We are offering 2,652,065 units, each consisting

of one share of our common stock, par value $0.0001 per share (“Common Stock”), and one warrant to purchase one share of our

Common Stock in a firm commitment underwritten public offering.

We are also offering to those purchasers whose purchase of units in this offering would otherwise result in such purchaser, together with its affiliates and certain related

parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding shares of common stock

immediately following the consummation of this offering, 984,300 pre-funded units

in lieu of units that would otherwise result in such purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the

purchaser, 9.99%) of our outstanding shares of common stock. Each pre-funded unit consists of one pre-funded warrant to purchase one

share of common stock and one warrant to purchase one share of common stock. The purchase price of each pre-funded unit will be equal

to the price per unit being sold to the public in this offering, minus $0.0001, and the exercise price of each pre-funded warrant included

in the pre-funded units will be $0.0001 per share. The pre-funded warrants included in the pre-funded units will be immediately exercisable

and may be exercised at any time until all of the pre-funded warrants are exercised in full. The warrant included in the pre-funded unit

is in the same form as the warrant included in the unit.

The units and the pre-funded units will not be issued or certificated.

The shares of common stock or pre-funded warrants, as the case may be, and the accompanying warrants can only be purchased together in

this offering, but the securities contained in the units or pre-funded units will be immediately separable upon issuance and will be

issued separately. The shares of common stock issuable from time to time upon exercise of the warrants and the pre-funded warrants are

also being offered by this prospectus.

The share and per share information in this prospectus

reflects a one-for-fifteen reverse stock split of the outstanding Common Stock of the Company, which became effective on September 22,

2022.

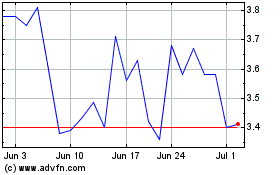

Our Common Stock is quoted for trading under the

symbol “ATXI” on the Nasdaq Capital Market. On October 6, 2022, the closing price of our Common Stock was $6.29 per share.

There is no established public trading market for the warrants or the pre-funded warrants, and we do not expect such a market to develop.

We are an “emerging growth company”

as defined under the federal securities laws and, as such, have elected to comply with certain reduced public company reporting requirements

for this prospectus and our other filings with the Securities and Exchange Commission.

We have granted the underwriter a 45-day option

to purchase up to an aggregate of 545,454 additional shares of Common Stock, additional pre-funded units and/or additional warrants from

us in any combination thereof, representing 15% of the securities sold in the offering, solely to cover over-allotments, if any, at the

public offering price per share, per pre-funded warrant and per warrant, respectively.

The underwriter expects to deliver the securities

against payment on or about October 11, 2022.

ABOUT THIS PROSPECTUS

This prospectus is part of the registration statement

that we filed with the Securities and Exchange Commission, or the “SEC,” pursuant to which we may, from time to time, offer

and sell or otherwise dispose of the securities covered by this prospectus. As permitted by the rules and regulations of the SEC, the

registration statement filed by us includes additional information not contained in this prospectus.

This prospectus and the documents incorporated

by reference into this prospectus include important information about us, the securities being offered and other information you should

know before investing in our securities. You should not assume that the information contained in this prospectus is accurate on any date

subsequent to the date set forth on the front cover of this prospectus or that any information we have incorporated by reference is correct

on any date subsequent to the date of the document incorporated by reference, even though this prospectus is delivered or securities

are sold or otherwise disposed of on a later date. It is important for you to read and consider all information contained in this prospectus,

including the documents incorporated by reference therein, in making your investment decision. You should also read and consider the

information in the documents to which we have referred you under “Where You Can Find More Information” and “Incorporation

of Certain Information by Reference” in this prospectus.

You should rely only on this prospectus and the

information incorporated or deemed to be incorporated by reference in this prospectus. We have not authorized anyone to give any information

or to make any representation to you other than those contained or incorporated by reference in this prospectus. If anyone provides you

with different or inconsistent information, you should not rely on it. This prospectus does not constitute an offer to sell or the solicitation

of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

Unless otherwise indicated, information contained

or incorporated by reference in this prospectus concerning our industry, including our general expectations and market opportunity, is

based on information from our own management estimates and research, as well as from industry and general publications and research,

surveys and studies conducted by third parties. Management estimates are derived from publicly available information, our knowledge of

our industry and assumptions based on such information and knowledge, which we believe to be reasonable. In addition, assumptions and

estimates of our and our industry’s future performance are necessarily uncertain due to a variety of factors, including those described

in section of this prospectus titled “Risk Factors.” These and other factors could cause our future performance to

differ materially from our assumptions and estimates.

We take no responsibility for, and can provide

no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the securities

offered hereby and only under circumstances and in jurisdictions where it is lawful to do so. No dealer, salesperson or other person

is authorized to give any information or to represent anything not contained in this prospectus, any applicable prospectus supplement

or any free writing prospectuses prepared by or on behalf of us or to which we have referred you or are incorporated by reference. This

prospectus is not an offer to sell securities, and it is not soliciting an offer to buy securities, in any jurisdiction where the offer

or sale is not permitted.

For investors outside the United States: we have

not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for

that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus

must inform themselves about, and observe any restrictions relating to, the offering of our securities and the distribution of this prospectus

outside the United States.

This prospectus contains summaries of certain

provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information.

All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have

been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is

a part, and you may obtain copies of those documents as described in this prospectus under “Where You Can Find More Information.”

This prospectus contains references to trademarks,

trade names and service marks belonging to other entities. Solely for convenience, trademarks, trade names and service marks referred

to in this prospectus may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that

the applicable licensor will not assert, to the fullest extent under applicable law, its rights to these trademarks and trade names.

We do not intend our use or display of other entities’ trade names, trademarks or service marks to imply a relationship with, or

endorsement or sponsorship of us by, any other entities.

PROSPECTUS SUMMARY

This summary highlights selected information

from this prospectus and does not contain all of the information that may be important to you in making an investment decision. This

summary is qualified in its entirety by the more detailed information included elsewhere in this prospectus and/or incorporated by reference

herein. Before making your investment decision with respect to our securities, you should carefully read this entire prospectus, including

the information in our filings with the SEC incorporated by reference into this prospectus.

References in this prospectus to the “Company,”

“we,” “us,” “our” and similar words refer to Avenue Therapeutics, Inc.

Our Business

Overview and Product Candidate Development

We are a specialty pharmaceutical company that

seeks to develop and commercialize therapies for the treatment of Central Nervous System (“CNS”) diseases. Our current lead

product candidate is intravenous (“IV”) Tramadol, for the treatment of post-operative acute pain. Under the terms of certain

agreements described herein, we have an exclusive license to develop and commercialize IV Tramadol in the United States.

We have spent significant resources developing

IV Tramadol since inception of the company. In 2016, we completed a pharmacokinetic study for IV Tramadol in healthy volunteers as well

as an end of Phase 2 meeting with the U.S. Food and Drug Administration (the “FDA”). In the third quarter of 2017, we initiated

a Phase 3 development program of IV Tramadol in patients with moderate-to-severe pain following bunionectomy where we announced in May 2018

that the study met its primary endpoint and all key secondary endpoints. In December 2018, we initiated the second Phase 3 trial

in patients with moderate-to-severe pain following abdominoplasty upon successful completion of the bunionectomy study. In June 2019,

we announced the study met its primary endpoint and all key secondary endpoints. In December 2017, we initiated an open-label safety

study, which was completed during the second quarter of 2019. The results showed that IV Tramadol is well-tolerated with a side effect

profile consistent with known pharmacology.

In

December 2019, we submitted a New Drug Application (“NDA”) for IV Tramadol and received a Complete Response Letter (the

“First CRL”) from the FDA in October 2020. In February 2021, we resubmitted the NDA for IV Tramadol. The FDA assigned

a Prescription Drug User Fee Act (“PDUFA”) goal date of April 12, 2021 for the resubmitted NDA for IV Tramadol. On June 14,

2021, we announced that we had received a second Complete Response Letter (the “Second CRL”) from the FDA regarding our NDA

for IV Tramadol. While efficacy and safety endpoints were met in clinical trials, the FDA expressed a desire for additional safety

data related to opioid stacking, which was not directly addressed in the Company’s Phase 3 trials.

We submitted a formal dispute resolution request

(“FDRR”) with the Office of Neuroscience of the FDA on July 27, 2021. On August 26, 2021, we received an Appeal

Denied Letter from the Office of Neuroscience of the FDA in response to the FDRR submitted on July 27, 2021. On August 31,

2021, we submitted a FDRR with the Office of New Drugs (“OND”) of the FDA. On October 21, 2021, we received a written

response from the OND of the FDA stating that the OND needed additional input from an Advisory Committee in order to reach a decision

on the FDRR. On February 15, 2022, we had our Advisory Committee meeting with the FDA. In the final part of the public meeting,

the Advisory Committee voted yes or no on the following question: “Has the Applicant submitted adequate information to support

the position that the benefits of their product outweigh the risks for the management of acute pain severe enough to require an opioid

analgesic in an inpatient setting?” The results were 8 ‘yes’ votes and 14 ‘no’ votes. On March 18,

2022, we received an Appeal Denied Letter from the OND in response to the FDRR that also recommend that as a path forward, we “request

a meeting with the Division regarding additional studies that can better assess the appropriate clinical setting for the administration

of tramadol IV and to evaluate the potential risk for opioid stacking”.

Following the receipt of the Appeal Denied Letter,

we submitted a Type A Meeting Request and related briefing document to the FDA on June 17, 2022. The meeting was granted by the

Division of Anesthesia, Analgesia, and Addiction Products (“DAAAP”) on June 27, 2022, and scheduled for August 9,

2022. We submitted a briefing document presenting a study design that we believe has the potential to address the concerns around the

safety risk of IV Tramadol in combination with other opioid analgesics for the management of moderate-to-moderately-severe pain in adults

in a medically supervised healthcare setting that was discussed in detail at the previously disclosed Advisory Committee meeting on February

15, 2022 and in the Appeal Denied letter received on March 18, 2022.

The meeting on August 9, 2022 was a collaborative

discussion on the study design and potential path forward. At the meeting, we presented a study design for a single safety clinical trial

that we believe could address the concerns regarding risks related to opioid stacking. The FDA stated that the proposed study design

appears reasonable and agreed on various study design aspects with the expectation that additional feedback would be provided to us upon

review of a more detailed study protocol. We intend to incorporate the FDA’s suggestions from the meeting minutes and submit a

detailed study protocol that could form the basis for the submission of a complete response to the second Complete Response Letter for

IV Tramadol.

We are also anticipating

expanding our business with the acquisition of Baergic Bio, Inc. and its asset BAER-101, which would strategically align with Avenue’s

goals of building a CNS pipeline. Baergic Bio is a clinical-stage pharmaceutical company founded in December 2019 that focuses on

the development of pharmaceutical products for the treatment of CNS disorders. Baergic Bio’s pipeline currently consists of a single

compound, BAER-101, a selective GABA-A positive allosteric modulator (“BAER-101”). BAER-101 (formally known as AZD7325) was

originally developed by AstraZeneca and has an established safety profile in early clinical trials including over 500 patients. Additional

details on the acquisition are described below.

Relationship with Fortress

We were incorporated in Delaware

on February 9, 2015, as a wholly owned subsidiary of Fortress Biotech, Inc. (“Fortress”), to develop and market pharmaceutical

products for the acute care setting in the United States. Fortress controls a voting majority of our capital stock pursuant to its ownership

of a class of preferred stock, some of the features of which have been contractually suspended. We anticipate remaining a majority owned

subsidiary of Fortress after the completion of this offering.

Relationship with InvaGen

On

November 12, 2018, we, InvaGen Pharmaceuticals Inc. (“InvaGen”) and Madison Pharmaceuticals, Inc. entered into a Stock Purchase

and Merger Agreement (the “SPMA”), pursuant to which InvaGen subsequently purchased in 2019, for $35 million, shares of our

Common Stock then representing 33.3% of the fully diluted capitalization of our stock. The SPMA also compelled InvaGen to acquire the

remaining issued and outstanding shares of our capital stock for approximately $180 million, if certain closing conditions were met on

or before April 30, 2021. Such closing conditions were not met as of such date, however, and InvaGen thereafter retained an option to

acquire the remaining issued and outstanding shares of our capital stock upon the same terms for so long as the SPMA remained in place.

On November 1, 2021, Avenue accrued the contractual right to terminate the SPMA, which it did on the same day in accordance with the

agreement’s terms.

Even

though we terminated the SPMA on November 1, 2021, InvaGen continues to hold 388,888 shares of our Common Stock and retains certain

rights (the “Historic Rights”) pursuant to the Stockholders Agreement, entered into on November 12, 2018 between us,

InvaGen and Fortress, including consent rights to certain equity issuances and changes to our capital stock and the right to nominate

three members of our board of directors. In connection with, and in anticipation of, this offering, we and InvaGen entered into that

certain Share Repurchase Agreement, dated July 28, 2022 (the “Share Repurchase Agreement”). Pursuant to the Share Repurchase

Agreement, we agreed to repurchase 100% of the shares in the Company held by InvaGen (the “InvaGen Shares”) for a purchase

price of $3 million, conditioned upon the consummation of a financing by the Company. In addition, we agreed to pay InvaGen an additional

amount as a contingent fee, payable in the form of seven and a half percent (7.5%) of the proceeds of future financings, up to $4 million.

Additionally, in connection with the closing of the repurchase of the InvaGen Shares, all of the Historic Rights will terminate, and

the two non-independent members of our board of directors originally selected by InvaGen will resign.

Proposed Acquisition of Baergic Bio

On May 11, 2022, we entered

into a stock contribution agreement (the “Contribution Agreement”) with Fortress pursuant to which Fortress agreed to transfer

its ownership of a majority of the outstanding shares (common and preferred) in a private subsidiary company of Fortress, Baergic Bio,

Inc. (“Baergic Bio”, or “Baergic”), to the Company. Under the Contribution Agreement, Fortress also agreed to

assign to the Company certain intercompany agreements existing between Fortress and Baergic, including a Founders Agreement and Management

Services Agreement. Consummation of the transactions contemplated by the Contribution Agreement is subject to the satisfaction of certain

conditions precedent, including: (i) the closing of an equity financing by the Company resulting in gross proceeds of no less than $7.5

million, (ii) the agreement by InvaGen to (A) have 100% of its shares in the Company repurchased by the Company and (B) terminate certain

of the agreements into which it entered with the Company and/or Fortress in connection with InvaGen’s 2019 equity investment in

the Company, which will eliminate certain negative consent rights of InvaGen over the Company and restore certain rights and privileges

of Fortress in the Company, and (iii) the sustained listing of the Company’s Common Stock on Nasdaq. As previously disclosed, we

have since entered into the Share Repurchase Agreement with InvaGen regarding the repurchase of the shares of our Common Stock it holds

and the termination of the Historic Rights, although no assurance can be given that the other required consents and approvals for the

closing of the Contribution Agreement will be obtained or that the closing conditions will be satisfied in a timely manner or at all.

Closing of the acquisition

of Baergic under the Contribution Agreement will allow us to take advantage of BAER-101’s unique selectivity profile and further

clinical development in areas of unmet need, while affording Baergic Bio with greater access to development expertise and funding. Evaluation

and negotiation of the Contribution Agreement was overseen, and execution of the Contribution Agreement was approved, by special committees

at the Company and Fortress levels, both of which exclusively comprised of independent and disinterested directors of the respective

companies’ boards.

The closing of this offering

is expected to satisfy one of the material conditions to the closing of the Baergic Bio contribution, however, there can be no assurance

that the other conditions to closing will be satisfied in a timely manner, or at all. You should carefully consider the information set

forth under “Risk Factors” in this prospectus.

Even

after the closing of this offering, we may need to obtain additional capital through the sale of debt or equity financings or other arrangements

to fund our operations and research and development activity; however, there can be no assurance that we will be able to raise needed

capital under acceptable terms, if at all. The sale of additional equity may dilute existing stockholders and newly issued shares may

contain senior rights and preferences compared to currently outstanding shares of Common Stock. Issued debt securities may contain covenants

and limit our ability to pay dividends or make other distributions to stockholders. If we are unable to obtain such additional financing,

future operations would need to be scaled back or discontinued.

Summary Risk Factors

Our business is subject

to risks of which you should be aware before making an investment decision. The risks described below are a summary of the principal

risks associated with an investment in us and are not the only risks we face. You should carefully consider these risk factors, the risk

factors described under the heading “Risk Factors”, and the other reports and documents that we have filed with the

Securities and Exchange Commission (“SEC”).

Risks Pertaining to the Influence of Fortress

| · | Fortress

controls a voting majority of our capital stock pursuant to its ownership of a class of preferred

stock, some of the features of which have been contractually suspended (Please see the section

titled “Risk Factors – InvaGen retains rights that may prevent us from taking

certain actions that could benefit our Company and its stockholders”). |

Risks Pertaining to Our Business

| · | InvaGen

retains rights that may prevent us from taking certain actions that could benefit our Company

and its stockholders. |

| · | If

we fail to satisfy applicable listing standards, our Common Stock may be delisted from the

Nasdaq Capital Market, which would impact the liquidity, and potentially the value, of your

investment. |

| · | We

currently have no drug products for sale, and only one drug product candidate, IV Tramadol.

Until the consummation of our acquisition of Baergic Bio, we are dependent on the success

of IV Tramadol, and cannot guarantee that we will receive regulatory approval, or that IV

Tramadol will be successfully commercialized. |

| · | If

serious adverse or unacceptable side effects are identified during the development of IV

Tramadol or any future product candidates, we may need to abandon or limit our development

of some of our product candidates. |

| · | We

are an “emerging growth company” and a “smaller reporting company,”

and the reduced disclosure requirements applicable to emerging growth companies and smaller

reporting companies may make our Common Stock less attractive to investors. |

Risks Pertaining to Our Finances

| · | There

is substantial doubt about our ability to continue as a going concern, which may hinder our

ability to obtain future financing. |

| · | We

have incurred significant losses since our inception. We expect to incur losses for the foreseeable

future, and may never achieve or maintain profitability. |

| · | We

do not have any products that are approved for commercial sale and therefore do not expect

to generate any revenues from product sales in the foreseeable future, if ever. |

| · | Raising

additional capital may cause dilution to our existing stockholders, restrict our operations

or require us to relinquish proprietary rights. |

Risks Pertaining to Reliance on Third Parties

| · | We

rely, and expect to continue to rely, on third parties to conduct our preclinical studies

and clinical trials, and those third parties may not perform satisfactorily, including failing

to meet deadlines for the completion of such trials or complying with applicable regulatory

requirements. |

| · | We

rely on clinical data and results obtained by third parties that could ultimately prove to

be inaccurate or unreliable. |

Risks Pertaining to Regulatory Approval

Process

| · | We

may not receive regulatory approval for IV Tramadol or BAER-101, or our approval may be significantly

delayed due to scientific or regulatory reasons. |

| · | We

may encounter FDA deficiencies that delay our approval, or we may not obtain approval, if

we do not sufficiently address the issues raised by the FDA. |

| · | Even

if we respond to the FDA’s requests for information and deficiencies, provide robust

scientific justifications and supporting data, there is no guarantee that the FDA will accept

our responses, or change its own preliminary conclusions about our product candidate. |

| · | Even

if IV Tramadol or BAER-101 receives regulatory approval, which may not occur, it and any

other products we may market will remain subject to substantial ongoing regulatory scrutiny. |

| · | We

will need to obtain FDA approval of any proposed product brand names, and any failure or

delay associated with such approval may adversely impact our business. |

| · | If

the Drug Enforcement Agency (“DEA”) decides to reschedule Tramadol from a Schedule

IV controlled substance to a more restrictive Schedule IV, Tramadol could lose its competitive

advantage, and our related clinical development and regulatory approval could be delayed

or prevented. |

Risks Pertaining to the Commercialization

of Product Candidates

| · | Current

and future legislation and regulation may increase the difficulty and cost for us to obtain

marketing approval of, and to commercialize, our product candidate and may affect the prices

we are able to obtain. |

| · | Public

concern regarding the safety of opioid drug products such as IV Tramadol could delay or limit

our ability to obtain regulatory approval, result in the inclusion of serious risk information

in our labeling, negatively impact market performance, or require us to undertake other activities

that may entail additional costs. |

| · | We

expect intense competition for IV Tramadol and BAER-101, and new products may emerge that

provide different or better therapeutic alternatives for our targeted indications. |

| · | If

IV Tramadol or BAER-101 does not achieve broad market acceptance, the revenues that we generate

from its sales will be limited. |

Risks Pertaining to Intellectual Property

and Potential Disputes Thereof

| · | If

we are unable to obtain and maintain patent protection for our technology and products or

if the scope of the patent protection obtained is not sufficiently broad, our competitors

could develop and commercialize technology and products similar or identical to ours, and

our ability to successfully commercialize our technology and products may be impaired. |

| · | If

we are sued for infringing intellectual property rights of third parties, it will be costly

and time consuming, and an unfavorable outcome in any litigation would harm our business. |

| · | If

we are unable to protect the confidentiality of our trade secrets, our business and competitive

position would be harmed. |

Risks Related to Our Acquisition

of Baergic Bio

| · | Our

ability to complete the acquisition is dependent on various closing conditions, including

the closing of this offering, and consent and approvals from third parties, any of which

could adversely affect the acquisition. |

| · | Uncertainty

regarding the acquisition can have a negative effect on current operations, as well as future

financial and business prospects, including negative impacts on stock prices. |

| · | Substantial

expenses will be incurred related to the acquisition of Baergic Bio and the integration of

its business operations with our current operation. |

Risks Related to this Offering

| · | If

the price of our Common Stock fluctuates significantly, your investment could lose value. |

| · | We

will have broad discretion in the use of proceeds of this offering designated for working

capital and general corporate purposes. |

| · | The

warrants are speculative in nature, holders of the warrants will have no rights as a common

stockholder until they acquire shares of our Common Stock and provisions of the warrants

could discourage an acquisition of us by a third party. |

Reverse Stock Split

On September 22, 2022, we effected a one-for-fifteen

reverse stock split of the shares of our Common Stock by filing on such date the Certificate of

Amendment to our Third Amended and Restated Certificate of Incorporation with the Secretary of State of the State of Delaware. No fractional

shares were issued as a result of the reverse stock split. Stockholders who would otherwise hold a fractional share of Common Stock received

(upon surrender to the exchange agent of certificates representing such shares), a cash payment in lieu thereof, without interest or

deduction, rounded to the nearest cent, in an amount equal to the product obtained by multiplying (a) the closing price per share of

our common stock as reported on the Nasdaq Stock Market as of September 22, 2022, by (b) the fraction of one share owned by the stockholder.

Corporate Information

We are a majority-controlled

subsidiary of Fortress. We currently have no subsidiaries, however, we anticipate that after our acquisition of Baergic Bio, that Baergic

Bio will become our sole subsidiary.

Avenue Therapeutics, Inc.

was incorporated in Delaware on February 9, 2015. Our executive offices are located at 2 Gansevoort Street, 9th Floor,

New York, NY 10014. Our telephone number is (781) 652-4500, and our email address is info@avenuetx.com. Information on our website, or

any other website, is not incorporated by reference in this prospectus. We have included our website address in this prospectus solely

as an inactive textual reference.

THE OFFERING

| Units Offered by Us |

2,652,065 units on a "firm commitment" basis, each consisting of one share of Common Stock and one warrant, each warrant exercisable for one share of Common Stock. The shares of Common Stock and warrants that are part of the units are immediately separable and will be issued separately in this offering. The warrants included within the units are exercisable immediately, have an exercise price equal to $3.30 (100% of the public offering price per unit), and expire five years after the date of issuance. |

| |

|

| Pre-Funded Units Offered by Us: |

We are also offering to those

purchasers whose purchase of units in this offering would otherwise result in the purchaser, together with its affiliates and

certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding shares

of common stock immediately following the consummation of this offering, 984,300 pre-funded units (each pre-funded unit consisting

of one pre-funded warrant to purchase one share of common stock and one warrant to purchase one share of common stock), in lieu of

units that would otherwise result in any such purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the

purchaser, 9.99%) of our outstanding shares of common stock.

The purchase price of each pre-funded

unit will be equal to the price per unit being sold to the public in this offering, minus $0.0001, and the exercise price of each

pre-funded warrant included in the pre-funded units will be $0.0001 per share. The pre-funded warrants included in the pre-funded

units will be immediately exercisable and may be exercised at any time until all of the pre-funded warrants are exercised in full.

For each pre-funded unit we sell,

the number of units we are offering will be decreased on a one-for-one basis. This prospectus also relates to the offering of the

shares of common stock issuable upon exercise of the pre-funded warrants. |

| |

|

| Shares of Common Stock Outstanding Prior to this Offering |

1,475,652 shares of Common Stock |

| |

|

| Shares of Common Stock Outstanding Following this Offering(1) |

4,127,717 shares of Common Stock |

| |

|

| Option to Purchase Additional Securities |

We have granted the underwriter a 45-day option from the date of this prospectus to purchase up to an aggregate of 545,454 additional shares of Common Stock, additional pre-funded units and/or additional warrants from us in any combination thereof, representing 15% of the securities sold in the offering, solely to cover over-allotments, if any, at the public offering price per share, per pre-funded warrant and per warrant, respectively. |

| |

|

| Nasdaq Capital Market Ticker Symbol of our Common Stock |

ATXI |

| Use of proceeds |

We estimate that we will receive approximately

$10.4 million in net proceeds from this offering (or approximately $12.1 million if the underwriter exercises its over-allotment option

in full), after deducting the estimated underwriting discounts and commissions and estimated offering expenses.

We intend to use the net proceeds

that we receive from this offering to repurchase all the shares of our Common Stock held by InvaGen for a purchase price of $3.0

million, with the remainder to be used for general corporate purposes and working capital, including the progression of IV Tramadol

through regulatory discussions and the development of BAER-101, the product candidate we expect to acquire in connection with our

acquisition of Baergic Bio. See “Use of Proceeds” for additional information. |

| |

|

| Lock-up |

We, all of our directors, officers and Fortress Biotech, Inc. have

agreed with the underwriter, subject to certain exceptions, not to sell, transfer or dispose of, directly or indirectly, any of our Common

Stock or securities convertible into or exercisable or exchangeable for our Common Stock for a period of 12 months, with respect to the

Company, and 90 days, with respect to officers, directors and Fortress Biotech, Inc., after the date of the final closing of this offering.

See “Underwriting” for more information. |

| |

|

| Risk factors |

Any investment in the Common

Stock offered hereby is speculative and involves a high degree of risk. You should carefully consider the information set forth under

“Risk Factors” in this prospectus. |

(1) The

number of shares of Common Stock to be outstanding after this offering is based on 1,475,652 shares of our Common Stock outstanding as

of June 30, 2022, and excludes:

| · | 996

shares of Common Stock issuable upon exercise of outstanding warrants having a weighted-average

exercise price of $10.05 per share; |

| · | 21,415

shares of Common Stock issuable upon the vesting and settlement of outstanding restricted

stock award/units; |

| · | 122,489

shares of Common Stock reserved for issuance and available for future grant under our 2015

Incentive Plan; |

| · | 545,454 shares of Common Stock issuable upon exercise of the warrants included in the units and the

pre-funded units; and |

| | | |

| | · | 984,300 shares of Common Stock issuable upon exercise of the pre-funded warrants. |

Except as otherwise indicated herein, all information

in this prospectus assumes the following

| · | a

one-for-fifteen reverse stock split of our Common Stock effective as of September 22, 2022;

and |

| · | no

exercise by the underwriter of its over-allotment option to purchase additional securities. |

CAUTIONARY NOTE REGARDING

FORWARD-LOOKING STATEMENTS

This prospectus contains

predictive or “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All

statements other than statements of current or historical fact contained in this prospectus, including statements that express our intentions,

plans, objectives, beliefs, expectations, strategies, predictions or any other statements relating to our future activities or other

future events or conditions are forward-looking statements. The words “anticipate,” “believe,” “continue,”

“could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,”

“project,” “will,” “should,” “would” and similar expressions, as they relate to us, are

intended to identify forward-looking statements.

These statements are

based on current expectations, estimates and projections made by management about our business, our industry and other conditions affecting

our financial condition, results of operations or business prospects. These statements are not guarantees of future performance and involve

risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and results may differ materially from

what is expressed or forecasted in, or implied by, the forward-looking statements due to numerous risks and uncertainties. Factors that

could cause such outcomes and results to differ include, but are not limited to, risks and uncertainties arising from:

| · | expectations

for increases or decreases in expenses; |

| · | expectations

for the clinical and pre-clinical development, manufacturing, regulatory approval, and commercialization

of our pharmaceutical product candidate or any other products we may acquire or in-license; |

| · | our use of clinical

research centers and other contractors; |

| · | expectations

for incurring capital expenditures to expand our research and development and manufacturing

capabilities; |

| · | expectations

for generating revenue or becoming profitable on a sustained basis; |

| · | expectations

or ability to enter into marketing and other partnership agreements; |

| · | expectations

or ability to enter into product acquisition and in-licensing transactions; |

| · | expectations

or ability to build our own commercial infrastructure to manufacture, market and sell our

product candidate; |

| · | acceptance of

our products by doctors, patients or payors; |

| · | our ability to

compete against other companies and research institutions; |

| · | our ability to

secure adequate protection for our intellectual property; |

| · | our ability to

attract and retain key personnel; |

| · | availability

of reimbursement for our products; |

| · | estimates

of the sufficiency of our existing cash and cash equivalents and investments to finance our

operating requirements, including expectations regarding the value and liquidity of our investments; |

| · | the volatility

of our stock price; |

| · | expectations

for future capital requirements; |

| · | uncertainty surrounding

the Baergic Bio acquisition; and |

| · | those

risks discussed in “Risk Factors” elsewhere in this prospectus, as well

as those described in any other filings which we make with the SEC. |

Any forward-looking

statements speak only as of the date on which they are made, and we undertake no obligation to publicly update or revise any forward-looking

statements to reflect events or circumstances that may arise after the date of this prospectus, except as required by applicable law.

Investors should evaluate any statements made by us in light of these important factors.

MARKET AND INDUSTRY DATA

AND FORECASTS

We obtained the industry and market data used

throughout this prospectus from our own internal estimates and research, as well as from independent market research, industry and general

publications and surveys, governmental agencies, publicly available information and research, surveys and studies conducted by third

parties. Internal estimates are derived from publicly available information released by industry analysts and third-party sources, our

internal research and our industry experience, and are based on assumptions made by us based on such data and our knowledge of our industry

and market, which we believe to be reasonable. In some cases, we do not expressly refer to the sources from which this data is derived.

In addition, while we believe the industry and market data included in this prospectus is reliable and based on reasonable assumptions,

such data involve material risks and other uncertainties and are subject to change based on various factors, including those discussed

in the section titled “Risk Factors.” These and other factors could cause results to differ materially from those

expressed in the estimates made by the independent parties or by us.

RISK FACTORS

Our business, results

of operations and financial condition and the industry in which we operate are subject to various risks. Accordingly, investing in our

securities involves a high degree of risk. We have listed below the most significant risk factors applicable to us, but they do not constitute

all of the risks that may be applicable to us. New risks may emerge from time to time, and it is not possible for us to predict all potential

risks or to assess the likely impact of all risks. Before making an investment decision, you should carefully consider these risks as

well as other information we include or incorporate by reference in this prospectus and any prospectus supplement. This prospectus also

contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated

in the forward-looking statements as a result of a number of factors, including the risks described below. See the section titled “Cautionary

Note Regarding Forward-Looking Statements.”

Risks Pertaining to Our Stockholders Agreement

with InvaGen Pharmaceuticals

InvaGen retains rights that may prevent

us from taking certain actions that could benefit our Company and its stockholders.

While the SPMA has been terminated, InvaGen retains

certain rights pursuant to the Stockholders Agreement between us and InvaGen. These rights exist as long as InvaGen maintains at least

75% of the shares of Common Stock acquired in the first stage closing. The following are some of the actions that shall not be taken

without the prior written consent of InvaGen:

| · | increase

in authorized shares of our stock; |

| · | any

agreement or transaction that would adversely treat the holders of our shares of Common Stock

as compared to the holders of shares of our Class A Preferred Stock; |

| · | issuance

of any shares of our capital stock or any securities convertible into, or other rights to

acquire, shares of our capital stock (including options, warrants or bonds), except for issuances

to our officers for services performed; |

| · | any

transfer or license of any asset for less than fair market value, as determined by a recognized

independent valuation firm agreed upon by us and InvaGen; or |

| · | entry

into any transaction or agreement with any affiliate of ours (including Fortress or its affiliates). |

While we expect that the Stockholders Agreement

will terminate in connection with the closing of the Contribution Agreement following this offering under the terms of our redemption

agreement with InvaGen, there can be no assurance that the Contribution Agreement or such redemption agreement closes on a timely basis,

or at all. Accordingly, for so long as we are bound by the Stockholders Agreement, we may be unable to take any of the above actions,

even if we believe doing so would be in the best interests of the Company and/or our stockholders, which could have a material adverse

effect on our business, financial condition and results of operations.

Risks Pertaining to the Influence of Fortress

Fortress controls a voting majority of

our Common Stock.

Pursuant to the terms of the Class A Preferred

Stock held by Fortress, Fortress will be entitled to cast, for each share of Class A Preferred Stock held by Fortress, the number of

votes that is equal to 1.1 times a fraction, the numerator of which is the sum of (A) the aggregate number of shares of outstanding Common

Stock and (B) the whole shares of Common Stock into which the shares of outstanding the Class A Preferred Stock are convertible and the

denominator of which is the aggregate number of shares of outstanding Class A Preferred Stock, or the “Class A Preferred Stock

Ratio.” Thus, Fortress will at all times have voting control of us. Further, for a period of ten years from the date of the first

issuance of shares of Class A Preferred Stock, the holders of record of the shares of Class A Preferred Stock (or other capital stock

or securities issued upon conversion of or in exchange for the Class A Preferred Stock), exclusively and as a separate class, shall be

entitled to appoint or elect the majority of our directors.

Accordingly, conflicts of interest may arise

between Fortress and its affiliates, on the one hand, and us and our other stockholders, on the other hand. In resolving these conflicts

of interests, Fortress may favor its own interests and the interests of its affiliates, over the interests of our other stockholders,

which could cause a material adverse effect on our business, financial condition and results of operations.

At such time (if ever) as InvaGen no longer

holds at least 75% of the shares of our Common Stock it received in its initial 2019 equity subscription, Fortress would have the right

to receive a significant grant of shares of our Common Stock annually, which would result in the dilution of your holdings of Common

Stock upon each grant, which could reduce their value.

Under the terms of the Amended and Restated Founders

Agreement, which became effective September 13, 2016, Fortress is entitled to receive a grant of shares of our Common Stock equal to

2.5% of the gross amount of any equity or debt financing. Additionally, the holders of Class A Preferred Stock, as a class, are to receive

an annual dividend, payable in shares of Common Stock in an amount equal to 2.5% of our fully-diluted outstanding capital stock as of

the business day immediately prior to the date such dividend is payable. Fortress currently owns all outstanding shares of Class A Preferred

Stock. At our Annual Meeting of Stockholders held on June 13, 2018, the Company’s stockholders approved an amendment to the Company’s

Third Amended and Restated Certificate of Incorporation, amending the Class A Preferred dividend payment date from February 17 to January

1 of each year. Fortress’ right to receive this dividend was contractually waived in connection with the Waiver and Termination

Agreement signed on November 12, 2018 between the Company, Fortress and InvaGen, but Fortress’ right to receive such dividend will

be revived at such time (if ever) as InvaGen no longer holds at least 75% of the shares of our Common Stock it received in its initial

2019 equity subscription, which we expect to occur shortly after the closing of this offering. These potential future share issuances

to Fortress and any other holder of Class A Preferred Stock will dilute your holdings in our Common Stock and, if our value has not grown

proportionately over the prior year, would result in a reduction in the value of your shares. The Amended and Restated Founders Agreement

has a term of 15 years and renews automatically for subsequent one-year periods unless terminated by Fortress or upon a Change in Control

(as defined in the Amended and Restated Founders Agreement).

We might have received better terms from

unaffiliated third parties than the terms we receive in our agreements with Fortress.

We entered into certain agreements with Fortress

in connection with our separation from Fortress into an independent company, including the Management Services Agreement, or the “MSA,”

and the Founders Agreement, and entered into the Contribution Agreement with Fortress in May 2022. While we believe the terms of these

agreements are reasonable, they might not reflect terms that would have resulted from arm’s-length negotiations between unaffiliated

third parties. The terms of the agreements relate to, among other things, payment of a royalty on product sales, the provision of employment

and transition services and the contribution to us of a majority of the outstanding equity securities of Baergic Bio currently held by

Fortress. We might have received better terms from third parties because, among other things, third parties might have competed with

each other to win our business. Effective November 12, 2018, the MSA fee and certain payment obligations pursuant to the Founders Agreement

were waived under the Waiver and Termination Agreement signed between the Company, Fortress and InvaGen.

The ownership by our executive officers

and some of our directors of equity securities of Fortress and/or rights to acquire equity securities of Fortress might create, or appear

to create, conflicts of interest.

Because of their current or former positions

with Fortress, some of our executive officers and directors own shares of Fortress common stock and/or options to purchase shares of

Fortress common stock. Their individual holdings of common stock and/or options to purchase common stock of Fortress may be significant

compared to their total assets. Ownership by our directors and officers, after our separation from Fortress, of common stock and/or options

to purchase common stock of Fortress create or might appear to create conflicts of interest when these directors and officers are faced

with decisions that could have different implications for Fortress than for us. For instance, and by way of example, if there were to

be a dispute between Fortress and us regarding the calculation of the royalty fee due to Fortress under the terms of the Founders Agreement,

then certain of our officers and directors may have and will appear to have a conflict of interest with regard to the outcome of such

dispute.

Risks Pertaining to Our Business and Industry

We currently have no drug products for

sale, and only one drug product candidate, IV Tramadol. Until the acquisition of Baergic Bio, we are dependent on the success of IV Tramadol

and cannot guarantee that this product candidate will receive regulatory approval or be successfully commercialized.

Our business success depends on our ability to

obtain regulatory approval to successfully commercialize, market and sell our only product candidate, IV Tramadol, and any significant

delays in obtaining approval to commercialize, market and sell IV Tramadol will have a substantial adverse impact on our business and

financial condition. Although we expect to become the indirect owner of Baergic Bio’s product candidate, BAER-101, shortly after

the consummation of this offering there is no assurance that the acquisition of Baergic Bio contemplated under the Contribution Agreement

will occur in a timely manner, or at all. Accordingly, we may remain reliant on IV Tramadol as our sole drug product candidate for the

foreseeable future.

If the application for IV Tramadol is approved,

our ability to generate revenues from IV Tramadol will depend on our ability to:

| · | establish

and maintain agreements with our contract manufacturers, wholesalers, distributors and group

purchasing organizations on commercially reasonable terms; |

| · | obtain

sufficient quantities of IV Tramadol from qualified third-party manufacturers that manufacture

in accordance with Current Good Manufacturing Practices (CGMP) requirements, as required

to meet commercial demand at launch and thereafter; |

| · | hire,

train, deploy and support our sales force; |

| · | create

market demand for IV Tramadol through our own marketing and sales activities, and any other

arrangements to promote this product candidate we may later establish; |

| · | conduct

such marketing and sales activities in a manner that is compliant with federal and state

laws, including restrictions on off-label promotion and anti-kickback requirements; |

| · | obtain

and maintain government and private payer reimbursement for our product; and |

| · | maintain

patent protection and regulatory exclusivity for IV Tramadol. |

We may not receive regulatory approval

for IV Tramadol, BAER-101 (following our acquisition of Baergic Bio) or future product candidates, or its or their approvals may be delayed,

which would have a material adverse effect on our business and financial condition.

IV Tramadol, BAER-101 (following our acquisition

of Baergic Bio) and other future product candidates and the activities associated with their development and commercialization, including

their design, testing, manufacture, safety, efficacy, recordkeeping, labeling, storage, approval, advertising, promotion, sale and distribution,

are subject to premarket approval and comprehensive regulation by the FDA, DEA and other regulatory agencies in the United States. Failure

to obtain marketing approval for IV Tramadol, BAER-101 or any future product candidates will prevent us from commercializing our product

candidates. We have not received approval to market IV Tramadol from regulatory authorities in any jurisdiction. We have only limited

experience in conducting preclinical and clinical studies and filing and supporting the applications necessary to gain marketing approvals

and expect to rely on third party contract research organizations as well as consultants and vendors to assist us in this process. Securing

marketing approval requires the submission of extensive preclinical and clinical data and supporting information to regulatory authorities

for each therapeutic indication to establish the product candidate’s safety and efficacy. Securing marketing approval also requires

the submission of information about the product manufacturing process to, and inspection of manufacturing facilities by, the regulatory

authorities.

Our product candidates IV Tramadol and BAER-101

(following our acquisition of Baergic Bio), or any future product candidates, must meet FDA’s standards for safety and efficacy,

but may be determined not to be effective, to be only moderately effective, to not be safe for use in its intended population, or may

prove to have undesirable or unintended side effects, toxicities or other characteristics that may preclude our obtaining marketing approval

or prevent or limit commercial use.

In December 2019, we submitted an NDA for IV

Tramadol and received the First CRL from the FDA in October 2020. In February 2021, we resubmitted the NDA for IV Tramadol. The FDA assigned

a PDUFA goal date of April 12, 2021 for the resubmitted NDA for IV Tramadol. On June 14, 2021, we announced that we had received the

Second CRL from the FDA regarding our NDA for IV Tramadol. We submitted a formal dispute resolution request FDRR with the Office of Neuroscience

of the FDA on July 27, 2021. On August 26, 2021, we received an Appeal Denied Letter from the Office of Neuroscience of the FDA in response

to the FDRR submitted on July 27, 2021. On August 31, 2021, we submitted a FDRR with the Office of New Drugs of the FDA. On October 21,

2021, we received a written response from the Office of New Drugs of the FDA stating that the OND needs additional input from an Advisory

Committee in order to reach a decision on the FDRR. On February 15, 2022, we had our Advisory Committee meeting with the FDA. In the

final part of the public meeting, the Advisory Committee voted yes or no on the following question: “Has the Applicant submitted

adequate information to support the position that the benefits of their product outweigh the risks for the management of acute pain severe

enough to require an opioid analgesic in an inpatient setting?” The results were 8 yes votes and 14 no votes. On March 18, 2022,

we received an Appeal Denied Letter from the Office of New Drugs in response to the FDRR. We are evaluating next steps with regard to

IV Tramadol.

Following the receipt of the Appeal Denied Letter,

we submitted a Type A Meeting Request and related briefing document to the FDA on June 17, 2022. The meeting was granted by the Division

of Anesthesia, Analgesia, and Addiction Products (“DAAAP”) on June 27, 2022, and scheduled for August 9, 2022. We submitted

a briefing document presenting a study design that we believe has the potential to address the concerns around the safety risk of IV

Tramadol in combination with other opioid analgesics for the management of moderate-to-moderately-severe pain in adults in a medically

supervised healthcare setting that was discussed in detail at the previously disclosed Advisory Committee meeting on February 15, 2022

and in the Appeal Denied letter received on March 18, 2022.

The meeting on August 9, 2022 was a collaborative

discussion on the study design and potential path forward. At the meeting, we presented a study design for a single safety clinical trial

that we believe could address the concerns regarding risks related to opioid stacking. The FDA stated that the proposed study design

appears reasonable and agreed on various study design aspects with the expectation that additional feedback would be provided to us upon

review of a more detailed study protocol. We intend to incorporate the FDA’s suggestions from the meeting minutes and submit a

detailed study protocol that could form the basis for the submission of a complete response to the second Complete Response Letter for

IV Tramadol.

The process of obtaining marketing approvals,

both in the United States and abroad, is expensive, may take many years if approval is granted at all, and can vary substantially based

upon a variety of factors, including the type, complexity and novelty of the product candidates involved. Changes in marketing approval

policies during the development period, changes in or the enactment of additional statutes or regulations, or changes in the regulatory

review process for each submitted product application, may cause delays in the approval or rejection of an application. Regulatory authorities

have substantial discretion in the approval process and may refuse to accept any application or may decide that our data is insufficient

for approval and require additional preclinical studies or clinical trials. In addition, varying interpretations of the data obtained

from preclinical and clinical testing could delay, limit or prevent marketing approval of a product candidate. Any marketing approval

we ultimately obtain may be limited or subject to restrictions or post-approval commitments that render the approved product not commercially

viable.

If we experience delays in obtaining approval

or if we fail to obtain approval of our product candidate or any future product candidates, the commercial prospects for our product

candidates may be harmed and our ability to generate revenue will be materially impaired, thereby negatively impacting our business,

financial condition and results of operations.

In addition, even if we were to obtain approval,

the approval of the indication for our product candidate by such regulatory authorities may, among other things, be more limited than

we request. Such regulatory authorities may not approve the price we intend to charge for our product, may grant approval contingent

on the performance of costly post-marketing clinical trials, or may approve a product candidate with a label that does not include the

labeling claims necessary or desirable for the successful commercialization of that product candidate. These regulatory authorities may

also require the label to contain warnings, contraindications, or precautions that limit the commercialization of that product. Any of

these scenarios could compromise the commercial prospects for our product candidates, including BAER-101 (following our acquisition of

Baergic Bio), or any future product candidates.

If serious adverse or unacceptable side

effects are identified during the development of our product candidates, we may need to abandon or limit our development of some of our

product candidates.

If our product candidate or future product candidates

are associated with undesirable side effects in clinical trials or have characteristics that are unexpected, we may need to abandon their

development or limit development to more narrow uses or subpopulations in which the undesirable side effects or other characteristics

are less prevalent, less severe or more acceptable from a risk-benefit perspective. In our industry, many compounds that initially showed

promise in early-stage testing have later been found to cause undesirable side effects that prevented further development of the compound.

In the event that our preclinical or clinical trials reveal a high and unacceptable severity and prevalence of side effects, our trials

could be delayed, suspended or terminated and the FDA or comparable foreign regulatory authorities could order us to cease further development

or deny approval of our product candidate or future product candidates for any or all targeted indications. The FDA could also issue

a letter requesting additional data or information prior to making a final decision regarding whether or not to approve a product candidate.

The number of requests for additional data or information issued by the FDA in recent years has increased, and resulted in substantial

delays in the approval of several new drugs. Undesirable side effects caused by our product candidate or future product candidates could

also result in the inclusion of serious risk information in our product labeling, application of burdensome post-market requirements,

or the denial of regulatory approval by the FDA or other regulatory authorities for any or all targeted indications, and in turn prevent

us from commercializing and generating revenues from the sale of our product candidate. Drug-related side effects could affect patient

recruitment or the ability of enrolled patients to complete the trial and could result in potential product liability claims.

For example, some of the adverse events observed

in the IV Tramadol clinical trials completed to date include nausea, dizziness, drowsiness, tiredness, sweating, vomiting, dry mouth,

somnolence and hypotension. With respect to BAER-101, some of the adverse events observed in clinical trials completed to date include

dizziness, somnolence, headache, and euphoric mood.

Additionally, if one or more of our current or

future product candidates receives marketing approval, and we or others later identify undesirable side effects caused by this product,

a number of potentially significant negative consequences could result, including:

| · | regulatory

authorities may require the addition of serious risk-related labeling statements, specific

warnings, precautions, or contraindication; |

| · | regulatory

authorities may suspend or withdraw their approval of the product, or require the suspension

of manufacturing, or the recall of the product from the market; |

| · | regulatory

authorities may require implementation of burdensome post-market risk mitigation strategies

and practices; |

| · | we

may be required to change the way the product is administered, conduct additional clinical

trials or change the labeling of the product; or |

| · | our

reputation may suffer. |

Any of these events could prevent us from achieving

or maintaining marketing approval and market acceptance of our product candidate or future product candidates or could substantially

increase our commercialization costs and expenses, which in turn could delay or prevent us from generating significant revenues from

its sale.

We may not be able to manage our business

effectively if we are unable to attract and retain key personnel.

We may not be able to attract or retain qualified

management and commercial, scientific and clinical personnel in the future due to the intense competition for qualified personnel among

biotechnology, pharmaceutical and other businesses. If we are not able to attract and retain necessary personnel to accomplish our business

objectives, we may experience constraints that will significantly impede the achievement of our development objectives, our ability to

raise additional capital and our ability to implement our business strategy, any of which may have a material adverse effect on our business,

financial condition and results of operations.

Our employees, consultants, or third-party

partners may engage in misconduct or other improper activities, including those that result in noncompliance with certain regulatory

standards and requirements, which could have a material adverse effect on our business.

We are exposed to the risk of employee fraud

or other misconduct. Misconduct by employees, consultants or third-party partners could include intentional failures to comply with FDA

regulations, provide accurate information to the FDA, comply with manufacturing standards we have established, comply with federal and

state healthcare fraud and abuse laws and regulations, report financial information or data accurately or disclose unauthorized activities

to us. In particular, sales, marketing and business arrangements in the healthcare industry are subject to extensive laws and regulations

intended to prevent fraud, kickbacks, self-dealing and other abusive practices. These laws and regulations may restrict or prohibit a

wide range of pricing, discounting, marketing and promotion, sales commission, customer incentive programs and other business arrangements.

Employee, consultant or third-party misconduct could also involve the improper use of information obtained in the course of clinical

trials, which could result in regulatory sanctions and serious harm to our reputation, as well as civil and criminal liability. The precautions

we take to detect and prevent this activity may not be effective in controlling unknown or unmanaged risks or losses or in protecting

us from governmental investigations or other actions or lawsuits stemming from a failure to be in compliance with such laws or regulations.

If any such actions are instituted against us, and we are not successful in defending ourselves or asserting our rights, those actions

could have a significant impact on our business and results of operations, including the imposition of significant fines or other civil

and/or criminal sanctions.

If we fail to comply with environmental,

health and safety laws and regulations, we could become subject to fines or penalties or incur costs that could harm our business.

We are subject to numerous environmental, health

and safety laws and regulations, including those governing laboratory procedures and the handling, use, storage, treatment and disposal

of hazardous materials and wastes. Our operations involve the use of hazardous and flammable materials, including chemicals and biological

materials. Our operations also produce hazardous waste products. We generally contract with third parties for the disposal of these materials

and wastes. We cannot eliminate the risk of contamination or injury from these materials. Although we believe that the safety procedures

for handling and disposing of these materials comply with the standards prescribed by these laws and regulations, we cannot eliminate

the risk of accidental contamination or injury from these materials. In the event of contamination or injury resulting from our use of

hazardous materials, we could be held liable for any resulting damages, and any liability could exceed our resources. We also could incur

significant costs associated with civil or criminal fines and penalties for failure to comply with such laws and regulations.

Although we maintain workers’ compensation

insurance to cover us for costs and expenses we may incur due to injuries to our employees resulting from the use of hazardous materials,

this insurance may not provide adequate coverage against potential liabilities. We do not maintain insurance for environmental liability

or toxic tort claims that may be asserted against us in connection with our storage or disposal of biological, hazardous or radioactive

materials.

In addition, we may incur substantial costs in

order to comply with current or future environmental, health and safety laws and regulations. These current or future laws and regulations

may impair our research, development or production efforts. Our failure to comply with these laws and regulations also may result in

substantial fines, penalties or other sanctions.

We are an “emerging growth company”

and a “smaller reporting company,” and the reduced disclosure requirements applicable to emerging growth companies and smaller

reporting companies may make our Common Stock less attractive to investors.

We are an “emerging growth company”

as that term is used in the JOBS Act, and may remain an emerging growth company until the earlier of (1) the last day of the fiscal year

(a) following the fifth anniversary of the completion of the initial public offering of our Common Stock, (b) in which we have total

annual gross revenue of at least $1.07 billion, or (c) in which we are deemed to be a large accelerated filer, which means the market

value of our outstanding Common Stock that is held by non-affiliates exceeds $700 million as of the prior June 30, and (2) the date on

which we have issued more than $1.0 billion in non-convertible debt during the prior three year period. For so long as we remain an emerging

growth company, we are permitted and intend to rely on exemptions from certain disclosure requirements that are applicable to other public

companies that are not emerging growth companies. These exemptions include:

| · | being

permitted to provide only two years of audited financial statements, in addition to any required

unaudited interim financial statements, with correspondingly reduced “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” disclosure

in our Annual Reports on Form 10-K; |

| · | not

being required to comply with the auditor attestation requirements in the assessment of our

internal control over financial reporting; |

| · | reduced

disclosure obligations regarding executive compensation; and |

| · | exemptions

from the requirements of holding a nonbinding advisory vote on executive compensation and

shareholder approval of any golden parachute payments not previously approved. |

In addition, the JOBS Act provides that an emerging

growth company can take advantage of an extended transition period for complying with new or revised accounting standards. This allows

an emerging growth company to delay the adoption of these accounting standards until they would otherwise apply to private companies.

We have elected to take advantage of this extended transition period.

We are also a smaller reporting company, and

we will remain a smaller reporting company until the fiscal year following the determination that our voting and non-voting common equity

held by non-affiliates is more than $250 million measured on the last business day of our second fiscal quarter, or our annual revenues

are more than $100 million during the most recently completed fiscal year and our voting and non-voting common equity held by non-affiliates

is more than $700 million measured on the last business day of our second fiscal quarter. Similar to emerging growth companies, smaller

reporting companies are able to provide simplified executive compensation disclosure, are exempt from the auditor attestation requirements

of the Sarbanes-Oxley Act, and have certain other reduced disclosure obligations, including, among other things, being required to provide

only two years of audited financial statements and not being required to provide selected financial data, supplemental financial information

or risk factors.

We have elected to take advantage of certain

of the reduced reporting obligations. We cannot predict whether investors will find our Common Stock less attractive if we rely on these

exemptions. If some investors find our Common Stock less attractive as a result, there may be a less active trading market for our Common

Stock and our stock price may be reduced or more volatile.

We are a “controlled company”

within the meaning of Nasdaq listing standards and, as a result, qualify for, and rely on, exemptions from certain corporate governance

requirements. You will not have the same protections afforded to stockholders of companies that are subject to such requirements.

We are a “controlled company” within

the meaning of Nasdaq listing standards. Under these rules, a company of which more than 50% of the voting power is held by an individual,

a group or another company is a “controlled company” and may elect not to comply with certain corporate governance requirements

of Nasdaq, including (i) the requirement that a majority of the Board of Directors consist of independent directors, (ii) the requirement

that we have a nominating and corporate governance committee that is composed entirely of independent directors with a written charter

addressing the committee’s purpose and responsibilities and (iii) the requirement that we have a compensation committee that is

composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities. We have

in the past relied on, and intend to continue to rely on, some or all of these exemptions.

Accordingly, you will not have the same protections

afforded to stockholders of companies subject to all of the corporate governance requirements of Nasdaq.

Certain of our directors currently serve,

and in the past, certain of our officers and directors have served, in similar roles with our parent company, affiliates, related parties

and other parties with whom we transact business; ongoing and future relationships and transactions between these parties could result

in conflicts of interest.

We sometimes share directors and/or officers

with certain of our parent company, affiliates, related parties or other companies with which we transact business, and such arrangements

could create conflicts of interest in the future, including with respect to the allocation of corporate opportunities. While we believe

that we have put in place policies and procedures to identify such conflicts and that any existing agreements that may give rise to such

conflicts and any such policies or procedures were negotiated at arm’s length in conformity with fiduciary duties, such conflicts

of interest may nonetheless arise. The existence and consequences of such potential conflicts could expose us to lost profits, claims

by our investors and creditors, violations of Nasdaq’s director and audit committee independence rules and harm to our results

of operations.

Risks Pertaining to Our Finances

We have incurred significant losses since