Current Report Filing (8-k)

March 22 2019 - 4:47PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

March 18, 2019

|

Carolina Trust BancShares, Inc.

|

|

(Exact name of registrant as specified in its charter)

|

|

North Carolina

|

000-55683

|

81-2019652

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

901 East Main Street, Lincolnton, North Carolina

|

28092

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code:

(704) 735-1104

|

|

|

(Former name or former address, if changed since last report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or

Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 3.01.

|

Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

|

On March 18, 2019, Carolina Trust BancShares, Inc. (the “Company”) provided initial notice to The Nasdaq Stock Market, Inc. (“Nasdaq”) that Carolina

Trust Bank, which is the Company’s wholly owned subsidiary bank (the “Bank”), had inadvertently made payments to a law firm affiliated with Mr. Johnathan L. Rhyne, Jr., who is a member of the Company’s board of directors and its Audit Committee. The

payments made to the law firm were for legal services rendered by another attorney in the firm in connection with home-equity line of credit, or HELOC, loans made by the Bank to various borrowers of the Bank. Mr. Rhyne did not participate in

rendering these legal services. The payments that were the subject of the Company’s notice to Nasdaq were for legal services rendered by the law firm over a four-year period of time during which Mr. Rhyne was serving on the Company’s Audit

Committee. The payments for the legal services totaled $3,300 during 2016, $9,920 during 2017, $5,450 during 2018, and $1,420 during 2019. Upon discovering the existence of these prior payments for legal services, the Bank discontinued any

additional payments to Mr. Rhyne’s law firm and took steps to ensure that no additional payments for legal services would be made to the firm.

By letter dated March 22, 2019, from Nasdaq’s Listing Qualifications department (the “Notice”), Nasdaq acknowledged the Company’s

disclosures of the payments and advised that, because of such payments, the Company did not comply with Nasdaq’s audit committee composition requirements under Nasdaq Listing Rule 5605(c)(2) (the “Rule”). Among other things, the Rule requires that

each member of the Audit Committee meet the criteria for independence set forth in Rule 10A-3(b)(1) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Due to the payments described above, the Notice indicated that one of

the members of the Company’s Audit Committee did not meet the criteria for independence set forth in Rule 10A-3 under the Exchange Act, as the payments to the law firm, under

Exchange

Act Rule 10A-3(b)(1), would be considered indirect acceptance by Mr. Rhyne of the payments for providing legal services. As a result, Nasdaq determined the Company was not in compliance with the Nasdaq Rule during the time period these payments

were made to the law firm because Mr. Rhyne did not meet the independence criteria under Exchange Act Rule 10A-3(b)(1)(ii).

The Notice indicated, however, that since the Company immediately took action to ensure no future payments will be made to the law firm

following Nasdaq’s determination, the Company has thereby regained compliance with the Rule that was the subject of its prior noncompliance, subject to reporting of the receipt of the Notice on this Current Report on Form 8-K. Other than the

matters above, which have now been addressed by the Company, the Company is not aware of any other continued listing criteria that it has not met or is not currently meeting. Since the work that Mr. Rhyne’s law firm provided will not continue in

the future, and, as a result, will not lead to future compensation being paid indirectly to Mr. Rhyne by the Bank, the Company has notified Nasdaq that it will permit Mr. Rhyne to continue serving on the Company’s Audit Committee going forward.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

Carolina Trust BancShares, Inc.

|

|

|

|

|

|

Date: March 22, 2019

|

By:

|

/s/ Edwin E. Laws

|

|

|

|

|

Name: Edwin E. Laws

|

|

|

|

|

Title: EVP and Chief Financial Officer

|

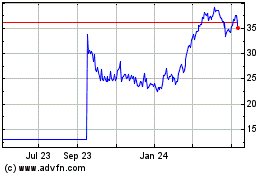

Maplebear (NASDAQ:CART)

Historical Stock Chart

From Mar 2024 to Apr 2024

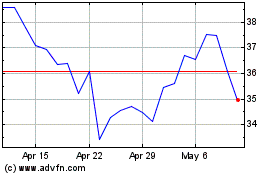

Maplebear (NASDAQ:CART)

Historical Stock Chart

From Apr 2023 to Apr 2024