As

filed with the Securities and Exchange Commission on March 23, 2020

Registration

No. 333-[ ]

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-3

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

Cadiz

Inc.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

77-0313235

|

(State

or other jurisdiction of

incorporation or organization)

|

|

(I.R.S.

Employer

Identification Number)

|

550

South Hope Street

Suite

2850

Los

Angeles, California 90071

(213)

271-1600

(Address,

including zip code, and telephone number,

including

area code, of registrant’s principal executive offices)

Timothy

J. Shaheen

Chief

Financial Officer

550

South Hope Street

Suite

2850

Los

Angeles, California 90071

(213)

271-1600

(Name,

address, including zip code, and telephone number,

including

area code, of agent for service)

Copies

of communications to:

Kevin

Friedmann, Esq.

Greenberg

Traurig, LLP

1840

Century Park East

Suite

1900

Los

Angeles, California 90067

(310)

586-7747

Approximate

date of commencement of proposed sale to the public: From time to time after the effective date of this Registration

Statement.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please

check the following box. ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415

under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans,

check the following box. þ

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please

check the following box and list the Securities Act registration statement number of the earlier effective registration statement

for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and

list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

☐

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall

become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box.

☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register

additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following

box. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated

filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange

Act. (Check one):

|

Large accelerated filer ☐

|

|

Accelerated filer þ

|

|

Non-accelerated filer ☐

|

|

Smaller reporting company þ

|

|

|

|

Emerging growth company ☐

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

☐

CALCULATION

OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered

|

|

Amount to be

Registered(1)

|

|

Proposed

Maximum

Offering Price

per Share

|

|

|

Proposed

Maximum

Aggregate Offering Price

|

|

|

Amount of

Registration Fee

|

|

|

Series 1 Preferred Stock, Par Value $0.01 per Share (“Preferred Shares”)

|

|

10,000 Shares

|

(2)

|

$

|

3,826.71

|

(3)

|

|

$

|

38,267,098.75

|

|

|

$

|

4,967.07

|

|

|

|

Common Stock, Par Value $0.01 Per Share, underlying Preferred Shares

|

|

4,050,500 Shares

|

(2)

|

|

-

|

(4)

|

|

|

-

|

(4)

|

|

|

-

|

|

(4)

|

|

Common Stock acquired upon conversion of 7.00% Convertible Senior Notes due 2020 (the “Notes”)

|

|

2,589,674 Shares

|

(5)

|

|

-

|

(6)

|

|

|

-

|

(6)

|

|

|

-

|

|

(6)

|

|

Other shares of Common Stock

|

|

1,022,464 Shares

|

|

|

9.45

|

(7)

|

|

|

9,659,728.64

|

|

|

$

|

1,253.83

|

|

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

|

6,220.90

|

|

|

|

(1)

|

This registration statement registers

the offer and sale of (i) 10,000 shares of our Preferred Shares, (ii) 4,050,500 shares of our common stock, par value

$0.01 per share, that may be acquired by selling securityholders upon conversion of the Preferred Shares (“Preferred

Conversion Shares”), (iii) 2,589,674 shares of our common stock acquired by selling securityholders upon conversion

of principal and accretion under a portion of original principal amount of our Notes issued by us in December 2015 and April

2016 pursuant to an indenture, dated December 10, 2015, between us and The Bank of New York Mellon Trust Company, N.A., as

Trustee (“Note Conversion Shares”) and (iv) 1,022,464 shares of common stock held by the selling securityholders

(“Additional Common Shares”). Estimated solely for the purpose of calculating the registration fee pursuant to

Rule 457(o) under the Securities Act.

|

|

(2)

|

Pursuant to Rule 416 under the Securities Act, this registration

statement shall also cover an indeterminate number of additional shares of common stock that may become issuable by virtue of any

stock dividend, stock split, recapitalization or other similar transaction.

|

|

(3)

|

Each Preferred Share is convertible by the holder into 405.05 shares of common stock. Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(g) under the Securities Act of 1933, the Proposed Maximum Offering Price Per Share is based upon the average high and low sales price of our common stock on March 16, 2020 on the Nasdaq Global Market multiplied by 405.05.

|

|

(4)

|

No additional consideration will be received upon conversion of the Preferred Shares, and therefore no registration fee is required with respect to the Preferred Conversion Shares pursuant to Rule 457(i) under the Securities Act.

|

|

(5)

|

Pursuant to Rule 429 under the Securities

Act of 1933, as amended (the “Securities Act”), the prospectus included herein is a combined prospectus that also relates

to securities that were registered by the Registration Statement on Form S-3 (File No. 333-211383) (the “Prior Registration

Statement”) and this registration statement constitutes a post-effective amendment to the Prior Registration Statement. A

filing fee of $9,386.17 was previously paid in connection with registering offers and sales, pursuant to the Prior Registration

Statement, of 13,808,765 shares of common stock issuable upon conversion of $56,941,000 in original principal amount of our Notes,

including accretion if held to maturity. Such post-effective amendment shall become effective concurrently with the

effectiveness of this registration statement in accordance with Section 8(a) of the Securities Act.

The 2,589,674 Note Conversion Shares registered pursuant to

this registration statement were included in the 13,808,765 shares registered under the Prior Registration Statement. A filing

fee of $9,386.17 was previously paid in connection with registering offers and sales pursuant to the Prior Registration Statement,

and as a result, no additional fee is required.

|

|

(6)

|

The filing fee with respect to the Note Conversion Shares was

previously paid on May 16, 2016, upon filing of the Prior Registration Statement.

|

|

(7)

|

Estimated solely for the purpose of calculating the registration

fee pursuant to Rule 457(g) under the Securities Act of 1933, the Proposed Maximum Offering Price Per Share is based upon the average

high and low sales price of our common stock on March 16, 2020 on the Nasdaq Global Market.

|

The

registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until

the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become

effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become

effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Information

in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities

and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

DATED MARCH

23, 2020, SUBJECT TO COMPLETION

PROSPECTUS

CADIZ

INC.

10,000

Shares of Series 1 Preferred Stock,

7,662,638

Shares of Common Stock

_____________________

The selling securityholders identified

in this prospectus may offer from time to time up to 10,000 shares of Series 1 Preferred Stock, or the “Preferred Shares,”

up to 4,050,500 shares of our common stock issuable upon conversion of the Preferred Shares, or the “Preferred Conversion

Shares,” 2,589,674 shares of our common stock, or the “Note Conversion Shares,” issued upon conversion of a

portion of our 7.00% Convertible Senior Notes due 2020, or the “2020 Notes” and 1,022,464 additional shares of our

common stock held by the selling securityholders, or the “Additional Common Shares.” We are contractually

obligated to register the Preferred Shares, the Preferred Conversion Shares, the Note Conversion Shares and the Additional Common

Shares, which the selling securityholders may resell.

Each

Preferred Share is convertible at any time at the option of the holder into 405.05 shares of our common stock, subject to adjustment

and subject to beneficial ownership limitations. On March 5, 2025, each outstanding Preferred Share will automatically convert

into shares of our common stock, subject to beneficial ownership limitations. Prior to March 5, 2025, each Preferred Share will

be entitled to 301.98 votes (subject to adjustment) on all matters on which stockholders are generally entitled to vote (subject

to such holder’s beneficial ownership limitation). After March 5, 2025, the Preferred Shares will have no voting rights,

except as required by applicable law.

Prior to March 5, 2025, subject to exceptions, if we liquidate,

dissolve or wind up, each Preferred Share will be entitled (1) to receive $2,734.09 per share (subject to adjustment) before any

payment may be made to holders of our common stock or any outstanding series of our preferred stock junior in liquidation preference

to the Preferred Shares and (2) to participate pro rata on an as-converted into common stock basis with all of our common stock

in the distribution of any remaining proceeds from the liquidation, dissolution or winding up. After March 5, 2025, Preferred Shares

will not receive any preference and will only be entitled to participate pro rata on an as-converted into common stock basis with

all of our common stock in the distribution of any remaining proceeds. Prior to March 5, 2025, the holders of Preferred Shares

will not be entitled to participate in any dividends or distributions. After March 5, 2025, Preferred Shares will rank pari passu

on an as-converted to common stock basis with all of our common stock as to dividends and distributions.

We will not receive any of the proceeds from the resale of the

Preferred Shares, the Preferred Conversion Shares, the Note Conversion Shares or the Additional Common Shares. We have agreed to

pay for the expenses of this offering.

The selling securityholders may sell the

shares covered by this prospectus from time to time through any of the means described in the section of this prospectus entitled

“Plan of Distribution.” The prices at which the selling securityholders may sell the Preferred Conversion

Shares, the Note Conversion Shares and the Additional Common shares will be determined by the prevailing market price for the shares

or in negotiated transactions. The prices at which the selling securityholders may sell the Preferred Shares will be determined

in negotiated transactions.

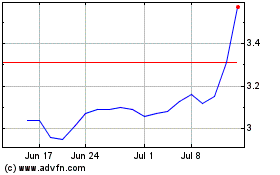

The Preferred Shares are not listed on any securities exchange. Our

common stock is traded on the Nasdaq Global Market under the symbol “CDZI”. On March 20, 2020, the

last reported sale price of our common stock on the Nasdaq Global Market was $9.70.

We

may amend or supplement this prospectus from time to time to update the disclosures set forth herein.

_____________________

Investing

in our securities involves a high degree of risk. You should carefully read and consider the “Risk Factors”

beginning on page 4.

_____________________

NEITHER

THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR

PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

_____________________

Prospectus

dated , 2020

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

document is called a prospectus and is part of a registration statement that we filed with the Securities and Exchange Commission,

or the Commission, using a “shelf” registration or continuous offering process. Under this shelf process, the selling

securityholders from time to time may offer and sell, in one or more offerings, the securities described in this prospectus. We

will not receive any proceeds from the resale by any selling securityholder of the offered securities described in this prospectus.

We

may provide a prospectus supplement containing specific information about the terms of a particular offering by a selling securityholder.

The prospectus supplement may add, update or change information in this prospectus. If there is any inconsistency between the

information in this prospectus and a prospectus supplement, you should rely on the information in that prospectus supplement.

You should read both this prospectus and any prospectus supplement together with the additional information described under the

sections entitled “Where You Can Find More Information” and “Information Incorporated by Reference.”

You

may rely only on the information contained or incorporated by reference in this prospectus. We have not authorized

anyone to provide information or to make representations not contained in this prospectus. This prospectus is neither

an offer to sell nor a solicitation of an offer to buy any securities other than those registered by this prospectus, nor is it

an offer to sell or a solicitation of an offer to buy securities where an offer or solicitation would be unlawful. Neither

the delivery of this prospectus, nor any sale made under this prospectus, means that the information contained incorporated by

reference in this prospectus is correct as of any time after the date of this prospectus.

Unless

the context otherwise requires, the terms “we,” “us,” “our,” “Cadiz,” and “the

Company” refer to Cadiz Inc., a Delaware corporation.

NOTICE

ABOUT FORWARD-LOOKING STATEMENTS

Information presented in this prospectus,

and in other documents which are incorporated by reference in this prospectus under the sections of this prospectus entitled “Where

You Can Find More Information” and “Information Incorporated by Reference,” that discusses financial projections,

information or expectations about our business plans, results of operations, products or markets, or otherwise makes statements

about future events, are forward-looking statements. Forward-looking statements can be identified by the use of words

such as “intends,” “anticipates,” “believes,” “estimates,” “projects,”

“forecasts,” “expects,” “plans,” and “proposes.” Although we believe

that the expectations reflected in these forward-looking statements are based on reasonable assumptions, there are a number of

risks and uncertainties that could cause actual results to differ materially from these forward-looking statements. These

include, among others, the cautionary statements in the “Risk Factors” section of this prospectus beginning on page 4. These

cautionary statements identify important factors that could cause actual results to differ materially from those described in

the forward-looking statements. When considering forward-looking statements in this prospectus, you should keep in

mind the cautionary statements in the “Risk Factors” section and other sections of this prospectus, and other cautionary

statements in documents which are incorporated by reference in this prospectus and listed in “Where You Can Find More Information”

and “Information Incorporated by Reference” beginning on pages 17 and 18, respectively.

PROSPECTUS

SUMMARY

About

Cadiz

We are a natural resources development company dedicated to

creating sustainable water and agricultural opportunities in California. We own approximately 45,000 acres of land with high-quality,

naturally recharging groundwater resources in three areas of Southern California’s Mojave Desert. These properties

are located in eastern San Bernardino County situated in close proximity to major highway, rail, energy and water infrastructure,

including the Colorado River Aqueduct, or the “CRA”, which is the primary transportation route for water imported into

Southern California from the Colorado River.

Our

properties offer opportunities for a wide array of sustainable activities including water supply projects, groundwater storage,

large-scale agricultural development and land conservation and stewardship programs. In addition to our land and water assets,

we also own pipeline and well infrastructure able to irrigate existing agriculture and to convey water to and from other communities

and agricultural ventures that may be short of supply and/or storage.

Our

main objective is to realize the highest and best use of our land, water and infrastructure assets in an environmentally responsible

way. We believe that the highest and best use of our assets will be realized through the development of a combination of water

supply, water storage and agricultural projects in accordance with a holistic land management strategy. Our present activities

are focused on developing our assets in ways that meet growing long-term demand for access to sustainable water supplies and agricultural

products.

Upon our founding in 1983 as Cadiz Land Company, we began an

agricultural development on a portion of our primary property in Cadiz, California, which is a 34,500-acre property at the base

of the Fenner and Orange Blossom Wash watersheds in eastern San Bernardino County, or the “Cadiz/Fenner Property.”

These watersheds span an area of more than 1,300 square miles and have 17 to 34 million acre-feet of fresh, high-quality groundwater

in storage – an amount comparable to Lake Mead, America’s largest surface reservoir.

We

have sustainably farmed portions of the Cadiz/Fenner Property since the late 1980s in accordance with permits from the County

of San Bernardino, the public agency responsible for groundwater use at the Cadiz/Fenner Property. The permits authorize the development

of up to 9,600 acres of the Cadiz/Fenner Property for farming and the associated use of underlying groundwater for irrigation.

The

Cadiz/Fenner Property is well-suited for various permanent and seasonal crops, and we have successfully grown citrus, organic

table grapes and raisins, and seasonal vegetables, such as melons, squash and asparagus. Today, we are engaged in agricultural

joint ventures at the Cadiz/Fenner Property and are the largest private agricultural operation in San Bernardino County. Presently,

the property has 2,100 acres leased to third parties for cultivation of citrus and 242 acres leased to our joint venture, SoCal

Hemp JV LLC, for the cultivation of industrial hemp.

In addition to our agricultural ventures,

we are presently developing the Cadiz Valley Water Conservation, Recovery and Storage Project, or the “Water Project,”

which is approved to capture and conserve millions of acre-feet of native groundwater currently being lost to evaporation from

the aquifer system beneath our Cadiz/Fenner Property, and provide 50,000 acre-feet of water per year, enough water for 400,000

people, to water providers throughout Southern California. A second phase of the Water Project would offer storage in the

aquifer system for up to one million acre-feet of imported water. Following a multi-year California Environmental Quality Act review

and permitting process, the Water Project received permits that allow the capture and conservation of 2.5 million acre-feet of

groundwater over 50 years in accordance with the terms of a groundwater management plan approved by San Bernardino County.

We believe that the ultimate implementation of the Water Project would provide a significant return on our investment and future

cash flow.

By

making new water supply and storage available in Southern California, we believe we can be part of the solution to the State’s

persistent water challenge. Available water supply in Southern California is constrained every year by regulatory restrictions

on each of the State’s three main water sources: (1) the CRA; (2) the State Water Project, which provides water supplies

from Northern California to the central and southern parts of the state; and (3) the Los Angeles Aqueduct, which delivers water

from the eastern Sierra Nevada mountains to Los Angeles. Southern California’s water providers and farmers rely on imports

from these systems to meet demand, but deliveries from all three into the region are consistently below capacity, even in wet

years.

Further,

the availability of supplies in California differs greatly from year to year due to natural hydrological variability. Over the

last decade, California experienced an historic drought featuring record-low winter precipitation, followed by record wet years.

The 2018-2019 winter was a wet year, with snowpack and rainfall well above average through the summer of 2019, however 2020 is

on track to be another dry year, with snowpack at 45% of normal through February. The rapid swings between wet and dry years challenges

California’s traditional supply system and supports the need for reliable storage and local supply.

Given

the variety of challenges and limitations presented by the State’s existing infrastructure, Southern California water providers

and farmers are presently pursuing investments in storage, supply and infrastructure to meet long-term demand and pursuing sustainable

water and agriculture sources. We have a record of sustainable agricultural development and groundwater management to support

our continued integration into California’s water and agriculture portfolio.

Our

current working capital requirements relate largely to the final development activities associated with the Water Project and

those activities consistent with the Water Project related to further development of our land and agricultural assets. While we

continue to believe that the ultimate implementation of the Water Project will provide a significant source of future cash flow,

we also believe there is substantial value in our underlying agricultural assets and our current agricultural ventures and lease

arrangements.

We

also continue to explore additional sustainable beneficial uses of our land and water resource assets, including the marketing

of our approved desert tortoise land conservation bank, which is located on our properties outside the Water Project area, and

other long-term legacy uses of our properties, such as land stewardship and conservation programs.

We

are a Delaware corporation with our principal executive offices located at 550 South Hope Street, Suite 2850, Los Angeles, California

90071. Our telephone number is (213) 271-1600. We maintain a corporate website at www.cadizinc.com. Our

website address provided in this prospectus is not intended to function as a hyperlink and the information on our website is not,

nor should it be considered, part of this prospectus or incorporated by reference into this prospectus.

The

following is a brief summary of the offering and certain terms of our Certificate of Designation of Series 1 Preferred Stock that

we filed with the Secretary of State of the State of Delaware on March 5, 2020 (the “Certificate of Designation”). For

a more complete description of the terms of the Preferred Shares, see “Description of the Preferred Shares” in this

prospectus.

|

Common Stock Offered

|

Up to 7,662,638 shares of our common stock consisting of: 4,050,500 Preferred Conversion Shares issuable to the selling securityholders upon conversion of the Preferred Shares, 2,589,674 Note Conversion Shares issued upon conversion of a portion of the outstanding amount payable under our 2020 Notes, and 1,022,464 Additional Common Shares held by two of the selling securityholders.

|

|

Preferred

Shares Offered

|

10,000

Preferred Shares, which we issued to two of the selling securityholders pursuant to Conversion and Exchange Agreements dated

March 5, 2020, in exchange for the satisfaction of an outstanding aggregate amount payable of $27,381,000 under our 2020

Notes.

|

|

Ranking

and Liquidation

|

Prior to March 5, 2025, or the “Mandatory Conversion Date”,

in the event of our voluntary or involuntary liquidation, dissolution or winding up, each Preferred Share will be entitled to receive

an amount in cash equal to $2,734.09 per share (subject to adjustment) before any payment may be made to holders of our common

stock or any outstanding series of our preferred stock junior in liquidation preference to the Preferred Shares. In addition,

prior to the Mandatory Conversion Date, the Preferred Shares will be entitled to participate pro rata on an as-converted into common

stock basis with all of our common stock in the distribution of any remaining proceeds from the voluntary or involuntary liquidation,

dissolution or winding up. After the Mandatory Conversion Date, Preferred Shares will not receive any preference and will only

be entitled to participate pro rata on an as-converted into common stock basis with all of our common stock in the distribution

of any remaining proceeds from the voluntary or involuntary liquidation, dissolution or winding up. See “Description

of the Preferred Shares––Ranking and Liquidation”.

|

|

Conversion

|

Each

Preferred Share is convertible at any time at the option of the holder into 405.05 shares of our common stock, provided that

the holder will be prohibited from converting Preferred Shares into shares of our common stock if, as a result of such conversion,

the holder, together with its affiliates, would beneficially own more than 9.9% of the total number of shares of our common

stock then issued and outstanding after giving effect to such conversion. On the Mandatory Conversion Date, each Preferred

Share will automatically convert into shares of our common stock at the conversion rate then in effect; provided, that the

Preferred Shares will not automatically convert shares of our common stock to the extent that, as a result of such conversion,

the holder, together with its affiliates, would beneficially own more than 9.9% of the total number of shares of our common

stock then issued and outstanding after giving effect to such conversion. Any Preferred Shares that remain outstanding after

the Mandatory Conversion Date as a result of such limitations will be convertible at any time thereafter, at the option of

the holder, subject to the beneficial ownership limitations in our Certificate of Designation. See “Description

of the Preferred Shares—Conversion Rights.”

|

|

Voting

Rights

|

Prior

to the Mandatory Conversion Date, each Preferred Share will be entitled to 301.98 votes on all matters on which stockholders

are generally entitled to vote (provided that no holder of Preferred Shares will be entitled to such number of votes in excess

of such holder’s beneficial ownership limitation). After the Mandatory Conversion Date, the Preferred Shares will

have no voting rights, except as required by applicable law. See “Description of the Preferred Shares—Voting

Rights.”

|

|

Dividends

|

Prior

to the Mandatory Conversion Date, the holders of Preferred Shares will not be entitled to participate in any dividends or

distributions. After the Mandatory Conversion Date, Preferred Shares will rank pari passu on an as-converted to common stock

basis with all of our common stock as to dividends and distributions. See “Description of the Preferred Shares—Dividends.”

|

|

Anti-Dilution

|

The

number of shares issuable upon conversion of the Preferred Shares and the number of votes to which each Preferred Share is

entitled are subject to proportionate adjustment upon the issuance by us of certain stock dividends, stock splits, and similar

proportionately applied changes affecting our outstanding shares of common stock. See “Description of the

Preferred Shares—Anti-Dilution.”

|

|

Redemption

|

At

any time after March 5, 2021, we may redeem Preferred Shares by payment of an amount per Preferred Share equal to $13.50 multiplied

by the Conversion Rate then in effect; provided, that as to each holder of Preferred Shares, the number of Preferred Shares

redeemed must be at least 25% of the Preferred Shares originally issued to such holder. See “Description

of the Preferred Shares—Redemption.”

|

|

Use

of Proceeds

|

We will not receive any of the proceeds from the sale of the

Preferred Shares, the Preferred Conversion Shares, the Note Conversion Shares or the Additional Common Shares by any of the selling

securityholders.

|

|

Listing

|

The Preferred Shares are not listed on any securities exchange. Our

common stock is listed on The Nasdaq Global Market under the symbol “CDZI.”

|

|

Risk

Factors

|

See

“Risk Factors” beginning on page 4 and other information included or incorporated by reference

in this prospectus for a discussion of factors you should consider carefully before investing in the Preferred Shares or shares

of our common stock.

|

RISK

FACTORS

An

investment in our securities involves a high degree of risk. You should carefully consider the following factors as

well as the other information contained and incorporated by reference in this prospectus, including the Risk factors disclosure

in our most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, before deciding to invest.

Risks

Related to the Preferred Shares

Fluctuations in the price of our common stock may affect

the value of the Preferred Shares and make them more difficult to resell.

Because the Preferred Shares are convertible into shares of

our common stock, volatility or depressed prices for our common stock could have a similar effect on the value of the Preferred

Shares and could limit the value of shares of our common stock receivable upon conversion of the Preferred Shares. Holders

who receive common stock upon conversion of the Preferred Shares will also be subject to the risk of volatility and depressed prices

of our common stock.

You

may have to pay taxes with respect to distributions on our common stock that you do not receive.

The

conversion rate of the Preferred Shares is subject to adjustment for certain events arising from stock splits and combinations,

stock dividends, cash dividends and certain other actions by us that modify our capital structure. If, for example,

the conversion rate is adjusted as a result of a distribution that is taxable to holders of our common stock, such as a cash dividend,

you may be required to include an amount in income for U.S. federal income tax purposes, notwithstanding the fact that you do

not receive an actual distribution. In addition, holders of the Preferred Shares may, in certain circumstances, be

deemed to have received a distribution subject to U.S. federal withholding taxes. If we pay withholding taxes on behalf

of a holder, we may, at our option, set off such amounts against any cash and/or common stock otherwise deliverable to such holder. See

“Certain U.S. Federal Income Tax Considerations” for more details.

An

active trading market for the Preferred Shares may not develop.

The

Preferred Shares are an issue of securities for which there is currently no active trading market and no active trading market

might ever develop. The Preferred Shares may trade at a discount from their initial offering price, depending on the

market for similar securities, the price, and volatility in the price, of our shares of common stock, our performance and other

factors. In addition, we do not know whether an active trading market will develop for the Preferred Shares. We

have no plans to list the Preferred Shares on a securities exchange or to include the Preferred Shares in any automated quotation

system. The liquidity of any market for the Preferred Shares will depend upon the number of holders of the Preferred

Shares, our results of operations and financial condition, the market for similar securities, the interest of securities dealers

in making a market in the Preferred Shares and other factors. An active or liquid trading market for the Preferred

Shares may not develop. To the extent that an active trading market does not develop, the liquidity and trading prices

for the Preferred Shares may be harmed.

Conversion

of the Preferred Shares will dilute the ownership interest of existing shareholders, including holders who had previously converted

their Preferred Shares.

The conversion of some or all of the Preferred

Shares into Preferred Conversion Shares may dilute the ownership interests of existing shareholders. Any sales in the

public market of the common stock issued upon such conversion could adversely affect prevailing market prices of our common stock. In

addition, the existence of the Preferred Shares may encourage short selling by market participants because the conversion of the

Preferred Shares into Preferred Conversion Shares could depress the price of our common stock.

The sale of a substantial amount of our common stock in

the market and the issuance of shares upon conversion of convertible instruments, including the Preferred Conversion Shares, could

adversely affect the prevailing market price of our common stock.

As of March 20, 2020, we had 34,772,030 shares

of common stock issued and outstanding and the closing sale price of our common stock on March 20, 2020 was $9.70.

We

may engage in transactions to issue convertible debt and warrants to purchase common stock, as we have in the past, which transactions

may include registration rights. The registration of such additional securities and the potential for high volume trades of our

common stock in connection with these financings may have a downward effect on our market price. Future issuance of our common

stock upon exercise of these warrants may have a further negative impact on our stock price.

Further, as of March 20, 2020, we have reserved for issuance,

but not yet issued, a substantial amount of additional shares, including the Preferred Conversion Shares. The issuance of shares

we are obligated to issue, which may increase dilution of existing investors and further depress the market price of our common

stock, which may negatively affect our stockholders’ equity and our ability to raise capital on terms acceptable to us in

the future.

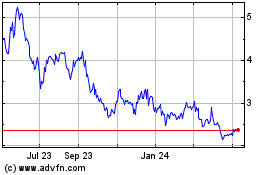

The

volatility of our stock price could adversely affect current and future stockholders.

The

market price of our common stock is volatile and fluctuates in response to various factors which are beyond our control. Such

fluctuations are particularly common in companies such as ours, which have not generated significant revenues. The

following factors, in addition to other risk factors described in this section, could cause the market price of our common stock

to fluctuate substantially:

|

|

●

|

Developments

involving the execution of our business plan;

|

|

|

●

|

Disclosure

of any adverse results in litigation;

|

|

|

●

|

Regulatory

developments affecting our ability to develop our properties;

|

|

|

●

|

Disruptions to the market and industry as a result of the global outbreak of the COVID-19 coronavirus;

|

|

|

●

|

The

dilutive effect or perceived dilutive effect of additional debt or equity financings;

|

|

|

●

|

Perceptions

in the marketplace of our company and the industry in which we operate; and

|

|

|

●

|

General

economic, political and market conditions.

|

In

addition, the stock markets, from time to time, experience extreme price and volume fluctuations that may be unrelated or disproportionate

to the operating performance of companies. These broad fluctuations may adversely affect the market price of our common stock.

Price volatility could be worse if the trading volume of our common stock is low.

The COVID-19 coronavirus could adversely impact our business

In December 2019, a novel strain of coronavirus,

COVID-19, was reported to have surfaced in Wuhan, China. Since then, the COVID-19 coronavirus has spread to multiple countries,

including the United States. If the COVID-19 coronavirus continues to spread, we may experience disruptions that could severely

impact our business, including; availability of necessary items or availability of workforce in a non-essential business either

due to voluntary or mandated quarantine.

The global outbreak of the COVID-19 coronavirus continues to rapidly

evolve. The extent to which the COVID-19 coronavirus may impact our business will depend on future developments, which are highly

uncertain and cannot be predicted with confidence, such as the ultimate geographic spread of the disease, the duration of the

outbreak, travel restrictions and social distancing in the United States and other countries, business closures or business disruptions

and the effectiveness of actions taken in the United States and other countries to contain and treat the disease.

DESCRIPTION

OF THE PREFERRED SHARES

On

March 5, 2020, we filed the Certificate of Designation with the Secretary of State of the State of Delaware to designate 10,000

shares of our preferred stock, par value $0.01 per share, as the Preferred Shares.

We issued the Preferred Shares pursuant to Conversion and Exchange

Agreements, dated March 5, 2020, between Cadiz Inc. and two of the selling securityholders, in exchange for the satisfaction of

an outstanding aggregate amount payable of $27,381,000 under our 2020 Notes.

The

following is a brief description of the Preferred Shares:

Ranking

and Liquidation. Prior to the Mandatory Conversion Date, subject to applicable law and the rights of the holders of any outstanding

series of our preferred stock, in the event of our voluntary or involuntary liquidation, dissolution or winding up, each Preferred

Share will be entitled to receive an amount in cash equal to $2,734.09 per share (as may be adjusted for any dividends of Preferred

Shares, subdivision of the outstanding Preferred Shares or combination of the outstanding Preferred Shares), before any payment

may be made to holders of our common stock or any outstanding series of our preferred stock junior in liquidation preference to

the Preferred Shares. In addition, prior to the Mandatory Conversion Date, subject to applicable law and the rights of the holders

of any outstanding series of our preferred stock, Preferred Shares will be entitled to participate pro rata on an as-converted

into common stock basis with all of our common stock in the distribution of any remaining proceeds from the voluntary or involuntary

liquidation, dissolution or winding up. After the Mandatory Conversion Date, subject to applicable law and the rights of the holders

of any outstanding series of our preferred stock, Preferred Shares will not receive any preference and will only be entitled to

participate pro rata on an as-converted into common stock basis with all of our common stock in the distribution of any remaining

proceeds from the voluntary or involuntary liquidation, dissolution or winding up.

Conversion.

Each Preferred Share is convertible at any time at the option of the holder into 405.05 shares of our common stock (the “Conversion

Rate”), provided that the holder will be prohibited from converting Preferred Shares into shares of our common stock if,

as a result of such conversion, the holder, together with its affiliates, would beneficially own more than 9.9% of the total number

of shares of our common stock then issued and outstanding after giving effect to such conversion. On the Mandatory Conversion

Date, each Preferred Share will automatically convert into shares of our common stock at the Conversion Rate then in effect; provided,

that the Preferred Shares will not automatically convert shares of our common stock to the extent that, as a result of such conversion,

the holder, together with its affiliates, would beneficially own more than 9.9% of the total number of shares of our common stock

then issued and outstanding after giving effect to such conversion. Any Preferred Shares that remain outstanding after the Mandatory

Conversion Date as a result of such limitations will be convertible at any time thereafter, at the option of the holder, subject

to the beneficial ownership limitations in the Certificate of Designation.

Voting

Rights. Prior to the Mandatory Conversion Date, except as provided by applicable law, each Preferred Share will be entitled

to 301.98 votes (the “Voting Rate”) on all matters on which stockholders are generally entitled to vote (provided

that no holder of Preferred Shares will be entitled to such number of votes in excess of such holder’s beneficial ownership

limitation). Additionally, prior to the Mandatory Conversion Date, the vote or written consent of holders of a majority of the

outstanding Preferred Shares, voting separately as a single class, will be required for certain amendments to our certificate

of incorporation, to liquidate us, to incur certain indebtedness other than permitted indebtedness, to enter into certain affiliate

transactions, to issue additional Preferred Shares and to issue any capital stock senior or having parity in preference to the

Preferred Shares, other than preferred shares that may be issued in one or more financing transactions as an alternative to our

incurring, and which the gross proceeds of shall be offset against, permitted indebtedness. Permitted indebtedness over which

the Preferred Shares will have no voting rights consists of (i) our existing debt as of March 5, 2020 and the refinancing of such

debt, (ii) up to $600 million of debt that we may incur related to our southern pipeline project or our northern pipeline project

(collectively, the “Pipeline Water Projects”), (iii) the establishment of related

infrastructure and farming costs for developing agriculture on land owned by us and our subsidiaries (the “Farming Project”),

(iv) working capital for the Pipeline Water Projects, the Farming Project or general corporate purposes, and (v) a refinancing

of any of the debt described in this sentence related to the Pipeline Water Projects. After the Mandatory Conversion Date,

the Preferred Shares will have no voting rights, except as required by applicable law.

Dividends.

Prior to the Mandatory Conversion Date, the holders of Preferred Shares will not be entitled to participate in any dividends or

distributions. After the Mandatory Conversion Date, subject to the applicable law and the rights of the holders of any outstanding

series of our preferred stock, Preferred Shares will rank pari passu on an as-converted to common stock basis with all of our

common stock as to dividends and distributions. However, holders of Preferred Shares will not be entitled to participate in dividends

consisting of shares of our common stock or other securities convertible into or exercisable for shares of our common stock to

the extent that, as a result of such dividend, the holder, together with its affiliates, would beneficially own more than 9.9%

of the total number of shares of our common stock then issued and outstanding after giving effect to such dividend.

Anti-Dilution.

The Conversion Rate and the Voting Rate are subject to proportionate adjustment upon the issuance by us of stock dividends, stock

splits, and similar proportionately applied changes affecting our outstanding shares of common stock.

Redemption.

At any time after March 5, 2021, we may redeem Preferred Shares by payment of an amount per Preferred Share equal to $13.50 (as

may be adjusted for any dividends of Preferred Shares, subdivision of the outstanding Preferred Shares or combination of the outstanding

Preferred Shares) multiplied by the Conversion Rate then in effect; provided, that as to each holder of Preferred Shares, the

number of shares redeemed must be at least 25% of the Preferred Shares originally issued to such holder. There will be no restriction

on the redemption of the Preferred Shares while there is any arrearage in the payment of dividends.

Rights

as a Stockholder. Except as otherwise provided in the Certificate of Designation, or by virtue of such holder’s ownership

of shares of our common stock, the holders of Preferred Shares do not have the rights or privileges of holders of shares of our

common stock, until they convert their Preferred Shares.

Amendments.

Certain terms of the Preferred Shares may be amended or modified with the vote or written consent of the holders of a majority

of the then-outstanding Preferred Shares.

Anti-Takeover

Effects of Certain Provisions of Delaware Law and Our Charter Documents

The

following is a summary of our Certificate of Incorporation and our Bylaws. This summary does not purport to be complete and is

qualified in its entirety by reference to our Certificate of Incorporation and our Bylaws. Our Certificate of Incorporation states

that we expressly elect not to be governed by Section 203 of the General Corporation Law of the State of Delaware.

Our

charter documents include provisions that may have the effect of discouraging, delaying or preventing a change in control or an

unsolicited acquisition proposal that a stockholder might consider favorable, including a proposal that might result in the payment

of a premium over the market price for the shares held by our stockholders. These provisions are summarized in the following paragraphs.

Special

Meeting of Stockholders. Neither our Certificate of Incorporation nor our Bylaws permit stockholder action by written

consent in lieu of a meeting of stockholders. Further, special meetings of stockholders may be called only by our Board of Directors,

Chief Executive Officer or President. In addition, our Bylaws provide advance notice procedures for stockholders seeking to bring

business before the annual meeting of stockholders or to nominate candidates for election as directors at the annual meeting of

stockholders, and specify certain requirements regarding the form and content of a stockholder’s notice. The foregoing could

have the effect of delaying or preventing unsolicited takeovers and changes in control or changes in our management.

Effects

of authorized but unissued common stock and blank check preferred stock. One of the effects of the existence of authorized

but unissued common stock and undesignated preferred stock may be to enable our Board of Directors to make more difficult or to

discourage an attempt to obtain control of our company by means of a merger, tender offer, proxy contest or otherwise, and thereby

to protect the continuity of management. If, in the due exercise of its fiduciary obligations, our Board of Directors were to

determine that a takeover proposal was not in our best interest, such shares could be issued by our Board of Directors without

stockholder approval in one or more transactions that might prevent or render more difficult or costly the completion of the takeover

transaction by diluting the voting or other rights of the proposed acquirer or insurgent stockholder group, by putting a substantial

voting block in institutional or other hands that might undertake to support the position of the incumbent Board of Directors,

by effecting an acquisition that might complicate or preclude the takeover, or otherwise.

In

addition, our certificate of incorporation grants our Board of Directors broad power to establish the rights and preferences of

authorized and unissued shares of preferred stock. The issuance of shares of preferred stock could decrease the amount of earnings

and assets available for distribution to holders of shares of common stock. The issuance also may adversely affect the rights

and powers, including voting rights, of those holders and may have the effect of delaying, deterring or preventing a change in

control of our company.

Cumulative

Voting. Our Certificate of Incorporation does not provide for cumulative voting in the election of directors which would allow

holders of less than a majority of the stock to elect some directors.

Vacancies.

Section 223 of the Delaware General Corporation Law and our Bylaws provide that all vacancies, including newly created directorships,

may be filled by the affirmative vote of a majority of directors then in office, even if less than a quorum.

Anti-Takeover

Effects of Delaware Law. We are subject to the “business combination” provisions of Section 203 of Delaware law.

In general, such provisions prohibit a publicly held Delaware corporation from engaging in various “business combination”

transactions with any interested stockholder for a period of three years after the date of the transaction in which the person

became an interested stockholder, unless:

|

|

●

|

prior to the date the interested stockholder obtained such status, the Board of Directors of the corporation approved either

the business combination or the transaction that resulted in the stockholder becoming an interested stockholder;

|

|

|

●

|

upon consummation of the transaction which resulted in the stockholder becoming an interested stockholder, the stockholder

owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced; or

|

|

|

●

|

on or subsequent to such date, the business combination is approved by the Board of Directors of the corporation and authorized

at an annual or special meeting of stockholders by the affirmative vote of at least 66 2/3% of the outstanding voting stock which

is not owned by the interested stockholder.

|

A

“business combination” is defined to include mergers, asset sales and other transactions resulting in financial benefit

to an interested stockholder. In general, an “interested stockholder” is a person who, together with affiliates and

associates, owns (or within three years, did own) 15% or more of a corporation’s voting stock. The statute could prohibit

or delay mergers or other takeover or change in control attempts with respect to us and, accordingly, may discourage attempts

to acquire us even though such a transaction may offer our stockholders the opportunity to sell their stock at a price above the

prevailing market price.

USE

OF PROCEEDS

We will not receive any proceeds from the

sale of any or all of the Preferred Shares, the Preferred Conversion Shares, the Note Conversion Shares or the Additional Common

Shares being offered by the selling securityholders under this prospectus.

SELLING

SECURITYHOLDERS

This prospectus covers the resale or other disposition of the

Preferred Shares, the Preferred Conversion Shares, the Note Conversion Shares and the Additional Common Shares, which we have agreed

to register. Accordingly, we have filed with the Commission a registration statement, of which this prospectus is a part, for the

resale of those shares.

We issued the Preferred Shares pursuant

to Conversion and Exchange Agreements, dated March 5, 2020, between Cadiz Inc. and each of the selling securityholders, in exchange

for the satisfaction of an outstanding aggregate amount payable of $27,381,000 under our 2020 Notes.

The

Note Conversion Shares were issued to the selling securityholders in March 2020 upon conversion of a portion of the aggregate amount

payable under our 2020 Notes, pursuant to the terms of the indenture, dated December 10, 2015, between us and The Bank of

New York Mellon Trust Company, N.A., as Trustee.

The Additional Common Shares are beneficially owned by LC Capital

Master Fund Ltd. or Mr. Lampe and were acquired in certain of our prior private placements from 2004 through 2009, or in open market

transactions or other transactions.

None of the

selling securityholders, except as noted in the table below, has held any position or office or had a material relationship with

us other than under our previously existing corporate term debt, under the terms of the agreements pursuant to which the Preferred

Shares were issued, or as a result of the ownership of our common stock.

We may amend

or supplement this prospectus from time to time to update the disclosures set forth herein.

The following table is based on information supplied to us by

the selling securityholders identified in the table. The table sets forth, as to the selling securityholders identified,

the number of Preferred Shares, Preferred Conversion Shares, the Note Conversion Shares and the Additional Common Shares that each

selling securityholder beneficially owns (including any shares the selling securityholder has the right to acquire within 60 days),

the number of shares of Preferred Shares, Preferred Conversion Shares, Note Conversion Shares and Additional Common Shares beneficially

owned by each selling securityholder that may be offered for sale from time to time by this prospectus and the number and percentage

of Preferred Shares, Preferred Conversion Shares, Note Conversion Shares and Additional Common Shares to be held by each such selling

securityholder assuming the sale of all Preferred Shares, Conversion Shares, Note Conversion Shares and Additional Common Shares

offered hereby.

|

|

|

Series 1 Preferred Stock

|

|

|

Common Stock

|

|

|

Name of Selling Securityholders

|

|

Shares

Beneficially

Owned

Before

Offering(1)

|

|

|

Shares

Which

May Be

Offered

Pursuant

to this

Prospectus

|

|

|

Shares

Beneficially

Owned

after

Offering(2)

|

|

|

Percentage

Ownership

after

Offering

|

|

|

Shares

Beneficially

Owned

Before

Offering

|

|

|

Shares

Which May

Be Offered

Pursuant

to this

Prospectus(3)

|

|

|

Shares

Beneficially

Owned after

Offering(4)

|

|

|

Percentage

Ownership

after

Offering(5)

|

|

LC Capital Master Fund Ltd.

c/o Lampe Conway & C LLC

680 Fifth Avenue, 12th Floor

New York, NY 10019

|

|

|

9,671

|

|

|

|

9,671

|

|

|

|

0

|

|

|

|

0

|

%

|

|

|

7,298,045

|

(6)

|

|

|

7,298,045

|

(7)

|

|

|

0

|

|

|

|

0

|

%

|

Steven G. Lampe

c/o Lampe Conway & C LLC

680 Fifth Avenue, 12th Floor

New York, NY 10019

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

0

|

%

|

|

|

146,092

|

(8)

|

|

|

146,092

|

(8)

|

|

|

0

|

|

|

|

0

|

%

|

Elkhorn Partners, Limited Partnership

8405 Indian Hills Drive, Unit 2A8 Omaha, NE 68114

|

|

|

329

|

|

|

|

329

|

|

|

|

0

|

|

|

|

0

|

%

|

|

|

482,101

|

(9)

|

|

|

218,501

|

(10)

|

|

|

263,600

|

|

|

|

*

|

|

|

(1)

|

Except as otherwise noted herein, the number and percentage of shares beneficially owned is determined in accordance with Rule 13d-3 of the Exchange Act, and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such rule, beneficial ownership includes any shares as to which the individual has sole or shared voting power or investment power and also any shares which the individual has the right to acquire within 60 days of the date of this prospectus through the exercise of any option or other right. Except as otherwise noted herein, the number of shares beneficially owned by each selling securityholder identified in this table is as of March 20, 2020. Unless otherwise indicated in the footnotes, each person has sole voting and investment power with respect to the shares shown as beneficially owned.

|

|

(2)

|

Assumes the sale of all Preferred Shares offered hereby.

|

|

(3)

|

Includes Preferred Conversion Shares issuable upon conversion of Preferred Shares. The number of Preferred Conversion Shares issuable upon conversion of each Preferred Share, when aggregated with the shares of our common stock beneficially owned by such holder, is subject to a 9.9% limitation based on the number of shares of our common stock outstanding after giving effect to such conversion.

|

|

(4)

|

Assumes the sale of all shares of common stock offered hereby, including the Preferred Conversion Shares, the Note Conversion Shares and the Additional Common Shares.

|

|

(5)

|

Based on 34,772,030 shares of common stock issued and outstanding as of March 20, 2020.

|

|

(6)

|

Includes 3,380,806 shares of common stock beneficially owned as of March 20, 2020. Includes 3,917,239 shares of common stock issuable upon conversion of 9,671 Preferred Shares. The number of shares of common stock issuable upon conversion of each Preferred Share, when aggregated with the shares of our common stock beneficially owned by such holder, is subject to a 9.9% limitation based on the number of shares of our common stock outstanding after giving effect to such conversion.

|

|

|

|

|

|

These securities held by LC Capital Master Fund Ltd. (“LC Capital”) may be deemed to be beneficially owned by LC Capital Partners, LP (“Partners”), LC Capital Advisors LLC (“Advisors”), LC Capital Offshore Fund, Ltd. (“Offshore”), Lampe, Conway& Co., LLC (“Lampe Conway”), Steven G. Lampe (“Lampe”) and Richard F. Conway (“Conway”) by virtue of the following relationships: (i) Partners and Offshore beneficially own 100% of the outstanding shares of LC Capital; (ii) Advisors is the sole general partner of Partners; (iii) Lampe Conway acts as investment manager to Partners, Offshore and LC Capital pursuant to certain investment management agreements, and as a result of such agreements, Lampe Conway shares voting and dispositive power over the securities; and (iv) Lampe and Conway act as the sole managing members of each of Advisors and Lampe Conway and are the natural persons with voting and dispositive power over these securities.

|

|

(7)

|

Includes 3,917,239 shares of common stock issuable upon conversion of 9,671 Preferred Shares. The number of shares of common stock issuable upon conversion of each Preferred Share, when aggregated with the shares of our common stock beneficially owned by such holder, is subject to a 9.9% limitation based on the number of shares of our common stock outstanding after giving effect to such conversion.

|

|

(7)

|

In addition to shares beneficially owned by LC Capital, Steven G. Lampe beneficially owns (i) 144,300 shares of our common stock over which he has sole voting and dispositive power, (ii) 1,208 shares of our common stock in a retirement account, and (iii) 584 shares of our common stock through an immediate family member sharing the same household.

|

|

(9)

|

Includes 348,840 shares of common stock beneficially owned as of March 20, 2020. Also includes 133,261 shares of common stock issuable upon conversion of 329 Preferred Shares.

|

|

|

|

|

|

The number of Preferred Conversion Shares issuable upon conversion of each Preferred Share, when aggregated with the shares of our common stock beneficially owned by such holder, is subject to a 9.9% limitation based on the number of shares of our common stock outstanding after giving effect to such conversion. The securities may be deemed to be beneficially owned by Mr. Alan Parsow, the sole managing partner of the selling securityholder. Mr. Parsow disclaims beneficial ownership over these securities. The selling securityholder has confirmed that it is not a registered broker-dealer or an affiliate of a broker dealer.

|

|

(10)

|

Includes 133,261 shares of common stock issuable upon conversion of 329 Preferred Shares.

|

|

|

|

|

|

The number of Preferred Conversion Shares issuable upon conversion of each Preferred Share, when aggregated with the shares of our common stock beneficially owned by such holder, is subject to a 9.9% limitation based on the number of shares of our common stock outstanding after giving effect to such conversion.

|

|

*

|

Less than 1%.

|

PLAN OF DISTRIBUTION

The Preferred Shares, the Preferred Conversion Shares, the Note

Conversion Shares and the Additional Common Shares will be offered and sold by the selling securityholders named in this prospectus,

by their donees, or by their other successors in interest. We have agreed to bear the expenses of the registration of

such shares, including legal and accounting fees, other than fees of counsel, if any, retained individually by the selling securityholders,

and any discounts or commissions payable with respect to sales of such shares.

The selling securityholders will act independently

of us in making decisions with respect to the timing, manner and size of each sale. Such sales may be made on one or

more exchanges or in the over-the-counter market or otherwise, at prices and under terms then prevailing or at prices related to

the then current market price or in negotiated transactions. The selling securityholders may sell their shares by one

or more of, or a combination of, the following methods:

|

|

●

|

purchases by a broker-dealer as principal and resale by such broker-dealer for its own account

pursuant to this prospectus;

|

|

|

●

|

ordinary brokerage transactions and transactions in which the broker solicits purchasers;

|

|

|

●

|

block trades in which the broker-dealer so engaged will attempt to sell the shares as agent

but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

●

|

block trades in which the broker-dealer so engaged will attempt to sell the shares as agent

but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

●

|

on any national securities exchange or quotation service on which the shares may be listed

or quoted at the time of sale;

|

|

|

●

|

on any national securities exchange or quotation service on which the shares may be listed

or quoted at the time of sale;

|

|

|

●

|

in the over-the-counter market;

|

|

|

●

|

in privately negotiated transactions;

|

|

|

●

|

in options transactions; and

|

|

|

●

|

by any other legally available means.

|

In addition, any shares that

qualify for sale pursuant to Rule 144 may be sold under Rule 144 rather than pursuant to this prospectus.

From time to time, a selling securityholder

may pledge or grant a security interest in some or all of the shares which the selling securityholder owns. If a selling

securityholder defaults in the performance of the selling securityholder’s secured obligations, the pledgees or secured parties

may offer and sell the shares from time to time by this prospectus (except, in some cases, if the pledgees or secured parties are

broker-dealers or are affiliated with broker-dealers). The selling securityholders also may transfer and donate shares

in other circumstances. Donees may also offer and sell the shares from time to time by this prospectus (except, in some

cases, if the donees are broker-dealers or are affiliated with broker-dealers). The number of shares beneficially owned

by a selling securityholder will decrease as and when a selling securityholder donates such securityholder’s shares or defaults

in performing obligations secured by such securityholder’s shares. The plan of distribution for the shares offered

and sold under this prospectus will otherwise remain unchanged, except that the donees, pledgees, other secured parties or other

successors in interest will be selling securityholders for purposes of this prospectus.

To the extent required, this prospectus

may be amended or supplemented from time to time to describe a specific plan of distribution.

In effecting sales, broker-dealers or agents

engaged by the selling securityholders may arrange for other broker-dealers to participate. Broker-dealers or agents

may receive commissions, discounts or concessions from the selling securityholders in amounts to be negotiated immediately prior

to the sale.

The selling securityholders and any broker-dealers

acting in connection with the sale of the shares covered by this prospectus may be deemed to be “underwriters” within

the meaning of Section 2(a)(11) of the Securities Act of 1933, and any commissions received by them and any profit realized

by them on the resale of the shares as principals may be deemed to be underwriting compensation under the Securities Act of 1933.

In order to comply with the securities laws

of certain states, if applicable, the shares must be sold in such jurisdictions only through registered or licensed brokers or

dealers. In addition, in certain states, the shares may not be sold unless they have been registered or qualified for

sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied with.

We have agreed to indemnify the selling

securityholders, their agents, representatives and advisers, and in connection with an underwritten offering, the underwriters

against liabilities they may incur as a result of any untrue statement or alleged untrue statement of a material fact in the registration

statement of which this prospectus forms a part, any omission or alleged omission in this prospectus or the registration statement

to state a material fact necessary in order to make the statements made not misleading or any violation or alleged violation of

any United States federal, state or common law rule or regulation applicable to us and relating to action required of or inaction

by us in connection with any such registration.. This indemnification includes liabilities that the selling securityholders

may incur under the Securities Act. We do not have to give such indemnification if the untrue statement or omission

was made in reliance upon and in conformity with information furnished in writing to us by the selling securityholders for use

in this prospectus or the registration statement.

We have advised the selling securityholders

that the anti-manipulation rules of Regulation M under the Exchange Act may apply to sales of shares in the market and to the activities

of the selling securityholders and their respective affiliates. The selling securityholders may indemnify any broker-dealer

that participates in transactions involving the sale of the shares against certain liabilities, including liabilities arising under

the Securities Act.

Transfer Agent

The transfer agent for our common stock

is Continental Stock Transfer & Trust Company, New York, New York.

CERTAIN U.S. FEDERAL INCOME TAX CONSIDERATIONS

The following is a summary of certain U.S. federal income tax

considerations relating to the purchase, ownership and disposition of the Preferred Shares, the Preferred Conversion Shares, the

Note Conversion Shares and the Additional Common Shares, as of the date of this prospectus. This summary applies only

to a beneficial owner who holds such shares as a capital asset (generally for investment purposes). This summary does

not discuss any state, local or foreign tax consequences, nor does it deal with beneficial owners of such shares that may be subject

to special treatment for U.S. federal income tax purposes. For example, this summary does not address:

|

|

●

|

tax consequences to beneficial owners who are dealers in securities or currencies, traders

in securities that elect to use the mark-to-market method of accounting for their securities, financial institutions, regulated

investment companies, real estate investment trusts, tax-exempt entities or insurance companies;

|

|

|

●

|

tax consequences to beneficial owners holding shares as part of a hedging, integrated, constructive

sale or conversion transaction, or a straddle;

|

|

|

●

|

tax consequences to U.S. holders (as defined below) whose “functional currency”

is not the U.S. dollar; or

|

|

|

●

|

U.S. federal estate, gift or alternative minimum tax consequences, if any (except to the

extent specifically discussed below in “—Non-U.S. Holders—U.S. Federal Estate Tax”).

|

The discussion below is based upon the provisions

of the Internal Revenue Code of 1986, as amended (the “Code”), and U.S. Treasury regulations, rulings and judicial

decisions as of the date of this prospectus. Those authorities may be changed, perhaps retroactively, so as to result

in U.S. federal income tax considerations different from those discussed below.

If a beneficial owner of the Preferred

Shares, Preferred Conversion Shares, Note Conversion Shares or Additional Common Shares is an entity classified as a partnership

for U.S. federal income tax purposes, the tax treatment of a partner will generally depend upon the status of the partner and

the activities of the partnership. If you are such an entity, or a partner in such an entity, you should consult your

own tax advisor.

No rulings have been sought or are expected

to be sought from the Internal Revenue Service (the “IRS”) with respect to any of the U.S. federal income tax considerations

discussed below. As a result, we cannot assure you that the IRS will agree with the tax consequences described below.

Each prospective investor should consult

its own tax advisor concerning the U.S. federal income and estate tax consequences to the investor of the ownership and disposition

of the applicable shares in light of the investor’s particular situation and any consequences arising under the laws of any

other taxing jurisdiction.

The following discussion is a summary of certain U.S. federal

income tax considerations that will apply to you if you are a U.S. holder of Preferred Shares, Preferred Conversion Shares, Note

Conversion Shares or Additional Common Shares.

For purposes of this discussion, a U.S.

holder is a beneficial owner of shares that is for U.S. federal tax purposes:

|

|

●

|

an individual who is a citizen or resident of the United States;

|

|

|

●

|

a corporation created or organized in or under the laws of the United States, any state thereof

or the District of Columbia;

|

|

|

●

|

an estate the income of which is subject to U.S. federal income taxation regardless of its

source; or

|

|

|

●

|

a trust that (i) is subject

to the primary supervision of a court within the United States and one or more United States persons have authority to control

all substantial decisions of the trust, or (ii) has a valid election in effect under applicable U.S. Treasury regulations to be

treated as a United States person.

|

Conversion of the Preferred Shares into

Shares of Our Common Stock

A U.S. holder of Preferred Shares generally

will not recognize gain or loss on the conversion of Preferred Shares into shares of our common stock. The U.S. holder’s