CapStar Financial Holdings, Inc. (“CapStar”)

(NASDAQ:CSTR) today reported net income of $10.7 million

or $0.48 per diluted share, for the quarter ended March 31, 2022,

compared with net income of $12.5 million or $0.56 per diluted

share, for the quarter ended December 31, 2021, and net income of

$11.0 million or $0.50 per diluted share, for the quarter ended

March 31, 2021. Annualized return on average assets and return on

average equity for the quarter ended March 31, 2022 were 1.37

percent and 11.39 percent, respectively. The first quarter included

a BOLI death benefit of $0.9 million, deferred loan origination

expense related to prior periods of $0.5 million and severance

expense of $0.4 million.

|

Four Key Drivers |

|

Targets |

|

1Q22 |

|

4Q21 |

|

1Q21 |

|

Annualized revenue growth |

|

> 5% |

|

-46.31% |

|

-5.61% |

|

-22.41% |

|

Net interest margin |

|

≥ 3.60% |

|

2.97% |

|

3.14% |

|

3.13% |

|

Efficiency ratio |

|

≤ 55% |

|

58.67% |

|

54.74% |

|

54.08% |

|

Annualized net charge-offs to average loans |

|

≤ 0.25% |

|

0.01% |

|

0.04% |

|

0.00% |

"CapStar’s first quarter results demonstrate continued progress

and momentum in strengthening non-mortgage related profitability

and growth in addition to executing a disciplined capital

allocation strategy,” said Timothy K. Schools, President and Chief

Executive Officer of CapStar. “Our return on average tangible

common equity was 13% despite significant excess equity available

to invest, end of period loan growth excluding PPP loans exceeded

$100 million for the second consecutive quarter leading to 31%

average loan growth, and we increased our dividend 67%. Supported

by outstanding bankers in outstanding markets, excess liquidity,

and excess equity, we are focused on the following capital

priorities: invest in and grow existing and new markets; pay a

competitive, sustainable dividend; and opportunistically repurchase

CapStar common stock."

"As we transition from the potential credit-related risks of the

recent pandemic to current supply chain, inflation, and interest

rate risks, we are optimistic about the continued strength of our

local economy and markets. Tennessee continues to experience

significant in-migration of both businesses and individuals.

Combined with the acquisition of a large number of locally-based

banks, most recently to include the sale of First Horizon to TD,

CapStar is poised to be a beneficiary of customers and talent. I am

proud of our team and excited for what we are building at

CapStar."

RevenueTotal revenue, defined as net interest

income plus noninterest income, totaled $30.2 million in the first

quarter. This represents a decline of $3.9 million from the

previous quarter. Net interest income and noninterest income

totaled $21.1 million and $9.1 million, a decrease of $1.9 million

and $2.0 million, respectively, from the fourth quarter of 2021. A

$1.1 million PPP fee decline and the aforementioned deferred

expense adjustment of $0.5 million contributed to the decrease in

net interest income. Noninterest income declined due to lower

Tri-Net division revenues following a record quarter.

First quarter 2022 average earning assets remained relatively

flat at $2.90 billion compared to December 31, 2021 as organic loan

growth was funded by redeploying excess liquidity. Loan growth

continued to accelerate during the quarter with average loans held

for investment, excluding PPP balances, increasing $141.6 million

from the prior quarter, or 31.1 percent linked-quarter annualized.

End of period loans held for investment, excluding PPP balances,

increased $101.8 million, or 21.3 percent linked-quarter

annualized, which benefited from $76.9 million in loan production

associated with the Company's recent Chattanooga expansion. The

current commercial loan pipeline remains strong, exceeding $500

million and continues to present the Company a tremendous

opportunity to utilize excess liquidity and capital to grow revenue

and earnings per share.

For the first quarter of 2022, the net interest margin decreased

17 basis points from the prior quarter to 2.97 percent primarily

resulting from the aforementioned deferred expense adjustment.

Excluding the deferred expense adjustment, influence of PPP and

excess liquidity accumulated during the pandemic, the Company

estimates its first quarter 2022 net interest margin was 3.32

percent, an 8 basis point decrease compared to the fourth quarter

of 2021. While the Company is managing to a more neutral interest

rate risk profile over time in order to enhance earnings

consistency, net interest income is expected to benefit modestly

from rising rates in 2022.

The Company's average deposits totaled $2.70 billion in the

first quarter of 2022, equal to the fourth quarter of 2021. During

the quarter, the Company experienced a $16.3 million reduction in

higher cost average time deposits and $15.6 million decrease in

average interest-bearing transaction accounts. These decreases were

offset by a $44.1 million increase in average savings and money

market deposits, creating an overall net increase of $12.2 million

in average interest-bearing deposits when compared to the fourth

quarter of 2021. During the quarter, the Company’s lowest cost

deposit category, noninterest bearing, comprised 26.9 percent of

total average deposits, a 70 basis point decrease compared to

December 31, 2021. Total deposit costs remained flat for the first

quarter at 0.19 percent. While in the short-term the Company is

experiencing a period of excess liquidity, a key longer-term

strategic initiative is to create a stronger deposit-led culture

with an emphasis on lower cost relationship-based deposits.

Noninterest income during the quarter decreased $2.0 million

from the fourth quarter ended December 31, 2021.This decrease was

primarily attributable to declines in Tri-Net and mortgage revenue,

offset by an increase in bank owned life insurance income

associated with death benefits. Despite the decrease, the Company's

unique fee businesses continue to support non-interest income,

which has exceeded 30 percent of total revenue for the past eight

quarters.

Noninterest Expense and Operating

Efficiency

Improving productivity and operating efficiency is a key focus

of the Company. During the quarter, the Company continued to

exhibit strong expense discipline. Noninterest expenses decreased

$0.9 million from the fourth quarter of 2021 to $17.7 million in

the first quarter of 2022. This decrease was primarily attributable

to a decline in compensation expense and other expenses, despite

$0.4 million of severance costs incurred during the first

quarter.

For the quarter ended March 31, 2022, the efficiency ratio was

58.67 percent, an increase from 54.74 percent in the fourth quarter

of 2021. Annualized noninterest expense as a percentage of average

assets decreased 7 basis points to 2.28 percent for the quarter

ended March 31, 2022 compared to 2.35 percent for the quarter ended

December 31, 2021. Assets per employee increased slightly to $8.0

million as of March 31, 2022 compared to $7.9 million in the

previous quarter. The continued discipline in productivity metrics

demonstrates the Company's commitment to outstanding

performance.

Asset Quality

Strong asset quality is a core tenant of the Company’s

culture. Continued sound risk management and an improving

economy led to continued low net charge-offs and strong credit

metrics. Annualized net charge offs to average loans for the

three months ended March 31, 2022, improved to 0.01 percent, a 3

basis point decline compared to the fourth quarter ended December

31, 2021. Past due loans as a percentage of total loans held

for investment improved to a record 0.17 percent at March 31, 2022

compared to 0.25 percent at December 31, 2021. Within this amount,

loans greater than 89 days past due totaled $1.1 million, or

0.05 percent of loans held for investment at March 31, 2022, an

improvement from 0.11 percent at December 31, 2021. Non-performing

assets to total loans and OREO were 0.18 percent at March 31, 2022

and December 31, 2021. Criticized and classified loans to

total loans, which were elevated during the pandemic, continued to

improve to 2.49 percent at March 31, 2022, a 15 basis point decline

from December 31, 2021.

In addition to providing reserves for the strong loan growth

experienced during the first quarter, the allowance for loan losses

declined $0.8 million based on improved asset quality trends and

other qualitative factors. The Company continues to retain a

portion of pandemic related reserves in the allowance for loan

losses. As a result, the allowance for loan losses plus the fair

value mark on acquired loans to total loans, less PPP loans,

declined 11 basis points to 1.16 percent at March 31, 2022 from

1.27 percent at December 31, 2021.

| Asset Quality

Data: |

|

3/31/2022 |

|

|

12/31/2021 |

|

|

9/30/2021 |

|

|

6/30/2021 |

|

|

3/31/2021 |

|

|

Annualized net charge-offs to average loans |

|

|

0.01 |

% |

|

|

0.04 |

% |

|

|

0.05 |

% |

|

|

0.01 |

% |

|

|

0.00 |

% |

|

Criticized and classified loans to total loans |

|

|

2.49 |

% |

|

|

2.64 |

% |

|

|

2.85 |

% |

|

|

3.95 |

% |

|

|

4.39 |

% |

|

Loans- past due to total end of period loans |

|

|

0.17 |

% |

|

|

0.25 |

% |

|

|

0.31 |

% |

|

|

0.49 |

% |

|

|

0.44 |

% |

|

Loans- over 89 days past due to total end of period loans |

|

|

0.05 |

% |

|

|

0.11 |

% |

|

|

0.12 |

% |

|

|

0.13 |

% |

|

|

0.14 |

% |

|

Non-performing assets to total loans held for investment and

OREO |

|

|

0.18 |

% |

|

|

0.18 |

% |

|

|

0.20 |

% |

|

|

0.22 |

% |

|

|

0.30 |

% |

|

Allowance for loan losses plus fair value marks / Non-PPP

Loans |

|

|

1.16 |

% |

|

|

1.27 |

% |

|

|

1.41 |

% |

|

|

1.47 |

% |

|

|

1.59 |

% |

|

Allowance for loan losses to non-performing loans |

|

|

596 |

% |

|

|

666 |

% |

|

|

657 |

% |

|

|

571 |

% |

|

|

446 |

% |

Income Tax Expense

The Company’s first quarter effective income tax rate decreased

to approximately 19.6 percent compared to 22.5 percent for the

prior quarter ended December 31, 2021 due to an increase in the

provision in the prior quarter to true up the effective tax rate

for 2021. The Company anticipates its effective tax rate for 2022

to be approximately 20 percent.

Capital

The Company continues to be well capitalized with tangible

equity of $321.6 million at March 31, 2022. Tangible book

value per share of common stock for the quarter ended March 31,

2022 was $14.49 compared to $14.99 and $13.34 for the quarters

ended December 31, 2021 and March 31, 2021, respectively, with the

change from December 31, 2021 being attributable to a decline in

the value of the investment portfolio related to an increase in

market interest rates, partially offset by ongoing

earnings.

| Capital

ratios: |

|

3/31/2022 |

|

|

12/31/2021 |

|

|

9/30/2021 |

|

|

6/30/2021 |

|

|

3/31/2021 |

|

|

Total risk-based capital |

|

|

15.60 |

% |

|

|

16.29 |

% |

|

|

16.23 |

% |

|

|

16.13 |

% |

|

|

16.29 |

% |

|

Common equity tier 1 capital |

|

|

13.58 |

% |

|

|

14.11 |

% |

|

|

13.95 |

% |

|

|

13.78 |

% |

|

|

13.79 |

% |

|

Leverage |

|

|

10.99 |

% |

|

|

10.69 |

% |

|

|

10.28 |

% |

|

|

10.17 |

% |

|

|

9.78 |

% |

In the first quarter of 2022, the Company repurchased $0.8

million in common stock under its share repurchase program. The

total remaining authorization for future purchases was $29.2

million as of March 31, 2022. The Plan will terminate on the

earlier of the date on which the maximum authorized dollar amount

of shares of common stock has been repurchased or January 31,

2023.

Dividend

On April 21, 2022, the Board of Directors of the Company

approved a quarterly dividend of $0.10 per common share, a $0.04 or

67% increase versus the prior quarter, payable on May 25, 2022 to

shareholders of record of CapStar’s common stock as of the close of

business on May 11, 2022.

Conference Call and Webcast Information

CapStar will host a conference call and webcast at 9:00 a.m.

Central Time on Friday, April 22, 2022. During the call, management

will review the first quarter results and operational highlights.

Interested parties may listen to the call by dialing (844)

412-1002. The conference ID number is 2594842. A simultaneous

webcast may be accessed on CapStar’s website

at ir.capstarbank.com by clicking on “News & Events.” An

archived version of the webcast will be available in the same

location shortly after the live call has ended.

About CapStar Financial Holdings, Inc.

CapStar Financial Holdings, Inc. is a bank holding company

headquartered in Nashville, Tennessee and operates primarily

through its wholly owned subsidiary, CapStar Bank, a

Tennessee-chartered state bank. CapStar Bank is a commercial bank

that seeks to establish and maintain comprehensive relationships

with its clients by delivering customized and creative banking

solutions and superior client service. As of March 31, 2022, on a

consolidated basis, CapStar had total assets of $3.2 billion, total

loans of $2.0 billion, total deposits of $2.8 billion, and

shareholders’ equity of $368.9 million. Visit www.capstarbank.com

for more information.

NON-GAAP MEASURES

This release includes financial information determined by

methods other than in accordance with generally accepted accounting

principles (“GAAP”). This financial information includes certain

operating performance measures, which exclude merger-related and

other charges that are not considered part of recurring operations.

Such measures include: “Efficiency ratio – operating,” “Expenses –

operating,” “Earnings per share – operating,” “Diluted earnings per

share – operating,” “Tangible book value per share,” “Return on

common equity – operating,” “Return on tangible common equity –

operating,” “Return on assets – operating,” and “Tangible common

equity to tangible assets.”

Management has included these non-GAAP measures because it

believes these measures may provide useful supplemental information

for evaluating CapStar’s underlying performance trends. Further,

management uses these measures in managing and evaluating CapStar’s

business and intends to refer to them in discussions about our

operations and performance. Operating performance measures should

be viewed in addition to, and not as an alternative to or

substitute for, measures determined in accordance with GAAP, and

are not necessarily comparable to non-GAAP measures that may be

presented by other companies. To the extent applicable,

reconciliations of these non-GAAP measures to the most directly

comparable GAAP measures can be found in the ‘Non-GAAP

Reconciliation Tables’ included in the exhibits to this

presentation.

CAPSTAR FINANCIAL HOLDINGS, INC. AND

SUBSIDIARYConsolidated Statements of Income

(unaudited) (dollars in thousands, except share

data)First quarter 2022 Earnings

Release

|

|

|

Three Months Ended |

|

|

|

|

March 31, |

|

|

|

|

2022 |

|

|

2021 |

|

| Interest

income: |

|

|

|

|

|

|

|

Loans, including fees |

|

$ |

20,367 |

|

|

$ |

22,014 |

|

|

Securities: |

|

|

|

|

|

|

|

Taxable |

|

|

1,754 |

|

|

|

1,596 |

|

|

Tax-exempt |

|

|

325 |

|

|

|

373 |

|

|

Federal funds sold |

|

|

10 |

|

|

|

— |

|

|

Restricted equity securities |

|

|

156 |

|

|

|

161 |

|

|

Interest-bearing deposits in financial institutions |

|

|

172 |

|

|

|

134 |

|

|

Total interest income |

|

|

22,784 |

|

|

|

24,278 |

|

| Interest

expense: |

|

|

|

|

|

|

|

Interest-bearing deposits |

|

|

436 |

|

|

|

446 |

|

|

Savings and money market accounts |

|

|

331 |

|

|

|

313 |

|

|

Time deposits |

|

|

484 |

|

|

|

931 |

|

|

Federal Home Loan Bank advances |

|

|

— |

|

|

|

12 |

|

|

Subordinated notes |

|

|

393 |

|

|

|

394 |

|

|

Total interest expense |

|

|

1,644 |

|

|

|

2,096 |

|

|

Net interest income |

|

|

21,140 |

|

|

|

22,182 |

|

|

Provision for loan losses |

|

|

(784 |

) |

|

|

650 |

|

|

Net interest income after provision for loan losses |

|

|

21,924 |

|

|

|

21,532 |

|

|

Noninterest income: |

|

|

|

|

|

|

|

Deposit service charges |

|

|

1,142 |

|

|

|

1,102 |

|

|

Interchange and debit card transaction fees |

|

|

1,222 |

|

|

|

1,092 |

|

|

Mortgage banking |

|

|

1,966 |

|

|

|

4,716 |

|

|

Tri-Net |

|

|

2,171 |

|

|

|

1,143 |

|

|

Wealth management |

|

|

440 |

|

|

|

459 |

|

|

SBA lending |

|

|

222 |

|

|

|

492 |

|

|

Net gain on sale of securities |

|

|

— |

|

|

|

26 |

|

|

Other noninterest income |

|

|

1,926 |

|

|

|

984 |

|

|

Total noninterest income |

|

|

9,089 |

|

|

|

10,014 |

|

|

Noninterest expense: |

|

|

|

|

|

|

|

Salaries and employee benefits |

|

|

10,269 |

|

|

|

9,427 |

|

|

Data processing and software |

|

|

2,647 |

|

|

|

2,827 |

|

|

Occupancy |

|

|

1,099 |

|

|

|

1,108 |

|

|

Equipment |

|

|

709 |

|

|

|

899 |

|

|

Professional services |

|

|

679 |

|

|

|

704 |

|

|

Regulatory fees |

|

|

280 |

|

|

|

257 |

|

|

Acquisition related expenses |

|

|

— |

|

|

|

67 |

|

|

Amortization of intangibles |

|

|

446 |

|

|

|

508 |

|

|

Other operating |

|

|

1,607 |

|

|

|

1,616 |

|

|

Total noninterest expense |

|

|

17,736 |

|

|

|

17,413 |

|

|

Income before income taxes |

|

|

13,277 |

|

|

|

14,133 |

|

| Income

tax expense |

|

|

2,604 |

|

|

|

3,103 |

|

|

Net income |

|

$ |

10,673 |

|

|

$ |

11,030 |

|

| Per

share information: |

|

|

|

|

|

|

|

Basic net income per share of common stock |

|

$ |

0.48 |

|

|

$ |

0.50 |

|

|

Diluted net income per share of common stock |

|

$ |

0.48 |

|

|

$ |

0.50 |

|

|

Weighted average shares outstanding: |

|

|

|

|

|

|

|

Basic |

|

|

22,198,339 |

|

|

|

22,045,501 |

|

|

Diluted |

|

|

22,254,644 |

|

|

|

22,076,600 |

|

This information is preliminary and based on CapStar data

available at the time of this earnings release.

CAPSTAR FINANCIAL HOLDINGS, INC. AND

SUBSIDIARYSelected Quarterly Financial Data

(unaudited) (dollars in thousands, except share

data)First quarter 2022 Earnings

Release

| |

|

Five Quarter Comparison |

|

| |

|

3/31/2022 |

|

|

12/31/2021 |

|

|

9/30/2021 |

|

|

6/30/2021 |

|

|

3/31/2021 |

|

|

Income Statement Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest income |

|

$ |

21,140 |

|

|

$ |

22,992 |

|

|

$ |

22,964 |

|

|

$ |

23,032 |

|

|

$ |

22,182 |

|

|

Provision for loan losses |

|

|

(784 |

) |

|

|

(651 |

) |

|

|

— |

|

|

|

(1,065 |

) |

|

|

650 |

|

|

Net interest income after provision for loan losses |

|

|

21,924 |

|

|

|

23,643 |

|

|

|

22,964 |

|

|

|

24,097 |

|

|

|

21,532 |

|

|

Deposit service charges |

|

|

1,142 |

|

|

|

1,117 |

|

|

|

1,187 |

|

|

|

1,109 |

|

|

|

1,102 |

|

|

Interchange and debit card transaction fees |

|

|

1,222 |

|

|

|

1,261 |

|

|

|

1,236 |

|

|

|

1,227 |

|

|

|

1,092 |

|

|

Mortgage banking |

|

|

1,966 |

|

|

|

2,740 |

|

|

|

4,693 |

|

|

|

3,910 |

|

|

|

4,716 |

|

|

Tri-Net |

|

|

2,171 |

|

|

|

3,996 |

|

|

|

1,939 |

|

|

|

1,536 |

|

|

|

1,143 |

|

|

Wealth management |

|

|

440 |

|

|

|

438 |

|

|

|

481 |

|

|

|

471 |

|

|

|

459 |

|

|

SBA lending |

|

|

222 |

|

|

|

279 |

|

|

|

911 |

|

|

|

377 |

|

|

|

492 |

|

|

Net gain (loss) on sale of securities |

|

|

— |

|

|

|

8 |

|

|

|

7 |

|

|

|

(13 |

) |

|

|

26 |

|

|

Other noninterest income |

|

|

1,926 |

|

|

|

1,295 |

|

|

|

1,197 |

|

|

|

1,266 |

|

|

|

984 |

|

|

Total noninterest income |

|

|

9,089 |

|

|

|

11,134 |

|

|

|

11,651 |

|

|

|

9,883 |

|

|

|

10,014 |

|

|

Salaries and employee benefits |

|

|

10,269 |

|

|

|

10,549 |

|

|

|

10,980 |

|

|

|

10,803 |

|

|

|

9,427 |

|

|

Data processing and software |

|

|

2,647 |

|

|

|

2,719 |

|

|

|

2,632 |

|

|

|

3,070 |

|

|

|

2,827 |

|

|

Occupancy |

|

|

1,099 |

|

|

|

1,012 |

|

|

|

1,028 |

|

|

|

1,057 |

|

|

|

1,108 |

|

|

Equipment |

|

|

709 |

|

|

|

867 |

|

|

|

760 |

|

|

|

980 |

|

|

|

899 |

|

|

Professional services |

|

|

679 |

|

|

|

521 |

|

|

|

469 |

|

|

|

460 |

|

|

|

704 |

|

|

Regulatory fees |

|

|

280 |

|

|

|

284 |

|

|

|

279 |

|

|

|

211 |

|

|

|

257 |

|

|

Acquisition related expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

256 |

|

|

|

67 |

|

|

Amortization of intangibles |

|

|

446 |

|

|

|

461 |

|

|

|

477 |

|

|

|

493 |

|

|

|

508 |

|

|

Other noninterest expense |

|

|

1,607 |

|

|

|

2,269 |

|

|

|

1,741 |

|

|

|

1,750 |

|

|

|

1,616 |

|

|

Total noninterest expense |

|

|

17,736 |

|

|

|

18,682 |

|

|

|

18,366 |

|

|

|

19,080 |

|

|

|

17,413 |

|

|

Net income before income tax expense |

|

|

13,277 |

|

|

|

16,095 |

|

|

|

16,249 |

|

|

|

14,900 |

|

|

|

14,133 |

|

|

Income tax expense |

|

|

2,604 |

|

|

|

3,625 |

|

|

|

3,147 |

|

|

|

2,824 |

|

|

|

3,103 |

|

|

Net income |

|

$ |

10,673 |

|

|

$ |

12,470 |

|

|

$ |

13,102 |

|

|

$ |

12,076 |

|

|

$ |

11,030 |

|

|

Weighted average shares - basic |

|

|

22,198,339 |

|

|

|

22,166,410 |

|

|

|

22,164,278 |

|

|

|

22,133,759 |

|

|

|

22,045,501 |

|

|

Weighted average shares - diluted |

|

|

22,254,644 |

|

|

|

22,221,989 |

|

|

|

22,218,402 |

|

|

|

22,198,829 |

|

|

|

22,076,600 |

|

|

Net income per share, basic |

|

$ |

0.48 |

|

|

$ |

0.56 |

|

|

$ |

0.59 |

|

|

$ |

0.55 |

|

|

$ |

0.50 |

|

|

Net income per share, diluted |

|

|

0.48 |

|

|

|

0.56 |

|

|

|

0.59 |

|

|

|

0.54 |

|

|

|

0.50 |

|

|

Balance Sheet Data (at period end): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

355,981 |

|

|

$ |

415,125 |

|

|

$ |

359,267 |

|

|

$ |

449,267 |

|

|

$ |

390,565 |

|

|

Securities available-for-sale |

|

|

460,558 |

|

|

|

459,396 |

|

|

|

483,778 |

|

|

|

500,339 |

|

|

|

474,788 |

|

|

Securities held-to-maturity |

|

|

1,775 |

|

|

|

1,782 |

|

|

|

1,788 |

|

|

|

2,395 |

|

|

|

2,401 |

|

|

Loans held for sale |

|

|

106,895 |

|

|

|

83,715 |

|

|

|

176,488 |

|

|

|

158,234 |

|

|

|

171,660 |

|

|

Loans held for investment |

|

|

2,047,555 |

|

|

|

1,965,769 |

|

|

|

1,894,249 |

|

|

|

1,897,838 |

|

|

|

1,931,687 |

|

|

Allowance for loan losses |

|

|

(20,857 |

) |

|

|

(21,698 |

) |

|

|

(22,533 |

) |

|

|

(22,754 |

) |

|

|

(23,877 |

) |

|

Total assets |

|

|

3,190,749 |

|

|

|

3,133,046 |

|

|

|

3,112,127 |

|

|

|

3,212,390 |

|

|

|

3,150,457 |

|

|

Non-interest-bearing deposits |

|

|

702,172 |

|

|

|

725,171 |

|

|

|

718,299 |

|

|

|

782,170 |

|

|

|

711,606 |

|

|

Interest-bearing deposits |

|

|

2,053,823 |

|

|

|

1,959,110 |

|

|

|

1,956,093 |

|

|

|

1,998,024 |

|

|

|

2,039,595 |

|

|

Federal Home Loan Bank advances and other borrowings |

|

|

29,566 |

|

|

|

29,532 |

|

|

|

29,499 |

|

|

|

29,487 |

|

|

|

29,455 |

|

|

Total liabilities |

|

|

2,821,832 |

|

|

|

2,752,952 |

|

|

|

2,741,799 |

|

|

|

2,852,639 |

|

|

|

2,806,513 |

|

|

Shareholders' equity |

|

$ |

368,917 |

|

|

$ |

380,094 |

|

|

$ |

370,328 |

|

|

$ |

359,752 |

|

|

$ |

343,944 |

|

|

Total shares of common stock outstanding |

|

|

22,195,071 |

|

|

|

22,166,129 |

|

|

|

22,165,760 |

|

|

|

22,165,547 |

|

|

|

22,089,873 |

|

|

Book value per share of common stock |

|

$ |

16.62 |

|

|

$ |

17.15 |

|

|

$ |

16.71 |

|

|

$ |

16.23 |

|

|

$ |

15.57 |

|

|

Tangible book value per share of common stock* |

|

|

14.49 |

|

|

|

14.99 |

|

|

|

14.53 |

|

|

|

14.03 |

|

|

|

13.34 |

|

|

Market value per share of common stock |

|

$ |

21.08 |

|

|

$ |

21.03 |

|

|

$ |

21.24 |

|

|

$ |

20.50 |

|

|

$ |

17.25 |

|

|

Capital ratios: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total risk-based capital |

|

|

15.60 |

% |

|

|

16.29 |

% |

|

|

16.23 |

% |

|

|

16.13 |

% |

|

|

16.29 |

% |

|

Tier 1 risk-based capital |

|

|

13.58 |

% |

|

|

14.11 |

% |

|

|

13.95 |

% |

|

|

13.78 |

% |

|

|

13.79 |

% |

|

Common equity tier 1 capital |

|

|

13.58 |

% |

|

|

14.11 |

% |

|

|

13.95 |

% |

|

|

13.78 |

% |

|

|

13.79 |

% |

|

Leverage |

|

|

10.99 |

% |

|

|

10.69 |

% |

|

|

10.28 |

% |

|

|

10.17 |

% |

|

|

9.78 |

% |

_____________________*This metric is a non-GAAP financial

measure. See Non-GAAP disclaimer in this earnings release and below

for discussion and reconciliation to the most directly comparable

GAAP financial measure.This information is preliminary and based on

CapStar data available at the time of this earnings release.

CAPSTAR FINANCIAL HOLDINGS, INC. AND

SUBSIDIARYSelected Quarterly Financial Data

(unaudited) (dollars in thousands, except share

data)First quarter 2022 Earnings

Release

| |

|

Five Quarter Comparison |

|

| |

|

3/31/2022 |

|

|

12/31/2021 |

|

|

9/30/2021 |

|

|

6/30/2021 |

|

|

3/31/2021 |

|

|

Average Balance Sheet Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and

cash equivalents |

|

$ |

380,262 |

|

|

$ |

470,963 |

|

|

$ |

411,101 |

|

|

$ |

301,773 |

|

|

$ |

341,092 |

|

|

Investment securities |

|

|

483,339 |

|

|

|

491,135 |

|

|

|

515,877 |

|

|

|

508,595 |

|

|

|

496,035 |

|

| Loans

held for sale |

|

|

90,163 |

|

|

|

123,962 |

|

|

|

173,402 |

|

|

|

147,912 |

|

|

|

164,867 |

|

| Loans

held for investment |

|

|

2,001,740 |

|

|

|

1,888,094 |

|

|

|

1,884,935 |

|

|

|

1,938,818 |

|

|

|

1,929,343 |

|

|

Assets |

|

|

3,153,320 |

|

|

|

3,159,308 |

|

|

|

3,171,182 |

|

|

|

3,078,748 |

|

|

|

3,078,745 |

|

| Interest

bearing deposits |

|

|

1,976,803 |

|

|

|

1,964,641 |

|

|

|

1,980,304 |

|

|

|

1,940,442 |

|

|

|

1,986,621 |

|

|

Deposits |

|

|

2,704,938 |

|

|

|

2,713,314 |

|

|

|

2,732,165 |

|

|

|

2,662,192 |

|

|

|

2,663,551 |

|

| Federal

Home Loan Bank advances and other borrowings |

|

|

29,547 |

|

|

|

29,514 |

|

|

|

29,495 |

|

|

|

29,467 |

|

|

|

33,879 |

|

|

Liabilities |

|

|

2,773,281 |

|

|

|

2,781,951 |

|

|

|

2,803,375 |

|

|

|

2,719,898 |

|

|

|

2,728,064 |

|

|

Shareholders' equity |

|

|

380,039 |

|

|

|

377,357 |

|

|

|

367,807 |

|

|

|

358,850 |

|

|

|

350,681 |

|

|

Performance Ratios: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annualized return on average assets |

|

|

1.37 |

% |

|

|

1.57 |

% |

|

|

1.64 |

% |

|

|

1.57 |

% |

|

|

1.45 |

% |

|

Annualized return on average equity |

|

|

11.39 |

% |

|

|

13.11 |

% |

|

|

14.13 |

% |

|

|

13.50 |

% |

|

|

12.76 |

% |

| Net

interest margin (1) |

|

|

2.97 |

% |

|

|

3.14 |

% |

|

|

3.12 |

% |

|

|

3.26 |

% |

|

|

3.13 |

% |

|

Annualized noninterest income to average assets |

|

|

1.17 |

% |

|

|

1.40 |

% |

|

|

1.46 |

% |

|

|

1.29 |

% |

|

|

1.32 |

% |

|

Efficiency ratio |

|

|

58.67 |

% |

|

|

54.74 |

% |

|

|

53.06 |

% |

|

|

57.97 |

% |

|

|

54.08 |

% |

|

Loans by Type (at period end): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial and industrial |

|

$ |

499,719 |

|

|

$ |

497,615 |

|

|

$ |

478,279 |

|

|

$ |

536,279 |

|

|

$ |

609,896 |

|

|

Commercial real estate - owner occupied |

|

|

231,933 |

|

|

|

209,261 |

|

|

|

193,139 |

|

|

|

200,725 |

|

|

|

197,758 |

|

|

Commercial real estate - non-owner occupied |

|

|

652,936 |

|

|

|

616,023 |

|

|

|

579,857 |

|

|

|

538,520 |

|

|

|

505,252 |

|

|

Construction and development |

|

|

208,513 |

|

|

|

214,310 |

|

|

|

210,516 |

|

|

|

198,448 |

|

|

|

170,965 |

|

| Consumer

real estate |

|

|

327,416 |

|

|

|

326,412 |

|

|

|

328,262 |

|

|

|

331,580 |

|

|

|

336,496 |

|

|

Consumer |

|

|

48,790 |

|

|

|

46,811 |

|

|

|

45,669 |

|

|

|

45,898 |

|

|

|

45,481 |

|

|

Other |

|

|

78,248 |

|

|

|

55,337 |

|

|

|

58,527 |

|

|

|

46,387 |

|

|

|

65,839 |

|

|

Asset Quality Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Allowance for loan losses to total loans |

|

|

1.02 |

% |

|

|

1.10 |

% |

|

|

1.19 |

% |

|

|

1.20 |

% |

|

|

1.24 |

% |

|

Allowance for loan losses to non-performing loans |

|

|

596 |

% |

|

|

666 |

% |

|

|

657 |

% |

|

|

571 |

% |

|

|

446 |

% |

|

Nonaccrual loans |

|

$ |

3,502 |

|

|

$ |

3,258 |

|

|

$ |

3,431 |

|

|

$ |

3,985 |

|

|

$ |

5,355 |

|

| Troubled

debt restructurings |

|

|

1,847 |

|

|

|

1,832 |

|

|

|

1,859 |

|

|

|

1,895 |

|

|

|

1,914 |

|

| Loans -

over 89 days past due |

|

|

1,076 |

|

|

|

2,120 |

|

|

|

2,333 |

|

|

|

2,389 |

|

|

|

2,720 |

|

| Total

non-performing loans |

|

|

3,502 |

|

|

|

3,258 |

|

|

|

3,431 |

|

|

|

3,985 |

|

|

|

5,355 |

|

| OREO and

repossessed assets |

|

|

178 |

|

|

|

266 |

|

|

|

349 |

|

|

|

184 |

|

|

|

523 |

|

| Total

non-performing assets |

|

|

3,680 |

|

|

|

3,524 |

|

|

|

3,780 |

|

|

|

4,169 |

|

|

|

5,878 |

|

|

Non-performing loans to total loans held for investment |

|

|

0.17 |

% |

|

|

0.17 |

% |

|

|

0.18 |

% |

|

|

0.21 |

% |

|

|

0.28 |

% |

|

Non-performing assets to total assets |

|

|

0.12 |

% |

|

|

0.11 |

% |

|

|

0.12 |

% |

|

|

0.13 |

% |

|

|

0.19 |

% |

|

Non-performing assets to total loans held for investment and

OREO |

|

|

0.18 |

% |

|

|

0.18 |

% |

|

|

0.20 |

% |

|

|

0.22 |

% |

|

|

0.30 |

% |

|

Annualized net charge-offs to average loans |

|

|

0.01 |

% |

|

|

0.04 |

% |

|

|

0.05 |

% |

|

|

0.01 |

% |

|

|

0.00 |

% |

| Net

charge-offs |

|

$ |

59 |

|

|

$ |

184 |

|

|

$ |

221 |

|

|

$ |

59 |

|

|

$ |

18 |

|

|

Interest Rates and Yields: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans |

|

|

3.97 |

% |

|

|

4.47 |

% |

|

|

4.41 |

% |

|

|

4.43 |

% |

|

|

4.36 |

% |

|

Securities (1) |

|

|

1.92 |

% |

|

|

1.84 |

% |

|

|

1.75 |

% |

|

|

1.77 |

% |

|

|

1.80 |

% |

| Total

interest-earning assets (1) |

|

|

3.20 |

% |

|

|

3.36 |

% |

|

|

3.35 |

% |

|

|

3.51 |

% |

|

|

3.42 |

% |

|

Deposits |

|

|

0.19 |

% |

|

|

0.19 |

% |

|

|

0.19 |

% |

|

|

0.21 |

% |

|

|

0.26 |

% |

|

Borrowings and repurchase agreements |

|

|

5.40 |

% |

|

|

5.29 |

% |

|

|

5.30 |

% |

|

|

5.36 |

% |

|

|

4.85 |

% |

| Total

interest-bearing liabilities |

|

|

0.33 |

% |

|

|

0.33 |

% |

|

|

0.34 |

% |

|

|

0.37 |

% |

|

|

0.42 |

% |

|

Other Information: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Full-time equivalent employees |

|

|

397 |

|

|

|

397 |

|

|

|

392 |

|

|

|

383 |

|

|

|

379 |

|

_____________________

This information is preliminary and based on CapStar data

available at the time of this earnings release.

(1) Net Interest Margin, Securities yields, and

Total interest-earning asset yields are calculated on a

tax-equivalent basis.CAPSTAR FINANCIAL HOLDINGS, INC. AND

SUBSIDIARYAnalysis of Interest Income and Expense,

Rates and Yields (unaudited) (dollars in

thousands)First quarter 2022 Earnings

Release

|

|

|

For the Three Months Ended March 31, |

|

|

|

|

2022 |

|

|

2021 |

|

| |

|

AverageOutstandingBalance |

|

|

InterestIncome/Expense |

|

|

AverageYield/Rate |

|

|

AverageOutstandingBalance |

|

|

InterestIncome/Expense |

|

|

AverageYield/Rate |

|

|

Interest-Earning Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans (1) |

|

$ |

2,001,740 |

|

|

$ |

19,599 |

|

|

|

3.97 |

% |

|

$ |

1,929,342 |

|

|

$ |

20,723 |

|

|

|

4.47 |

% |

|

Loans held for sale |

|

|

90,163 |

|

|

|

768 |

|

|

|

3.46 |

% |

|

|

164,867 |

|

|

|

1,291 |

|

|

|

3.56 |

% |

|

Securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable investment securities (2) |

|

|

426,144 |

|

|

|

1,909 |

|

|

|

1.79 |

% |

|

|

431,406 |

|

|

|

1,757 |

|

|

|

1.63 |

% |

|

Investment securities exempt from federal income tax (3) |

|

|

57,195 |

|

|

|

326 |

|

|

|

2.89 |

% |

|

|

64,629 |

|

|

|

373 |

|

|

|

2.92 |

% |

|

Total securities |

|

|

483,339 |

|

|

|

2,235 |

|

|

|

1.92 |

% |

|

|

496,035 |

|

|

|

2,130 |

|

|

|

1.80 |

% |

|

Cash balances in other banks |

|

|

305,922 |

|

|

|

172 |

|

|

|

0.23 |

% |

|

|

298,722 |

|

|

|

134 |

|

|

|

0.18 |

% |

|

Funds sold |

|

|

20,149 |

|

|

|

10 |

|

|

|

0.19 |

% |

|

|

153 |

|

|

|

— |

|

|

|

1.27 |

% |

| Total

interest-earning assets |

|

|

2,901,313 |

|

|

|

22,784 |

|

|

|

3.20 |

% |

|

|

2,889,119 |

|

|

|

24,278 |

|

|

|

3.42 |

% |

|

Noninterest-earning assets |

|

|

252,007 |

|

|

|

|

|

|

|

|

|

189,626 |

|

|

|

|

|

|

|

| Total

assets |

|

$ |

3,153,320 |

|

|

|

|

|

|

|

|

$ |

3,078,745 |

|

|

|

|

|

|

|

|

Interest-Bearing Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing deposits: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing transaction accounts |

|

$ |

949,313 |

|

|

|

436 |

|

|

|

0.19 |

% |

|

$ |

944,651 |

|

|

|

446 |

|

|

|

0.19 |

% |

|

Savings and money market deposits |

|

|

660,721 |

|

|

|

331 |

|

|

|

0.20 |

% |

|

|

583,590 |

|

|

|

313 |

|

|

|

0.22 |

% |

|

Time deposits |

|

|

366,769 |

|

|

|

484 |

|

|

|

0.54 |

% |

|

|

458,380 |

|

|

|

931 |

|

|

|

0.82 |

% |

|

Total interest-bearing deposits |

|

|

1,976,803 |

|

|

|

1,251 |

|

|

|

0.26 |

% |

|

|

1,986,621 |

|

|

|

1,690 |

|

|

|

0.35 |

% |

|

Borrowings and repurchase agreements |

|

|

29,547 |

|

|

|

393 |

|

|

|

5.40 |

% |

|

|

33,879 |

|

|

|

406 |

|

|

|

4.85 |

% |

| Total

interest-bearing liabilities |

|

|

2,006,350 |

|

|

|

1,644 |

|

|

|

0.33 |

% |

|

|

2,020,500 |

|

|

|

2,096 |

|

|

|

0.42 |

% |

|

Noninterest-bearing deposits |

|

|

728,134 |

|

|

|

|

|

|

|

|

|

676,929 |

|

|

|

|

|

|

|

| Total

funding sources |

|

|

2,734,484 |

|

|

|

|

|

|

|

|

|

2,697,429 |

|

|

|

|

|

|

|

|

Noninterest-bearing liabilities |

|

|

38,797 |

|

|

|

|

|

|

|

|

|

30,635 |

|

|

|

|

|

|

|

|

Shareholders’ equity |

|

|

380,039 |

|

|

|

|

|

|

|

|

|

350,681 |

|

|

|

|

|

|

|

| Total

liabilities and shareholders’ equity |

|

$ |

3,153,320 |

|

|

|

|

|

|

|

|

$ |

3,078,745 |

|

|

|

|

|

|

|

| Net

interest spread (4) |

|

|

|

|

|

|

|

|

2.86 |

% |

|

|

|

|

|

|

|

|

3.00 |

% |

| Net

interest income/margin (5) |

|

|

|

|

$ |

21,140 |

|

|

|

2.97 |

% |

|

|

|

|

$ |

22,182 |

|

|

|

3.13 |

% |

_____________________

(1) Average loan balances include nonaccrual

loans. Interest income on loans includes amortization of deferred

loan fees, net of deferred loan costs.(2) Taxable

investment securities include restricted equity

securities.(3) Yields on tax exempt securities,

total securities, and total interest-earning assets are shown on a

tax equivalent basis.(4) Net interest spread is

the average yield on total average interest-earning assets minus

the average rate on total average interest-bearing

liabilities.(5) Net interest margin is annualized

net interest income calculated on a tax equivalent basis divided by

total average interest-earning assets for the period.

This information is preliminary and based on CapStar data

available at the time of this earnings release.

CAPSTAR FINANCIAL HOLDINGS, INC. AND

SUBSIDIARYNon-GAAP Financial Measures (unaudited)

(dollars in thousands except share data)First

quarter 2022 Earnings Release

|

|

|

Five Quarter Comparison |

|

|

|

|

3/31/2022 |

|

|

12/31/2021 |

|

|

9/30/2021 |

|

|

6/30/2021 |

|

|

3/31/2021 |

|

|

Operating net income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

10,673 |

|

|

$ |

12,470 |

|

|

$ |

13,102 |

|

|

$ |

12,076 |

|

|

$ |

11,030 |

|

|

Add: acquisition related expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

256 |

|

|

|

67 |

|

|

Less: income tax impact of acquisition related expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(67 |

) |

|

|

(18 |

) |

|

Operating net income |

|

$ |

10,673 |

|

|

$ |

12,470 |

|

|

$ |

13,102 |

|

|

$ |

12,265 |

|

|

$ |

11,079 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating diluted net income per share of common stock: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating net income |

|

$ |

10,673 |

|

|

$ |

12,470 |

|

|

$ |

13,102 |

|

|

$ |

12,265 |

|

|

$ |

11,079 |

|

|

Weighted average shares - diluted |

|

|

22,254,644 |

|

|

|

22,221,989 |

|

|

|

22,218,402 |

|

|

|

22,198,829 |

|

|

|

22,076,600 |

|

|

Operating diluted net income per share of common stock |

|

$ |

0.48 |

|

|

$ |

0.56 |

|

|

$ |

0.59 |

|

|

$ |

0.55 |

|

|

$ |

0.50 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating annualized return on average assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating net income |

|

$ |

10,673 |

|

|

$ |

12,470 |

|

|

$ |

13,102 |

|

|

$ |

12,265 |

|

|

$ |

11,079 |

|

|

Average assets |

|

|

3,153,320 |

|

|

|

3,159,308 |

|

|

|

3,171,182 |

|

|

|

3,078,748 |

|

|

|

3,078,745 |

|

|

Operating annualized return on average assets |

|

|

1.37 |

% |

|

|

1.57 |

% |

|

|

1.64 |

% |

|

|

1.60 |

% |

|

|

1.46 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating annualized return on average tangible equity: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average total shareholders' equity |

|

$ |

380,039 |

|

|

$ |

377,357 |

|

|

$ |

367,807 |

|

|

$ |

358,850 |

|

|

$ |

350,681 |

|

|

Less: average intangible assets |

|

|

(47,604 |

) |

|

|

(48,054 |

) |

|

|

(48,527 |

) |

|

|

(49,012 |

) |

|

|

(49,514 |

) |

|

Average tangible equity |

|

|

332,435 |

|

|

|

329,303 |

|

|

|

319,280 |

|

|

|

309,838 |

|

|

|

301,167 |

|

|

Operating net income |

|

$ |

10,673 |

|

|

$ |

12,470 |

|

|

$ |

13,102 |

|

|

$ |

12,265 |

|

|

$ |

11,079 |

|

|

Operating annualized return on average tangible equity |

|

|

13.02 |

% |

|

|

15.02 |

% |

|

|

16.28 |

% |

|

|

15.88 |

% |

|

|

14.92 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating efficiency ratio: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total noninterest expense |

|

$ |

17,736 |

|

|

$ |

18,682 |

|

|

$ |

18,366 |

|

|

$ |

19,080 |

|

|

$ |

17,413 |

|

|

Less: acquisition related expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(256 |

) |

|

|

(67 |

) |

|

Total operating noninterest expense |

|

|

17,736 |

|

|

|

18,682 |

|

|

|

18,366 |

|

|

|

18,824 |

|

|

|

17,346 |

|

|

Net interest income |

|

|

21,140 |

|

|

|

22,992 |

|

|

|

22,964 |

|

|

|

23,032 |

|

|

|

22,182 |

|

|

Total noninterest income |

|

|

9,089 |

|

|

|

11,134 |

|

|

|

11,651 |

|

|

|

9,883 |

|

|

|

10,014 |

|

|

Total revenues |

|

$ |

30,229 |

|

|

$ |

34,126 |

|

|

$ |

34,615 |

|

|

$ |

32,915 |

|

|

$ |

32,196 |

|

|

Operating efficiency ratio: |

|

|

58.67 |

% |

|

|

54.74 |

% |

|

|

53.06 |

% |

|

|

57.19 |

% |

|

|

53.88 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating annualized pre-tax pre-provision income to average

assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes |

|

$ |

13,277 |

|

|

$ |

16,095 |

|

|

$ |

16,249 |

|

|

$ |

14,900 |

|

|

$ |

14,133 |

|

|

Add: acquisition related expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

256 |

|

|

|

67 |

|

|

Add: provision for loan losses |

|

|

(784 |

) |

|

|

(651 |

) |

|

|

— |

|

|

|

(1,065 |

) |

|

|

650 |

|

|

Operating pre-tax pre-provision income |

|

|

12,493 |

|

|

|

15,444 |

|

|

|

16,249 |

|

|

|

14,091 |

|

|

|

14,850 |

|

|

Average assets |

|

$ |

3,153,320 |

|

|

$ |

3,159,308 |

|

|

$ |

3,171,182 |

|

|

$ |

3,078,748 |

|

|

$ |

3,078,745 |

|

|

Operating annualized pre-tax pre-provision income to average

assets: |

|

|

1.61 |

% |

|

|

1.94 |

% |

|

|

2.03 |

% |

|

|

1.84 |

% |

|

|

1.96 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Tangible

Equity: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total shareholders' equity |

|

$ |

368,917 |

|

|

$ |

380,094 |

|

|

$ |

370,328 |

|

|

$ |

359,752 |

|

|

$ |

343,944 |

|

|

Less: intangible assets |

|

|

(47,313 |

) |

|

|

(47,759 |

) |

|

|

(48,220 |

) |

|

|

(48,697 |

) |

|

|

(49,190 |

) |

|

Tangible equity |

|

$ |

321,604 |

|

|

$ |

332,335 |

|

|

$ |

322,108 |

|

|

$ |

311,055 |

|

|

$ |

294,754 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Tangible

Book Value per Share of Common Stock: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tangible common equity |

|

$ |

321,604 |

|

|

$ |

332,335 |

|

|

$ |

322,108 |

|

|

$ |

311,055 |

|

|

$ |

294,754 |

|

|

Total shares of common stock outstanding |

|

|

22,195,071 |

|

|

|

22,166,129 |

|

|

|

22,165,760 |

|

|

|

22,165,547 |

|

|

|

22,089,873 |

|

|

Tangible book value per share of common stock |

|

$ |

14.49 |

|

|

$ |

14.99 |

|

|

$ |

14.53 |

|

|

$ |

14.03 |

|

|

$ |

13.34 |

|

CAPSTAR FINANCIAL HOLDINGS, INC. AND

SUBSIDIARYNon-GAAP Financial Measures (unaudited)

(dollars in thousands except share data)First

quarter 2022 Earnings Release

| |

|

Five Quarter Comparison |

|

| |

|

3/31/2022 |

|

|

12/31/2021 |

|

|

9/30/2021 |

|

|

6/30/2021 |

|

|

3/31/2021 |

|

|

Net interest income |

|

$ |

21,140 |

|

|

$ |

22,992 |

|

|

$ |

22,964 |

|

|

$ |

23,032 |

|

|

$ |

22,182 |

|

|

Less: PPP loan income |

|

|

(493 |

) |

|

|

(1,691 |

) |

|

|

(1,897 |

) |

|

|

(2,686 |

) |

|

|

(2,260 |

) |

|

Less: Excess liquidity interest income |

|

|

(437 |

) |

|

|

(479 |

) |

|

|

(545 |

) |

|

|

(545 |

) |

|

|

(504 |

) |

|

Plus: Impact of deferred cost adjustment |

|

|

545 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Adjusted net interest income |

|

|

20,755 |

|

|

|

20,822 |

|

|

|

20,522 |

|

|

|

19,801 |

|

|

|

19,418 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average interest earning assets |

|

|

2,901,313 |

|

|

|

2,920,478 |

|

|

|

2,931,134 |

|

|

|

2,848,857 |

|

|

|

2,889,119 |

|

|

Less: Average PPP loans |

|

|

(14,144 |

) |

|

|

(42,055 |

) |

|

|

(95,257 |

) |

|

|

(173,733 |

) |

|

|

(204,459 |

) |

|

Less: Excess liquidity |

|

|

(348,535 |

) |

|

|

(447,548 |

) |

|

|

(411,926 |

) |

|

|

(301,325 |

) |

|

|

(334,109 |

) |

|

Adjusted interest earning assets |

|

|

2,538,634 |

|

|

|

2,430,875 |

|

|

|

2,423,951 |

|

|

|

2,373,799 |

|

|

|

2,350,551 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest margin (1) |

|

|

2.97 |

% |

|

|

3.14 |

% |

|

|

3.12 |

% |

|

|

3.26 |

% |

|

|

3.13 |

% |

|

Adjusted Net interest margin (1) |

|

|

3.32 |

% |

|

|

3.40 |

% |

|

|

3.36 |

% |

|

|

3.36 |

% |

|

|

3.35 |

% |

|

|

|

Five Quarter Comparison |

|

|

|

|

3/31/2022 |

|

|

12/31/2021 |

|

|

9/30/2021 |

|

|

6/30/2021 |

|

|

3/31/2021 |

|

|

Allowance for loan losses |

|

$ |

20,857 |

|

|

$ |

21,698 |

|

|

$ |

22,533 |

|

|

$ |

22,754 |

|

|

$ |

23,877 |

|

|

Purchase accounting marks |

|

|

2,838 |

|

|

|

3,003 |

|

|

|

3,288 |

|

|

|

3,533 |

|

|

|

3,615 |

|

|

Allowance for loan losses and purchase accounting fair value

marks |

|

|

23,695 |

|

|

|

24,701 |

|

|

|

25,821 |

|

|

|

26,287 |

|

|

|

27,492 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans held for investment |

|

|

2,047,555 |

|

|

|

1,965,769 |

|

|

|

1,894,249 |

|

|

|

1,897,838 |

|

|

|

1,931,687 |

|

|

Less: PPP Loans net of deferred fees |

|

|

6,529 |

|

|

|

26,539 |

|

|

|

64,188 |

|

|

|

109,940 |

|

|

|

210,810 |

|

|

Non-PPP Loans |

|

|

2,041,026 |

|

|

|

1,939,230 |

|

|

|

1,830,061 |

|

|

|

1,787,898 |

|

|

|

1,720,877 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Allowance for loan losses plus fair value marks / Non-PPP

Loans |

|

|

1.16 |

% |

|

|

1.27 |

% |

|

|

1.41 |

% |

|

|

1.47 |

% |

|

|

1.59 |

% |

_____________________

(1) Net interest margin and adjusted net

interest margin are shown on a tax equivalent basis.

CONTACT

Michael J. FowlerChief Financial

Officer(615) 732-7404

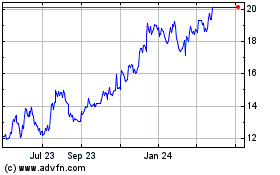

CapStar Financial (NASDAQ:CSTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

CapStar Financial (NASDAQ:CSTR)

Historical Stock Chart

From Apr 2023 to Apr 2024