Current Report Filing (8-k)

February 23 2022 - 8:01AM

Edgar (US Regulatory)

0001398805

false

0001398805

2022-02-16

2022-02-16

0001398805

us-gaap:CommonStockMember

2022-02-16

2022-02-16

0001398805

BEEM:WarrantsMember

2022-02-16

2022-02-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported):

February 16, 2022

BEAM GLOBAL

(Exact Name of Registrant as Specified in Charter)

| Nevada |

|

000-53204 |

|

26-1342810 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

| 5660 Eastgate Drive, San Diego, CA |

92121 |

| (Address of Principal Executive Offices) |

(Zip Code) |

Registrant’s telephone number, including

area code: (858) 799-4583

___________________________________________________

(Former name or Former Address, if Changed Since

Last Report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| o |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| o |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| o |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| o |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. o

Securities registered pursuant to Section 12(b) of the Act:

| |

|

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock |

|

BEEM |

|

NASDAQ Capital Market |

| Warrants |

|

BEEMW |

|

NASDAQ Capital Market |

| Item 1.01. | Entry into a Material Definitive Agreement. |

On February 16, 2022,

Beam Global (“Beam”) entered into an Asset Purchase Agreement (the “Purchase Agreement”) with AllCell Technologies,

LLC (“AllCell”), a leader in energy storage solutions and technologies, whereby Beam agreed to purchase substantially all

of the assets and business of AllCell for 1,055,000 shares of Beam Common Stock at closing (the “Closing Consideration”).

The Closing Consideration is subject to a cash adjustment based on the net amount of certain AllCell assets and liabilities (primarily

consisting of inventory minus customer deposits) purchased by Beam at Closing. In addition, AllCell is eligible to earn an additional

number of shares of Beam Common Stock if it meets certain revenue milestones (the “Earnout Consideration”). The Earnout Consideration

is: (i) two times the amount of AllCell revenue and contracted backlog that is greater than $7.5 million for 2022, and (ii) two times

the amount of AllCell 2023 revenue only which exceeds the greater of $13.5 million and 135% of the 2022 revenue, capped at $20 million.

Revenues exceeding $20 million in 2023 will not be eligible for the Earnout Consideration. The Closing Consideration and the Earnout Consideration

is referred to as the “Purchase Price.”

The closing of the transactions

underlying the Purchase Agreement is expected to occur on or around March 1, 2022, subject to customary closing conditions. The Purchase

Agreement includes customary indemnification provisions and a number of other covenants and agreements of the parties concerning the transactions

contemplated by the Purchase Agreement.

All Beam Common Stock

issued to AllCell to satisfy the Closing Consideration and any Earnout Consideration will be issued in a private placement and will be

subject to transfer restrictions under the Securities Act of 1933, as amended. Beam has agreed to file a resale registration statement

with the SEC to register the resale of up to $10 million of the Common Stock issued to AllCell for the Closing Consideration. Pursuant

to the terms of the Purchase Agreement, AllCell agreed not to sell shares of Beam Common Stock (i) in an amount greater than four percent

(4%) of the average weekly volume of shares of Beam Common Stock during any trading week and (ii) on more than three days in any week

and (iii) in an amount greater than ten percent (10%) of the average daily trading volume on any trading day.

The preceding description of the Purchase Agreement

does not purport to be complete, and is qualified in its entirety by reference to the Agreement which is filed as an Exhibit to this Current

Report on Form 8-K. The representations, warranties and covenants contained in the Purchase Agreement have been made solely for the benefit

of the parties to the Purchase Agreement and: (i) may be intended not as statements of fact but rather as a way of allocating risk among

the parties if those statements prove to be inaccurate; and (ii) were made only as of the date of the Purchase Agreement or such other

dates as may be specified in the Purchase Agreement and are subject to more recent developments. Accordingly, any such representations

and warranties should not be relied upon as characterizations of the actual state of facts or affairs on the date they were made or at

any other time.

| Item 3.02. | Unregistered Sales of Equity Securities. |

The information set forth

in Item 1.01 of this Current Report on Form 8-K is hereby incorporated by reference into this Item 3.02. The

issuance and sale of the shares of Beam Common Stock to AllCell for the Purchase Price will not be registered under the Securities Act

of 1933, as amended (the “Securities Act”), and were offered pursuant to the exemption provided in Section 4(a)(2) under the

Securities Act and Rule 506(b) promulgated thereunder.

| Item 7.01 |

Regulation FD Disclosure |

On February 23, 2022, the Company posted on its

corporate website a recent video. In the video, Desmond Wheatley, President, CEO and Chairman of the Company, discuss the transaction

with AllCell. The Video is available on the Company’s website at https://beamforall.com/beam-ceo-interview-allcell-technologies-aquisition/.

The information contained in the video is summary

information that should be considered in the context of the Company’s filings with the SEC and other public announcements the Company

may make by press release or otherwise from time to time. The information contained in the video speaks as of its date.

The information in this Item 7.01 of this Current

Report on Form 8-K, including the information in the video, is furnished and shall not be deemed to be “filed” for

the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject

to the liabilities of that section.

The information in this Item 7.01 of this Current

Report on Form 8-K, including the information in the video, shall not be incorporated by reference into any filing under the

Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date of this Current Report, regardless of any

general incorporation language in any such filing.

The video contains “forward-looking statements.”

Forward-looking statements can generally be identified by the use of words such as “anticipate,” “believe,” “continue,”

“could,” “going to,” “expect,” “forecast,” “intend,” “may,” “plan,”

“project,” “potential,” “seek,” “should,” “think,” “will,” “would”

and similar expressions, or they may use future dates. These forward-looking statements are subject to assumptions, risks and uncertainties

that may change at any time, and viewers of the videos are therefore cautioned that actual results could differ materially from those

expressed in any forward-looking statements. Factors that could cause actual results to differ include risks and uncertainties discussed

in the Company’s filings with the SEC, including the “Risk Factors” sections of the Company’s Annual Report on

Form 10-K for the year ended December 31, 2020. The Company undertakes no obligation to update any forward-looking statements

as a result of new information, future developments or otherwise, except as expressly required by law. All forward-looking statements

in this document are qualified in their entirety by this cautionary statement. Investors should not place undue reliance on these forward-looking

statements.

| Item 9.01. |

Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

BEAM GLOBAL |

| |

|

|

| Dated: February 23, 2022 |

By: |

/s/ Katherine H. McDermott |

| |

Name: |

Katherine H. McDermott |

| |

Title: |

Chief Financial Officer |

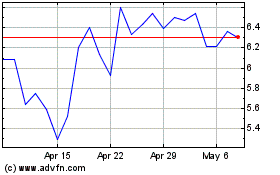

Beam Global (NASDAQ:BEEM)

Historical Stock Chart

From Mar 2024 to Apr 2024

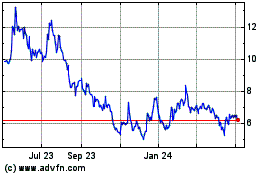

Beam Global (NASDAQ:BEEM)

Historical Stock Chart

From Apr 2023 to Apr 2024