Filed Pursuant to Rule 424(b)(4)

File No. 333-264809

| FINAL PROSPECTUS |

|

DATED MAY 13, 2022 |

3,434,103 Shares of Class A Common Stock

underlying a Warrant to Purchase Class A

Common Stock

This prospectus relates to

the proposed resale, from time to time, by the selling stockholder named in this prospectus or their permitted assigns of up to 3,434,103

shares of our Class A common stock, $0.0001 par value per share, issuable upon exercise of Class A common stock purchase warrants (the

“Warrants”).

We are not selling any shares

of Class A common stock under this prospectus and will not receive any proceeds from the sale of shares of common stock by the selling

security holders. To the extent the Warrants are exercised for cash, if at all, we will receive the exercise price of such Warrants; however,

we cannot predict when or if the Warrants will be exercised and it is possible that the Warrants may expire and never be exercised, or

they will be exercised cashlessly, in accordance with the terms of the Warrants, in which case we will not receive any cash proceeds.

The selling security holder will bear all commissions and discounts, if any, attributable to the sale of the shares of common stock. We

will bear all costs, expenses and fees in connection with the registration of the shares of Class A common stock issuable to the selling

stockholder upon the exercise of the Warrants.

The shares of Class A common

stock may be sold by the selling stockholder to or through underwriters or dealers, directly to purchasers or through agents designated

from time to time or through any other means described in tis prospectus. For additional information regarding the methods of sale you

should refer to the section of this prospectus entitled “Plan of Distribution” on page 13. Information concerning the selling

security holder is set forth under the section of this prospectus entitled “Selling Stockholder” on page 11.

We may amend or supplement

this prospectus from time to time by filing amendments or supplements as required. You should read the entire prospectus and any amendments

or supplements carefully before you make your investment decision.

Our Class A common stock

is listed on the Nasdaq Capital Market under the symbol “BOXL.” On May 6, 2022, the last reported sale price of our common

stock on the Nasdaq Stock Market was $1.07.

Investing in our securities

involves a high degree of risk. See “Risk Factors” on page 7 of this prospectus for a discussion of information that should

be considered in connection with an investment in our securities.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this

prospectus is May 13, 2022.

TABLE OF CONTENTS

You should rely only on the information contained

or incorporated by reference in this prospectus. We have not authorized any other person to provide you with different information. If

anyone provides you with different or inconsistent information, you should not rely on it. This prospectus may only be used where it is

legal to offer and sell shares of our common stock. If it is against the law in any jurisdiction to make an offer to sell these shares,

or to solicit an offer from someone to buy these shares, then this prospectus does not apply to any person in that jurisdiction, and no

offer or solicitation is made by this prospectus to any such person. You should assume that the information appearing in this prospectus

is accurate only as of the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or of any

sale of common stock. Our business, financial condition, results of operations and prospects may have changed since such date. Information

contained on our website is not a part of this prospectus.

ABOUT THIS PROSPECTUS

This prospectus is part of

a registration statement on Form S-3 that we filed with the U.S. Securities and Exchange Commission (the “SEC”). You should

read this prospectus and the information and documents incorporated by reference carefully. Such documents contain important information

you should consider when making your investment decision. See “Where You Can Find More Information” and “Incorporation

of Certain Information by Reference” in this prospectus.

This prospectus contains summaries

of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete

information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to

herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus

is a part, and you may obtain copies of those documents as described below under “Where You Can Find More Information.”

The distribution of this prospectus

and the sale of the shares in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession

of this prospectus must inform themselves about, and observe any restrictions relating to, the distribution of this prospectus and the

sale of the shares outside the United States. This prospectus does not constitute, and may not be used in connection with, an offer to

sell, or a solicitation of an offer to buy, the shares by any person in any jurisdiction in which it is unlawful for such person to make

such an offer or solicitation.

We have not authorized any

other person to provide you with different information. If anyone provides you with different or inconsistent information, you should

not rely on it. You should assume that the information appearing in this prospectus is accurate as of the date of filing only and that

any information incorporated by reference is accurate only as of the date of the document incorporated by reference, unless we indicate

otherwise. Our business, financial condition, results of operations and prospects may have changed since those dates.

Unless the context requires

otherwise or unless otherwise indicated, all references to “Boxlight,” “BOXL,” the “Company,” “we,”

“us” or “our” refers to Boxlight Corporation.

PROSPECTUS SUMMARY

This

summary highlights certain information about us, this offering, and selected information contained in this elsewhere or incorporated by

reference into this prospectus. This summary is not complete and does not contain all of the information that you should consider before

deciding whether to invest in our common stock. For a more complete understanding of our company and this offering, we encourage you to

read and consider the more detailed information included in or incorporated by reference into this prospectus, including “Risk Factors”

and the financial statements and related notes. Please see the sections titled “Where You Can Find More Information” and “Incorporation

of Certain Information by Reference” in this prospectus. Unless we specify otherwise, all references in this prospectus

to “Boxlight” “we,” “our,” “us” and the “Company” refer to Boxlight Corporation.

and our subsidiaries.

Company Overview

Boxlight Corporation is seeking

to become a world leading innovator and integrator of interactive products and software for schools, education, business, and government

interactive spaces. We currently design, produce and distribute interactive displays, collaboration software, supporting accessories and

professional services. We also distribute science, technology, engineering, and math (or “STEM”) products, including our robotics

and coding system, 3D printing solution and portable science lab. Our products are integrated into our software suite that provides tools

for presentation creation and delivery, assessment, and collaboration.

To date, we have generated

substantially all of our revenue from the sale of our hardware (primarily consisting of interactive displays) and software to the educational

market in the United States and Europe.

We have also implemented a

comprehensive plan to reach and maintain profitability both from our core business operations and as a result of making strategic business

acquisitions. Highlights of our plan include:

| |

● |

Integrating products of the acquired companies and cross training our sales reps to increase their offerings and productivity. |

| |

|

|

| |

● |

Hiring new sales representatives with significant industry experience in their respective territories. |

| |

|

|

| |

● |

Expanding our reseller partner network both in key territories and in new markets, thereby increasing our penetration and reach. |

Recent Acquisitions

On December 31, 2021,

the Company acquired 100% of the membership interests of FrontRow Calypso, LLC, a Delaware corporation (“FrontRow”), from

the FrontRow equity holders, Phonic Ear Inc. and Calypso Systems LLC (the “FrontRow Equityholders”). As consideration for

the acquisition, the Company paid the FrontRow Equityholders $34.7 million in cash. Based in Petaluma, California, FrontRow produces technology

that improves communication in learning environments, including developing network-based solutions for intercom, paging, bells, mass notification,

classroom sound, lesson sharing, AV control and management.

For further information about

our acquisition of FrontRow, see our Current Report on Form 8-K dated January 5, 2022.

On March 23, 2021, the

Company acquired 100% of the outstanding shares of Interactive Concepts BV, a company incorporated and registered in Belgium and a distributor

of interactive technologies (“Interactive”), for total consideration of approximately $3.3 million in cash, common stock and

deferred consideration. Interactive has been the Company’s key distributor in Belgium and Luxembourg.

On September 24, 2020,

the Company acquired Sahara Presentation Systems PLC, a leader in distributed and manufactured AV solutions (“Sahara”). Headquartered

in the United Kingdom, Sahara is a leader in distributed AV products and a manufacturer of multi-award-winning touchscreens and digital

signage products under its globally renowned Clevertouch brand. In consideration for the acquisition, the Company paid to the shareholders

of Sahara a total purchase price of GBP 74.0 million (approximately USD $94.9 million) in the form of GBP 52.0 million (approximately

USD $66.7 million) in cash and GBP 22.0 million (approximately USD $28.2 million) in our Series B convertible preferred stock and

our Series C convertible preferred stock.

For further information about

our acquisitions of Interactive Concepts and Sahara, see our Annual Report on Form 10-K for the year ended December 31, 2021 and our Current

Report on Form 8-K dated September 25, 2020.

Acquisition Strategy

and Challenges

Our growth strategy includes

acquiring assets and technologies of companies that have products, technologies, industry specializations or geographic coverage that

extend or complement our existing business. The process to undertake a potential acquisition is time-consuming and costly. We expect to

expend significant resources to undertake business, financial and legal due diligence on our potential acquisition targets, and there

is no guarantee that we will complete any acquisition that we pursue.

We believe we can achieve

significant cost-savings by merging the operations of the companies we acquire and after their acquisition leverage the opportunity to

reduce costs through the following methods:

| |

● |

Staff reductions – consolidating resources, such as accounting, marketing, and human resources. |

| |

|

|

| |

● |

Economies of scale – improved purchasing power with a greater ability to negotiate prices with suppliers. |

| |

|

|

| |

● |

Improved market reach and industry visibility – increase in customer base and entry into new markets. |

We pride ourselves in providing

industry-leading service and support and have received numerous product awards, including the following:

We pride ourselves in providing

industry-leading service and support and have received numerous product awards:

| • | In

2021, Boxlight received Tech & Learning's 2021 Awards of Excellence - Best Tools for Back to School, in both Primary and

Secondary levels for: MimioConnect® blended learning platform, MimioSTEM solutions, Boxlight-EOS Professional Development Learning

Solutions, and our ProColor interactive flat panel. Clevertouch was awarded for Best Business Growth and Corporate Social Responsibility

by InAVation Awards and 4 AV Awards for Product, Manufacturer, Distributor, and Channel Team of the Year. |

| • | In

2020, UX Pro won Collaboration Innovation of the Year from AV News Awards, Best in Show for InfoComm Awards, AvTechnology Europe,

and “Best of Show” at ISE. IMPACT Plus won Innovation Design, high-quality, functionality, ergonomics and ecology from Plus

X Awards in Germany, Collaboration Innovation from AV News Awards, Best in Show at InfoComm from Tech & Learning magazine, Best

at Show at InfoComm from Installation magazine and best at ISE Show from Installation. |

| • | In

2019, Clevertouch won Interactive Display of the Year at AV Magazine’s AV Awards, Keiba Awards, Best of Show from Installation

and best of Show for IMPACT Plus at Best of Show Tech&Learning awards, as well as the Pro Series Technology for Conferencing

and Collaboration at the Innovation Awards, and the AV Display Innovation of the Year at the AV News Awards. |

| • | In

2018, Clevertouch won Best in Show for InfoComm from Tech&Learning magazine and Collaboration Product of the Year for Plus Series,

as well as the Collaboration Product of the Year for Pro Series and Marketing Professional of the Year for Adam Kingshott. |

| • | In

2017, Clevertouch’s Plus Series won Interactive Screen of the year at AV Magazine’s AV Awards. Our MimioStudio

with MimioMobile was a BETT Awards finalist in the tools for teaching, learning and assessment area, our Labdisc product was named Best

of BETT 2017 for the Tech & Learning award, won the Best in Show at TCEA and our P12 Projector Series won the Tech &

Learning best in show award at ISTE in 2017, |

| • | In

2016, Clevertouch won Interactive Screen of the Year at AV Magazine’s AV Awards with Plus Series. Our MimioMobile App with

Mimio Studio Classroom Software won the 2016 Cool Tool Award and we received the 2016 Award of Excellence for our MimioTeach at the 34th

Tech & Learning Awards of Excellence program honoring new and upgraded software. |

| • | In

2015, Clevertouch won manufacturer of the Year at AV Magazine’s AV Awards. |

Since the Company launched

its patented interactive projectors in 2007, we have sold them to public schools in the United States and in 49 other countries, as well

as to the Department of Defense International Schools, and in approximately 3,000 classrooms in 20 countries, including the Job Corp,

the Library of Congress, the Centers for Disease Control and Prevention, the Federal Emergency Management Agency, nine foreign governments

and the City of Moscow and numerous Fortune 500 companies, including Verizon, GE Healthcare, PepsiCo, First Energy, ADT, Motorola, First

Data and Transocean. In addition, we custom built 4,000 projectors for the Israeli Defense Forces.

The COVID-19 pandemic has

had a significant impact on economies worldwide, resulting in workforce and travel restrictions, and supply chain and production disruptions

across many sectors. While factors have had a significant impact on our supply chain, the financial performance of our business has actually

improved substantially since the pandemic started in 2020, has continued throughout 2021 and into 2022 as demand for our products and

solutions in the education, government and corporate sectors increased. Indeed, we believe that COVID-19 has actually accelerated the

move toward unified communications, thus creating greater demand for our products and solutions.

Our Portfolio

We currently offer products

within the following categories:

| • | Front-of-Class Display

(Mimio and Clevertouch Brands) |

| • | Educational

Software & Content (Mimio Connect, Lynx Whiteboard, Oktopus, Mimio Studio) |

| • | Peripherals

and Accessories |

| • | Professional

Development |

Boxlight Connected Classroom

are permutations of these products coming together to create a holistic integrated solution centered around the teacher and learners within

and outside the confines of the physical room.

Recent Developments

Acquisition of FrontRow Calypso, LLC

On

December 31, 2021, the Compamny and its wholly owned subsidiary, Boxlight, Inc. (“Boxlight”), consummated the acquisition

of 100% of the membership interests of FrontRow Calypso, LLC, a Delaware limited liability company (“FrontRow”). FrontRow

was acquired in exchange for payment of $34.7 million to Phonic Ear Inc. and Calypso Systems, LLC, the equity holders of FrontRow (the

“Equityholders”). The acquisition occurred pursuant to the terms of a membership interest purchase agreement, dated October

29, 2021 (the “Purchase Agreement”), between the Company, Boxlight, FrontRow and the Equityholders.

Whitehawk Credit Agreement

In

order to finance the acquisition of FrontRow, the Company and substantially all of its direct and indirect subsidiaries, including Boxlight

and FrontRow as guarantors, entered into a maximum $68.5 million term loan credit facility, dated December 31, 2021 (the “Credit

Agreement”), with Whitehawk Finance LLC, as lender (the “Lender”), and White Hawk Capital Partners, LP, as collateral

agent. Under the terms of the Credit Agreement, the Company received an initial term loan of $58.5 million on December 31, 2021 (the “Initial

Loan”) and was provided with a subsequent delayed draw facility of up to $10 million that may be provided for additional working

capital purposes under certain conditions (the “Delayed Draw”). The Initial Loan and Delayed Draw are collectively referred

to as the “Term Loans.” The proceeds of the Initial Loan were used to finance the Company’s acquisition of FrontRow,

pay off all indebtedness owed to our existing lenders, Sallyport Commercial Finance, LLC and Lind Global Asset Management, LLC, pay related

fees and transaction costs, and provide working capital. Of the Initial Loan, $8.5 million was subject to repayment on February 28, 2022,

with quarterly interest payments commencing March 31, 2022 and the $50.0 million remaining balance plus any Delayed Draw loans becoming

due and payable in full on December 31, 2025. The Term Loans will bear interest at the LIBOR rate plus 10.75%; provided that after

June 30, 2022, if the Company’s Senior Leverage Ratio (as defined in the Credit Agreement) is less than 2.25, the interest rate

would be reduced to LIBOR plus 10.25%. Such terms are subject to the Company maintaining a borrowing base in terms compliant with the

Credit Agreement.

In

conjunction with our receipt of the Initial Loan, we issued to the Lender (i) 528,169 shares of Class A common stock (the “Shares”),

which Shares were registered pursuant to our existing shelf registration statement on Form S-3 (SEC File No. 3330239939) on January 5,

2022, (ii) a warrant to purchase 2,043,291 shares of Class A common stock (subject to increase to the extent of 3% of any Series

B and Series C convertible preferred stock converted into Class A common stock), exercisable at $2.00 per share (the “Warrant”),

which Warrant is subject to adjustment on March 31, 2022 with respect to its exercise price based on the arithmetic volume weighted

average prices for the 30 trading days prior to March 31, 2022, in the event our stock is then trading below $2.00 per share and certain

customary anti-dilution adjustments, (iii) a 3% fee of $1,800,000, (iv) a $500,000 original issue discount and $50,000 in agency

fees, and (v) certain costs related to entering into the Credit Agreement and closing on the Initial Loan. In addition, we have agreed

to register for resale the shares issuable upon exercise of the Warrant. Effective March 31, 2022, the exercise price of the Warrant was

adjusted to $1.19 and the total number of shares of Class A common stock issuable upon exercise of the Warrant was increased to 3,434,103

shares in accordance with its terms.

The Company was unable

to repay $8.5 million of the Initial Loan on February 28, 2022. Following the Company’s receipt on March 29, 2022 of a Notice

of Events of Default and Reservation of Rights (the “Notice”) described below, on April 4, 2022, the Company, the Lender

and the Collateral Agent amended the Credit Agreement. The principal elements of the amendment included (a) an extension of time for

the Loan Parties to repay $8.5 million of the principal amount of the Initial Loan from February 28, 2022 to February 28, 2023, and

(b) forbearance on $3,500,000 of over advances to grant the Loan Parties until May 16, 2022 to allow the Company to come into

compliance with the borrowing base requirements set forth in the Credit Agreement. In such connection, the Loan Parties have

obtained credit insurance on certain key customers whose principal offices are located in the European Union and Australia as their

accounts owed to the Loan Parties had previously been deemed ineligible for inclusion in the borrowing base calculation primarily

due to the perceived inability of the Collateral Agent to enforce security interests on such accounts.

In addition, the Lender and

Collateral Agent agreed to (i) reduce, through June 30, 2022, the minimum cash reserve requirement for the Loan Parties, (ii) reduce the

interest rate by 50 basis points (to 9.75%) after delivery of the Loan Parties’ June 30, 2023 financial statements, subject to the

Loan Parties maintaining 1.75 EBITDA coverage ratio, and (iii) waive all prior Events of Default under the Credit Agreement.

The preceding summary is qualified

in its entirety by reference to the Credit Agreement, which is filed as Exhibit 10.1 to our Current Report on Form 8-K, dated January 5,

2022, and incorporated herein by reference, and the amendment to the Credit Agreement, which is filed as Exhibit 10.1 to our Current Report

on Form 8-K, dated April 4, 2022, and incorporated herein by reference.

Summary Risk Factors

Some of the factors that could

materially and adversely affect our business, financial condition, results of operations and cash flows include, but are not limited to,

the following:

| • | our

inability to predict or anticipate the duration or adapt to the long-term economic and business consequences related to the ongoing conflict

between Russia and the Ukraine, as well as the ongoing COVID-19 pandemic; |

| • | our

inability to predict or adapt to the unstable market and economic conditions of the global economy; |

| • | our

ability to continue to attract and retain customers; |

| • | our

ability to sell additional products and services to customers; |

| • | our

ability to raise funds in a timely fashion and successfully manage cash flow needs and financing plans; |

| • | our

ability to successfully maintain a competitive position in our industry and market; |

| • | our

ability to manage our business and sell our products within a changing and evolving industry environment; |

| • | our

ability to locate and leverage potential growth opportunities; |

| • | our

ability to achieve expected technological advances by us or by third parties and our ability to leverage them; |

| • | our

ability to integrate our business acquisitions fully and successfully into Boxlight’s existing business and platform; |

| • | the

effects of future regulation; and |

| • | our

ability to protect and monetize our intellectual property. |

For additional discussion of risk factors that

may affect our business, see “Risk Factors” on page 7 of this prospectus.

Corporate Information

We are a Nevada

corporation. Our principal executive/administrative offices are located at 2750 Premiere Parkway, Suite 900, Duluth, Georgia 30097,

and our telephone number is (678) 367-0809. Our website address is https://www.boxlight.com. Information on or accessed through our website

is not incorporated into this prospectus and is not a part of this prospectus.

The Offering

| Securities we are offering |

|

3,434,103 shares of Class A common stock issuable upon exercise of an outstanding Warrant. |

| |

|

|

| Shares of Class A Common stock outstanding before this offering (1) |

|

65,682,688 shares of Class A common stock. |

| |

|

|

| Shares of Class A Common stock outstanding after this offering, assuming exercise of the Warrant (1) |

|

69,116,791 shares of Class A common stock. |

| |

|

|

| Use of proceeds |

|

While we may receive some proceeds from the selling stockholder’s exercise of the Warrant (which may also be exercised cashlessly), we will not receive any proceeds from the shares of Class A common stock underlying the Warrant offered under this prospectus. For further information, see the “Use of Proceeds” section below. |

| |

|

|

| Nasdaq Capital Market Listing Symbol |

|

“BOXL” |

| |

|

|

| Risk factors |

|

See “Risk Factors” as well as other information included or incorporated by reference in this prospectus beginning on page 7 for a discussion of factors you should carefully consider before deciding to invest in our Class A common stock. |

| |

(1) |

The number of shares of our Class A common stock outstanding excludes: |

| |

● |

8,264,583 shares of Class A common stock issuable upon exercise of options and restricted stock units granted under Amendment No. 2 to the Boxlight Corporation 2014 Stock Incentive Plan (the “Plan”) and the Boxlight Corporation 2020 Incentive Plan, of which 2,939,869 shares were exercisable as of March 31, 2022 and 3,055,855 additional shares are reserved for issuance thereunder; and |

| |

|

|

| |

● |

70,000 shares of Class A

common stock issuable upon exercise of outstanding warrants with exercise prices of $0.70 per share, of which 60,000 shares were

exercisable as of March 31, 2022. |

RISK FACTORS

An investment in our securities

involves a number of risks. Before deciding to invest in our securities, you should carefully consider the risks described herein and discussed

under the section captioned “Risk Factors” contained in our Annual Report on Form 10-K for the year ended December 31, 2021,

as well as any subsequently filed Quarterly Report on Form 10-Q, which reports incorporated by reference in this prospectus, together

with the other information in this prospectus, and the information and documents incorporated by reference herein. If any of these risks

actually occurs, our business, financial condition, results of operations or cash flow could be harmed. This could cause the trading price

of our common stock to decline, resulting in a loss of all or part of your investment. The risks described in the documents referenced

above are not the only ones that we face. Additional risks not presently known to us or that we currently deem immaterial may also affect

our business.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains “forward-looking

statements.” Forward-looking statements reflect the current view about future events. When used in this prospectus, the words “anticipate,”

“believe,” “estimate,” “expect,” “future,” “intend,” “plan,” or

the negative of these terms and similar expressions, as they relate to us or our management, identify forward-looking statements. Such

statements include, but are not limited to, statements contained in this prospectus relating to our business strategy, our future operating

results and liquidity and capital resources outlook. You should not place undue reliance on forward-looking statements, because they involve

known and unknown risks, uncertainties and other factors, which are, in some cases, beyond our control and which could materially affect

our results. Forward-looking statements are based on our current expectations and assumptions regarding our business, the economy and

other future conditions. Because forward–looking statements relate to the future, they are subject to inherent uncertainties, risks

and changes in circumstances that are difficult to predict. No forward-looking statement is a guarantee of future performance. Our actual

results may differ materially from those contemplated by the forward-looking statements. They are neither statements of historical fact

nor guarantees of assurance of future performance. We caution you therefore against relying on any of these forward-looking statements.

You should read this prospectus and the documents that we reference herein and have filed as exhibits hereto with the Securities and Exchange

Commission, or the SEC, with the understanding that our actual future results and circumstances may be materially different from what

we expect.

Important factors that could

cause actual results to differ materially from those in the forward-looking statements include, without limitation, market acceptance

of our products; our ability to protect our intellectual property rights; the impact of any infringement actions or other litigation brought

against us; competition from other providers and products; our ability to develop and commercialize new and improved products and services;

our ability to complete capital raising transactions; and other factors (including the risks contained in the section of this prospectus

entitled “Risk Factors”) relating to our industry, our operations and results of operations. Actual results may differ significantly

from those anticipated, believed, estimated, expected, intended or planned.

Forward-looking statements

include statements concerning the following:

| |

● |

our possible or assumed future results of operations; |

| |

|

|

| |

● |

our business strategies; |

| |

|

|

| |

● |

our ability to attract and retain customers; |

| |

|

|

| |

● |

our ability to sell additional products and services to customers; |

| |

|

|

| |

● |

our cash needs and financing plans; |

| |

|

|

| |

● |

our competitive position; |

| |

|

|

| |

● |

our industry environment; |

| |

|

|

| |

● |

our potential growth opportunities; |

| |

|

|

| |

● |

expected technological advances by us or by third parties and our ability to leverage them; |

| |

|

|

| |

● |

our inability to predict or anticipate the duration or long-term economic and business consequences of the ongoing COVID-19 pandemic; |

| |

|

|

| |

● |

our inability to predict either the short or long-term economic effects of the ongoing war between Russia and the Ukraine, and the effects that the war may have on supply chains in the near or longer-term; |

| |

|

|

| |

● |

the effects of future regulation; and |

| |

|

|

| |

● |

our ability to protect or monetize our intellectual property. |

Forward-looking statements

are made based on management’s beliefs, estimates and opinions on the date the statements are made and we undertake no obligation

to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as may be required

by applicable law. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee

future results, levels of activity, performance or achievements.

USE OF PROCEEDS

All of the shares of our Class

A common stock offered by this prospectus are being registered for the account of the selling stockholder. We will not receive any

of the proceeds from the sale of these shares. We have agreed to pay all costs, expenses and fees relating to the registration of the

shares of our common stock covered by this prospectus. The selling stockholder will bear all commissions and discounts, if any, attributable

to the sale of the shares.

We may, however, receive cash

proceeds equal to the exercise price of the Warrants that the selling stockholder may exercise, to the extent any such Warrants are exercised

for cash. We expect to use any proceeds received by us from the cash exercise of these Warrants for general corporate purposes.

We cannot predict when or

if these Warrants will be exercised, and it is possible that these Warrants may expire and never be exercised. The Warrants are exercisable

under certain circumstances on a cashless basis and if the Warrants are exercised on a cashless basis we will not receive any proceeds

from the exercise of the Warrants. As a result, we may never receive meaningful, or any, cash proceeds from the exercise of these Warrants,

and we cannot plan on any specific uses of any proceeds we may receive beyond the purposes described herein.

SELLING

STOCKHOLDER

This prospectus covers the

sale from time to time by the selling stockholder or by any of its pledgees, donees, transferees or other successors-in-interest of up

to an aggregate of 3,434,103 shares of Class A common stock issuable upon exercise of a warrant (the “Warrant”). As used in

this prospectus, the term “selling stockholder” includes the selling stockholder identified below and any donees, pledgees,

transferees or other successors-in-interest selling shares received after the date of this prospectus from the selling stockholder as a

gift, pledge or other non-sale related transfer.

The Warrant was issued to

the selling stockholder, Whitehawk Finance, LLC, a Delaware limited lability company (“Whitehawk”), in conjunction with our

entry into a $58.5 million credit agreement (the “Credit Agreement”) with Whitehawk and its affiliates on December 31, 2021.

The Warrant is exercisable for $1.19 per share, subject to certain customary anti-dilution adjustments, expires on December 31, 2026,

and is subject to certain registration rights, pursuant to which we agreed to file a registration statement with the SEC to register for

resale by Whitehawk the shares of our Class A common stock issuable upon exercise of this Warrant. We are required to use reasonable best

efforts to have such registration statement declared effective by the SEC as soon as practicable after the filing thereof. In accordance

with our agreement with Whitehawk, we are obligated to obtain effectiveness of this registration statement by no later than July 31, 2022,

or as late as August 15, 2022, in the event this registration statement is subject to SEC review.

The table below lists the selling stockholder and

other information regarding the beneficial ownership of the shares of Class A common stock held by the selling stockholder. The second

column lists the number of shares of Class A common stock beneficially owned by the selling stockholder based on its ownership of shares

of Class A common stock and Warrants as of May 6, 2022.

Beneficial

ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to the securities.

The percentages set forth below are based on 65,682,688 shares of Class A common stock outstanding as of May 6, 2022. Neither

the selling stockholder nor any of their respective affiliates has held a position or office, or had any other material relationship,

with us or any of our predecessors or affiliates. Beneficial ownership is determined in accordance with Section 13(d) of the Exchange

Act and Rule 13d-3 thereunder.

The shares of Class A common

stock being offered under this prospectus may be offered for sale from time to time during the period the registration statement of which

this prospectus is a part remains effective, by or for the accounts of the selling stockholder listed below or by any of its pledgees,

donees, transferees or other successors-in-interest.

| Name of | |

Shares of

Common Stock

Beneficially

Owned

Prior to | | |

Maximum

Number of shares

of Common Stock

to be Sold

Pursuant to this | | |

Shares of

Common Stock

Beneficially Owned

After Offering(1) | |

| Beneficial Owner | |

Offering | | |

Prospectus | | |

Number | | |

Percentage | |

| Whitehawk Capital Finance, LLC | |

| 3,962,264 | (1) | |

| 3,434,103 | | |

| 528,161 | | |

| * | % |

| (*) |

Indicates beneficial ownership of less than 1%.

(1)

Consists of 528,161 shares of Class A common stock and a warrant to purchase 3,434,103 shares of Class A common stock. |

Transfer Agent and Registrar

The transfer agent and registrar

for our common stock is V Stock Transfer LLC.

Listing

The shares of our common stock

are listed on The Nasdaq Capital Market under the symbol “BOXL.” On May 6, 2022, our last reported sale price per share for

our common stock as reported on The Nasdaq Capital Market was $1.07.

PLAN OF DISTRIBUTION

The selling stockholder may,

from time to time, sell, transfer or otherwise dispose of any or all of their shares of Class A common stock or interests in shares of

Class A common stock on any stock exchange, market or trading facility on which the shares are traded or in private transactions. These

dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price,

at varying prices determined at the time of sale, or at negotiated prices.

The selling stockholder may

use any one or more of the following methods when disposing of shares or interests therein:

| • | ordinary brokerage transactions and transactions in which the

broker-dealer solicits purchasers; |

| • | block trades in which the broker-dealer will attempt to sell the shares as agent, but may position and

resell a portion of the block as principal to facilitate the transaction; |

| • | purchases by a broker-dealer as principal and resale by the

broker-dealer for its account; |

| • | an exchange distribution in accordance with the rules of the applicable exchange; |

| • | privately negotiated transactions; |

| • | short sales effected after the date the registration statement of which this prospectus is a part is declared

effective by the SEC; |

| • | through the writing or settlement of options or other hedging transactions, whether through an options

exchange or otherwise; |

| • | broker-dealers may agree with the Selling Stockholders to sell a specified number of such shares at a

stipulated price per share; |

| • | directly to one or more purchasers; |

| • | through one or more underwriters on a firm commitment or best-efforts basis; |

| • | transactions in which a broker-dealer solicits purchasers on a best efforts basis; |

| • | a combination of any such methods of sale; and |

| • | any other method permitted by law. |

The selling stockholder may,

from time to time, pledge or grant a security interest in some or all of the shares of Class A common stock owned by them and, if they

default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the shares of Class A common

stock, from time to time, under this prospectus, or under an amendment to this prospectus under Rule 424(b)(3) or other applicable provision

of the Securities Act amending the list of selling stockholders to include the pledgee, transferee or other successors in interest as

selling stockholders under this prospectus. The selling stockholder also may transfer the shares of Class A common stock in other circumstances,

in which case the transferees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

In connection with the sale

of our common stock or interests therein, the selling stockholder may enter into hedging transactions with broker-dealers or other financial

institutions, which may in turn engage in short sales of the common stock in the course of hedging the positions they assume. The selling

stockholder may also sell shares of our Class A common stock short and deliver these securities to close out their short positions, or

loan or pledge the common stock to broker-dealers that in turn may sell these securities. The selling stockholder may also enter into

option or other transactions with broker-dealers or other financial institutions or the creation of one or more derivative securities

which require the delivery to such broker-dealer or other financial institution of shares offered by this prospectus, which shares such

broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The aggregate proceeds to

the selling stockholder from the sale of the Class A common stock offered by them will be the purchase price of the Class A common stock

less discounts or commissions, if any. The selling stockholder reserves the right to accept and, together with its agents from time to

time, to reject, in whole or in part, any proposed purchase of Class A common stock to be made directly or through agents. We will not

receive any of the proceeds from this offering.

The selling stockholder may

also resell all or a portion of the shares in open market transactions in reliance upon Rule 144 under the Securities Act, provided that

they meet the criteria and conform to the requirements of that rule.

The selling stockholder and

any underwriters, broker-dealers or agents that participate in the sale of the common stock or interests therein may be “underwriters”

within the meaning of Section 2(11) of the Securities Act. Any discounts, commissions, concessions or profit they earn on any resale of

the shares may be underwriting discounts and commissions under the Securities Act. The selling stockholder will be subject to the prospectus

delivery requirements of the Securities Act, unless an exemption therefrom is available.

In order to comply with the

securities laws of some states, if applicable, the Class A common stock may be sold in these jurisdictions only through registered or

licensed brokers or dealers. In addition, in some states the Class A common stock may not be sold unless it has been registered or qualified

for sale or an exemption from registration or qualification requirements is available and is complied with.

We have advised the selling

stockholder that the anti-manipulation rules of Regulation M under the Exchange Act may apply to sales of shares in the market and to

the activities of the selling stockholder and its affiliates. In addition, to the extent applicable we will make copies of this prospectus

(as it may be supplemented or amended from time to time) available to the selling stockholder for the purpose of satisfying any prospectus

delivery requirements of the Securities Act. The selling stockholder may indemnify any broker-dealer that participates in transactions

involving the sale of the shares against certain liabilities, including liabilities arising under the Securities Act.

We will pay all expenses of

the registration of the shares of common stock. The selling stockholder will pay any and all of their respective underwriting discounts

and selling commissions.

We have agreed with the Selling

Stockholder to keep the registration statement of which this prospectus constitutes a part effective until such time as all of the shares

of Class A common stock issuable upon exercise of the Warrant covered by this prospectus have been sold or disposed of pursuant to and

in accordance with the registration statement.

LEGAL MATTERS

The legality of the securities

offered hereby has been passed on for us by Michelman & Robinson, LLP, Los Angeles, California and New York, New York.

EXPERTS

The consolidated financial

statements as of and for the years ended December 31, 2021 and 2020 incorporated by reference in this Registration Statement on Form S-3

have been so incorporated in reliance on the report of Dixon Hughes Goodman LLP, an independent registered public accounting firm which

prepared the report for the years ended December 31, 2021 and 2020, which is also incorporated by reference, given on the authority of

said firm as an expert in auditing and accounting.

WHERE YOU CAN FIND MORE INFORMATION

We file quarterly and current

reports, proxy statements, and other information with the SEC. The SEC maintains a website that contains these reports, proxy and information

statements, and other information we file electronically with the SEC. Our filings are available free of charge at the SEC’s website

at www.sec.gov.

You

can obtain copies of any of the documents incorporated by reference in this prospectus from us, or as described above, through the SEC’s

website. Documents incorporated by reference are available from us, without charge, excluding all exhibits unless specifically incorporated

by reference in the documents. You may obtain documents incorporated by reference in this prospectus by writing to us at the following

address Boxlight Corporation, 2750 Premiere Parkway, Suite 900, Duluth, GA 30097, by emailing us at investor.relations@boxlight.com,

or by calling us at (678) 367-0809. We also maintain a website, https://investors.boxlight.com/financial-information/sec-filings/default.aspx,

through which you can obtain copies of the documents that we have filed with the SEC. We use our website as a channel of distribution

for material company information. Important information, including financial information, analyst presentations, financial news releases,

and other material information about us is routinely posted on and accessible at https://investors.boxlight.com/corporate-profile/default.aspx.

The information set forth on, or accessible from, our website is not part of this prospectus.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate

by reference” the information we have filed with the SEC, which means that we can disclose important information to you without

actually including the specific information in this prospectus by referring you to those documents. The information incorporated by reference

is an important part of this prospectus and later information that we file with the SEC will automatically update and supersede this information.

Therefore, before you decide to invest in the shares of common stock offered by this prospectus, you should always check for reports we

may have filed with the SEC after the date of this prospectus. The following documents previously filed with the SEC are incorporated

by reference in this prospectus:

| |

● |

our Annual Report on Form 10-K for the fiscal year ended December 31, 2021, filed with the SEC on April 13, 2022; |

| |

|

|

| |

● |

our Current Reports on Form 8-K (other than information furnished rather than filed) as filed with the SEC on January 5, 2022, February 18, 2022, March 17, 2022, March 17, 2022, April 4, 2022 and April 11, 2022; |

| |

|

|

| |

● |

the description of our common stock contained in our Registration Statement on Form 8-A/A, filed with the SEC on November 17, 2015, including any amendments or reports filed for the purpose of updating such description. |

All future documents filed

by us with the SEC pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act (other than portions of these documents that are

deemed to have been furnished and not filed in accordance with SEC rules, including current reports on Form 8-K furnished under Item 2.02

and Item 7.01 and any exhibits related thereto furnished under Item 9.01, unless such Form 8-K expressly provides to the contrary) after

the date of the initial filing of the registration statement and prior to effectiveness of the registration statement and after the date

of this prospectus and prior to termination of the offering under this prospectus shall be deemed to be incorporated in this prospectus

by reference and to be a part hereof from the date of filing of such documents.

Any statement contained in

a document incorporated or deemed to be incorporated by reference in this prospectus will be deemed to be modified or superseded to the

extent that a statement contained herein or in any other subsequently filed document that also is or is deemed to be incorporated by reference

in this prospectus modifies or supersedes that statement. Any statement so modified or superseded will not be deemed, except as so modified

or superseded, to constitute a part of this prospectus.

We undertake to provide without

charge to any person, including any beneficial owner, to whom a copy of this prospectus is delivered, upon oral or written request of

such person, a copy of any or all of the documents that have been incorporated by reference in this prospectus, excluding any exhibits

to those documents unless the exhibit is specifically incorporated by reference as an exhibit in this prospectus. You should direct requests

for documents to us at the following address: 2750 Premier Parkway, suite 900, Duluth, GA 30097, Attention: Investor Relations, by emailing

us at investor.relations@boxlight.com, or by calling us at 866-972-1549.

3,434,103 Shares

of

Class A Common Stock

___________________

PROSPECTUS

___________________

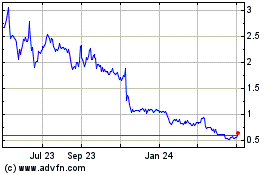

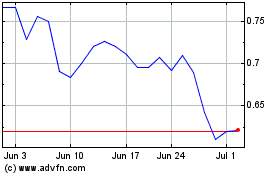

Boxlight (NASDAQ:BOXL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Boxlight (NASDAQ:BOXL)

Historical Stock Chart

From Apr 2023 to Apr 2024