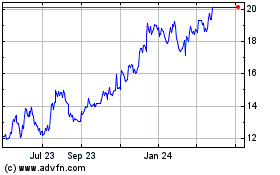

CapStar Financial Holdings, Inc. (“CapStar”)

(NASDAQ:CSTR) today reported net income of $10.3 million

or $0.47 per diluted share, for the quarter ended December 31,

2022, compared with net income of $8.0 million or $0.37 per diluted

share, for the quarter ended September 30, 2022, and net income of

$12.5 million or $0.56 per diluted share, for the quarter ended

December 31, 2021. Annualized return on average assets and return

on average equity for the quarter ended December 31, 2022 were

1.31% and 11.78%, respectively. Fourth quarter results include a

$0.7 million recovery related to an operational loss that occurred

in third quarter 2022.

For the twelve months ended December 31, 2022, the Company

reported net income of $39.0 million or $1.77 per diluted share,

compared with $48.7 million or $2.19 per diluted share, for the

same period of 2021. Year to date 2022 return on average assets and

return on average equity were 1.24% and 10.74%, respectively.

|

Four Key Drivers |

|

Targets |

|

2022 |

|

4Q22 |

|

3Q22 |

|

4Q21 |

|

Annualized revenue growth |

|

> 5% |

|

-9.89% |

|

33.30% |

|

-19.51% |

|

-5.61% |

|

Net interest margin |

|

≥ 3.60% |

|

3.33% |

|

3.44% |

|

3.50% |

|

3.14% |

|

Efficiency ratio |

|

≤ 55% |

|

57.51% |

|

53.23% |

|

62.21% |

|

54.74% |

|

Annualized net charge-offs to average loans |

|

≤ 0.25% |

|

0.02% |

|

0.03% |

|

0.02% |

|

0.04% |

Concurrently, the Company announced the hiring of a team of

experienced SBA professionals from top 10 SBA originators to expand

our SBA division and its fee contribution to the bank. Led by newly

appointed director Marc Gilson, an SBA lending professional with

over 25 years experience, the division now includes three business

development officers along with additions to our existing team

totaling 14 dedicated and experienced professionals in processing,

underwriting, approval, loan closing and servicing.

“CapStar’s 2022 performance and results were outstanding,” said

Timothy K. Schools, President and Chief Executive Officer of

CapStar. “Our Company delivered excellent service to our valued

customers across each of our markets, investments in Chattanooga

and Knoxville approached $450 million in loans helping us remix our

earning assets into higher yielding balances through the addition

of numerous new customers, net interest margin expanded due to a

rise in rates as well as an emphasis on disciplined pricing, our

focus on productivity and operating efficiency continues, and our

net charge-offs remain limited. Further, we added a new office in

Asheville and key hires in our existing markets. With the year’s

strong performance and our focus on capital management, we were

pleased to return a record $17.9 million to shareholders in the

form of share repurchases and dividends.”

“It is an exciting time at CapStar and our employees' hard work

was recognized in 2022 by being named the fourteenth highest

performing bank among the nation’s top 300 publicly traded banks by

Bank Director. As we look to 2023, we will continue to deliver

exemplary service and seek to expand existing and new relationships

while remaining actively focused on the challenging deposit

environment and uncertain economic environment. While the outlook

for this year remains clouded with an array of possible outcomes,

we are very excited about our progress and the prospects of our

markets and company.”

Revenue

Total revenue, defined as net interest income plus noninterest

income, was $31.2 million in the fourth quarter of 2022 compared to

the third quarter of 2022 revenue of $28.8 million.

As previously communicated, loans produced in our Tri-Net

division since the spring have proved challenging to achieve a gain

on sale. Additional production was ceased in early July. Third

quarter 2022 revenue was negatively impacted by $2.1 million

related to realized and unrealized losses associated with selling

or transferring to held for investment the remaining Tri-Net loans

in held for sale.

Fourth quarter net interest income declined $0.6 million to

$25.0 million as a result of increased deposit pricing pressure and

a shift into higher cost deposit categories. Noninterest income for

the fourth quarter of 2022 was $6.3 million, an increase of $3.0

million from the previous quarter, or when adjusting for the

Tri-Net impact, an increase of $1.0 million largely due to improved

SBA revenues.

Fourth quarter 2022 average earning assets remained relatively

flat at $2.89 billion compared to the third quarter 2022 as fourth

quarter growth in loans held for investment was principally funded

by a decline in loans held for sale. Average loans held for

investment, excluding Tri-Net loan transfers from held for sale to

held for investments during the third quarter, increased $59.5

million, or 11% linked-quarter annualized. The current commercial

loan pipeline remains strong, exceeding $450 million. The Company

remains conservative maintaining pricing discipline and limiting

commercial real estate lending as a result of an uncertain economic

outlook and in an effort to balance loan demand with funding in a

challenging deposit environment.

For the fourth quarter of 2022, the net interest margin

decreased 6 basis points from the prior quarter to 3.44% primarily

resulting from increased deposit pricing pressure and a shift into

higher cost deposit categories.

The Company's average deposits totaled $2.66 billion in the

fourth quarter of 2022, flat compared to the third quarter of 2022.

During the quarter, the Company experienced a $155.4 million

increase in higher cost average time deposits, primarily a result

of brokered deposit issuances. These increases were partially

offset by a $80.2 million decrease in interest-bearing transaction

accounts, creating an overall net increase of $83.6 million in

average interest-bearing deposits when compared to the third

quarter of 2022. During the quarter, the Company’s

noninterest-bearing deposits decreased 12% from the linked quarter

to 22% of total average deposits as of December 31, 2022. Total

deposit costs increased 58 basis points to 1.20% compared to 0.62%

for the prior quarter.

Noninterest income for the fourth quarter of 2022 was $6.3

million compared to the third quarter of 2022 noninterest income of

$3.3 million, or $5.3 million when adjusted for the previously

discussed Tri-Net losses. The $1.0 million increase versus adjusted

third quarter was largely attributable to a $0.9 million

improvement in the Company’s SBA division driven by the expansion

of the SBA division in the fourth quarter. The Company’s mortgage

and Tri-Net divisions provided little contribution in the fourth

quarter.

Noninterest Expense and Operating

Efficiency

Noninterest expense was $16.6 million for the fourth quarter of

2022, compared to $17.9 million in the third quarter of 2022. Third

quarter expenses included a $1.5 million wire fraud and a $0.7

million operational loss, offset by an $0.8 million voluntary

executive incentive reversal. Fourth quarter expenses included a

$0.7 million recovery of the third quarter operational loss.

Excluding the third quarter wire fraud, operational loss and

incentive reversal, and the fourth quarter operation loss recovery,

adjusted noninterest expense was $17.4 million in the fourth

quarter and $16.5 million for the third quarter. Commissions and

incentives for the SBA division contributed $0.4 million to the

quarter's $0.9 million increase.

The efficiency ratio was 53.23% for the quarter ended December

31, 2022 and 62.21% for the quarter ended September 30, 2022. The

fourth quarter efficiency ratio adjusted for the operational loss

recovery was 55.57%. The third quarter ratio adjusted for the wire

fraud, operational loss, executive incentive reversal, and Tri-Net

losses was 53.44%.

Annualized noninterest expense, adjusted for the wire fraud,

operational loss and recovery and executive incentive reversal, as

a percentage of average assets increased 14 basis points to 2.20%

for the quarter ended December 31, 2022 compared to 2.08% for the

quarter ended September 30, 2022. Assets per employee declined to

$7.9 million as of December 31, 2022 compared to $8.2 million in

the previous quarter.

Asset Quality

The provision for credit losses for fourth quarter totaled $1.5

million, an increase from $0.9 million in third quarter 2022, as a

result of continued strong loan growth and $0.7 million in specific

reserves related to two impaired loans. Net loan charge-offs in

fourth quarter were $172 thousand, or 0.03% of average loans held

for investment, compared with $120 thousand, or 0.02% in third

quarter 2022. For the year 2022, net loan charge-offs totaled $366

thousand or 0.02% of average loans held for investment.

Past due loans improved to $11.6 million or 0.50% of total loans

held for investment at December 31, 2022 compared to $14.4 million

or 0.63% of total loans held for investment at September 30, 2022.

The decrease was primarily related to the renewal of loans that had

matured. Past dues are largely comprised of three relationships

totaling $8.9 million for which the Company believes at this time

there is nominal risk of loss beyond the impairment-related

specific reserve of $0.7 million recorded in the fourth

quarter.

Non-performing assets to total loans and OREO increased to 0.46%

at December 31, 2022 compared to 0.30% at September 30,

2022. The increase in non-performing assets is principally

related to one of the three previously noted past due relationships

that totals $3.4 million but which has a 90% SBA guaranty of $3.0

million.

The allowance for loan losses plus the fair value mark on

acquired loans to total loans increased to 1.13% as of December 31,

2022 compared to 1.09% as of September 30, 2022.

|

Asset Quality Data: |

|

12/31/22 |

|

9/30/22 |

|

6/30/22 |

|

3/31/22 |

|

12/31/21 |

|

Annualized net charge-offs to average loans |

|

0.03% |

|

0.02% |

|

0.00% |

|

0.01% |

|

0.04% |

|

Criticized and classified loans to total loans |

|

1.31% |

|

1.79% |

|

2.12% |

|

2.49% |

|

2.64% |

|

Loans- past due to total end of period loans |

|

0.50% |

|

0.63% |

|

0.12% |

|

0.17% |

|

0.25% |

|

Loans- over 90 days past due to total end of period loans |

|

0.44% |

|

0.27% |

|

0.02% |

|

0.05% |

|

0.11% |

|

Non-performing assets to total loans held for investment and

OREO |

|

0.46% |

|

0.30% |

|

0.11% |

|

0.18% |

|

0.18% |

|

Allowance for loan losses plus fair value marks / Non-PPP

Loans |

|

1.13% |

|

1.09% |

|

1.09% |

|

1.16% |

|

1.27% |

|

Allowance for loan losses to non-performing loans |

|

222% |

|

333% |

|

974% |

|

596% |

|

666% |

Income Tax Expense

The Company’s fourth quarter effective income tax rate increased

slightly to 21% when compared to 20% in the prior quarter ended

September 30, 2022. The Company's effective tax rate for 2022 was

approximately 20%.

Capital

The Company continues to be well capitalized with tangible

equity of $308.1 million at December 31, 2022. Tangible book

value per share of common stock for the quarter ended December 31,

2022 was $14.19 compared to $13.72 and $14.99 for the quarters

ended September 30, 2022 and December 31, 2021, respectively, with

the changes being attributable to a decline in the value of the

investment portfolio related to an increase in market interest

rates, partially offset by ongoing earnings. Excluding the

impact of after-tax gain or loss within the available for sale

investment portfolio, tangible book value per share of common stock

for the quarter ended December 31, 2022 was $16.57 compared to

$16.16 and $15.13 for the quarters ended September 30, 2022 and

December 31, 2021, respectively.

|

Capital ratios: |

|

12/31/22 |

|

9/30/22 |

|

6/30/22 |

|

3/31/22 |

|

12/31/21 |

|

Total risk based capital |

|

14.51% |

|

14.59% |

|

14.79% |

|

15.60% |

|

16.29% |

|

Common equity tier 1 capital |

|

12.61% |

|

12.70% |

|

12.87% |

|

13.58% |

|

14.11% |

|

Leverage |

|

11.40% |

|

11.22% |

|

11.10% |

|

10.99% |

|

10.69% |

As a component of the Company’s capital allocation strategy,

$17.9 million was returned to shareholders in 2022 in the form of

share repurchases and dividends. In total, 523,663 shares were

repurchased at an average price of $19.12 of which 198,610 shares

were repurchased in fourth quarter 2022 for an average price of

$17.39. The Board of Directors of the Company renewed a common

stock share repurchase of up to $10 million on January 18, 2023.

The Plan will terminate on the earlier of the date on which the

maximum authorized dollar amount of shares of common stock has been

repurchased or January 31, 2024.

Dividend

On January 18, 2023, the Board of Directors of the Company

approved a quarterly dividend of $0.10 per common share payable on

February 22, 2023 to shareholders of record of CapStar’s common

stock as of the close of business on February 8, 2023.

Conference Call and Webcast Information

CapStar will host a conference call and webcast at 10:30 a.m.

Central Time on Friday, January 20, 2023. During the call,

management will review the fourth quarter results and operational

highlights. Interested parties may listen to the call by

registering here to access the live call, including for

participants who plan to ask a question during the call. A

simultaneous webcast may be accessed on CapStar’s website

at ir.capstarbank.com by clicking on “News & Events.” An

archived version of the webcast will be available in the same

location shortly after the live call has ended.

About CapStar Financial Holdings, Inc.

CapStar Financial Holdings, Inc. is a bank holding company

headquartered in Nashville, Tennessee and operates primarily

through its wholly owned subsidiary, CapStar Bank, a

Tennessee-chartered state bank. CapStar Bank is a commercial bank

that seeks to establish and maintain comprehensive relationships

with its clients by delivering customized and creative banking

solutions and superior client service. As of December 31, 2022, on

a consolidated basis, CapStar had total assets of $3.1 billion,

total loans of $2.3 billion, total deposits of $2.7 billion, and

shareholders’ equity of $354.2 million. Visit www.capstarbank.com

for more information.

NON-GAAP MEASURES

Certain releases may include financial information determined by

methods other than in accordance with generally accepted accounting

principles (“GAAP”). This financial information may include certain

operating performance measures, which exclude merger-related and

other charges that are not considered part of recurring operations.

Such measures may include: “Efficiency ratio – operating,”

“Expenses – operating,” “Earnings per share – operating,” “Diluted

earnings per share – operating,” “Tangible book value per share,”

“Return on common equity – operating,” “Return on tangible common

equity – operating,” “Return on assets – operating”, "Tangible

common equity to tangible assets" or other measures.

Management may include these non-GAAP measures because it

believes these measures may provide useful supplemental information

for evaluating CapStar’s underlying performance trends. Further,

management uses these measures in managing and evaluating CapStar’s

business and intends to refer to them in discussions about our

operations and performance. Operating performance measures should

be viewed in addition to, and not as an alternative to or

substitute for, measures determined in accordance with GAAP, and

are not necessarily comparable to non-GAAP measures that may be

presented by other companies. To the extent applicable,

reconciliations of these non-GAAP measures to the most directly

comparable GAAP measures can be found in the ‘Non-GAAP

Reconciliation Tables’ included in the exhibits to this

presentation.

CAPSTAR FINANCIAL HOLDINGS, INC. AND

SUBSIDIARYConsolidated Statements of Income

(unaudited) (dollars in thousands, except share

data)Fourth quarter 2022 Earnings

Release

|

|

|

Three Months Ended |

|

|

Year Ended |

|

|

|

|

December 31, |

|

|

December 31, |

|

|

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

| Interest income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans, including fees |

|

$ |

30,024 |

|

|

$ |

22,284 |

|

|

$ |

101,501 |

|

|

$ |

89,219 |

|

|

Securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable |

|

|

2,000 |

|

|

|

1,682 |

|

|

|

7,642 |

|

|

|

6,573 |

|

|

Tax-exempt |

|

|

310 |

|

|

|

335 |

|

|

|

1,268 |

|

|

|

1,408 |

|

|

Federal funds sold |

|

|

45 |

|

|

|

9 |

|

|

|

76 |

|

|

|

21 |

|

|

Restricted equity securities |

|

|

240 |

|

|

|

157 |

|

|

|

784 |

|

|

|

640 |

|

|

Interest-bearing deposits in financial institutions |

|

|

1,187 |

|

|

|

192 |

|

|

|

2,262 |

|

|

|

598 |

|

|

Total interest income |

|

|

33,806 |

|

|

|

24,659 |

|

|

|

113,533 |

|

|

|

98,459 |

|

| Interest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing deposits |

|

|

2,200 |

|

|

|

410 |

|

|

|

4,479 |

|

|

|

1,626 |

|

|

Savings and money market accounts |

|

|

2,701 |

|

|

|

307 |

|

|

|

5,102 |

|

|

|

1,203 |

|

|

Time deposits |

|

|

3,151 |

|

|

|

556 |

|

|

|

5,421 |

|

|

|

2,873 |

|

|

Federal funds purchased |

|

|

— |

|

|

|

— |

|

|

|

2 |

|

|

|

— |

|

|

Federal Home Loan Bank advances |

|

|

401 |

|

|

|

— |

|

|

|

862 |

|

|

|

12 |

|

|

Subordinated notes |

|

|

394 |

|

|

|

394 |

|

|

|

1,575 |

|

|

|

1,575 |

|

|

Total interest expense |

|

|

8,847 |

|

|

|

1,667 |

|

|

|

17,441 |

|

|

|

7,289 |

|

|

Net interest income |

|

|

24,959 |

|

|

|

22,992 |

|

|

|

96,092 |

|

|

|

91,170 |

|

| Provision for loan losses |

|

|

1,548 |

|

|

|

(651 |

) |

|

|

2,474 |

|

|

|

(1,066 |

) |

|

Net interest income after provision for loan losses |

|

|

23,411 |

|

|

|

23,643 |

|

|

|

93,618 |

|

|

|

92,236 |

|

| Noninterest income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposit service charges |

|

|

1,206 |

|

|

|

1,117 |

|

|

|

4,781 |

|

|

|

4,515 |

|

|

Interchange and debit card transaction fees |

|

|

1,250 |

|

|

|

1,261 |

|

|

|

5,053 |

|

|

|

4,816 |

|

|

Mortgage banking income |

|

|

637 |

|

|

|

2,740 |

|

|

|

5,073 |

|

|

|

16,058 |

|

|

Tri-Net |

|

|

39 |

|

|

|

3,996 |

|

|

|

78 |

|

|

|

8,613 |

|

|

Wealth management |

|

|

403 |

|

|

|

438 |

|

|

|

1,687 |

|

|

|

1,850 |

|

|

SBA lending |

|

|

1,446 |

|

|

|

279 |

|

|

|

2,501 |

|

|

|

2,060 |

|

|

Net gain on sale of securities |

|

|

1 |

|

|

|

8 |

|

|

|

8 |

|

|

|

28 |

|

|

Other noninterest income |

|

|

1,303 |

|

|

|

1,295 |

|

|

|

5,341 |

|

|

|

4,741 |

|

|

Total noninterest income |

|

|

6,285 |

|

|

|

11,134 |

|

|

|

24,522 |

|

|

|

42,681 |

|

| Noninterest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Salaries and employee benefits |

|

|

9,875 |

|

|

|

10,549 |

|

|

|

38,065 |

|

|

|

41,758 |

|

|

Data processing and software |

|

|

2,797 |

|

|

|

2,719 |

|

|

|

11,152 |

|

|

|

11,248 |

|

|

Occupancy |

|

|

1,032 |

|

|

|

1,012 |

|

|

|

4,299 |

|

|

|

4,205 |

|

|

Equipment |

|

|

753 |

|

|

|

867 |

|

|

|

2,988 |

|

|

|

3,507 |

|

|

Professional services |

|

|

522 |

|

|

|

521 |

|

|

|

2,175 |

|

|

|

2,155 |

|

|

Regulatory fees |

|

|

266 |

|

|

|

284 |

|

|

|

1,080 |

|

|

|

1,031 |

|

|

Acquisition related expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

323 |

|

|

Amortization of intangibles |

|

|

399 |

|

|

|

461 |

|

|

|

1,690 |

|

|

|

1,939 |

|

|

Other noninterest expense |

|

|

984 |

|

|

|

2,269 |

|

|

|

7,921 |

|

|

|

7,375 |

|

|

Total noninterest expense |

|

|

16,628 |

|

|

|

18,682 |

|

|

|

69,370 |

|

|

|

73,541 |

|

|

Income before income taxes |

|

|

13,068 |

|

|

|

16,095 |

|

|

|

48,770 |

|

|

|

61,376 |

|

| Income tax expense |

|

|

2,735 |

|

|

|

3,625 |

|

|

|

9,753 |

|

|

|

12,699 |

|

|

Net income |

|

$ |

10,333 |

|

|

$ |

12,470 |

|

|

$ |

39,017 |

|

|

$ |

48,677 |

|

| Per share information: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic net income per share of common stock |

|

$ |

0.47 |

|

|

$ |

0.56 |

|

|

$ |

1.77 |

|

|

$ |

2.20 |

|

|

Diluted net income per share of common stock |

|

$ |

0.47 |

|

|

$ |

0.56 |

|

|

$ |

1.77 |

|

|

$ |

2.19 |

|

|

Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

21,887,351 |

|

|

|

22,166,410 |

|

|

|

22,010,462 |

|

|

|

22,127,919 |

|

|

Diluted |

|

|

21,926,821 |

|

|

|

22,221,989 |

|

|

|

22,059,855 |

|

|

|

22,179,461 |

|

This information is preliminary and based on CapStar data

available at the time of this earnings release.

CAPSTAR FINANCIAL HOLDINGS, INC. AND

SUBSIDIARYSelected Quarterly Financial Data

(unaudited) (dollars in thousands, except share

data)Fourth quarter 2022 Earnings

Release

| |

|

Five Quarter Comparison |

|

| |

|

12/31/2022 |

|

|

9/30/2022 |

|

|

6/30/2022 |

|

|

3/31/2022 |

|

|

12/31/2021 |

|

| Income Statement

Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest income |

|

$ |

24,959 |

|

|

$ |

25,553 |

|

|

$ |

24,440 |

|

|

$ |

21,140 |

|

|

$ |

22,992 |

|

|

Provision for loan losses |

|

|

1,548 |

|

|

|

867 |

|

|

|

843 |

|

|

|

(784 |

) |

|

|

(651 |

) |

|

Net interest income after provision for loan losses |

|

|

23,411 |

|

|

|

24,686 |

|

|

|

23,597 |

|

|

|

21,924 |

|

|

|

23,643 |

|

|

Deposit service charges |

|

|

1,206 |

|

|

|

1,251 |

|

|

|

1,182 |

|

|

|

1,142 |

|

|

|

1,117 |

|

|

Interchange and debit card transaction fees |

|

|

1,250 |

|

|

|

1,245 |

|

|

|

1,336 |

|

|

|

1,222 |

|

|

|

1,261 |

|

|

Mortgage banking |

|

|

637 |

|

|

|

765 |

|

|

|

1,705 |

|

|

|

1,966 |

|

|

|

2,740 |

|

|

Tri-Net |

|

|

39 |

|

|

|

(2,059 |

) |

|

|

(73 |

) |

|

|

2,171 |

|

|

|

3,996 |

|

|

Wealth management |

|

|

403 |

|

|

|

385 |

|

|

|

459 |

|

|

|

440 |

|

|

|

438 |

|

|

SBA lending |

|

|

1,446 |

|

|

|

560 |

|

|

|

273 |

|

|

|

222 |

|

|

|

279 |

|

|

Net gain (loss) on sale of securities |

|

|

1 |

|

|

|

7 |

|

|

|

— |

|

|

|

— |

|

|

|

8 |

|

|

Other noninterest income |

|

|

1,303 |

|

|

|

1,118 |

|

|

|

994 |

|

|

|

1,926 |

|

|

|

1,295 |

|

|

Total noninterest income |

|

|

6,285 |

|

|

|

3,272 |

|

|

|

5,876 |

|

|

|

9,089 |

|

|

|

11,134 |

|

|

Salaries and employee benefits |

|

|

9,875 |

|

|

|

8,712 |

|

|

|

9,209 |

|

|

|

10,269 |

|

|

|

10,549 |

|

|

Data processing and software |

|

|

2,797 |

|

|

|

2,861 |

|

|

|

2,847 |

|

|

|

2,647 |

|

|

|

2,719 |

|

|

Occupancy |

|

|

1,032 |

|

|

|

1,092 |

|

|

|

1,076 |

|

|

|

1,099 |

|

|

|

1,012 |

|

|

Equipment |

|

|

753 |

|

|

|

743 |

|

|

|

783 |

|

|

|

709 |

|

|

|

867 |

|

|

Professional services |

|

|

522 |

|

|

|

468 |

|

|

|

506 |

|

|

|

679 |

|

|

|

521 |

|

|

Regulatory fees |

|

|

266 |

|

|

|

269 |

|

|

|

265 |

|

|

|

280 |

|

|

|

284 |

|

|

Acquisition related expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Amortization of intangibles |

|

|

399 |

|

|

|

415 |

|

|

|

430 |

|

|

|

446 |

|

|

|

461 |

|

|

Other noninterest expense |

|

|

984 |

|

|

|

3,371 |

|

|

|

1,959 |

|

|

|

1,607 |

|

|

|

2,269 |

|

|

Total noninterest expense |

|

|

16,628 |

|

|

|

17,931 |

|

|

|

17,075 |

|

|

|

17,736 |

|

|

|

18,682 |

|

|

Net income before income tax expense |

|

|

13,068 |

|

|

|

10,027 |

|

|

|

12,398 |

|

|

|

13,277 |

|

|

|

16,095 |

|

|

Income tax expense |

|

|

2,735 |

|

|

|

1,988 |

|

|

|

2,426 |

|

|

|

2,604 |

|

|

|

3,625 |

|

|

Net income |

|

$ |

10,333 |

|

|

$ |

8,039 |

|

|

$ |

9,972 |

|

|

$ |

10,673 |

|

|

$ |

12,470 |

|

|

Weighted average shares - basic |

|

|

21,887,351 |

|

|

|

21,938,259 |

|

|

|

22,022,109 |

|

|

|

22,198,339 |

|

|

|

22,166,410 |

|

|

Weighted average shares - diluted |

|

|

21,926,821 |

|

|

|

21,988,085 |

|

|

|

22,074,260 |

|

|

|

22,254,644 |

|

|

|

22,221,989 |

|

|

Net income per share, basic |

|

$ |

0.47 |

|

|

$ |

0.37 |

|

|

$ |

0.45 |

|

|

$ |

0.48 |

|

|

$ |

0.56 |

|

|

Net income per share, diluted |

|

|

0.47 |

|

|

|

0.37 |

|

|

|

0.45 |

|

|

|

0.48 |

|

|

|

0.56 |

|

| Balance Sheet Data (at

period end): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

135,305 |

|

|

$ |

199,913 |

|

|

$ |

113,825 |

|

|

$ |

355,981 |

|

|

$ |

415,125 |

|

|

Securities available-for-sale |

|

|

396,416 |

|

|

|

401,345 |

|

|

|

437,420 |

|

|

|

460,558 |

|

|

|

459,396 |

|

|

Securities held-to-maturity |

|

|

1,240 |

|

|

|

1,762 |

|

|

|

1,769 |

|

|

|

1,775 |

|

|

|

1,782 |

|

|

Loans held for sale |

|

|

44,708 |

|

|

|

43,122 |

|

|

|

85,884 |

|

|

|

106,895 |

|

|

|

83,715 |

|

|

Loans held for investment |

|

|

2,312,798 |

|

|

|

2,290,269 |

|

|

|

2,234,833 |

|

|

|

2,047,555 |

|

|

|

1,965,769 |

|

|

Allowance for loan losses |

|

|

(23,806 |

) |

|

|

(22,431 |

) |

|

|

(21,684 |

) |

|

|

(20,857 |

) |

|

|

(21,698 |

) |

|

Total assets |

|

|

3,117,169 |

|

|

|

3,165,706 |

|

|

|

3,096,537 |

|

|

|

3,190,749 |

|

|

|

3,133,046 |

|

|

Non-interest-bearing deposits |

|

|

512,076 |

|

|

|

628,846 |

|

|

|

717,167 |

|

|

|

702,172 |

|

|

|

725,171 |

|

|

Interest-bearing deposits |

|

|

2,167,743 |

|

|

|

2,004,827 |

|

|

|

1,913,320 |

|

|

|

2,053,823 |

|

|

|

1,959,110 |

|

|

Federal Home Loan Bank advances and borrowings |

|

|

44,666 |

|

|

|

149,633 |

|

|

|

74,599 |

|

|

|

29,566 |

|

|

|

29,532 |

|

|

Total liabilities |

|

|

2,762,987 |

|

|

|

2,818,341 |

|

|

|

2,738,802 |

|

|

|

2,821,832 |

|

|

|

2,752,952 |

|

|

Shareholders' equity |

|

$ |

354,182 |

|

|

$ |

347,365 |

|

|

$ |

357,735 |

|

|

$ |

368,917 |

|

|

$ |

380,094 |

|

|

Total shares of common stock outstanding |

|

|

21,714,380 |

|

|

|

21,931,624 |

|

|

|

21,934,554 |

|

|

|

22,195,071 |

|

|

|

22,166,129 |

|

|

Book value per share of common stock |

|

$ |

16.31 |

|

|

$ |

15.84 |

|

|

$ |

16.31 |

|

|

$ |

16.62 |

|

|

$ |

17.15 |

|

|

Tangible book value per share of common stock * |

|

|

14.19 |

|

|

|

13.72 |

|

|

|

14.17 |

|

|

|

14.49 |

|

|

|

14.99 |

|

|

Tangible book value per share of common stock plus after-tax

unrealized available for sale investment losses* |

|

|

16.57 |

|

|

|

16.16 |

|

|

|

15.86 |

|

|

|

15.53 |

|

|

|

15.13 |

|

|

Market value per common share |

|

|

17.66 |

|

|

|

18.53 |

|

|

|

19.62 |

|

|

|

21.08 |

|

|

|

21.03 |

|

| Capital

ratios: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total risk based capital |

|

|

14.51 |

% |

|

|

14.59 |

% |

|

|

14.79 |

% |

|

|

15.60 |

% |

|

|

16.29 |

% |

|

Tangible common equity to tangible assets* |

|

|

10.03 |

% |

|

|

9.65 |

% |

|

|

10.19 |

% |

|

|

10.23 |

% |

|

|

10.77 |

% |

|

Tangible common equity to tangible assets less after-tax unrealized

available for sale investment (gains) losses* |

|

|

11.52 |

% |

|

|

11.17 |

% |

|

|

11.27 |

% |

|

|

10.88 |

% |

|

|

10.86 |

% |

|

Common equity tier 1 capital |

|

|

12.61 |

% |

|

|

12.70 |

% |

|

|

12.87 |

% |

|

|

13.58 |

% |

|

|

14.11 |

% |

|

Leverage |

|

|

11.40 |

% |

|

|

11.22 |

% |

|

|

11.10 |

% |

|

|

10.99 |

% |

|

|

10.69 |

% |

_____________________*This metric is a non-GAAP financial

measure. See Non-GAAP disclaimer in this earnings release and below

for discussion and reconciliation to the most directly comparable

GAAP financial measure.This information is preliminary and based on

CapStar data available at the time of this earnings release.

CAPSTAR FINANCIAL HOLDINGS, INC. AND

SUBSIDIARYSelected Quarterly Financial Data

(unaudited) (dollars in thousands, except share

data)Fourth quarter 2022 Earnings

Release

| |

|

Five Quarter Comparison |

|

| |

|

12/31/2022 |

|

|

9/30/2022 |

|

|

6/30/2022 |

|

|

3/31/2022 |

|

|

12/31/2021 |

|

| Average Balance Sheet

Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

154,150 |

|

|

$ |

154,543 |

|

|

$ |

189,542 |

|

|

$ |

380,262 |

|

|

$ |

470,963 |

|

|

Investment securities |

|

|

415,414 |

|

|

|

450,933 |

|

|

|

473,167 |

|

|

|

483,339 |

|

|

|

491,135 |

|

|

Loans held for sale |

|

|

37,945 |

|

|

|

94,811 |

|

|

|

114,223 |

|

|

|

90,163 |

|

|

|

123,962 |

|

|

Loans held for investment |

|

|

2,309,349 |

|

|

|

2,241,355 |

|

|

|

2,147,750 |

|

|

|

2,001,740 |

|

|

|

1,888,094 |

|

|

Assets |

|

|

3,124,928 |

|

|

|

3,146,841 |

|

|

|

3,128,864 |

|

|

|

3,153,320 |

|

|

|

3,159,308 |

|

|

Interest-bearing deposits |

|

|

2,076,743 |

|

|

|

1,993,172 |

|

|

|

1,936,910 |

|

|

|

1,976,803 |

|

|

|

1,964,641 |

|

|

Deposits |

|

|

2,662,954 |

|

|

|

2,659,268 |

|

|

|

2,664,614 |

|

|

|

2,704,938 |

|

|

|

2,713,314 |

|

|

Federal Home Loan Bank advances and other borrowings |

|

|

74,812 |

|

|

|

88,584 |

|

|

|

70,516 |

|

|

|

29,547 |

|

|

|

29,514 |

|

|

Liabilities |

|

|

2,776,902 |

|

|

|

2,782,703 |

|

|

|

2,767,714 |

|

|

|

2,773,281 |

|

|

|

2,781,951 |

|

|

Shareholders' equity |

|

$ |

348,027 |

|

|

$ |

364,138 |

|

|

$ |

361,150 |

|

|

$ |

380,039 |

|

|

$ |

377,357 |

|

| Performance

Ratios: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annualized return on average assets |

|

|

1.31 |

% |

|

|

1.01 |

% |

|

|

1.28 |

% |

|

|

1.37 |

% |

|

|

1.57 |

% |

|

Annualized return on average equity |

|

|

11.78 |

% |

|

|

8.76 |

% |

|

|

11.08 |

% |

|

|

11.39 |

% |

|

|

13.11 |

% |

|

Net interest margin (1) |

|

|

3.44 |

% |

|

|

3.50 |

% |

|

|

3.41 |

% |

|

|

2.97 |

% |

|

|

3.14 |

% |

|

Annualized noninterest income to average assets |

|

|

0.80 |

% |

|

|

0.41 |

% |

|

|

0.75 |

% |

|

|

1.17 |

% |

|

|

1.40 |

% |

|

Efficiency ratio |

|

|

53.23 |

% |

|

|

62.21 |

% |

|

|

56.32 |

% |

|

|

58.67 |

% |

|

|

54.74 |

% |

| Loans by Type (at

period end): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial and industrial |

|

$ |

496,347 |

|

|

$ |

499,048 |

|

|

$ |

510,987 |

|

|

$ |

499,719 |

|

|

$ |

497,615 |

|

|

Commercial real estate - owner occupied |

|

|

246,109 |

|

|

|

235,519 |

|

|

|

241,461 |

|

|

|

231,933 |

|

|

|

209,261 |

|

|

Commercial real estate - non-owner occupied |

|

|

803,611 |

|

|

|

832,156 |

|

|

|

786,610 |

|

|

|

652,936 |

|

|

|

616,023 |

|

|

Construction and development |

|

|

229,972 |

|

|

|

198,869 |

|

|

|

205,573 |

|

|

|

208,513 |

|

|

|

214,310 |

|

|

Consumer real estate |

|

|

402,615 |

|

|

|

386,628 |

|

|

|

357,849 |

|

|

|

327,416 |

|

|

|

326,412 |

|

|

Consumer |

|

|

53,382 |

|

|

|

52,715 |

|

|

|

53,227 |

|

|

|

48,790 |

|

|

|

46,811 |

|

|

Other |

|

|

80,762 |

|

|

|

85,334 |

|

|

|

79,126 |

|

|

|

78,248 |

|

|

|

55,337 |

|

| Asset Quality

Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Allowance for loan losses to total loans |

|

|

1.03 |

% |

|

|

0.98 |

% |

|

|

0.97 |

% |

|

|

1.02 |

% |

|

|

1.10 |

% |

|

Allowance for loan losses to non-performing loans |

|

|

222 |

% |

|

|

333 |

% |

|

|

974 |

% |

|

|

596 |

% |

|

|

666 |

% |

|

Nonaccrual loans |

|

|

10,714 |

|

|

|

6,734 |

|

|

|

2,225 |

|

|

|

3,502 |

|

|

|

3,258 |

|

|

Troubled debt restructurings |

|

|

344 |

|

|

|

344 |

|

|

|

86 |

|

|

|

1,847 |

|

|

|

1,832 |

|

|

Loans - over 90 days past due |

|

|

10,222 |

|

|

|

6,096 |

|

|

|

494 |

|

|

|

1,076 |

|

|

|

2,120 |

|

|

Total non-performing loans |

|

|

10,714 |

|

|

|

6,734 |

|

|

|

2,225 |

|

|

|

3,502 |

|

|

|

3,258 |

|

|

OREO and repossessed assets |

|

|

- |

|

|

|

165 |

|

|

|

165 |

|

|

|

178 |

|

|

|

266 |

|

|

Total non-performing assets |

|

$ |

10,714 |

|

|

$ |

6,899 |

|

|

$ |

2,390 |

|

|

$ |

3,680 |

|

|

$ |

3,524 |

|

|

Non-performing loans to total loans held for investment |

|

|

0.46 |

% |

|

|

0.29 |

% |

|

|

0.10 |

% |

|

|

0.17 |

% |

|

|

0.17 |

% |

|

Non-performing assets to total assets |

|

|

0.34 |

% |

|

|

0.22 |

% |

|

|

0.08 |

% |

|

|

0.12 |

% |

|

|

0.11 |

% |

|

Non-performing assets to total loans held for investment and

OREO |

|

|

0.46 |

% |

|

|

0.30 |

% |

|

|

0.11 |

% |

|

|

0.18 |

% |

|

|

0.18 |

% |

|

Annualized net charge-offs to average loans |

|

|

0.03 |

% |

|

|

0.02 |

% |

|

|

0.00 |

% |

|

|

0.01 |

% |

|

|

0.04 |

% |

|

Net charge-offs |

|

$ |

172 |

|

|

$ |

120 |

|

|

$ |

16 |

|

|

$ |

59 |

|

|

$ |

184 |

|

| Interest Rates and

Yields: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans |

|

|

5.03 |

% |

|

|

4.62 |

% |

|

|

4.25 |

% |

|

|

3.97 |

% |

|

|

4.47 |

% |

|

Securities (1) |

|

|

2.53 |

% |

|

|

2.29 |

% |

|

|

2.11 |

% |

|

|

1.92 |

% |

|

|

1.84 |

% |

|

Total interest-earning assets (1) |

|

|

4.66 |

% |

|

|

4.17 |

% |

|

|

3.69 |

% |

|

|

3.20 |

% |

|

|

3.36 |

% |

|

Deposits |

|

|

1.20 |

% |

|

|

0.62 |

% |

|

|

0.23 |

% |

|

|

0.19 |

% |

|

|

0.19 |

% |

|

Borrowings and repurchase agreements |

|

|

4.22 |

% |

|

|

3.41 |

% |

|

|

2.79 |

% |

|

|

5.40 |

% |

|

|

5.29 |

% |

|

Total interest-bearing liabilities |

|

|

1.63 |

% |

|

|

0.93 |

% |

|

|

0.41 |

% |

|

|

0.33 |

% |

|

|

0.33 |

% |

| Other

Information: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Full-time equivalent employees |

|

|

397 |

|

|

|

387 |

|

|

|

391 |

|

|

|

397 |

|

|

|

397 |

|

_____________________This information is preliminary and based

on CapStar data available at the time of this earnings release.

(1) Net Interest Margin, Securities yields, and

Total interest-earning asset yields are calculated on a

tax-equivalent basis.

CAPSTAR FINANCIAL HOLDINGS, INC. AND

SUBSIDIARYAnalysis of Interest Income and Expense,

Rates and Yields (unaudited) (dollars in

thousands)Fourth quarter 2022 Earnings

Release

|

|

|

For the Three Months Ended December 31, |

|

|

|

|

2022 |

|

|

2021 |

|

| |

|

AverageOutstandingBalance |

|

|

InterestIncome/Expense |

|

|

AverageYield/Rate |

|

|

AverageOutstandingBalance |

|

|

InterestIncome/Expense |

|

|

AverageYield/Rate |

|

| Interest-Earning Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans held for investment (1) |

|

$ |

2,309,349 |

|

|

$ |

29,278 |

|

|

|

5.03 |

% |

|

$ |

1,888,094 |

|

|

$ |

21,291 |

|

|

|

4.47 |

% |

|

Loans held for sale |

|

|

37,945 |

|

|

|

746 |

|

|

|

7.80 |

% |

|

|

123,962 |

|

|

|

993 |

|

|

|

3.18 |

% |

|

Securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable investment securities (2) |

|

|

361,563 |

|

|

|

2,239 |

|

|

|

2.48 |

% |

|

|

432,165 |

|

|

|

1,839 |

|

|

|

1.70 |

% |

|

Investment securities exempt from federal income tax (3) |

|

|

53,851 |

|

|

|

310 |

|

|

|

2.91 |

% |

|

|

58,970 |

|

|

|

335 |

|

|

|

2.88 |

% |

|

Total securities |

|

|

415,414 |

|

|

|

2,549 |

|

|

|

2.53 |

% |

|

|

491,135 |

|

|

|

2,174 |

|

|

|

1.84 |

% |

|

Cash balances in other banks |

|

|

122,493 |

|

|

|

1,187 |

|

|

|

3.84 |

% |

|

|

397,381 |

|

|

|

192 |

|

|

|

0.19 |

% |

|

Funds sold |

|

|

1,608 |

|

|

|

46 |

|

|

|

— |

|

|

|

19,906 |

|

|

|

9 |

|

|

|

— |

|

| Total interest-earning

assets |

|

|

2,886,809 |

|

|

|

33,806 |

|

|

|

4.66 |

% |

|

|

2,920,478 |

|

|

|

24,659 |

|

|

|

3.36 |

% |

|

Noninterest-earning assets |

|

|

238,119 |

|

|

|

|

|

|

|

|

|

238,830 |

|

|

|

|

|

|

|

| Total assets |

|

$ |

3,124,928 |

|

|

|

|

|

|

|

|

$ |

3,159,308 |

|

|

|

|

|

|

|

| Interest-Bearing

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing deposits: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing transaction accounts |

|

$ |

741,347 |

|

|

|

2,200 |

|

|

|

1.18 |

% |

|

$ |

964,932 |

|

|

|

410 |

|

|

|

0.17 |

% |

|

Savings and money market deposits |

|

|

717,999 |

|

|

|

2,701 |

|

|

|

1.49 |

% |

|

|

616,610 |

|

|

|

307 |

|

|

|

0.20 |

% |

|

Time deposits |

|

|

617,397 |

|

|

|

3,151 |

|

|

|

2.02 |

% |

|

|

383,099 |

|

|

|

556 |

|

|

|

0.58 |

% |

|

Total interest-bearing deposits |

|

|

2,076,743 |

|

|

|

8,052 |

|

|

|

1.54 |

% |

|

|

1,964,641 |

|

|

|

1,273 |

|

|

|

0.26 |

% |

|

Borrowings and repurchase agreements |

|

|

74,812 |

|

|

|

795 |

|

|

|

4.22 |

% |

|

|

29,514 |

|

|

|

394 |

|

|

|

5.29 |

% |

| Total interest-bearing

liabilities |

|

|

2,151,555 |

|

|

|

8,847 |

|

|

|

1.63 |

% |

|

|

1,994,155 |

|

|

|

1,667 |

|

|

|

0.33 |

% |

|

Noninterest-bearing deposits |

|

|

586,211 |

|

|

|

|

|

|

|

|

|

748,673 |

|

|

|

|

|

|

|

| Total funding sources |

|

|

2,737,766 |

|

|

|

|

|

|

|

|

|

2,742,828 |

|

|

|

|

|

|

|

|

Noninterest-bearing liabilities |

|

|

39,135 |

|

|

|

|

|

|

|

|

|

39,123 |

|

|

|

|

|

|

|

|

Shareholders’ equity |

|

|

348,027 |

|

|

|

|

|

|

|

|

|

377,357 |

|

|

|

|

|

|

|

| Total liabilities and

shareholders’ equity |

|

$ |

3,124,928 |

|

|

|

|

|

|

|

|

$ |

3,159,308 |

|

|

|

|

|

|

|

| Net interest spread (4) |

|

|

|

|

|

|

|

|

3.03 |

% |

|

|

|

|

|

|

|

|

3.03 |

% |

| Net interest income/margin

(5) |

|

|

|

|

$ |

24,959 |

|

|

|

3.44 |

% |

|

|

|

|

$ |

22,992 |

|

|

|

3.14 |

% |

_____________________(1) Average loan balances

include nonaccrual loans. Interest income on loans includes

amortization of deferred loan fees, net of deferred loan

costs.(2) Taxable investment securities include

restricted equity securities.(3) Yields on tax

exempt securities, total securities, and total interest-earning

assets are shown on a tax equivalent basis.(4) Net

interest spread is the average yield on total average

interest-earning assets minus the average rate on total average

interest-bearing liabilities.(5) Net interest

margin is annualized net interest income calculated on a tax

equivalent basis divided by total average interest-earning assets

for the period.

This information is preliminary and based on CapStar data

available at the time of this earnings release.

CAPSTAR FINANCIAL HOLDINGS, INC. AND

SUBSIDIARYNon-GAAP Financial Measures (unaudited)

(dollars in thousands except share data)Fourth

quarter 2022 Earnings Release

|

|

|

Five Quarter Comparison |

|

|

|

|

12/31/2022 |

|

|

9/30/2022 |

|

|

6/30/2022 |

|

|

3/31/2022 |

|

|

12/31/2021 |

|

| Operating net income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

10,333 |

|

|

$ |

8,039 |

|

|

$ |

9,972 |

|

|

$ |

10,673 |

|

|

$ |

12,470 |

|

|

Add: acquisition related expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Less: income tax impact of acquisition related expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Operating net income |

|

$ |

10,333 |

|

|

$ |

8,039 |

|

|

$ |

9,972 |

|

|

$ |

10,673 |

|

|

$ |

12,470 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating diluted net income

per share of common stock: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating net income |

|

$ |

10,333 |

|

|

$ |

8,039 |

|

|

$ |

9,972 |

|

|

$ |

10,673 |

|

|

$ |

12,470 |

|

|

Weighted average shares - diluted |

|

|

21,926,821 |

|

|

|

21,988,085 |

|

|

|

22,074,260 |

|

|

|

22,254,644 |

|

|

|

22,221,989 |

|

|

Operating diluted net income per share of common stock |

|

$ |

0.47 |

|

|

$ |

0.37 |

|

|

$ |

0.45 |

|

|

$ |

0.48 |

|

|

$ |

0.56 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating annualized return on

average assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating net income |

|

$ |

10,333 |

|

|

$ |

8,039 |

|

|

$ |

9,972 |

|

|

$ |

10,673 |

|

|

$ |

12,470 |

|

|

Average assets |

|

$ |

3,124,928 |

|

|

$ |

3,146,841 |

|

|

$ |

3,128,864 |

|

|

$ |

3,153,320 |

|

|

$ |

3,159,308 |

|

|

Operating annualized return on average assets |

|

|

1.31 |

% |

|

|

1.01 |

% |

|

|

1.28 |

% |

|

|

1.37 |

% |

|

|

1.57 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating annualized return on

average tangible equity: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average total shareholders' equity |

|

$ |

348,027 |

|

|

$ |

364,138 |

|

|

$ |

361,150 |

|

|

$ |

380,039 |

|

|

$ |

377,357 |

|

|

Less: average intangible assets |

|

|

(46,328 |

) |

|

|

(46,737 |

) |

|

|

(47,160 |

) |

|

|

(47,604 |

) |

|

|

(48,054 |

) |

|

Average tangible equity |

|

|

301,699 |

|

|

|

317,401 |

|

|

|

313,990 |

|

|

|

332,435 |

|

|

|

329,303 |

|

|

Operating net income |

|

$ |

10,333 |

|

|

$ |

8,039 |

|

|

$ |

9,972 |

|

|

$ |

10,673 |

|

|

$ |

12,470 |

|

|

Operating annualized return on average tangible equity |

|

|

13.59 |

% |

|

|

10.05 |

% |

|

|

12.74 |

% |

|

|

13.02 |

% |

|

|

15.02 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating efficiency

ratio: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total noninterest expense |

|

$ |

16,628 |

|

|

$ |

17,931 |

|

|

$ |

17,075 |

|

|

$ |

17,736 |

|

|

$ |

18,682 |

|

|

Less: acquisition related expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Total operating noninterest expense |

|

|

16,628 |

|

|

|

17,931 |

|

|

|

17,075 |

|

|

|

17,736 |

|

|

|

18,682 |

|

|

Net interest income |

|

|

24,959 |

|

|

|

25,553 |

|

|

|

24,440 |

|

|

|

21,140 |

|

|

|

22,992 |

|

|

Total noninterest income |

|

|

6,285 |

|

|

|

3,272 |

|

|

|

5,876 |

|

|

|

9,089 |

|

|

|

11,134 |

|

|

Total revenues |

|

$ |

31,244 |

|

|

$ |

28,825 |

|

|

$ |

30,316 |

|

|

$ |

30,229 |

|

|

$ |

34,126 |

|

|

Operating efficiency ratio: |

|

|

53.23 |

% |

|

|

62.21 |

% |

|

|

56.32 |

% |

|

|

58.67 |

% |

|

|

54.74 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating annualized pre-tax

pre-provision income to average assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes |

|

$ |

13,068 |

|

|

$ |

10,027 |

|

|

$ |

12,398 |

|

|

$ |

13,277 |

|

|

$ |

16,095 |

|

|

Add: acquisition related expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Add: provision for loan losses |

|

|

1,548 |

|

|

|

867 |

|

|

|

843 |

|

|

|

(784 |

) |

|

|

(651 |

) |

|

Operating pre-tax pre-provision income |

|

|

14,616 |

|

|

|

10,894 |

|

|

|

13,241 |

|

|

|

12,493 |

|

|

|

15,444 |

|

|

Average assets |

|

$ |

3,124,928 |

|

|

$ |

3,146,841 |

|

|

$ |

3,128,864 |

|

|

$ |

3,153,320 |

|

|

$ |

3,159,308 |

|

|

Operating annualized pre-tax pre-provision income to average

assets: |

|

|

1.86 |

% |

|

|

1.37 |

% |

|

|

1.70 |

% |

|

|

1.61 |

% |

|

|

1.94 |

% |

CAPSTAR FINANCIAL HOLDINGS, INC. AND

SUBSIDIARYNon-GAAP Financial Measures (unaudited)

(dollars in thousands except share data)Fourth

quarter 2022 Earnings Release

|

|

|

Five Quarter Comparison |

|

|

|

|

12/31/2022 |

|

|

9/30/2022 |

|

|

6/30/2022 |

|

|

3/31/2022 |

|

|

12/31/2021 |

|

| Tangible Equity: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total shareholders' equity |

|

$ |

354,182 |

|

|

$ |

347,365 |

|

|

$ |

357,735 |

|

|

$ |

368,917 |

|

|

$ |

380,094 |

|

|

Less: intangible assets |

|

|

(46,069 |

) |

|

|

(46,468 |

) |

|

|

(46,883 |

) |

|

|

(47,313 |

) |

|

|

(47,759 |

) |

|

Tangible equity |

|

$ |

308,113 |

|

|

$ |

300,897 |

|

|

$ |

310,852 |

|

|

$ |

321,604 |

|

|

$ |

332,335 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Tangible book value per share

of common stock: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tangible equity |

|

$ |

308,113 |

|

|

$ |

300,897 |

|

|

$ |

310,852 |

|

|

$ |

321,604 |

|

|

$ |

332,335 |

|

|

Total shares of stock outstanding |

|

|

21,714,380 |

|

|

|

21,931,624 |

|

|

|

21,934,554 |

|

|

|

22,195,071 |

|

|

|

22,166,129 |

|

|

Tangible book value per share of common stock |

|

$ |

14.19 |

|

|

$ |

13.72 |

|

|

$ |

14.17 |

|

|

$ |

14.49 |

|

|

$ |

14.99 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Tangible book value per share

of common stock plus after-tax unrealized available for sale

investment losses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total shareholders' equity |

|

$ |

354,182 |

|

|

$ |

347,365 |

|

|

$ |

357,735 |

|

|

$ |

368,917 |

|

|

$ |

380,094 |

|

|

Less: intangible assets |

|

|

(46,069 |

) |

|

|

(46,468 |

) |

|

|

(46,883 |

) |

|

|

(47,313 |

) |

|

|

(47,759 |

) |

|

Add: after-tax unrealized available for saleinvestment (gains)

losses |

|

|

51,760 |

|

|

|

53,488 |

|

|

|

37,034 |

|

|

|

23,041 |

|

|

|

2,978 |

|

|

Tangible equity plus after-tax unrealized available for sale

investment (gains) losses |

|

$ |

359,873 |

|

|

$ |

354,385 |

|

|

$ |

347,886 |

|

|

$ |

344,645 |

|

|

$ |

335,313 |

|

|

Total shares of common stock outstanding |

|

|

21,714,380 |

|

|

|

21,931,624 |

|

|

|

21,934,554 |

|

|

|

22,195,071 |

|

|

|

22,166,129 |

|

|

Tangible book value per share of common stock plus after-tax

unrealized available for sale investment losses |

|

$ |

16.57 |

|

|

$ |

16.16 |

|

|

$ |

15.86 |

|

|

$ |

15.53 |

|

|

$ |

15.13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Tangible common equity to

tangible assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|