0001419554

true

S-1/A

0001419554

2022-01-01

2022-06-30

0001419554

dei:BusinessContactMember

2022-01-01

2022-06-30

0001419554

2021-12-31

0001419554

2020-12-31

0001419554

2022-06-30

0001419554

2021-01-01

2021-12-31

0001419554

2020-01-01

2020-12-31

0001419554

2022-04-01

2022-06-30

0001419554

2021-04-01

2021-06-30

0001419554

2021-01-01

2021-06-30

0001419554

us-gaap:CommonStockMember

2019-12-31

0001419554

us-gaap:AdditionalPaidInCapitalMember

2019-12-31

0001419554

us-gaap:RetainedEarningsMember

2019-12-31

0001419554

2019-12-31

0001419554

us-gaap:CommonStockMember

2020-12-31

0001419554

us-gaap:AdditionalPaidInCapitalMember

2020-12-31

0001419554

us-gaap:RetainedEarningsMember

2020-12-31

0001419554

us-gaap:CommonStockMember

2021-12-31

0001419554

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001419554

us-gaap:RetainedEarningsMember

2021-12-31

0001419554

us-gaap:CommonStockMember

2022-03-31

0001419554

us-gaap:AdditionalPaidInCapitalMember

2022-03-31

0001419554

us-gaap:RetainedEarningsMember

2022-03-31

0001419554

2022-03-31

0001419554

us-gaap:CommonStockMember

2021-03-31

0001419554

us-gaap:AdditionalPaidInCapitalMember

2021-03-31

0001419554

us-gaap:RetainedEarningsMember

2021-03-31

0001419554

2021-03-31

0001419554

us-gaap:CommonStockMember

2020-01-01

2020-12-31

0001419554

us-gaap:AdditionalPaidInCapitalMember

2020-01-01

2020-12-31

0001419554

us-gaap:RetainedEarningsMember

2020-01-01

2020-12-31

0001419554

us-gaap:CommonStockMember

2021-01-01

2021-12-31

0001419554

us-gaap:AdditionalPaidInCapitalMember

2021-01-01

2021-12-31

0001419554

us-gaap:RetainedEarningsMember

2021-01-01

2021-12-31

0001419554

us-gaap:CommonStockMember

2022-01-01

2022-03-31

0001419554

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-03-31

0001419554

us-gaap:RetainedEarningsMember

2022-01-01

2022-03-31

0001419554

2022-01-01

2022-03-31

0001419554

us-gaap:CommonStockMember

2022-04-01

2022-06-30

0001419554

us-gaap:AdditionalPaidInCapitalMember

2022-04-01

2022-06-30

0001419554

us-gaap:RetainedEarningsMember

2022-04-01

2022-06-30

0001419554

us-gaap:CommonStockMember

2021-01-01

2021-03-31

0001419554

us-gaap:AdditionalPaidInCapitalMember

2021-01-01

2021-03-31

0001419554

us-gaap:RetainedEarningsMember

2021-01-01

2021-03-31

0001419554

2021-01-01

2021-03-31

0001419554

us-gaap:CommonStockMember

2021-04-01

2021-06-30

0001419554

us-gaap:AdditionalPaidInCapitalMember

2021-04-01

2021-06-30

0001419554

us-gaap:RetainedEarningsMember

2021-04-01

2021-06-30

0001419554

us-gaap:CommonStockMember

2022-06-30

0001419554

us-gaap:AdditionalPaidInCapitalMember

2022-06-30

0001419554

us-gaap:RetainedEarningsMember

2022-06-30

0001419554

us-gaap:CommonStockMember

2021-06-30

0001419554

us-gaap:AdditionalPaidInCapitalMember

2021-06-30

0001419554

us-gaap:RetainedEarningsMember

2021-06-30

0001419554

2021-06-30

0001419554

2021-10-11

2021-10-12

0001419554

us-gaap:IPOMember

2021-10-14

2021-10-15

0001419554

us-gaap:IPOMember

2021-10-15

0001419554

us-gaap:IPOMember

us-gaap:WarrantMember

2021-10-15

0001419554

BBLG:WallachBethCapitalLLCMember

2021-10-14

2021-10-15

0001419554

BBLG:WallachBethCapitalLLCMember

us-gaap:OverAllotmentOptionMember

2021-10-15

0001419554

BBLG:HankeyCapitalLLCMember

2021-12-31

0001419554

BBLG:HankeyCapitalLLCMember

2021-12-31

0001419554

BBLG:HankeyCapitalLLCMember

2022-06-30

0001419554

BBLG:CollateralSharesMember

2021-01-01

2021-12-31

0001419554

BBLG:CollateralSharesMember

2020-01-01

2020-12-31

0001419554

BBLG:CollateralSharesMember

2022-01-01

2022-06-30

0001419554

BBLG:CollateralSharesMember

2021-01-01

2021-06-30

0001419554

us-gaap:WarrantMember

2021-01-01

2021-12-31

0001419554

us-gaap:WarrantMember

2020-01-01

2020-12-31

0001419554

us-gaap:EmployeeStockOptionMember

2021-01-01

2021-12-31

0001419554

us-gaap:EmployeeStockOptionMember

2020-01-01

2020-12-31

0001419554

BBLG:ConvertiblePromissoryNotesMember

2021-01-01

2021-12-31

0001419554

BBLG:ConvertiblePromissoryNotesMember

2020-01-01

2020-12-31

0001419554

us-gaap:WarrantMember

2022-01-01

2022-06-30

0001419554

us-gaap:WarrantMember

2021-01-01

2021-06-30

0001419554

us-gaap:EmployeeStockOptionMember

2022-01-01

2022-06-30

0001419554

us-gaap:EmployeeStockOptionMember

2021-01-01

2021-06-30

0001419554

BBLG:ConvertiblePromissoryNotesMember

2022-01-01

2022-06-30

0001419554

BBLG:ConvertiblePromissoryNotesMember

2021-01-01

2021-06-30

0001419554

BBLG:FirstandSecondSecuredConvertibleNotesandWarrantsMember

BBLG:HankeyCapitalLLCMember

2019-01-01

0001419554

BBLG:FirstandSecondSecuredConvertibleNotesandWarrantsMember

BBLG:HankeyCapitalLLCMember

2018-12-30

2019-01-02

0001419554

BBLG:FirstandSecondSecuredConvertibleNotesandWarrantsMember

BBLG:HankeyCapitalLLCMember

us-gaap:PrimeRateMember

2019-01-01

0001419554

BBLG:FirstandSecondSecuredConvertibleNotesandWarrantsMember

BBLG:HankeyCapitalLLCMember

srt:MinimumMember

2019-01-01

0001419554

BBLG:FirstandSecondSecuredConvertibleNotesandWarrantsMember

BBLG:HankeyCapitalLLCMember

2020-12-31

0001419554

BBLG:FirstandSecondSecuredConvertibleNotesandWarrantsMember

BBLG:HankeyCapitalLLCMember

2020-01-01

2020-12-31

0001419554

BBLG:SecondCreditFacilityConvertibleSecuredTermNoteMember

BBLG:HankeyCapitalLLCMember

2021-12-31

0001419554

BBLG:SecondCreditFacilityConvertibleSecuredTermNoteMember

BBLG:HankeyCapitalLLCMember

us-gaap:PrimeRateMember

2021-12-31

0001419554

BBLG:SecondCreditFacilityConvertibleSecuredTermNoteMember

BBLG:HankeyCapitalLLCMember

srt:MinimumMember

2021-12-31

0001419554

BBLG:SecondCreditFacilityConvertibleSecuredTermNoteMember

BBLG:HankeyCapitalLLCMember

2020-01-01

2020-12-31

0001419554

BBLG:FirstandSecondSecuredConvertibleNotesandWarrantsMember

BBLG:HankeyCapitalLLCMember

2021-01-01

2021-12-31

0001419554

BBLG:HankeyCapitalLLCMember

2021-01-01

2021-12-31

0001419554

BBLG:AllOutstandingNotesMember

BBLG:HankeyCapitalLLCMember

2021-12-31

0001419554

BBLG:AllOutstandingNotesMember

BBLG:HankeyCapitalLLCMember

2020-12-31

0001419554

BBLG:AllOutstandingNotesMember

BBLG:HankeyCapitalLLCMember

2021-01-01

2021-12-31

0001419554

BBLG:AllOutstandingNotesMember

BBLG:HankeyCapitalLLCMember

2020-01-01

2020-12-31

0001419554

BBLG:FirstSecuredConvertibleNoteMember

2021-01-01

2021-12-31

0001419554

BBLG:FirstSecuredConvertibleNoteMember

2021-12-31

0001419554

BBLG:FirstSecuredConvertibleNoteMember

2020-12-31

0001419554

BBLG:SecondSecuredConvertibleNoteMember

2021-01-01

2021-12-31

0001419554

BBLG:SecondSecuredConvertibleNoteMember

2021-12-31

0001419554

BBLG:SecondSecuredConvertibleNoteMember

2020-12-31

0001419554

BBLG:ThirdSecuredConvertibleNoteMember

2021-01-01

2021-12-31

0001419554

BBLG:ThirdSecuredConvertibleNoteMember

2021-12-31

0001419554

BBLG:ThirdSecuredConvertibleNoteMember

2020-12-31

0001419554

BBLG:FirstCreditFacilityMember

2021-01-01

2021-12-31

0001419554

BBLG:FirstCreditFacilityMember

2021-12-31

0001419554

BBLG:FirstCreditFacilityMember

2020-12-31

0001419554

BBLG:SecondCreditFacilityMember

2021-01-01

2021-12-31

0001419554

BBLG:SecondCreditFacilityMember

2021-12-31

0001419554

BBLG:SecondCreditFacilityMember

2020-12-31

0001419554

BBLG:OctoberTwoThousandTwentyOneMember

BBLG:VestedAndUnexercisedCommonStockWarrantsMember

2021-12-31

0001419554

BBLG:OctoberTwoThousandTwentyOneMember

BBLG:VestedAndUnexercisedCommonStockWarrantsMember

2021-01-01

2021-12-31

0001419554

BBLG:OctoberTwoThousandTwentyOneOneMember

BBLG:VestedAndUnexercisedCommonStockWarrantsMember

2021-12-31

0001419554

BBLG:OctoberTwoThousandTwentyOneOneMember

BBLG:VestedAndUnexercisedCommonStockWarrantsMember

2021-01-01

2021-12-31

0001419554

BBLG:OctoberTwoThousandTwentyOneMember

BBLG:VestedAndUnexercisedCommonStockWarrantsMember

2022-06-30

0001419554

BBLG:OctoberTwoThousandTwentyOneOneMember

BBLG:VestedAndUnexercisedCommonStockWarrantsMember

2022-06-30

0001419554

BBLG:TwoThousandFifteenEquityIncentivePlanMember

2021-12-31

0001419554

BBLG:TwoThousandFifteenEquityIncentivePlanMember

2021-01-01

2021-12-31

0001419554

BBLG:TwoThousandFifteenEquityIncentivePlanMember

2022-06-30

0001419554

BBLG:TwoThousandFifteenEquityIncentivePlanMember

2022-01-01

2022-06-30

0001419554

us-gaap:EmployeeStockOptionMember

2022-06-30

0001419554

BBLG:AugustTwoThousandFifteenMember

2021-12-31

0001419554

BBLG:AugustTwoThousandFifteenMember

2021-01-01

2021-12-31

0001419554

BBLG:SeptemberTwoThousandFifteenMember

2021-12-31

0001419554

BBLG:SeptemberTwoThousandFifteenMember

2021-01-01

2021-12-31

0001419554

BBLG:NovemberTwoThousandFifteenMember

2021-12-31

0001419554

BBLG:NovemberTwoThousandFifteenMember

2021-01-01

2021-12-31

0001419554

BBLG:DecemberTwoThousandFifteenMember

2021-12-31

0001419554

BBLG:DecemberTwoThousandFifteenMember

2021-01-01

2021-12-31

0001419554

BBLG:JanuaryTwoThousandSixteenMember

2021-12-31

0001419554

BBLG:JanuaryTwoThousandSixteenMember

2021-01-01

2021-12-31

0001419554

BBLG:MayTwoThousandSixteenMember

2021-12-31

0001419554

BBLG:MayTwoThousandSixteenMember

2021-01-01

2021-12-31

0001419554

BBLG:SeptemberTwoThousandSixteenMember

2021-12-31

0001419554

BBLG:SeptemberTwoThousandSixteenMember

2021-01-01

2021-12-31

0001419554

BBLG:JanuaryTwoThousandSeventeenMember

2021-12-31

0001419554

BBLG:JanuaryTwoThousandSeventeenMember

2021-01-01

2021-12-31

0001419554

BBLG:JanuaryTwoThousandEighteenMember

2021-12-31

0001419554

BBLG:JanuaryTwoThousandEighteenMember

2021-01-01

2021-12-31

0001419554

BBLG:JanuaryTwoThousandNineteenMember

2021-12-31

0001419554

BBLG:JanuaryTwoThousandNineteenMember

2021-01-01

2021-12-31

0001419554

BBLG:OctoberTwoThousandTwentyOneMember

2021-12-31

0001419554

BBLG:OctoberTwoThousandTwentyOneMember

2021-01-01

2021-12-31

0001419554

BBLG:AugustTwoThousandFifteenMember

2022-06-30

0001419554

BBLG:AugustTwoThousandFifteenMember

2022-01-01

2022-06-30

0001419554

BBLG:SeptemberTwoThousandFifteenMember

2022-06-30

0001419554

BBLG:SeptemberTwoThousandFifteenMember

2022-01-01

2022-06-30

0001419554

BBLG:NovemberTwoThousandFifteenMember

2022-06-30

0001419554

BBLG:NovemberTwoThousandFifteenMember

2022-01-01

2022-06-30

0001419554

BBLG:DecemberTwoThousandFifteenMember

2022-06-30

0001419554

BBLG:DecemberTwoThousandFifteenMember

2022-01-01

2022-06-30

0001419554

BBLG:JanuaryTwoThousandSixteenMember

2022-06-30

0001419554

BBLG:JanuaryTwoThousandSixteenMember

2022-01-01

2022-06-30

0001419554

BBLG:MayTwoThousandSixteenMember

2022-06-30

0001419554

BBLG:MayTwoThousandSixteenMember

2022-01-01

2022-06-30

0001419554

BBLG:SeptemberTwoThousandSixteenMember

2022-06-30

0001419554

BBLG:SeptemberTwoThousandSixteenMember

2022-01-01

2022-06-30

0001419554

BBLG:JanuaryTwoThousandSeventeenMember

2022-06-30

0001419554

BBLG:JanuaryTwoThousandSeventeenMember

2022-01-01

2022-06-30

0001419554

BBLG:JanuaryTwoThousandEighteenMember

2022-06-30

0001419554

BBLG:JanuaryTwoThousandEighteenMember

2022-01-01

2022-06-30

0001419554

BBLG:JanuaryTwoThousandNineteenMember

2022-06-30

0001419554

BBLG:JanuaryTwoThousandNineteenMember

2022-01-01

2022-06-30

0001419554

BBLG:OctoberTwoThousandTwentyOneMember

2022-06-30

0001419554

BBLG:OctoberTwoThousandTwentyOneMember

2022-01-01

2022-06-30

0001419554

BBLG:JanuaryTwoThousandTwentyTwoMember

us-gaap:ShareBasedCompensationAwardTrancheOneMember

2022-06-30

0001419554

BBLG:JanuaryTwoThousandTwentyTwoMember

us-gaap:ShareBasedCompensationAwardTrancheOneMember

2022-01-01

2022-06-30

0001419554

BBLG:JanuaryTwoThousandTwentyTwoMember

us-gaap:ShareBasedCompensationAwardTrancheTwoMember

2022-06-30

0001419554

BBLG:JanuaryTwoThousandTwentyTwoMember

us-gaap:ShareBasedCompensationAwardTrancheTwoMember

2022-01-01

2022-06-30

0001419554

BBLG:JanuaryTwoThousandTwentyTwoMember

us-gaap:ShareBasedCompensationAwardTrancheThreeMember

2022-06-30

0001419554

BBLG:JanuaryTwoThousandTwentyTwoMember

us-gaap:ShareBasedCompensationAwardTrancheThreeMember

2022-01-01

2022-06-30

0001419554

srt:MinimumMember

2021-01-01

2021-12-31

0001419554

srt:MaximumMember

2021-01-01

2021-12-31

0001419554

srt:MinimumMember

2022-01-01

2022-06-30

0001419554

srt:MaximumMember

2022-01-01

2022-06-30

0001419554

BBLG:OctoberTwoThousandSixteenNotePurchaseAgreementMember

BBLG:NoncurrentStockholdersMember

2021-01-01

2021-12-31

0001419554

BBLG:EmployeeMember

2021-12-31

0001419554

BBLG:LicenseAgreementMember

2021-01-01

2021-12-31

0001419554

BBLG:LicenseAgreementMember

BBLG:FirstCommercialSaleMember

2021-01-01

2021-12-31

0001419554

BBLG:LicenseAgreementMember

BBLG:AfterFirstCommercialSaleMember

2021-01-01

2021-12-31

0001419554

BBLG:LicenseAgreementMember

BBLG:ThirdPartyMember

2021-01-01

2021-12-31

0001419554

BBLG:UniversityOfCaliforniaLosAngelesTechnologyDevelopmentGroupMember

BBLG:LicenseAgreementMember

srt:MinimumMember

2021-01-01

2021-12-31

0001419554

BBLG:UniversityOfCaliforniaLosAngelesTechnologyDevelopmentGroupMember

BBLG:LicenseAgreementMember

srt:MaximumMember

2021-01-01

2021-12-31

0001419554

BBLG:LicenseAgreementMember

BBLG:UniversityOfCaliforniaLosAngelesTechnologyDevelopmentGroupMember

BBLG:FirstSubjectInFeasibilityStudyMember

2021-01-01

2021-12-31

0001419554

BBLG:LicenseAgreementMember

BBLG:UniversityOfCaliforniaLosAngelesTechnologyDevelopmentGroupMember

BBLG:FirstSubjectInPivotalStudyMember

2021-01-01

2021-12-31

0001419554

BBLG:LicenseAgreementMember

BBLG:UniversityOfCaliforniaLosAngelesTechnologyDevelopmentGroupMember

BBLG:PreMarketApprovalOfLicensedProductOrLicensedMethodMember

2021-01-01

2021-12-31

0001419554

BBLG:LicenseAgreementMember

BBLG:UniversityOfCaliforniaLosAngelesTechnologyDevelopmentGroupMember

BBLG:FirstCommercialSaleOfLicensedProductOrLicensedMethodMember

2021-01-01

2021-12-31

0001419554

BBLG:UniversityOfCaliforniaLosAngelesTechnologyDevelopmentGroupMember

2021-01-01

2021-12-31

0001419554

BBLG:UniversityOfCaliforniaLosAngelesTechnologyDevelopmentGroupMember

BBLG:LicenseAgreementMember

2021-01-01

2021-12-31

0001419554

BBLG:UniversityOfCaliforniaLosAngelesTechnologyDevelopmentGroupMember

BBLG:LicenseAgreementMember

2020-01-01

2020-12-31

0001419554

BBLG:LicenseAgreementMember

2022-01-01

2022-06-30

0001419554

BBLG:LicenseAgreementMember

BBLG:FirstCommercialSaleMember

2022-01-01

2022-06-30

0001419554

BBLG:LicenseAgreementMember

BBLG:AfterFirstCommercialSaleMember

2022-01-01

2022-06-30

0001419554

BBLG:LicenseAgreementMember

BBLG:ThirdPartyMember

2022-01-01

2022-06-30

0001419554

BBLG:LicenseAgreementMember

BBLG:UniversityOfCaliforniaLosAngelesTechnologyDevelopmentGroupMember

srt:MinimumMember

2022-01-01

2022-06-30

0001419554

BBLG:LicenseAgreementMember

BBLG:UniversityOfCaliforniaLosAngelesTechnologyDevelopmentGroupMember

srt:MaximumMember

2022-01-01

2022-06-30

0001419554

BBLG:LicenseAgreementMember

BBLG:UniversityOfCaliforniaLosAngelesTechnologyDevelopmentGroupMember

BBLG:FirstSubjectInFeasibilityStudyMember

2022-01-01

2022-06-30

0001419554

BBLG:LicenseAgreementMember

BBLG:UniversityOfCaliforniaLosAngelesTechnologyDevelopmentGroupMember

BBLG:FirstSubjectInPivotalStudyMember

2022-01-01

2022-06-30

0001419554

BBLG:LicenseAgreementMember

BBLG:UniversityOfCaliforniaLosAngelesTechnologyDevelopmentGroupMember

BBLG:PreMarketApprovalOfLicensedProductOrLicensedMethodMember

2022-01-01

2022-06-30

0001419554

BBLG:LicenseAgreementMember

BBLG:UniversityOfCaliforniaLosAngelesTechnologyDevelopmentGroupMember

BBLG:FirstCommercialSaleOfLicensedProductOrLicensedMethodMember

2022-01-01

2022-06-30

0001419554

BBLG:LicenseAgreementMember

BBLG:UniversityOfCaliforniaLosAngelesTechnologyDevelopmentGroupMember

2022-04-01

2022-06-30

0001419554

BBLG:LicenseAgreementMember

BBLG:UniversityOfCaliforniaLosAngelesTechnologyDevelopmentGroupMember

BBLG:ScenarioOneMember

2022-01-01

2022-06-30

0001419554

BBLG:LicenseAgreementMember

BBLG:UniversityOfCaliforniaLosAngelesTechnologyDevelopmentGroupMember

BBLG:ScenarioTwoMember

2022-01-01

2022-06-30

0001419554

BBLG:LicenseAgreementMember

BBLG:UniversityOfCaliforniaLosAngelesTechnologyDevelopmentGroupMember

BBLG:ScenarioThreeMember

2022-01-01

2022-06-30

0001419554

BBLG:UniversityOfCaliforniaLosAngelesTechnologyDevelopmentGroupMember

2022-01-01

2022-06-30

0001419554

BBLG:LicenseAgreementMember

BBLG:UniversityOfCaliforniaLosAngelesTechnologyDevelopmentGroupMember

2022-01-01

2022-06-30

0001419554

BBLG:LicenseAgreementMember

BBLG:UniversityOfCaliforniaLosAngelesTechnologyDevelopmentGroupMember

2021-01-01

2021-06-30

0001419554

BBLG:Ms.WalshMember

us-gaap:SubsequentEventMember

2022-01-01

2022-01-03

0001419554

BBLG:Ms.WalshMember

us-gaap:SubsequentEventMember

2022-01-03

0001419554

BBLG:Mr.FrelickMember

us-gaap:SubsequentEventMember

2022-01-01

0001419554

srt:DirectorMember

2022-01-01

0001419554

us-gaap:SubsequentEventMember

BBLG:SupplyAndDevelopmentSupportAgreementMember

BBLG:MusculoskeletalTransplantFoundationIncMember

2022-03-02

2022-03-03

0001419554

us-gaap:SubsequentEventMember

us-gaap:StockOptionMember

2022-08-01

2022-08-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

As

filed with the Securities and Exchange Commission on October 4, 2022

Registration

Statement No. 333-267588

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

AMENDMENT

NO. 2

TO

FORM

S-1

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

BONE

BIOLOGICS CORPORATION

(Exact

name of registrant as specified in its charter)

| Delaware |

|

2834 |

|

42-1743430 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Primary

Standard Industrial

Classification

Code Number) |

|

(I.R.S.

Employer

Identification

Number) |

2

Burlington Woods Drive, Suite 100

Burlington,

MA 01803

(781)

552-4452

(Address

and telephone number of registrant’s principal executive offices)

Jeffrey

Frelick

Chief

Executive Officer

Bone

Biologics Corporation

2

Burlington Woods Drive, Suite 100

Burlington,

MA 01803

(781)

552-4452

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

David

Ficksman, Esq.

TroyGould

PC

1801

Century Park East, 16th Floor

Los

Angeles, CA 90067

Tel.:

(310) 553-4441 |

|

Richard

A. Friedman, Esq.

Stephen

Cohen, Esq.

Sheppard,

Mullin, Richter & Hampton LLP

30

Rockefeller Plaza

New

York, NY 10112-0015

Tel.:

(212) 653-8700 |

Approximate

date of commencement of proposed sale to the public:

As

soon as practicable after the effective date of this registration statement becomes effective.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933 check the following box: ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

| |

|

Emerging

growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date

as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The

information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration

statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does

it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject

to Completion, dated October 4, 2022

PRELIMINARY

PROSPECTUS

BONE

BIOLOGICS CORPORATION

1,923,077 Units

Each Unit Consisting of

One Share of Common Stock

One Series A Warrant to Purchase One Share of Common Stock

One Series B Warrant to Purchase One Share of Common Stock, and

One Series C Warrant to Purchase One Share of

Common Stock

(and the shares of Common Stock underlying such

Warrants)

We

are offering 1,923,077 units (each a “Unit,” and collectively the “Units”). The assumed public offering price

of the Units is $2.60 per Unit (the “Offering Price”). Each unit consists of: (i) one share of common stock, par value $0.001

per share; (ii) one Series A warrant (the “Series A Warrants”) to purchase one share of common stock at an exercise price

equal to $3.12 per share (120% of the per Unit offering price), exercisable until the fifth anniversary of the issuance date; (iii) one

Series B warrant (the “Series B Warrants”) to purchase one share of common stock at an exercise price equal to $2.60 per

share (100% of the per Unit offering price), exercisable until the fifth anniversary of the issuance date; and (iv) one Series C warrant

(the “Series C Warrants,” and together with the Series A Warrants and the Series B Warrants, the “Purchase Warrants”)

to purchase one share of common stock at an exercise price equal to $4.16 per share (160% of the per Unit offering price), exercisable

until the fifth anniversary of the issuance date. The Purchase Warrants are subject to certain adjustment and cashless exercise provisions

as described herein. The Units have no stand-alone rights and will not be certificated or issued as stand-alone securities. The shares

of common stock and Purchase Warrants may be transferred separately immediately upon issuance. Holders of the Series C Warrants may execute

such warrants on a “cashless” basis upon the earlier of (i) 15 Trading Days from the issuance date of such warrant or (ii)

the time when $10.0 million of volume is traded in the our common stock, if the volume weighted average price (“VWAP”) of

our common stock on any trading day on or after the closing date fails to exceed the exercise price of the Series C Warrant (subject

to adjustment for any stock splits, stock dividends, stock combinations, recapitalizations and similar events). In such event, the aggregate

number of Warrant Shares issuable in such cashless exercise pursuant to any given Notice of Exercise electing to effect a cashless exercise

shall equal the product of (x) the aggregate number of Warrant Shares that would be issuable upon exercise of this Warrant in accordance

with the terms of this Warrant if such exercise were by means of a cash exercise rather than a cashless exercise and (y) 1.00. The shares

of our common stock and the Purchase Warrants are immediately separable and will be issued separately, but will be purchased together

in this offering.

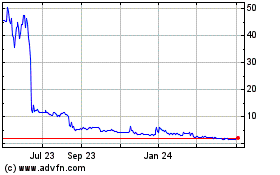

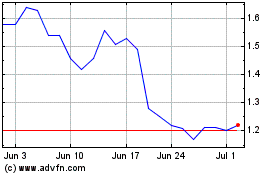

Our

common stock is listed on The Nasdaq Capital Market under the symbol “BBLG.” On September 30, 2022, the last reported sale

price of our common stock on The Nasdaq Capital Market was $1.05 per share. We do not intend to apply for any listing of any of

the Purchase Warrants on the Nasdaq Capital Market or any other securities exchange or nationally recognized trading system, and we do

not expect a market to develop for the Series A Warrants, Series B Warrants or the Series C Warrants. We have assumed a public offering

price of $2.60 per Unit. The actual public offering price per Unit will be determined between us and the underwriters at the time of

pricing and may be at a discount to this assumed offering price. Therefore, the assumed public offering price per Unit and the exercise

prices of the Purchase Warrants used throughout this prospectus may not be indicative of the final offering and exercise prices.

Investing

in our securities involves risks. See “Risk Factors” beginning on page 13.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | |

| Per

Unit | | |

| Total | |

| Price to the

public(1) | |

$ | 2.60 | | |

$ | 5,000,000 | |

| Underwriting discounts

and commissions | |

$ | 0.21 | | |

$ | 400,000 | |

| Proceeds to us (before

expenses)(2) | |

$ | 2.39 | | |

$ | 4,600,000 | |

| (1) |

The public offering price and underwriting discount and

commissions in respect of each Unit corresponds to the assumed public offering price per share of common stock of $2.60,

the public offering price per accompanying Series A Warrant of $3.12 (120% of the per Unit offering price), the public

offering price per accompanying Series B Warrant of $2.60 (100% of the per Unit offering price) and the public offering price

per accompanying Series C Warrant of $4.16 (160% of the per Unit offering price). |

| |

|

| (2) |

Does

not include a non-accountable expense allowance equal to 1% of the gross proceeds of this offering payable to the underwriters, or

the reimbursement of certain expenses of the underwriters. We refer you to “Underwriting” beginning on page 80 of this

prospectus for additional information regarding underwriting compensation. |

We

have granted the underwriters the option for a period of 45 days to purchase up to an additional 288,461 shares of common stock

at the public offering price and/or Series A Warrants to purchase an aggregate of 288,461 shares of common stock at a price of

$0.01 per share and/or Series B Warrants to purchase an aggregate of 288,461 shares of common stock at a price of $0.01 per share

and/or Series C Warrants to purchase an aggregate of 288,461 shares of common stock at a price of $0.01 per share, in any combination

thereof, from us at the public offering price per security, less underwriting discounts and commissions, solely to cover over-allotments,

if any.

The

underwriter expects to deliver the shares on or about _____, 2022.

WallachBeth

Capital, LLC

Prospectus

dated _______, 2022

TABLE

OF CONTENTS

We

have not, and the underwriters have not, authorized anyone to provide any information or to make any representations other than those

contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We take

no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give to you.

You

should rely only on the information contained in this prospectus. No dealer, salesperson or other person is authorized to give information

that is not contained in this prospectus. This prospectus is not an offer to sell nor is it seeking an offer to buy these securities

in any jurisdiction where the offer or sale is not permitted. The selling stockholders are offering to sell and seeking offers to buy

our common stock only in jurisdictions where offers and sales are permitted. The information in this prospectus is accurate only as of

the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of these securities.

All

trademarks, trade names and service marks appearing in this prospectus are the property of their respective owners. Solely for convenience,

the trademarks and trade names in this prospectus are referred to without the ® and TM symbols, but such references should

not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights

thereto.

PROSPECTUS

SUMMARY

The

following summary highlights selected information contained elsewhere in this prospectus and is qualified in its entirety by the more

detailed information and financial statements included elsewhere in this prospectus. It does not contain all the information that may

be important to you and your investment decision. You should carefully read this entire prospectus, including the matters set forth under

“Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,”

and our financial statements and related notes included elsewhere in this prospectus. In this prospectus, unless context requires otherwise,

references to “we,” “us,” “our,” “BBLG” “Bone Biologics,” or the “Company”

refer to Bone Biologics Corporation.

Glossary

of Abbreviations and Defined Terms

| Abbreviations |

|

|

| |

|

|

| BMP |

|

Bone

Morphogenic Protein |

| CDMO |

|

Contract

Development and Manufacturing Organization |

| cGMP |

|

current

Good Manufacturing Practice |

| CRO |

|

Contract

Research Organization |

| DBM |

|

Demineralized

bone matrix is allograft bone that has had the inorganic mineral removed |

| DDD |

|

Degenerative

disc disease |

| HREC |

|

Human

Research Ethics Committee |

| IDE |

|

Investigational

Device Exemption |

| IRB |

|

Institutional

Review Board |

| MTF |

|

Musculoskeletal

Transplant Foundation |

| NB1

Device |

|

Product

combination kit that includes vial of NELL-1 recombinant protein and demineralized bone matrix |

| NDA |

|

New

Drug Application |

| NELL-1 |

|

Neural

epidermal growth factor-like 1 protein (NELL-1) |

| PMA |

|

Pre-market

approval |

| REMS |

|

Risk

Evaluation and Mitigation Strategies |

| rhBMP-2 |

|

Recombinant

Bone Morphogenic Protein |

| rhNELL-1 |

|

Recombinant

NELL-1 |

| TLIF |

|

Transforaminal

lumbar interbody fusion |

| UCLA

TDG |

|

UCLA

Technology Development Group on behalf of UC Regents |

| Defined

Terms |

|

|

| |

|

|

| Alkaline

phosphatase assay |

|

Alkaline

phosphatase is an enzyme that is found throughout your body. ALP blood tests measure the level of ALP in your blood that comes from

your bones. |

| Athymic

mouse model |

|

A

mouse that provides an experiment model for conducting research because it mounts no rejection response. |

| Demineralized

Bone |

|

Bone

that has had the calcium removed. |

| Osteostimulative |

|

Stimulates

bone growth. |

| Osteosynthetic |

|

The

reduction and fixation of a bone fracture with implantable devices. |

Phylogenetically

advanced spine model |

|

Evolutionary

advancement of spine systems that exist in large animal models. |

| Recombinant |

|

Relating

to or denoting an organism, cell, or genetic material formed by recombination. |

| Retrolisthesis |

|

A

medical condition in which a vertebra in the spine becomes displaced and moves forward or backward. |

| Spondylolisthesis |

|

A

spinal disorder in which one vertebra (spinal bone) slips onto the vertebra below it. |

Company

Overview

We

are a medical device company that is currently focused on bone regeneration in spinal fusion using the recombinant human protein known

as NELL-1/DBM. The NELL-1/DBM combination product is an osteostimulative recombinant protein that provides target specific control over

bone regeneration. The protein, as part of the UCB-1 technology platform, has been licensed exclusively for worldwide applications to

us through a technology transfer from the UCLA Technology Development Group on behalf of UC Regents (“UCLA TDG”). UCLA TDG

and the Company received guidance from the FDA that NELL-1/DBM will be classified as a combination product with a device lead.

The

Company was founded by University of California professors in collaboration with an Osaka University professor and a University of Southern

California surgeon in 2004 as a privately-held company with proprietary, patented technology that has been validated in sheep and non-human

primate models to facilitate bone growth. Our platform technology has application in delivering improved outcomes in the surgical specialties

of spinal, orthopedic, general orthopedic, plastic reconstruction, neurosurgery, interventional radiology, and sports medicine. Lead

product development and clinical studies are targeted on spinal fusion surgery, one of the larger segments in the orthopedic market.

We

are a development stage entity. The production and marketing of our products and ongoing research and development activities will be

subject to extensive regulation by numerous governmental authorities in the United States. Prior to marketing in the United States, any

combination product developed by us must undergo rigorous preclinical (animal) and clinical (human) testing and an extensive regulatory

approval process implemented by the FDA under the Food, Drug and Cosmetic Act. There can be no assurance that we will not encounter problems

in clinical trials that will cause us or the FDA to delay or suspend the clinical trials.

Our

success will depend in part on our ability to obtain patents and product license rights, maintain trade secrets, and operate without

infringing on the proprietary rights of others, both in the United States and other countries. There can be no assurance that patents

issued to or licensed by us will not be challenged, invalidated, rendered unenforceable, or circumvented, or that the rights granted

thereunder will provide proprietary protection or competitive advantages to us.

UCLA

TDG Exclusive License Agreement

Effective

April 9, 2019, the Company entered into an Amended and Restated Exclusive License Agreement dated as of March 21, 2019 and amended through

three sets of amendments (as so amended the “Amended License Agreement”) with the UCLA TDG. The Amended License Agreement

amends and restates the Amended and Restated Exclusive License Agreement, dated as of June 19, 2017 (the “2017 Agreement”).

The 2017 Agreement amended and restated the Exclusive License Agreement, effective March 15, 2006, between the Company and UCLA TDG,

as amended by ten amendments. Under the terms of the Amended License Agreement, the Regents have continued to grant the Company exclusive

rights to develop and commercialize NELL-1 (the “Licensed Product”) for spinal fusion by local administration, osteoporosis

and trauma applications. The Licensed Product is a recombinant human protein growth factor that is essential for normal bone development.

We

have agreed to pay an annual maintenance fee to UCLA TDG of $10,000 as well as pay certain royalties to UCLA TDG under the Amended License

Agreement at the rate of 3.0% of net sales of licensed products or licensed methods. We must pay the royalties to UCLA TDG on a quarterly

basis. Upon a first commercial sale, we also must pay a minimum annual royalty between $50,000 and $250,000, depending on the calendar

year which is after the first commercial sale. If we are required to pay any third party any royalties as a result of us making use of

UCLA TDG patents, then we may reduce the royalty owed to UCLA TDG by 0.333% for every percentage point paid to a third party. If we grant

sublicense rights to a third party to use the UCLA TDG patent, then we will pay UCLA TDG 10% to 20% of the sublicensing income we receive

from such sublicense.

We

are obligated to make the following milestone payments to UCLA TDG for each Licensed Product or Licensed Method:

| |

● |

$100,000

upon enrollment of the first subject in a Feasibility Study; |

| |

|

|

| |

● |

$250,000

upon enrollment of the first subject in a Pivotal Study: |

| |

|

|

| |

● |

$500,000

upon Pre-Market Approval of a Licensed Product or Licensed Method; and |

| |

|

|

| |

● |

$1,000,000

upon the First Commercial Sale of a Licensed Product or Licensed Method. |

We

are also obligated pay to UCLA TDG a fee (the “Diligence Fee”) of $8,000,000 upon the sale of any Licensed Product (the “Triggering

Sale Date”) in accordance with the payment schedule below:

| |

● |

Due

upon cumulative Net Sales equaling $50,000,000 following the Triggering Sale Date - $2,000,000; |

| |

|

|

| |

● |

Due

upon cumulative Net Sales equaling $100,000,000 following the Triggering Sale Date - $2,000,000; and |

| |

|

|

| |

● |

Due

upon cumulative Net Sales equaling $200,000,000 following the Triggering Sale Date - $4,000,000. |

The

Company’s obligation to pay the Diligence Fee will survive termination or expiration of the agreement and the Company is prohibited

from assigning, selling, or otherwise transferring any of its assets related to any Licensed Product unless the Company’s foregoing

Diligence Fee obligation is assigned, sold, or transferred along with such assets, or unless the Company pays UCLA TDG the Diligence

Fee within ten (10) days of such assignment, sale or other transfer of such rights to any Licensed Product.

We

are also obligated to pay UCLA TDG a cash milestone payment within thirty (30) days of a Liquidity Event (including a Change of Control

Transaction and a payment election by UCLA TDG exercisable after December 22, 2016) such payment to equal the greater of:

| |

● |

$500,000;

or |

| |

|

|

| |

● |

2%

of all proceeds in connection with a Change of Control Transaction. |

As

of June 30, 2022, none of the above milestones has been met.

We

are obligated to diligently proceed with developing and commercializing licensed products under UCLA TDG patents set forth in the Amended

License Agreement. UCLA TDG has the right to either terminate the license or reduce the license to a non-exclusive license if we do not

meet certain diligence milestone deadlines set forth in the Amended License Agreement.

We

must reimburse or pre-pay UCLA TDG for patent prosecution and maintenance costs incurred during the term of the Amended License Agreement.

We have the right to bring infringement actions against third party infringers of the Amended License Agreement, UCLA TDG may join voluntarily,

at its own expense, or, at our expense, be joined involuntarily to the action. We are required to indemnify UCLA TDG against any third

party claims arising out of our exercise of the rights under the Amended License Agreement or any sublicense.

Products

We

have developed a stand-alone platform technology through significant laboratory and small and large animal research over more than ten

years to generate the current applications across broad fields of use. The platform technology is our recombinant human protein, known

as NELL-1, a proprietary skeletal specific growth factor which is a bone void filler. NELL-1 provides regulation over skeletal tissue

formation and stem cell differentiation during bone regeneration. The Company obtained the platform technology pursuant to an exclusive

license agreement with UCLA TDG.

We

are currently focused on bone regeneration in lumbar spinal fusion, in keeping with our exclusive license agreement, using NELL-1 in

combination with DBM, a demineralized bone matrix from Musculoskeletal Transplant Foundation (“MTF”). The NELL-1/DBM medical

device is a combination product which is an osteostimulative recombinant protein that provides target specific control over bone regeneration.

Leveraging the resources of investors and strategic partners, we have successfully surpassed four critical milestones:

| |

● |

Demonstrating

a successful small laboratory scale pilot run for the manufacturing of the recombinant NELL-1 protein in Chinese hamster ovary cells; |

| |

|

|

| |

● |

Validation

of protein dosing and efficacy in established large animal sheep models pilot study; |

| |

|

|

| |

● |

Completed

pivotal animal study; and |

| |

|

|

| |

● |

Filed

for a clinical trial outside the United States. |

Our

lead product is expected to be purified NELL-1 mixed with 510(k) cleared DBM Demineralized Bone Putty recommended for use in conjunction

with applicable hardware consistent with the indication. The NELL-1/DBM Fusion Device will be comprised of a single dose vial of NELL-1

recombinant protein freeze dried onto DBM. A vial of NELL-1/DBM will be sold in a convenience kit with a diluent and a syringe of 510(k)

cleared demineralized bone (“DBM Putty”) produced by MTF. A delivery device will allow the surgeon to mix the reconstituted

NELL-1 with the appropriate quantity of DBM Putty just prior to implantation.

The

NELL-1/DBM Fusion Device is intended for use in lumbar spinal fusion and may have a variety of other spine and orthopedic applications.

While

the product is initially targeted at the lumbar spine fusion market, in keeping with our exclusive license agreement, we believe NELL-1’s

novel set of characteristics, target specific mechanism of action, efficacy, safety and affordability position the product well for application

in a variety of procedures including:

| |

Spine Implants.

This is the largest market for bone substitute product, representing greater than 70% of the total U.S. market according to Transparency

Market Research. While use of the patient’s own bone, also referred to as autograft, to enhance fusion of vertebral segments

remains the optimal use for this type of treatment, complications associated with use of autograft bone including pain, increased

surgical time and infection limit its use. |

| |

|

| |

Non-Union Trauma

Cases. While the majority of fractures heal without the need for osteosynthetic products, bone substitutes are used in complicated

breaks where the bone does not mend naturally. Management believes that NELL-1 is expected to perform as well as high-priced growth

factors in this market. |

| |

|

| |

Osteoporosis.

The medical need to find a solution to counter a decrease in bone mass and density seen in women most frequently after menopause

or a similar effect on astronauts in microgravity environments for an extended period is a major medical challenge. The systemic

use of NELL-1 to stimulate bone regeneration throughout the body thereby increasing bone density could have a very significant impact

on the treatment of osteoporosis. |

UCLA’s

initial research was funded with approximately $18 million in resources from UCLA TDG and government grants. Since licensing the exclusive

worldwide intellectual property rights from UCLA TDG, our continued development has been funded through various strategic investments.

Our research and development expenses for the years ended December 31, 2021 and 2020 were $45,500 and $102,293, respectively. We anticipate

that it will require approximately $15 million to complete first in man studies and an estimated additional $27 million to achieve

FDA approval for a spine interbody fusion indication. These amounts are estimates based on data currently available to us, and are subject

to many factors including the various risk factors discussed below under “Risk Factors.”

NELL-1’s

powerful specific bone and cartilage forming properties are derived from the ability of NELL-1 to only target cells that exhibit an activated

“master switch” to develop into bone or cartilage. NELL-1 is a function specific recombinant human protein that has been

proven in laboratory bench models to recapitulate normal human growth and development to provide control over bone and cartilage regeneration.

NELL-1

was isolated in 1996, and the first NELL-1 patent on bone regeneration was filed in 1999. Subsequent patents and continuations in part

describing NELL-1 manufacturing, delivery, and cartilage regeneration were filed to further strengthen the patent portfolio.

Research

& Publications

We

believe our scientific evidence validates the many benefits of NELL-1. Currently there is a comprehensive database of more than 80 research

publications and abstracts of preclinical studies with NELL-1 of which more than 45 are peer-reviewed publications.

We

completed a preclinical study, which shows our rhNELL-1 growth factor effectively promotes bone formation in a phylogenetically advanced

spine model. In addition, rhNELL-1 was shown to be well tolerated and there were no findings of inflammation.

Bone

Biologics has received Human Research Ethics Committee (“HREC”) approval for the first center of a multicenter pilot clinical

trial to evaluate NB1 (“NELL-1/DBM”) in 30 patients in Australia. The pilot study will evaluate the safety and effectiveness

of NB1 in adult subjects with spinal degenerative disc disease (“DDD”) at one level from L2-S1, who may also have up to Grade

1 spondylolisthesis or Grade 1 retrolisthesis at the involved level who undergo transforaminal lumbar interbody fusion (“TLIF”).

Proposed

Initial Clinical Application

The

NELL-1/DBM Fusion Device will be indicated for spinal fusion procedures in skeletally mature patients with DDD at one level from L4-S1.

These DDD patients may also have up to Grade I spondylolisthesis at the involved level. The NELL-1/DBM Fusion Device is to be implanted

via an anterior open or an anterior laparoscopic approach in conjunction with a cleared intervertebral body fusion device. Patients receiving

the device should have had at least six months of non-operative treatment prior to treatment with the device. A cervical indication is

currently under consideration. This indication for use would fill a current clinical gap, created by potentially dangerous inflammatory

responses caused by commercially available catalytic bone growth agents, the subject of a Public Health Notification from the FDA on

July 1, 2008 about life threatening complications associated with a recombinant human protein in cervical spine fusion. We do not expect

our product to see the same adverse events with NELL-1/DBM as have been observed with other commercially available protein. We have performed

a rat femoral onlay model to compare proinflammatory response of rhBMP-2 and NELL-1 within Helistate collagen sponges. While NELL-1 induced

normal healing, rhBMP-2 induced significant amounts of swelling and histological evidence of intense inflammatory response.

Description

of the DBM Putty to Be Used With Nell-1

The

DBM Demineralized Bone Putty provided as part of the convenience kit with NELL-1/DBM is a Class II device. The common name is “Bone

Void Filler Containing Human Demineralized Bone Matrix.” The product is regulated under 21 C.F.R. §888.3045 Resorbable calcium

salt bone void filler device, Product Codes MQV, GXP, and MBP. MTF is the manufacturer of the DBM Putty that was cleared by the FDA for

spine indication in December 2006.

DBM

Putty is a matrix composed of processed human cortical bone. Demineralized bone granules are mixed with sodium hyaluronate to form the

DBM Putty. Every lot of final DBM Putty product is tested in an athymic mouse model or in an alkaline phosphatase assay, which has been

shown to have a positive correlation with the athymic mouse model, to ensure osteostimulation.

Based

upon extensive discussions with regulatory experts and a specific communication from the FDA in response to a submission of our plan

under the Amended License Agreement between UCLA TDG and the Company we believe the NELL-1/DBM Fusion Device will be regulated as a Class

III medical device and will therefore require submission and approval of a pre-market approval (“PMA”).

Our

Business Strategy

Our

business plan is to develop our target specific growth factor for bone regeneration that has demonstrated increases in the quantity and

quality of bone, while displaying strong safety profile. Our spine fusion product focus continues to advance from the research to the

development stage and then to clinical stage to allow for the approval for use of our target specific protein exhibiting efficacy and

safety by matching or exceeding current market approved products. The utilization of investment partners is critical to facilitate the

development through pre Investigational Device Exemption (“IDE”), clinical, and ultimate commercialization as we fund the

pre-IDE work and continue achieving milestones.

Risks

Associated with Our Business

Our

business is subject to a number of risks of which you should be aware of before making an investment decision. Some of these risks include

the following:

| |

● |

We

have incurred substantial losses since our inception and anticipate that we will continue to incur substantial and increasing losses

for the foreseeable future. |

| |

|

|

| |

● |

We

will require substantial additional financing to achieve our goals, and a failure to obtain this necessary capital when needed could

force us to delay, limit, reduce or terminate our product development or commercialization efforts. |

| |

|

|

| |

● |

We

currently have no source of revenues. We may never generate revenues or achieve profitability. |

| |

|

|

| |

● |

We

expect to continue to incur significant operating and non-operating expenses, which may make it difficult for us to secure sufficient

financing and may lead to uncertainty about our ability to continue as a going concern. |

| |

|

|

| |

● |

There

is substantial doubt about our ability to continue as a going concern, which may affect our ability to obtain future financing and

may require us to curtail our operations. We will need to raise additional capital to support our operations. |

| |

|

|

| |

● |

We

are dependent in part on technologies we license, and if we lose the right to license such technologies or we fail to license new

technologies in the future, our ability to develop new products would be harmed, and if we fail to meet our obligations under our

current or future license agreements, we may lose the ability to develop our lead product candidate or other product candidates. |

| |

|

|

| |

● |

We

expect to face substantial competition, which may result in others discovering, developing or commercializing products before or

more successfully than we do. |

| |

|

|

| |

● |

We

are currently a pre-clinical stage medical device company with our lead product candidate in pre-clinical development. If we are

unable to successfully develop and commercialize our lead product candidate or experience significant delays in doing so, our business

may be materially harmed. |

| |

|

|

| |

● |

Our

success relies on third-party suppliers and manufacturers. Any failure by such third parties, including, but not limited to, failure

to successfully perform and comply with regulatory requirements, could negatively impact our business and our ability to develop

and market our product candidate, and our business could be substantially harmed. |

| |

● |

Our

future success is dependent on the regulatory approval of our lead product candidate or other product candidates. |

| |

|

|

| |

● |

Our

business may be adversely affected by the ongoing coronavirus pandemic. |

| |

|

|

| |

● |

Business

interruptions could adversely affect future operations, revenues, and financial conditions, and may increase our cost of expenses. |

| |

|

|

| |

● |

Our

failure to find third party collaborators to assist or share in the costs of product development could materially harm our business,

financial condition, and results of operations. |

| |

|

|

| |

● |

If

we fail to comply with our obligations under our license agreement with licensors, we could lose rights that are important to our

business. |

| |

|

|

| |

● |

We

may infringe the intellectual property rights of others, which may prevent or delay our product development efforts. |

| |

|

|

| |

● |

Our

intellectual property may not be sufficient to protect our products from competition. |

Implications

of Being a Smaller Reporting Company

We

are a smaller reporting company as defined in the Securities Exchange Act of 1934, as amended. We may take advantage of certain of the

scaled disclosures available to smaller reporting companies and will be able to take advantage of these scaled disclosures for so long

as (i) the market value of our voting and non-voting common stock held by non-affiliates is less than $250 million measured on the last

business day of our second fiscal quarter or (ii) our annual revenue is less than $100 million during the most recently completed fiscal

year and the market value of our voting and non-voting common stock held by non-affiliates is less than $700 million measured on the

last business day of our second fiscal quarter. Specifically, as a smaller reporting company, we may choose to present only the two most

recent fiscal years of audited financial statements in our Annual Report on Form 10-K and have reduced disclosure obligations regarding

executive compensation, and, similar to emerging growth companies, if we are a smaller reporting company with less than $100 million

in annual revenue, we would not be required to obtain an attestation report on internal control over financial reporting issued by our

independent registered public accounting firm.

Corporate

Information

We

were incorporated under the laws of the State of Delaware on October 18, 2007 as AFH Acquisition X, Inc. Pursuant to a Merger Agreement,

dated September 19, 2014, by and among the Company, its wholly-owned subsidiary, Bone Biologics Acquisition Corp., a Delaware corporation

(“Merger Sub”), and Bone Biologics, Inc. Merger Sub merged with and into Bone Biologics Inc., with Bone Biologics Inc. remaining

as the surviving corporation in the merger. Upon the consummation of the merger, the separate existence of Merger Sub ceased. On September

22, 2014, the Company officially changed its name to “Bone Biologics Corporation” to more accurately reflect the nature of

its business and Bone Biologics, Inc. became a wholly owned subsidiary of the Company. Bone Biologics, Inc. was incorporated in California

on September 9, 2004.

Our

principal executive offices are located at 2 Burlington Woods Drive, Suite 100, Burlington MA 01803 and our telephone number is (781)

552-4452. Our website address is www.bonebiologics.com. The information contained on our website

is not incorporated by reference into this prospectus, and you should not consider any information contained on, or that can be accessed

through, our website as part of this prospectus or in deciding whether to invest in our common stock.

THE

OFFERING

| Units

offered by us |

|

1,923,077

Units, each consisting of: (i) one share of common stock; (ii) one Series A warrant (the “Series A Warrants”) to purchase

one share of common stock at an exercise price equal to $3.12 per share (120% of the per Unit offering price), exercisable until

the fifth anniversary of the issuance date; (iii) one Series B warrant (the “Series B Warrants) to purchase one share of common

stock at an exercise price equal to $2.60 per share (100% of the per Unit offering price), exercisable until the fifth anniversary

of the issuance date; and (iv) one Series C warrant to purchase one share of common stock at an exercise price equal to $4.16 per

share (160% of the per Unit offering price), exercisable until the fifth anniversary of the issuance date (the “Series C Warrants,”

and together with the Series A Warrants and the Series B Warrants, the “Purchase Warrants”). The Purchase Warrants are

subject to certain adjustment and cashless exercise provisions as described herein. Holders of the Series C Warrants may execute

such warrants on a “cashless” basis upon the earlier of (i) 15 Trading Days from the issuance date of such warrant or

(ii) the time when $10.0 million of volume is traded in shares of our common stock, if the volume weighted average price (“VWAP”)

of our common stock on any trading day on or after the closing date fails to exceed the exercise price of the Series C Warrant

(subject to adjustment for any stock splits, stock dividends, stock combinations, recapitalizations and similar events). In such

event, the aggregate number of Warrant Shares issuable in such cashless exercise pursuant to any given Notice of Exercise electing

to effect a cashless exercise shall equal the product of (x) the aggregate number of Warrant Shares that would be issuable upon exercise

of this Warrant in accordance with the terms of this Warrant if such exercise were by means of a cash exercise rather than a cashless

exercise and (y) 1.00. The shares of our common stock and the Purchase Warrants will be immediately separable and will be issued

separately, but will be purchased together in this offering. |

| |

|

|

Common stock outstanding prior

to this offering |

|

10,350,579

shares |

| |

|

|

| Common

stock to be outstanding immediately after this offering |

|

12,273,656

shares (12,562,117 shares if the underwriters

exercise their over-allotment option in full) |

| |

|

|

| Option

to purchase additional shares |

|

The

underwriters have an option for a period of 45 days to purchase up to 288,461 additional shares of our common stock at the offering

price and/or Series A Warrants to purchase up to an aggregate of 288,461 shares of our common stock at a price of $0.01 per share,

and/or Series B Warrants to purchase up to an aggregate of 288,461 shares of our common stock at a price of $0.01 per share, and/or

Series C Warrants to purchase up to an aggregate of 288,461 shares of our common stock at a price of $0.01 per share in any combinations

thereof, from us at the public offering price per security, less the underwriting discounts and commissions, for 45 days after the date

of this prospectus to cover over-allotments, if any. See “Underwriting” for additional information.

Because

the warrants will not be listed on a national securities exchange or other nationally recognized trading market, the underwriters will

be unable to satisfy any overallotment of shares and warrants without exercising the underwriters’ overallotment option with respect

to the warrants. As a result, the underwriters will exercise their overallotment option for all of the warrants which are over-allotted,

if any, at the time of the initial offering of the shares and the warrants. However, because our common stock is publicly traded, the

underwriters may satisfy some or all of the overallotment of shares of our common stock, if any, by purchasing shares in the open market

and will have no obligation to exercise the overallotment option with respect to our common stock.

|

| |

|

|

| Use

of proceeds |

|

We

estimate that the net proceeds from this offering will be approximately $4,363,000, or approximately $5,045,000 if

the underwriters exercise their over-allotment option in full, at an assumed public offering price of $2.60 per Unit, after

deducting the underwriting discounts and commissions, the non-accountable expense allowance payable to the underwriters, and estimated

offering expenses payable by us. We intend to use the net proceeds from this offering to fund our planned clinical trials, maintain

and extend our patent portfolio, retention of contract research organizations, and for working capital and other general corporate

purposes. See “Use of Proceeds” for a more complete description of the intended use of proceeds from this offering. |

| |

|

|

| Lock-up

agreements |

|

Our

executive officers, directors and certain of our shareholders have agreed with the underwriters not to sell, transfer or dispose

of any shares or similar securities for a period of 180 days after the date of this prospectus. For additional information regarding

our arrangement with the underwriters, please see “Underwriting.” |

| |

|

|

| Risk

factors |

|

See

“Risk Factors” on page 13 and other information included in this prospectus for a discussion of factors to consider carefully

before deciding to invest in shares of our common stock. |

| |

|

|

| Nasdaq

Capital Market symbol |

|

“BBLG”

for shares of our common stock. |

The

number of shares of our common stock to be outstanding after this offering is based on 10,350,579 shares of our common stock outstanding

as of September 3, 2022, assumes no exercise of the Purchase Warrants included in the Units or exercise by the underwriters of their

over-allotment option, and excludes the following:

| |

● |

452,824

shares of common stock issuable upon exercise

of outstanding common stock options issued to members of management, consultants, and directors at a weighted average exercise price

of $21.76 per common share. |

| |

|

|

| |

● |

1,827,650

shares of common stock issuable upon exercise of outstanding common stock Public Warrants at an average exercise price of $6.30 per

common share. |

| |

|

|

| |

● |

107,176

shares of common stock reserved for future grants

pursuant to our 2015 Equity Incentive Plan. |

| |

● |

96,153

shares of common stock issuable upon exercise

of Warrants to be issued to the underwriters as part of this offering at an exercise price of $3.12 per common share (120%

of the per Unit offering price). |

| |

|

|

| |

Except

as otherwise indicated herein, all information in this prospectus assumes or gives effect to: |

| |

|

|

| |

● |

no

exercise by the underwriters of their option to purchase an additional 288,461 shares of common stock. |

Summary

Financial Data

The

following tables set forth our summary financial data as of the dates and for the periods indicated. We have derived the summary statement

of operations data for the years ended December 31, 2021 and 2020 from our audited financial statements included elsewhere in this prospectus.

The summary statements of operations data for the six months ended June 30, 2022 and 2021 and the summary balance sheet data

as of June 30, 2022 have been derived from our unaudited financial statements included elsewhere in this prospectus. The following summary

financial data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results

of Operations” and our financial statements and related notes and other information included elsewhere in this prospectus. Our

historical results are not necessarily indicative of the results to be expected in the future and the results for the six months ended

June 30, 2022 are not necessarily indicative of the results that may be expected for the full fiscal year ending December 31, 2022.

| Statement of Operations Data: | |

| | |

| |

| | |

Years Ended December 31, | | |

Six Months Ended June 30, (unaudited) | |

| | |

2021 | | |

2020 | | |

2022 | | |

2021 | |

| Revenues | |

$ | — | | |

$ | — | | |

$ | — | | |

$ | — | |

| Operating costs and expenses | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 82,044 | | |

| 340,672 | | |

| 54,000 | | |

| 47,516 | |

| General and administrative | |

| 1,019,432 | | |

| 484,342 | | |

| 1,103,203 | | |

| 365,289 | |

| Total operating expenses | |

| 1,101,476 | | |

| 825,014 | | |

| 1,157,203 | | |

| 412,805 | |

| Interest expense - related party | |

| (805,109 | ) | |

| (998,076 | ) | |

| - | | |

| (510,840 | ) |

| Gain on forgiveness of deferred compensation | |

| 297,500 | | |

| - | | |

| - | | |

| - | |

| Provision for income taxes | |

| (1,600 | ) | |

| (1,600 | ) | |

| (1,600 | ) | |

| - | |

| Net loss | |

$ | (1,610,685 | ) | |

$ | (1,824,690 | ) | |

$ | (1,158,803 | ) | |

$ | (923,645 | ) |

| Net loss per common share – basic and diluted | |

$ | (0.35 | ) | |

$ | (0.63 | ) | |

$ | (0.11 | ) | |

$ | (0.32 | ) |

| Weighted average common shares outstanding – basic and diluted | |

| 4,541,861 | | |

| 2,911,333 | | |

| 10,350,579 | | |

| 2,911,333 | |

| Balance Sheet Data | |

| |

| | |

As of June 30, 2022 | |

| | |

Actual | | |

As Adjusted(1) | |

| Cash | |

$ | 5,454,522 | | |

$ | 9,817,522 | |

| Total assets | |

$ | 5,658,881 | | |

$ | 10,021,881 | |

| Total liabilities | |

$ | 70,636 | | |

$ | 70,636 | |

| Accumulated deficit | |

$ | (71,634,410 | ) | |

$ | (71,634,410 | ) |

| Total stockholders’ equity | |

$ | 5,588,245 | | |

$ | 9,951,245 | |

| (1) |

On

an as adjusted basis to give further effect to the issuance and sale of shares of common stock included in the Units to be sold in

this offering at an assumed public offering price of $2.60 per share, after deducting the estimated underwriting discounts

and commissions, the non-accountable expense allowance payable to the underwriters, and estimated offering costs payable by us. |

| |

|

| (2)

|

Each

$1.00 increase (decrease) in the assumed public offering price of $2.60 per share would increase (decrease) the pro forma

as adjusted amount of each of cash, working capital, total assets and total stockholders’ equity (deficiency) by approximately

$1,750,000, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the

same, and after deducting underwriting discounts and commissions and the non-accountable expense allowance payable to the underwriters.

Each increase (decrease) of 500,000 shares in the number of shares offered by us at the assumed public offering price per share of

$2.60 would increase (decrease) the pro forma amount of each of cash, working capital, total assets and total stockholders’

equity (deficiency) by approximately $1,183,000. |

RISK

FACTORS

An

investment in our common stock involves a high degree of risk. Before making an investment decision, you should give careful consideration

to the following risk factors, in addition to the other information included in this prospectus, including our financial statements and

related notes, before deciding whether to invest in shares of our common stock. The occurrence of any of the adverse developments described

in the following risk factors could materially and adversely harm our business, financial condition, results of operations or prospects.

In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks

Relating to Our Financial Position and Capital Needs

Our

limited operating history makes it difficult to evaluate our current business and future prospects.

We

have a limited operating history, and there is a risk that we will be unable to continue as a going concern. We have minimal assets and

no significant financial resources. Our limited operating history makes it difficult to evaluate our current business model and future

prospects. Accordingly, you should consider our prospects in light of the costs, uncertainties, delays and difficulties frequently encountered

by companies in the early stages of development. Potential investors should carefully consider the risks and uncertainties that a new

company with no operating history will face. In particular, potential investors should consider that there is a significant risk that

we will not be able to:

| |

● |

implement

or execute our current business plan, which may or may not be sound; |

| |

|

|

| |

● |

maintain

our anticipated management and advisory team; and |

| |

|

|

| |

● |

raise

sufficient funds in the capital markets to effectuate our business plan. |

If

we cannot execute any one of the foregoing or similar matters relating to our business, the business may fail, in which case you would

lose the entire amount of your investment in the Company.

Our

long-term capital requirements are subject to numerous risks.

We

anticipate that it will require approximately $15 million to complete first in man studies and an estimated additional $27 million

to achieve FDA approval for a spine interbody fusion indication. These amounts are estimates based on data currently available to us,

and are subject to many factors, including the risk factors discussed herein. We anticipate we will need to raise substantial additional