Bank of Marin Bancorp, "Bancorp" (NASDAQ: BMRC), parent company

of Bank of Marin, "Bank," announced earnings of $7.5 million in the

first quarter of 2019, compared to $9.7 million in the fourth

quarter of 2018 and $6.4 million in the first quarter of 2018.

Diluted earnings per share were $0.54 in the first quarter of 2019,

compared to $0.69 in the prior quarter and $0.46 in the same

quarter last year.

“Our solid first quarter results demonstrate that staying true

to a time-tested formula leads to consistent performance through

economic cycles,” said Russell A. Colombo, President and Chief

Executive Officer. “Our credit quality remains excellent, and our

low cost of deposits continues to be a competitive advantage. By

maintaining disciplined fundamentals, with rigorous lending

practices and a strong relationship banking model, we are

delivering value for customers and shareholders alike.”

Bancorp also provided the following highlights in the first

quarter of 2019:

- Loans totaled $1,772.5 million at

March 31, 2019, compared to $1,763.9 million at

December 31, 2018. New loan originations of $34.0 million in

the first quarter were distributed across Commercial Banking and

Consumer Banking.

- Strong credit quality remains a

cornerstone of the Bank's consistent performance. Non-accrual loans

represented only 0.04% of the Bank's loan portfolio at

March 31, 2019 and December 31, 2018. There was no provision

for loan losses recorded in the first quarter of 2019.

- Total deposits increased by $3.8

million in the first quarter to $2,178.6 million. Non-interest

bearing deposits increased $10.3 million from December 31, 2018 and

represented 49% of total deposits at March 31, 2019. The cost of

average deposits increased to 0.18% for the first quarter of 2019,

compared to 0.14% for the prior quarter.

- First quarter net income reflects the

typical increases in expenses associated with year-end resets of

payroll taxes and 401K contributions, stock-based award vesting and

performance share payouts. The first quarter of 2019 also included

accelerated stock-based compensation expense for three newly

retirement-eligible employees, the purchase of new bank-owned life

insurance policies and a one-time pay cycle adjustment.

- All capital ratios were above

regulatory requirements. The total risk-based capital ratio for

Bancorp was 14.9% at March 31, 2019 and December 31,

2018. Tangible common equity to tangible assets was 11.4% at

March 31, 2019, compared to 11.3% at December 31, 2018

(refer to footnote 3 in Financial Highlights table for a definition

of this non-GAAP financial measure).

- The Board of Directors declared a cash

dividend of $0.19 per share. This represents the 56th consecutive

quarterly dividend paid by Bank of Marin Bancorp. The dividend is

payable on May 10, 2019, to shareholders of record at the

close of business on May 3, 2019.

- The Board of Directors is considering

an extension of the share repurchase authority to utilize the

remaining approved budget, and expects to make a final

determination prior to the current May 1, 2019, expiration.

- On April 1, 2019, we expanded our

presence in the East Bay by opening a loan production office in

Walnut Creek that will serve commercial businesses across the

Diablo Valley. In addition, well-established banker Rob Holden has

joined Bank of Marin to lead our San Francisco team.

Loans and Credit Quality

Loans grew $8.7 million in the first quarter of 2019 and totaled

$1,772.5 million at March 31, 2019. Loan originations for the three

months ended March 31, 2019 and March 31, 2018 were $34.0 million

and $37.4 million, respectively. New loan originations were

partially offset by loan payoffs of $26.1 million in the first

quarter of 2019 and $31.5 million in the same quarter last year.

The largest portion of payoffs in the current quarter came from the

sale of assets underlying loans and the successful completion of

construction projects.

Non-accrual loans totaled $719 thousand, or 0.04% of the loan

portfolio at March 31, 2019, compared to $697 thousand, or

0.04% at December 31, 2018, and $392 thousand, or 0.02% a year

ago. Classified loans totaled $14.8 million at March 31, 2019,

compared to $12.6 million at December 31, 2018 and $27.8

million at March 31, 2018. The $2.2 million increase in the

first quarter of 2019 was primarily due to a well-secured

owner-occupied commercial real estate loan. In April 2019, we

received a $2.2 million paydown on a $2.7 million substandard

classified land development loan and upgraded the remaining balance

to a Pass risk rating due to the low loan-to-value ratio and the

borrower’s improved financial condition. There were no loans

classified doubtful at March 31, 2019 or December 31,

2018. Accruing loans past due 30 to 89 days totaled $2,194 thousand

at March 31, 2019, compared to $1,121 thousand at

December 31, 2018 and $388 thousand a year ago.

There was no provision for loan losses recorded in the first

quarter of 2019, consistent with last quarter and the same quarter

a year ago. Net charge-offs were $4 thousand in the first quarter

of 2019, compared to net recoveries of $4 thousand for the three

months ended December 31, 2018 and March 31, 2018. The ratio of

loan loss reserves to loans, including acquired loans, was 0.89% at

March 31, 2019, 0.90% at December 31, 2018, and 0.94% at

March 31, 2018.

Investments

The investment securities portfolio totaled $595.7 million at

March 31, 2019, compared to $619.7 million at December 31, 2018 and

$572.9 million at March 31, 2018. The decrease from the prior

quarter was primarily attributed to calls, principal paydowns,

sales and maturities of $34.6 million, partially offset by $11.3

million in purchases.

Deposits

Total deposits were $2,178.6 million at March 31, 2019,

compared to $2,174.8 million at December 31, 2018 and $2,186.6

million at March 31, 2018. The increase in deposit balances during

the first quarter of 2019, was primarily due to normal cash

fluctuations in some of our large business accounts. The average

cost of deposits in the first quarter of 2019 was 0.18%, an

increase of 4 basis points from the prior quarter and an increase

of 10 basis points from the same quarter a year ago, primarily due

to an increase in market interest rates.

Earnings

“Bank of Marin's investment in people, infrastructure and

acquisitions continues to produce benefits in terms of loan growth

and expense control,” said Tani Girton, EVP and Chief Financial

Officer. “The ongoing strength of the Bank is reflected in the

year-over-year increase of 17 basis points in net interest margin,

efficiency ratio in the low 60's and return on assets of

1.19%.”

Net interest income totaled $23.8 million in the first quarter

of 2019, compared to $23.3 million in the prior quarter and $21.9

million in the same quarter a year ago. The $574 thousand and

$1,955 thousand increases from the prior quarter and comparative

quarter a year ago were reflective of growth in average earning

assets of $5.6 million and $85.7 million, respectively, and higher

yields across earning asset classes.

The tax-equivalent net interest margin was 4.02% in the first

quarter of 2019, compared to 3.85% in both the prior quarter and

same quarter a year ago. The 17 basis point increase from the prior

quarter was primarily due to the early redemption of a high-rate

subordinated debenture due to NorCal Community Bancorp Trust I in

October 2018. The 17 basis point increase from the first quarter of

2018 was primarily due to a more favorable mix of interest-earning

assets toward higher yielding loans and investment securities.

Loans obtained through the acquisition of other banks are

classified as either purchased credit impaired ("PCI") or non-PCI

loans and are recorded at fair value at acquisition date. For

acquired loans not considered credit impaired, the level of

accretion varies due to maturities and early payoffs. Accretion on

PCI loans fluctuates based on changes in cash flows expected to be

collected. Gains on payoffs of PCI loans are recorded as interest

income when the payoff amounts exceed the recorded investment. PCI

loans totaled $2.1 million at March 31, 2019, December 31, 2018 and

March 31, 2018.

As our acquired loans from prior acquisitions continue to pay

off, we expect the accretion on these loans to continue to decline.

Accretion and gains on payoffs of purchased loans recorded to

interest income were as follows:

Three months ended March 31, 2019 December 31,

2018 March 31, 2018 (dollars in thousands; unaudited)

DollarAmount

Basis pointimpact to netinterest

margin

DollarAmount

Basis pointimpact to netinterest

margin

DollarAmount

Basis pointimpact to netinterest

margin

Accretion on PCI loans 1 $ 59 1 bps $

62 1 bps $ 112 2 bps Accretion

on non-PCI loans 2 $ 42 1 bps $ 214 3 bps $ 99 2 bps Gains on

payoffs of PCI loans $ — 0 bps $ — 0 bps $ 128 2 bps 1

Accretable yield on PCI loans totaled $875 thousand, $934

thousand and $1.1 million at March 31, 2019, December 31, 2018 and

March 31, 2018, respectively. 2 Unaccreted purchase discounts on

non-PCI loans totaled $666 thousand, $708 thousand and $1.1 million

at March 31, 2019, December 31, 2018 and March 31, 2018,

respectively.

Non-interest income of $1.8 million in the first quarter of 2019

decreased $1.7 million from $3.4 million in the fourth quarter due

to a $956 thousand pre-tax gain on sale of 6,500 shares of Visa

Inc. Class B restricted common stock and a $180 thousand Federal

Home Loan Bank special dividend in the fourth quarter.

Additionally, the Bank incurred $283 thousand non-refundable costs

for underwriting two new bank-owned life insurance policies

purchased in the first quarter and deposit network income declined

$163 thousand. The decrease of $471 thousand from $2.2 million in

the first quarter last year was primarily related to the costs

associated with the newly purchased bank-owned life insurance

policies and the decrease in deposit network income mentioned

above.

Non-interest expense totaled $15.5 million in the first quarter

of 2019, $13.7 million in the prior quarter, and $16.1 million in

the same quarter a year ago. The increase of $1.8 million from the

prior quarter was primarily due to a $1.2 million increase in

salaries and benefits from stock-based compensation ($498 thousand

due to certain participants meeting retirement eligibility

requirements and $64 thousand vesting of performance awards), $136

thousand one-time pay cycle adjustment, six additional full-time

equivalent ("FTE") staff, and $339 thousand more in 401(k) employer

matching contributions. Additionally, there was a $129 thousand

provision for losses on off-balance sheet commitments in the first

quarter of 2019. The $553 thousand decrease from the same quarter a

year ago was primarily related to a decrease in professional fees

of $713 thousand (mostly attributed to core processing contract

negotiations) and data processing expenses of $366 thousand (mostly

attributed to Bank of Napa acquisition-related expenses in 2018).

These decreases were partially offset by additional FTE staff,

merit increases, the one-time pay cycle adjustment and the

provision for losses on off-balance sheet commitments.

Share Repurchase Program

Bancorp's Board of Directors approved the repurchase of up to

$25.0 million common stock through May 1, 2019. Bancorp

repurchased 113,904 shares totaling $4.8 million in the first

quarter of 2019 for a cumulative total of 285,121 shares totaling

$11.8 million as of March 31, 2019.

Earnings Call and Webcast Information

Bank of Marin Bancorp will present its first quarter earnings

call via webcast on Monday, April 22, 2019 at 8:30 a.m. PT/11:30

a.m. ET. Investors will have the opportunity to listen to the

webcast online through Bank of Marin’s website at

https://www.bankofmarin.com under “Investor Relations.” To listen

to the webcast live, please go to the website at least 15 minutes

early to register, download and install any necessary audio

software. For those who cannot listen to the live broadcast, a

replay will be available at the same website location shortly after

the call.

About Bank of Marin Bancorp

Founded in 1990 and headquartered in Novato, Bank of Marin is

the wholly owned subsidiary of Bank of Marin Bancorp (NASDAQ:

BMRC). A leading business and community bank in the San Francisco

Bay Area, with assets of $2.5 billion, Bank of Marin has 23 retail

branches, 5 commercial banking offices and 1 loan production office

located across the North Bay, San Francisco and East Bay regions.

Bank of Marin provides commercial banking, personal banking, and

wealth management and trust services. Specializing in providing

legendary service to its customers and investing in its local

communities, Bank of Marin has consistently been ranked one of the

“Top Corporate Philanthropists" by the San Francisco Business Times

and one of the “Best Places to Work” by the North Bay Business

Journal. Bank of Marin Bancorp is included in the Russell 2000

Small-Cap Index and NASDAQ ABA Community Bank Index. For more

information, go to www.bankofmarin.com.

Forward-Looking Statements

This release may contain certain forward-looking statements that

are based on management's current expectations regarding economic,

legislative, and regulatory issues that may impact Bancorp's

earnings in future periods. Forward-looking statements can be

identified by the fact that they do not relate strictly to

historical or current facts. They often include the words

“believe,” “expect,” “intend,” “estimate” or words of similar

meaning, or future or conditional verbs such as “will,” “would,”

“should,” “could” or “may.” Factors that could cause future results

to vary materially from current management expectations include,

but are not limited to, general economic conditions, economic

uncertainty in the United States and abroad, changes in interest

rates, deposit flows, real estate values, costs or effects of

acquisitions, competition, changes in accounting principles,

policies or guidelines, legislation or regulation (including the

Tax Cuts & Jobs Act of 2017), and other economic, competitive,

governmental, regulatory and technological factors (including

external fraud and cyber-security threats) affecting Bancorp's

operations, pricing, products and services. These and other

important factors are detailed in various securities law filings

made periodically by Bancorp, copies of which are available from

Bancorp without charge. Bancorp undertakes no obligation to release

publicly the result of any revisions to these forward-looking

statements that may be made to reflect events or circumstances

after the date of this press release or to reflect the occurrence

of unanticipated events.

BANK OF MARIN BANCORP FINANCIAL HIGHLIGHTS

March 31, 2019 (dollars in

thousands, except per share data; unaudited)

March

31, 2019

December 31, 2018

March 31, 2018

Quarter-to-Date

Net income $ 7,479 $ 9,662 $ 6,389 Diluted earnings per common

share 4 $ 0.54 $ 0.69 $ 0.46 Return on average assets 1.19 % 1.52 %

1.05 % Return on average equity 9.54 % 12.37 % 8.70 % Efficiency

ratio 60.62 % 51.34 % 66.64 % Tax-equivalent net interest margin 1

4.02 % 3.85 % 3.85 % Net charge-offs (recoveries) $ 4 $ (4 ) $ (4 )

Net charge-offs (recoveries) to average loans — — —

At Period

End

Total assets $ 2,534,076 $ 2,520,892 $ 2,510,043 Loans: Commercial

and industrial $ 237,646 $ 230,739 $ 231,680 Real estate:

Commercial owner-occupied 310,588 313,277 300,377 Commercial

investor-owned 878,494 873,410 828,945 Construction 72,271 76,423

64,978 Home equity 124,512 124,696 124,699 Other residential

117,558 117,847 95,621 Installment and other consumer loans 31,469

27,472 25,440 Total loans $ 1,772,538 $

1,763,864 $ 1,671,740 Non-performing loans: 2

Commercial and industrial $ 309 $ 319 $ — Home equity 346 313 392

Installment and other consumer loans 64 65 —

Total non-accrual loans $ 719 $ 697 $ 392

Classified loans (graded substandard and doubtful) $ 14,811

$ 12,608 $ 27,807 Total accruing loans 30-89 days past due $ 2,194

$ 1,121 $ 388 Allowance for loan losses to total loans 0.89 % 0.90

% 0.94 % Allowance for loan losses to non-performing loans 21.99x

22.71x 40.26x Non-accrual loans to total loans 0.04 % 0.04 % 0.02 %

Total deposits $ 2,178,629 $ 2,174,840 $ 2,186,594

Loan-to-deposit ratio 81.4 % 81.1 % 76.5 % Stockholders' equity $

320,664 $ 316,407 $ 298,464 Book value per share 4 $ 23.26 $ 22.85

$ 21.37 Tangible common equity to tangible assets 3 11.4 % 11.3 %

10.6 % Total risk-based capital ratio - Bank 13.9 % 14.0 % 14.7 %

Total risk-based capital ratio - Bancorp 14.9 % 14.9 % 15.1 %

Full-time equivalent employees 296 290 288 1 Net interest

income is annualized by dividing actual number of days in the

period times 360 days. 2 Excludes accruing troubled-debt

restructured loans of $14.0 million, $14.3 million and $16.2

million at March 31, 2019, December 31, 2018 and March 31, 2018,

respectively. Excludes purchased credit-impaired (PCI) loans with

carrying values of $2.1 million that were accreting interest at

March 31, 2019, December 31, 2018 and March 31, 2018. These amounts

are excluded as PCI loan accretable yield interest recognition is

independent from the underlying contractual loan delinquency

status. 3 Tangible common equity to tangible assets is considered

to be a meaningful non-GAAP financial measure of capital adequacy

and is useful for investors to assess Bancorp's ability to absorb

potential losses. Tangible common equity includes common stock,

retained earnings and unrealized gain on available for sale

securities, net of tax, less goodwill and intangible assets of

$35.5 million, $35.7 million and $36.4 million at March 31, 2019,

December 31, 2018 and March 31, 2018, respectively. Tangible assets

exclude goodwill and intangible assets. 4 Share and per share data

have been adjusted to reflect the two-for-one stock split effective

November 27, 2018.

BANK OF MARIN BANCORP

CONSOLIDATED STATEMENTS OF

CONDITION

At March 31, 2019, December 31, 2018

and March 31, 2018

(in thousands, except share data;

unaudited)

March 31,2019

December 31,2018

March 31,2018

Assets Cash and due from banks $ 51,639 $ 34,221 $ 159,347

Investment securities Held-to-maturity, at amortized cost 152,845

157,206 149,013

Available-for-sale (at fair value;

amortized cost $442,386, $465,910 and $431,871 at March 31, 2019,

December 31, 2018 and March 31, 2018, respectively)

442,885 462,464 423,882

Total investment securities

595,730 619,670 572,895

Loans, net of allowance for loan losses of

$15,817, $15,821 and $15,771 at March 31, 2019, December 31, 2018

and March 31, 2018, respectively

1,756,721 1,748,043 1,655,969 Bank premises and equipment, net

7,237 7,376 8,297 Goodwill 30,140 30,140 30,140 Core deposit

intangible 5,349 5,571 6,262 Operating lease right-of-use assets

12,465 — — Interest receivable and other assets

74,795 75,871 77,133

Total

assets $ 2,534,076

$ 2,520,892 $ 2,510,043

Liabilities and Stockholders' Equity

Liabilities Deposits Non-interest bearing $ 1,076,382 $

1,066,051 $ 1,065,470 Interest bearing Transaction accounts 130,001

133,403 166,117 Savings accounts 180,758 178,429 180,730 Money

market accounts 680,806 679,775 628,335 Time accounts

110,682 117,182 145,942 Total

deposits 2,178,629 2,174,840 2,186,594 Borrowings and other

obligations 309 7,000 — Subordinated debentures 2,657 2,640 5,772

Operating lease liabilities 14,349 — — Interest payable and other

liabilities 17,468 20,005

19,213 Total liabilities 2,213,412

2,204,485 2,211,579

Stockholders' Equity Preferred stock, no par value,

Authorized - 5,000,000 shares, none issued — — —

Common stock, no par value,

Authorized - 30,000,000 shares; Issued and

outstanding - 13,786,808, 13,844,353 and 13,970,252 at March 31,

2019, December 31, 2018 and March 31, 2018, respectively

137,125 140,565 145,282 Retained earnings 184,793 179,944 160,556

Accumulated other comprehensive loss, net of taxes

(1,254 ) (4,102 ) (7,374 ) Total stockholders' equity

320,664 316,407 298,464

Total liabilities and stockholders' equity

$ 2,534,076 $

2,520,892 $ 2,510,043

BANK OF MARIN BANCORP

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

Three months ended (in thousands, except per share amounts;

unaudited) March 31, 2019

December 31, 2018

March 31, 2018

Interest income Interest

and fees on loans $ 20,695 $ 20,732 $ 18,887 Interest on investment

securities 4,097 3,912 3,157 Interest on federal funds sold and due

from banks 139 373 403

Total interest income 24,931 25,017 22,447

Interest

expense Interest on interest-bearing transaction accounts 77 68

52 Interest on savings accounts 18 18 18 Interest on money market

accounts 764 566 216 Interest on time accounts 119 116 156 Interest

on borrowings and other obligations 47 — — Interest on subordinated

debentures 60 977 114

Total interest expense 1,085

1,745 556 Net interest income 23,846 23,272

21,891 Provision for loan losses — —

— Net interest income after provision for loan

losses 23,846 23,272

21,891

Non-interest income Service charges on deposit

accounts 479 484 477 Wealth Management and Trust Services 438 426

515 Debit card interchange fees, net 380 403 396 Merchant

interchange fees, net 87 81 80 (Losses) earnings on bank-owned life

insurance, net (60 ) 228 228 Dividends on FHLB stock 196 377 196

(Losses) gains on investment securities, net (6 ) 955 — Other

income 257 469 350

Total non-interest income 1,771 3,423

2,242

Non-interest expense Salaries and

related benefits 9,146 7,933 9,017 Occupancy and equipment 1,531

1,514 1,507 Depreciation and amortization 556 518 547 Federal

Deposit Insurance Corporation insurance 179 188 191 Data processing

1,015 1,004 1,381 Professional services 586 481 1,299 Directors'

expense 179 170 174 Information technology 259 228 269 Amortization

of core deposit intangible 222 230 230 Provision for losses on

off-balance sheet commitments 129 — — Other expense

1,726 1,439 1,466 Total

non-interest expense 15,528 13,705

16,081 Income before provision for income

taxes 10,089 12,990 8,052 Provision for income taxes

2,610 3,328 1,663

Net

income $ 7,479

$ 9,662 $ 6,389

Net income per common share:1 Basic $ 0.54 $ 0.70 $ 0.46 Diluted $

0.54 $ 0.69 $ 0.46 Weighted average shares:1 Basic 13,737 13,841

13,827 Diluted 13,924 14,033

14,011

Comprehensive income: Net income $

7,479 $ 9,662 $ 6,389 Other comprehensive income (loss) Change in

net unrealized gain or loss on available-for-sale securities 3,939

7,714 (6,170 ) Reclassification adjustment for losses on

available-for-sale securities in net income 6 — — Amortization of

net unrealized losses on securities transferred from

available-for-sale to held-to-maturity 101

120 136 Subtotal 4,046 7,834 (6,034 )

Deferred tax expense (benefit) 1,198

2,318 (1,784 ) Other comprehensive income (loss), net

of tax 2,848 5,516 (4,250

)

Comprehensive income $ 10,327

$ 15,178 $ 2,139 1 Share and per share

data have been adjusted to reflect the two-for-one stock split

effective November 27, 2018.

BANK OF MARIN BANCORP AVERAGE STATEMENTS OF

CONDITION AND ANALYSIS OF NET INTEREST INCOME Three

months ended Three months ended Three months ended March 31, 2019

December 31, 2018 March 31, 2018

Interest Interest Interest

Average Income/ Yield/ Average Income/ Yield/ Average Income/

Yield/ (dollars in thousands) Balance Expense

Rate Balance Expense Rate

Balance Expense Rate Assets Interest-bearing

due from banks 1 $ 22,690 $ 139 2.45 % $ 65,961 $ 373 2.21 % $

104,850 $ 403 1.54 % Investment securities 2, 3 619,562 4,191 2.71

% 600,914 4,000 2.66 % 532,544 3,276 2.46 % Loans 1, 3, 4

1,756,316 20,887 4.76 %

1,726,045 20,933 4.75 %

1,675,490 19,119 4.56 % Total

interest-earning assets 1 2,398,568 25,217 4.21 % 2,392,920 25,306

4.14 % 2,312,884 22,798 3.94 % Cash and non-interest-bearing due

from banks 30,947 38,943 45,815 Bank premises and equipment, net

7,512 7,529 8,501 Interest receivable and other assets, net

104,685

84,651 89,018

Total assets

$ 2,541,712

$ 2,524,043

$ 2,456,218

Liabilities and Stockholders' Equity Interest-bearing

transaction accounts $ 127,733 $ 77 0.24 % $ 130,546 $ 68 0.21 % $

168,371 $ 52 0.13 % Savings accounts 180,355 18 0.04 % 177,018 18

0.04 % 180,253 18 0.04 % Money market accounts 673,137 764 0.46 %

643,459 566 0.35 % 582,961 216 0.15 % Time accounts including CDARS

113,389 119 0.43 % 121,838 116 0.38 % 154,543 156 0.41 % Borrowings

and other obligations 1 7,414 47 2.55 % 76 — 2.52 % — — — %

Subordinated debentures 1 2,647 60

9.05 % 2,770 977

138.09 % 5,753 114

7.90 % Total interest-bearing liabilities 1,104,675 1,085 0.40 %

1,075,707 1,745 0.64 % 1,091,881 556 0.21 % Demand accounts

1,086,947 1,118,785 1,049,502 Interest payable and other

liabilities 32,163 19,662 16,903 Stockholders' equity

317,927 309,889

297,932

Total liabilities &

stockholders' equity $ 2,541,712

$

2,524,043

$ 2,456,218

Tax-equivalent net interest income/margin 1

$ 24,132 4.02 % $

23,561 3.85 % $ 22,242

3.85 % Reported net interest income/margin 1

$ 23,846 3.98 %

$ 23,272 3.81 %

$ 21,891 3.79 % Tax-equivalent net interest

rate spread 3.81 %

3.49 %

3.74 % 1 Interest income/expense is

divided by actual number of days in the period times 360 days to

correspond to stated interest rate terms, where applicable. 2

Yields on available-for-sale securities are calculated based on

amortized cost balances rather than fair value, as changes in fair

value are reflected as a component of stockholders' equity.

Investment security interest is earned on 30/360 day basis monthly.

3 Yields and interest income on tax-exempt securities and loans are

presented on a taxable-equivalent basis using the Federal statutory

rate of 21 percent in 2019 and 2018. 4 Average balances on loans

outstanding include non-performing loans. The amortized portion of

net loan origination fees is included in interest income on loans,

representing an adjustment to the yield.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190422005153/en/

Beth DrummeyMarketing & Corporate Communications

Manager415-763-4529 | bethdrummey@bankofmarin.com

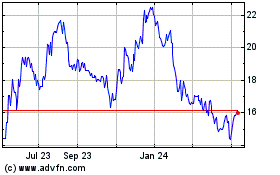

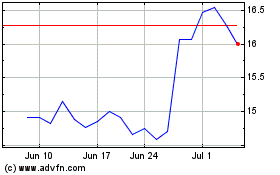

Bank of Marin Bancorp (NASDAQ:BMRC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bank of Marin Bancorp (NASDAQ:BMRC)

Historical Stock Chart

From Apr 2023 to Apr 2024