As

filed with the Securities and Exchange Commission on December 14, 2018

Registration

No. 333- _______

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON, D.C.

20549

FORM S-3

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

BORQS TECHNOLOGIES, INC.

(Exact

Name of Registrant as Specified in Its Charter)

|

British

Virgin Islands

|

|

7373

|

|

N/A

|

(State

or Other Jurisdiction of

Incorporation or Organization)

|

|

(Primary

Standard Industrial

Classification Code Number)

|

|

(I.R.S.

Employer

Identification Number)

|

Building

B23-A,

Universal Business Park

No. 10 Jiuxianqiao Road

Chaoyang District, Beijing 100015,

China

(86) 10-5975-6336

(Address,

Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Pat

Sek Yuen Chan

Chief

Executive Officer

Borqs

Technologies, Inc.

Building

B23-A,

Universal

Business Park

No.

10 Jiuxianqiao Road

Chaoyang

District, Beijing 100015

China

(86) 10-5975-6336

(Name,

Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copies

to

Barry

I. Grossman, Esq.

Ellenoff

Grossman & Schole LLP

1345

Avenue of Americas

New

York, NY 10105

(212)

370-1300

Fax:

(212) 370-7889

Approximate

date of commencement of proposed sale to the public

: From time to time after the effective date of this Registration Statement.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please

check the following box: ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415

under the Securities Act of 1933, as amended, other than securities offered only in connection with dividend or interest reinvestment

plans, check the following box: ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please

check the following box and list the Securities Act registration statement number of the earlier effective registration statement

for the same offering: ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and

list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become

effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register

additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following

box. ☐

Indicate

by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act.

|

Large

accelerated filer

☐

|

Accelerated

filer ☐

|

|

Non-accelerated

filer ☒ (Do not check if a smaller reporting company)

|

Smaller

reporting company ☐

|

|

|

Emerging

growth company ☒

|

CALCULATION

OF REGISTRATION FEE

|

Title

of Each Class of Securities to be Registered

|

|

Amount

to

be

Registered(1)(2)

|

|

|

Proposed

Maximum

Aggregate

Offering

Price per

Security(1)(2)

|

|

|

Proposed

Maximum

Aggregate

Offering

Price(2)

|

|

|

Amount

of Registration

Fee

|

|

|

Primary Offering:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ordinary Shares,

no par value per share (3)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred Shares,

no par value (3)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Debt Securities(3)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Warrants

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rights

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Units

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

Primary Offering

|

|

|

|

|

|

|

|

|

|

$

|

100,000,000.00

|

|

|

$

|

12,120.00

|

|

|

Ordinary

Shares, no par value

|

|

|

700,000

|

|

|

$

|

3.94

|

(4)

|

|

$

|

2,758,000.00

|

|

|

$

|

334.27

|

|

|

TOTAL

|

|

|

|

|

|

|

|

|

|

$

|

102,758,000.00

|

|

|

$

|

12,454.27

|

|

|

(1)

|

With

respect to the primary offering, such indeterminate number or amount of debt securities, ordinary shares, preferred shares,

warrants and units to purchase any combination of the foregoing securities, and rights, as may from time to time be issued

at indeterminate prices, with an aggregate initial offering price not to exceed $100,000,000. Securities registered hereunder

may be sold separately or together in any combination with other securities registered hereunder.

|

|

|

|

|

(2)

|

With

respect to the primary offering, estimated solely for the purpose of calculating the registration fee for a primary offering

pursuant to Rule 457(o) under the Securities Act of 1933, as amended (the “Securities Act”). Pursuant

to Rule 457(o) under the Securities Act and General Instruction II.D. of Form S-3, the table does not specify

by each class information as to the amount to be registered or proposed maximum offering price per unit.

|

|

|

|

|

(3)

|

Subject

to footnote (1), there are also being registered hereunder an indeterminate principal amount or number of shares of debt securities,

preferred stock or ordinary shares that may be issued upon conversion of, or in exchange for, debt securities or preferred

shares registered hereunder or upon exercise of warrants registered hereunder, as the case may be.

|

|

|

|

|

(4)

|

Estimated

solely for the purpose of calculating the registration fee for the secondary offering, pursuant to Rule 457(c) under

the Securities Act, based on the average of the high and low prices of the Registrant’s Ordinary Shares on The NASDAQ

Capital Market on December 7, 2018.

|

The

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until

the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become

effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become

effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY

NOTE

This

registration statement contains two prospectuses:

|

|

●

|

Offering

Prospectus. A base prospectus which covers the offering, issuance and sale by us of up to $100,000,000 of our ordinary

shares, preferred shares, debt securities, warrants, rights and/or units;

|

|

|

|

|

|

|

●

|

Resale

Prospectus. A prospectus to be used for the resale by the selling shareholders of up to 700,000 shares of the Registrant’s

ordinary shares; and

|

The

Resale Prospectus is substantively identical to the Offering Prospectus, except for the following principal points:

|

|

●

|

the outside and inside covers are different;

|

|

|

|

|

|

|

●

|

the tables of contents are different;

|

|

|

|

|

|

|

●

|

the section entitled “About this Prospectus” on page ii of the Offering Prospectus is not included in the Resale Prospectus;

|

|

|

|

|

|

|

●

|

the section entitled “The Securities We

May Offer” beginning on page 6 of the Offering Prospectus is not included in the Resale Prospectus;

|

|

|

|

|

|

|

●

|

the section entitled “Use of Proceeds” on page 8 of the Offering Prospectus is different;

|

|

|

|

|

|

|

●

|

the section entitled “Description of

Capital Stock and Securities We May Offer” on page 9 of the Offering Prospectus is different and is entitled

“The Offering”;

|

|

|

|

|

|

|

●

|

a section entitled “Selling Stockholders” is included in the Resale Prospectus; and

|

|

|

|

|

|

|

●

|

the section entitled “Plan of Distribution” beginning on page 23 of the Offering Prospectus is different.

|

The

Registrant has included in this Registration Statement a set of alternate pages for the Resale Prospectus to reflect the foregoing

differences. The Offering Prospectus will exclude the alternate pages and will be used for the public offering by the Registrant.

The Resale Prospectus will be substantively identical to the Offering Prospectus except for the addition or substitution of the

alternate pages and will be used for the resale offering by the selling shareholders.

The

information in this prospectus is not complete and may be changed. We may not sell the securities until the Registration Statement

filed with the Securities and Exchange Commission, of which this prospectus is a part, is effective. This prospectus is not an

offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is

not permitted.

SUBJECT

TO COMPLETION, DATED DECEMBER 14, 2018

PROSPECTUS

$100,000,000

|

Ordinary

Shares

|

Preferred

Shares

|

|

Debt

Securities

|

Warrants

|

|

Rights

|

Units

|

We

may offer and sell from time to time, in one or more series, any one of the following securities of our company, for total gross

proceeds up to $100,000,000:

|

|

●

|

ordinary

shares;

|

|

|

|

|

|

|

●

|

preferred

shares;

|

|

|

|

|

|

|

●

|

secured

or unsecured debt securities consisting of notes, debentures or other evidences of indebtedness which may be senior debt securities,

senior subordinated debt securities or subordinated debt securities, each of which may be convertible into equity securities;

|

|

|

|

|

|

|

●

|

warrants

to purchase our securities;

|

|

|

|

|

|

|

●

|

rights

to purchase any of the foregoing securities; or

|

|

|

|

|

|

|

●

|

units

comprised of, or other combinations of, the foregoing securities.

|

We

will provide specific terms of these offerings and securities in one or more supplements to this prospectus. We may also authorize

one or more free writing prospectuses to be provided to you in connection with these offerings. The prospectus supplement, and

any documents incorporated by reference, may also add, update or change information contained in this prospectus. You should read

this prospectus, the applicable prospectus supplement, any documents incorporated by reference and any related free writing prospectus

carefully before buying any of the securities being offered.

We

may offer and sell these securities to or through one or more underwriters, dealers and agents, or directly to purchasers, on

a continuous or delayed basis.

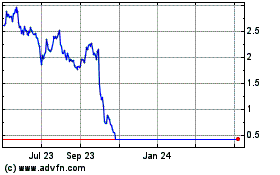

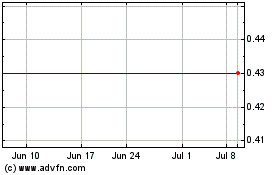

Our

ordinary shares is traded on The NASDAQ Capital Market under the symbol “BRQS.” The last reported sale price of our

ordinary shares on The NASDAQ Capital Market on December 7, 2018 was $3.97 per share.

Investing

in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described under the

heading “Risk Factors” contained in the applicable prospectus supplement and in any related free writing prospectus,

and under similar headings in the other documents that are incorporated by reference into this prospectus or any prospectus supplement

before making a decision to purchase our securities.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is , 2018.

Table

of Contents

You

should rely only on the information we have provided or incorporated by reference in this prospectus or in any prospectus supplement.

We have not authorized anyone to provide you with information different from that contained or incorporated by reference in this

prospectus or in any prospectus supplement.

This

prospectus and any prospectus supplement is an offer to sell only the securities offered hereby, but only under circumstances

and in jurisdictions where it is lawful to do so.

You

should assume that the information contained in this prospectus and in any prospectus supplement is accurate only as of their

respective dates and that any information we have incorporated by reference is accurate only as of the date of the document incorporated

by reference, regardless of the time of delivery of this prospectus or any prospective supplement or any sale of securities.

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission, or

SEC, utilizing a “shelf” registration process. Under this shelf registration process, we may offer and sell, either

individually or in combination, in one or more offerings, any combination of the securities described in this prospectus, for

total gross proceeds of up to $100,000,000. This prospectus provides you with a general description of the securities we may offer.

Each time we offer securities under this prospectus, we will provide a prospectus supplement that will contain more specific information

about the terms of that offering. We may also authorize one or more free writing prospectuses to be provided to you that may contain

material information relating to these offerings. The prospectus supplement and any related free writing prospectus that we may

authorize to be provided to you may also add, update or change any of the information contained in this prospectus or in the documents

that we have incorporated by reference into this prospectus.

We

urge you to read carefully this prospectus, any applicable prospectus supplement and any free writing prospectuses we have authorized

for use in connection with a specific offering, together with the information incorporated herein by reference as described under

the heading “Incorporation of Certain Information by Reference,” before investing in any of the securities being offered.

You should rely only on the information contained in, or incorporated by reference into, this prospectus and any applicable prospectus

supplement, along with the information contained in any free writing prospectuses we have authorized for use in connection with

a specific offering. We have not authorized anyone to provide you with different or additional information. This prospectus is

an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do

so.

The

information appearing in this prospectus, any applicable prospectus supplement or any related free writing prospectus is accurate

only as of the date on the front of the document and any information we have incorporated by reference is accurate only as of

the date of the document incorporated by reference, regardless of the time of delivery of this prospectus, any applicable prospectus

supplement or any related free writing prospectus, or any sale of a security. Our business, financial condition, results of operations

and prospects may have changed since those dates.

This

prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made

to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents.

Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits

to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below

under the section entitled “Where You Can Find More Information.”

We

further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any

document that is incorporated by reference herein were made solely for the benefit of the parties to such agreement, including,

in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation,

warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made.

Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state

of our affairs.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus and any accompanying prospectus supplement and the documents we have filed or will file with the SEC that are or will

be incorporated by reference into this prospectus and the accompanying prospectus supplement contain forward-looking statements,

within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), that involve risks and uncertainties. Any statements contained, or incorporated by reference,

in this prospectus and any accompanying prospectus that are not statements of historical fact may be forward-looking statements.

When we use the words “anticipate,” “believe,” “could,” “estimate,” “expect,”

“intend,” “may,” “plan,” “predict,” “project,” “will”

and other similar terms and phrases, including references to assumptions, we are identifying forward-looking statements. Forward-looking

statements involve risks and uncertainties which may cause our actual results, performance or achievements to be materially different

from those expressed or implied by forward-looking statements.

A

variety of factors, some of which are outside our control, may cause our operating results to fluctuate significantly. They include:

|

|

●

|

Our

future capital needs are uncertain and our independent registered public accounting firm has expressed in its report on our

2017 audited financial statements a substantial doubt about our ability to continue as a going concern;

|

|

|

●

|

We

generate a significant portion of our net revenues from a small number of major customers and key projects;

|

|

|

●

|

We

are dependent upon the Android platform and, if Google determines to no longer develop the Android platform and our further

development is not taken up by reliable alternative sources, our business could be materially harmed;

|

|

|

●

|

Our

control of our VIEs is based upon contract rather than equity;

|

|

|

●

|

We

face potential risks associated with our ability to fund our expansion plans, including acquisitions, and our operations due

to fund restrictions both from currency transfer and conversion restrictions placed on us by the PRC government; and

|

|

|

●

|

The

current license to operate our services in the PRC is based on an MVNO license issued to us in July 2018 by the MIIT, which

is valid until July 12, 2023. If we cannot maintain the license, we will need to cease operating as a MVNO and our total revenues

will be significantly reduced.

|

The

risks and uncertainties related to our business and our industry also include, but are not limited to:

|

|

●

|

Our

ability to manage our business expansion and increasingly complicated operations effectively;

|

|

|

●

|

Our

ability to use, protect and enhance our brands;

|

|

|

●

|

Our

ability to compete effectively in the marketplace;

|

|

|

●

|

Our

ability to remediate our material weakness and maintain an effective system of internal controls; and

|

|

|

●

|

Our

ability to make acquisitions, including our potential acquisition of KADI, and to successfully integrate these acquisitions

and establish and maintain strategic relationships.

|

The

foregoing does not represent an exhaustive list of risks that may impact upon the forward-looking statements used herein or in

the documents incorporated by reference herein. Please see “Risk Factors” in our reports filed with the SEC or in

a prospectus supplement related to this prospectus for additional risks which could adversely impact our business and financial

performance. Moreover, new risks regularly emerge and it is not possible for our management to predict all risks, nor can we assess

the impact of all risks on our business or the extent to which any risk, or combination of risks, may cause actual results to

differ from those contained in any forward-looking statements. All forward-looking statements included in this prospectus and

any accompanying prospectus supplement are based on information available to us on the date hereof or thereof. Except to the extent

required by applicable laws or rules, we undertake no obligation to publicly update or revise any forward-looking statement, whether

as a result of new information, future events or otherwise. All subsequent written and oral forward-looking statements attributable

to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained throughout

(or incorporated by reference in) this prospectus, any accompanying prospectus and the documents we have filed with the SEC.

PROSPECTUS

SUMMARY

This

summary highlights information contained in greater detail elsewhere in this prospectus. This summary is not complete and does

not contain all of the information you should consider in making your investment decision. You should read the entire prospectus

carefully before making an investment in our ordinary shares. You should carefully consider, among other things, our consolidated

financial statements and related notes and the sections titled “Risk Factors” and “Management’s Discussion

and Analysis of Financial Condition and Results of Operations” included elsewhere in this prospectus.

BORQS

TECHNOLOGIES, INC.

Overview

Borqs

Technologies, Inc. (“we”, “the Company” or “Borqs”) is a global leader in software, development

services and products providing customizable, differentiated and scalable Android-based smart connected devices and cloud service

solutions. We are a leading provider of commercial grade Android platform software for mobile chipset manufacturers, mobile device

Original Equipment Manufacturers (“OEMs”) and mobile operators, as well as complete product solutions of mobile connected

devices for enterprise and consumer applications.

Our

Connected Solutions Business Unit (“BU”) works closely with chipset partners to develop new connected devices. Borqs

developed the reference Android software platform and hardware platform for Intel and Qualcomm phones and tablets. In recent years,

we have been awarded significant business contracts from Intel and Qualcomm, leading global chipset manufacturers. We provide

Connected Solutions customers with customized, integrated, commercial grade Android platform software and service solutions to

address vertical market segment needs through the targeted BorqsWare software platform solutions. The BorqsWare software platform

consists of BorqsWare Client Software and BorqsWare Server Software. The BorqsWare Client Software platform has been used in Android

phones, tablets, watches and various Internet-of-things (“IoT”) devices. The BorqsWare Server Software platform consists

of back-end server software that allows customers to develop their own mobile end-to-end services for their devices. Our activities

with Intel have reduced over the last two years due to Intel’s strategy to exit the mobile industry, and there are no material

agreements with Intel on which we are substantially dependent. For the year 2017, Intel was no longer a customer of the Company.

However, our activities with Qualcomm have increased over the last two years, including developmental work on chipsets for mobile

devices and wearable products.

Our

Mobile Virtual Network Operator (“MVNO”) BU provides a full range 2G/3G/4G voice and data services for general consumer

usage and IoT devices, as well as traditional telecom services such as voice conferencing, and acts as a sales and promotion channel

for the products developed by the Connected Solutions BU.

The Connected Solutions BU represented 73.4%, 70.9% and 79.2%

of our net revenues in the year ended December 31, 2015, 2016 and 2017, respectively. In the year ended December 31, 2015, 2016

and 2017, Borqs generated 85%, 93% and 86% of its net revenues from customers headquartered outside of China and 15%, 7% and 14%

of its net revenues from customers headquartered within China. As of September 30, 2018, Borqs had collaborated with 6 mobile chipset

manufacturers and 29 mobile device OEMs to commercially launch Android based connected devices in 11 countries, and sales of connected

devices with the BorqsWare software platform solutions are embedded in more than 14 million units worldwide.

Borqs

has dedicated significant resources to research and development, and has research and development centers in Beijing, China and

Bangalore, India. As of September 30, 2018, 365 of our 571 employees were technical professionals dedicated to platform research

and development and product specific customization.

Borqs

has achieved significant growth since inception in 2007. Net revenues increased from $75.1 million in 2015 to $120.6 million in

2016, to $154.3 million in 2017. We recorded net income of $0.8 million and $2.6 million in the years 2015 and 2016 respectively.

For 2017, we had a net loss of $12.4 million which included non-cash merger related costs of $14.5 million; excluding such non-cash

merger related costs would result in non-GAAP adjusted net income of $2.1 million for 2017 as compared to a net income of $2.6

million for 2016. We recorded a net loss of $2.2 million in the three months ended September 30, 2018 and a net income of $1.2

million in the nine months ended September 30, 2018, as compared with a net loss of $11.6 million in the three months ended September

30, 2017 and a net loss of $12.5 million in the nine months ended September 30, 2017.

Recent

Developments

Potential

acquisition of Shanghai KADI Technologies Co., Ltd.

On January 8, 2018, we entered into a letter of intent to acquire

a 60% equity interest in Shanghai KADI Technologies Co., Ltd (“KADI”), a Chinese company that develops software and

hardware solutions for electric vehicle control modules, such as charging, battery management and vehicle controls. Pursuant to

the letter of intent, and as is being negotiated in a definitive agreement, we intend to pay $11.7 million in cash to KADI and

$3.3 million in our ordinary shares to the selling shareholders of KADI based on achievement of net income targets for the years

2018, 2019 and 2020. KADI is not a customer or supplier of Borqs. In accordance with the letter of intent, we have made four scheduled

cash advances to KADI totaling $600,000 which will be deducted from our initial cash payments to KADI under the definitive agreement

being negotiated. If the transaction is not consummated within nine months after the signing of the letter of intent, the advance

payments will be converted into shares representing five percent of the outstanding capital stock of KADI. There are no termination

fees or penalties under the letter of intent.

According

to the letter of intent, if the transaction was not consummated within nine months after the signing of the letter of intent,

the advance payments would be converted into shares representing five percent of the outstanding capital stock of KADI.

KADI

has worked with the leading automotive companies in China, including Chery, Dong Feng Motors, Geely Auto and Shenzhen Pin Chuan

Electric Energy Co. Its founder, Dr. Hu Lin, has nearly 20 years of professional experience working with companies in the automotive

industry, including Volkswagen and Delphi.

KADI

has been awarded a RMB320 million (US$50 million) multi-year supply contract for its core electric control modules from Shenzhen

Espirit Technology Co., Ltd. (“Espirit”), which is a key automotive contractor in China. Borqs believes that KADI’s

products will complement Borqs’ existing automobile in-vehicle-infotainment (IVI) solutions, in terms of sales and distribution,

and research and development. Borqs anticipates that the experience of its software engineers will enhance KADI’s capabilities

while Borqs’ supply chain management team will ensure efficient delivery of hardware products. Assuming the acquisition

of KADI is completed, Borqs expects to provide $7.7 million to KADI in 2018 to service the Espirit supply contract, of which approximately

$4 million is anticipated to be used for capital expenditures, and $3.7 million is anticipated to be used for working capital

needs. We are in discussions with KADI to negotiate a modified payment schedule in light of the fact that the proceeds raised

in this offering are insufficient to fund the acquisition of KADI.

Beginning

in May 2018, KADI has delivered certain control modules, including steering control, air conditioning and for other electric bus

functions, to Dong Feng Motor Group’s Super Dragon Electric Bus Program. Such products represent approximately 10% of the

Espirit supply contract.

Upon

the completion of our acquisition of 60% of KADI, we will have an exclusive option, valid until December 31, 2021, to purchase

the remaining 40% of KADI at a 9% premium to the consideration paid for the first 60%.

Repurchase

of Shares from Zhengqi.

On January 10, 2018, we entered into a stock repurchase agreement (“Stock Repurchase Agreement”)

with Zhengqi International Holding Limited (“Zhengqi”), pursuant to which we agreed to repurchase 966,136 of our ordinary

shares that were originally issued and sold to Zhengqi on August 18, 2017, at an aggregate purchase price of approximately $10

million, or $10.40 per share. In addition, Zhengqi agreed to forfeit all of its rights to 1,278,776 shares held in escrow. The

Stock Repurchase Agreement provides that those shares will be treated in the following manner: transfer 51,151 shares (4% of the

total) to the indemnity escrow account; and deliver 1,227,625 shares to the former Borqs International Holding Corp. shareholders

based on their respective proportionate interests in the merger consideration. We and Zhengqi are currently making arrangements

for the completion of this transaction, which we anticipate will be within 2018. As of August 3, 2018, the 1,278,776 escrow shares

were forfeited and released from escrow and the Company had obtained the consent of its existing lenders with respect to the transaction.

The return and cancellation of the 966,136 shares remain in process.

Investment in Shenzhen Crave Communication Co., Ltd.

On

January 18, 2018, we entered into an agreement with Shenzhen Crave Communication Co., Ltd (“Crave”) and Colmei Technology

International Ltd. (“Colmei”), along with the shareholders of Crave and Colmei (“CC Selling Shareholders”),

pursuant to which we agreed to acquire 13.8% of the outstanding shares of Crave and 13.8% of the outstanding shares of Colmei from

the CC Selling Shareholders. The transaction closed on March 22, 2018, and under the agreement, the purchase consideration consists

of ordinary shares and cash. On the closing, we issued 473,717 ordinary shares to the order of the CC Selling Shareholders and

agreed to pay cash in the amount of $10.0 million to be paid to the CC Selling Shareholders over a period of 36 months. In addition,

subject to board approval, we agreed to issue 183,342 additional shares to the CC Selling Shareholders if the aggregate value of

the ordinary shares initially issued at the closing to the CC Selling Shareholders under this agreement was less than $3.0 million

on August 18, 2018 (the “Calculation Date”). On December 12, 2018, our board of directors approved the issuance of

the 183,342 shares.

Crave

is a manufacturer of mobile terminal devices located in Shenzhen China. With multiple high speed SMT lines, assembly lines and

packaging lines, its annual capacity reaches over 10 million units in its Shenzhen facility. Crave exports final products for

customers in South America, India, Indonesia, the Philippines and Vietnam. Colmei, which is under common ownership with Crave,

is a sales entity located in Hong Kong that has established relationships with international banks to facilitate transactions

with its global clients. Crave is one of our material suppliers from which we source necessary components for our customers, and

we believe our investments in Colmei and Crave provide us with indirect access to supply chain financing, competitive component

pricing and prioritized production capacity. Prior to this investment, we have contracted Crave and Colmei for multiple projects

related to manufacturing our products, including a large variety of phone models and releases.

Award

of MVNO License to Yuantel Telecom

. On July 23, 2018, the Ministry of Industry and Information Technology of China (the “MIIT”)

awarded the official commercial MVNO license to Yuantel Telecom, our subsidiary that runs our mobile virtual network operator

or MVNO business. The license is valid from July 12, 2018 to July 12, 2023.

Corporate

History and Information

We

were incorporated in the British Virgin Islands on July 1, 2015 as a blank check company, formed for the purpose of acquiring,

engaging in a share exchange, share reconstruction and amalgamation with, purchasing all or substantially all of the assets of,

entering into contractual arrangements with, or engaging in any other similar business combination with one or more businesses

or entities. As a result of a merger on August 18, 2017 of one of our subsidiaries (which we formed for this purpose) with and

into Borqs International Holding Corp (“Borqs International”), a company incorporated in the Cayman Islands in 2007,

we acquired the entire issued share capital of Borqs International, which became our wholly-owned subsidiary, and we ceased to

be a shell company. We conduct our business principally through BORQS Beijing Ltd. (“Borqs Beijing”), which is our

wholly-owned Chinese subsidiary. In addition, we conduct parts of our operations through subsidiaries in China, India, Hong Kong

and South Korea.

As of December 14, 2018, we were authorized to issue an unlimited

number of shares and our share capital consisted of 32,190,864 issued and 32,186,692 outstanding ordinary shares (including the

700,000 ordinary shares granted to certain selling stockholders identified in the Resale Prospectus and 183,342 ordinary shares

to be issued to the shareholders of Crave and Colmei), and we had issued 5,750,000 public warrants, 531,875 private warrants, and

417,166 assumed warrants. Our ordinary shares and public warrants began trading on The Nasdaq Capital Market (“Nasdaq”)

under the symbols “BRQS” and “BRQSW,” respectively, on or around August 21, 2017. On October 12, 2017,

we were notified by Nasdaq that we were not in compliance with Nasdaq Listing Rules 5505(a)(3) and 5515(a)(4), given that our ordinary

shares and public warrants did not meet the minimum initial listing requirements of 300 round lot holders of ordinary shares and

400 round lot holders of public warrants. On December 11, 2017, we were notified that our request for continued listing of

our ordinary shares on Nasdaq was granted, subject to providing an update regarding the status of our efforts to evidence compliance

with the minimum 300 round lot shareholder requirement on or before February 14, 2018, and full compliance with that requirement

by no later than April 10, 2018. The Panel also advised the Company that it had determined to delist our warrants. To regain compliance

with Nasdaq’s listing requirement of 300 round lot holders of ordinary shares, we implemented a restricted ordinary shares

purchase program with eligible employees of our wholly-owned subsidiary in India, Borqs Software Solutions Private Ltd. Pursuant

to the program, 222 employees purchased an aggregate of 29,170 ordinary shares at a purchase price of $9.40 per share, which was

deducted from their regular compensation on March 23, 2018. On April 12, 2018, we were notified by the Panel that we had regained

compliance with the listing requirement of 300 round lot holders and that our ordinary shares would continue to be listed on Nasdaq.

Our public warrants have been trading on the OTC Markets system under the symbol “BRQSW” since October 23, 2017.

Our

principal executive offices are located at Building B23-A, Universal Business Park, No. 10 Jiuxianqiao Road, Chaoyang District,

Beijing, 100015 China. Our telephone number is +86 10-5975-6336. Our website address is

www.borqs.com

. The information

contained on our website is not incorporated by reference into this prospectus.

The

following diagram illustrates our current corporate structure of each of our material subsidiaries, consolidated VIEs and the

subsidiaries of the VIEs.

Corporate

Organizational Chart

Borqs

Subsidiaries and Consolidated Affiliated Entities

The

following is a summary of our material subsidiaries and consolidated affiliated entities:

Borqs

Beijing Ltd. (“Borqs Beijing”), a wholly foreign owned enterprise established under the laws of the PRC in 2007, is

our primary operating entity and 100% owned by Borqs Hong Kong Limited;

Borqs

Hong Kong Limited (“Borqs Hong Kong”), a limited company established under the laws of Hong Kong in 2007, engages

in the software and services business and is 100% owned by Borqs International Holding Corp.;

Borqs

Software Solutions Private Limited (“Borqs Software Solutions”), a private limited company established under the laws

of India in 2009, engages in the R&D for software and is 99.99% owned by Borqs International Holding Corp. and 0.01% owned

by Borqs Hong Kong;

Borqs

Korea (“Borqs Korea”), a company established under the laws of South Korea in 2012, engages in the R&D of software

and is 100% owned by Borqs Hong Kong;

Beijing

Borqs Software Technology Co, Ltd. (“Borqs Software”), a company established under the laws of the PRC in 2008, engages

in government subsidized software development and engineering projects as well as other software and services business and is

100% owned by Beijing Big Cloud Century Technology Limited (“BC-Tech”), which is 100% owned by Borqs Beijing;

Beijing

Borqs Wireless Technology Co, Ltd. (“Borqs Wireless”), a company established under the laws of the PRC in 2013, engages

in software development and engineering projects as well as other software and services business and is 100% owned by BC-Tech,

which is 100% owned by Borqs Beijing;

Beijing

Big Cloud Century Network Technology Co., Ltd. (“BC-NW”), a company established under the laws of the PRC in 2014,

is the variable interest entity through which Borqs Beijing controls Yuantel Telecom, the entity which operates the MVNO business;

Yuantel

(Beijing) Telecommunications Technology Co., Ltd. (“Yuantel Telecom”), a company established under the laws of the

PRC in 2004, engages in MVNO services and is 95% owned by Yuantel (Beijing) Investment Management Co., Ltd., which is 79% owned

by BC-NW, which is 100% beneficially owned and controlled by Borqs Beijing through contractual control arrangements; and

Beijing

Tongbaohuida Technology Co., Ltd. (“Tongbaohuida”), a company established under the laws of the PRC in 2012 and is

100% owned by Yuantel Telecom. Tongbaohuida has been inactive for the years 2016 and 2017.

Implications

of Being an Emerging Growth Company

We

are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, or “JOBS Act.”

We have elected to take advantage of specified reduced reporting and other requirements available to us, as an emerging growth

company, that are otherwise applicable to public companies. These provisions include, among other things:

|

|

●

|

exemption

from the auditor attestation requirement in the assessment of our internal controls over financial reporting;

|

|

|

●

|

exemption

from new or revised financial accounting standards applicable to public companies until such standards are also applicable

to private companies;

|

|

|

●

|

exemption

from compliance with any new requirements adopted by the Public Company Accounting Oversight Board (United States), requiring

mandatory audit firm rotation or a supplement to our auditor’s report in which the auditor would be required to provide

additional information about the audit and our financial statements;

|

|

|

●

|

an

exemption from the requirement to seek non-binding advisory votes on executive compensation and golden parachute arrangements;

and

|

|

|

●

|

reduced

disclosure about executive compensation arrangements.

|

We

may take advantage of these provisions until October 20, 2020, unless we earlier cease to be an emerging growth company, which

would occur if our annual gross revenues exceed $1.0 billion, if we issue more than $1.0 billion in non-convertible debt in a

three-year period, or if the market value of our ordinary shares held by non-affiliates exceeds $700.0 million as of any January

1 before that time, in which case we would no longer be an emerging growth company as of the following December 31. Investors

may find our ordinary shares less attractive if we rely on the exemptions, which may result in a less active trading market and

increased volatility in our stock price. We have taken advantage of the reduced reporting requirement with respect to disclosure

regarding our executive compensation arrangements and expect to take advantage of the exemption from auditor attestation on the

effectiveness of our internal control over financial reporting. For as long as we take advantage of the reduced reporting obligations,

the information that we provide shareholders may be different from information provided by other public companies. We have not

elected to “opt out” of the extended transition period relating to the exemption from new or revised financial accounting

standards and as a result, we will not necessarily comply with new or revised accounting standards on the relevant dates on which

adoption of such standards is required for non-emerging growth companies.

Legal

Proceedings

The

Company recently completed arbitration before the International Chamber of Commerce with Samsung Electronics Co., Ltd. (“Samsung”)

to resolve a dispute regarding royalties payable to the Company under a software license agreement the Company had with Samsung.

Samsung alleged that, for the period starting the fourth quarter of 2010 through mid-2012, the Company was overpaid royalties

in the amount of approximately $1.67 million due to a clerical error in Samsung’s accounting department that enabled the

Company to receive royalties on sales of Samsung handsets that did not contain its software. Samsung was seeking repayment of

the $1.67 million plus accrued interest of 12% per annum and as well as reimbursements of reasonable fees including attorney fees

and arbitration costs.

After

arbitration hearings held in May 2018, on November 27, 2018, the International Chamber of Commerce notified the Company of its

decision and issuance of an arbitration award (the “Award”), which the Company received on November 29, 2018. Pursuant

to the Award, the Company has the obligation to pay Samsung an aggregate of $2,546,401 plus an interest of 9% per annum starting

May 16, 2018 until full payment is paid. Samsung was also awarded its attorney’s fees and expenses in the aggregate amount

of approximately $1.73 million. The Company is currently in discussion with Samsung to structure a payment schedule for its obligations

under the Award. The Company is also considering to file a separate complaint against Samsung for infringing its intellectual

property that has been used in certain Samsung mobile phone models other than the models in China.

To

the knowledge of our management, there is no material litigation currently pending or contemplated against us, any of our officers

or directors in their capacity as such or against any of our property.

The

Securities We May Offer

We

may offer and sell from time to time up to an aggregate of $100,000,000 of any of, or units comprised of, or other combinations

of, the following securities:

Ordinary

Shares

. We may issue ordinary shares. Holders of ordinary shares are entitled to receive ratably dividends if, as and when

dividends are declared from time to time by our board of directors out of funds legally available for that purpose, after payment

of dividends required to be paid on outstanding preferred shares or series ordinary shares. Holders of ordinary shares are entitled

to one vote per share. Holders of ordinary shares have no cumulative voting rights in the election of directors.

Preferred

Shares

. We may issue preferred shares in one or more series. Our board of directors will determine the dividend, voting, conversion

and other rights of the series of preferred shares being offered.

Debt

Securities

. We may offer debt securities, which may be secured or unsecured, senior, senior subordinated or subordinated,

may be guaranteed by our subsidiaries, and may be convertible into shares of our ordinary shares. We may issue debt securities

either separately or together with, upon conversion of or in exchange for other securities. It is likely that the debt securities

that we may issue will not be issued under an indenture.

Warrants

.

We may issue warrants to preferred shares, ordinary shares or debt securities of our company. We may issue warrants independently

or together with other securities. Warrants sold with other securities as a unit may be attached to or separate from the other

securities. To the extent the warrants are publicly-traded, we will issue warrants under one or more warrant agreements between

us and a warrant agent that we will name in the applicable prospectus supplement.

Rights

.

We may issue rights to purchase preferred shares or ordinary shares or debt securities of our company. We may issue rights independently

or together with other securities. Rights sold with other securities as a unit may be attached to or separate from the other securities

and may be (but shall not be required to be) publicly-listed securities.

Units

.

We may also issue units comprised of one or more of the other securities described in this prospectus in any combination. Each

unit will be issued so that the holder of the unit is also the holder of each security included in the unit. Thus, the holder

of a unit will have the rights and obligations of a holder of each included security.

Prospectus

Supplement

. We will describe the terms of any such offering in a supplement to this prospectus. Any prospectus supplement

may also add, update or change information contained in this prospectus. Such prospectus supplement will contain, among other

pertinent information, the following information about the offered securities:

|

|

●

|

title

and amount;

|

|

|

|

|

|

|

●

|

offering

price, underwriting discounts and commissions or agency fees, and our net proceeds;

|

|

|

|

|

|

|

●

|

any

market listing and trading symbol;

|

|

|

|

|

|

|

●

|

names

of lead or managing underwriters or agents and description of underwriting or agency arrangements; and

|

|

|

|

|

|

|

●

|

the

specific terms of the offered securities.

|

This

prospectus may not be used to offer or sell securities without a prospectus supplement which includes a description of the method

and terms of this offering.

RISK

FACTORS

We

have included discussions of the risks, uncertainties and assumptions under the heading “Risk Factors” included in

our Annual Report on Form 10-K for the year ended December 31, 2017, as updated by our subsequent filings under the Exchange

Act, which risk factors are incorporated by reference into this prospectus. See “Where You Can Find More Information”

for an explanation of how to get a copy of this report. Additional risks related to our securities may also be described in a

prospectus supplement and in any related free writing prospectus that we may authorize to be provided to you.

Investing

in our securities involves a high degree of risk.

Before deciding whether to invest in our securities, you should carefully

consider the risk factors we describe in any prospectus supplement and in any related free writing prospectus that we may authorize

to be provided to you or in any report incorporated by reference into this prospectus or such prospectus supplement, including

our Annual Report on Form 10-K for the year ended December 31, 2017, or any Annual Report on Form 10-K or Quarterly

Report on Form 10-Q that is incorporated by reference into this prospectus or such prospectus supplement after the date of this

prospectus. Although we discuss key risks in those risk factor descriptions, additional risks not currently known to us or

that we currently deem immaterial also may impair our business. Our subsequent filings with the SEC may contain amended and

updated discussions of significant risks. We cannot predict future risks or estimate the extent to which they may affect

our financial performance.

Please

also read carefully the section above entitled “Cautionary Note Regarding Forward-Looking Statements.”

USE

OF PROCEEDS

Except

as otherwise disclosed in the applicable prospectus supplement, we intend to use the net proceeds from the sales of securities

hereunder for working capital and general corporate purposes, which includes, without limitation, investing in or acquiring companies

that are synergistic with or complementary to our technologies. The amounts and timing of these expenditures will depend on numerous

factors, including the development of our current business initiatives, technological advances and the competitive environment

for our products. As of the date of this prospectus, we cannot specify with certainty all of the particular uses for the net proceeds

to us from the sale of the securities offered by us hereunder and the applicable prospectus supplement. Accordingly, our management

will have broad discretion in the timing and application of these proceeds. Pending application of the net proceeds as described

above, we intend to temporarily invest the proceeds in short-term, interest-bearing instruments.

DESCRIPTION

OF CAPITAL STOCK AND SECURITIES WE MAY OFFER

Securities

We

are a company incorporated in the British Virgin Islands as a BVI business company (company number 1880410) and our affairs are

governed by our memorandum and articles of association, the BVI Business Companies Act (as amended) and the common law of the

British Virgin Islands. We are authorized to issue an unlimited number of both ordinary shares of no par value and preferred shares

of no par value. The following description summarizes certain terms of our shares as set out more particularly in our memorandum

and articles of association. Because it is only a summary, it may not contain all the information that is important to you.

Ordinary

Shares

As of December 14, 2018, there were 32,186,692 ordinary shares

outstanding (including the 700,000 ordinary shares granted to the selling stockholders identified in the Resale Prospectus and

183,342 ordinary shares to be issued to the shareholders of Crave and Colmei). Under the BVI Business Companies Act (as amended),

the ordinary shares are deemed to be issued when the name of the shareholder is entered in our register of members. Our register

of members is maintained by our transfer agent, Continental Stock Transfer & Trust Company. Our transfer agent has entered

the name of Cede & Co. in our register of members as nominee for each of the respective public shareholders. If (a) information

that is required to be entered in the register of members is omitted from the register or is inaccurately entered in the register,

or (b) there is unreasonable delay in entering information in the register, a shareholder of the company, or any person who is

aggrieved by the omission, inaccuracy or delay, may apply to the British Virgin Islands Courts for an order that the register be

rectified, and the court may either refuse the application or order the rectification of the register, and may direct the company

to pay all costs of the application and any damages the applicant may have sustained.

Any

action required or permitted to be taken by our shareholders must be effected by a meeting of shareholders of our company, duly

convened and held in accordance with our memorandum and articles of association. A resolution of our members may not be taken

by a resolution consented to in writing.

At

any general meeting of our shareholders, the chairman of the meeting is responsible for deciding in such manner as he or she considers

appropriate whether any resolution proposed has been carried or not and the result of his decision shall be announced to the meeting

and recorded in the minutes of the meeting. If the chairman has any doubt as to the outcome of the vote on a proposed resolution,

the chairman shall cause a poll to be taken of all votes cast upon such resolution. If the chairman fails to take a poll then

any member present in person or by proxy who disputes the announcement by the chairman of the result of any vote may immediately

following such announcement demand that a poll be taken and the chairman shall cause a poll to be taken. If a poll is taken at

any meeting, the result shall be announced to the meeting and recorded in the minutes of the meeting.

A

resolution of our shareholders shall be duly and validly passed if it is approved at a duly convened and constituted meeting of

our shareholders by the affirmative vote of a majority of the votes of the shares entitled to vote thereon which were present

at the meeting and were voted. Each ordinary share in our company confers upon the shareholder the right to one vote at any meeting

of our shareholders or on any resolution of shareholders.

The

rights and obligations attaching to our ordinary shares may only be varied by a resolution passed at a meeting by the holders

of more than fifty percent (50%) of the ordinary shares present at a duly convened and constituted meeting of our shareholders

holding ordinary shares which were present at the meeting. The other provisions of our memorandum and articles of association

may be amended if approved by a resolution of our shareholders or by a resolution of our directors (save that no amendment may

be made by a resolution of our directors (a) to restrict the rights or powers of our shareholders to amend the memorandum or articles,

(b) to change the percentage of shareholders required to pass a resolution of shareholders to amend the memorandum or articles,

(c) in circumstances where the memorandum or articles cannot be amended by our shareholders, or (d) to change clauses 7, 8 or

11 of our memorandum (or any of the defined terms used in any such clause or regulation).

In

accordance with our memorandum and articles of association, our Board is divided into three classes, with the number of directors

in each class to be as nearly equal as possible. Our existing Class I directors will serve until our 2018 annual general meeting,

our existing Class II directors will serve until our 2019 annual general meeting, and our existing Class III directors will serve

until our 2020 annual general meeting. Commencing at our 2018 annual general meeting, and at each following annual general meeting,

directors elected to succeed those directors whose terms expire shall be elected for a term of office to expire at the third annual

general meeting following their election. There is no cumulative voting with respect to the election of directors, with the result

that the holders of more than 50% of the votes of the shares entitled to vote at any general meeting of our members at which the

election of directors is voted upon can elect all of the directors (and the holders of more than 50% of the votes of the shares

entitled to vote at any general meeting of our members at which the removal of our directors is voted upon can remove a director

with or without cause).

Our

shareholders are entitled to receive ratable dividends when, as and if declared by the Board. Under the laws of the British

Virgin Islands, and as provided in our memorandum and articles of association, our directors may authorize a distribution (including

any interim dividend that the directors consider to be justified by the profits of our company) only if, immediately after the

distribution, the value of our assets will exceed our liabilities, and we will be able to pay our debts as and when they fall

due. In the event of a liquidation or winding up of the company, our shareholders are entitled to share ratably in all assets

remaining available for distribution to them after payment of liabilities and after provision is made for each class of shares,

if any, having preference over the ordinary shares. Our shareholders have no preemptive or other subscription rights. There are

no sinking fund provisions applicable to the ordinary shares, except that we will provide our shareholders with the redemption

rights set forth above.

We,

directly or through agents, dealers or underwriters designated from time to time, may offer, issue and sell, together or separately,

up to $100,000,000 in the aggregate of:

|

|

●

|

ordinary

shares;

|

|

|

|

|

|

|

●

|

preferred

shares;

|

|

|

|

|

|

|

●

|

secured

or unsecured debt securities consisting of notes, debentures or other evidences of indebtedness which may be senior debt securities,

senior subordinated debt securities or subordinated debt securities, each of which may be convertible into equity securities;

|

|

|

|

|

|

|

●

|

warrants

to purchase our securities;

|

|

|

|

|

|

|

●

|

rights

to purchase our securities; or

|

|

|

|

|

|

|

●

|

units

comprised of, or other combinations of, the foregoing securities.

|

We

may issue the debt securities as exchangeable for or convertible into ordinary shares, preferred shares or other securities. The

preferred shares may also be exchangeable for and/or convertible into shares of ordinary shares, another series of preferred shares

or other securities. The debt securities, the preferred shares, the ordinary shares and the warrants are collectively referred

to in this prospectus as the “securities.” When a particular series of securities is offered, a supplement to this

prospectus will be delivered with this prospectus, which will set forth the terms of the offering and sale of the offered securities.

Preferred

Shares

Our

memorandum and articles of association authorizes the creation and issuance without shareholder approval of an unlimited number

of preferred shares divided into five classes, Class A through Class E each with such further designation, rights and preferences

as may be determined by a resolution of our Board to amend the memorandum and articles of association to create such designations,

rights and preferences. We have five classes of preferred shares to give us flexibility as to the terms on which each Class is

issued. Unlike Delaware law, all shares of a single class must be issued with the same rights and obligations. Accordingly, starting

with five classes of preferred shares will allow us to issue shares at different times on different terms. Accordingly, our Board

is empowered, without shareholder approval, to issue preferred shares with dividend, liquidation, redemption, voting or other

rights, which could adversely affect the voting power or other rights of the holders of ordinary shares. These preferred shares

could be utilized as a method of discouraging, delaying or preventing a change in control of us.

No

preferred shares are currently issued or outstanding. Although we do not currently intend to issue any preferred shares, we may

do so in the future.

The

rights attached to any class of preferred shares in issue, may only be amended by a resolution passed at a meeting by the holders

of more than fifty percent (50%) of the preferred shares of that same class present at a duly convened and constituted meeting

of our members holding preferred shares in such class which were present at the meeting and voted, unless otherwise provided by

the terms of issue of such class. If our preferred shareholders want us to hold a meeting of preferred shareholders (or of a class

of preferred shareholders), they may requisition the directors to hold one upon the written request of preferred shareholders

entitled to exercise at least 30 percent of the voting rights in respect of the matter for which the meeting is requested. Under

British Virgin Islands law, we may not increase the required percentage to call a meeting above 30 percent.

Under

the BVI Business Companies Act (as amended) there are no provisions which specifically prevent the issuance of preferred shares

or any such other “poison pill” measures. Our memorandum and articles of association also do not contain any express

prohibitions on the issuance of any preferred shares. Therefore, the directors, without the approval of the holders of ordinary

shares, may issue preferred shares that have characteristics that may be deemed anti-takeover. Additionally, such a designation

of shares may be used in connection with plans that are poison pill plans. However, under the BVI Business Companies Act (as amended),

a director in the exercise of his powers and performance of his duties is required to act honestly and in good faith in what the

director believes to be the best interests of the company, and a director is also required to exercise his powers as a director

for a proper purpose.

You

should refer to the prospectus supplement relating to the series of preferred shares being offered for the specific terms of that

series, including:

|

|

●

|

the

title of the series and the number of shares in the series;

|

|

|

|

|

|

|

●

|

the

price at which the preferred shares will be offered;

|

|

|

|

|

|

|

●

|

the

dividend rate or rates or method of calculating the rates, the dates on which the dividends will be payable, whether or not

dividends will be cumulative or noncumulative and, if cumulative, the dates from which dividends on the preferred shares being

offered will cumulate;

|

|

|

|

|

|

|

●

|

the

voting rights, if any, of the holders of shares of the preferred shares being offered;

|

|

|

|

|

|

|

●

|

the

provisions for a sinking fund, if any, and the provisions for redemption, if applicable, of the preferred shares being offered,

including any restrictions on the foregoing as a result of arrearage in the payment of dividends or sinking fund installments;

|

|

|

|

|

|

|

●

|

the

liquidation preference per share;

|

|

|

|

|

|

|

●

|

the

terms and conditions, if applicable, upon which the preferred shares being offered will be convertible into our ordinary shares,

including the conversion price, or the manner of calculating the conversion price, and the conversion period;

|

|

|

|

|

|

|

●

|

the

terms and conditions, if applicable, upon which the preferred shares being offered will be exchangeable for debt securities,

including the exchange price, or the manner of calculating the exchange price, and the exchange period;

|

|

|

|

|

|

|

●

|

any

listing of the preferred shares being offered on any securities exchange;

|

|

|

|

|

|

|

●

|

a

discussion of any material federal income tax considerations applicable to the preferred shares being offered;

|

|

|

|

|

|

|

●

|

any

preemptive rights;

|

|

|

|

|

|

|

●

|

the

relative ranking and preferences of the preferred shares being offered as to dividend rights and rights upon liquidation,

dissolution or the winding up of our affairs;

|

|

|

|

|

|

|

●

|

any

limitations on the issuance of any class or series of preferred shares ranking senior or equal to the series of preferred

shares being offered as to dividend rights and rights upon liquidation, dissolution or the winding up of our affairs; and

|

|

|

|

|

|

|

●

|

any

additional rights, preferences, qualifications, limitations and restrictions of the series.

|

Upon

issuance, the shares of preferred shares will be fully paid and nonassessable, which means that its holders will have paid their

purchase price in full and we may not require them to pay additional funds.

Any

preferred shares terms selected by our board of directors could decrease the amount of earnings and assets available for distribution

to holders of our ordinary shares or adversely affect the rights and power, including voting rights, of the holders of our ordinary

shares without any further vote or action by the shareholders. The rights of holders of our ordinary shares will be subject to,

and may be adversely affected by, the rights of the holders of any preferred shares that may be issued by us in the future. The

issuance of preferred shares could also have the effect of delaying or preventing a change in control of our company or make removal

of management more difficult.

Debt

Securities

As

used in this prospectus, the term “debt securities” means the debentures, notes, bonds and other evidences of indebtedness

that we may issue from time to time. The debt securities will either be senior debt securities, senior subordinated debt or subordinated

debt securities. We may also issue convertible debt securities. Debt securities issued under an indenture (which we refer to herein

as an Indenture) will be entered into between us and a trustee to be named therein. It is likely that convertible debt securities

will not be issued under an Indenture.

The

Indenture or forms of Indentures, if any, will be filed as exhibits to the registration statement of which this prospectus is

a part. The statements and descriptions in this prospectus or in any prospectus supplement regarding provisions of the Indentures

and debt securities are summaries thereof, do not purport to be complete and are subject to, and are qualified in their entirety

by reference to, all of the provisions of the Indentures (and any amendments or supplements we may enter into from time to time

which are permitted under each Indenture) and the debt securities, including the definitions therein of certain terms.

General

Unless

otherwise specified in a prospectus supplement, the debt securities will be direct secured or unsecured obligations of our company.

The senior debt securities will rank equally with any of our other unsecured senior and unsubordinated debt. The subordinated

debt securities will be subordinate and junior in right of payment to any senior indebtedness.

We

may issue debt securities from time to time in one or more series, in each case with the same or various maturities, at par or

at a discount. Unless indicated in a prospectus supplement, we may issue additional debt securities of a particular series without

the consent of the holders of the debt securities of such series outstanding at the time of the issuance. Any such additional

debt securities, together with all other outstanding debt securities of that series, will constitute a single series of debt securities

under the applicable Indenture and will be equal in ranking.

Should

an indenture relate to unsecured indebtedness, in the event of a bankruptcy or other liquidation event involving a distribution

of assets to satisfy our outstanding indebtedness or an event of default under a loan agreement relating to secured indebtedness

of our company or its subsidiaries, the holders of such secured indebtedness, if any, would be entitled to receive payment of

principal and interest prior to payments on the senior indebtedness issued under an Indenture.

Prospectus

Supplement

Each

prospectus supplement will describe the terms relating to the specific series of debt securities being offered. These terms will

include some or all of the following:

|

|

●

|

the

title of debt securities and whether they are subordinated, senior subordinated or senior debt securities;

|

|

|

|

|

|

|

●

|

any

limit on the aggregate principal amount of debt securities of such series;

|

|

|

|

|

|

|

●

|

the

percentage of the principal amount at which the debt securities of any series will be issued;

|

|

|

|

|

|

|

●

|

the

ability to issue additional debt securities of the same series;

|

|

|

|

|

|

|

●

|

the

purchase price for the debt securities and the denominations of the debt securities;

|

|

|

|

|

|

|

●

|

the

specific designation of the series of debt securities being offered;

|

|

|

|

|

|

|

●

|

the

maturity date or dates of the debt securities and the date or dates upon which the debt securities are payable and the rate

or rates at which the debt securities of the series shall bear interest, if any, which may be fixed or variable, or the method

by which such rate shall be determined;

|

|

|

|

|

|

|

●

|

the

basis for calculating interest if other than 360-day year or twelve 30-day months;

|

|

|

|

|

|

|

●

|

the

date or dates from which any interest will accrue or the method by which such date or dates will be determined;

|

|

|

|

|

|

|

●

|

the

duration of any deferral period, including the maximum consecutive period during which interest payment periods may be extended;

|

|

|

|

|

|

|

●

|

whether

the amount of payments of principal of (and premium, if any) or interest on the debt securities may be determined with reference

to any index, formula or other method, such as one or more currencies, commodities, equity indices or other indices, and the

manner of determining the amount of such payments;

|

|

|

|

|

|

|

●

|

the