BIO-key International, Inc. (Nasdaq: BKYI), an

innovative provider of workforce and customer identity and access

management (IAM) solutions featuring Identity-Bound Biometrics

(IBB) and large-scale identity solutions, today reported results

for its fourth quarter (Q4’21) and year ended December 31, 2021

(FY’21). BIO-key will host a conference call today at 10:00 a.m. ET

(details below) to review its results and outlook.

BIO-key’s® revenue increased 80% to $5.1M in

FY’21, from $2.8M in 2020 (FY’20), driven primarily by deployments

of its PortalGuard® IAM solution and the launch of a cloud hosted

version, PortalGuard IDaaS (IDentity-as-a-Service), in November

2020.

2021 & Recent

Highlights:

- Increased PortalGuard

Penetration of Secondary Educational Institutions -

PortalGuard now supports over 2.5M students and faculty

nationwide.

- Added or Expanded

Numerous Government Customers, including

a U.S. Department of Justice division; a Foreign Defense Ministry;

a West Coast State; and Election Boards & County Governments in

New Mexico; South Dakota; Missouri; New York; and Florida.

- Began Initial Technology and Mobile

Biometric Enrollment Equipment Deployments, for its

Large-Scale ID Projects in Africa.

- Added over 100 Channel

Alliance Partners, including: Intelisys; NGEN; Appsian;

Cyberlitica; Kristel Communications and UVS Infotech.

- Secured a

$1.2M, three-year contract extension for

fingerprint biometric security support services from a Fortune 500

telecommunications customer.

- Launched a Range of New

Products and features, including SSO Concierge; a new

PortalGuard Admin Panel; MobileAuth™ App with PalmPositive™; FIDO2

Compliant Security Keys; a Next-Generation EcoID II USB Compact

Fingerprint Scanner; and the MobilePOS Pro Android All-in-one

Terminal for biometric-secured Commerce.

- Awarded U.S.

Patent for Enabling Next-generation Continuous Biometric

User Authentication, increasing BIO-key’s IP Portfolio to 18

patents.

In March 2022, BIO-key further expanded its

global customer base and geographic reach with the acquisition of

Swivel Secure Europe, a Madrid-based IAM solutions provider serving

customers in Europe, the Middle East and Africa (EMEA). Swivel

Secure generated approximately $3.1M in revenue and $578K in

operating income in calendar 2021.

BIO-key CEO Michael DePasquale commented, “2021

was a year of transformational growth for BIO-key, as we advanced

our core Identity and Access Management business, launched a range

of new solutions, expanded our Channel Partner Program, and

commenced deployments for our large-scale Civil ID contracts in

Africa. We substantially expanded our sales & marketing reach

in 2021, adding over 100 partners to our CAP program, and launched

a Master Agent Referral Program with Intelisys, positioning

PortalGuard as the first IAM platform to be offered through their

extensive network.

“We also made excellent progress deploying our

new cloud-hosted PortalGuard IDaaS solution, which we launched late

in 2020. We are achieving solid new customer engagement,

particularly in higher education, enterprise and government

verticals that are very receptive to PortalGuard’s support for

sixteen multi-factor authentication (MFA) methods, including

BIO-key’s advanced biometric solutions. PortalGuard IDaaS continues

to gain momentum in higher education as a strong, user friendly,

attractively priced, scalable and easy-to-deploy solution for their

hybrid access needs. In the first year of deployment we migrated

approximately 7% of our existing customers to our IDaaS solution,

increasing average annual recurring revenue by roughly 300% and

forming a growing base of recurring software subscription revenue

that we look to build on in the years to come. Currently, IDaaS

revenue accounts for approximately 80% of our total software and

non-recurring service revenue.

“Our continued focus on innovation and new

product development resulted in the launch of several new products

and product upgrades. New products included our new MobilePOS Pro,

a handheld Point-of-Sale mobile commerce terminal with biometric ID

verification for secure, fraud-free transactions in banking,

healthcare and social and aid worker applications. We introduced a

line of cryptographic FIDO2 compliant security keys for expanded

authentication options and launched our new EcoID II Compact USB

fingerprint scanner with new NIST-tested algorithms. We also

introduced our Single Sign-On or SSO Concierge which eliminates the

need for passwords for thick client applications not supported by

identity federation protocols.

“I am extremely proud of the industry awards and

acknowledgements BIO-key received during the year, including for

our Technology and Best Solution Awards, and for our organization

being Certified™ by Great Place to Work® for the first

time.

“Our large-scale Africa projects kicked off in

2021 after COVID and other external delays. These projects

represent a large opportunity in terms of revenue and profits for

our company. Hardware shipments resumed in 2021 and there are

increasing signs that these projects should gain momentum in 2022.

We are currently planning on supplying tens of thousands of

Pocket10 biometric fingerprint readers in a partnership with

Specta, an online lending platform owned by Sterling Bank Nigeria

Plc. These shipments are part of the National Identity Management

Commission’s (NIMC) mandated enrollment program for Nigerian

citizens.

“Subsequent to year end we acquired Swivel

Secure Europe. The transaction substantially expands our

international team, operations, customer base, and growth

potential, and should provide a material benefit to both our top-

and bottom-line in 2022.

Outlook“Awareness of the need

for enhanced cybersecurity has never been more widespread. In 2021,

the President signed EO 14028, “Improving the Nation’s

Cybersecurity” to support defenses and protect critical

infrastructure of the Federal Government. Just last week, the White

House warned companies that we are currently in a critical moment

with a need to accelerate work to improve domestic cybersecurity

and bolster national resilience. BIO-key’s solutions and products

directly address these issues and are critical elements of a

holistic approach to cybersecurity.

“Considering this backdrop, the momentum we have

in our business, the addition of Swivel Secure Europe, and the

building progress in our African projects, we have never been more

optimistic about our prospects. Supported by our strong capital

position, our talented global management and product development

teams, we are very optimistic about our growth in 2022 and beyond.

Reflecting the visibility we have on our business, we are

initiating full-year 2022 revenue guidance in the range of $10-13M,

representing potential growth in excess of 100% over 2021. We

estimate that we can achieve break-even operations within this

revenue range, subject to our mix of hardware and higher-margin

software revenue.

Financial ResultsFY’21 revenue

increased 80% to $5.1M from $2.8M in FY’20, due primarily to

revenue from the Company’s PortalGuard IAM solutions, as well as

increased sales of biometric hardware, including fingerprint

readers. Q4’21 revenue declined to $935K from $1.1M in Q4’20, which

had benefitted from the PortalGuard IDaaS launch and strong

services and hardware sales.

Gross profit grew to $3.4M in FY’21 from $2.0M

in FY’20, due primarily to a 166% increase in higher-margin license

fee revenue to $2.5M in FY’21. Gross margin on license fee revenue

was 93% in FY’21 vs. 95% in FY’20. In Q4’21, license fee revenue

increased 52% to $544k from $357k in Q4’20 and represented 88% of

total gross profit vs. 69% in Q4’20.

Operating expenses increased to $8.4M in FY’21

(164% of revenue) from $7.2M (255% of revenue) in FY’20. The

increase reflected higher investments in research, development and

engineering expense with an increase in personnel and spending to

support new product development, as well as a full year of expenses

related to PortalGuard operations in FY’21. Total operating

expenses increased 18.% to $2.6M in Q4’21, due principally to

increased research, development and engineering expenses related to

the development of next generation solutions.

BIO-key reported a reduced operating loss of

$4.9M in FY’21 vs. $5.2M in FY’20, as revenue growth outpaced

expense growth. The company’s Q4’21 operating loss increased to $2M

from a loss of $1.4M in Q4’20, due to lower revenues and higher

expenses in Q4’21.

BIO-key reported a reduced net loss available to

common stockholders of $5.1M, or $0.65 per share, in FY’21, as

compared to $9.8M, or $2.08 per share, in FY’20. Weighted average

basic shares outstanding were approximately 7.8M in FY’21 vs. 4.7M

in FY’20, with both years reflecting a 1-for-8 reverse split in

Q4’20, following a successful capital raise in Q3’20. Due to the

offering, interest expense was reduced to just $18K in 2021 from

$4.3M in FY’21. BIO-key’s net loss to stockholders increased to $2M

in Q4’21 from $1.4M in Q4’20, primarily due to lower operating

income.

Financial StrengthBIO-key ended

the year with $14.0M of current assets; including $7.75M of cash

and cash equivalents; $11.9M of net working capital; and $15.6M of

stockholders’ equity.

| Conference Call

Details |

|

| Date / Time: |

Today, Tuesday, March 29th at

10 a.m. ET |

| Call Dial In #: |

1-877-418-5460 U.S. or 1-412-717-9594

International |

| Live Webcast / Replay: |

Investor Webcast &

Replay – Available for 3 months. |

| Audio Replay: |

1-877-344-7529 U.S. or

1-412-317-0088 Int’l; code 8157908 |

| |

|

About BIO-key International,

Inc. (www.BIO-key.com)BIO-key has over two decades of

expertise in providing authentication technology for thousands of

organizations and millions of users and is revolutionizing

authentication with biometric-centric, multi-factor identity and

access management (IAM) solutions, including PortalGuard that

provides convenient and secure access to devices, information,

applications, and high-value transactions. BIO-key's patented

software and hardware solutions, with industry-leading biometric

capabilities, enable large-scale on-premises and

Identity-as-a-Service (IDaaS) solutions as well as customized

enterprise and cloud solutions.

BIO-key Safe Harbor

StatementAll statements contained in this press release

other than statements of historical facts are "forward-looking

statements" as defined in the Private Securities Litigation Reform

Act of 1995 (the "Act"). The words "estimate," "project,"

"intends," "expects," "anticipates," "believes" and similar

expressions are intended to identify forward-looking statements.

Such forward-looking statements are made based on management's

beliefs, as well as assumptions made by, and information currently

available to, management pursuant to the "safe-harbor" provisions

of the Act. These statements are not guarantees of future

performance or events and are subject to risks and uncertainties

that may cause actual results to differ materially from those

included within or implied by such forward-looking statements.

These risks and uncertainties include, without limitation, our

history of losses and limited revenue; our ability to raise

additional capital; our ability to protect our intellectual

property; changes in business conditions; changes in our sales

strategy and product development plans; changes in the marketplace;

continued services of our executive management team; security

breaches; competition in the biometric technology and identity

access management industries; market acceptance of biometric

products generally and our products under development; our ability

to execute and deliver on contracts in Africa; our ability to

expand into Asia, Africa and other foreign markets; our ability to

integrate the operations and personnel of PistolStar and Swivel

Secure into our business; the duration and severity of the current

coronavirus COVID-19 pandemic and its effect on our business

operations, sales cycles, personnel, and the geographic markets in

which we operate; the duration and extent of continued hostilities

in Ukraine and its impact on our European customers, delays in the

development of products and statements of assumption underlying any

of the foregoing as well as other factors set forth under the

caption "Risk Factors" in our Annual Report on Form 10-K and other

filings with the Securities and Exchange Commission. Readers are

cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date made. Except as

required by law, we undertake no obligation to disclose any

revision to these forward-looking statements whether as a result of

new information, future events, or otherwise.

| Engage with

BIO-key |

|

| Facebook – Corporate: |

https://www.facebook.com/BIOkeyInternational/ |

| LinkedIn – Corporate: |

https://www.linkedin.com/company/bio-key-international |

| Twitter – Corporate: |

@BIOkeyIntl |

| Twitter – Investors: |

@BIO_keyIR |

| StockTwits: |

BIO_keyIR |

|

Media Contact |

Investor Contact |

| Erin Knapp |

William Jones, David

Collins |

| Matter Communications |

Catalyst IR |

| BIO-key@matternow.com |

BKYI@catalyst-ir.com |

| 914-260-3158 |

212-924-9800 |

|

BIO-key International, Inc. and

SubsidiariesCONSOLIDATED STATEMENTS OF

OPERATIONS |

| |

| |

|

Three months endedDecember

31, |

|

|

Years endedDecember 31, |

|

| |

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Services |

|

$ |

288,191 |

|

|

$ |

503,667 |

|

|

$ |

1,273,354 |

|

|

$ |

1,432,228 |

|

| License fees |

|

|

544,199 |

|

|

|

356,672 |

|

|

|

2,555,809 |

|

|

|

962,038 |

|

| Hardware |

|

|

102,542 |

|

|

|

203,491 |

|

|

|

1,285,326 |

|

|

|

442,516 |

|

|

Total revenues |

|

|

934,932 |

|

|

|

1,063,830 |

|

|

|

5,114,489 |

|

|

|

2,836,782 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Costs and other

expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of services |

|

|

174,815 |

|

|

|

165,274 |

|

|

|

686,175 |

|

|

|

502,214 |

|

| Cost of license fees |

|

|

49,871 |

|

|

|

20,405 |

|

|

|

183,199 |

|

|

|

49,891 |

|

| Cost of hardware |

|

|

147,365 |

|

|

|

124,821 |

|

|

|

803,555 |

|

|

|

242,721 |

|

|

Total costs and other expenses |

|

|

372,051 |

|

|

|

310,500 |

|

|

|

1,672,929 |

|

|

|

794,826 |

|

| Gross Profit |

|

|

562,881 |

|

|

|

753,330 |

|

|

|

3,441,560 |

|

|

|

2,041,956 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Selling, general and

administrative |

|

|

1,752,344 |

|

|

|

1,765,119 |

|

|

|

6,028,360 |

|

|

|

5,848,687 |

|

| Research, development and

engineering |

|

|

809,856 |

|

|

|

409,761 |

|

|

|

2,355,056 |

|

|

|

1,396,436 |

|

|

Total operating expenses before impairment |

|

|

2,562,200 |

|

|

|

2,174,880 |

|

|

|

8,383,416 |

|

|

|

7,245,123 |

|

| Operating

loss |

|

|

(1,999,319 |

) |

|

|

(1,421,550 |

) |

|

|

(4,941,856 |

) |

|

|

(5,203,167 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income

(expense) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income |

|

|

299 |

|

|

|

3,741 |

|

|

|

4,075 |

|

|

|

30,649 |

|

| Foreign Currency Loss |

|

|

- |

|

|

|

- |

|

|

|

(50,000 |

) |

|

|

- |

|

| Investment-debt security

reserve |

|

|

(30,000 |

) |

|

|

- |

|

|

|

(60,000 |

) |

|

|

- |

|

| Government grant – Paycheck

Protection Program |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

340,819 |

|

| Interest expense |

|

|

- |

|

|

|

(19,635 |

) |

|

|

(18,000 |

) |

|

|

(4,343,212 |

) |

| Loss on extinguishment of

debt |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(499,076 |

) |

|

Total other income (expense) |

|

|

(29,701 |

) |

|

|

(15,894 |

) |

|

|

(123,925 |

) |

|

|

(4,470,820 |

) |

| Net loss |

|

|

(2,029,020 |

) |

|

|

(1,437,444 |

) |

|

|

(5,065,781 |

) |

|

|

(9,673,987 |

) |

| Deemed dividend from trigger

of anti-dilution provision feature |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(112,686 |

) |

| Net loss available to common

stockholders |

|

$ |

(2,029,020 |

) |

|

$ |

(1,437,444 |

) |

|

|

(5,065,781 |

) |

|

|

(9,786,673 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and Diluted Loss

per Common Share |

|

$ |

(0.26 |

) |

|

$ |

(0.18 |

) |

|

$ |

(0.65 |

) |

|

$ |

(2.08 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted Average

Shares Outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and Diluted |

|

|

7,797,573 |

|

|

|

7,771,523 |

|

|

|

7,791,741 |

|

|

|

4,700,787 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All BIO-key shares issued and outstanding for all periods reflect

BIO-key’s 1-for-8 reverse stock split, which was effective November

20, 2020. |

|

BIO-key International, Inc. and

SubsidiariesCONSOLIDATED BALANCE

SHEETS |

| |

| |

|

December 31, |

|

| |

|

2021 |

|

|

2020 |

|

|

ASSETS |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

7,754,046 |

|

|

$ |

16,993,096 |

|

| Accounts receivable, net |

|

|

970,626 |

|

|

|

548,049 |

|

| Due from factor |

|

|

49,500 |

|

|

|

60,453 |

|

| Note receivable |

|

|

82,000 |

|

|

|

295,000 |

|

| Inventory |

|

|

4,940,660 |

|

|

|

330,947 |

|

| Prepaid expenses and

other |

|

|

216,041 |

|

|

|

201,507 |

|

| Investment – debt

security |

|

|

- |

|

|

|

512,821 |

|

|

Total current assets |

|

|

14,012,873 |

|

|

|

18,941,873 |

|

| Resalable software license

rights |

|

|

48,752 |

|

|

|

58,882 |

|

| Investment – debt

security |

|

|

452,821 |

|

|

|

- |

|

| Equipment and leasehold

improvements, net |

|

|

69,168 |

|

|

|

81,793 |

|

| Capitalized contract costs,

net |

|

|

249,012 |

|

|

|

165,315 |

|

| Deposits and other assets |

|

|

8,712 |

|

|

|

8,712 |

|

| Note receivable, net |

|

|

113,000 |

|

|

|

- |

|

| Operating lease right-of-use

assets |

|

|

254,100 |

|

|

|

487,325 |

|

| Intangible assets, net |

|

|

1,298,077 |

|

|

|

1,514,146 |

|

| Goodwill |

|

|

1,262,526 |

|

|

|

1,262,526 |

|

|

Total non-current assets |

|

|

3,756,168 |

|

|

|

3,578,699 |

|

| TOTAL

ASSETS |

|

$ |

17,769,041 |

|

|

$ |

22,520,572 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

427,772 |

|

|

$ |

244,158 |

|

| Accrued liabilities |

|

|

865,627 |

|

|

|

508,487 |

|

| Note payable – PistolStar

acquisition, net of debt discount |

|

|

- |

|

|

|

232,000 |

|

| Deferred revenue –

current |

|

|

565,355 |

|

|

|

657,349 |

|

| Operating lease liabilities,

current portion |

|

|

177,188 |

|

|

|

234,309 |

|

|

Total current liabilities |

|

|

2,035,942 |

|

|

|

1,876,303 |

|

| Deferred revenue – long

term |

|

|

67,300 |

|

|

|

44,987 |

|

| Operating lease liabilities,

net of current portion |

|

|

86,974 |

|

|

|

264,163 |

|

|

Total non-current liabilities |

|

|

154,274 |

|

|

|

309,150 |

|

| TOTAL

LIABILITIES |

|

|

2,190,216 |

|

|

|

2,185,453 |

|

| |

|

|

|

|

|

|

|

|

| Commitments |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

Common stock — authorized, 170,000,000 shares; issued and

outstanding; 7,814,572 and 1,812,483 of $.0001 par value at

December 31, 2020 and December 31, 2019, respectively |

|

|

786 |

|

|

|

782 |

|

| Additional paid-in

capital |

|

|

120,153,509 |

|

|

|

119,844,026 |

|

| Accumulated deficit |

|

|

(104,575,470 |

) |

|

|

(99,509,689 |

) |

| TOTAL STOCKHOLDERS’

EQUITY |

|

|

15,578,825 |

|

|

|

20,335,119 |

|

| TOTAL LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

$ |

17,769,041 |

|

|

$ |

22,520,572 |

|

| |

|

All BIO-key shares issued and outstanding for all periods reflect

BIO-key’s 1-for-8 reverse stock split, which was effective November

20, 2020. |

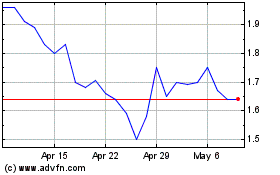

BIO key (NASDAQ:BKYI)

Historical Stock Chart

From Mar 2024 to Apr 2024

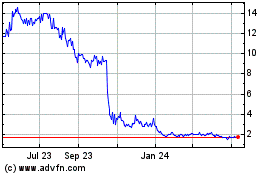

BIO key (NASDAQ:BKYI)

Historical Stock Chart

From Apr 2023 to Apr 2024