Holds Dividend Steady at 23 Cents Per

Share

Bank of Marin Bancorp, "Bancorp" (Nasdaq: BMRC), parent company

of Bank of Marin, "Bank," announced earnings of $7.4 million in the

second quarter of 2020, compared to $7.2 million in the first

quarter of 2020 and $8.2 million in the second quarter of 2019.

Diluted earnings per share were $0.55 in the second quarter of 2020

compared to $0.53 in the prior quarter and $0.60 in the same

quarter last year. Earnings for the first six months of 2020

totaled $14.6 million compared to $15.7 million in the same period

last year. Diluted earnings per share were $1.07 and $1.13 in the

first six months of 2020 and 2019, respectively.

Net income included the positive pretax impact of $1.7 million

in interest income and accreted processing fees, net of amortized

loan origination costs, related to Small Business Administration

("SBA") Paycheck Protection Program ("PPP") loans, which

contributed $0.09 to diluted earnings per share in the second

quarter and first six months of 2020. A $2.0 million provision for

loan losses negatively impacted diluted earnings per share by

approximately $0.11 in the second quarter. Year-to-date provisions

of $4.2 million reduced EPS by $0.23 in the first half of 2020.

The Bank has responded to the COVID-19 pandemic in a number of

ways, funding over $300 million in SBA PPP loans to over 1,800

small businesses, reaching nearly 28,000 employees in our markets,

while also accommodating loan payment relief requests for over 260

loans with balances exceeding $386 million, lowering interest rate

floors on commercial Prime Rate loans, waiving ATM and overdraft

fees, and cancelling early withdrawal penalties for certificates of

deposit when allowed by law.

"Though the pandemic created sudden and substantial financial

hardship for many, our sound underwriting and strong capital and

liquidity positions enabled us to efficiently help businesses

access resources like the Paycheck Protection Program," said

Russell A. Colombo, President and Chief Executive Officer. "Our

more than 30-year history of consistently strong performance is

proof of our ability to navigate through economic downturns and

emerge ready to grow along with our customers. We will continue to

work together now to ensure they bridge the gap to recovery.”

Bancorp provided the following highlights from the second

quarter of 2020:

- Loans totaled $2,110.2 million at June 30, 2020, compared to

$1,843.9 million at March 31, 2020, an increase of $266 million,

primarily due to SBA PPP loans, which totaled $298.9 million or 14%

of loan balances at June 30, 2020.

- In the first quarter of 2020, with the onset of the pandemic,

we identified industries within our loan portfolio that could be

most impacted by the pandemic, including retail, transportation and

energy, medical and dental, hospitality, health clubs and movie

theaters, private schools, and the wine industry. Not including SBA

PPP loans, exposure to these segments totaled $429.8 million at

June 30, 2020, or 20% of the loan portfolio, $365.7 million (or

85%) of which was real estate secured with an average loan-to-value

ratio ("LTV") of 38%. The greatest exposure was related to retail

businesses and retail-related commercial real estate at $198.0

million or 9% of the total portfolio, $184.8 million of which is

secured by commercial real estate with an average LTV of 39%. The

wine-industry exposure was $76.7 million, or 4% of the total

portfolio, of which $42.1 million is real estate secured, education

was $67.4 million, or 3% of the total portfolio, of which $63.0

million is secured by real estate, and hospitality was $48.1

million, of which $45.3 million is secured by real estate.

- As of June 30, 2020, we had made $102.5 million in PPP loans to

industries most impacted by the pandemic, the largest of which were

in the medical and dental sector at $33.4 million, hospitality at

$16.6 million, retail (mostly commercial real estate) at $16.3

million and education at $11.7 million.

- While our credit quality remains strong, with non-accrual loans

representing only 0.08% of total loans, we considered the impact of

the COVID-19 pandemic and recorded a $2.0 million provision for

loan losses and $260 thousand provision for losses on off-balance

sheet commitments in the second quarter of 2020 versus $2.2 million

and $102 thousand, respectively, in the prior quarter. SBA PPP

loans are fully guaranteed by the SBA and did not contribute to the

provisions.

- Total deposits increased $472.8 million in the second quarter

to $2,779.9 million, primarily due to temporary increases in our

deposits from SBA PPP borrowers. Non-interest bearing deposits

represented 52% of total deposits in the second quarter compared to

49% in the prior quarter. The cost of average deposits decreased 12

basis points to 0.09% in the second quarter, compared to 0.21% in

the first quarter of 2020.

- All capital ratios were above regulatory requirements. The

total risk-based capital ratio for Bancorp was 15.8% at June 30,

2020, compared to 15.3% at March 31, 2020. Tangible common equity

to tangible assets was 10.1% at June 30, 2020, compared to 11.7% at

March 31, 2020 (refer to footnote 3 on page 7 for a definition of

this non-GAAP financial measure). The decrease is related to the

rise in total loans associated with SBA PPP loans.

- The Board of Directors has suspended its search for a Chief

Executive Officer. Our current CEO, Russell A. Colombo, is

committed to remaining in the job as long as needed.

- As announced on June 30, 2020, Timothy D. Myers was appointed

Executive Vice President and Chief Operating Officer of Bank of

Marin. Mr. Myers will be responsible for the management of

Commercial Banking, Retail Banking, Wealth Management & Trust

Services and Marketing.

- Also in June, the Bank hired Jake Nguyen, Senior Vice President

and Commercial Banking Regional Manager for the San Mateo

Commercial Banking Office ("CBO"), which will open in the third

quarter of 2020 to serve commercial banking clients in the

Peninsula and South Bay regions.

- The Board of Directors declared a cash dividend of $0.23 per

share on July 17, 2020. This represents the 61st consecutive

quarterly dividend paid by Bank of Marin Bancorp. The dividend is

payable on August 7, 2020, to shareholders of record at the close

of business on July 31, 2020.

Loans and Credit Quality

Loans increased by $266 million in the second quarter and

totaled $2,110.2 million at June 30, 2020, primarily due to $298.9

million in SBA PPP loans. Non-PPP-related loan originations were

$41.8 million and $71.6 million for the second quarter and first

six months of 2020, compared to $42.2 million and $76.1 million for

the same periods in 2019. Loan payoffs totaled $31.7 million in the

second quarter and $83.4 million in the first six months of 2020,

compared to $43.3 million and $69.3 million in the respective 2019

periods. These loan payoffs did not include $45.7 million and $16.8

million decreases in line utilization during the three and six

months ended June 30, 2020. Loan payoffs in the second quarter,

outside of home equity line of credit and consumer loan payoffs,

consisted largely of loans refinanced by outside parties and

payoffs with borrower cash.

As of June 30, 2020, the Bank had originated $298.9 million in

SBA PPP loans to small businesses that needed funding to weather

the economic downturn. We were able to assist 178 non-profit

organizations that received $57.4 million, which helped protect

payroll for over 6,000 of their employees. Notably, 73% of the PPP

loans were for $150 thousand or less, and almost 90% were $350

thousand or less. Only 48 loans were one million dollars or

greater, representing approximately 30% of the total balance.

The Bank has provided payment relief for over 260 loans with

balances exceeding $386 million. Of the loans on payment relief,

almost 50% fell into pandemic-impacted industries, the largest

being retail-related commercial real estate at $69.7 million,

hotels and motels at $36.9 million, and education-related

commercial real estate at $25.3 million. Over 90% of the payment

relief loans are secured by real estate and have an average LTV of

45%, with the average LTVs being 43% for retail-related properties,

39% for hotels and motels, and 37% for education properties.

Non-accrual loans totaled $1,587 thousand, or 0.08% of the loan

portfolio at June 30, 2020, compared to $1,632 thousand, or 0.09%

at March 31, 2020, and $574 thousand, or 0.03% a year ago.

Classified loans totaled $13.5 million at June 30, 2020, compared

to $12.1 million at March 31, 2020 and $10.3 million at June 30,

2019. There were no loans classified doubtful at June 30, 2020,

March 31, 2020, or June 30, 2019. Accruing loans past due 30 to 89

days totaled $83 thousand at June 30, 2020, compared to $1,315

thousand at March 31, 2020 and $343 thousand a year ago.

In accordance with the accounting relief provisions of the

Coronavirus Aid, Relief and Economic Security ("CARES") Act passed

in March 2020, the Bank postponed the adoption of the current

expected credit loss ("CECL") accounting standard. Implementation

may be delayed until the end of the national emergency or December

31, 2020, whichever occurs first. The Bank will be prepared to

adopt CECL in the event that the national emergency ends prior to

year-end. Had we adopted the CECL standard as of January 1, 2020,

the increase to our allowance for loan losses would have ranged

from 5% to 15% of the amount recorded as of December 31, 2019 based

on economic forecasts at that time and not including the subsequent

COVID-19 pandemic related impact.

Under the existing incurred loss model we made certain

adjustments to qualitative factors impacted by the COVID-19

pandemic, primarily to account for the significant increase in the

unemployment rate, and recorded a $2.0 million and $2.2 million

loan loss provision in the second and first quarters of 2020,

respectively. There was no provision for loan losses recorded in

the first half of last year. Net charge-offs were $16 thousand in

the second quarter of 2020, compared to net recoveries of $7

thousand for the prior quarter and $18 thousand in the second

quarter a year ago. The ratio of allowance for loan losses to total

loans, including acquired loans and SBA-guaranteed PPP loans, was

0.99% at June 30, 2020, 1.02% at March 31, 2020, and 0.90% at June

30, 2019. Excluding $298.9 million in SBA PPP loans, the ratio of

allowance for loan losses to total loans would have been 1.15% at

June 30, 2020.

Cash, Cash Equivalents and Restricted Cash

Total cash, cash equivalents and restricted cash were $397.7

million at June 30, 2020, compared to $156.3 million at March 31,

2020. The $241.4 million increase was primarily due to temporary

increases in SBA PPP borrowers' deposit accounts. Effective March

26, 2020, the Federal Reserve reduced the reserve requirement

ratios to zero percent in response to the COVID-19 pandemic

resulting in no restricted cash requirements as of March 31, 2020

and June 30, 2020.

Investments

The investment securities portfolio decreased from $580.0

million at March 31, 2020 to $555.6 million at June 30, 2020. The

decrease was primarily attributed to paydowns, maturities and calls

of $21.3 million, and sales of $6.2 million, partially offset by

purchases of $2.0 million.

Deposits

Total deposits were $2,779.9 million at June 30, 2020, compared

to $2,307.1 million at March 31, 2020. The $472.8 million increase

during the second quarter was primarily due to temporary increases

in deposits from SBA PPP borrowers. The average cost of deposits in

the second quarter of 2020 was 0.09%, a decrease of 12 basis points

from the prior quarter, primarily attributed to lower interest

rates impacting money market accounts.

Earnings

"Even in the strongest economic times, Bank of Marin

continuously prepared for an eventual downturn. Given our

conservative posture, we entered this environment from a position

of strength,” said Tani Girton, EVP and Chief Financial Officer.

“Our foundation of disciplined risk management enables us to adapt

to challenges and continue to make necessary investments for the

future, so we are confident about the long-term prospects for our

customers and the Bank."

Net interest income totaled $24.4 million in the second quarter

of 2020, compared to $24.1 million in the prior quarter and $23.8

million a year ago. The $256 thousand increase from the prior

quarter was primarily related to the recognition of $1.2 million in

SBA PPP loan fees, $532 thousand interest on SBA PPP loans and

lower deposit interest expense, largely offset by the full quarter

impact of lower interest rates across all interest earning asset

categories. The $586 thousand increase from the comparative quarter

a year ago was reflective of the reasons mentioned above and higher

average loan balances.

Net interest income totaled $48.5 million in the first six

months of 2020, compared to $47.6 million for the same period in

2019. The $859 thousand increase is attributable to the same

drivers mentioned above.

The tax-equivalent net interest margin was 3.53% in the second

quarter, 3.88% in the prior quarter, and 4.02% in the second

quarter of 2019. The tax-equivalent net interest margin was 3.70%

in the first six months of 2020, compared to 4.03% for the same

period in 2019. The decreases in tax-equivalent net interest margin

were mostly attributed to the full quarter impact of lower interest

rates. SBA PPP loans lowered 2020 net interest margin by 3 basis

points in the second quarter, and 2 basis points in the first

half.

Non-interest income totaled $1.8 million in the second quarter

of 2020, $3.1 million in the prior quarter, and $2.3 million in the

same quarter a year ago. The decrease of $1.3 million from the

prior quarter was due to fewer gains from the sale of investment

securities, lower ATM fees and service charges on deposit accounts

related to waivers in response to the pandemic, and lower deposit

network fees. The $461 thousand decrease from the same quarter a

year ago was due to lower ATM fees and service charges on deposit

accounts and small decreases in most other non-interest income

categories.

Non-interest income increased $888 thousand to $4.9 million in

the first six months of 2020, compared to $4.0 million in 2019,

mostly attributable to higher gains on the sale of investment

securities in the first half of 2020 and $283 thousand

non-refundable costs for underwriting two new bank-owned life

insurance policies purchased in the first quarter of 2019.

Increases were partially offset by lower service charges and

interchange fees in the first six months of 2020.

Non-interest expense decreased $1.4 million to $14.1 million in

the second quarter of 2020 from $15.5 million in the prior quarter.

The decrease was primarily due to lower salaries and benefits as

the second quarter included $890 thousand in SBA PPP-related

deferred loan origination costs. Additionally, the first quarter

typically includes higher expenses such as the reset of 401K

matching and payroll taxes, prior year bonus accrual true-ups, and

stock-based compensation for participants meeting retirement

eligibility criteria not present in the second quarter. These

positive variances were partially offset by a $158 thousand

increase in the provision for losses on off-balance sheet loan

commitments.

Non-interest expense decreased $775 thousand to $14.1 million in

the second quarter of 2020 from $14.9 million in the second quarter

of 2019. The decrease was primarily due to deferral of SBA PPP loan

origination costs and lower data processing expenses due to our

digital platform conversion, partially offset by the provision for

losses on off-balance sheet loan commitments.

Non-interest expense decreased $834 thousand to $29.6 million in

the first half of 2020 from $30.4 million in the first half of

2019. The decrease was primarily associated with $890 thousand in

SBA PPP-related deferred loan origination costs, decreases in

expenses related to data processing costs due to the digital

platform conversion, and lower FDIC deposit insurance expense.

These positive variances were partially offset by the provision for

losses on off-balance sheet loan commitments and higher occupancy

and equipment costs.

Share Repurchase Program

In response to the COVID-19 pandemic, the share repurchase

program approved by the Board on January 24, 2020, was suspended on

March 20, 2020. The program will be monitored with the opportunity

to reinstitute when the Board deems appropriate. There were no

share repurchases by Bancorp in the second quarter of 2020,

compared to 92,664 shares repurchased totaling $3.2 million in the

prior quarter, and 134,620 share repurchases totaling $5.6 million

in the second quarter of 2019.

Earnings Call and Webcast Information

Bank of Marin Bancorp will present its second quarter earnings

call via webcast on Monday, July 20, 2020 at 8:30 a.m. PT/11:30

a.m. ET. Investors will have the opportunity to listen to the

webcast online through Bank of Marin’s website at

https://www.bankofmarin.com under “Investor Relations.” To listen

to the webcast live, please go to the website at least 15 minutes

early to register, download and install any necessary audio

software. For those who cannot listen to the live broadcast, a

replay will be available at the same website location shortly after

the call.

About Bank of Marin Bancorp

Founded in 1989 and headquartered in Novato, Bank of Marin is

the wholly owned subsidiary of Bank of Marin Bancorp (Nasdaq:

BMRC). A leading business and community bank in the San Francisco

Bay Area, with assets of $3.2 billion, Bank of Marin has 22

branches, 5 commercial banking offices and 1 loan production office

located across 8 Bay Area counties. Bank of Marin provides

commercial banking, personal banking, and wealth management and

trust services. Specializing in providing legendary service to its

customers and investing in its local communities, Bank of Marin has

consistently been ranked one of the “Top Corporate Philanthropists"

by the San Francisco Business Times and one of the “Best Places to

Work” by the North Bay Business Journal. Bank of Marin Bancorp is

included in the Russell 2000 Small-Cap Index and Nasdaq ABA

Community Bank Index. For more information, go to www.bankofmarin.com.

Forward-Looking Statements

This release may contain certain forward-looking statements that

are based on management's current expectations regarding economic,

legislative, and regulatory issues that may impact Bancorp's

earnings in future periods. Forward-looking statements can be

identified by the fact that they do not relate strictly to

historical or current facts. They often include the words

“believe,” “expect,” “intend,” “estimate” or words of similar

meaning, or future or conditional verbs such as “will,” “would,”

“should,” “could” or “may.” Factors that could cause future results

to vary materially from current management expectations include,

but are not limited to, natural disasters (such as wildfires and

earthquakes), pandemics such as COVID-19 and the economic impact

caused directly by the disease and by government responses thereto,

general economic conditions, economic uncertainty in the United

States and abroad, changes in interest rates, deposit flows, real

estate values, costs or effects of acquisitions, competition,

changes in accounting principles, policies or guidelines,

legislation or regulation (including the Tax Cuts & Jobs Act of

2017 and the Coronavirus Aid, Relief and Economic Security Act of

2020, as amended), interruptions of utility service in our markets

for sustained periods, and other economic, competitive,

governmental, regulatory and technological factors (including

external fraud and cybersecurity threats) affecting Bancorp's

operations, pricing, products and services. These and other

important factors are detailed in various securities law filings

made periodically by Bancorp, copies of which are available from

Bancorp without charge. Bancorp undertakes no obligation to release

publicly the result of any revisions to these forward-looking

statements that may be made to reflect events or circumstances

after the date of this press release or to reflect the occurrence

of unanticipated events.

BANK OF MARIN BANCORP

FINANCIAL HIGHLIGHTS

June 30, 2020

(dollars in thousands, except per share

data; unaudited)

June 30, 2020

March 31, 2020

June 30, 2019

Quarter-to-Date

Net income

$

7,406

$

7,228

$

8,235

Diluted earnings per common share

$

0.55

$

0.53

$

0.60

Return on average assets

1.01

%

1.09

%

1.32

%

Return on average equity

8.52

%

8.54

%

10.26

%

Efficiency ratio

54.00

%

56.79

%

57.23

%

Tax-equivalent net interest margin 1

3.53

%

3.88

%

4.04

%

Cost of deposits

0.09

%

0.21

%

0.20

%

Net charge-offs (recoveries)

$

16

$

(7)

$

(18)

Year-to-Date

Net income

$

14,634

$

15,714

Diluted earnings per common share

$

1.07

$

1.13

Return on average assets

1.05

%

1.26

%

Return on average equity

8.53

%

9.90

%

Efficiency ratio

55.42

%

58.91

%

Tax-equivalent net interest margin 1

3.70

%

4.03

%

Cost of deposits

0.15

%

0.19

%

Net charge-offs (recoveries)

$

9

$

(14)

At Period End

Total assets

$

3,181,540

$

2,697,738

$

2,463,987

Loans:

Commercial and industrial 2

$

525,117

$

264,405

$

234,832

Real estate:

Commercial owner-occupied

296,163

306,371

306,327

Commercial investor-owned

946,389

930,479

878,969

Construction

66,368

63,425

63,563

Home equity

112,911

116,968

125,968

Other residential

136,859

135,929

124,120

Installment and other consumer loans

26,394

26,283

31,100

Total loans

$

2,110,201

$

1,843,860

$

1,764,879

Non-performing loans: 3

Commercial and industrial

$

—

$

—

$

354

Real estate:

Commercial investor-owned

907

$

942

—

Home equity

625

633

157

Installment and other consumer loans

55

57

63

Total non-accrual loans

$

1,587

$

1,632

$

574

Classified loans (graded substandard and

doubtful)

$

13,545

$

12,056

$

10,251

Total accruing loans 30-89 days past

due

$

83

$

1,315

$

343

Allowance for loan losses to total

loans

0.99

%

1.02

%

0.90

%

Allowance for loan losses to

non-performing loans

13.15x

11.57x

27.59x

Non-accrual loans to total loans

0.08

%

0.09

%

0.03

%

Total deposits

$

2,779,866

$

2,307,110

$

2,102,040

Loan-to-deposit ratio

75.9

%

79.9

%

84.0

%

Stockholders' equity

$

352,240

$

345,940

$

327,667

Book value per share

$

25.92

$

25.50

$

23.99

Tangible common equity to tangible assets

4

10.1

%

11.7

%

12.0

%

Total risk-based capital ratio - Bank

15.0

%

14.4

%

14.6

%

Total risk-based capital ratio -

Bancorp

15.8

%

15.3

%

15.2

%

Full-time equivalent employees

295

296

293

1 Net interest income is annualized by

dividing actual number of days in the period times 360 days.

2 Includes SBA PPP loans of $298.9 million

at June 30, 2020.

3 Excludes accruing troubled-debt

restructured loans of $10.3 million, $11.1 million and $11.7

million at June 30, 2020, March 31, 2020 and June 30, 2019,

respectively.

4 Tangible common equity to tangible

assets is considered to be a meaningful non-GAAP financial measure

of capital adequacy and is useful for investors to assess Bancorp's

ability to absorb potential losses. Tangible common equity includes

common stock, retained earnings and unrealized gain on available

for sale securities, net of tax, less goodwill and intangible

assets of $34.4 million, $34.6 million and $35.3 million at June

30, 2020, March 31, 2020, and June 30, 2019, respectively. Tangible

assets exclude goodwill and intangible assets.

BANK OF MARIN BANCORP

CONSOLIDATED STATEMENTS OF

CONDITION

At June 30, 2020, March 31,

2020 and June 30, 2019

(in thousands, except share data;

unaudited)

June 30, 2020

March 31, 2020

June 30, 2019

Assets

Cash, cash equivalents and restricted

cash

$

397,699

$

156,274

$

58,757

Investment securities

Held-to-maturity, at amortized cost

125,781

131,140

148,879

Available-for-sale (at fair value;

amortized cost $411,047, $431,519, and $368,712 at June 30, 2020,

March 31, 2020, and June 30, 2019 respectively)

429,775

448,868

378,131

Total investment securities

555,556

580,008

527,010

Loans, net of allowance for loan losses of

$20,868, $18,884 and $15,835 at June 30, 2020, March 31, 2020 and

June 30, 2019 respectively

2,089,333

1,824,976

1,749,044

Bank premises and equipment, net

5,278

5,708

6,872

Goodwill

30,140

30,140

30,140

Core deposit intangible

4,258

4,471

5,128

Operating lease right-of-use assets

23,090

22,225

12,515

Interest receivable and other assets

76,186

73,936

74,521

Total assets

$

3,181,540

$

2,697,738

$

2,463,987

Liabilities and Stockholders'

Equity

Liabilities

Deposits

Non-interest bearing

$

1,442,849

$

1,130,460

$

1,056,655

Interest bearing

Transaction accounts

146,811

137,802

121,232

Savings accounts

190,561

167,210

172,255

Money market accounts

904,163

776,271

647,592

Time accounts

95,482

95,367

104,306

Total deposits

2,779,866

2,307,110

2,102,040

Borrowings and other obligations

140

185

297

Subordinated debenture

2,743

2,725

2,674

Operating lease liabilities

24,574

23,726

14,332

Interest payable and other liabilities

21,977

18,052

16,977

Total liabilities

2,829,300

2,351,798

2,136,320

Stockholders' Equity

Preferred stock, no par value, Authorized

- 5,000,000 shares, none issued

—

—

—

Common stock, no par value, Authorized -

30,000,000 shares; Issued and outstanding - 13,591,835, 13,565,969

and 13,659,143 at June 30, 2020, March 31, 2020 and June 30, 2019,

respectively

128,633

127,684

132,151

Retained earnings

211,613

207,328

190,416

Accumulated other comprehensive income,

net of taxes

11,994

10,928

5,100

Total stockholders' equity

352,240

345,940

327,667

Total liabilities and stockholders'

equity

$

3,181,540

$

2,697,738

$

2,463,987

BANK OF MARIN BANCORP

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

Three months ended

Six months ended

(in thousands, except per share amounts;

unaudited)

June 30, 2020

March 31, 2020

June 30, 2019

June 30, 2020

June 30, 2019

Interest income

Interest and fees on loans

$

21,217

$

20,887

$

20,988

$

42,104

$

41,683

Interest on investment securities

3,741

4,165

3,763

7,906

7,860

Interest on federal funds sold and due

from banks

39

332

190

371

329

Total interest income

24,997

25,384

24,941

50,381

49,872

Interest expense

Interest on interest-bearing transaction

accounts

39

66

91

105

168

Interest on savings accounts

17

16

17

33

35

Interest on money market accounts

383

971

787

1,354

1,551

Interest on time accounts

142

161

175

303

294

Interest on borrowings and other

obligations

1

2

24

3

71

Interest on subordinated debenture

40

49

58

89

118

Total interest expense

622

1,265

1,152

1,887

2,237

Net interest income

24,375

24,119

23,789

48,494

47,635

Provision for loan losses

2,000

2,200

—

4,200

—

Net interest income after provision for

loan losses

22,375

21,919

23,789

44,294

47,635

Non-interest income

Service charges on deposit accounts

293

451

485

744

964

Wealth Management and Trust Services

421

504

473

925

911

Debit card interchange fees, net

308

360

414

668

794

Merchant interchange fees, net

47

73

87

120

174

Earnings on bank-owned life insurance

234

275

235

509

175

Dividends on Federal Home Loan Bank

stock

146

208

193

354

389

Gains on sale of investment securities,

net

115

800

61

915

55

Other income

249

449

326

698

583

Total non-interest income

1,813

3,120

2,274

4,933

4,045

Non-interest expense

Salaries and related benefits

7,864

9,477

8,868

17,341

18,014

Occupancy and equipment

1,661

1,663

1,578

3,324

3,109

Depreciation and amortization

526

526

572

1,052

1,128

Federal Deposit Insurance Corporation

insurance

116

2

174

118

353

Data processing

829

786

1,004

1,615

2,019

Professional services

550

544

535

1,094

1,121

Directors' expense

175

174

187

349

366

Information technology

252

250

284

502

543

Amortization of core deposit

intangible

213

213

221

426

443

Provision for losses on off-balance sheet

commitments

260

102

—

362

129

Other expense

1,695

1,732

1,493

3,427

3,219

Total non-interest expense

14,141

15,469

14,916

29,610

30,444

Income before provision for income

taxes

10,047

9,570

11,147

19,617

21,236

Provision for income taxes

2,641

2,342

2,912

4,983

5,522

Net income

$

7,406

$

7,228

$

8,235

$

14,634

$

15,714

Net income per common share:

Basic

$

0.55

$

0.53

$

0.60

$

1.08

$

1.15

Diluted

$

0.55

$

0.53

$

0.60

$

1.07

$

1.13

Weighted average shares:

Basic

13,514

13,525

13,655

13,519

13,696

Diluted

13,585

13,656

13,818

13,621

13,871

Comprehensive income:

Net income

$

7,406

$

7,228

$

8,235

$

14,634

$

15,714

Other comprehensive income

Change in net unrealized gains or losses

on available- for-sale securities included in net income

1,494

9,812

8,982

11,306

12,921

Reclassification adjustment for (gains) on

available-for- sale securities in net income

(115)

(800)

(61)

(915)

(55)

Amortization of net unrealized losses on

securities transferred from available-for-sale to

held-to-maturity

135

110

104

245

205

Other comprehensive income, before tax

1,514

9,122

9,025

10,636

13,071

Deferred tax expense

448

2,697

2,671

3,145

3,869

Other comprehensive income, net of tax

1,066

6,425

6,354

7,491

9,202

Total comprehensive income

$

8,472

$

13,653

$

14,589

$

22,125

$

24,916

BANK OF MARIN BANCORP

AVERAGE STATEMENTS OF

CONDITION AND ANALYSIS OF NET INTEREST INCOME

Three months ended

Three months ended

Three months ended

June 30, 2020

March 31, 2020

June 30, 2019

Interest

Interest

Interest

Average

Income/

Yield/

Average

Income/

Yield/

Average

Income/

Yield/

(in thousands; unaudited)

Balance

Expense

Rate

Balance

Expense

Rate

Balance

Expense

Rate

Assets

Interest-earning deposits with banks 1

$

173,161

$

39

0.09

%

$

99,362

$

332

1.32

%

$

30,928

$

190

2.43

%

Investment securities 2, 3

550,483

3,886

2.82

%

556,897

4,266

3.06

%

567,813

3,844

2.71

%

Loans 1, 3, 4

2,043,197

21,399

4.14

%

1,833,180

21,066

4.55

%

1,758,874

21,180

4.76

%

Total interest-earning assets 1

2,766,841

25,324

3.62

%

2,489,439

25,664

4.08

%

2,357,615

25,214

4.23

%

Cash and non-interest-bearing due from

banks

37,680

40,844

34,437

Bank premises and equipment, net

5,543

5,939

7,108

Interest receivable and other assets,

net

133,639

118,909

107,089

Total assets

$

2,943,703

$

2,655,131

$

2,506,249

Liabilities and Stockholders' Equity

Interest-bearing transaction accounts

$

142,778

$

39

0.11

%

$

138,395

$

66

0.19

%

$

124,620

$

91

0.29

%

Savings accounts

182,371

17

0.04

%

163,439

16

0.04

%

174,102

17

0.04

%

Money market accounts

794,654

383

0.19

%

760,616

971

0.51

%

661,363

787

0.48

%

Time accounts including CDARS

95,076

142

0.60

%

96,157

161

0.67

%

115,272

175

0.61

%

Borrowings and other obligations 1

156

1

2.62

%

358

2

1.81

%

3,608

24

2.59

%

Subordinated debenture 1

2,733

40

5.73

%

2,715

49

7.19

%

2,664

58

8.69

%

Total interest-bearing liabilities

1,217,768

622

0.21

%

1,161,680

1,265

0.44

%

1,081,629

1,152

0.43

%

Demand accounts

1,332,986

1,119,975

1,073,909

Interest payable and other liabilities

43,255

33,045

28,621

Stockholders' equity

349,694

340,431

322,090

Total liabilities & stockholders'

equity

$

2,943,703

$

2,655,131

$

2,506,249

Tax-equivalent net interest income/margin

1

$

24,702

3.53

%

$

24,399

3.88

%

$

24,062

4.02

%

Reported net interest income/margin 1

$

24,375

3.49

%

$

24,119

3.83

%

$

23,789

3.98

%

Tax-equivalent net interest rate

spread

3.41

%

3.64

%

3.80

%

Six months ended

Six months ended

June 30, 2020

June 30, 2019

Interest

Interest

Average

Income/

Yield/

Average

Income/

Yield/

(in thousands; unaudited)

Balance

Expense

Rate

Balance

Expense

Rate

Assets

Interest-earning deposits with banks 1

$

136,261

$

371

0.54

%

$

26,832

$

329

2.44

%

Investment securities 2, 3

553,690

8,151

2.94

%

593,545

8,034

2.71

%

Loans 1, 3, 4

1,938,189

42,465

4.33

%

1,757,602

42,067

4.76

%

Total interest-earning assets 1

2,628,140

50,987

3.84

%

2,377,979

50,430

4.22

%

Cash and non-interest-bearing due from

banks

39,262

32,702

Bank premises and equipment, net

5,741

7,308

Interest receivable and other assets,

net

126,274

105,894

Total assets

$

2,799,417

$

2,523,883

Liabilities and Stockholders' Equity

Interest-bearing transaction accounts

$

140,587

$

105

0.15

%

$

126,168

$

168

0.27

%

Savings accounts

172,905

33

0.04

%

177,211

35

0.04

%

Money market accounts

777,635

1,354

0.35

%

667,218

1,551

0.47

%

Time accounts including CDARS

95,616

303

0.64

%

114,336

294

0.52

%

Borrowings and other obligations 1

257

3

2.06

%

5,500

71

2.56

%

Subordinated debenture 1

2,724

89

6.46

%

2,655

118

8.87

%

Total interest-bearing liabilities

1,189,724

1,887

0.32

%

1,093,088

2,237

0.41

%

Demand accounts

1,226,481

1,080,392

Interest payable and other liabilities

38,150

30,383

Stockholders' equity

345,062

320,020

Total liabilities & stockholders'

equity

$

2,799,417

$

2,523,883

Tax-equivalent net interest income/margin

1

$

49,100

3.70

%

$

48,193

4.03

%

Reported net interest income/margin 1

$

48,494

3.65

%

$

47,635

3.98

%

Tax-equivalent net interest rate

spread

3.52

%

3.81

%

1 Interest income/expense is divided by

actual number of days in the period times 360 days to correspond to

stated interest rate terms, where applicable.

2 Yields on available-for-sale securities

are calculated based on amortized cost balances rather than fair

value, as changes in fair value are reflected as a component of

stockholders' equity. Investment security interest is earned on

30/360 day basis monthly.

3 Yields and interest income on tax-exempt

securities and loans are presented on a taxable-equivalent basis

using the Federal statutory rate of 21 percent in 2020 and

2019.

4 Average balances on loans outstanding

include non-performing loans. The amortized portion of net loan

origination fees is included in interest income on loans,

representing an adjustment to the yield.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200720005129/en/

MEDIA: Beth Drummey Marketing & Corporate Communications

Manager 415-763-4529 | bethdrummey@bankofmarin.com

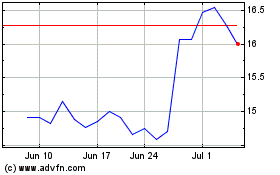

Bank of Marin Bancorp (NASDAQ:BMRC)

Historical Stock Chart

From Mar 2024 to Apr 2024

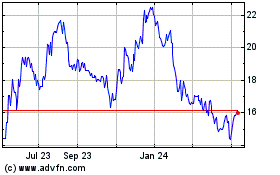

Bank of Marin Bancorp (NASDAQ:BMRC)

Historical Stock Chart

From Apr 2023 to Apr 2024