Baudax Bio, Inc. (NASDAQ:BXRX) (the “Company”), a pharmaceutical

company focused on developing and commercializing innovative

products for acute care settings, today reported financial results

for the three months ended March 31, 2021.

“The first quarter has been busy and fruitful at

Baudax. ANJESO sustained marked progress in the areas of new

account wins, increasing units sold, reorder rates, and deepening

usage across the hospital and ambulatory surgery center space.

Although we are seeing some relief from COVID in the marketplace,

it continues to impact elective surgical procedures and hospital

administration’s focus as well as access into accounts, which the

team will need to continue to monitor to maintain the growth of

ANJESO,” said Gerri Henwood, President and CEO of Baudax Bio. “We

continue to receive positive feedback from physicians using ANJESO

for the management of moderate to severe pain in the acute care

setting.”

First Quarter 2021 and Recent Business

Highlights

-

Continued Progress on U.S. Launch of ANJESO.

Baudax Bio built infrastructure, executed group purchasing

organization agreements with the top three medical distributors and

began developing awareness and knowledge of ANJESO in 2020. In the

first quarter of 2021 we have seen more meaningful progress in

deepening usage of ANJESO in early users as reflected in sales to

existing hospitals and ambulatory surgery centers, which doubled in

the first quarter of 2021 compared to the fourth quarter of 2020.

Total unit sales grew 40% in the first quarter of 2021 compared to

the fourth quarter of 2020 and the reorder rate was nearly 70% for

the same comparable period.During the first quarter, formulary wins

grew by 22 institutions, for a total of 90 institutions as of March

31, 2021, an increase of over 30% from the fourth quarter.

-

Publication of ANJESO Phase IIIb Data in Pain

Medicine. In April 2021, the company announced the online

publication of ANJESO Phase IIIb data in the peer-reviewed medical

journal Pain Medicine. The data highlights the safety and pain

management efficacy of preoperative ANJESO injection in total knee

arthroplasty (TKA). This study also reported that ANJESO decreased

the need for opioids following surgery. The findings published were

especially compelling because they suggest select measures of

health care resource utilization (HRU) were lower in the ANJESO

treated patients.

-

Announced Partial Adjournment of Annual Meeting of

Shareholders. In April 2021, Baudax Bio partially

adjourned its 2021 Annual Meeting of Shareholders solely with

respect to Proposal 3 set forth in its Definitive Proxy Statement

filed with the Securities and Exchange Commission on March 11,

2021. Proposal 3 is a proposal to amend the Company’s Amended and

Restated Articles of Incorporation to increase the number of

authorized, not issued, shares of common stock from 100 million

shares to 190 million shares. This adjournment provides its

shareholders additional time to vote on Proposal 3. The Annual

Meeting will resume with respect to Proposal 3 at 10:00 a.m.

Eastern time on May 6, 2021.

- Richard

S. Casten Strengthens Management Team in Chief Financial Officer

Role. In March 2021, Baudax Bio announced the appointment

of Richard S. Casten, CPA, MBA as Chief Financial Officer. In this

role, Mr. Casten will be responsible for leading and directing the

financial activities of the Company. Mr. Casten brings to Baudax

Bio 25 years of diversified financial experience across

pharmaceutical, Fortune 500 consumer products and public

accounting.

- In

February, Announced $17.6 Million Offering Priced At-the-Market

under Nasdaq Rules. Baudax Bio announced that it entered

into a definitive agreement with institutional and accredited

investors for the purchase and sale of an aggregate of 11,000,000

shares of common stock at a purchase price of $1.60 per share in a

registered direct offering, priced at-the-market under Nasdaq

rules. The gross proceeds from the offering were approximately

$17.6 million, prior to deducting fees and expenses.

- In

January, Announced Exercise of Warrants for Gross Proceeds of $13.4

Million. Baudax Bio announced the agreement by an

accredited healthcare-focused institutional investor to cash

exercise certain warrants to purchase up to an aggregate of

10,300,430 shares of common stock having an exercise price of $1.18

issued by the company in December 2020. In connection therewith,

Baudax Bio sold the exercising holder new warrants, which are cash

exercisable for an aggregate of 10,300,430 shares of common stock

at an exercise price of $1.60 per share, for an aggregate purchase

price $1,287,554, or $0.125 per warrant. The gross proceeds to

Baudax Bio from the exercise of the warrants and the sale of the

additional warrants was $13.4 million, prior to deducting fees and

expenses.

First Quarter 2021 Financial

Results

As of March 31, 2021, Baudax Bio had cash,

cash equivalents and short-term investments of

$38.2 million.

Net product revenue for the three months ended

March 31, 2021 was $0.2 million, related to sales of ANJESO in

the U.S. There was no product revenue recognized during the three

months ended March 31, 2020.

Cost of sales for the three months ended

March 31, 2021 was $0.8 million and consisted of product

costs, royalty expense and certain fixed costs associated with the

manufacturing of ANJESO including supply chain and quality costs.

Certain product costs of ANJESO units recognized as revenue during

the three months ended March 31, 2021 were incurred prior to

the FDA approval of ANJESO in February 2020, and therefore are not

included in cost of sales during the period. Baudax Bio expects

that over time, its cost of sales will increase as sales increase

and as inventory values change to include all direct and indirect

costs and expenses post FDA approval. No cost of sales was recorded

for the three months ended March 31, 2020.

Research and development expenses for the three

months ended March 31, 2021 were $1.1 million, compared

to $3.1 million for the three months ended March 31,

2020. The decrease of $2.0 million was primarily due to a

decrease of $1.7 million as a result of re-allocating costs related

to supply chain, regulatory, quality, and medical affairs

associated with support of the commercial launch of ANJESO from

research and development expense to cost of sales and selling,

general and administrative expense and a decrease in personnel

costs of $0.3 million.

Selling, general and administrative expenses for

the three months ended March 31, 2021 were $12.1 million,

compared to $8.0 million for the same prior year period. The

increase of $4.1 million was primarily due to the commercial

launch of ANJESO, specifically, an increase in personnel related

costs of $1.6 million, an increase of $1.3 million attributable to

medical affairs and regulatory support reallocated from research

and development expense post FDA approval, an increase of $0.3

million in public company costs and an increase of $0.3 million in

marketing costs. In addition, the first quarter of 2020 included

$0.5 million in reimbursed general and administrative expenses

related to the Transition Services Agreement with Recro Pharma,

which ended on December 31, 2020.

Baudax Bio reported a net loss, including

non-cash charges of $5.1 million, of $16.9 million, or $(0.27)

per share, for the three months ended March 31, 2021. The

non-cash charge of $5.1 million was associated with

stock-based compensation, non-cash interest expense, depreciation,

amortization, changes in warrant valuations, and changes in fair

value of contingent consideration. This compares to a net loss,

including non-cash charges of $32.0 million, of $40.3 million,

or $(4.03) per share, for the comparable period in 2020. The

non-cash charge of $32.0 million in 2020 was associated with

changes in fair value of contingent consideration, stock-based

compensation, change in warrant valuation, depreciation and

amortization.

About Baudax Bio

Baudax Bio is a pharmaceutical company focused

on developing and commercializing innovative products for acute

care settings. The launch of Baudax Bio’s first commercial product

ANJESO® began in mid-2020. ANJESO is the first and only 24-hour,

intravenous (IV) COX-2 preferential non-steroidal anti-inflammatory

(NSAID) for the management of moderate to severe pain, which can be

administered alone or in combination with other non-NSAID

analgesics. It has successfully completed three Phase III clinical

trials, including two pivotal efficacy trials, a large double-blind

Phase III safety trial and a Phase IIIb program evaluating ANJESO

and its health economic impact in specific surgical settings. In

addition to ANJESO, Baudax Bio has a pipeline of other innovative

pharmaceutical assets including two novel neuromuscular blocking

agents (NMBAs) and a proprietary chemical reversal agent specific

to these NMBAs which is currently in preclinical studies. For more

information, please visit www.baudaxbio.com.

Cautionary Statement Regarding Forward

Looking Statements

This press release contains forward-looking

statements that involve risks and uncertainties. Such

forward-looking statements reflect Baudax Bio’s expectations about

its future performance and opportunities that involve substantial

risks and uncertainties. When used herein, the words “anticipate,”

“believe,” “estimate,” “may,” “upcoming,” “plan,” “target,” “goal,”

“intend,” and “expect,” and similar expressions, as they relate to

Baudax Bio or its management, are intended to identify such

forward-looking statements. These forward-looking statements are

based on information available to Baudax Bio as of the date of

publication on this internet site and are subject to a number of

risks, uncertainties, and other factors that could cause Baudax

Bio’s performance to differ materially from those expressed in, or

implied by, these forward-looking statements. These forward-looking

statements are subject to risks and uncertainties including, among

other things, the ongoing economic and social consequences of the

COVID-19 pandemic, including any adverse impact on the commercial

launch of ANJESO® or disruption in supply chain, Baudax Bio’s

ability to maintain regulatory approval for ANJESO, Baudax Bio’s

ability to successfully commercialize ANJESO; the acceptance of

ANJESO by the medical community, including physicians, patients,

health care providers and hospital formularies; Baudax Bio’s

ability and that of Baudax Bio’s third party manufacturers to

successfully scale-up our commercial manufacturing process for

ANJESO, Baudax Bio’s ability to produce commercial supply in

quantities and quality sufficient to satisfy market demand for

ANJESO, Baudax Bio’s ability to raise future financing for

continued product development, payment of milestones and ANJESO

commercialization, Baudax Bio’s ability to pay its debt and satisfy

conditions necessary to access future tranches of debt, Baudax

Bio’s ability to comply with the financial and other covenants

under its credit facility, Baudax Bio’s ability to manage costs and

execute on our operational and budget plans, the accuracy of Baudax

Bio’s estimates of the potential market for ANJESO, Baudax Bio’s

ability to achieve its financial goals; and Baudax Bio’s ability to

obtain, maintain and successfully enforce adequate patent and other

intellectual property protection. These forward-looking statements

should be considered together with the risks and uncertainties that

may affect Baudax Bio’s business and future results included in

Baudax Bio’s filings with the Securities and Exchange Commission at

www.sec.gov. These forward-looking statements are based on

information currently available to Baudax Bio, and Baudax Bio

assumes no obligation to update any forward-looking statements

except as required by applicable law.

CONTACTS:Investor

Relations Contact:Argot PartnersSam Martin / Claudia

Styslinger(212)

600-1902sam@argotpartners.comclaudia@argotpartners.com

Media Contact:Argot

PartnersDavid Rosen(212) 600-1902david.rosen@argotpartners.com

BAUDAX BIO, INC.Consolidated

Balance Sheets(Unaudited)

| (amounts in thousands,

except share and per share data) |

|

March 31, 2021 |

|

|

December 31, 2020 |

|

|

Assets |

|

|

|

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

30,690 |

|

|

$ |

30,342 |

|

|

Short-term investments |

|

|

7,495 |

|

|

|

— |

|

|

Accounts receivable, net |

|

|

163 |

|

|

|

51 |

|

|

Inventory, net |

|

|

2,773 |

|

|

|

2,978 |

|

|

Prepaid expenses and other current assets |

|

|

2,569 |

|

|

|

3,346 |

|

|

Total current assets |

|

|

43,690 |

|

|

|

36,717 |

|

|

Property, plant and equipment, net |

|

|

5,039 |

|

|

|

5,052 |

|

|

Intangible assets, net |

|

|

23,610 |

|

|

|

24,254 |

|

|

Goodwill |

|

|

2,127 |

|

|

|

2,127 |

|

| Other

long-term assets |

|

|

520 |

|

|

|

583 |

|

|

Total assets |

|

$ |

74,986 |

|

|

$ |

68,733 |

|

|

Liabilities and Shareholders' Equity |

|

|

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

1,140 |

|

|

$ |

3,653 |

|

|

Accrued expenses and other current liabilities |

|

|

4,680 |

|

|

|

5,326 |

|

|

Current portion of long-term debt, net |

|

|

1,196 |

|

|

|

683 |

|

|

Current portion of contingent consideration |

|

|

7,107 |

|

|

|

8,467 |

|

|

Total current liabilities |

|

|

14,123 |

|

|

|

18,129 |

|

|

Long-term debt, net |

|

|

8,185 |

|

|

|

8,469 |

|

| Warrant

liability |

|

|

83 |

|

|

|

65 |

|

|

Long-term portion of contingent consideration |

|

|

53,348 |

|

|

|

56,576 |

|

| Other

long-term liabilities |

|

|

241 |

|

|

|

293 |

|

|

Total liabilities |

|

|

75,980 |

|

|

|

83,532 |

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

|

Shareholders’ equity: |

|

|

|

|

|

|

|

|

|

Preferred stock, $0.01 par value. Authorized, 10,000,000 shares;

none issued and outstanding |

|

|

— |

|

|

|

— |

|

|

Common stock, $0.01 par value. Authorized, 100,000,000 shares;

issued and outstanding, 70,142,608 shares at March 31, 2021

and 48,688,480 shares at December 31, 2020 |

|

|

701 |

|

|

|

487 |

|

|

Additional paid-in capital |

|

|

127,537 |

|

|

|

97,034 |

|

|

Accumulated deficit |

|

|

(129,232 |

) |

|

|

(112,320 |

) |

|

Total shareholders’ equity (deficit) |

|

|

(994 |

) |

|

|

(14,799 |

) |

|

Total liabilities and shareholders’ equity |

|

$ |

74,986 |

|

|

$ |

68,733 |

|

BAUDAX BIO, INC.Consolidated and

Combined Statements of Operations(Unaudited)

|

|

|

For the Three Months Ended March 31, |

|

| (amounts in thousands,

except share and per share data) |

|

2021 |

|

|

2020 |

|

|

Revenue, net |

|

$ |

198 |

|

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

Cost of sales |

|

|

821 |

|

|

|

— |

|

|

Research and development |

|

|

1,108 |

|

|

|

3,070 |

|

|

Selling, general and administrative |

|

|

12,088 |

|

|

|

8,046 |

|

|

Amortization of intangible assets |

|

|

644 |

|

|

|

215 |

|

|

Change in warrant valuation |

|

|

18 |

|

|

|

1,378 |

|

|

Change in contingent consideration valuation |

|

|

1,841 |

|

|

|

27,626 |

|

|

Total operating expenses |

|

|

16,520 |

|

|

|

40,335 |

|

|

Operating loss |

|

|

(16,322 |

) |

|

|

(40,335 |

) |

| Other

expense: |

|

|

|

|

|

|

|

|

|

Interest and other expense |

|

|

(590 |

) |

|

|

37 |

|

|

Net loss |

|

$ |

(16,912 |

) |

|

$ |

(40,298 |

) |

|

|

|

|

|

|

|

|

|

|

| Per

share information: |

|

|

|

|

|

|

|

|

| Net loss

per share of common stock, basic and diluted |

|

$ |

(0.27 |

) |

|

$ |

(4.03 |

) |

| Weighted

average common shares outstanding, basic and diluted |

|

|

62,584,129 |

|

|

|

10,001,228 |

|

|

|

|

|

|

|

|

|

|

|

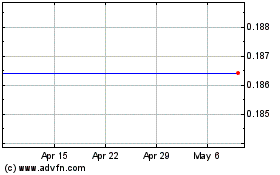

Baudax Bio (NASDAQ:BXRX)

Historical Stock Chart

From Mar 2024 to Apr 2024

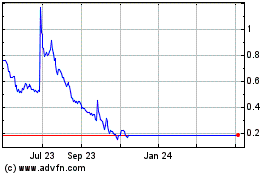

Baudax Bio (NASDAQ:BXRX)

Historical Stock Chart

From Apr 2023 to Apr 2024