WSGF - Vaycaychella Announces Goldman Small Cap Research RPT And $0.20 PPS TGT With Airbnb IPO Presented As Proxy And Comp

December 08 2020 - 8:53AM

InvestorsHub NewsWire

Dallas, TX -- December 8, 2020 --

InvestorsHub NewsWire -- via goldmanresearch

-- World Series of Golf, Inc. (USOTC:

WSGF) (“WSGF”), through its new subsidiary Vaycaychella (parent

corporate name change pending), a sharing economy technology

business serving the short-term rental market, today announced that

Goldman Small Cap Research has published an initial analyst report

covering WSGF’s new Vaycaychella operation. Goldman plans to

provide ongoing coverage.

- The initial report includes a $0.20

six-month target share price

- First revenue expected to be reported in

Q4 2020

- 2021 to 2022 conservative revenue outlook

growing from $500K to $4M

- Major upside potential form current PPS

with Airbnb IPO as comp and proxy

- Business model combines Booking.com,

Airbnb, Indiegogo and LendingClub

- Analyst discloses intent to make potential

stock purchase in open market

See the full

report:

WSGF -

The Next Generation Sharing Economy Firm; Substantial Stock Gains

Ahead

Report

Highlights

Vaycaychella,

a wholly owned subsidiary of World Series of Golf,

Inc. (OTC

– WSGF), is poised to emerge as the next innovator in

the sharing economy industry, which is slated to reach $335 billion

in size by 2025, according to Brookings Institution. Tracing its

concept roots to three years ago, Vaycaychella had built a business

serving short-term vacation rental operators with financing to

acquire and renovate real estate properties as vacation

destinations. The current customer base

spans Caribbean vacation destination clients

from Mexico to Puerto Rico. Vaycaychella has

provided over $1.25 million in acquisition and renovation

financing secured by 10 premium beachfront houses and other

properties with a combined estimated value of

approximately $12 million. The Company has also added a

Caribbean-based boutique hotel and an historic building in Puerto

Rico.

Evolving from

the success with its original business model, Vaycaychella today is

an innovative, sharing economy technology enterprise serving the

short-term rental market. In our view, Vaycaychella has smartly

combined the best of sharing economy apps such

as Booking.com (NASDAQ

– BKNG) with short term rentals like Airbnb,

along with crowd-sourcing and P2P investing and lending platforms

such as Indiegogo and LendingClub (NASDAQ

– LC).

Through the

introduction of a P2P app currently in beta, Vaycaychella empowers

existing and would-be short-term rental property owners along with

providing investors with access to potential opportunities. Via

this automated platform, capital (investment or loans) for property

acquisitions and improvements can be financed outside the

conventional lending and investment market. As a critical mass of

users and properties are on-boarded, the pilot ecosystem model will

go live. In this second stage, complementary services and features

to investors, and owners/operators will be launched, thereby

maximizing revenue potential for the

Company.

Major Price

Appreciation Lies

Ahead

While

naysayers may believe that building a sharing economy technology

enterprise serving the short-term rental market during the COVID-19

health pandemic is an uphill battle, we believe timing could not be

better in the short term and well into 2021. For starters, sharing

economy apps are taking an increasing share of the $32

billion Caribbean vacation market. Later this week, one

of the hottest IPOs in years, and certainly the number one IPO of

the year, is slated to be priced. This event alone should favorably

impact trading activity and upside for Vaycaychella, and in turn

WSGF’s shares. Looking further into 2021, our six-month price

target is $0.20. While on the surface it could be considered

optimistic, we believe it is on point for the reasons

below.

Airbnb as

Proxy: Already the company has twice raised

the IPO price range and the appetite is strong. Interestingly, the

Company has fared well in this environment, especially for those

users seeking “near-home” vacation spots. Plus, its business

outside the US represents the largest percentage of business and

arguably the most important growth driver. As a fellow sharing

economy technology player focused on the short-term rental market,

Airbnb’s trading activity, direction, and valuation should serve as

a proxy for WSGF’s shares both in the near term and going forward.

Clearly, this bodes well for

investors.

Relative

Unknown: Until

recently, Vaycaychella has been a relatively quiet enterprise. With

the launch of the P2P app in beta, and with additional deals

planned ahead, we expect Vaycaychella, and in turn WSGF, to receive

a much higher profile, adding value to shareholders.

Hidden

Value: The

Company’s current loan portfolio is collateralized by $12M in

property, including homes and boutique hotels. Not only does this

limit downside risk but it illustrates potential underlying value

of the properties to the Company. In addition, this figure gives

investors a view into prospective loan servicing cash flow for the

current portfolio and the type of financeable properties going

forward. We expect more closings throughout 2021, increasing

the value of the overall enterprise. Separately, it doesn’t hurt

that the stock trades above its 50 and 200

DMAs.

Innovation: Based

on our due diligence, there is nothing like Vaycaychella operating

in the short-term rental property market today. While this may be

an intangible characteristic, it is a key cog in the Company’s

success.

Valuation: In

our view, valuation will be driven by news, development, and

onboarding milestones, as well as revenue generation. Over the next

few months, we expect new markets will be opened and additional

properties will come online for financing, loan servicing revenue

and potentially other streams as well. App development, the

onboarding of investors, owner/operators, properties, etc. will

serve as key milestones throughout the beta, as will the soft

launch or full launch, which should occur in about six months or

so. Interestingly, a cursory review of private P2P app companies

indicates that when apps evolve from Beta to Launch stage, a number

of private firms are in the Series B funding stage. With a median

$21M pre-money valuation for this stage, according to KPMG’s 3Q20

Venture Pulse report, our roughly $18M valuation projection is

affirmed.

Finally,

although some revenue will be booked in 4Q20, our focus is on 2021

and 20222. Thus, we preliminarily project 2021 revenue of around

$500,000. (It depends on property acquisition timing, app

onboarding, new services, etc.). We believe at least half of this

figure could come from Company-financed properties alone. For 2022,

we project $4M in revenue. Revenue source opportunities will be key

in getting a firm handle on this figure, as we expect new services

such as credit card processing or ecommerce product sales to be

offered sometime in 2H21. As illustrated in Table I in the

Valuation section, the current average Price/Revenue multiple for

the WSGF peer group on next year’s sales is 5.5x. By assigning a

20% discount to this multiple for our 2022 forecast, our six-month

target is again confirmed. Moreover, Price/Revenue multiple

expansion is in the cards next year as

well.

Analyst Buying

in Open Market: Since 1992,

the analyst has only twice bought shares in the open market of a

stock under coverage. However, the WSGF opportunity appears

to be extremely compelling. As a result, the analyst may purchase

shares in the open market once a 48-hour window has passed

following the release of the report. If shares are purchased, the

amount and price per share will be disclosed in future reports and

updates.

Our 6-month

price target of $0.20 and is based on a Price/Sales multiple

discount to WSGF’s peer group, among other

factors. We

expect a series of milestones, multiple revenue streams, and novel

innovation should drive WSGF’s stock markedly higher over the

coming months.

Goldman Small

Cap Research has recently published research analyst reports on

Solar Integrated Roofing (SIRC),

iQSTEL (IQST)

and Electro Medical Technologies (EMED) among other

companies. To learn more about Goldman Small Cap Research,

visit https://www.goldmanresearch.com/.

To learn more and keep up with the latest

updates at Vaycaychella, visit https://www.vaycaychella.com/.

At the company website, you will find a blog with frequent industry

publications on the short-term rental market in general, as well as

entries specific to Vaycaychella.

Disclaimer/Safe Harbor: This news release

contains forward-looking statements within the meaning of the

Securities Litigation Reform Act. The statements reflect the

Company's current views with respect to future events that involve

risks and uncertainties. Among others, these risks include the

expectation that any of the companies mentioned herein will achieve

significant sales, the failure to meet schedule or performance

requirements of the companies' contracts, the companies' liquidity

position, the companies' ability to obtain new contracts, the

emergence of competitors with greater financial resources and the

impact of competitive pricing. In the light of these uncertainties,

the forward-looking events referred to in this release might not

occur.

WSGF

Contact:

William “Bill” Justice

bill@vaycaychella.com

(800) 871-0376

SOURCE: goldmanresearch

Booking (NASDAQ:BKNG)

Historical Stock Chart

From Mar 2024 to Apr 2024

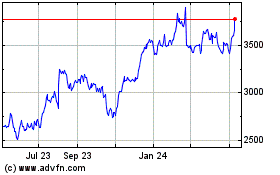

Booking (NASDAQ:BKNG)

Historical Stock Chart

From Apr 2023 to Apr 2024