UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13A-16 OR 15D-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For

the month of May 2019

Commission

File Number 001-37593

|

|

BORQS

TECHNOLOGIES, INC.

|

|

|

|

(Translation of registrant’s

name into English)

|

|

|

|

Building

B23-A,

Universal

Business Park

No.

10 Jiuxianqiao Road

Chaoyang

District, Beijing, China

|

|

|

|

(Address of principal

executive offices)

|

|

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐.

Note

:

Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual

report to security holders.

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐.

Note

:

Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document

that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant

is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country

exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not

required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already

been the subject of a Form 6-K submission or other Commission filing on EDGAR.

INFORMATION

CONTAINED IN THIS FORM 6-K REPORT

Chongqing

Transaction

On

April 29, 2019, Borqs Technologies, Inc., a British Virgin Islands corporation (the “

Company

”), entered into

a Securities Purchase Agreement (the “

Purchase Agreement

”) with Chongqing City Youtong Equity Investment Fund,

Limited Liability Partnership, a limited liability partnership formed under the laws of the People’s Republic of China (the

“

Purchaser

”). Pursuant to the Purchase Agreement, the Company agreed to sell to and the Purchaser agreed to

purchase from the Company, an aggregate of 3,734,283 ordinary shares (the “

Shares

”) of the Company at $3.713

per share, for total gross proceeds of approximately $13,865,393, consisting of $10,399,045 cash consideration and rights to use

other assets valued at $3,466,348 to be determined within six months after closing of the cash portion. The initial closing of

the transactions contemplated by the Purchase Agreement occurred on May 16, 2019, at which the Company received cash consideration

in the amount of $10,399,045 in exchange for 2,800,172 newly issued Shares.

The

issuance of the Shares is made in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act

of 1933, as amended and/or Regulation S thereunder. The Shares are subject to a one-year lock-up starting from the date of the

applicable closing date.

Samsung

Settlement

As

previously reported on its Current Report on Form 8-K filed on December 6, 2018, the Company was in arbitration pending before

the International Chamber of Commerce with Samsung Electronics Co., Ltd. (“

Samsung

”) to resolve a dispute regarding

royalties payable to the Company under a software license agreement the Company had with Samsung. After arbitration hearings held

in May 2018, on November 27, 2018, the International Chamber of Commerce notified the Company of its decision and issuance of

an arbitration award (the “

Award

”), which the Company received on November 29, 2018. Pursuant to the Award,

the Company has the obligation to pay Samsung an aggregate of $2,546,401 plus an interest of 9% per annum starting May 16, 2018

until full payment is paid. Samsung was also awarded its attorney’s fees and expenses in the aggregate amount of approximately

$1.73 million.

On

April 26, 2019, the Company and certain subsidiaries of the Company entered into a settlement agreement (the “

Settlement

Agreement

”) with Samsung, pursuant to which the Company and Samsung agreed to release and discharge the other party

and affiliates thereof from all actions and claims, including, but not limited to, claims and demands that were or could have

been raised in connection with the Award. In exchange for such mutual release, the Company agreed to pay Samsung $4,279,945 (the

“

Settlement Amount

”) and accrued interest from March 31, 2019 on the outstanding Settlement Amount at a rate

of 9% per annum (the “

Settlement Payment

”). The Settlement Payment will be made over a period of 24 months

beginning on March 31, 2019 (the “

Payment Term

”) with a monthly installment of $178,331.04 plus interest. The

first payment of $100,000 was due on April 30, 2019, the second payment of $309,091.51 was due on May 20, 2019 and each remaining

installment will be due on the last day of each month during the Payment Term. In addition, the Company and its subsidiaries granted

to Samsung a second priority security interest in their assets, accounts, inventory and other property, and a perfected security

interest in an escrow account containing ordinary shares of the Company with an aggregate fair market value of at least $5 million

(the “

Escrow Shares

”). The Company initially deposited 1,082,305 unregistered Escrow Shares into the designated

escrow account and has agreed to file a registration statement on an appropriate form to register the Escrow Shares by June 28,

2019.

Events

of default under the Settlement Agreement include the Company’s failure to perform its obligations thereunder, including,

but not limited to, a failure to make the payment on a due date set forth thereunder and a failure to pledge the Escrow Shares

pursuant to the terms of the Settlement Agreement. Upon the occurrence of an event of default by the Company, Samsung may pursue

all its rights and remedies in law and in equity, including foreclosure on the above referenced collateral and Escrow Shares,

and enforce the Award.

The

summary descriptions of the Purchase Agreement and the Settlement Agreement do not purport to be complete and are qualified in

their entirety by reference to the complete text of such agreements, copies of which are filed as Exhibits 10.1 and 10.2 to this

report and are incorporated herein by reference.

Nasdaq

Notice of Delisting

On

May 17, 2019, the Company received written notice (the “

Notice

”) from the Listing Qualifications Department

(the “

Staff

”) of The NASDAQ Stock Market LLC (“

Nasdaq

”) indicating that, based upon the

Company’s non-compliance with Nasdaq Listing Rule 5250(c)(1) resulting from its failure to file the Annual Report on Form

20-F for fiscal year 2018 within the time period set forth under rules and regulations of the Securities and Exchange Commission,

the Company would be required to submit a plan to regain compliance with Rule 5250(c)(1) for the Staff’s consideration by

no later than July 16, 2019.

The

Company intends to timely submit a compliance plan for the Staff’s review. If the Staff accepts the plan, the Staff may

grant the Company an extension of up to 180 calendar days from the date of the Notice to evidence compliance with Rule 5250(c)(1).

If the Staff does not accept the Company’s plan, the Company would be entitled to request a hearing, at which hearing it

would present its plan to a Nasdaq Hearings Panel and request the continued listing of its securities on Nasdaq pursuant to and

pending the completion of such plan. During the pendency of the hearing process, the Company’s securities would continue

to be listed on Nasdaq.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

|

BORQS TECHNOLOGIES INC.

|

|

|

(registrant)

|

|

|

|

|

Dated: May 22, 2019

|

By:

|

/s/

Anthony K. Chan

|

|

|

|

Anthony K. Chan

|

|

|

|

Chief Financial Officer

|

EXHIBIT

INDEX

The

following exhibits are filed as part of this Form 6-K:

|

Exhibit

|

|

Description

|

|

|

|

|

|

10.1

|

|

Securities Purchase Agreement, dated April 29, 2019, by and between the Company and Chongqing City Youtong Equity Investment Fund, Limited Liability Partnership

|

|

|

|

|

|

10.2

|

|

Settlement Agreement, dated April 26, 2019, by and among the Company, Borqs International Holdings Corp., Borqs Hong Kong Limited, Borqs Beijing Ltd. and Samsung Electronics Co., Ltd.

|

4

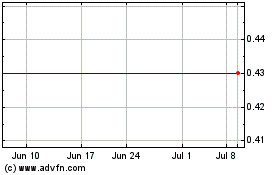

Borqs Technologies (NASDAQ:BRQS)

Historical Stock Chart

From Mar 2024 to Apr 2024

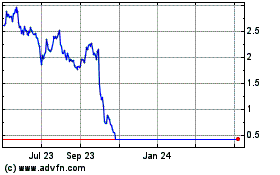

Borqs Technologies (NASDAQ:BRQS)

Historical Stock Chart

From Apr 2023 to Apr 2024