Autolus Announces Proposed Public Offering in the United States

December 08 2022 - 4:03PM

Autolus Therapeutics plc (Nasdaq: AUTL), a clinical-stage

biopharmaceutical company developing next-generation programmed T

cell therapies, today announced that it has commenced an

underwritten public offering of American Depositary Shares

(“ADSs”), each ADS representing one ordinary share. All ADSs to be

sold in the proposed offering will be offered by Autolus. Autolus

also intends to grant the underwriters a 30-day option to purchase

up to 15 percent of the ADSs sold in connection with the offering

at the public offering price, on the same terms and conditions. The

offering is subject to market conditions, and there can be no

assurance as to whether or when the offering may be completed or

the actual size or terms of the offering.

Jefferies LLC, William Blair & Company, L.L.C. and Wells

Fargo Securities, LLC are acting as joint bookrunners for the

offering.

The securities are being offered pursuant to an effective shelf

registration statement that was previously filed with the

Securities and Exchange Commission (“SEC”). The offering will be

made only by means of a written prospectus and prospectus

supplement that form a part of the registration statement, which,

for the avoidance of doubt, will not constitute a “prospectus” for

the purposes of the Regulation (EU) 2017/1129 and has not been

reviewed by any competent authority in any member state in the

European Economic Area. A preliminary prospectus supplement

relating to the securities will be filed with the SEC and will be

available on the SEC’s website at www.sec.gov.

When available, copies of the preliminary prospectus supplement

and the accompanying prospectus relating to these securities may be

obtained for free from the joint book-running managers for the

offering, Jefferies LLC, Attention: Equity Syndicate Prospectus

Department, 520 Madison Avenue, 2nd Floor, New York, NY 10022, by

telephone at (877) 821-7388 or by email at

Prospectus_Department@Jefferies.com; William Blair & Company,

L.L.C., Attention: Prospectus Department, 150 North Riverside

Plaza, Chicago, IL 60606, by telephone at (800) 621-0687, or by

email at prospectus@williamblair.com; or Wells Fargo Securities,

LLC, Attention: Equity Syndicate Department, 500 West 33rd Street,

New York, New York, 10001, at (833) 690-2713 or email a request to

cmclientsupport@wellsfargo.com. For the avoidance of doubt, such

prospectus will not constitute a “prospectus” for the purposes of

Regulation (EU) 2017/1129 and will not have been reviewed by any

competent authority in any member state in the European Economic

Area.

This press release does not constitute an offer to sell or the

solicitation of an offer to buy securities, and shall not

constitute an offer, solicitation or sale in any jurisdiction in

which such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of that

jurisdiction.

About Autolus

Autolus is a clinical-stage biopharmaceutical company developing

next-generation, programmed T cell therapies for the treatment of

cancer. Using a broad suite of proprietary and modular T cell

programming technologies, the company is engineering precisely

targeted, controlled and highly active T cell therapies that are

designed to better recognize cancer cells, break down their defense

mechanisms and eliminate these cells. Autolus has a pipeline of

product candidates in development for the treatment of

hematological malignancies and solid tumors.

Forward-Looking Statements

This press release contains certain forward-looking statements

within the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995, including statements with

regard to Autolus’ proposed securities offering. Words such as

“anticipates,” “believes,” “expects,” “intends,” “projects,” and

“future” or similar expressions are intended to identify

forward-looking statements. These forward-looking statements are

subject to the inherent uncertainties in predicting future results

and conditions and no assurance can be given that the proposed

securities offering discussed above will be consummated on the

terms described or at all. Completion of the proposed offering and

the terms thereof are subject to numerous factors, many of which

are beyond the control of Autolus, including, without limitation,

market conditions, failure of customary closing conditions and the

risk factors and other matters set forth in Autolus’ Annual Report

on Form 20-F for the year ended December 31, 2021 and other filings

Autolus makes with the SEC from time to time. Autolus undertakes no

obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, except as may be required by law.

Contacts:

Olivia Manser+44 (0) 7780 471568 o.manser@autolus.com

Julia Wilson +44 (0) 7818 430877 j.wilson@autolus.com

Susan A Noonan S.A. Noonan

Communications+1-917-513-5303susan@sanoonan.com

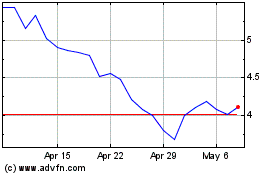

Autolus Therapeutics (NASDAQ:AUTL)

Historical Stock Chart

From Mar 2024 to Apr 2024

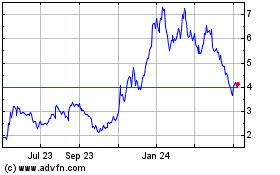

Autolus Therapeutics (NASDAQ:AUTL)

Historical Stock Chart

From Apr 2023 to Apr 2024