August 10, 2021 -- InvestorsHub NewsWire -- via NetworkNewsWire

Editorial Coverage: In 2020, Canada became the largest

exporter of dried cannabis flower in the world. Today,

Canada is looking over its shoulder at a formidable competitor in

Colombia, which recently instigated some legislative changes that

position the country to become the global cannabis leader. Colombia

was already recognized for its robust infrastructure, distribution

and exports of certain cannabis products such as medicinal oils and

extracts, but the country had a gaping hole in exports by keeping

dried cannabis flower strictly verboten. That hole was filled on

July 23, 2021, when Colombian President Ivan Duque signed a

legislative decree ending the prohibition on the export of dried

cannabis flower — a significant global market and a potential

windfall for Flora Growth

Corp. (NASDAQ:

FLGC) (Profile) and its expansive global

operations. The broader industry should also benefit from this

latest development since most majors,

including Canopy

Growth Corporation (NASDAQ:

CGC), Tilray

Inc. (NASDAQ:

TLRY), Cronos

Group Inc. (NASDAQ:

CRON) and Sundial Growers Inc. (NASDAQ:

SNDL), support the mainstream worldwide evolution of

legal cannabis.

- Colombia made history by modifying its cannabis laws, including

allowing export of dried cannabis flower.

- Flora’s Cosechemos cultivation facility, located in

Bucaramanga, Colombia, offers an ideal cannabis-growing climate and

features an expansive 247-acre land package.

- Free sunlight and water from natural onsite springs, along with

optimized cultivation techniques, results in strong yields per

cannabis plant; costs only $0.06/gram compared to $1.89 in North

America.

- Flora leverages cost-effective cannabis cultivation in Colombia

to supply cannabis and its derivatives for portfolio of premium

brands and products across several verticals.

- Flora has more than 280 products, cosmetic and pharmaceutical

manufacturing licenses, and 2,500-plus points of distribution

across Latin America and the United States.

Click here to view the custom infographic of

the Flora Growth editorial.

Colombia: A New Cannabis Star

Near-perfect growing conditions, skilled labor and friendly

regulations have underscored Colombia’s emergence in the legal

cannabis space since the country first allowed the production of

medical cannabis just over five years ago. However, until now,

dried cannabis flower, or buds, could only be processed for export

as a medicinal oil or extract for fear that flowers would find

their way to the black market. The new law puts Colombia “at the

forefront in terms of regulatory competitiveness,” according

to President

Duque, adding that his country will now participate in new

markets, including food, beverages, cosmetics, and textiles, in

addition to pharmaceuticals.

Upon signing the decree, Duque quoted experts in saying legal

cannabis will represent a $64 billion global market by 2024 while

noting that cannabis will serve as a tool for “economic

reactivation” in Colombia post the COVID-19 pandemic. “According to

a 2019 study, in Colombia, the cannabis sector generated 17.3

agricultural jobs per hectare,” said Colombia’s Minister of

Justice Wilson Ruiz. The Colombian hierarchy seems determined

to catapult the country into global leadership as a legal cannabis

exporter in order to boost the economy and create a lot of jobs at

home.

These circumstances may play right into the hands

of Flora Growth

Corp. (NASDAQ:

FLGC), which is focused on cannabis cultivation and processing

operations in Colombia to supply international markets. The new

decree could prove to be a bonanza for established licensed

producers, especially when considering the extremely low production

costs and that dried cannabis flower represents the majority of

sales in countries with mature markets, such as the United

States, Germany, United Kingdom, and Australia.

Headquartered in Miami and already having established a globally

recognized house of brands, Flora is positioned to be one of the

world’s lowest-cost cannabis producers and has strategically

positioned itself as a global cannabis consumer packaged goods

(CPG) company with a vast international distribution platform.

Flora has more than 280 products, cosmetic and pharmaceutical

manufacturing licenses, and 2,500-plus points of distribution

across Latin America and the United States.

Further, Flora has two separate LOIs executed for significant

acquisitions and is forging partnerships to expand the breadth of

its distribution domain by leveraging networks of others. Flora

fundamentally believes against vertical integration and has

positioned itself to be nimble and asset light, allowing it to work

with the best of the best in their respective channels to bring

product to market and capture incremental revenue while derisking

the prospect of entering new jurisdictions and channel segments.

Against this backdrop, the regulatory update in Colombia is likely

to be a growth accelerator and supercharge revenues. Soaring

revenues with high margin product is the holy grail of Wall

Street.

A 25-Fold Advantage

It’s no industry secret that outdoor growing is far less

expensive than greenhouse cultivation, but Flora has taken it to

another level in Colombia. Free sunlight and water in three pilot

plantings on 4.94 acres at Flora’s Cosechemos farm allowed for

testing of 30 varieties of non-psychoactive (high-cannabidiol or

CBD) cannabis and optimization of its growing techniques, which

resulted in a cost base of just $0.06 per gram. That compares to

$1.89 per gram in North America, calculated through an average of

four major North American licensed producers.

Flora’s cost is even 60% lower than its nearest Colombian peer.

In response to the updated laws in Colombia, Flora

promptly signed a

letter of intent with an international distributor to

supply dried flower and derivatives immediately following the first

commercial harvest and obtaining all requisite import licenses.

With that harvest, Flora also expects to start supplying the

Australian markets with medical cannabis, as well as

over-the-counter CBD products via a partnership with Evergreen

Pharmacare.

Production of high-CBD strains of cannabis are already well

underway at Cosechemos, with prep work now being done to propagate

strains high in THC, the psychoactive component in cannabis.

Moreover, an extraction lab at the facility constructed to EU-GMP

standards is expected to be completed this quarter, for which Flora

will seek EU-GMP certification. As soon as Flora receives the

requisite paperwork in order for it to export its cannabis

products, the company will be positioned to immediately capitalize

on the massive global dried cannabis flower market segment that was

previously unavailable.

Ideal Climate, Plenty of Acreage

Colombia’s climate is ideal for the cultivation of cannabis

year-round, and Flora owns some of the country’s finest farming

acreage. Flora’s Cosechemos farm in Bucaramanga, Colombia, covers

247 acres (10.8 million square feet). Flora also holds the rights

to another 5,268 acres (230 million square feet) licensed in Puerto

Boyacá, Santander, about 170 miles southwest of Bucaramanga.

Situated on the equator, Flora’s licensed land in Colombia’s

climate is perfect for year-round cannabis cultivation. The

property sees 12.8 hours of sunshine 365 days per year, has

extremely fertile soil, and receives optimal wind conditions (3 mph

average), which helps reduce risks of contamination from other

plants. The land also hosts six natural spring water deposits,

meaning Flora has zero water costs.

Colombia is the cut-flower capital of the world, and a top

producer of coffee, bananas and more, resulting in a highly skilled

agricultural labor force that work for roughly one-tenth of

comparable peers in the United States. The combination of

these factors facilitates a minimum of three harvests per year,

which is up to three times that of its North American peers.

Marketing Opportunity for New Products

Unlike Canada and the U.S., where companies must essentially

rely on word of mouth for awareness and branding, Colombia is

removing marketing restrictions on its domestic cannabis products.

For Flora, this means advertising across its portfolio of products

to drive sales at its more than 1,500 points of distribution

throughout Colombia. It could also be beneficial as it relates to

an LOI with

Avaria for Flora to introduce Avaria’s KaLaya, an

award-winning pain cream distributed across Canada to Colombia and

the Americas.

The new Colombian regulations allowing cannabinoid-infused food

and beverage opens the door for developing new products and

introducing products already in the Flora’s Kasa Wholefoods food

and beverage unit. A perfect storm brewing, the new laws dovetail

with Kasa recently signing a distribution agreement with

Importaciones y Asesorias Tropi S.A.S., Colombia’s largest CPG

distributor, which is expected to generate $10

million in annual revenue for Flora by delivering premium

and sustainable canned products to Colombians, with the opportunity

to expand the product line in the future.

Follow the Money: Cannabis Investment

Duque referencing a $64 billion market in 2024 seems in line

with other pundit’s forecasts. Fortune Business Insights in June

said it foresees the global cannabis market reaching $97.35 billion

by 2026 with 32.9% compound annual growth. Safe to say, the legal

cannabis market is still growing in leaps and bounds, which breeds

bullishness in major players throughout the world.

Canopy Growth Corporation (NASDAQ:

CGC) is a story for the ages for long-term

traders that watched it grow from a tiny company named Tweed

Marijuana into the industry’s 700-pound gorilla that keeps rolling

up companies, including recently

acquiring Supreme Cannabis. Canopy paid $435 million for

Supreme, with the main prizes being the 7ACRES brand and a

production facility in Kincardine, Ontario, with a history of

producing premium flower.

Tilray Inc. (NASDAQ:

TLRY), a leading global cannabis-lifestyle and

consumer packaged goods company, has completed a

“business combination” with Aphria Inc. bringing together

two highly complementary businesses to create the leading

cannabis-focused CPG company with the largest global geographic

footprint in the industry. The combined company will operate

as Tilray with the strategic footprint and operational scale

necessary to compete more effectively in today’s consolidating

cannabis market with a strong, flexible balance sheet, strong cash

balance, and access to capital.

Cronos Group Inc. (NASDAQ:

CRON) is another major looking to get bigger

through investment in others. In June, a Cronos subsidiary agreed

to an option to

acquire a 10.5% stake in PharmaCann, one of the largest

vertically integrated cannabis companies in the United States.

PharmaCann operates six production facilities and 23 dispensaries

under the Verilife™ brand in six states. This is in addition to its

organic growth initiatives, including the recent launch of a new

line of dual flavor cannabis gummies called SOURZ by Spinach™.

Sundial Growers Inc. (NASDAQ:

SNDL) is also participating in the merger and

acquisition (M&A) game as a direct part of its two-prong

strategy. M&A on one hand, Sundial’s other business is as a

licensed producer of small-batch cannabis using state-of-the-art

indoor facilities. Sundial completed its latest acquisition in

June, finalizing

its buyout of cannabis retailer Inner Spirit Holdings Ltd.

for about $131 million. The acquisition gave Sundial the

well-established Spiritleaf franchised and corporate-owned stores,

representing Canada’s largest single-brand recreational cannabis

retailer with 100-plus stores across six provinces.

The global cannabis market is turning from one of pure

speculation to one underpinned by solid fundamentals and real

investment opportunities. Soaring revenues and high margins are

strong indicators of potential future success in any almost sector.

Combine these attributes with the burgeoning cannabis market, and

it might just deliver some eye-popping rewards.

For more information about Flora Growth Corp.

(NASDAQ: FLGC), please visit Flora Growth

Corp. (NASDAQ:

FLGC).

About NetworkNewsWire

NetworkNewsWire (“NNW”) is a financial news and

content distribution company, one of 50+ brands within

the InvestorBrandNetwork (“IBN”), that

provides: (1) access to a network of wire

solutions via InvestorWire to reach all target markets,

industries and demographics in the most effective manner

possible; (2) article and editorial

syndication to 5,000+ news outlets; (3)

enhanced press release solutions to ensure maximum

impact; (4) social media distribution via IBN

millions of social media followers; and (5) a

full array of corporate communications solutions. As a multifaceted

organization with an extensive team of contributing journalists and

writers, NNW is uniquely positioned to best serve private and

public companies that desire to reach a wide audience comprising

investors, consumers, journalists and the general public. By

cutting through the overload of information in today’s market, NNW

brings its clients unparalleled visibility, recognition and brand

awareness. NNW is where news, content and information converge.

To receive SMS text alerts from NetworkNewsWire, text

“STOCKS” to 77948 (U.S. Mobile Phones Only)

For more information, please visit https://www.NetworkNewsWire.com

Please see full terms of use and disclaimers on the

NetworkNewsWire website applicable to all content provided by NNW,

wherever published or re-published: http://NNW.fm/Disclaimer

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

NetworkNewsWire is part of the InvestorBrandNetwork

DISCLAIMER: NetworkNewsWire (NNW) is the source of the Article

and content set forth above. References to any issuer other than

the profiled issuer are intended solely to identify industry

participants and do not constitute an endorsement of any issuer and

do not constitute a comparison to the profiled issuer. The

commentary, views and opinions expressed in this release by NNW are

solely those of NNW. Readers of this Article and content agree that

they cannot and will not seek to hold liable NNW for any investment

decisions by their readers or subscribers. NNW is a news

dissemination and financial marketing solutions provider and are

NOT registered broker-dealers/analysts/investment advisers, hold no

investment licenses and may NOT sell, offer to sell or offer to buy

any security.

The Article and content related to the profiled company

represent the personal and subjective views of the Author, and are

subject to change at any time without notice. The information

provided in the Article and the content has been obtained from

sources which the Author believes to be reliable. However, the

Author has not independently verified or otherwise investigated all

such information. None of the Author, NNW, or any of their

respective affiliates, guarantee the accuracy or completeness of

any such information. This Article and content are not, and should

not be regarded as investment advice or as a recommendation

regarding any particular security or course of action; readers are

strongly urged to speak with their own investment advisor and

review all of the profiled issuer’s filings made with the

Securities and Exchange Commission before making any investment

decisions and should understand the risks associated with an

investment in the profiled issuer’s securities, including, but not

limited to, the complete loss of your investment.

NNW HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E the Securities Exchange Act of 1934, as amended and

such forward-looking statements are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. “Forward-looking statements” describe future expectations,

plans, results, or strategies and are generally preceded by words

such as “may”, “future”, “plan” or “planned”, “will” or “should”,

“expected,” “anticipates”, “draft”, “eventually” or “projected”.

You are cautioned that such statements are subject to a multitude

of risks and uncertainties that could cause future circumstances,

events, or results to differ materially from those projected in the

forward-looking statements, including the risks that actual results

may differ materially from those projected in the forward-looking

statements as a result of various factors, and other risks

identified in a company’s annual report on Form 10-K or 10-KSB and

other filings made by such company with the Securities and Exchange

Commission. You should consider these factors in evaluating the

forward-looking statements included herein, and not place undue

reliance on such statements. The forward-looking statements in this

release are made as of the date hereof and NNW undertakes no

obligation to update such statements.

SOURCE: NetworkNewsWire

Editorial Coverage

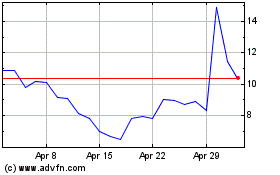

Canopy Growth (NASDAQ:CGC)

Historical Stock Chart

From Mar 2024 to Apr 2024

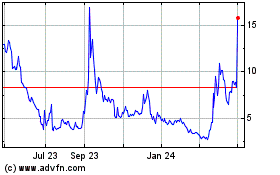

Canopy Growth (NASDAQ:CGC)

Historical Stock Chart

From Apr 2023 to Apr 2024