Current Report Filing (8-k)

February 23 2021 - 10:18AM

Edgar (US Regulatory)

Canopy Growth Corp 00-0000000 false 0001737927 0001737927 2021-02-23 2021-02-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 23, 2021

Canopy Growth Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Canada

|

|

001-38496

|

|

N/A

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

1 Hershey Drive

Smiths Falls, Ontario

|

|

K7A 0A8

|

|

(Address of principal executive officers)

|

|

(Zip Code)

|

(855) 558-9333

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Shares, no par value

|

|

CGC

|

|

NASDAQ Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 7.01

|

Regulation FD Disclosure.

|

On February 23, 2021, Canopy Growth Corporation (“Canopy Growth”) issued a press release announcing that the Arrangement (as defined below) involving Canopy Growth, Canopy Growth’s wholly-owned subsidiary, The Tweed Tree Lot Inc. (“Tweed NB”), RIV Capital Inc. (formerly Canopy Rivers Inc. (“RIV Capital”)) and its wholly-owned subsidiary, RIV Capital Corporation (formerly Canopy Rivers Corporation (“RCC”)) had closed. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

The information set forth in Item 7.01 of this Current Report on Form 8-K (“Current Report”), including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of such section. The information set forth in Item 7.01 of this Current Report, including Exhibit 99.1 attached hereto, shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any incorporation by reference language in any such filing.

On February 23, 2021, Canopy Growth closed its previously-announced plan of arrangement under the Business Corporations Act (Ontario) (the “Arrangement”) involving Canopy Growth, RIV Capital, RCC and Tweed NB.

Pursuant to the Arrangement, among other things, Canopy Growth acquired from RCC (i) 19,445,285 exchangeable shares in the capital of TerrAscend Corp. (“TerrAscend”); (ii) 2,225,714 common share purchase warrants in the capital of TerrAscend with an exercise price of C$5.95 per common share of TerrAscend (each, a “TerrAscend Share”); (iii) 333,723 common share purchase warrants in the capital of TerrAscend with an exercise price of C$6.49 per TerrAscend Share; (iv) a C$13.2 million loan receivable owing by TerrAscend Canada Inc., a wholly-owned subsidiary of TerrAscend, to RCC; (v) all of the Class A preferred shares in the capital of Les Serres Vert Cannabis Inc. (“Vert Mirabel”); and (vi) 143 common shares in the capital of Vert Mirabel, thereby increasing Canopy Growth’s ownership of the issued and outstanding common shares in the capital of Vert Mirabel from approximately 41% to approximately 55%. In addition, all of the obligations of Tweed NB owing to RCC pursuant to a royalty agreement between the parties was terminated.

In exchange for the foregoing, Canopy Growth (i) surrendered 36,468,318 Class B multiple voting shares and 15,223,938 Class A subordinate voting shares in the capital of RIV Capital; (ii) made a cash payment to RCC of approximately C$115 million; and (iii) issued 3,647,902 common shares in the capital of Canopy Growth to RCC. As a result, following completion of the Arrangement, Canopy Growth no longer has any equity, debt or other interest in RIV Capital.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

CANOPY GROWTH CORPORATION

|

|

|

|

|

By:

|

|

/s/ Phil Shaer

|

|

|

|

Phil Shaer

Chief Legal Officer

|

Date: February 23, 2021

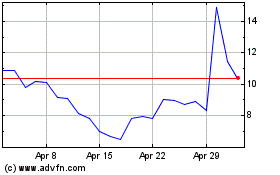

Canopy Growth (NASDAQ:CGC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Canopy Growth (NASDAQ:CGC)

Historical Stock Chart

From Apr 2023 to Apr 2024