Amended Annual Report (10-k/a)

April 01 2019 - 6:32AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K /A

(Amendment No. 1)

|

|

x

|

Annual

Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

for the fiscal year ended December 31

,

2018

|

or

|

|

o

|

Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

for the transition period from to

|

Commission File Number: 001-34058

CAPRICOR

THERAPEUTICS, INC.

(Exact Name Of Registrant As Specified

In Its Charter)

|

Delaware

|

88-0363465

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

8840 Wilshire Blvd., 2

nd

Floor, Beverly Hills, California 90211

(Address of principal executive

offices including zip code)

(310) 358-3200

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b)

of the Act:

|

Title of Each Class

|

Name of Each Exchange on Which Registered

|

|

Common Stock, par value $0.001 per share

|

The Nasdaq Capital Market

|

Securities registered pursuant to Section 12(g)

of the Act:

None

Indicate by check mark if the registrant is a well-known

seasoned issuer, as defined in Rule 405 of the Securities Act.

¨

Yes

x

No

Indicate by check mark if the registrant is not

required to file reports pursuant to Section 13 or Section 15(d) of the Act.

¨

Yes

x

No

Indicate by check mark whether the registrant (1)

has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12

months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days.

x

Yes

¨

No

Indicate by check mark whether the registrant has

submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes

x

No

¨

Indicate by check mark if disclosure of delinquent

filers in response to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s

knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment

to this Form 10-K.

x

Indicate by check mark whether the registrant is

a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer” “smaller reporting company”

and “emerging growth company” in Rule 12b-2 of the Exchange Act:

|

Large accelerated filer

|

¨

|

|

Accelerated filer

|

¨

|

|

Non-accelerated filer

|

x

|

|

Smaller reporting company

|

x

|

|

|

|

|

Emerging growth company

|

¨

|

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

¨

Indicate by check mark whether the registrant is

a shell company (as defined in Rule 12b-2 of the Exchange Act).

¨

Yes

x

No

The aggregate market value of the registrant’s

common stock held by non-affiliates of the registrant as of June 30, 2018 was $29,043,739, based on the last reported sale of the

registrant’s common stock on The Nasdaq Capital Market on June 29, 2018 of $1.34 per share.

As of March 28, 2019, there were 33,661,346 shares

of the registrant’s common stock, par value $0.001 per share, issued and outstanding.

EXPLANATORY NOTE

Capricor Therapeutics, Inc. (the “Company”)

is filing this Amendment No. 1 to its Annual Report on Form 10-K/A (this “Amendment No. 1”) to amend its Annual Report

on Form 10-K for the fiscal year ended December 31, 2018, as filed with the U.S. Securities and Exchange Commission on March 29,

2019 (the “Original 10-K”). This Amendment No. 1 is being filed to correct a clerical error in Item 12 of Part III

of the Original 10-K. Specifically, an incorrect version of the “Equity Compensation Plan Information” table was included

in Item 12 of Part III of the Original 10-K. This Amendment No. 1 replaces that table with a corrected version.

In addition, due to a filing error, the

list of exhibits in Item 15 of Part IV of the Original 10-K contained incorrect hyperlinks to certain of the exhibits incorporated

into the Original 10-K by reference. Further, as required by Rule 12b-15 promulgated under the Securities Exchange Act of 1934,

as amended, new certifications pursuant to Sections 302 and 906 of the Sarbanes-Oxley Act of 2002 by the Company’s principal

executive officer and principal financial officer are filed herewith as exhibits to this Amendment No. 1. Accordingly,

Item 15 of Part IV of the Original 10-K has been amended and restated in its entirety to (i) correct the hyperlinks to certain

of the exhibits listed therein, and (ii) include the certifications as exhibits.

Except as noted above, this Amendment No.

1 does not amend, modify or otherwise update any other information in the Original 10-K or reflect any events occurring after the

filing of the Original 10-K. Accordingly, this Amendment No. 1 should be read in conjunction with the Original 10-K.

PART III

|

|

ITEM 12.

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS.

|

The following table

sets forth certain information known to us regarding the beneficial ownership of our common stock as of March 28, 2019 by:

|

|

•

|

each named executive officer

as defined and named in this proxy statement;

|

|

|

•

|

all of our directors and

executive officers as a group; and

|

|

|

•

|

each person known by us

to beneficially own more than five percent of our common stock (based on information supplied in Schedules 13D and 13G filed with

the SEC).

|

Except as indicated

by footnote, and subject to applicable community property laws, each person identified in the table possesses sole voting and dispositive

power with

respect to all capital stock shown to be held by that person. The address of each named

executive officer and director, unless indicated otherwise, is c/o Capricor Therapeutics, Inc., 8840 Wilshire Blvd., 2

nd

Floor, Beverly Hills, California 90211.

|

Name of Beneficial Owner

|

|

Shares of Common Stock Beneficially Owned

(1)

|

|

|

Percentage of Common Stock Beneficially Owned

(1)

|

|

|

Named Executive Officers and Directors:

|

|

|

|

|

|

|

|

|

|

Frank Litvack, M.D.

(2)

|

|

|

2,244,231

|

|

|

|

6.3

|

|

|

George Dunbar

(3)

|

|

|

249,563

|

|

|

|

*

|

|

|

Louis Manzo

(4)

|

|

|

1,256,835

|

|

|

|

3.7

|

|

|

Earl Collier

(5)

|

|

|

248,938

|

|

|

|

*

|

|

|

David Musket

(6)

|

|

|

421,983

|

|

|

|

1.2

|

|

|

Joshua Kazam

(7)

|

|

|

164,538

|

|

|

|

*

|

|

|

Anthony Bergmann

(8)

|

|

|

124,370

|

|

|

|

*

|

|

|

Linda Marbán, Ph.D.

(9)

|

|

|

1,460,991

|

|

|

|

4.2

|

|

|

Karen Krasney, J.D.

(10)

|

|

|

293,183

|

|

|

|

*

|

|

|

Deborah Ascheim, M.D.

|

|

|

-

|

|

|

|

-

|

|

|

Directors and executive officers as a group (9 individuals)

|

|

|

6,464,632

|

|

|

|

16.6

|

|

|

5% Stockholders:

|

|

|

|

|

|

|

|

|

|

Dr. Eduardo Marbán

(11)

c/o Capricor Therapeutics, Inc.

8840 Wilshire Blvd., 2

nd

Floor

Beverly Hills, CA 90211

|

|

|

3,108,354

|

|

|

|

9.2

|

|

|

Edward A. St. John

(12)

2560 Lord Baltimore Drive

Baltimore, MD 21244

|

|

|

2,777,378

|

|

|

|

8.3

|

|

|

Cedars-Sinai Medical Center

(13)

8700 Beverly Blvd.

West Hollywood, CA 90048

|

|

|

4,049,959

|

|

|

|

12.0

|

|

*Represents less than

1%.

|

|

(1)

|

We have based percentage

ownership of our common stock on 33,661,346 shares of our common stock outstanding as of March 28, 2019. Beneficial ownership

is determined in accordance with Rule 13d-3 under the Exchange Act, and includes any shares as to which the security holder has

sole or shared voting power or dispositive power, and also any shares which the security holder has the right to acquire within

60 days of March 28, 2019, whether through the exercise or conversion of any stock option, convertible security, warrant or other

right. The indication herein that shares are beneficially owned is not an admission on the part of the security holder that he,

she or it is a direct or indirect beneficial owner of those shares.

|

|

|

(2)

|

Includes 2,244,231 shares

issuable upon the exercise of stock options that are exercisable or will become exercisable within 60 days of March 28, 2019.

The shares issuable upon the exercise of stock options issued to Dr. Litvack are subject to early exercise under the Capricor

Therapeutics, Inc. 2012 Restated Equity Incentive Plan and the Capricor Therapeutics, Inc. 2012 Non-Employee Director Stock Option

Plan. As of March 28, 2019, Dr. Litvack has not indicated his intent to exercise early. If the option holder elects to take advantage

of the early exercise feature and purchase shares prior to the vesting of such shares, the shares will be deemed restricted stock

and will be subject to a repurchase option in favor of the Company if the option holder’s service to the Company terminates

prior to vesting.

|

|

|

(3)

|

Includes 249,563 shares

issuable upon the exercise of stock options that are exercisable or will become exercisable within 60 days of March 28, 2019.

The shares issuable upon the exercise of stock options issued to Mr. Dunbar are subject to early exercise under the Capricor Therapeutics,

Inc. 2012 Non-Employee Director Stock Option Plan and the Capricor Therapeutics, Inc. 2012 Restated Equity Incentive Plan. As

of March 28, 2019, Mr. Dunbar has not indicated his intent to exercise early. If the option holder elects to take advantage of

the early exercise feature and purchase shares prior to the vesting of such shares, the shares will be deemed restricted stock

and will be subject to a repurchase option in favor of the Company if the option holder’s service to the Company terminates

prior to vesting.

|

|

|

(4)

|

Includes (i) 638,155 shares

held by Coniston Corporation, an entity of which Louis Manzo holds all voting shares and 1% of the non-voting shares and of which

99% of the non-voting shares are held by several irrevocable trusts established for the benefit of Mr. Manzo’s children.

Mr. Manzo holds all voting power with respect to the shares of Coniston Corporation; (ii) 159,132 shares held directly by Mr.

Manzo; and (iii) 459,548 shares issuable upon the exercise of stock options held directly by Mr. Manzo that are exercisable or

will become exercisable within 60 days of March 28, 2019. Certain shares issuable upon the exercise of stock options issued to

Mr. Manzo are subject to early exercise under the Capricor Therapeutics, Inc. 2012 Non-Employee Director Stock Option Plan and

the Capricor Therapeutics, Inc. 2012 Restated Equity Incentive Plan. As of March 28, 2019, Mr. Manzo has not indicated his intent

to exercise early. If the option holder elects to take advantage of the early exercise feature and purchase shares prior to the

vesting of such shares, the shares will be deemed restricted stock and will be subject to a repurchase option in favor of the

Company if the option holder’s service to the Company terminates prior to vesting.

|

|

|

(5)

|

Includes 248,938 shares

issuable upon the exercise of stock options which are exercisable or will become exercisable within 60 days of March 28, 2019.

The shares issuable upon the exercise of stock options issued to Mr. Collier are subject to early exercise under the Capricor

Therapeutics, Inc. 2012 Non-Employee Director Stock Option Plan and the Capricor Therapeutics, Inc. 2012 Restated Equity Incentive

Plan. As of March 28, 2019, Mr. Collier has not indicated his intent to exercise early. If the option holder elects to take advantage

of the early exercise feature and purchase shares prior to the vesting of such shares, the shares will be deemed restricted stock

and will be subject to a repurchase option in favor of the Company if the option holder’s service to the Company terminates

prior to vesting.

|

|

|

(6)

|

Includes (i) 70,962 shares

held by SEP FBO David B. Musket, Pershing LLC as Custodian; (ii) 25,000 held by David B. Musket; and (iii) 326,021 shares issuable

upon the exercise of stock options held directly by David B. Musket, which are exercisable or will become exercisable within 60

days of March 28, 2019. The shares issuable upon the exercise of stock options issued to Mr. Musket are subject to early exercise

under the Capricor Therapeutics, Inc. 2012 Non-Employee Director Stock Option Plan and the Capricor Therapeutics, Inc. 2012 Restated

Equity Incentive Plan. As of March 28, 2019, Mr. Musket has not indicated his intent to exercise early. If the option holder elects

to take advantage of the early exercise feature and purchase shares prior to the vesting of such shares, the shares will be deemed

restricted stock and will be subject to a repurchase option in favor of the Company if the option holder’s service to the

Company terminates prior to vesting.

|

|

|

(7)

|

Includes (i) 19,298 shares

held directly by Joshua Kazam; (ii) 12,276 shares held by the Kazam Family Trust, of which Mr. Kazam’s spouse is the trustee

and his children are beneficiaries; (iii) 3,310 shares held by Mr. Kazam’s spouse as custodian for the benefit of their

minor children, to which Mr. Kazam disclaims beneficial ownership except to the extent of his pecuniary interest therein; and

(iv) 129,654 shares issuable upon the exercise of stock options that are exercisable or will become exercisable within 60 days

of March 28, 2019. The shares issuable upon the exercise of stock options issued to Mr. Kazam are subject to early exercise under

the Capricor Therapeutics, Inc. 2012 Restated Equity Incentive Plan. As of March 28, 2019, Mr. Kazam has not indicated his intent

to exercise early. If the option holder elects to take advantage of the early exercise feature and purchase shares prior to the

vesting of such shares, the shares will be deemed restricted stock and will be subject to a repurchase option in favor of the

Company if the option holder’s service to the Company terminates prior to vesting.

|

|

|

(8)

|

Includes (i) 2,030 shares

held by Mr. Bergmann and (ii) 122,340 shares issuable upon the exercise of stock options held directly by Mr. Bergmann that are

exercisable or will become exercisable within 60 days of March 28, 2019. The shares issuable upon the exercise of stock options

issued to Mr. Bergmann are subject to early exercise under the Capricor Therapeutics, Inc. 2012 Restated Equity Incentive Plan.

As of March 28, 2019, Mr. Bergmann has not indicated her intent to exercise early. If the option holder elects to take advantage

of the early exercise feature and purchase shares prior to the vesting of such shares, the shares will be deemed restricted stock

and will be subject to a repurchase option in favor of the Company if the option holder’s service to the Company terminates

prior to vesting.

|

|

|

(9)

|

Includes (i) 199,509 shares

held by Dr. Linda Marbán; (ii) 9,200 shares held by Linda and Eduardo Marbán as joint tenants with rights of survivorship;

and (iii) 1,252,282 shares issuable upon the exercise of stock options held directly by Dr. Linda Marbán which are exercisable

or will become exercisable within 60 days of March 28, 2019. Certain shares issuable upon the exercise of stock options issued

to Dr. Linda Marbán are subject to early exercise under the Capricor Therapeutics, Inc. 2012 Restated Equity Incentive

Plan. As of March 28, 2019, Dr. Linda Marbán has not indicated her intent to exercise early. If the option holder elects

to take advantage of the early exercise feature and purchase shares prior to the vesting of such shares, the shares will be deemed

restricted stock and will be subject to a repurchase option in favor of the Company if the option holder’s service to the

Company terminates prior to vesting.

|

|

|

(10)

|

Includes (i) 11,156 shares

held by Ms. Krasney and (ii) 282,027 shares issuable upon the exercise of stock options held directly by Ms. Krasney that are

exercisable or will become exercisable within 60 days of March 28, 2019. The shares issuable upon the exercise of stock options

issued to Ms. Krasney are subject to early exercise under the Capricor Therapeutics, Inc. 2012 Restated Equity Incentive Plan.

As of March 28, 2019, Ms. Krasney has not indicated her intent to exercise early. If the option holder elects to take advantage

of the early exercise feature and purchase shares prior to the vesting of such shares, the shares will be deemed restricted stock

and will be subject to a repurchase option in favor of the Company if the option holder’s service to the Company terminates

prior to vesting.

|

|

|

(11)

|

Includes (i) 3,099,154

shares held by Dr. Eduardo Marbán and (ii) 9,200 shares held by Linda and Eduardo Marbán as joint tenants with rights

of survivorship.

|

|

|

(12)

|

Includes (i) 1,556,141 shares held by MD BTI, LLC (the

“

MD BTI, LLC Shares

”), (ii) 324,196 shares held by MD BTI, Inc. (the “

MD BTI, Inc. Shares

”);

and (iii) 897,041 shares held directly by Edward A. St. John, LLC (the “

Edward A. St. John, LLC Shares

”).

Edward A. St. John, LLC, a Delaware limited liability company, is the company manager (the “

Company Manager

”)

of MD BTI, LLC. Edward A. St. John, an individual, is the general manager of Company Manager. As the company manager of MD BTI,

LLC, Company Manager is deemed to be the beneficial owner of the MD BTI, LLC Shares and is therefore deemed to have shared voting

and dispositive power over the MD BTI, LLC Shares. Mr. St. John is the sole member and general manager of Company Manager and

is therefore deemed to be the beneficial owner of the MD BTI, LLC Shares, the Edward A. St. John, LLC Shares. Additionally, Mr.

St. John is the president of MD BTI, Inc. and is therefore deemed to be the beneficial owner of the MD BTI, Inc. Shares. As a

result of the foregoing, Mr. St. John has the sole power to vote or direct the vote of 897,041 shares; has the shared power to

vote or direct the vote of 1,880,337 shares; has the sole power to dispose or direct the disposition of 897,041 shares; and has

the shared power to dispose or direct the disposition of 1,880,337 shares.

|

|

|

(13)

|

Includes (i) 4,049,959 shares held by Cedars-Sinai Medical

Center. Thomas M. Priselac, the President and Chief Executive Officer of Cedars-Sinai Medical Center, and Edward M. Prunchunas,

the Senior Vice President and Chief Financial Officer of Cedars-Sinai Medical Center, are deemed to share voting and dispositive

power with respect to the shares held by Cedars-Sinai Medical Center. The Company is a party to two Exclusive License Agreements

and a lease agreement with Cedars-Sinai Medical Center. See the section of this annual report entitled “Certain Relationships

and Related Party Transactions”.

|

Securities Authorized for Issuance Under Equity

Compensation Plans

We have

two equity-incentive plans that have been approved by stockholders: (i) the 2006 Stock Option Plan; and (ii) the 2012 Restated

Equity Incentive Plan. The Company also maintains the 2012 Non-Employee Director Stock Option Plan, which has not been approved

by stockholders.

The following

table sets forth additional information with respect to the shares of common stock that may be issued upon the exercise of options

and other rights under our existing equity compensation plans and arrangements in effect as of December 31, 2018. The information

includes the number of shares covered by, and the weighted average exercise price of, outstanding options, warrants, and rights,

and the number of shares remaining available for future grant, excluding the shares to be issued upon exercise of outstanding options,

warrants, and rights.

Equity

Compensation Plan Information

|

Plan Category

|

|

Number of

securities to

be issued

upon exercise

of outstanding

options,

warrants and

rights

(A)

|

|

|

Weighted-average exercise price of outstanding options, warrants and rights

(B)

|

|

|

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column

(A))(C)

|

|

|

Equity compensation plans approved by security holders:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The 2006 Stock Option Plan

|

|

|

569,545

|

|

|

$

|

0.36

|

|

|

|

-

|

|

|

The 2012 Restated Equity Incentive Plan

|

|

|

4,099,389

|

|

|

$

|

2.51

|

|

|

|

511,298

|

|

|

Equity compensation plans not approved by security holders:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2012 Non-Employee Director Stock Option Plan

(1)

|

|

|

2,344,206

|

|

|

$

|

0.37

|

|

|

|

60,044

|

|

|

Total

|

|

|

7,013,140

|

|

|

$

|

1.62

|

|

|

|

571,342

|

|

(1) Following the consummation of the merger between Nile Therapeutics, Inc. and Capricor, Inc., 2,697,311 shares of common stock were reserved under the 2012 Non-Employee Director Plan for the issuance of stock options to members of the Board who are not employees of the Company.

PART IV

|

|

ITEM 15.

|

EXHIBITS AND FINANCIAL STATEMENT SCHEDULES

|

(a)(1) Financial Statements

The financial statements required by this item are included

in a separate section of this Annual Report on Form 10-K beginning on page 77.

(a)(2) Financial Statement Schedules

Financial Statement Schedules have been omitted because they

are either not applicable or the required information is included in the consolidated financial statements or notes thereto listed

in (a)(1) above.

(a)(3) Exhibits

The following exhibits are filed herewith or incorporated herein

by reference:

|

101

|

The following financial information formatted in eXtensible Business Reporting Language (XBRL): (i) Consolidated Balance Sheets as of December 31, 2018 and 2017, (ii) Consolidated Statements of Operations and Comprehensive Income (Loss) for the years ended December 31, 2018 and 2017, (iii) Consolidated Statement of Stockholders’ Equity (Deficit) for the period from December 31, 2016 through December 31, 2018, (iv) Consolidated Statements of Cash Flows for the years ended December 31, 2018 and 2017, and (v) Notes to Consolidated Financial Statements (incorporated by reference to Exhibit 32.2 to the Company’s Annual Report on Form 10-K, filed with the Commission on March 29, 2019).

|

* Filed herewith.

† Indicates management contract or compensatory plan

or arrangement.

+ The Company has requested and/or received confidential treatment

with respect to certain portions of this exhibit. Omitted portions have been filed separately with the SEC.

SIGNATURES

Pursuant to the requirements

of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on

its behalf by the undersigned, thereunto duly authorized, on April 1, 2019.

|

|

CAPRICOR THERAPEUTICS, INC.

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Linda Marbán, Ph.D.

|

|

|

|

Linda Marbán, Ph.D.

Chief Executive Officer

|

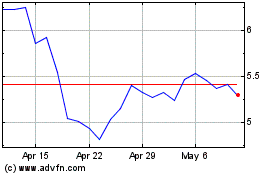

Capricor Therapeutics (NASDAQ:CAPR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Capricor Therapeutics (NASDAQ:CAPR)

Historical Stock Chart

From Apr 2023 to Apr 2024