Amended Current Report Filing (8-k/a)

November 05 2020 - 4:12PM

Edgar (US Regulatory)

false000107553100010755312020-08-042020-08-040001075531us-gaap:CommonStockMember2020-08-042020-08-040001075531bkng:A0.8SeniorNotesDueMarch2022Member2020-08-042020-08-040001075531bkng:A2.15SeniorNotesDueNovember2022Member2020-08-042020-08-040001075531bkng:A2.375SeniorNotesDueSeptember2024MemberMember2020-08-042020-08-040001075531bkng:A1.8SeniorNotesDueMarch2027Member2020-08-042020-08-04

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

(Amendment No. 3)

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) August 4, 2020

Booking Holdings Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

1-36691

|

|

06-1528493

|

(State or other Jurisdiction of

Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

800 Connecticut Avenue

|

Norwalk

|

Connecticut

|

|

06854

|

|

(Address of principal offices)

|

|

(Zip Code)

|

Registrant's telephone number, including area code: (203) 299-8000

N/A

(Former name or former address, if changed since last report)

Securities Registered Pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class:

|

|

Trading Symbol(s)

|

|

Name of Each Exchange on which Registered:

|

|

Common Stock par value $0.008 per share

|

|

BKNG

|

|

The NASDAQ Global Select Market

|

|

0.800% Senior Notes Due 2022

|

|

BKNG 22A

|

|

The NASDAQ Stock Market LLC

|

|

2.150% Senior Notes Due 2022

|

|

BKNG 22

|

|

The NASDAQ Stock Market LLC

|

|

2.375% Senior Notes Due 2024

|

|

BKNG 24

|

|

The NASDAQ Stock Market LLC

|

|

1.800% Senior Notes Due 2027

|

|

BKNG 27

|

|

The NASDAQ Stock Market LLC

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.05 Costs Associated with Exit or Disposal Activities.

On August 4, 2020, Booking Holdings Inc. (the “Company”) filed a Current Report on Form 8-K (the “Original 8-K”) with the U.S. Securities and Exchange Commission to announce restructuring actions at Booking.com as a result of the impact of the COVID-19 pandemic on Booking.com and the travel industry. On September 10, 2020 and October 15, 2020, the Company filed amendments to the Original 8-K to announce ranges of estimated costs associated with portions of the restructuring actions available at the time of filing (the “First and Second Amendments”). This Current Report on Form 8-K/A amends and supplements the Original 8-K as amended by the First and Second Amendments to disclose the Company’s estimate of certain additional costs related to the previously announced restructuring actions.

The Company estimates the total costs associated with employment termination and related costs for Booking.com’s restructuring actions (including Rentalcars.com) to be approximately $140 million (inclusive of those employment termination and related costs previously disclosed in the First and Second Amendments). In addition to approximately $40 million of restructuring expenses recorded in the financial statements for the nine months ended September 30, 2020, the Company estimates that it will record approximately $100 million of additional employment termination and related costs during the three months ending December 31, 2020 and in early 2021. The estimates are subject to finalization of the Company’s plans following consultation with employees, works councils, employee representatives and other relevant organizations and the outcome of the voluntary leaver schemes launched by the Company. This estimate may change as the Company finalizes its cost reduction plans. Subject to the ongoing consultations, the Company still expects that by the time the restructuring activities are complete, the workforce will have been reduced by up to approximately 25%, as compared to when the Company began the restructuring activities at Booking.com, due to these restructuring activities and attrition.

The Company’s evaluation of various alternative courses of action related to leased facilities impacted by the reduction in workforce and other contract terminations and modifications is still in progress and the Company may incur additional costs resulting from such actions. Therefore, the Company is currently unable to make a good faith determination of an estimate or range of estimates of other restructuring costs required by paragraph (b), or an estimate or range of estimates required by paragraphs (c) and (d) of Item 2.05 of Form 8-K with respect to the restructuring actions. The Company will file an additional amendment or amendments to the Original 8-K after it determines such estimate or range of estimates. This Current Report on Form 8-K/A supplements and does not supersede the Original 8-K and the First and Second Amendments. The remainders of the Original 8-K and the First and Second Amendments are unchanged. Accordingly, this Current Report on Form 8-K/A should be read in conjunction with the Original 8-K and the First and Second Amendments.

This Current Report on Form 8-K/A contains forward-looking statements. These forward-looking statements reflect our views regarding current expectations and projections about future events and conditions and are based on currently available information. These forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions that are difficult to predict, including the Risk Factors identified in our most recently filed quarterly report on Form 10-Q and annual report on Form 10-K; therefore, our actual results could differ materially from those expressed, implied or forecast in any such forward-looking statements. Expressions of future goals and expectations and similar expressions, including “may,” “will,” “should,” “could,” “aims,” “seeks,” “expects,” “plans,” “anticipates,” “intends,” “believes,” “estimates,” “predicts,” “potential,” “targets,” and “continue,” reflecting something other than historical fact are intended to identify forward-looking statements. Unless required by law, we undertake no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise. However, readers should carefully review the reports and documents we file or furnish from time to time with the Securities and Exchange Commission, particularly our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BOOKING HOLDINGS INC.

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Sue D'Emic

|

|

|

|

Name:

|

Sue D'Emic

|

|

|

|

Title:

|

Senior Vice President, Chief Accounting Officer and Controller

|

Date: November 5, 2020

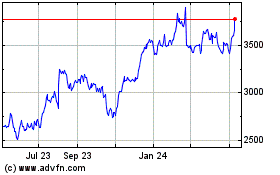

Booking (NASDAQ:BKNG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Booking (NASDAQ:BKNG)

Historical Stock Chart

From Apr 2023 to Apr 2024