Item 1.01. Entry into a Material Definitive Agreement.

On September 10, 2019, the Board of Directors of Broadway Financial Corporation (the “Company”) declared a dividend of one preferred share purchase right (a “Right”) for each share of common stock, par value $0.01 per share, and non-voting common stock, par value $0.01 per share, of the Company (collectively, the “Common Shares”) outstanding on September 23, 2019 (the “Record Date”) to the stockholders of record as of the close of business on that date. In connection with the distribution of the Rights, the Company entered into a Rights Agreement (the “Rights Agreement”), dated as of September 10, 2019, between the Company and Computershare Trust Company, N.A., as rights agent. Each Right will, when it becomes exercisable, entitle the registered holder thereof to purchase from the Company one one-thousandth of a share of Series B Junior Participating Preferred Stock, par value $0.01 per share (the “Preferred Shares”), of the Company at a price of $3.60 per one one-thousandth of a Preferred Share (the “Purchase Price”), subject to adjustment.

The Rights Agreement and the related distribution of Rights were approved by the Board of Directors to implement a stockholder rights plan that is intended to augment the ability of the Board to protect the interests of the Company’s stockholders in the event of non-negotiated attempts to acquire control of the Company, including accumulations of Broadway Financial Corporation stock in open market or private purchases or in a tender offer, that do not provide fair value to all stockholders. In general, the Rights Agreement is intended to achieve this result by significantly diluting the stock ownership of any person or group who or which acquires beneficial ownership of 10% or more of the Company’s outstanding Common Shares (an “Acquiring Person”), subject to certain exceptions.

The Rights are in all respects subject to and governed by the provisions of the Rights Agreement. The following description of the Rights Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Rights Agreement, which is attached hereto as Exhibit 4.1 and incorporated herein by reference.

Distribution Date; Exercisability; Expiration

Initially, the Rights will be attached to all outstanding Common Shares and no separate certificates evidencing the Rights (“Right Certificates”) will be issued. Until the Distribution Date (as defined below), the Rights will be transferred with and only with the Common Shares. As long as the Rights are attached to the Common Shares, the Company will issue one Right with each new Common Share so that all Common Shares will have Rights attached.

The Rights will separate and begin trading separately from the Common Shares, and Right Certificates will be issued to evidence the Rights, on the earlier to occur of:

(i) the Close of Business (as such term is defined in the Rights Agreement) on the tenth day after the date of public announcement by the Company or an Acquiring Person that an Acquiring Person has become such; or

(ii) the Close of Business on the tenth Business Day (or such later date as may be determined by the board of directors of the Company prior to the time any individual, firm, corporation, or other entity (any “Person”) becomes an “Acquiring Person”) after the date of the commencement by any Person (other than the Company, its Affiliates or Subsidiaries (each as defined in the Rights Agreement), or their employee benefit plans) of a tender or exchange offer the consummation of which would result in any Person becoming the Beneficial Owner (as defined below) of Common Shares aggregating 10% or more of the then outstanding Common Shares.

The earlier of the above dates is referred to in the Rights Agreement as the “Distribution Date.” As soon as practicable after the Distribution Date, unless the Rights are recorded in book-entry or other uncertificated form, the Company will prepare and cause Right Certificates to be sent to each record holder of Common Shares as of the Distribution Date.

2

An “Acquiring Person” will not include (i) the Company or any Affiliate or Subsidiary of the Company (as such terms are defined in the Rights Agreement), (ii) any employee benefit plan of the Company or of any Affiliate or Subsidiary of the Company or any entity holding Common Shares for or pursuant to the terms of any such plan, or (iii) any Person who or which, together with all Affiliates and Associates of such Person, is, as of 5 p.m. Pacific Time on the date the Rights Agreement was first publicly announced, which was September 11, 2019 (the “Grandfathered Time”), the Beneficial Owner of 10% or more of the then outstanding Common Shares (a “Grandfathered Person”), unless such Grandfathered Person becomes the Beneficial Owner of a percentage of the Common Shares then outstanding exceeding the percentage of the then outstanding Common Shares that such Grandfathered Person, together with all Affiliates and Associates of such Grandfathered Person, Beneficially Owned as of the Grandfathered Time (the “Grandfathered Percentage”). If any Grandfathered Person sells, transfers, or otherwise disposes of any outstanding Common Shares after the Grandfathered Time, the Grandfathered Percentage with respect to such Grandfathered Person will, after such sale, transfer or disposition, be the lesser of (i) the Grandfathered Percentage as in effect immediately prior to such sale, transfer or disposition or (ii) the percentage of the then outstanding Common Shares that such Grandfathered Person Beneficially Owns immediately following such sale, transfer or disposition. Upon the first decrease of a Grandfathered Person’s Beneficial Ownership below 10%, such Grandfathered Person will no longer be deemed to be a Grandfathered Person.

A Person is deemed under the Rights Agreement to have “Beneficial Ownership” of, and to “Beneficially Own,” Common Shares or other securities:

(i) which a Person or any of such Person’s Affiliates or Associates Beneficially Owns, directly or indirectly;

(ii) which such Person or any of such Person’s Affiliates or Associates, directly or indirectly, has (A) the right to acquire (whether such right is exercisable immediately or only upon the occurrence of certain events, or after the passage of time, or both) pursuant to any agreement, arrangement or understanding, whether written or oral (other than customary agreements with and between underwriters and selling group members with respect to a bona fide public offering of securities), or upon the exercise of conversion rights, exchange rights, rights (other than the Rights), warrants or options, or otherwise; provided, however, that a Person shall not be deemed to be the Beneficial Owner of, or to Beneficially Own, securities tendered pursuant to a tender or exchange offer made by or on behalf of such Person or any of such Person’s Affiliates or Associates until such tendered securities are accepted for purchase or exchange; (B) the sole or shared right to vote or dispose of (including any such right pursuant to any agreement, arrangement or understanding, whether written or oral); provided, however, that a Person shall not be deemed the Beneficial Owner of, or to Beneficially Own, any security if the agreement, arrangement or understanding to vote such security (1) arises solely from a revocable proxy or consent given to such Person in response to a public proxy or consent solicitation made pursuant to, and in accordance with, the applicable rules and regulations promulgated under the Exchange Act, (2) is not also then reportable on Schedule 13D under the Exchange Act (or any comparable or successor report), and (3) does not constitute a trust, proxy, power of attorney or other device with the purpose or effect of allowing two or more persons, Acting in Concert, to avoid being deemed to be Beneficial Owners of such security or otherwise avoid the status of “Acquiring Person” under the terms of this Agreement or as part of a plan or scheme to evade the reporting requirements under Schedule 13D or Sections 13(d) or 13(g) of the Exchange Act; or (C) “beneficial ownership” of as determined pursuant to Rule 13d-3 of the General Rules and Regulations under the Exchange Act;

3

(iii) which are Beneficially Owned, directly or indirectly, by any other Person (or any Affiliate or Associate thereof) which is Acting in Concert with such Person or any of such Person’s Affiliates or Associates, or with which such Person or any of such Person’s Affiliates or Associates is Acting in Concert or has any agreement, arrangement or understanding (other than customary agreements with and between underwriters and selling group members with respect to a bona fide public offering of securities) (A) for the purpose of acquiring, holding, voting (except to the extent contemplated by the proviso to clause (B) of subparagraph (ii) of this definition of Beneficial Owner) or disposing of any securities of the Company or (B) to obtain control of, or to exercise a controlling influence over the management or policies of, the Company; or

(iv) which are the subject of a derivative transaction entered into by such Person (or any of Affiliate or Associate thereof), including, for these purposes, any derivative security acquired by such Person (or any Affiliate or Associate thereof) that gives such Person (or any Affiliate or Associate thereof) the economic equivalent of ownership of an amount of securities due to the fact that the value of the derivative security is explicitly determined by reference to the price or value of such securities, or that provides such Person (or any Affiliate or Associate thereof) an opportunity, directly or indirectly, to profit or to share in any profit derived from any change in the value of such securities, in any case without regard to whether (A) such derivative security conveys any voting rights in such securities to such Person (or any Affiliate or Associate thereof); (B) the derivative security is required to be, or capable of being, settled through delivery of such securities; or (C) such Person (or any Affiliate or Associate thereof) may have entered into other transactions that hedge the economic effect of such derivative security.

In determining the number of Common Shares that are Beneficially Owned by virtue of the operation of subparagraph (iv) of the above described definition of “Beneficial Owner”, the subject Person will be deemed to Beneficially Own (without duplication) the notional or other number of Common Shares that, pursuant to the documentation evidencing the derivative security, may be acquired upon the exercise or settlement of the applicable security or as the basis upon which the value or settlement amount of such security, or the opportunity of the holder of such derivative security to profit or share in any profit, is to be calculated, in whole or in part, and in any case (or if no such number of Common Shares is specified in such documentation or otherwise) as determined by the Board of Directors of the Company in good faith to be the number of Common Shares to which the derivative security relates.

“Acting in Concert” is defined in the Rights Agreement to mean knowing participation in a joint activity or parallel action towards a common goal, whether or not pursuant to an express written or oral agreement. A Person who or which is Acting in Concert with another Person will also be deemed to be Acting in Concert with any third party who is also Acting in Concert with such other Person.

Notwithstanding anything to the contrary in the definition of Beneficial Ownership in the Rights Agreement, the phrase “then outstanding,” when used with reference to the Beneficial Ownership of securities of the Company by any Person, means the number of such securities then issued and outstanding together with the number of such securities not then actually issued and outstanding which such Person would be deemed to own beneficially under the Rights Agreement definitions.

The Rights are not exercisable until the Distribution Date. The Rights will expire on the earlier of the Close of Business on September 10, 2029, unless such date is extended (the “Final Expiration Date”) or (ii) the redemption or exchange of the Rights as described below.

Flip-in Event

If a Person or group becomes an Acquiring Person at any time after the date of the Rights Agreement (with certain limited exceptions), each Right held by a Person other than the Acquiring Person, Affiliates or Associates of the Acquiring Person, or their respective transferees (with certain exceptions) will become exercisable for Common Shares having a value equal to two times the Purchase Price of the Right. From and after the announcement that any Person has become an Acquiring Person, if the Rights evidenced by a Right Certificate are or were acquired or Beneficially Owned by an Acquiring Person or any Associate or Affiliate of an

4

Acquiring Person, such Rights shall become void, and any holder of such Rights shall not thereafter be entitled to exercise them. If the Board of Directors so elects, the Company may deliver upon payment of the Purchase Price of a Right an amount of cash, securities, or other property equivalent in value to the Common Shares issuable upon exercise of a Right. If the Board of Directors so elects, the Company may also permit the Rights to be exercised for 50% of the Common Shares (or cash, securities or other property) that would otherwise be purchasable upon such exercise in consideration of surrender to the Company of the Rights so exercised and without payment of the Purchase Price.

Exchange

At any time after any Person becomes an Acquiring Person, but prior to the acquisition by the Acquiring Person of 50% or more of the Common Shares then outstanding, the Board of Directors may exchange the Rights (other than Rights owned by any Person which have become void), in whole or in part, at an exchange ratio of one Common Share per Right (subject to adjustment). In certain circumstances, the Company may elect to exchange the Rights for cash or other securities of the Company having a value equal to one Common Share, subject to payment of cash in lieu of the issuance of fractional shares.

Flip-over Event

If, at any time after a Person becomes an Acquiring Person, (i) the Company consolidates with, or merges with, any other Person (or any Person consolidates with, or merges with, the Company) and, in connection with such consolidation or merger, all or part of the Common Shares are or will be changed into or exchanged for stock or other securities of any other Person or cash or any other property; or (ii) the Company sells 50% or more of its consolidated assets or earning power (as defined in the Rights Agreement), then proper provision will be made so that each holder of a Right will thereafter have the right to receive, upon exercise thereof at the then current Purchase Price of the Right, that number of shares of common stock of the acquiring company which at the time of such transaction will have a market value equal to two times the then current per share market price of the common stock of the acquiring company.

Redemption

At any time prior to the time any Person becomes an Acquiring Person, the Board of Directors may redeem the Rights in whole, but not in part, at a price of $0.001 per Right (the “Redemption Price”). The redemption of the Rights by the Company may be made effective at such time, on such basis and with such conditions as the Board of Directors in its sole discretion may establish. The Company may, at its option, pay the Redemption Price in cash, Common Shares (based on the current per share market price of the Common Shares at the time of redemption) or any other form of consideration deemed appropriate by the Board of Directors. Immediately on any redemption of the Rights, the right to exercise the Rights will terminate and the only right of the holders of Rights will be to receive the Redemption Price.

Amendment

The terms of the Rights may be amended by the Board of Directors without the consent of the holders of the Rights (including, without limitation, to change the Purchase Price or the Final Expiration Date), except that from and after such time as any Person becomes an Acquiring Person no such amendment may adversely affect the interests of the holders of the Rights.

5

Anti-Dilution Provisions

The Board of Directors may adjust the Purchase Price, the number of Preferred Shares issuable and the number of outstanding Rights to prevent dilution that may occur from a stock dividend, a stock split or a reclassification of the Preferred Shares or Common Shares.

With certain exceptions, no adjustments to the Purchase Price will be made until the cumulative adjustments amount to at least 1% of the Purchase Price. No fractional Preferred Shares will be issued, other than fractions which are integral multiples of one one-thousandths of a Preferred Share and, in lieu thereof, an adjustment in cash may be made by the Company based on the current market price of the Preferred Shares, which market price will be determined on the basis of the current market price of the Common Shares if the Preferred Shares are not then publicly traded.

Rights of Holders

Until a Right is exercised, the holder thereof, as such, will have no rights as a stockholder of the Company, including, without limitation, the right to vote or to receive dividends.

Preferred Stock Rights

Each one one-thousandth of a Preferred Share will entitle the holder thereof to the same dividends and liquidation rights as the holder held one Common Share and will be treated the same as a Common Share in the event of a merger, consolidation or other share exchange.

Item 3.03. Material Modifications to Rights of Security Holders.

The information set forth in Items 1.01 and 5.03 of this Current Report on Form 8-K is incorporated herein by reference.

Item 5.03. Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

In connection with the adoption of the Rights Agreement, on September 11, 2019, the Company filed a Certificate of Designation, Preferences and Rights of Series B Junior Participating Preferred Stock, $0.01 par value (the “Certificate of Designation”), with the Secretary of State of the State of Delaware. The Certificate of Designation sets forth the rights, powers, and preferences of the Preferred Shares.

The summary of the rights, powers, and preferences of the Preferred Shares set forth in Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 5.03. A copy of the Certificate of Designation is attached hereto as Exhibit 3.1 and is incorporated herein by reference.

Item 8.01. Other Events.

On September 11, 2019, the Company issued a press release announcing the Rights Agreement and the declaration of the dividend of the Rights. A copy of the press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

6

Item 9.01. Exhibits.

(d) Exhibits

|

Exhibit

No.

|

|

Description of Exhibit

|

|

3.1

|

|

Certificate of Designation, Preferences and Rights of Series B Junior Participating Preferred Stock, $0.01 par value, of Broadway Financial Corporation, as filed with the Secretary of State of the State of Delaware on September 11, 2019.

|

|

|

|

|

|

4.1

|

|

Rights Agreement, dated as of September 10, 2019, between Broadway Financial Corporation and Computershare Trust Company, N.A., as rights agent.

|

|

|

|

|

|

99.1

|

|

Press Release dated September 11, 2019.

|

7

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

BROADWAY FINANCIAL CORPORATION

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Brenda J. Battey

|

|

|

|

Name: Brenda J. Battey

|

|

|

|

Title: Chief Financial Officer

|

|

|

|

|

|

|

Date: September 11, 2019

|

|

|

|

8

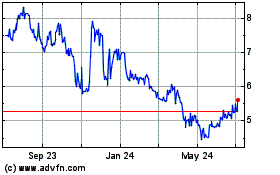

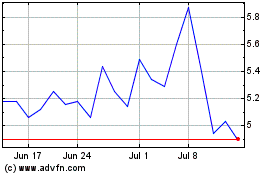

Broadway Financial (NASDAQ:BYFC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Broadway Financial (NASDAQ:BYFC)

Historical Stock Chart

From Apr 2023 to Apr 2024