Current Report Filing (8-k)

April 24 2020 - 8:31AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

April 20, 2020

Avinger, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-36817

|

|

20-8873453

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

400 Chesapeake Drive

Redwood City, California 94063

(Address of principal executive offices, including zip code)

(650) 241-7900

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.001 per share

|

AVGR

|

The NASDAQ Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR § 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR § 240.12b-2).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Item 2.02 Results of Operations and Financial Condition.

Avinger, Inc. (the “Company”) expects revenue in the first quarter of 2020 to be approximately $2.25 million, an increase of 22% over the first quarter of 2019. Total Pantheris revenue for the first quarter of 2020 is expected to grow 76% over the prior year, to approximately $1.6 million, with new sales of Pantheris SV and increased sales of the Pantheris next generation device both contributing to growth of the product line. In addition, the Company launched 11 new Lumivascular sites during the first quarter in high volume areas, such as Arizona, Michigan, and Louisiana, which also contributed to revenue growth for the quarter. Net loss attributable to common shareholders for the first quarter of 2020 is expected to be in the range of $6.5 million to $7.0 million, compared to Net loss attributable to common shareholders of $5.95 million for the first quarter of 2019.

This information is intended to be furnished under Item 2.02 of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

On April 23, 2020, the Company received loan proceeds of $2.3 million (the “Loan”) pursuant to the Paycheck Protection Program (the “PPP”) under the Coronavirus Aid, Relief, and Economic Security (“CARES”) Act.

The Loan, which was in the form of a promissory note, dated April 20, 2020 (the “Promissory Note”), between the Company and Silicon Valley Bank as the lender, matures on April 20, 2022 and bears interest at a fixed rate of 1% per annum, payable monthly commencing in six months. Under the terms of the PPP, the principal may be forgiven if the Loan proceeds are used for qualifying expenses as described in the CARES Act, such as payroll costs, mortgage interest, rent, and utilities. No assurance can be provided that the Company will obtain forgiveness of the Loan in whole or in part. In addition, details of the PPP continue to evolve regarding which companies are qualified to receive loans pursuant to the PPP and on what terms, and the Company may be required to repay some or all of the Loan due to these changes or different interpretations of the PPP requirements.

The Promissory Note evidencing the PPP Loan contains customary representations, warranties, and covenants for this type of transaction, including customary events of default relating to, among other things, payment defaults and breaches of representations and warranties or other provisions of the Promissory Note. The occurrence of an event of default may result in, among other things, the Company becoming obligated to repay all amounts outstanding.

The representations, warranties and covenants contained in the Promissory Note are made only for purposes of the Promissory Note and as of specific dates; are solely for the benefit of the parties to the Promissory Note; and may be subject to limitations agreed upon by the parties, including being qualified by confidential disclosures made by each contracting party to the other for the purposes of allocating contractual risk between them that differ from those applicable to investors. Investors should not rely on the representations, warranties and covenants or any description thereof as characterizations of the actual state of facts or condition of the Company or the Lenders or any of their respective subsidiaries, affiliates, businesses or stockholders. Moreover, information concerning the subject matter of the representations, warranties and covenants may change after the date of the Promissory Note, which subsequent information may or may not be fully reflected in public disclosures or statements by the Company or the Lenders. Accordingly, investors should read the representations and warranties in the Promissory Note not in isolation but only in conjunction with the other information about the Company or the Lenders and their respective subsidiaries that the respective companies include in reports, statements and other filings made with the SEC.

The foregoing description of the Promissory Note and the Loan does not purport to be complete and is qualified in its entirety by reference to the full text of the Promissory Note attached to this Form 8-K as Exhibit 10.1 and incorporated herein by reference.

Item 3.01. Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

As previously reported, on March 10, 2020, Avinger, Inc. (the “Company”) received a letter from the Listing Qualifications Department of The NASDAQ Stock Market, LLC (“Nasdaq”) notifying the Company that the Company was not in compliance with Nasdaq Listing Rule 5550(a)(2), as the minimum bid price for the Company’s listed securities was less than $1 for the previous 30 consecutive business days. The Company initially had a period of 180 calendar days, or until September 8, 2020, to regain compliance with the rule referred to in this paragraph. To regain compliance,

On April 20, 2020, the Company received a subsequent written notice from Nasdaq indicating that Nasdaq filed an immediately effective rule change with SEC on April 16, 2020, pursuant which the compliance periods for bid price and market value of publicly held shares requirements were tolled through June 30, 2020. As a result, the Company now has until November 20, 2020 to regain compliance with Nasdaq’s minimum bid price requirement.

Safe Harbor Statement

Certain statements in this current report regarding future events and future financial performance are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve risks and uncertainties. Actual results may differ materially from those contemplated (expressed or implied) by such forward-looking statements, because of, among other things, the risks and uncertainties related to COVID-19 and the risk factors identified in the “Risk Factors” section of our Annual Report on Form 10-K filed with the SEC on March 6, 2020.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

AVINGER, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: April 24, 2020

|

By:

|

/s/ Mark Weinswig

|

|

|

|

|

|

Mark Weinswig

Chief Financial Officer

|

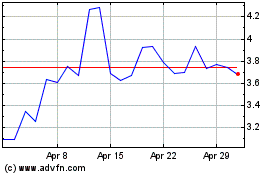

Avinger (NASDAQ:AVGR)

Historical Stock Chart

From Mar 2024 to Apr 2024

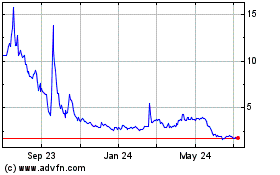

Avinger (NASDAQ:AVGR)

Historical Stock Chart

From Apr 2023 to Apr 2024