Avinger, Inc. (Nasdaq: AVGR), a commercial-stage medical device

company marketing the first and only intravascular image-guided,

catheter-based system for diagnosis and treatment of patients with

Peripheral Artery Disease (PAD), today reported results for the

fourth quarter and full year ended December 31, 2018.

Fourth Quarter and Recent Highlights

- Achieved revenue of $2.0 million for the fourth quarter of

2018;

- Reported $1.0 million in Pantheris revenue, a 74% increase

compared to the fourth quarter of 2017 and an 18% increase from the

third quarter of 2018;

- Announced treatment of 500th patient with next-generation

Pantheris in December 2018, as more than 65 sites have adopted the

new platform since FDA clearance;

- Received CE Marking for Pantheris SV (Small Vessel) and treated

first patients globally at initial sites in Europe, including a

live case transmission as part of LINC 2019;

- Received clearance for commercial distribution of Pantheris and

treated first patients in Australia;

- Released preliminary data analysis from the SCAN clinical study

indicating that OCT imaging with Pantheris was statistically

superior or equivalent to IVUS on all parameters evaluated as a

diagnostic imaging tool in the peripheral arteries; and

- Raised gross proceeds of $11.5 million in November from the

sale of securities in an underwritten public offering.

Jeff Soinski, Avinger’s president and CEO, commented, “We are

excited with the continued momentum for our next-generation

Pantheris atherectomy device, including treatment of our 500th

patient in December. Pantheris fourth quarter revenue increased 18%

quarter-over-quarter, with more than 65 of our Lumivascular centers

now using the next-generation device. Feedback from the field

continues to be excellent, with clinical results, product

reliability and case volume all tracking positively for the next

generation device. We continued to build our sales organization in

the fourth quarter and expect to increase sales headcount in 2019

as we scale utilization and drive revenue growth.

“On the new product front, we remain enthusiastic about the

potential for Pantheris SV to expand our available market with the

first-ever image-guided atherectomy system for the treatment of

small vessels. We received CE Marking for Pantheris SV in October

and completed our first clinical cases in the fourth quarter. We

were excited to have Pantheris SV featured in a successful live

case transmission at LINC 2019, one of the top global forums for

thought leadership in the field of vascular medicine. Our 510(k)

application for U.S. pre-marketing clearance of Pantheris SV is

pending and we have now submitted all additional data requested as

part of the review process. By allowing for the treatment of

lesions in smaller diameter vessels, we believe Pantheris SV has

the potential to expand our available market by as much as 50%,

which should allow us to address a significantly larger portion of

the estimated $500 million atherectomy market.

“As we look to 2019, we intend to focus on five strategic goals

as the pillars of our growth strategy. These include driving

utilization at current sites and in current markets, launching new

sites in underserved areas with high rates of PAD, launching new

devices to expand our addressable market and revenue per site

opportunity, continuing to produce compelling clinical data

confirming the unique benefits of Avinger’s Lumivascular platform

and maintaining a lean operating structure as we push to scale the

business. We look forward to reporting our progress on these

initiatives in the quarters ahead.”

Fourth Quarter 2018 Financial ResultsTotal

revenue was $2.0 million for the fourth quarter ended December 31,

2018, an increase of 6% from the fourth quarter of 2017 and roughly

flat with the third quarter of 2018.

Gross margin for the fourth quarter of 2018 was 28%, compared to

9% for the fourth quarter of 2017 and 27% for the third quarter of

2018. Operating expenses for the fourth quarter of 2018 were $6.4

million, a 27% decrease compared to $8.8 million in the fourth

quarter of 2017 and an increase of 13% compared to $5.7 million in

the third quarter of 2018.

Operating loss for the fourth quarter of 2018 was $5.8 million,

a 32% improvement compared to $8.6 million for the fourth quarter

of 2017 and a decrease of 14% compared to $5.1 million in the third

quarter of 2018. Net loss attributable to common stockholders for

the fourth quarter of 2018 was $6.9 million, compared to $10.2

million for the fourth quarter of 2017 and compared to $6.2 million

for the third quarter of 2018.

Adjusted EBITDA, as defined under non-GAAP measures in this

press release, was a loss of $4.2 million for the fourth quarter of

2018, an improvement of approximately $2.6 million compared to a

loss of $6.8 million for the fourth quarter of 2017 and a decline

of $0.1 million compared to a loss of $4.1 million in the third

quarter of 2018. For more information regarding non-GAAP financial

measures discussed in this press release, please see “Non-GAAP

Financial Measures” below, as well as the reconciliation of GAAP to

non-GAAP measures provided in the tables below.

Full Year 2018 Financial ResultsTotal revenue

was $7.9 million for 2018, compared to $9.9 million in 2017. The

year-over-year decrease in revenue was primarily related to the

reduction in the commercial sales organization implemented in

2017.

Gross profit was $1.4 million for 2018, compared to a loss of

$3.1 million in 2017 and gross margin for 2018 was 17%, up from

-31% in 2017. This improvement was primarily related to lower

excess and obsolete inventory charges in 2018.

Operating expenses for 2018 were $23.5 million, a decrease of

41% compared to $39.5 million in 2017. The decrease was primarily

attributable to the cost reduction activities implemented in 2017

and 2018.

Loss from operations for 2018 was $22.1 million, compared to

$42.6 million for 2017.

Adjusted EBITDA, a non-GAAP measure, was a loss of $17.2 million

for 2018, compared to a $29.3 million loss for 2017. For more

information regarding non-GAAP financial measures discussed in this

press release, please see “Non-GAAP Financial Measures” below, as

well as the reconciliation of GAAP to non-GAAP measures provided in

the tables below.

Balance SheetCash and cash equivalents totaled

$16.4 million as of December 31, 2018, compared to $10.0 million as

of September 30, 2018.

As of December 31, 2018, there were approximately 34.9 million

shares of common stock, 41,800 shares of Series A preferred stock,

1,701 shares of Series B preferred stock and 2,170 shares of Series

C preferred stock outstanding. Each share of the Series A preferred

stock is convertible into 500 shares of the Company’s common stock

at a conversion price of $2.00 per share. Each share of Series B

preferred stock, after taking into account the effect of the

November fundraising, is convertible into approximately 2,500

shares of the Company’s common stock at a conversion price of

$0.40. Each share of the Series C preferred stock is convertible

into 2,500 shares of the Company’s common stock at a conversion

price of $0.40 per share. Assuming conversion of all outstanding

shares of preferred stock (other than conversions of Series A

Preferred Stock, which have been suspended until such time as our

stockholders have approved an amended and restated certificate of

incorporation authorizing at least 125 million shares of common

stock), the Company would have approximately 44.6 million shares of

common stock outstanding at December 31, 2018, excluding

outstanding warrants.

Conference Call Avinger will hold a conference

call today, March 6, 2019 at 4:30pm ET to discuss its fourth

quarter 2018 and year-end financial results.

Individuals interested in listening to the conference call may

do so by dialing 877-407-9205 for domestic callers or

+1-201-689-8054 for international callers. To listen to a live

webcast, please visit the investor relations section of the Avinger

web site at www.avinger.com.

A replay of the call will be available beginning March 6, 2019

at approximately 7:30pm PT/10:30pm ET through March 13, 2019. To

access the replay, dial 877-481-4010 reference Conference ID:

44910. The webcast will also be available on Avinger's website for

six months following the completion of the call at

www.avinger.com.

About Avinger, Inc.

Avinger is a commercial-stage medical device company that

designs and develops the first and only image-guided,

catheter-based system for the diagnosis and treatment of patients

with Peripheral Artery Disease (PAD). PAD is estimated to affect

over 12 million people in the U.S. and over 200 million worldwide.

Avinger is dedicated to radically changing the way vascular disease

is treated through its Lumivascular platform, which currently

consists of the Lightbox imaging console, the Ocelot family of

chronic total occlusion (CTO) catheters, and the Pantheris® family

of atherectomy devices. Avinger is based in Redwood City,

California. For more information, please

visit www.avinger.com.

Forward-Looking Statements

This news release contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934 and the Private

Securities Litigation Reform Act of 1995. These forward-looking

statements include statements regarding our future performance, the

anticipated increase in sales headcount, the impact of Pantheris SV

on our available market, driving utilization rates at current sites

and in current markets, launching new sites, launching new devices,

producing clinical data and maintaining a lean operating structure.

Such statements are based on current assumptions that involve risks

and uncertainties that could cause actual outcomes and results to

differ materially. These risks and uncertainties, many of which are

beyond our control, include our dependency on a limited number of

products; our ability to demonstrate the benefits of our

Lumivascular platform; the resource requirements related to

Pantheris; the outcome of clinical trial results; potential

exposure to third-party product liability, intellectual property

and other litigation; lack of long-term data demonstrating the

safety and efficacy of our Lumivascular platform products;

experiences of high-volume users of our products may lead to better

patient outcomes than those of physicians that are less proficient;

reliance on third-party vendors; dependency on physician adoption;

reliance on key personnel; and requirements to obtain regulatory

approval to commercialize our products; as well as the other risks

described in the section entitled "Risk Factors" and elsewhere in

our Annual Report on Form 10-K filed with the Securities and

Exchange Commission on March 6, 2019. These forward-looking

statements speak only as of the date hereof and should not be

unduly relied upon. Avinger disclaims any obligation to update

these forward-looking statements.

Non-GAAP Financial

Measures Avinger has provided

in this press release financial information that has not been

prepared in accordance with generally accepted accounting

principles in the United States (GAAP). The Company uses these

non-GAAP financial measures internally in analyzing its financial

results and believes that the use of these non-GAAP financial

measures is useful to investors as an additional tool to evaluate

ongoing operating results and trends and in comparing the Company’s

financial results with other companies in its industry, many of

which present similar non-GAAP financial measures.

The presentation of these non-GAAP financial measures are not

meant to be considered in isolation or as a substitute for

comparable GAAP financial measures, and should be read only in

conjunction with the Company’s financial statements prepared in

accordance with GAAP. A reconciliation of the Company’s non-GAAP

financial measures to their most directly comparable GAAP measures

has been provided in the financial statement tables included in

this press release, and investors are encouraged to review these

reconciliations.

Adjusted EBITDA. Avinger defines Adjusted EBITDA as Loss from

Operations plus Stock-based Compensation expense plus Depreciation

and Amortization expense plus charges related to our organizational

and facilities restructuring activities and litigation settlement

expense. Investors are cautioned that there are a number of

limitations associated with the use of non-GAAP financial measures

as analytical tools. Furthermore, these non-GAAP financial measures

are not based on any standardized methodology prescribed by GAAP,

and the components that Avinger excludes in its calculation of

non-GAAP financial measures may differ from the components that its

peer companies exclude when they report their non-GAAP results of

operations. Avinger compensates for these limitations by providing

specific information regarding the GAAP amounts excluded from these

non-GAAP financial measures. In the future, the Company may also

exclude other non-recurring expenses and other expenses that do not

reflect the Company’s core business operating results.

Public Relations Contact:Phil PreussVP of

Marketing & Business OperationsAvinger, Inc.(650)

241-7942pr@avinger.com

Investor Contact:Mark WeinswigChief Financial

OfficerAvinger, Inc.(650) 241-7916ir@avinger.com

Matt KrepsDarrow Associates Investor Relations(214)

597-8200mkreps@darrowir.com

| |

|

|

|

|

|

|

|

|

| Condensed Statements of

Operations and Comprehensive Loss |

|

|

|

|

|

|

|

|

| (in thousands) (unaudited) |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

For the Three Months Ended |

|

|

|

For the Years Ended |

| |

December

31, |

|

September

30, |

|

December

31, |

|

December

31, |

|

December

31, |

| |

2018 |

|

2018 |

|

2017 |

|

2018 |

|

2017 |

| |

|

|

|

|

|

|

|

|

|

| Revenue |

$ |

2,028 |

|

$ |

2,020 |

|

$ |

1,913 |

|

$ |

7,915 |

|

$ |

9,934 |

|

| Cost of revenue |

|

1,470 |

|

|

|

1,477 |

|

|

|

1,734 |

|

|

|

6,531 |

|

|

|

13,002 |

|

| Gross profit (loss) |

|

558 |

|

|

|

543 |

|

|

|

179 |

|

|

|

1,384 |

|

|

|

(3,068 |

) |

| |

|

28 |

% |

|

|

27 |

% |

|

|

9 |

% |

|

|

17 |

% |

|

|

-31 |

% |

| Operating expense |

|

|

|

|

|

|

|

| Research and development |

|

1,669 |

|

|

|

1,404 |

|

|

|

1,977 |

|

|

|

6,009 |

|

|

|

11,319 |

|

| Selling, general, and administrative |

|

4,719 |

|

|

|

4,259 |

|

|

|

4,685 |

|

|

|

17,442 |

|

|

|

25,120 |

|

| Litigation settlement |

|

- |

|

|

|

- |

|

|

|

1,760 |

|

|

|

- |

|

|

|

1,760 |

|

| Restructuring charges |

|

- |

|

|

|

- |

|

|

|

350 |

|

|

|

- |

|

|

|

1,285 |

|

| Total operating expense |

|

6,388 |

|

|

|

5,663 |

|

|

|

8,772 |

|

|

|

23,451 |

|

|

|

39,484 |

|

| |

|

|

|

|

|

|

|

|

|

| Operating income/(loss) |

|

(5,830 |

) |

|

(5,120 |

) |

|

(8,593 |

) |

|

(22,067 |

) |

|

(42,552 |

) |

| |

|

|

|

|

|

|

|

|

|

| Other income (expense): |

|

|

|

|

|

|

|

|

|

| Interest expense, net |

|

(257 |

) |

|

|

(270 |

) |

|

|

(1,559 |

) |

|

|

(5,478 |

) |

|

|

(6,191 |

) |

| Other income (expense), net |

|

(3 |

) |

|

|

2 |

|

|

|

2 |

|

|

|

(13 |

) |

|

|

11 |

|

| Net loss and comprehensive loss |

|

(6,090 |

) |

|

|

(5,388 |

) |

|

|

(10,150 |

) |

|

|

(27,558 |

) |

|

|

(48,732 |

) |

| Accretion of preferred stock dividends |

|

(836 |

) |

|

|

(836 |

) |

|

|

- |

|

|

|

(2,918 |

) |

|

|

- |

|

| Deemed dividend arising from beneficial

conversion |

|

|

|

|

|

|

|

|

|

| feature of convertible preferred

stock |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(5,216 |

) |

|

|

- |

|

| Net loss attributable to common stockholders |

$ |

(6,926 |

) |

|

$ |

(6,224 |

) |

|

$ |

(10,150 |

) |

|

$ |

(35,692 |

) |

|

$ |

(48,732 |

) |

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Net loss per share attributable to common

stockholders |

|

|

|

|

|

|

|

|

|

| basic and

diluted |

$ |

(0.31 |

) |

|

$ |

(0.56 |

) |

|

$ |

(12.58 |

) |

|

$ |

(3.34 |

) |

|

$ |

(74.74 |

) |

| |

|

|

|

|

|

|

|

|

|

| Weighted average common shares used to

compute |

|

|

|

|

|

|

|

|

|

| net loss per share, basic and diluted |

|

22,409 |

|

|

|

11,194 |

|

|

|

807 |

|

|

|

10,687 |

|

|

|

652 |

|

| |

|

|

|

|

| Condensed Balance

Sheets |

|

|

|

|

| (in thousands, except per

share amounts) (unaudited) |

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

December

31, |

|

December 31, |

| Assets |

|

|

|

2018 |

|

2017 |

| Current

assets: |

|

|

|

|

| |

|

Cash and cash

equivalents |

|

$ |

16,410 |

|

|

$ |

5,389 |

|

| |

|

Accounts receivable,

net of allowance for doubtful accounts of $260 and $146 |

|

|

|

|

| |

|

at December 31,

2018 and December 31, 2017, respectively |

|

|

1,154 |

|

|

|

1,127 |

|

| |

|

Inventories |

|

|

3,422 |

|

|

|

4,295 |

|

| |

|

Prepaid expenses and

other current assets |

|

|

635 |

|

|

|

640 |

|

| |

Total

current assets |

|

|

21,621 |

|

|

|

11,451 |

|

| |

|

|

|

|

|

|

| Property and equipment, net |

|

|

2,078 |

|

|

|

2,950 |

|

| Other assets |

|

|

- |

|

|

|

687 |

|

| |

Total

assets |

|

$ |

23,699 |

|

|

$ |

15,088 |

|

| |

|

|

|

|

|

|

| Liabilities and stockholders'

equity (deficit) |

|

|

|

|

| |

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

| |

|

Accounts payable |

|

$ |

1,148 |

|

|

$ |

1,273 |

|

| |

|

Accrued

compensation |

|

|

1,197 |

|

|

|

863 |

|

| |

|

Accrued expenses and

other current liabilities |

|

|

1,449 |

|

|

|

3,597 |

|

| |

|

Borrowings |

|

|

7,486 |

|

|

|

44,744 |

|

| |

|

Preferred stock

dividends payable |

|

|

2,918 |

|

|

|

- |

|

| |

Total

current liabilities |

|

|

14,198 |

|

|

|

50,477 |

|

| Other long-term liabilities |

|

|

41 |

|

|

|

301 |

|

| |

Total

liabilities |

|

|

14,239 |

|

|

|

50,778 |

|

| |

|

|

|

|

|

|

| Stockholders' equity (deficit): |

|

|

|

|

| Common stock, par value

$0.001 |

|

|

34 |

|

|

|

1 |

|

| Additional paid-in

capital |

|

|

338,311 |

|

|

|

265,636 |

|

| Accumulated

deficit |

|

|

(328,885 |

) |

|

|

(301,327 |

) |

| |

Total

stockholders' equity (deficit) |

|

|

9,460 |

|

|

|

(35,690 |

) |

| |

Total

liabilities and stockholders' equity (deficit) |

|

$ |

23,699 |

|

|

$ |

15,088 |

|

| |

|

|

|

|

| Reconciliation of Adjusted

EBITDA to Loss from Operations |

|

|

|

|

| (in thousands) |

|

|

|

|

| (unaudited) |

|

|

|

|

| |

|

|

|

Three Months Ended |

|

Years Ended |

| |

|

|

|

December

31, |

|

September

30, |

|

December

31, |

|

December

31, |

|

December

31, |

| |

|

|

|

|

2018 |

|

|

|

2018 |

|

|

|

2017 |

|

|

|

2018 |

|

|

|

2017 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from operations |

$ |

(5,830 |

) |

|

$ |

(5,120 |

) |

|

$ |

(8,593 |

) |

|

$ |

(22,067 |

) |

|

$ |

(42,552 |

) |

| Add: Stock-based compensation |

|

1,052 |

|

|

|

768 |

|

|

|

769 |

|

|

|

3,080 |

|

|

|

4,966 |

|

| Add: Restructuring charges |

|

- |

|

|

|

- |

|

|

|

350 |

|

|

|

- |

|

|

|

1,285 |

|

| Add: Specific inventory charges |

|

- |

|

|

|

- |

|

|

|

320 |

|

|

|

528 |

|

|

|

5,500 |

|

| Add: Depreciation and

amortization |

|

546 |

|

|

|

217 |

|

|

|

314 |

|

|

|

1,281 |

|

|

|

1,476 |

|

| |

Adjusted EBITDA |

$ |

(4,232 |

) |

|

$ |

(4,135 |

) |

|

$ |

(6,840 |

) |

|

$ |

(17,178 |

) |

|

$ |

(29,325 |

) |

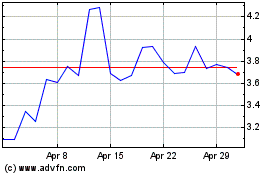

Avinger (NASDAQ:AVGR)

Historical Stock Chart

From Mar 2024 to Apr 2024

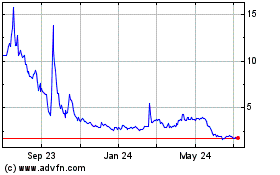

Avinger (NASDAQ:AVGR)

Historical Stock Chart

From Apr 2023 to Apr 2024