UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 2)*

Bumble Inc.

(Name of Issuer)

Class A Common Stock, par value $0.01 per share

(Title of Class of Securities)

12047B105

(CUSIP Number)

Bumble Inc.

1105 West 41st Street

Austin, Texas 78756

Attn: Laura Franco, Chief Legal Officer

Tel: (512) 696-1409

with a copy to:

Evan Rosen, Esq.

Davis

Polk & Wardwell LLP

450 Lexington Avenue

New York, NY 10017

Tel:

(212) 450-4505

(Name, Address and Telephone Number of Person Authorized to Receive Notices

and Communications)

March 2, 2023

(Date of Event Which Requires Filing of this Statement)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note: Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form

with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

CUSIP No. 12047B105

|

|

|

|

|

|

|

| 1 |

|

NAMES OF REPORTING PERSONS

Whitney Wolfe Herd |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) (a) ☐ (b) ☒

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (SEE

INSTRUCTIONS) OO |

| 5 |

|

CHECK IF DISCLOSURE OF

LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E)

☐ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION United States of America |

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

23,688,443 |

| |

8 |

|

SHARED VOTING POWER

604,650 |

| |

9 |

|

SOLE DISPOSITIVE POWER

23,688,443 |

| |

10 |

|

SHARED DISPOSITIVE POWER

604,650 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

24,293,093 |

| 12 |

|

CHECK IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

☒ |

| 13 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (11) 15.1% |

| 14 |

|

TYPE OF REPORTING PERSON

(SEE INSTRUCTIONS) IN |

CUSIP No. 12047B105

|

|

|

|

|

|

|

| 1 |

|

NAMES OF REPORTING PERSONS

Beehive Holdings II, LP |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) (a) ☐ (b) ☒

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (SEE

INSTRUCTIONS) OO |

| 5 |

|

CHECK IF DISCLOSURE OF

LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E)

☐ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

1,457,532 |

| |

8 |

|

SHARED VOTING POWER

0 |

| |

9 |

|

SOLE DISPOSITIVE POWER

1,457,532 |

| |

10 |

|

SHARED DISPOSITIVE POWER

0 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,457,532 |

| 12 |

|

CHECK IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

☒ |

| 13 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (11) 1.0% |

| 14 |

|

TYPE OF REPORTING PERSON

(SEE INSTRUCTIONS) PN |

CUSIP No. 12047B105

|

|

|

|

|

|

|

| 1 |

|

NAMES OF REPORTING PERSONS

Beehive Holdings III, LP |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) (a) ☐ (b) ☒

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (SEE

INSTRUCTIONS) OO |

| 5 |

|

CHECK IF DISCLOSURE OF

LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E)

☐ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

22,230,911 |

| |

8 |

|

SHARED VOTING POWER

0 |

| |

9 |

|

SOLE DISPOSITIVE POWER

22,230,911 |

| |

10 |

|

SHARED DISPOSITIVE POWER

0 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

22,230,911 |

| 12 |

|

CHECK IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

☒ |

| 13 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (11) 13.9% |

| 14 |

|

TYPE OF REPORTING PERSON

(SEE INSTRUCTIONS) PN |

This Amendment No. 2 (“Amendment No. 2”) to Schedule 13D relates to

shares of Class A common stock, par value $0.01 per share (the “Class A Common Stock”) of Bumble Inc., a Delaware corporation (the “Issuer”), and amends the initial statement on Schedule 13D

filed on February 26, 2021, as amended by Amendment No. 1 to the Schedule 13D filed on March 24, 2021 (as so amended, the “Schedule 13D”). Capitalized terms used but not defined in this Amendment No. 2 shall have

the same meanings ascribed to them in the Schedule 13D.

| Item 4. |

Purpose of Transaction |

Item 4 of the Schedule 13D is hereby amended and supplemented with the following:

On March 2, 2023, BX Buzz ML-1 Holdco L.P., BX Buzz ML-2 Holdco L.P., BX

Buzz ML-3 Holdco L.P., BX Buzz ML-4 Holdco L.P., BX Buzz ML-5 Holdco L.P., BX Buzz ML-6

Holdco L.P. and BX Buzz ML-7 Holdco L.P. (collectively, the “Holdco Entities”) the Issuer, Buzz Holdings L.P., and Beehive Holdings III, LP entered into an underwriting agreement (the

“Underwriting Agreement”) with the underwriters named therein (the “Underwriters”). Pursuant to the Underwriting Agreement, the Holdco Entities and Beehive Holdings III, LP agreed to sell to the Underwriters

11,750,000 shares and 2,000,000 shares, respectively, of Class A Common Stock at a price of $22.173 per share, and in the aggregate, 13,750,000 shares of Class A Common Stock at a price of $22.173 per share (the “March 2023

Offering”). Pursuant to the Underwriting Agreement, the Holdco Entities also granted to the Underwriters a 30-day option to purchase up to an additional 2,062,500 shares of Class A Common Stock.

The March 2023 Offering closed on March 8, 2023.

Pursuant to the Underwriting Agreement, the Holdco Entities and Beehive Holdings III, LP have

entered into a lock-up agreement (the “Lock-Up Agreement”) with the Underwriters pursuant to which

each has agreed with the Underwriters, subject to customary exceptions, not to offer, sell, contract to sell, pledge, grant any option to purchase, make any short sale or otherwise dispose of any shares of Class A Common Stock, or any options

or warrants to purchase any shares of Class A Common Stock, or any securities convertible into, exchangeable for or that represent the right to receive shares of Class A Common Stock (including, without limitation, Common Units) during the

period from March 2, 2023 continuing through the date 60 days thereafter, except with the prior written consent of the Underwriters. The foregoing description of the Lock-Up Agreement set forth in this

Item 4 does not purport to be complete and is qualified in its entirety by reference to the full text of the Lock-Up Agreement, which has been filed as Exhibit G hereto and is incorporated herein by reference.

| Item 5. |

Interest in Securities of the Issuer |

Items 5(a)-(c) of the Schedule 13D are hereby amended and restated as follows:

(a) and (b) Calculations of the percentage of the shares of Class A Common Stock beneficially owned assumes that there were 137,375,380 shares of

Class A Common Stock outstanding as of March 8, 2023, following the closing of the March 2023 Offering, based on 130,169,045 shares of Class A Common Stock outstanding as of January 31, 2023, as set forth in the prospectus filed

by the Issuer on March 6, 2023 and the additional 7,206,335 shares of Class A Common Stock issued upon conversion of an equal number of Common Units by certain of the Holdco Entities and Beehive Holdings III, LP in connection with the

March 2023 Offering, and takes into account any shares of Class A Common Stock underlying Common Units and/or vested Incentive Units, as applicable.

The aggregate number and percentage of the Class A Common Stock beneficially owned by each Reporting Person and, for each Reporting Person, the number of

shares as to which there is sole power to vote or to direct the vote, shared power to vote or to direct the vote, sole power to dispose or to direct the disposition, or shared power to dispose or to direct the disposition are set forth on rows 7

through 11 and row 13 of the cover pages of this Schedule 13D and are incorporated herein by reference.

As of the date hereof, Beehive Holdings II, LP

directly holds one share of Class B Common Stock and vested Incentive Units, which are convertible into 1,457,532 Common Units within 60 days of January 31, 2023 (assuming the $25.9166 volume-weighted average price of the Class A

Common Stock on January 30, 2023), which are exchangeable for shares of Class A Common Stock on a one-for-one basis and Beehive Holdings III, LP directly holds

one share of Class B Common Stock and 22,230,911 Common Units, which are exchangeable for shares of Class A Common Stock on a one-for-one basis. Ms. Wolfe

Herd may also be deemed to have shared investment and voting power over the 465,116 shares of Class A Common Stock held directly by her spouse, 23,255 shares of Class A Common Stock held directly by a trust, of which Ms. Wolfe

Herd’s spouse is the trustee, and 116,279 shares of Class A Common Stock held in a foundation over which Ms. Wolfe Herd’s spouse may be deemed to have shared voting and dispositive power. The above excludes unvested Incentive

Units.

In general, each share of Class A Common Stock entitles its holder to one vote on all matters on which

Issuer stockholders are entitled to vote generally. Shares of Class B Common Stock have no economic rights but each share generally entitles each holder, without regard to the number of shares of Class B Common Stock held by such holder,

to a number of votes that is equal to the aggregate number of Common Units held by such holder on all matters on which Issuer stockholders are entitled to vote generally. Holders of shares of Class B Common Stock vote together with holders of

Class A Common Stock as a single class on all matters on which stockholders are entitled to vote generally, except as otherwise required by law. Notwithstanding the foregoing, unless they elect otherwise, each of the Beehive Entities is

entitled to outsized voting rights as follows. Until the High Vote Termination Date (as defined below), each share of Class A Common Stock held by them, if any, entitles such person to ten votes and each such Beehive Entity that holds

Class B Common Stock is entitled, without regard to the number of shares of Class B Common Stock held by such Beehive Entity, to a number of votes equal to 10 times the aggregate number of Common Units held by such Beehive Entity.

“High Vote Termination Date” means the earlier to occur of (i) seven years from the closing of the Issuer’s initial public offering and (ii) the date the parties to the Stockholders Agreement (as defined below) cease

to own in the aggregate 7.5% of the outstanding shares of Class A Common Stock, assuming exchange of all Common Units. The Class A Common Stock held by Ms. Wolfe Herd’s spouse and the trust and foundation described above are

entitled to one vote per share.

The general partner of Beehive Holdings II, LP is Beehive Holdings Management II, LLC. The general partner of Beehive

Holdings III, LP is Beehive Holdings Management III, LLC. Ms. Wolfe Herd is the sole member of Beehive Holdings Management II, LLC and Beehive Holdings Management III, LLC.

By virtue of the Stockholders Agreement (as defined below), the Reporting Persons and affiliates of The Blackstone Group Inc. (“Blackstone”)

are deemed to be members of a group for purposes of Section 13(d) of the Securities Exchange Act of 1934, as amended. Blackstone and its affiliates are filing a separate Schedule 13D to report the Class A Common Stock that they may be

deemed to beneficially own. As of the date hereof, collectively, the Reporting Persons and Blackstone and its affiliates may be deemed to beneficially own in the aggregate 90,080,527 shares of

Class A Common Stock, representing 47.4% of the outstanding Class A Common Stock.

(c) Except as set forth in this Amendment No. 2, none of

the Reporting Persons has effected any transaction in Class A Common Stock during the past 60 days.

| Item 6. |

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer

|

Item 6 of the Schedule 13D is hereby amended and supplemented as follows:

The information set forth in Items 3, 4 and 5 of the Schedule 13D is hereby incorporated by reference into this Item 6.

| Item 7. |

Material to Be Filed as Exhibits. |

Item 7 of the Schedule 13D is hereby amended and supplemented as follows:

|

|

|

| Exhibit G |

|

Form of Lock-Up Agreement, dated as of March 2, 2023 (incorporated herein by reference to Annex I to the Form of Underwriting Agreement filed as Exhibit 1.1 to the Issuer’s Current

Report on Form 8-K filed with the SEC on March 8, 2023 (File No. 001-40054)) |

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: March 8, 2023

|

|

|

| WHITNEY WOLFE HERD |

|

|

| By: |

|

/s/ Whitney Wolfe Herd |

| Name: |

|

Whitney Wolfe Herd |

|

| BEEHIVE HOLDINGS II, LP |

| By: Beehive Holdings Management II, LLC, its general partner |

|

|

| By: |

|

/s/ Whitney Wolfe Herd |

| Name: |

|

Whitney Wolfe Herd |

| Title: |

|

Managing Member |

|

| BEEHIVE HOLDINGS III, LP |

| By: Beehive Holdings Management III, LLC, its general partner |

|

|

| By: |

|

/s/ Whitney Wolfe Herd |

| Name: |

|

Whitney Wolfe Herd |

| Title: |

|

Managing Member |

[Bumble Inc. – Schedule 13D/A]

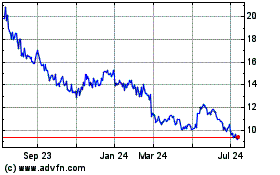

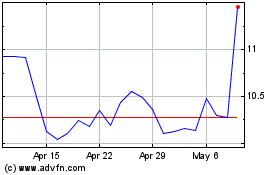

Bumble (NASDAQ:BMBL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bumble (NASDAQ:BMBL)

Historical Stock Chart

From Apr 2023 to Apr 2024