PROSPECTUS SUPPLEMENT

| (To Prospectus dated November 2, 2020) |

Filed Pursuant to Rule 424(b)(5) |

| |

Registration No. 333-249597 |

B.O.S. BETTER ONLINE SOLUTIONS LTD.

450,000 Ordinary Shares

Warrants to Purchase 225,000 Ordinary Shares

We are offering to certain

investors, pursuant to this prospectus supplement and the accompanying base prospectus, up to an aggregate of 450,000 of our ordinary

shares, no par value per share (the “Ordinary Shares”), together with warrants, exercisable for a period of five years

from the closing date, to purchase an aggregate of 225,000 Ordinary Shares, at an exercise price $2.20 per share. The Ordinary Shares

and the warrants will be issued in units consisting of one Ordinary Share and one-half warrant, which will be immediately detachable.

The purchase price for each Ordinary Share and each accompanying one-half warrant is $2.20. This prospectus supplement also relates to

the offering of Ordinary Shares upon any exercise of the warrants issued in this offering.

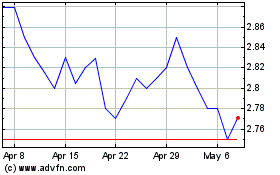

Our Ordinary Shares are traded

on the NASDAQ Capital Market under the symbol “BOSC”. On April 29, 2022, the last reported sale price of our Ordinary Shares

on the NASDAQ Capital Market was $2.20 per share. You are urged to obtain current market quotations for the Ordinary Shares. There is

no established public trading market for the warrants, and we do not expect a market to develop. In addition, we do not intend to apply

for a listing of the warrants on any national securities exchange.

As of the date of this prospectus

supplement, the aggregate market value of our outstanding Ordinary Shares held by non-affiliates was approximately $13.69 million based

on 5,251,518 outstanding Ordinary Shares, of which 4,360,077 are held by non-affiliates, and a per share price of $3.14, which was the

last reported price on the Nasdaq Capital Market of our Ordinary Shares on March 29, 2022. We have not offered any securities pursuant

to General Instruction I.B.5. of Form F-3 during the prior 12-month period that ends on and includes the date of this prospectus supplement.

Investing in our securities

involves a high degree of risk. Before buying any of our securities, you should carefully read “Risk Factors” on page S-4

of this prospectus supplement and under similar headings in the other documents that are incorporated by reference into this prospectus

supplement and the accompanying prospectus.

NEITHER THE SECURITIES

AND EXCHANGE COMMISSION NOR ANY OTHER REGULATORY BODY HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ACCURACY OR ADEQUACY

OF THIS REGISTRATION STATEMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus supplement is May 2,

2022.

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

You should rely only on the

information contained or incorporated by reference in this prospectus supplement and prospectus. We have not authorized any other person

to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it.

We are not, and any underwriter or agent is not, making an offer to sell these securities in any jurisdiction where the offer or sale

is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover

of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

ABOUT THIS PROSPECTUS SUPPLEMENT

On October 22, 2020, we filed

with the SEC a registration statement on Form F-3 (File No. 333-249597) utilizing a shelf registration process relating to the securities

described in this prospectus supplement, which registration statement was declared effective on November 2, 2020. Under this shelf registration

process, we may, from time to time, sell up to $10 million in the aggregate of Ordinary Shares, warrants and units, of which approximately

$4.4 million will remain available for sale following the offering and as of the date of this prospectus supplement.

This document is in two parts.

The first part is this prospectus supplement, which describes the specific terms of this offering and also adds to and updates information

contained in the accompanying prospectus and the documents incorporated by reference into the prospectus. The second part, the accompanying

prospectus, gives more general information, some of which does not apply to this offering. You should read this entire prospectus supplement

as well as the accompanying prospectus and the documents incorporated by reference that are described under “Where You Can Find

More Information” and “Incorporation of Certain Documents by Reference” in this prospectus supplement and the accompanying

prospectus.

If the description of the

offering varies between this prospectus supplement and the accompanying prospectus, you should rely on the information contained in this

prospectus supplement. However, if any statement in one of these documents is inconsistent with a statement in another document having

a later date – for example, a document incorporated by reference in this prospectus supplement and the accompanying prospectus –

the statement in the document having the later date modifies or supersedes the earlier statement. Except as specifically stated, we are

not incorporating by reference any information submitted under any Current Report on Form 6-K into any filing under the Securities Act

of 1933, as amended, or the Securities Act, or the Securities Exchange Act of 1934, as amended, or the Exchange Act, into this prospectus

supplement or the accompanying prospectus.

Any statement contained in

a document incorporated by reference, or deemed to be incorporated by reference, into this prospectus supplement or the accompanying prospectus

will be deemed to be modified or superseded for purposes of this prospectus supplement or the accompanying prospectus to the extent that

a statement contained herein, therein or in any other subsequently filed document which also is incorporated by reference in this prospectus

supplement or the accompanying prospectus modifies or supersedes that statement. Any such statement so modified or superseded will not

be deemed, except as so modified or superseded, to constitute a part of this prospectus supplement or the accompanying prospectus.

We further note that the representations,

warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference in

this prospectus supplement and the accompanying prospectus were made solely for the benefit of the parties to such agreement, including,

in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation,

warranty or covenant to you unless you are a party to such agreement. Moreover, such representations, warranties or covenants were accurate

only as of the date when made or expressly referenced therein. Accordingly, such representations, warranties and covenants should not

be relied on as accurately representing the current state of our affairs unless you are a party to such agreement.

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This prospectus supplement,

the accompanying prospectus and the documents we have filed with the SEC that are incorporated herein by reference contain forward-looking

statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. Forward-looking statements deal

with our current plans, intentions, beliefs and expectations and statements of future economic performance. Statements containing terms

such as “believe,” “do not believe,” “plan,” “expect,” “intend,” “estimate,”

“anticipate” and other phrases of similar meaning are considered to contain uncertainty and are forward-looking statements.

In addition, from time to time we or our representatives have made or will make forward-looking statements orally or in writing. Furthermore,

such forward-looking statements may be included in various filings that we make with the SEC, or press releases or oral statements made

by or with the approval of one of our authorized executive officers. These forward-looking statements are subject to certain known and

unknown risks and uncertainties, as well as assumptions that could cause actual results to differ materially from those reflected in these

forward-looking statements. Factors that might cause actual results to differ include, but are not limited to, those set forth under “Item

3, Key Information Regarding BOS—D. Risk Factors” incorporated by reference in this prospectus supplement and those discussed

in “Item 5, Operating and Financial Review and Prospects,” in our Annual Report on Form 20-F for the fiscal year ended December

31, 2021 and in our future filings made with the SEC. Readers are cautioned not to place undue reliance on any forward-looking statements

contained in this prospectus supplement, the accompanying prospectus or the documents we have filed with the SEC that are incorporated

herein by reference, which reflect management’s opinions only as of their respective dates. Except as required by law, we undertake

no obligation to revise or publicly release the results of any revisions to any forward-looking statements. You are advised, however,

to consult any additional disclosures we have made or will make in our reports to the SEC on Forms 20-F and 6-K. All subsequent written

and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the

cautionary statements contained in this prospectus, any prospectus supplement or any related issuer free writing prospectus.

PROSPECTUS SUPPLEMENT SUMMARY

The following summary highlights

selected information contained or incorporated by reference in this prospectus supplement or the accompanying prospectus. This summary

does not contain all of the information you should consider before investing in the securities. Before making an investment decision,

you should read the entire prospectus and any supplement hereto carefully, including the risk factors section as well as the financial

statements and the notes to the financial statements incorporated herein by reference

Unless the context otherwise

requires, all references in this prospectus to “BOS,” “we,” “our,” “our company,” “us”

and the “Company” refer to B.O.S. Better Online Solutions Ltd. and its consolidated subsidiaries.

All references in this prospectus

to “Ordinary Shares” refer to our Ordinary Shares, of no nominal value per share.

All references in this prospectus

to “dollars” or “$” are to United States Dollars.

All references in this prospectus

to “shekels” or “NIS” are to New Israeli Shekels.

OUR COMPANY

We were incorporated in Israel

in 1990 and are subject to the Israeli Companies Law 1999 – 5759 (the “Israeli Companies Law”). Our executive offices,

shipping and service operations are located in Israel. Our address in Israel is 20 Freiman Street, Rishon LeZion, 75100, Israel.

Our address in the United

States is B.O.S. Better Online Solutions Ltd. c/o Ruby-tech, Inc. 147-20 184th St., Jamaica NY 11413, USA, telephone 508-655-2312

Our telephone number is 972-3-954-2000

and our website address is www.boscom.com. Our commercial websites are: Supply Chain Division - www.bossupplychain.com; Intelligent

Robotics Division – www.bosrobotics.com and RFID Division – www.bosrfid.com. The information contained on, or linked from,

our websites is not a part of this prospectus.

B.O.S is a global provider

of RFID (radio-frequency identification) and Robotic systems and of Supply Chain solutions to enterprises. BOS operates through three

business divisions:

| |

● |

Supply Chain Division – offers electro-mechanical components, mainly to customers in the aerospace, defense and other industries worldwide and a supply chain service provider for aviation customers that prefer to consolidate their component acquisitions through a supplier that is able to provide a comprehensive solution to their components-supply needs. |

| |

● |

RFID Division – offers comprehensive turn-key solutions for Automatic Identification and Data Collection (AIDC), combining a mobile infrastructure with software application of manufacturers that we represent. The division also offers on-site inventory count services in the fields of apparel, food, convenience and pharma, asset tagging and counting services for corporate and governmental entities. |

| |

● |

Intelligent Robotics Division - offers comprehensive technological solutions for increasing productivity in industrial and logistics processes. |

In January 2016, the Company

completed the acquisition of the assets of iDnext Ltd. and its subsidiary Next-Line Ltd., which offers on-site inventory count services

in the fields of apparel, food, convenience and pharma, and asset tagging and counting services for corporate and governmental entities.

In June 2019, the Company

acquired the business operations of Imdecol Ltd (“Imdecol”), in order to expand the Company’s technological capabilities

and exposure to international markets and take advantage of the increasing demand from manufacturers for improvements in the productivity

of their production lines.

In March

2022, the Company’s RFID division, BOS-Dimex, acquired the assets of Dagesh Inventory Counting and Maintenance Ltd., which provides

inventory counting services in Israel, mainly for retail stores.

THE OFFERING

| Issuer: |

|

BOS Better Online Solutions Ltd. |

| |

|

|

| Ordinary Shares offered by us pursuant to this prospectus supplement: |

|

450,000 of our ordinary shares, no par value per share (the “Ordinary Shares”), together with warrants, exercisable for a period of five years from the closing date, to purchase an aggregate of 225,000 Ordinary Shares, at an exercise price $2.20 per share. The Ordinary Shares and the warrants will be issued in units consisting of one Ordinary Share and one-half warrant, which will be immediately detachable. |

| |

|

|

| Ordinary Shares to be outstanding immediately after this offering (1): |

|

5,701,518 |

| |

|

|

| Warrants offered by us |

|

We are offering warrants to purchase up to 225,000 Ordinary Shares. Each Ordinary Share is being sold together with one-half of a warrant to purchase one Ordinary Share. Each warrant will have an exercise price per share of $2.20, will be immediately exercisable and will expire on May 3, 2027. This prospectus supplement also relates to the offering of the Ordinary Shares issuable upon exercise of such warrants. |

| |

|

|

| Use of proceeds: |

|

We intend to use the net proceeds from this offering for general corporate purposes. See “Use of Proceeds” on page S-7 of this prospectus supplement. |

| |

|

|

| Transfer agent and registrar: |

|

American Stock Transfer and Trust Company |

| |

|

|

| Risk factors: |

|

Investing in our securities involves a high degree of risk. For a discussion of factors you should consider carefully before deciding to invest in our Ordinary Shares, see the information contained in or incorporated by reference under the heading “Risk Factors” beginning on page S-4 of this prospectus supplement, on page 4 of the accompanying prospectus, and in the other documents incorporated by reference into this prospectus supplement. |

| |

|

|

| The Nasdaq Capital Market Symbol: |

|

BOSC |

| (1) | The number of our Ordinary Shares

to be outstanding immediately after this offering is based on 5,701,518 Ordinary Shares outstanding as of April 28, 2022 and 450,000

Ordinary Shares under this Offering, and excludes 225,000 Ordinary Shares issuable upon exercise of the warrants under this Offering,

1,020,000 warrants previously granted and 259,833 Ordinary Shares subject to director and employee share options. |

RISK FACTORS

The following is a summary of certain risks

that should be carefully considered along with the other information contained or incorporated by reference in this prospectus supplement

and the accompanying prospectus. You should carefully consider the risk factors incorporated by reference to our Annual Report on Form

20-F for the fiscal year ended December 31, 2021 and the other information contained in this prospectus supplement and accompanying prospectus,

as updated by our subsequent filings under the Exchange Act. If any of the following events actually occur, our business, operating results,

prospects or financial condition could be materially and adversely affected. This could cause the trading price of our Ordinary Shares

to decline and you may lose all or part of your investment. The risks described below are not the only ones that we face. Additional

risks not presently known to us or that we currently deem immaterial may also significantly impair our business operations and could

result in a complete loss of your investment.

RISKS RELATED TO THIS OFFERING

Our Ordinary Shares may be delisted from the

Nasdaq Stock Market as a result of our failure to meet the Nasdaq Capital Market continued listing requirements.

Over the years, the Company

has received several notices from the Nasdaq Stock Market advising it of the non-compliance of its shares with continued listing requirements

on the Nasdaq Capital Market.

There can be no assurance

that the Company will continue to qualify for listing on the Nasdaq Capital Market. If the Company’s Ordinary Shares are delisted

from the Nasdaq Capital Market, trading in its Ordinary Shares could be conducted on the over-the-counter market. In addition, if the

Company’s Ordinary Shares were delisted from the Nasdaq Capital Market, it would be subject to the so-called penny stock rules that

impose restrictive sales practice requirements on broker-dealers who sell those securities. Consequently, de-listing, if it occurred,

could affect the ability of our shareholders to sell their Ordinary Shares in the secondary market. The restrictions applicable to shares

that are de-listed, as well as the lack of liquidity for shares that are traded on an electronic bulletin board, may adversely affect

the market price of such shares.

Unfavorable global economic conditions could

have a material adverse effect on our business, operating results and financial condition.

A

financial and economic downturn in Israel, India or in one or more of our overseas markets may cause revenues of our customers to decrease. This

may result in reductions in sales of products and services in some markets, longer sales cycles, slower adoption of new technologies and

increased price competition. In addition, weakness in the end-user market could negatively affect the cash flow of our customers who could,

in turn, delay paying their obligations to us. This could increase our credit risk exposure and cause delays in our recognition of revenues

on future sales to these customers.

In

December 2019, a new strain of coronavirus (“COVID-19”) was reported to have surfaced in Wuhan, Hubei Province, China. Since

January of 2020, COVID-19 has spread globally, including in Israel. In response to the COVID-19 virus, countries have taken different

measures in relation to prevention and containment including lock-down and quarantine. The COVID-19 virus continues to impact worldwide

economic activity and pose the risk that we or our employees, contractors, suppliers, customers and other business partners may be prevented

from conducting certain business activities for an indefinite period of time, including due to shutdowns that may be requested or mandated

by governmental authorities or otherwise elected by companies as a preventive measure.

The

Company relies, with respect to some of its products, on manufacturers in China. The effects of the COVID-19 may result in such products

not being produced and/or shipped to the Company. In addition, mandated government authority measures or other measures elected by companies

as preventive measures may lead to our consumers being unable to complete purchases or other activities. COVID-19 may have an adverse

effect on trading, on our operations and on the collection of our customers’ debt. Its continuous spread and protective measures

taken by the authorities may adversely affect our future results of operations, cash flows and financial condition.

Our

customers’ businesses or cash flows have been and may continue to be negatively impacted by COVID-19, which may continue to lead

them to seek adjustments to payment terms or delay making payments or default on their payables, any of which may impact the timely receipt

and/or collectability of our receivables.

Our

operations are subject to a range of external factors related to the COVID-19 pandemic that are not within our control. We have taken

precautionary measures intended to minimize the risk of the spread of the virus to our employees, customers, and the communities in which

we operate. There can be no assurance that precautionary measures, whether adopted by us or imposed by others, will be effective, and

such measures could negatively affect our sales, marketing, business development activities and customer service efforts, delay and lengthen

our sales cycles, decrease our employees’ and customers’ productivity, or create operational or other challenges especially

with respect to extended supply lead times, any of which could harm our business and results of operations.

Although

there are effective vaccines for COVID-19 that have been approved for use, not all of our employees are vaccinated. In addition, new strains

of the virus have appeared (primarily, and most recently the Omicron variant), which may complicate treatment and vaccination programs.

Accordingly,

concerns remain regarding additional surges of COVID-19 as seen for example, towards the end of 2021, and the economic impact thereof,

all of which may impact our future results of operations and financial condition.

Since our management will have broad discretion

in how we use the proceeds from this offering, we may use the proceeds in ways with which you disagree.

We have not allocated specific

amounts of the net proceeds from this offering for any specific purpose. Accordingly, our management will have significant flexibility

in applying the net proceeds of this offering. You will be relying on the judgment of our management with regard to the use of these net

proceeds, and you will not have the opportunity, as part of your investment decision, to influence how the proceeds are being used. It

is possible that the net proceeds will be invested in a way that does not yield a favorable, or any, return for us. The failure of our

management to use such funds effectively could have a material adverse effect on our business, financial condition, operating results

and cash flow.

We rely on the foreign private issuer exemption

for certain corporate governance requirements under the Nasdaq Stock Market Rules. This may afford less protection to holders of our Ordinary

Shares.

We are a foreign private issuer

as such term is defined under U.S. federal securities laws. As a foreign private issuer, we have elected to follow certain home country

corporate governance practices, instead of certain requirements of the Marketplace Rules of the Nasdaq Capital Market, or the Nasdaq Marketplace

Rules. We may in the future elect to follow Israeli corporate governance practices with regard to, among other things, the composition

of our board of directors (“Board of Directors”), compensation of officers, director nomination procedures and quorum requirements

at shareholders’ meetings. In addition, we may elect to follow Israeli corporate governance practices instead of the Nasdaq requirements

to obtain shareholder approval for certain dilutive events (such as for the establishment or amendment of certain equity-based compensation

plans, issuances that will result in a change of control of the company, certain transactions other than a public offering involving issuances

of a 20% or more interest in the company and certain acquisitions of the stock or assets of another company). Accordingly, our shareholders

may not be afforded the same protection as provided under Nasdaq’s corporate governance rules. Following our home country governance

practices as opposed to the requirements that would otherwise apply to a U.S. company listed on the Nasdaq Capital Market may provide

less protection than is accorded to investors of domestic issuers.

Future sales of our Ordinary Shares, whether

by us or our shareholders, could cause our stock price to decline.

If our existing shareholders

sell, or indicate an intent to sell, substantial amounts of our Ordinary Shares in the public market, the trading price of our Ordinary

Shares could decline significantly. Similarly, the perception in the public market that our shareholders might sell shares of our Ordinary

Shares could also depress the market price of our Ordinary Shares. A decline in the price of shares of our Ordinary Shares might impede

our ability to raise capital through the issuance of additional shares of our Ordinary Shares or other equity securities. In addition,

the issuance and sale by us of additional Ordinary Shares or securities convertible into or exercisable for our Ordinary Shares, or the

perception that we will issue such securities, could reduce the trading price for our Ordinary Shares as well as make future sales of

equity securities by us less attractive or not feasible. The sale of Ordinary Shares issued upon the exercise of our outstanding options

and warrants could further dilute the holdings of our then existing shareholders.

You will experience immediate dilution in the

book value per share of the Ordinary Shares you purchase.

Because the price per share

of our Ordinary Shares being offered is substantially higher than the net tangible book value per share of our Ordinary Shares, you will

suffer substantial dilution in the net tangible book value of the Ordinary Shares you purchase in this offering. Based on an offering

price of $2.20 per share, after deducting estimated offering commissions and expenses, the net tangible book value of one ordinary share

as of December 31, 2021 would have been $1.85 per share. If you purchase Ordinary Shares in this offering, your value per share will be

diluted by $0.35 per share in the net tangible book value of the ordinary share.

You may experience future dilution as a result

of future equity offerings or other equity issuances.

We may in the future issue

additional Ordinary Shares or other securities convertible into or exchangeable for our Ordinary Shares. We cannot assure you that we

will be able to sell our Ordinary Shares or other securities in any other offering or other transactions at a price per share that is

equal to or greater than the price per share paid by investors in this offering. The price per share at which we sell additional Ordinary

Shares or other securities convertible into or exchangeable for our Ordinary Shares in future transactions may be higher or lower than

the price per share in this offering

Our share price has been and may continue to

be volatile, which could result in substantial losses for individual shareholders.

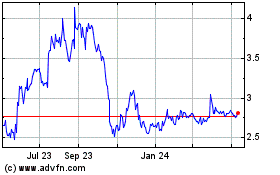

The market price of our Ordinary

Shares has been and may continue to be highly volatile and subject to wide fluctuations. From January 1, 2020 through April 28, 2022,

the daily closing price of our Ordinary Shares in Nasdaq has ranged from $1.41 to $4.86 per share. We believe that these fluctuations

have been in response to a number of factors including the following, some of which are beyond our control:

| |

● |

variations between actual results and projections; |

| |

|

|

| |

● |

the limited trading volume in our stock; |

| |

|

|

| |

● |

changes in our bank debts; and |

| |

|

|

| |

● |

Nasdaq Capital Market Listing Standards non-compliance notices; |

Accordingly, our Ordinary

Shares that an investor purchases, whether in this offering or in the secondary market, may trade at a price lower than that at which

they were purchased, and, similarly, the value of our other securities may decline. Current levels of market volatility are unprecedented.

The capital and credit markets have been experiencing volatility and disruption for more than a year. In some cases, the markets have

produced downward pressure on stock prices and credit availability for certain issuers without regard to those issuers’ underlying

financial strength.

A significant decline in our

stock price could result in substantial losses for individual shareholders and could lead to costly and disruptive securities litigation.

We have not paid and do not intend to pay dividends

on our Ordinary Shares. Investors in this offering may never obtain a return on their investment.

We have not paid dividends

on our Ordinary Shares inception, and do not intend to pay any dividends on our Ordinary Shares in the foreseeable future. We intend to

reinvest earnings, if any, in the development and expansion of our business. Accordingly, you will need to rely on sales of your Ordinary

Shares after price appreciation, which may never occur, in order to realize a return on your investment.

The warrants are speculative in nature.

The warrants offered hereby

do not confer any rights of ownership of our Ordinary Shares on the holders of the warrants except as otherwise provided in the warrants.

Specifically, commencing on the date of issuance, holders of the warrants may exercise their right to acquire the Ordinary Shares and

pay an exercise price of $2.20. Furthermore, each warrant will expire on May 3, 2027, which is approximately five (5) years from the original

issuance date. In the event the price of our Ordinary Shares does not exceed the exercise price of the warrants during the period when

the warrants are exercisable, the warrants may not have any value.

Holders of the warrants will have no rights

as holders of our Ordinary Shares except as otherwise provided in the warrants until they acquire our Ordinary Shares.

Until you acquire our Ordinary

Shares upon exercise of your warrants, you will have no rights with respect to our Ordinary Shares issuable upon exercise of your warrant.

Upon exercise of your warrant, you will be entitled to the rights of a holder of our Ordinary Shares in respect of the Ordinary Shares

issued to you, only as to matters for which the record date occurs after the exercise.

There is no established market for the warrants

to purchase our Ordinary Shares being offered in this offering.

There is no established trading

market for the warrants and we do not expect a market to develop. In addition, we do not intend to apply for the listing of the warrants

on any national securities exchange or other trading market. Without an active trading market, the liquidity of the warrants will be limited.

The exercise price of the warrants offered

by this prospectus will not be adjusted for certain dilutive events.

The exercise price of the

warrants offered by this prospectus are subject to adjustment for certain events, including, but not limited to, the payment of a stock

dividend, stock splits, certain issuances of capital stock, options, convertible securities and other securities. However, the exercise

prices will not be adjusted for dilutive issuances of securities and there may be transactions or occurrences that may adversely affect

the market price of our Ordinary Shares or the market value of such warrants without resulting in an adjustment of the exercise prices

of such warrants.

Provisions of the warrants offered by this

prospectus could discourage an acquisition of us by a third party.

In addition to the discussion

of the provisions of our articles of association, certain provisions of the warrants offered by this prospectus could make it more difficult

or expensive for a third party to acquire us. The warrants prohibit us from engaging in certain transactions constituting “fundamental

transactions” unless, among other things, the surviving entity assumes our obligations under the warrants. These and other provisions

of the warrants offered by this prospectus could prevent or deter a third party from acquiring us even where the acquisition could be

beneficial to you.

USE OF PROCEEDS

We estimate that the net proceeds

from this offering will be approximately $919,000, after deducting the financial advisory fees and the estimated offering expenses payable

by us.

We intend to use the net proceeds

from this offering for general corporate purposes.

The amounts and timing of

our use of proceeds will vary depending on a number of factors, including the amount of cash generated or used by our operations, and

the rate of growth, if any, of our business. As a result, we will retain broad discretion in the allocation of the net proceeds of this

offering. In addition, while we have not entered into any agreements, commitments or understandings relating to any significant transaction

as of the date of this prospectus supplement, we may use a portion of the net proceeds to pursue acquisitions, joint ventures and other

strategic transactions.

DIVIDEND POLICY

We have never declared or

paid any cash dividends on our Ordinary Shares. We anticipate that we will retain any earnings to support operations and to finance the

growth and development of our business. Therefore, we do not expect to pay cash dividends in the foreseeable future. Any future determination

relating to our dividend policy will be made at the discretion of our board of directors and will depend on a number of factors, including

future earnings, capital requirements, financial conditions and future prospects and other factors the board of directors may deem relevant.

DILUTION

If you invest in our Ordinary

Shares in this offering, your interest will be diluted immediately to the extent of the difference between the offering price per ordinary

share you will pay in this offering and the as adjusted net tangible book value per share of our Ordinary Shares after giving effect to

this offering. Our historical net tangible book value as of December 31, 2021 was approximately $9.65 million or $1.84 per share. Historical

net tangible book value per share represents the amount of our total tangible assets less total liabilities, divided by the number of

shares of our Ordinary Shares outstanding on December 31, 2021.

After giving effect to the

sale of Ordinary Shares in this offering at an offering price of $2.20 our share, and after deducting estimated offering commissions and

estimated offering expenses payable by us, our pro forma as adjusted net tangible book value as of December 31, 2021 would have been approximately

$10.54 million or $1.85 per share. This represents an immediate increase in pro forma as adjusted net tangible book value of $0.01 per

share to existing shareholders and an immediate dilution of $0.35 per share to new investors purchasing securities in this offering. The

following table illustrates this per share dilution to investors participating in this offering:

| Public offering price per share of common stock |

|

$ | 2.20 | |

| Pro Forma net tangible book value per share as of December 31, 2021 |

|

$ | 1.84 | |

| Increase in pro forma net tangible book value per share attributable to this offering |

|

$ | 0.01 | |

| Pro forma as adjusted net tangible book value per share as of December 31, 2021, after giving effect to this offering |

|

$ | 1.85 | |

| Dilution per share to new investors purchasing our common stock in this offering |

|

$ | 0.35 | |

The discussion above excludes

225,000 Ordinary Shares issuable upon exercise of the warrants under this Offering and 1,020,000 warrants previously granted and 259,833

Ordinary Shares subject to director and employee share options.

To the extent that any of

our outstanding options or warrants are exercised and any of our outstanding convertible securities are converted, additional options

or other awards are issued under our equity incentive plans or we otherwise issue additional Ordinary Shares in the future at a price

less than the offering price, there may be further dilution to new investors purchasing our Ordinary Shares in this offering.

DESCRIPTION OF OUR SECURITIES WE ARE OFFERING

We are offering to certain

investors, pursuant to this prospectus supplement and the accompanying base prospectus, up to an aggregate of 450,000 of our Ordinary

Shares of no nominal value, together with warrants to purchase up to an aggregate of 225,000 Ordinary Shares. The Ordinary Shares and

the warrants will be issued in units consisting of one Ordinary Share and one-half warrant, which will be immediately detachable. The

material terms and provisions of our ordinary shares are described under the caption “Description of Ordinary Shares” beginning

on page 6 of the accompanying prospectus.

The warrants are exercisable

for a period of five years from the closing date, at an exercise price of $2.20 per share. The warrants will be subject to adjustment

in the case of stock splits, stock dividends, combinations of shares and similar recapitalization transactions.

The warrant holders must surrender

payment in cash of the exercise price of the shares being acquired upon exercise of the warrants. If, however, we are unable to offer

and sell the shares underlying the warrants pursuant to this prospectus supplement due to the ineffectiveness of the registration statement

of which this prospectus supplement is a part, then the warrants may be exercised on a “cashless” basis.

There is no public trading

market for the warrants and we do not intend that the warrants will be listed for trading on Nasdaq or any other securities exchange or

market.

Except as otherwise provided

in the warrants or by virtue of such holder’s ownership of our Ordinary Shares, the holder of a warrant will not have the rights

or privileges of a holder of our Ordinary Shares, including any voting rights, until the holder exercises the warrant.

PLAN OF DISTRIBUTION

We have entered into securities

purchase agreements with the investors pursuant to which we will sell to the investors 450,000 of our Ordinary Shares, in this takedown

from our shelf registration statement, together with warrants to purchase an aggregate of 225,000 Ordinary Shares. We negotiated the price

for the securities offered in this offering with the investors. The factors considered in determining the price included the recent market

price of our ordinary shares, the general condition of the securities market at the time of this offering, the history of, and the prospects,

for the industry in which we compete, our past and present operations, and our prospects for future revenues.

We entered into securities

purchase agreements directly with investors on April 29, 2022, and we will only sell to investors who have entered into a securities purchase

agreements.

We expect to deliver the Ordinary

Shares and warrants being offered pursuant to this prospectus supplement on or about May 3, 2022, subject to customary closing conditions.

We are not offering Ordinary

Shares and warrants under this prospectus supplement through a placement agent, underwriter or securities broker or dealer.

We have agreed to pay AGES

Financial Services, Ltd. a financial advisory fee of $39,600 and expense reimbursement of $10,000. In addition, we have agreed to issue

to AGES, warrants to purchase 9,000 Ordinary Shares on the same terms as the warrants being issued to investors.

After deducting our estimated

offering expenses and offering commissions payable by us, we expect the net proceeds from this offering to be approximately $919,000.

Transfer Agent and Registrar

The transfer agent and registrar

for our ordinary shares is American Stock Transfer and Trust Company with a mailing address of 6201 15th Avenue, Brooklyn, NY 11219.

Listing

Our Ordinary Shares are quoted

on the Nasdaq Capital Market under the trading symbol “BOSC.”

LEGAL MATTERS

The validity of the Ordinary

Shares offered in this prospectus, will be passed upon for us by Gornitzky & Co., our Israeli counsel. Certain other legal matters

relating to United States law will be passed upon for us by Phillips Nizer LLP, New York, New York.

EXPERTS

Financial statements of B.O.S.

Better Online Solutions Ltd, incorporated by reference in this prospectus supplement and prospectus and elsewhere in the registration

statement have been so incorporated by reference in reliance upon the reports of Fahn Kanne & Co. Grant Thornton Israel, independent

registered public accounting firm, upon their authority as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC

a registration statement on Form F-3 under the Securities Act, with respect to the securities offered by this prospectus supplement. However,

as is permitted by the rules and regulations of the SEC, this prospectus supplement, which is part of our registration statement on Form

F-3, omits certain non-material information, exhibits, schedules and undertakings set forth in the registration statement. For further

information about us, and the securities offered by this prospectus, please refer to the registration statement.

We are subject to the reporting

requirements of the Exchange Act that are applicable to a foreign private issuer. In accordance with the Exchange Act, we file reports,

including annual reports on Form 20-F by April 30 of each year.

The registration statement

on Form F-3 of which this prospectus supplement forms a part, including the exhibits and schedules thereto, and reports and other information

filed by us with the SEC are available at the SEC’s website at http://www.sec.gov.

As a foreign private issuer,

we are exempt from the rules under the Exchange Act prescribing the furnishing and content of proxy statements to shareholders and our

officers, directors and principal shareholders are exempt from the “short-swing profits” reporting and liability provisions

contained in Section 16 of the Exchange Act and related Exchange Act rules.

We maintain a corporate website

at www.boscom.com. Information contained on, or that can be accessed through, our website does not constitute a part of this prospectus.

We have included our website in this prospectus solely as an inactive textual reference.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The SEC allows us to “incorporate

by reference” into this prospectus supplement the information we file with or submit to it. This means that we can disclose important

information to you by referring to those documents. Each document incorporated by reference is current only as of the date of such document,

and the incorporation by reference of such document shall not create any implication that there has been no change in our affairs since

the date therefor or that the information contained therein is current as of any time subsequent to its date. The information incorporated

by reference is considered to be part of this prospectus supplement and should be read with the same care. When we update the information

contained in documents that have been incorporated by reference by making future filings with the SEC, the later information filed with

or submitted to the SEC will update and supersede such information. We incorporate by reference into this prospectus the documents listed

below:

| |

(a) |

Our annual report on Form 20-F for the fiscal year ended December 31, 2021, filed with the SEC on March 31, 2022 (SEC File No. 001-14184); |

| |

|

|

| |

(b) |

The description of our Ordinary Shares contained in Exhibit 2.1 to our Annual Report on Form 20-F for the fiscal year ended December 31, 2019, filed with the SEC on March 31, 2020, which description is incorporated herein by reference; |

| |

|

|

| |

(c) |

Form 6-K furnished on April 26, 2022. |

| |

|

|

| |

(d) |

Form 6-K furnished on May 2, 2022. |

In addition, we incorporate

by reference into this prospectus supplement all documents and any future filings we make with the SEC under Sections 13(a), 13(c),

14 or 15(d) of the Exchange Act and any reports on Form 6-K we submit to the SEC pursuant to the Exchange Act after the date of this prospectus

supplement but prior to the termination of the offering, that we specifically identify in such forms as being incorporated by reference.

As you read the above documents,

you may find inconsistencies in information from one document to another. If you find inconsistencies between the documents and this prospectus,

you should rely on the statements made in the most recent document.

Unless expressly incorporated

by reference, nothing in this prospectus supplement shall be deemed to incorporate by reference information furnished to, but not filed

with the SEC. We will deliver to each person (including any beneficial owner) to whom this prospectus supplement has been delivered a

copy of any or all of the information that has been incorporated by reference into this prospectus supplement but not delivered with this

prospectus supplement. We will provide this information upon written or oral request, and at no cost to the requester. Requests should

be directed to:

B.O.S. Better Online Solutions Ltd.

20 Freiman Street

Rishon LeZion, 75100, Israel

Tel.: (+972) 3-954-2070

Fax: (+972) 3-649-8390

Attn.: Eyal Cohen, CEO

ENFORCEABILITY OF CIVIL LIABILITIES

We are incorporated under

the laws of the State of Israel. Most of our directors and all of our officers reside outside of the United States. It may be difficult

to enforce civil liabilities under the Securities Act and the Exchange Act in original actions instituted in Israel.

In addition, it may be difficult

to assert U.S. securities law claims in original actions instituted in Israel. Israeli courts may refuse to hear a claim based on an alleged

violation of U.S. securities laws because Israel is not the most appropriate forum in which to bring such a claim. In addition, even if

an Israeli court agrees to hear a claim, it may determine that Israeli law and not U.S. law is applicable to the claim. If U.S. law is

found to be applicable, the content of applicable U.S. law must be proven as a fact which can be a time-consuming and costly process.

Certain matters of procedure will also be governed by Israeli law.

However, subject to specified

time limitations, Israeli courts may enforce a United States final executory judgment in a civil matter, including a monetary or compensatory

judgment in a non-civil matter, obtained after due process before a court of competent jurisdiction according to the laws of the state

in which the judgment is given and the rules of private international law currently prevailing in Israel. The rules of private international

law currently prevailing in Israel do not prohibit the enforcement of a judgment by Israeli courts provided that:

| |

● |

the judgment is enforceable in the state in which it was given; |

| |

|

|

| |

● |

adequate service of process has been effected and the defendant has had a reasonable opportunity to present his arguments and evidence; |

| |

|

|

| |

● |

the judgment and the enforcement of the judgment are not contrary to the law, public policy, security or sovereignty of the State of Israel; |

| |

|

|

| |

● |

the judgment was not obtained by fraud and does not conflict with any other valid judgment in the same matter between the same parties; |

| |

|

|

| |

● |

an action between the same parties in the same matter is not pending in any Israeli court at the time the lawsuit is instituted in the foreign court; and |

| |

|

|

| |

● |

the prevailing law of the foreign state in which the judgment is rendered allows for the enforcement of judgments in Israel. |

Our subsidiary, Ruby-tech

Inc. is our agent to receive service of process in any action against us in any competent court of the United States arising out of this

offering or any purchase or sale of securities in connection with this offering.

If a foreign judgment is enforced

by an Israeli court, it generally will be payable in Israeli currency, which can then be converted into non-Israeli currency and transferred

out of Israel. The usual practice in an action before an Israeli court to recover an amount in a non-Israeli currency is for the Israeli

court to issue a judgment for the equivalent amount in Israeli currency at the rate of exchange in force on the date of the judgment,

but the judgment debtor may make payment in foreign currency. Pending collection, the amount of the judgment of an Israeli court stated

in Israeli currency ordinarily will be linked to the Israeli consumer price index plus interest at an annual statutory rate set by Israeli

regulations prevailing at the time. Judgment creditors must bear the risk of unfavorable exchange rates.

B.O.S. BETTER ONLINE SOLUTIONS LTD.

Prospectus

$10,000,000

Ordinary Shares

Warrants

Units

Through this prospectus, we may periodically offer:

This prospectus provides you

with a general description of the securities that we may offer. Each time we sell securities, we will provide a prospectus supplement

that will contain specific information about the terms of the offering. The prospectus supplement may also add, update or change information

contained in this prospectus. You should read both this prospectus and any prospectus supplement, together with additional information

described below under the headings “Where You Can Find More Information,” and “Incorporation of Certain Documents by

Reference” before purchasing any of our securities. This prospectus may not be used to offer or sell securities unless accompanied

by a prospectus supplement.

To the extent there is a conflict

between the information contained in this prospectus and the prospectus supplement, you should rely on the information in the prospectus

supplement, provided that if any statement in one of these documents is inconsistent with a statement in another document having a later

date, for example, a document incorporated by reference in this prospectus or any prospectus supplement, the statement in the document

having the later date modifies or supersedes the earlier statement.

Our Ordinary Shares are traded

on the NASDAQ Capital Market under the symbol “BOSC”. On October 20, 2020, the last reported sale price of our Ordinary Shares

on the NASDAQ Capital Market was $ 2.55 per share. You are urged to obtain current market quotations for the Ordinary Shares.

The securities may be sold

directly by us to investors, through agents designated from time to time, to or through underwriters or dealers, or through a combination

of such methods. For additional information on the methods of sale, you should refer to the section entitled “Plan of Distribution.”

If any underwriters are involved in the sale of our securities with respect to which this prospectus is being delivered, the names of

such underwriters and any applicable commissions or discounts will be set forth in a prospectus supplement. The net proceeds we expect

to receive from such sale will also be set forth in a prospectus supplement.

You should read both this

prospectus and any prospectus supplement, together with the additional information described under the heading “Incorporation of

Certain Documents by Reference” before you decide to invest in our Ordinary Shares.

INVESTING IN OUR ORDINARY

SHARES INVOLVES A HIGH DEGREE OF RISK. SEE “RISK FACTORS” ON PAGE 4 OF THIS PROSPECTUS TO READ ABOUT FACTORS YOU SHOULD CONSIDER

BEFORE PURCHASING OUR ORDINARY SHARES.

NEITHER THE SECURITIES

AND EXCHANGE COMMISSION NOR ANY OTHER REGULATORY BODY HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ACCURACY OR ADEQUACY

OF THIS REGISTRATION STATEMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is November 3, 2020.

TABLE OF CONTENTS

You should rely only on the

information contained or incorporated by reference in this prospectus or any supplement. We have not authorized any other person to provide

you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not,

and any underwriter or agent is not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted.

You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus.

Our business, financial condition, results of operations and prospects may have changed since that date.

PROSPECTUS SUMMARY

About This Prospectus

This prospectus is part of

a registration statement that we filed with the Securities and Exchange Commission, or SEC, utilizing a “shelf” registration

process, relating to the ordinary shares, warrants and units described in this prospectus. Under this shelf process, we may sell the securities

described in this prospectus in one or more offerings up to a total initial offering price of $10,000,000. The offer and sale of securities

under this prospectus may be made from time to time, in one or more offerings in any manner described under the section in this prospectus

entitled “Plan of Distribution.”

Each time we sell securities,

we will provide a prospectus supplement that will contain specific information about the terms of that offering. The prospectus supplement

may also add, update or change information contained in this prospectus. You should read both this prospectus and any prospectus supplement

together with additional information described under the heading “Where You Can Find More Information” and “Incorporation

of Certain Documents by Reference.”

This prospectus does not contain

all of the information set forth in the registration statement, certain parts of which are omitted in accordance with the rules and regulations

of the SEC. Accordingly, you should refer to the registration statement and its exhibits for further information about us and our Ordinary

Shares. Copies of the registration statement and its exhibits are on file with the SEC. Statements contained in this prospectus concerning

the documents we have filed with the SEC are not intended to be comprehensive, and in each instance we refer you to a copy of the actual

document filed as an exhibit to the registration statement or otherwise filed with the SEC.

We have not authorized anyone

to provide you with information different from that contained or incorporated by reference in this prospectus. The information contained

in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any

sale of Ordinary Shares.

Unless the context otherwise

requires, all references in this prospectus to “BOS,” “we,” “our,” “our company,” “us”

and the “Company” refer to B.O.S. Better Online Solutions Ltd. and its consolidated subsidiaries.

All references in this prospectus

to “Ordinary Shares” refer to our Ordinary Shares, nominal value NIS 80.00 per share.

All references in this prospectus

to “dollars” or “$” are to United States Dollars.

All references in this prospectus

to “shekels” or “NIS” are to New Israeli Shekels.

The Company

We were incorporated in Israel

in 1990 and are subject to the Israeli Companies Law 1999 – 5759 (the “Israeli Companies Law”). Our executive

offices, shipping and service operations are located in Israel. Our address in Israel is 20 Freiman Street, Rishon LeZion, 75100,

Israel.

Our address in the United

States is B.O.S. Better Online Solutions Ltd. c/o Ruby-tech, Inc. 147-20 184th St., Jamaica NY 11413, USA, telephone 508-655-2312

Our telephone number is 972-3-954-2000

and our website address is www.boscom.com. Our commercial websites are: Supply Chain Division - www.odem.co.il; Intelligent

Robotics Division and RFID Division – www.dimex.co.il; www.idnext.co.il; and www.imdecol.com. The information contained

on, or linked from, our websites is not a part of this prospectus.

B.O.S is a global provider

of RFID and Robotic systems and of Supply Chain solutions to enterprises. BOS operates through three business divisions:

| |

● |

Supply Chain Division – offers electro-mechanical components, mainly to customers in the aerospace, defense and other industries worldwide and a supply chain service provider for aviation customers that prefer to consolidate their component acquisitions through a supplier that is able to provide a comprehensive solution to their components-supply needs. |

| |

● |

RFID Division – offers comprehensive turn-key solutions for Automatic Identification and Data Collection (AIDC), combining a mobile infrastructure with software application of manufacturers that we represent. The division also offers on-site inventory count services in the fields of apparel, food, convenience and pharma, asset tagging and counting services for corporate and governmental entities. |

| |

● |

Intelligent Robotics Division - offers comprehensive technological solutions for increasing productivity in industrial and logistics processes. |

In January 2016, the Company

completed the acquisition of the assets of iDnext Ltd. and its subsidiary Next-Line Ltd., which offers on-site inventory count services

in the fields of apparel, food, convenience and pharma, and asset tagging and counting services for corporate and governmental entities.

In June 2019, the Company

acquired the business operations of Imdecol Ltd (“Imdecol”), in order to expand the Company’s technological capabilities

and exposure to international markets, and take advantage of the increasing demand from manufacturers for improvements in the productivity

of their production lines.

THE OFFERING

General

This prospectus relates to

the sale by the Company of any combination of securities described in this prospectus in one or more offerings up to a total dollar amount

of $10,000,000. This prospectus provides you with a general description of the securities that we may offer. Each time we sell securities,

we will provide a prospectus supplement that will contain specific information about the terms of the offering. The prospectus supplement

may also add, update or change information contained in this prospectus. You should read both this prospectus and any prospectus supplement,

together with additional information described below under the headings “Where You Can Find More Information,” and “Incorporation

of Certain Documents by Reference” before purchasing any of our securities.

MATERIAL CHANGES

Except as otherwise described

in our Annual Report on Form 20-F for the fiscal year ended December 31, 2019 (the “Form 20-F”), and in our Reports of Foreign

Private Issuer on Form 6-K filed under the Securities Exchange Act of 1934, as amended, or the Exchange Act and incorporated by reference

or disclosed herein, no reportable material changes have occurred since December 31, 2019.

RISK FACTORS

Before making an investment

decision, you should carefully consider the risks described under “Risk Factors” in the applicable prospectus supplement and

in our Annual Report on Form 20-F for the fiscal year ended December 31, 2021, or any updates in our Reports of Foreign Private Issuer

on Form 6-K, together with all of the other information appearing in this prospectus or incorporated by reference into this prospectus

and any applicable prospectus supplement, in light of your particular investment objectives and financial circumstances. For a description

of those reports and documents, and information about where you can find them, please see “Where You Can Find More Information and

Incorporation of Certain Information.” The risks so described are not the only risks facing our company. Additional risks not presently

known to us or that we currently deem immaterial may also impair our business operations. Our business, financial condition and results

of operations could be materially adversely affected by any of these risks. The trading price of our securities could decline due to any

of these risks, and you may lose all or part of your investment.

FORWARD-LOOKING STATEMENTS

This prospectus, including

the information incorporated by reference into this prospectus, contains, and any prospectus supplement may contain, forward-looking statements

within the meaning of the federal securities laws. These statements address, among other things: our strategy; the anticipated development

of our products; the results of completed acquisitions and our ability to make future acquisitions; our projected capital expenditures

and liquidity; our development of additional revenue sources; our development and expansion of relationships; the market acceptance of

our products; our technological advancement; our compliance with regulatory requirements; and our ability to operate due to political,

economic and security conditions. Actual results could differ materially from those anticipated, expressed or implied in these forward-looking

statements as a result of various factors, including all the risks discussed above and elsewhere in this prospectus.

We urge you to consider that

statements that use the terms “believe”, “do not believe”, “expect”, “plan”, “intend”,

“estimate”, “anticipate”, “projections”, “forecast”, “may”, “continue”,

“should”, “predict”, “potential” or the negative of these terms or similar expressions are intended

to identify forward-looking statements. These statements reflect our current views with respect to future events. These statements are

based on beliefs and assumptions and are subject to risks and uncertainties. These risk factors and uncertainties include, amongst others,

the dependency of sales being generated from one or few major customers, the uncertainty of BOS being able to maintain current gross profit

margins, inability to keep up or ahead of technology and to succeed in a highly competitive industry, inability to maintain marketing

and distribution arrangements and to expand our overseas markets, uncertainty with respect to the prospects of legal claims against BOS,

the effect of exchange rate fluctuations, general worldwide economic conditions and continued availability of financing for working capital

purposes and to refinance outstanding indebtedness; and additional risks and uncertainties set forth in this prospectus, including under

the heading “Risk Factors.” Therefore, we caution you to consider the matters described under the heading “Risk Factors”

and certain other matters discussed in this prospectus, the documents incorporated by reference in this prospectus and other publicly

available resources. Except as required by applicable law, including the federal securities laws of the United States, we do not intend

to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Market data and forecasts

used in this prospectus have been obtained from independent industry sources that we believe to be reliable. We have not independently

verified the data obtained from these sources and we cannot assure you of the accuracy or completeness of the data. Forecasts and other

forward-looking information obtained from these sources are subject to the same qualifications and additional uncertainties accompanying

any estimates of future market size.

OFFER STATISTICS AND EXPECTED TIMETABLE

We may offer and sell from

time to time pursuant to this prospectus (as may be detailed in prospectus supplements) an indeterminate number of securities as shall

have a maximum aggregate offering price of $10,000,000. The actual per share price of the securities that we will offer pursuant hereto

will depend on a number of factors that may be relevant as of the time of offer (see “Plan of Distribution” below).

CAPITALIZATION AND INDEBTEDNESS

The table below sets forth

our condensed consolidated current liabilities and capitalization at June 30, 2020. This table was prepared in accordance with the U.S.

Generally Accepted Accounting Principles.

Consolidated Capitalization (in US thousands of dollars)

| | |

December 31,

2021 | |

| Short term debt | |

| |

| Secured | |

$ | 740 | |

| Unsecured | |

$ | 8,012 | |

| Total short term debt | |

$ | 8,752 | |

| | |

| | |

| Long term debt | |

| | |

| Secured | |

$ | 681 | |

| Unsecured | |

$ | 977 | |

| Total long term debt | |

$ | 1,658 | |

| | |

| | |

| Shareholders equity | |

| | |

| Share capital: Ordinary Shares | |

| | |

| Issued 5,250,518 Ordinary Shares and additional paid on capital | |

$ | 84,854 | |

| Accumulated other comprehensive loss | |

$ | (243 | ) |

| Accumulated deficit | |

$ | (70,264 | ) |

| Total shareholders’ equity | |

$ | 14,347 | |

The Company’s operations

are financed through cash flows from operating activities, from long term loans and from equity investments. (See “Item 5B. Liquidity

and Capital Resources” in our Form 20-F).

REASONS FOR THE OFFER AND USE OF PROCEEDS

Our management will have broad

discretion over the use of the net proceeds from the sale of our securities pursuant to this prospectus. Unless we state otherwise

in a prospectus supplement, we currently intend to use the net proceeds from the sale of the securities offered pursuant to this prospectus

for general corporate purposes and working capital requirements. From time to time we may evaluate the possibility of acquiring business,

products and technologies, and we may use a portion of the proceeds as consideration for acquisitions. Until we use the net proceeds for

these purposes, we may invest them in interest-bearing deposits.

DESCRIPTION OF ORDINARY SHARES

A description of our Ordinary

Shares can be found in Exhibit 2.1 to our Annual Report on Form 20-F for the fiscal year ended December 31, 2019, which description is

incorporated herein by reference.

Our Ordinary Shares are traded

on the NASDAQ Capital Market under the symbol “BOSC”.

DESCRIPTION OF WARRANTS

Warrants may be issued independently

or together with any other securities and may be attached to, or separate from, such securities. Each series of warrants will be issued

under a separate warrant agreement. The terms of any warrants to be issued and a description of the material provisions of the applicable

warrant agreement will be set forth in the applicable prospectus supplement.

The applicable prospectus

supplement will describe the following terms of any warrants in respect of which the prospectus is being delivered:

| |

☐ |

the title of such warrants; |

| |

|

|

| |

☐ |

the aggregate number of such warrants; |

| |

|

|

| |

☐ |

the price or prices at which such warrants will be issued; |

| |

☐ |

the currency or currencies, in which the price of such warrants will be payable; |

| |

|

|

| |

☐ |

the date on which the right to exercise such warrants shall commence and the date on which such right shall expire; |

| |

|

|

| |

☐ |

if applicable, the minimum or maximum amount of such warrants which may be exercised at any one time; |

| |

|

|

| |

☐ |

if applicable, the designation and terms of the securities with which such warrants are issued and the number of such warrants issued with each such security; |

| |

|

|

| |

☐ |

if applicable, the date on and after which such warrants and the related securities will be separately transferable; |

| |

|

|

| |

☐ |

information with respect to book-entry procedures, if any; |

| |

|

|

| |

☐ |

any material Israeli and U.S. federal income tax consequences; |

| |

|

|

| |

☐ |

the anti-dilution provisions of the warrants, if any; and |

| |

|

|

| |

☐ |

any other terms of such warrants, including terms, procedures and limitations relating to the exchange and exercise of such warrants. |

DESCRIPTION OF UNITS

We may, from time to time,

issue units comprised of one or more of the other securities that may be offered under this prospectus, in any combination. Each unit

will be issued so that the holder of the unit is also the holder of each security included in the unit. Thus, the holder of a unit will

have the rights and obligations of a holder of each included security. The unit agreement under which a unit is issued may provide that

the securities included in the unit may not be held or transferred separately at any time, or at any time before a specified date.

Any applicable prospectus

supplement will describe:

| |

☐ |

the material terms of the units and of the securities comprising the units, including whether and under what circumstances those securities may be held or transferred separately; |

| |

|

|

| |

☐ |

any material provisions relating to the issuance, payment, settlement, transfer or exchange of the units or of the securities comprising the units; and |

| |

|

|

| |

☐ |

any material provisions of the governing unit agreement that differ from those described above. |

PLAN OF DISTRIBUTION

We may, from time to time,

sell any or all of the Ordinary Shares on the Nasdaq Capital Market or any other stock exchange, market or trading facility on which the

shares are traded or in private transactions.

These sales may be at fixed

or negotiated prices. We may use any one or more of the following methods when selling shares:

| |

● |

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| |

|

|

| |

● |

block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| |

|

|

| |

● |

purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

| |

|

|

| |

● |

an exchange distribution in accordance with the rules of the applicable exchange; |

| |

|

|

| |

● |

privately negotiated transactions; |

| |

|

|

| |

● |

“at the market” or through market makers or into an existing market for the shares; |

| |

|

|

| |

● |

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| |

● |

a combination of any such methods of sale; or |

| |

|

|

| |

● |

any other method permitted pursuant to applicable law. |

We may engage brokers and

dealers, and any brokers or dealers may arrange for other broker-dealers to participate in sales of the securities. Broker-dealers may

agree to sell a specified number of the securities at a stipulated price per security. If the broker-dealer is unable to sell securities

acting as agent, it may purchase as principal any unsold securities at the stipulated price. Broker-dealers who acquire securities as

principals may thereafter resell the securities from time to time in transactions in any stock exchange or automated interdealer quotation

system on which the securities are then listed, at prices and on terms then prevailing at the time of sale, at prices related to the then-current

market price or in negotiated transactions. Broker-dealers may use block transactions and sales to and through broker-dealers, including

transactions of the nature described above.

To the extent required under

the Securities Act, the aggregate amount of the Company’s securities being offered and the terms of the offering, the names of any

agents, brokers, dealers or underwriters and any applicable commission with respect to a particular offer will be set forth in an accompanying

prospectus supplement. Any underwriters, dealers, brokers or agents participating in the distribution of the securities may receive compensation

in the form of underwriting discounts, concessions, commissions or fees, in compliance with the rules of FINRA.

The SEC may take the view

that, under certain circumstances, any broker-dealers or agents that participate in the distribution of the Ordinary Shares may be deemed

to be “underwriters” within the meaning of the Securities Act. Commissions, discounts or concessions received by any such

broker-dealer or agent may be deemed to be underwriting commissions under the Securities Act.

If underwriters are

used in an offering of offered securities, such offered securities will be acquired by the underwriters for their own account and may

be resold from time to time in one or more transactions, including negotiated transactions, at a fixed public offering price or at varying

prices determined at the time of sale. The securities may be either offered to the public through underwriting syndicates represented

by one or more managing underwriters or by one or more underwriters without a syndicate. Unless otherwise set forth in the prospectus

supplement, the underwriters will not be obligated to purchase offered securities unless specified conditions are satisfied, and if the

underwriters do purchase any offered securities, they will purchase all offered securities.

In

connection with underwritten offerings of the offered securities and in accordance with applicable law and industry practice, underwriters

may over-allot or effect transactions that stabilize, maintain or otherwise affect the market price of the offered securities at levels

above those that might otherwise prevail in the open market, including by entering stabilizing bids, effecting syndicate covering transactions

or imposing penalty bids, each of which is described below.

| |

☐ |

A

stabilizing bid means the placing of any bid, or the effecting of any purchase, for the purpose of pegging, fixing or maintaining

the price of a security. |

| |

|

|

| |

☐ |

A

syndicate covering transaction means the placing of any bid on behalf of the underwriting syndicate or the effecting of any purchase

to reduce a short position created in connection with the offering. |

| |

|

|

| |

☐ |

A

penalty bid means an arrangement that permits the managing underwriter to reclaim a selling concession from a syndicate member in

connection with the offering when offered securities originally sold by the syndicate members are purchased in syndicate covering