Report of Foreign Issuer (6-k)

June 05 2020 - 6:08AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the Month of June 2020

Commission file number 0-30070

AUDIOCODES

LTD.

(Translation of registrant’s name

into English)

1 Hayarden Street • Airport City,

Lod 7019900 • ISRAEL

(Address of principal executive office)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F x

Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ____

Note: Regulation S-T Rule 101(b)(1) only permits the

submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ____

Note: Regulation S-T Rule 101(b)(7) only permits the

submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer

must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized

(the registrant's "home country"), or under the rules of the home country exchange on which the registrant's securities

are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed

to the registrant's security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission

or other Commission filing on EDGAR.

On June 4, 2020, AudioCodes Ltd. (the “Company”)

entered into an underwriting agreement (the “Underwriting Agreement”), with BofA Securities, Inc. and Citigroup Global

Markets Inc., as representatives of the several underwriters named therein (the “Underwriters”), relating to an underwritten

public offering (the “Offering”), of 2,600,000 ordinary shares of the Company at a public offering price of $35.00

per share. The Offering is expected to close on or about June 9, 2020, subject to the satisfaction of customary closing conditions.

In addition, the Company granted the Underwriters a 30-day option to purchase up to an additional 390,000 ordinary shares. The

gross proceeds of the offering before deducting the underwriting discount and offering expenses, and assuming no exercise of the

Underwriters’ option to purchase additional shares, are expected to be approximately $91 million.

The foregoing description

of the Underwriting Agreement is only a summary and is qualified in its entirety by reference to the Underwriting Agreement, a

copy of which is attached as Exhibit 1.1 to this Form 6-K.

The Offering is being

made pursuant to the Company’s effective registration statement on Form F-3ASR (File No. 333-238867), previously

filed with the Securities and Exchange Commission.

On June 4, 2020, the

Company issued a press release titled, “AudioCodes Announces Pricing of Public Offering of Ordinary Shares.” A copy

of this press release is attached as Exhibit 99.1 to this Form 6-K.

The information contained

in this Report, including the attached Exhibits, is incorporated by reference into (i) the Company’s Registration Statement

on Form F-3ASR, File No. 333-238867; (ii) the Company’s Registration Statement on Form S-8, File No. 333-11894; (iii) the

Company’s Registration Statement on Form S-8, File No. 333-13268; (iv) the Company’s Registration Statement on Form

S-8, File No. 333-105473; (v) the Company’s Registration Statement on Form S-8, File No. 333-144825; (vi) the Company’s

Registration Statement on Form S-8, File No. 333-160330; (vii) the Company’s Registration Statement on Form S-8, File No.

333-170676; (viii) the Company’s Registration Statement on Form S-8, File No. 333-190437; (ix) the Company’s Registration

Statement on Form S-8, File No. 333-210438; and (x) the Company’s Registration Statement on Form S-8, File No. 333-230388.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

AUDIOCODES LTD.

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ ITAMAR ROSEN

|

|

|

|

|

Itamar Rosen, Advocate

|

|

|

|

|

Chief Legal Officer and Company Secretary

|

|

|

|

|

|

|

Dated: June 5, 2020

EXHIBIT INDEX

|

Exhibit No.

|

|

Description

|

|

1.1

|

|

Underwriting Agreement, dated as of June 4, 2020, by and among the Company, BofA Securities, Inc. and Citigroup Global Markets Inc.

|

|

5.1

|

|

Opinion of Goldfarb Seligman & Co., Israeli counsel to the Company, as to the validity of the ordinary shares (including consent).

|

|

23.1

|

|

Consent of Goldfarb Seligman & Co. (included in Exhibit 5.1).

|

|

99.1

|

|

Press release dated June 4, 2020 and titled, “AudioCodes Announces Pricing of Public Offering of Ordinary Shares.”

|

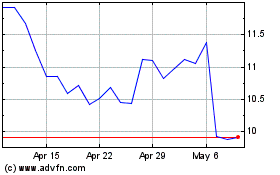

AudioCodes (NASDAQ:AUDC)

Historical Stock Chart

From Mar 2024 to Apr 2024

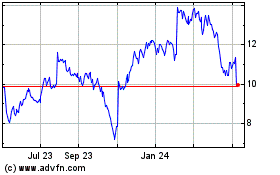

AudioCodes (NASDAQ:AUDC)

Historical Stock Chart

From Apr 2023 to Apr 2024