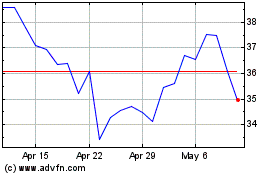

Maplebear (NASDAQ:CART)

Historical Stock Chart

From Mar 2024 to Apr 2024

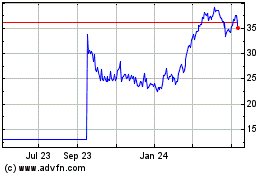

Maplebear (NASDAQ:CART)

Historical Stock Chart

From Apr 2023 to Apr 2024