Filed pursuant to Rule

424(b)(5)

Registration

No. 333-235891

PROSPECTUS SUPPLEMENT

(to Prospectus dated

April 18, 2021)

AUDDIA

INC.

140,186

Shares of Common Stock

Up

to $10,000,000 of Shares of Common Stock

This prospectus supplement

relates to the issuance and sale of up to ten million dollars ($10,000,000) in shares of the common stock, $0.001 per share (“common

stock”), of Auddia Inc., a Delaware corporation (“AUUD” or the “Company”), to White Lion Capital LLC (“White

Lion”) pursuant to a purchase agreement (the “White Lion Purchase Agreement”) entered into on November 14, 2022, and

140,186 shares of common stock (the “Commitment Shares”) to be issued to White Lion in consideration for entering into the

White Lion Purchase Agreement. White Lion may be an “underwriter” of this offering under the meaning of Section 2(a)(11) of

the Securities Act of 1933, as amended.

The shares being offered

are shares of our Common Stock that we may sell from time to time until December 31, 2023, at our sole discretion, to White Lion under

the White Lion Purchase Agreement. See “The Offering” on page S-5 of this prospectus supplement and the “Purchase Agreement with White Lion “ on page S-6 of this prospectus supplement.

On the commencement date

of the White Lion Purchase Agreement, which is the date of this prospectus supplement, we will issue to White Lion the Commitment Shares.

This

prospectus supplement and the accompanying prospectus also cover the resale of these shares by White Lion to the public. See “Purchase Agreement with White Lion” for a description of the White Lion Purchase Agreement and additional information regarding White Lion.

The purchase price for the

shares of common stock offered hereby to White Lion will be based upon formulas set forth in the White Lion Purchase Agreement depending

on the type of purchase notice we submit to White Lion from time to time. We will pay the expenses incurred in connection with the issuance

of the shares of our common stock, including legal and accounting fees. See “Plan of Distribution”. Our common stock and our

Series A Warrants are currently quoted on the Nasdaq Capital Market (“Nasdaq”) under the symbols “AUUD”and “AUUDW”

respectively. On November 11, 2022, the closing price as reported on Nasdaq was $1.42 per share for our common stock and $0.3627 for our

Series A Warrants.

INVESTING IN OUR

COMMON STOCK INVOLVES CERTAIN RISKS. SEE “RISK FACTORS” ON PAGE S-7 OF THIS PROSPECTUS SUPPLEMENT AND

ON PAGE 4 OF THE ACCOMPANYING PROSPECTUS TO READ ABOUT FACTORS YOU SHOULD CONSIDER BEFORE INVESTING IN OUR COMMON STOCK. YOU SHOULD

ALSO REVIEW CAREFULLY THE RISKS AND UNCERTAINTIES DESCRIBED IN OUR ANNUAL REPORT ON FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 2021

OUR QUARTERLY REPORT ON FORM 10-Q FOR THE QUARTER ENDED SEPTEMBER 30, 2022 AND IN OUR PERIODIC AND CURRENT REPORTS THAT WE FILE WITH

THE SECURITIES AND EXCHANGE COMMISSION AFTER THE DATE OF THIS PROSPECTUS SUPPLEMENT, WHICH ARE INCORPORATED BY REFERENCE INTO THIS

PROSPECTUS SUPPLEMENT. YOU SHOULD READ THE ENTIRE PROSPECTUS SUPPLEMENT AND THE ACCOMPANYING PROSPECTUS CAREFULLY BEFORE YOU MAKE

YOUR INVESTMENT DECISION.

NEITHER THE SECURITIES

AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS

IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this Prospectus Supplement is November

15, 2022

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

PROSPECTUS

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS SUPPLEMENT

This document contains two

parts. The first part is this prospectus supplement, which describes the terms of this offering of common stock and also adds to and updates

information contained in the accompanying prospectus and the documents incorporated or deemed incorporated by reference in this prospectus

supplement and the accompanying prospectus. The second part is the accompanying prospectus, which contains a description of our common

stock and gives more general information, some of which may not apply to this offering. If there is any inconsistency between the information

in this prospectus supplement and the accompanying prospectus, you should rely on this prospectus supplement. Before purchasing any shares

of our common stock, you should read carefully both this prospectus supplement and the accompanying prospectus, together with the documents

incorporated or deemed incorporated by reference in this prospectus supplement or accompanying prospectus (as described below under the

heading “Incorporation of Certain Documents by Reference”), any related free writing prospectus and the additional information

described below under the heading “Where You Can Find More Information.”

This prospectus supplement

and the accompanying prospectus are part of an effective registration statement that we filed with the Securities and Exchange Commission

(the “SEC”) using a “shelf” registration process. This prospectus supplement and the accompanying prospectus,

which form a part of the registration statement, do not contain all of the information set forth in the registration statement. For further

information with respect to us and our common stock, reference is made to the registration statement, including the exhibits to the registration

statement and the documents incorporated by reference into the registration statement. Statements contained in this prospectus supplement

and the accompanying prospectus as to the contents of any contract or other document referred to in this prospectus supplement and accompanying

prospectus are not necessarily complete and, where that contract or other document is an exhibit to the registration statement, we refer

you to the full text of the contract or other document filed as an exhibit to the registration statement. The registration statement and

the exhibits can be obtained from the SEC as indicated under the heading “Where You Can Find More Information.”

You should rely only on the

information contained in or incorporated by reference into this prospectus supplement and the accompanying prospectus and the other information

to which we refer you. Neither we nor any underwriter, broker-dealer, agent or other person have authorized anyone to provide you with

any information other than that contained in or incorporated by reference into this prospectus supplement or the accompanying prospectus.

If anyone provides you with different or inconsistent information, you should not rely on it.

This prospectus supplement

and the accompanying prospectus do not constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction

to any person to whom it is unlawful to make such an offer or solicitation in that jurisdiction. You should assume that the information

appearing in this prospectus supplement and the accompanying prospectus is accurate as of the date on its respective cover, and that any

information incorporated by reference in this prospectus supplement or the accompanying prospectus is accurate only as of the date of

the document incorporated by reference, unless we indicate otherwise. Our business, financial condition, results of operations and prospects

may have changed since those dates.

Unless

the context indicates otherwise, as used in this prospectus, unless the context otherwise requires, references to “we,” “us,”

“our,” “the Company” and “AUUD” refer to Auddia Inc.

CAUTIONARY NOTE REGARDING

FORWARD-LOOKING STATEMENTS

This

prospectus supplement and the accompanying prospectus and the information incorporated by reference in this prospectus supplement and

the accompanying prospectus contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended

(the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

These statements are therefore entitled to the protection of the safe harbor provisions of these laws. These statements may be identified

by the use of forward-looking terminology such as “anticipate,” “believe,” “budget,” “contemplate,”

“continue,” “could,” “envision,” “estimate,” “expect,” “forecast,”

“guidance,” “indicate,” “intend,” “may,” “might,” “outlook,” “plan,”

“possibly,” “potential,” “predict,” “probably,” pro-forma,” “project,”

“seek,” “should,” “target,” “will,” “would,” “will be,” “will

continue” or the negative of or other variation on these words or comparable terminology.

We

have based these forward-looking statements on our current expectations, assumptions, estimates and projections. While we believe these

expectations, assumptions, estimates and projections are reasonable, these forward-looking statements are only predictions and involve

a number of risks and uncertainties, many of which are beyond our control. These and other important factors may cause our actual results,

performance or achievements to differ materially from any future results, performance or achievements expressed or implied by these forward-looking

statements. Management cautions that the forward-looking statements contained in this prospectus supplement and the information incorporated

by reference are not guarantees of future performance, and we cannot assume that such statements will be realized or the forward-looking

events and circumstances will occur. The risks, uncertainties and assumptions that could cause actual results to differ materially from

those anticipated or implied in our forward-looking statements include, but are not limited to, those set forth in the section entitled

“Risk Factors” in the accompanying prospectus and in “Risk Factors” section below.

Some of the factors that

could cause actual results to differ from our expectations are:

| |

· |

the early state of the Company’s development; |

| |

|

|

| |

· |

the Company’s ability to continue as a going concern; |

| |

|

|

| |

· |

the Company’s ability to compete in an unproven market; |

| |

|

|

| |

· |

resistance by potential customers to new technologies; |

| |

|

|

| |

· |

performance issues with the Company’s products; |

| |

|

|

| |

· |

uncertainties related to estimates, assumptions and projections relating to unpaid losses and loss adjustment expenses and other accounting policies; |

| |

|

|

| |

· |

reliance on key personnel; |

| |

|

|

| |

· |

introduction of competing products by other companies; |

| |

|

|

| |

· |

inflation and other changes in economic conditions, including changes in the financial markets; |

| |

|

|

| |

· |

security breaches and other system disruptions; |

| |

|

|

| |

· |

legislative and regulatory developments, especially in the gathering and use of information about private citizens; |

| |

|

|

| |

· |

weather conditions and natural disasters (including, but not limited to, the severity and frequency of storms, hurricanes, tornados and hail); and |

| |

|

|

| |

· |

acts of war and terrorist activities, among other man-made disasters. |

Given

these risks and uncertainties, you are cautioned not to place undue reliance on any forward-looking statements. The forward-looking statements

included or incorporated by reference into this prospectus supplement and in the information incorporated by reference are made only as

of the date of this prospectus supplement. Except as required by applicable law, including the securities laws of the United States and

the rules and regulations of the SEC, we do not undertake and specifically decline any obligation to update or revise any forward-looking

statements in this prospectus supplement after we distribute this prospectus supplement, or publicly announce the results of any revisions

to any such statements to reflect future events or developments, whether as a result of any new information, future events or otherwise.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights

selected information about us and this offering appearing in this prospectus supplement, the accompanying prospectus and the documents

incorporated or deemed incorporated by reference herein and therein. This summary may not contain all of the information that you should

consider before making an investment decision. You should read carefully the more detailed information included or referred to under the

heading “Risk Factors” of this prospectus supplement and the other information included in this prospectus supplement, the

accompanying prospectus, the documents incorporated or deemed incorporated by reference herein and therein, including our Annual Report

on Form 10-K for the year ended December 31, 2021, before deciding to invest in our common stock.

The Company

We

are a technology company headquartered in Boulder, CO that is reinventing how consumers engage with audio through the development of a

proprietary Artificial Intelligence (“AI”) platform for audio and innovative technologies for podcasts. We are leveraging

these technologies to bring to market two industry first apps, Faidr (previously known as the Auddia App) and Vodacast.

Faidr

gives consumers the opportunity to listen to any AM/FM radio station with no commercials while personalizing the listening experience

through skips, the insertion of on-demand content and programming of audio routines to customize listening sessions such as a daily commute.

The Faidr App represents the first time consumers can access the local content uniquely provided by radio in the commercial free and personalized

manner many consumers have come to demand for media consumption.

The

Company launched all major U.S. radio stations on its Faidr App on February 15, 2022.

Vodacast

is a podcasting platform that provides a unique suite of tools that helps Podcasters create additional digital content for their podcast

episodes as well as plan their episodes, build their brand around their Podcast and monetize their content with new monetization channels.

Vodcast also gives users the ability to go deeper into the stories through supplemental, digital content,, comment, and contribute their

own content to episode feeds.

Both

of our offerings address large and rapidly growing audiences. Faidr and Vodacast mobile apps are available today through the iOS and Android

app stores.

THE OFFERING

| The Common Stock offered by us |

Up to ten million dollars ($10,000,000) of shares

of common stock.

140,186 shares of our common stock being issued

to White Lion as consideration for its commitment to purchase shares of our common stock under the White Lion Purchase Agreement, or the

Commitment Shares. We will not receive any cash proceeds from the issuance of these Commitment Shares. |

| |

|

| Common stock outstanding before the offering |

12,514,763

shares (1) |

| |

|

| Common Stock to be outstanding after the Offering |

19,697,203 shares, which

includes 140,186 Commitment Shares and assumes the sale of 7,042,254 shares at a price of $1.42 per share, which was the closing

price of our common stock on the Nasdaq Capital Market (“Nasdaq”) on November 11, 2022, for the $10,000,000 of

additional shares of our Common Stock we may sell to White Lion from time to time. The actual number of shares issued will vary

depending on the sales prices under this offering, but will not be greater than 2,501,700 shares, representing 19.99% of the shares

of our common stock outstanding on the date of the White Lion Purchase Agreement, unless, in accordance with applicable Nasdaq

rules, we obtain stockholder approval of the issuance of shares of our common stock under the White Lion Purchase Agreement in

excess of the Exchange Cap (as defined therein), or the average price of all applicable sales of our common stock to White Lion

under the White Lion Purchase Agreement is equal to or greater than the $1.23 Minimum Price (as defined therein). |

| |

|

| Common Stock Purchase Series A Warrants Outstanding |

3,498,898 (2) |

| |

|

| Risk Factors |

Investing in our common

stock involves certain risks. See “Risk Factors” on page S-7 of this prospectus supplement and on

page 4 of the accompanying prospectus. |

| |

|

| Use of Proceeds |

Proceeds will be used as described in the “Use of Proceeds” section of this prospectus supplement. |

| |

|

| Nasdaq Symbol Common Stock |

AUUD |

| |

|

| Nasdaq Symbol Warrants |

AUUDW |

| (1) |

As of November 10, 2022. |

| (2) |

As of November 10, 2022, there are 3,498,898 Series A Warrants outstanding.

Each Series A Warrant entitles the holder to purchase one share of common stock. The Warrants have an exercise price of $4.54 per share

and expire in February of 2026. No Series A Warrants are being offered as part of this Offering.

|

PURCHASE AGREEMENT

WITH WHITE LION

On November 14, 2022, we

entered into the White Lion Purchase Agreement with White Lion under which the Company may require White Lion to purchase a maximum of

$10,000,000 of common stock (“White Lion Purchase Shares”) over a term that ends on the earliest of December 31, 2023 or (ii)

the date on which White Lion shall have made payment for shares of our Company’s equal to the Commitment Amount (the “Commitment

Period”).

In consideration for the

Investor’s execution and delivery of, and performance under the White Lion Purchase Agreement, the Company has issued to White Lion

140,186 shares of common stock (the “Commitment Shares”) as a commitment fee.

The White Lion Purchase Agreement

provides that, upon the terms and subject to the conditions and limitations set forth in the agreement, the Company has the right, but

not the obligation, from time to time, in its sole discretion, to deliver to White Lion a purchase notice (a “White Lion Purchase

Notice”) directing White Lion to purchase (each, a “White Lion Purchase”) a specified dollar amount of White Lion Purchase

Shares (the “White Lion Purchase Amount”) equal to the lesser of (i) up to thirty percent (30%) of the average daily trading

volume of the common stock during the five (5) business days before the date of the Purchase Notice, or (ii) the Investment Limit (described

below) divided by the highest closing price of the common stock over the most recent five (5) business days including the purchase date.

The Investment Limit is $500,000, subject to increase at the sole discretion of White Lion.

The White Lion Purchase Price

will be set at ninety-seven percent (97%) of the lowest daily dollar volume-weighted average price for the common stock during the three

(3) business days after the date of the White Lion Purchase Notice (the “Valuation Period’). On the last day of the Valuation

Period, White Lion will wire the Company an amount equal to the number of shares specified on the White Lion Purchase Notice multiplied

by the White Lion Purchase Price.

The White Lion Purchase Agreement

prohibits the Company from directing White Lion to purchase any shares of common stock if those shares, when combined with all other shares

of our common stock then beneficially owned by White Lion and its affiliates, would result in their combined beneficial ownership, at

any single point in time, of more than 4.99% of the then total outstanding shares of common stock. Notwithstanding the foregoing,

White Lion, in its discretion, may waive this prohibition and purchase up to 19.99% of the then total outstanding shares of the common

stock.

There are no trading volume

requirements or restrictions under the White Lion Purchase Agreement. We will control the timing and amount of any sales of our common

stock to White Lion.

The

Company is not permitted to deliver a White Lion Purchase Notice at any time that an event of default under the White Lion Purchase Agreement

has occurred and is continuing.

The

above description of the White Lion Purchase Agreement is qualified in its entirety by reference to the White Lion Purchase Agreement,

which is incorporated by reference into this prospectus supplement.

RISK FACTORS

Investing

in our securities involves a high degree of risk. You should carefully review the risks and uncertainties discussed in the “Risk

Factors” section that is found on page 4 of the accompanying prospectus and the risk factors described below before

deciding whether to purchase any common stock being offered under this prospectus supplement/ Each of the risk factors described in

this prospectus supplement or in the accompanying prospectus could adversely affect our business, operating results and financial

condition, as well as adversely affect the value of an investment in the common stock. The occurrence of any of these risks might

cause you to lose all or part of your investment. Moreover, the risks described below are not the only risks we face. Additional

risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially and adversely

affect our business, financial condition, and results of operations. If any of these risks actually occurs, our business, financial

condition and results of operations could suffer. In that case, the trading price of our common stock could decline, and you may

lose all or part of your investment.

Risks related to our

financial position and need for additional capital

Our auditors have

previously expressed substantial doubt about our ability to continue as a going concern, which may hinder our ability to obtain further

financing.

Our

past working capital deficiency, stockholders’ deficit and recurring losses from operations have raised substantial doubt about

our ability to continue as a going concern. As a result, our independent registered public accounting firm included an explanatory paragraph

in its report on our financial statements for the year ended December 31, 2020 with respect to this uncertainty. The report of our independent

registered public accounting firm on our financial statements for the year ended December 31, 2021 did not have such an explanatory paragraph,

based upon the receipt of the net proceeds from our February 2021initial public offering and, the July 2021 exercise of our publicly traded

Series A Warrants.

As

of September 30, 2022, our existing cash was only sufficient to fund our current operating plans through December 31, 2022. We recently

closed on $2 million of debt financing. However, we will still require additional capital to maintain our operations through the end of

2023. We therefore expect and need to raise additional funds. If we are unable to raise capital when needed or on acceptable terms, we

would be forced to delay, reduce or eliminate our technology development and commercialization efforts.

We have incurred

significant net losses since inception and anticipate that we will continue to incur net losses for the foreseeable future and may never

achieve or maintain profitability.

Since

inception, we have incurred significant net losses. We expect to continue to incur net losses in the near term. Our net losses were $13,478,069

and $4,051,221 for the years ended December 31, 2021 and 2020, respectively. For the year ended December 31, 2021 our cash used in operations

was $5,471,545. At September 30, 2022, we had cash and equivalents on hand of $957,130. To date, we have devoted our efforts towards securing

financing, building, and evolving our technology platform, marketing our mobile app product for radio stations as well as initiating our

marketing efforts for our music player. We expect to continue to incur significant expenses and operating losses for the foreseeable future.

We anticipate that our expenses will increase substantially if, and as, we:

| |

· |

incur costs related to the national launch of our Faidr App and as we continue obtaining market acceptance; |

| |

· |

recruit and retain podcasters to our Vodacast App and retaining listeners on the platform; |

| |

· |

continue to develop and improve our technology; |

| |

· |

effectively addressing any competing technological and market developments; |

| |

· |

add operational, business development & marketing personnel; and |

| |

· |

incur legal expenses related to avoiding and defending against intellectual property infringement, misappropriation and other claims |

To

become profitable, we must develop and eventually commercialize one or more product candidates, including Faidr and Vodacast, with significant

market potential. This will require us to be successful in a range of challenging activities, and our expenses will increase substantially

as we seek to bring these products to market. We may never succeed in any or all of these activities and, even if we do, we may never

generate revenue that is significant or large enough to achieve profitability. If we do achieve profitability, we may not be able to sustain

or increase profitability on a quarterly or annual basis. Our failure to become and remain profitable would decrease the value of our

company and could impair our ability to raise capital, develop new products, expand our business or continue our operations. A decline

in the value of our Company also could cause stockholders to lose all or part of their investment.

We need additional

funding, which may not be available on acceptable terms, or at all. Failure to obtain this capital when needed may force us to delay,

limit or terminate our product development efforts or other operations.

We

expect our expenses to increase in connection with our ongoing activities, particularly as we continue to invest in sales, marketing and

engineering resources and bring our products to market. Furthermore, we expect to incur additional costs associated with operating as

a public company. We need additional funding to complete the development of our full product line and scale products with a demonstrated

market fit.

Building

and scaling technology products is a time-consuming, expensive and uncertain process that takes years to complete, and we may never generate

the necessary user experience required to obtain market acceptance and achieve meaningful product sales. In addition, our product candidates,

once developed, may not achieve commercial success. The majority of revenue will be derived from or based on sales of products that may

not be commercially available for many years, if at all. Accordingly, we will need to continue to rely on revenues from existing products

and/or additional financing to achieve our business objectives. Adequate additional financing may not be available to us on acceptable

terms, or at all.

Sales of our common stock to White Lion may cause substantial

dilution to our existing stockholders and the sale of common stock acquired by White Lion could cause the price of our common stock to

decline.

This prospectus supplement

relates to the offering of our common stock with an aggregate amount of up to $10,000,000 that we may issue and sell to White Lion from

time to time pursuant to the White Lion Purchase Agreement. It is anticipated that the common stock offered to White Lion in this offering

will be sold from time to time during the Commitment Period. The number of shares ultimately offered for sale to White Lion under this

prospectus supplement is dependent upon the number of shares we elect to sell to White Lion under the White Lion Purchase Agreement. Depending

upon market liquidity at the time, sales into the public markets of shares we issue to White Lion under the White Lion Purchase Agreement

may cause the trading price of our common stock to decline.

White

Lion may ultimately purchase all, some or none of the shares offered hereby. After White Lion has acquired common stock under the White

Lion Purchase Agreement, it may sell all, some or none of those shares. Sales to White Lion by us pursuant to the White Lion Purchase

Agreement under this prospectus supplement may result in substantial dilution to the interests of other holders of our common stock. The

sale of a substantial number of our shares to White Lion in this offering, or anticipation of such sales, could make it more difficult

for us to sell equity or equity-related securities in the future at a time and at a price that we might otherwise wish to effect sales.

However, we have the right to control the timing and amount of any sales of our shares to White Lion.

The

extent to which we rely on White Lion as a source of funding will depend on a number of factors, including the prevailing market price

of our common stock and the extent to which we are able to secure working capital from other sources.

USE OF PROCEEDS

We may receive up to $10,000,000

in aggregate gross proceeds under the White Lion Purchase Agreement from sales of our common stock with an aggregate offering amount

of $10,000,000 that we may make to White Lion after the date of this prospectus supplement. We estimate that the net proceeds to us from

the sale of our common stock to White Lion pursuant to the Purchase Agreement will be up to approximately, but not exceeding, US$10,000,000

over the Commitment Period, assuming that we sell the full amount of the shares that we have the right, but not the obligation, to sell

to White Lion under the White Lion Purchase Agreement, and after estimated fees and expenses. We may sell fewer than all of the shares

offered by this prospectus supplement, in which case our net offering proceeds will be less. Because we are not obligated to sell any

shares of common stock under the White Lion Purchase Agreement, the actual total offering amount and proceeds to us, if any, are not

determinable at this time. There can be no assurance that we will receive any proceeds under or fully utilize the White Lion Purchase

Agreement. See “Plan of Distribution” elsewhere in this prospectus supplement for more information.

We intend to use the net

proceeds from this offering for working capital and general corporate purposes.

The foregoing represents

our current intentions based upon our present plans and business conditions to use and allocate the net proceeds of this offering. Our

management, however, will have significant flexibility and discretion to apply the net proceeds of this offering. If an unforeseen event

occurs or business conditions change, we may use the proceeds of this offering differently than as described in this prospectus supplement.

Unforeseen events or changed business conditions may result in application of the proceeds of this offering in a manner other than as

described in this prospectus supplement.

To the extent that the net

proceeds we receive from this offering are not immediately applied for the above purposes, we plan to invest the net proceeds in bank

deposits.

DILUTION

If you invest in our common

stock, your interest will be diluted immediately to the extent of the difference between the public offering price per share and the adjusted

net tangible book value per share of our common stock after this offering.

Our net tangible book value

on September 30, 2022 was approximately $625,000, or $0.05 per share. “Net tangible book value” is total assets minus the

sum of liabilities and intangible assets. “Net tangible book value per share” is net tangible book value divided by the total

number of shares outstanding.

After giving effect to the

issuance of the 140,186 Commitment Shares, and the sale of up to $10.0 million of Purchase Notice Shares (without giving effect to the

Exchange Cap) at an assumed offering price of $1.42 per share, the last reported sale price of our common stock on The Nasdaq Capital

Market on November 11, 2022, and after deducting estimated offering expenses payable by us of $75,000, and adjusted to our issuance of

$2,200,000 of secured bridge notes for net proceeds of $2,000,000 on November 14, 2022, our net tangible book value as of September 30,

2022 would have been $10,424,206, or $0.53 per share of common stock. This represents an immediate increase in net tangible book value

of $0.48 per share to our existing stockholders and an immediate decrease in net tangible book value of $0.89 per share to investors participating

in this offering. The following table illustrates this dilution per share to investors participating in this offering:

| Assumed offering price per share | |

$ | 1.42 | |

| Net tangible book value per share as of September 30, 2022 | |

$ | 0.05 | |

| Increase in net tangible book value per common stock to existing investors | |

$ | 0.48 | |

| | |

| | |

| As adjusted net tangible book value per share as of September 30, 2022, after giving effect to this offering, adjusted for issuance of $2.2 million of secured bridge notes on November 14, 2022 | |

$ | 0.53 | |

| Net dilution per share to White Lion Capital | |

$ | 0.89 | |

The above discussion and table

are based on 12,514,763 shares outstanding as of November 10, 2022, and excludes, as of such date, shares of common stock issuable upon

exercise of the outstanding options and warrants.

To the extent that any of

our outstanding options or warrants are exercised, we grant additional options or other awards under our equity incentive plan or issue

additional warrants, or we issue additional common stock in the future, there may be further dilution.

PLAN OF DISTRIBUTION

Pursuant to this prospectus

supplement, we are offering up to $10,000,000 in shares of our common stock to White Lion pursuant to the White Lion Purchase Agreement,

as well as the 140,186 Commitment Shares previously issued to White Lion as consideration for entry into the White Lion Purchase Agreement.

This prospectus supplement also covers the resale of these shares by White Lion to the public.

We may, from time to time

and at our sole discretion, direct White Lion to purchase shares of our common stock, but the maximum amount of shares that may be sold

on any single business day pursuant to a White Lion Purchase Notice generally shall not exceed the lesser of (i) such number of shares

as would cause White Lion to beneficially own in excess of 4.99% of the number of our common stock outstanding immediately after giving

effect to such issuance and sale, (ii) thirty percent (30%) of the average daily trading volume of the common stock during the five (5)

business days before the date of the Purchase Notice, or (iii) the Investment Limit divided by the highest closing price of the common

stock over the most recent five (5) business days including the purchase date. The foregoing share amounts and related market prices will

be adjusted for any reorganization, recapitalization, non-cash dividend, stock split, reverse stock split or other similar transaction

occurring after the date of this prospectus supplement. The purchase price per share is based on the market price of our common stock

at the time of sale as computed under the White Lion Purchase Agreement. White Lion may not assign or transfer its rights and obligations

under the White Lion Purchase Agreement. See “Purchase Agreement With White Lion.”

The shares we may from time

to time issue to White Lion under this prospectus supplement, may be sold or distributed from time to time by White Lion, as the selling

stockholder, directly to one or more purchasers or through brokers, dealers, or underwriters who may act solely as agents at market prices

prevailing at the time of sale, at prices related to the prevailing market prices, at negotiated prices, or at fixed prices, which may

be changed. The sale of the shares of our common stock offered by this prospectus supplement could be effected in one or more of the following

methods:

| |

• |

ordinary brokers’ transactions; |

| |

• |

transactions involving cross or block trades; |

| |

• |

through brokers, dealers, or underwriters who may act solely as agents; |

| |

• |

“at the market” into an existing market for our common stock; |

| |

• |

in other ways not involving market makers or established business markets, including direct sales to purchasers or sales effected through agents; |

| |

• |

in privately negotiated transactions; or |

| |

• |

any combination of the foregoing. |

In order to comply withthe

securities laws of certain states, if applicable, the shares may be sold only through registered or licensed brokers or dealers. In addition,

in certain states, the shares may not be sold unless they have been registered or qualified for sale in the state or an exemption from

the state’s registration or qualification requirement is available and complied with.

White Lion is an “underwriter”

within the meaning of Section 2(a)(11) of the Securities Act. White Lion is not a licensed broker dealer or an affiliate of a licensed

broker dealer, and is not a member of the Financial Industry Regulatory Authority.

White Lion has informed us

that it intends to use one or more registered broker-dealers to effectuate all sales, if any, of our common stock that it may acquire

from us pursuant to the White Lion Purchase Agreement. Such sales will be made at prices and at terms then prevailing or at prices

related to the then current market price. Each such registered broker-dealer will be an underwriter within the meaning of Section 2(a)(11)

of the Securities Act. White Lion has informed us that each such broker-dealer may receive commissions from White Lion and, if so, such

commissions will not exceed customary brokerage commissions.

Brokers, dealers, underwriters

or agents participating in the distribution of the shares of our common stock offered by this prospectus supplement may receive compensation

in the form of commissions, discounts, or concessions from the purchasers, for whom the broker-dealers may act as agent, of the shares

sold by the selling stockholder through this prospectus supplement. The compensation paid to any such particular broker-dealer by any

such purchasers of shares of our common stock sold by the White Lion may be less than or in excess of customary commissions. Neither we

nor the White Lion can presently estimate the amount of compensation that any agent will receive from any purchasers of shares of our

common stock sold by White Lion.

We know of no existing arrangements

between the selling stockholder or any other stockholder, broker, dealer, underwriter or agent relating to the sale or distribution of

the shares of our common stock offered by this prospectus supplement.

We may from time to time

file with the SEC one or more supplements to this prospectus supplement or amendments to the registration statement of which this prospectus

supplement forms a part to amend, supplement or update information contained in this prospectus supplement, including, if and when required

under the Securities Act, to disclose certain information relating to a particular sale of shares offered by this prospectus supplement

by White Lion, including the names of any brokers, dealers, underwriters or agents participating in the distribution of such shares by

the selling stockholder, any compensation paid by White Lion to any such brokers, dealers, underwriters or agents, and any other required

information.

We estimate that the total

expenses for the offering will be approximately $75,000.

We have agreed to indemnify

White Lion and certain other persons against certain liabilities in connection with the offering of shares of our common stock offered

hereby, including liabilities arising under the Securities Act. White Lion has agreed to indemnify us against liabilities under the Securities

Act that may arise from certain written information furnished to us by White Lion specifically for use in this prospectus supplement or,

if such indemnity is unavailable, to contribute amounts required to be paid in respect of such liabilities.

White Lion also agreed that

neither it, nor any of its affiliates, would execute any short sales during the period from November 14, 2022 to the end of the Commitment

Period.

We have advised White Lion

that it is required to comply with Regulation M promulgated under the Exchange Act. With certain exceptions, Regulation M precludes White

Lion, any affiliated purchasers, and any broker-dealer or other person who participates in the distribution from bidding for or purchasing,

or attempting to induce any person to bid for or purchase any security which is the subject of the distribution until the entire distribution

is complete. Regulation M also prohibits any bids or purchases made in order to stabilize the price of a security in connection with the

distribution of that security. All of the foregoing may affect the marketability of the securities offered by this prospectus supplement.

This offering will terminate

on the earlier of December 31, 2023 or (ii) the date on which White Lion shall have made payment for shares of our Company’s equal

to the Commitment Amount.

Our common stock is listed on the Nasdaq and trades

under the symbol “AUUD.” The transfer agent of our common stock is VStock Transfer, LLC.

INCORPORATION OF CERTAIN

DOCUMENTS BY REFERENCE

We

are incorporating by reference into this prospectus supplement and the accompanying prospectus the documents listed below that we have

filed with the SEC, which means we can disclose important information to you by referring you to those documents. The information incorporated

by reference is considered to be a part of this prospectus supplement and the accompanying prospectus. We incorporate by reference:

| |

· |

Our Annual Report on Form 10-K for the year ended December 31, 2021, filed on February 17, 2022; |

| |

|

|

| |

· |

Our Quarterly Reports on Form 10-Q for the quarters ending: September 30, 2022, (filed on November 14, 2022); June 30, 2022 (filed on August 12, 2022); and March 31, 2022 (filed on May 12, 2022); |

| |

|

|

| |

· |

Our Current Reports on Form 8-K filed May 23, July 20, August 1, November 3 and November 14, 2022; and |

| |

|

|

| |

· |

Our Registration Statement on Form 8-A, filed with the SEC on February 16, 2021, including any amendments or reports filed for the purpose of updating the description of our common stock therein. |

In addition, we also incorporate

by reference into this prospectus supplement and the accompanying prospectus all documents (other than current reports furnished under

Item 2.02 or Item 7.01 of Form 8-K and exhibits filed on that form which are related to those items) that are filed by us with the SEC

pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act before the termination of the offering of our common stock to which

this prospectus supplement and the accompanying prospectus relate, except for any document or portion of such document deemed to be “furnished”

and not filed in accordance with SEC rules.

The information relating

to us contained in this prospectus supplement and the accompanying prospectus does not purport to be comprehensive and should be read

together with the information contained in the documents incorporated or deemed to be incorporated by reference into this prospectus supplement

and the accompanying prospectus.

We

will provide to each person, including any beneficial owner, to whom a prospectus supplement and accompanying prospectus is delivered,

without charge, upon written or oral request, a copy of any or all of the documents that are incorporated by reference into this prospectus

supplement and the accompanying prospectus but not delivered with the prospectus supplement and accompanying prospectus, including exhibits

that are specifically incorporated by reference into such documents. You may request a copy of these filings without charge by contacting

Auddia Inc. Attention: Investor Relations, 2100 Central Avenue, Suite 200, Boulder, CO 80301, Telephone # (303) 219-9771.

Information

that we file later with the SEC and that is incorporated by reference in this prospectus supplement will automatically update and supersede

information contained in this prospectus supplement and the accompanying prospectus as if that information were included in this prospectus

supplement and the accompanying prospectus. That information will become part of this prospectus supplement and the accompanying prospectus

from the date the information is filed with the SEC.

WHERE YOU CAN FIND

MORE INFORMATION

We

are subject to the informational requirements of the Exchange Act and, accordingly, file periodic reports, proxy statements and other

information with the SEC. You can obtain these reports, proxy statements and other information that we file electronically with the SEC

on the SEC’s website at www.sec.gov. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K

and amendments to these reports that are filed or furnished pursuant to Section 13 of the Exchange Act are available on our website at

www.aitx.ai, as soon as reasonably practicable after they are electronically filed with the SEC. The information on our website is not

part of this prospectus, except to the extent filed with the SEC and specifically incorporated into this prospectus by reference.

This prospectus is part of

a registration statement that we filed with the SEC under the Securities Act. This prospectus does not contain all of the information

presented in the registration statement and its exhibits in accordance with SEC rules. Our descriptions in this prospectus of the provisions

of documents filed as exhibits to the registration statement or otherwise filed with the SEC are only summaries of the terms of those

documents and are not intended to be comprehensive. For a complete description of the content of the documents, you should obtain copies

of the full document.

LEGAL MATTERS

Certain

legal matters in connection with the offering and the validity of the securities offered by this prospectus supplement and accompanying

prospectus will be passed upon by Carroll Legal LLC, Denver, Colorado.

EXPERTS

Our balance sheets at December

31, 2021 and 2020 and the related statement of operations, changes in stockholders’ equity (deficit) and cash flows for the years

ended December 31, 2021 and 2020, incorporated in this prospectus by reference, have been audited by Daszkal Bolton LLP, independent registered

public accounting firm, with respect thereto, and has been so included in reliance upon the report of such firm given on their authority

as experts in accounting and auditing.

PROSPECTUS

AUDDIA INC.

$50,000,000

COMMON STOCK

PREFERRED STOCK

WARRANTS

SUBSCRIPTION RIGHTS

DEBT SECURITIES

UNITS

We may offer and sell from

time to time, in one or more series, any one of the following securities of our company, for total gross proceeds of up to $50,000,000:

| |

· |

common stock; |

| |

· |

preferred stock; |

| |

· |

warrants to purchase common stock, preferred stock, debt securities, other securities or any combination of those securities; |

| |

· |

subscription rights to purchase common stock, preferred stock, debt securities, other securities or any combination of those securities; |

| |

· |

secured or unsecured debt securities consisting of notes, debentures or other evidences of indebtedness which may be senior debt securities, senior subordinated debt securities or subordinated debt securities, each of which may be convertible into equity securities; or |

| |

· |

units comprised of, or other combinations of, the foregoing securities. |

We may offer and sell these

securities separately or together, in one or more series or classes and in amounts, at prices and on terms described in one or more offerings.

We may offer securities through underwriting syndicates managed or co-managed by one or more underwriters or dealers, through agents or

directly to purchasers. The prospectus supplement for each offering of securities will describe in detail the plan of distribution for

that offering. For general information about the distribution of securities offered, please see “Plan of Distribution” in

this prospectus.

Each time our securities are

offered, we will provide a prospectus supplement containing more specific information about the particular offering and attach it to this

prospectus. The prospectus supplements may also add, update or change information contained in this prospectus.

This prospectus may not

be used to offer or sell securities without a prospectus supplement which includes a description of the method and terms of this offering.

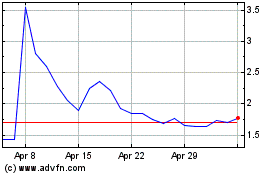

Our common stock is quoted

on the Nasdaq Capital Market under the symbol “AUUD.” The last reported sale price of our common stock on the Nasdaq Capital

Market on April 8, 2022 was $2.05 per share. The aggregate market value of our outstanding common stock held by non-affiliates is $18,380,130

based on 12,514,763 shares of outstanding common stock, of which 8,965,917 shares are held by non-affiliates, and a per share price of

$2.05, which was the closing sale price of our common stock as quoted on the Nasdaq Capital Market on April 8, 2022.

Our Series A Warrants are

quoted on the Nasdaq Capital Market under the symbol “AUUDW.” The last reported sale price of our Series A warrants on the

Nasdaq Capital Market on April 8, 2022 was $0.60 per warrant.

Pursuant to General Instruction

I.B.6 of Form S-3, in no event will we sell securities pursuant to this prospectus with a value of more than one-third of the aggregate

market value of our common stock held by non-affiliates in any twelve-month period, so long as the aggregate market value of our common

stock held by non-affiliates is less than $75,000,000. In the event that subsequent to the date of this prospectus, the aggregate market

value of our outstanding common stock held by non-affiliates equals or exceeds $75,000,000, then the one-third limitation on sales shall

not apply to additional sales made pursuant to this prospectus. We have not offered any securities pursuant to General Instruction I.B.6

of Form S-3 during the twelve calendar months prior to and including the date of this prospectus.

If we decide to seek a listing

of any preferred stock, purchase contracts, warrants, subscriptions rights, depositary shares, debt securities or units offered by this

prospectus, the related prospectus supplement will disclose the exchange or market on which the securities will be listed, if any, or

where we have made an application for listing, if any.

Investing in our securities

is highly speculative and involves a significant degree of risk. See “Risk Factors” beginning on page 5 and the risk factors

in our most recent Annual Report on Form 10-K, which is incorporated by reference herein, as well as in any other recently filed quarterly

or current reports and, if any, in the relevant prospectus supplement. We urge you to carefully read this prospectus and the accompanying

prospectus supplement, together with the documents we incorporate by reference, describing the terms of these securities before investing.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy

or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is April 18, 2022

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of

a registration statement on Form S-3 that we filed with the Securities and Exchange Commission, or SEC, utilizing a “shelf”

registration process. Under this shelf registration process, we may offer and sell, either individually or in combination, in one or more

offerings, any of the securities described in this prospectus, for total gross proceeds of up to $50,000,000. This prospectus provides

you with a general description of the securities we may offer. Each time we offer securities under this prospectus, we will provide a

prospectus supplement to this prospectus that will contain more specific information about the terms of that offering. We may also authorize

one or more free writing prospectuses to be provided to you that may contain material information relating to these offerings. The prospectus

supplement and any related free writing prospectus that we may authorize to be provided to you may also add, update or change any of the

information contained in this prospectus or in the documents that we have incorporated by reference into this prospectus.

We urge you to read carefully

this prospectus, any applicable prospectus supplement and any free writing prospectuses we have authorized for use in connection with

a specific offering, together with the information incorporated herein by reference as described under the heading “Incorporation

of Documents by Reference,” before investing in any of the securities being offered. You should rely only on the information contained

in, or incorporated by reference into, this prospectus and any applicable prospectus supplement, along with the information contained

in any free writing prospectuses we have authorized for use in connection with a specific offering. We have not authorized anyone to provide

you with different or additional information. This prospectus is an offer to sell only the securities offered hereby, but only under circumstances

and in jurisdictions where it is lawful to do so.

The

information appearing in this prospectus, any applicable prospectus supplement or any related free writing prospectus is accurate only

as of the date on the front of the document and any information we have incorporated by reference is accurate only as of the date of the

document incorporated by reference, regardless of the time of delivery of this prospectus, any applicable prospectus supplement or any

related free writing prospectus, or any sale of a security.

This

prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the

actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some

of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration

statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the section entitled

“Where You Can Find Additional Information.”

This prospectus contains,

or incorporates by reference, trademarks, tradenames, service marks and service names of Auddia Inc.

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This prospectus and any accompanying

prospectus or prospectus supplement and the documents incorporated by reference herein and therein may contain forward looking statements

that involve significant risks and uncertainties. All statements other than statements of historical fact contained in this prospectus

and any accompanying prospectus supplement and the documents incorporated by reference herein, including statements regarding future events,

our future financial performance, business strategy, and plans and objectives of management for future operations, are forward-looking

statements. We have attempted to identify forward-looking statements by terminology including “anticipates,” “believes,”

“can,” “continue,” “could,” “estimates,” “expects,” “intends,”

“may,” “plans,” “potential,” “predicts,” “should,” or “will” or

the negative of these terms or other comparable terminology. Although we do not make forward looking statements unless we believe we have

a reasonable basis for doing so, we cannot guarantee their accuracy. These statements are only predictions and involve known and unknown

risks, uncertainties and other factors, including the risks outlined under “Risk Factors” or elsewhere in this prospectus

and the documents incorporated by reference herein, which may cause our or our industry’s actual results, levels of activity, performance

or achievements expressed or implied by these forward-looking statements. Moreover, we operate in a highly regulated, very competitive,

and rapidly changing environment. New risks emerge from time to time and it is not possible for us to predict all risk factors, nor can

we address the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause our actual

results to differ materially from those contained in any forward-looking statements.

We have based these forward-looking

statements largely on our current expectations and assumptions about future events and financial trends that we believe may affect our

financial condition, results of operations, business strategy, short term and long term business operations, and financial needs. These

forward-looking statements are subject to certain risks and uncertainties that could cause our actual results to differ materially from

those reflected in the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited

to, those discussed in this prospectus, and in particular, the risks discussed below and under the heading “Risk Factors”

and those discussed in other documents we file with the SEC which are incorporated by reference herein. This prospectus, and any accompanying

prospectus or prospectus supplement, should be read in conjunction with the consolidated financial statements for the fiscal years ended

December 31, 2021 and 2020 and related notes, which are incorporated by reference herein.

We undertake no obligation

to revise or publicly release the results of any revision to these forward-looking statements, except as required by law. In light of

the significant risks, uncertainties and assumptions that accompany forward-looking statements, the forward-looking events and circumstances

discussed in this prospectus and any accompanying prospectus or prospectus supplement may not occur and actual results could differ materially

and adversely from those anticipated or implied in the forward-looking statement.

You should not place undue

reliance on any forward-looking statement, each of which applies only as of the date of this prospectus, or any accompanying prospectus

or any prospectus supplement. Except as required by law, we undertake no obligation to update or revise publicly any of the forward-looking

statements after the date of this prospectus to conform our statements to actual results or changed expectations.

Any forward-looking statement

you read in this prospectus, any accompanying prospectus, or any prospectus supplement or any document incorporated by reference reflects

our current views with respect to future events and is subject to these and other risks, uncertainties and assumptions relating to our

operations, operating results, growth strategy and liquidity. You should not place undue reliance on these forward-looking statements

because such statements speak only as to the date when made. We assume no obligation to publicly update or revise these forward-looking

statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking

statements, even if new information becomes available in the future, except as otherwise required by applicable law. You are advised,

however, to consult any further disclosures we make on related subjects in our reports on Forms 10-Q, 8-K and 10-K filed with the SEC.

You should understand that it is not possible to predict or identify all risk factors. Consequently, you should not consider any such

list to be a complete set of all potential risks or uncertainties.

PROSPECTUS SUMMARY

This summary highlights

selected information contained elsewhere in this prospectus. This summary does not contain all the information that you should consider

before investing in our Company. You should carefully read the entire prospectus, including all documents incorporated by reference herein.

In particular, attention should be directed to our “Risk Factors,” “Information With Respect to the Company,”

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements

and related notes thereto contained herein or otherwise incorporated by reference hereto, before making an investment decision.

As used herein, and any

amendment or supplement hereto, unless otherwise indicated, “we,” “us,” “our,” the “Company,”

or “Auddia” means Auddia Inc.

Overview

We

are a technology company headquartered in Boulder, CO that is reinventing how consumers engage with audio through the development of a

proprietary Artificial Intelligence (“AI”) platform for audio and innovative technologies for podcasts. We are leveraging

these technologies to bring to market two industry first apps, Faidr (previously known as the Auddia App) and Vodacast.

Faidr

gives consumers the opportunity to listen to any AM/FM radio station with no commercials while personalizing the listening experience

through skips, the insertion of on-demand content and programming of audio routines to customize listening sessions such as a daily commute.

The Faidr App represents the first time consumers can access the local content uniquely provided by radio in the commercial free and personalized

manner many consumers have come to demand for media consumption.

The

Company launched all major U.S. radio stations on its Faidr App on February 15, 2022.

Vodacast

is a podcasting platform that provides a unique suite of tools that helps Podcasters create additional digital content for their podcast

episodes as well as plan their episodes, build their brand around their Podcast and monetize their content with new monetization channels.

Vodcast also gives users the ability to go deeper into the stories through supplemental, digital content,, comment, and contribute their

own content to episode feeds.

Both

of our offerings address large and rapidly growing audiences. Faidr and Vodacast mobile apps are available today through the iOS and Android

app stores.

Emerging Growth Company under the JOBS Act

As a company with less than

$1.07 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” under the Jumpstart Our Business

Startups Act of 2012, or the JOBS Act. As an emerging growth company, we have elected to take advantage of reduced reporting requirements

and are relieved of certain other significant requirements that are otherwise generally applicable to public companies. As an emerging

growth company:

| |

· |

We may present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations; |

| |

|

|

| |

· |

We are exempt from the requirement to obtain an attestation and report from our auditors on whether we maintained effective internal control over financial reporting under the Sarbanes-Oxley Act; |

| |

· |

We are permitted to provide less extensive disclosure about our executive compensation arrangements; and |

| |

|

|

| |

· |

We are not required to give our stockholders non-binding advisory votes on executive compensation or golden parachute arrangements. |

We may take advantage of these

provisions until December 31, 2026 (the last day of the fiscal year following the fifth anniversary of our initial public offering) if

we continue to be an emerging growth company. We would cease to be an emerging growth company if we have more than $1.07 billion in annual

revenue, have more than $700 million in market value of our shares held by non-affiliates or issue more than $1.0 billion of non-convertible

debt over a three-year period. We may choose to take advantage of some but not all of these reduced burdens. We have elected to provide

two years of audited financial statements. Additionally, we have elected to take advantage of the extended transition period provided

in Section 7(a)(2)(B) of the Securities Act of 1933, as amended, or the Securities Act, for complying with new or revised accounting standards

that have different effective dates for public and private companies until the earlier of the date we (i) are no longer an emerging growth

company or (ii) affirmatively and irrevocably opt out of the extended transition period provided in Section 7(a)(2)(B) of the Securities

Act.

Corporate Information

Our principal executive offices

are located at 2100 Central Avenue, Suite 200, Boulder, Colorado 80301, and our telephone number is (303) 219-9771, and our Internet website

address is https://www.auddiainc.com. The information on our website is not a part of, or incorporated in, this prospectus.

RISK FACTORS

Investing in our securities

is highly speculative and involves a high degree of risk. Before deciding whether to invest in our securities, you should carefully

consider the risk factors we describe in any accompanying prospectus or any future prospectus supplement, as well as in any related free

writing prospectus for a specific offering of securities, and the risk factors incorporated by reference into this prospectus, any accompanying

prospectus or such prospectus supplement. You should also carefully consider other information contained and incorporated by reference

in this prospectus and any applicable prospectus supplement, including our financial statements and the related notes thereto incorporated

by reference in this prospectus. The risks and uncertainties described in the applicable prospectus supplement and our other filings with

the SEC incorporated by reference herein are not the only ones we face. Additional risks and uncertainties not presently known to us or

that we currently consider immaterial may also adversely affect us. If any of the described risks occur, our business, financial condition

or results of operations could be materially harmed. In such case, the value of our securities could decline and you may lose all or part

of your investment.

USE OF PROCEEDS

Unless otherwise indicated

in a prospectus supplement, we intend to use the net proceeds from these sales for general corporate purposes, which includes, without

limitation, continuing to build out the Faidr and Vodacast platforms, expanding our sales and marketing efforts, research and development

expenses, sales and support staff, and software development. The amounts and timing of these expenditures will depend on numerous factors,

including the development of our current business initiatives.

DIVIDEND POLICY

We have never paid or declared

any cash dividends on our common stock, and we do not anticipate paying any cash dividends on our common stock in the foreseeable future.

We intend to retain all available funds and any future earnings to fund the development and expansion of our business. Any future determination

to pay dividends will be at the discretion of our board of directors and will depend upon a number of factors, including our results of

operations, financial condition, future prospects, contractual restrictions, restrictions imposed by applicable law and other factors

our board of directors deems relevant. Our future ability to pay cash dividends on our stock may also be limited by the terms of any future

debt or preferred securities or future credit facility.

PLAN OF DISTRIBUTION

We may sell the securities

from time to time to or through underwriters or dealers, through agents, or directly to one or more purchasers. A distribution of the

securities offered by this prospectus may also be effected through the issuance of derivative securities, including without limitation,

warrants, rights to purchase and subscriptions. In addition, the manner in which we may sell some or all of the securities covered by

this prospectus includes, without limitation, through:

| |

· |

a block trade in which a broker-dealer will

attempt to sell as agent, but may position or resell a portion of the block, as principal, in order to facilitate the transaction; |

| |

|

|

| |

· |

purchases by a broker-dealer, as principal, and resale by the broker-dealer for its account; or |

| |

|

|

| |

· |

ordinary brokerage transactions and transactions in which a broker solicits purchasers. |

A prospectus supplement or

supplements with respect to each series of securities will describe the terms of the offering, including, to the extent applicable:

| |

· |

the terms of the offering; |

| |

|

|

| |

· |

the name or names of the underwriters or

agents and the amounts of securities underwritten or purchased by each of them, if any; |

| |

|

|

| |

· |

the public offering price or purchase price

of the securities or other consideration therefor, and the proceeds to be received by us from the sale; |

| |

|

|

| |

· |

any delayed delivery requirements; |

| |

|

|

| |

· |

any over-allotment options under which underwriters may purchase additional securities from us; |

| |

|

|

| |

· |

any underwriting discounts or agency fees and other items constituting underwriters’ or agents’ compensation; |

| |

|

|

| |

· |

any discounts or concessions allowed or re-allowed or paid to dealers; and |

| |

|

|

| |

· |

any securities exchange or market on which the securities may be listed. |

The offer and sale of the

securities described in this prospectus by us, the underwriters or the third parties described above may be effected from time to time

in one or more transactions, including privately negotiated transactions, either:

| |

· |

at a fixed price or prices, which may be changed; |

| |

|

|

| |

· |

in an “at the market” offering within the meaning of Rule 415(a)(4) of the Securities Act of 1933, as amended, or the Securities Act; |

| |

|

|

| |

· |

at prices related to such prevailing market prices; or |

| |

|

|

| |

· |

at negotiated prices. |

Only underwriters named in

the prospectus supplement will be underwriters of the securities offered by the prospectus supplement.

Underwriters and Agents; Direct Sales

If underwriters are used in

a sale, they will acquire the offered securities for their own account and may resell the offered securities from time to time in one

or more transactions, including negotiated transactions, at a fixed public offering price or at varying prices determined at the time

of sale. We may offer the securities to the public through underwriting syndicates represented by managing underwriters or by underwriters

without a syndicate.

Unless the prospectus supplement

states otherwise, the obligations of the underwriters to purchase the securities will be subject to the conditions set forth in the applicable

underwriting agreement. Subject to certain conditions, the underwriters will be obligated to purchase all of the securities offered by

the prospectus supplement, other than securities covered by any over-allotment option. Any public offering price and any discounts or

concessions allowed or re-allowed or paid to dealers may change from time to time. We may use underwriters with whom we have a material

relationship. We will describe in the prospectus supplement, naming the underwriter, the nature of any such relationship.

We may sell securities directly

or through agents we designate from time to time. We will name any agent involved in the offering and sale of securities, and we will

describe any commissions we will pay the agent in the prospectus supplement. Unless the prospectus supplement states otherwise, our agent

will act on a best-efforts basis for the period of its appointment.

We may authorize agents or

underwriters to solicit offers by certain types of institutional investors to purchase securities from us at the public offering price

set forth in the prospectus supplement pursuant to delayed delivery contracts providing for payment and delivery on a specified date in

the future. We will describe the conditions to these contracts and the commissions we must pay for solicitation of these contracts in

the prospectus supplement.

Dealers

We may sell the offered securities

to dealers as principals. The dealer may then resell such securities to the public either at varying prices to be determined by the dealer

or at a fixed offering price agreed to with us at the time of resale.

Institutional Purchasers

We may authorize agents, dealers

or underwriters to solicit certain institutional investors to purchase offered securities on a delayed delivery basis pursuant to delayed

delivery contracts providing for payment and delivery on a specified future date. The applicable prospectus supplement or other offering

materials, as the case may be, will provide the details of any such arrangement, including the offering price and commissions payable

on the solicitations.

We will enter into such delayed

contracts only with institutional purchasers that we approve. These institutions may include commercial and savings banks, insurance companies,

pension funds, investment companies and educational and charitable institutions.

Indemnification; Other Relationships

We may provide agents, underwriters,

dealers and remarketing firms with indemnification against certain civil liabilities, including liabilities under the Securities Act,

or contribution with respect to payments that the agents or underwriters may make with respect to these liabilities. Agents, underwriters,

dealers and remarketing firms, and their affiliates, may engage in transactions with, or perform services for, us in the ordinary course

of business. This includes commercial banking and investment banking transactions.

Market-Making; Stabilization and Other Transactions

There is currently no market

for any of the offered securities, other than our common stock, which is quoted on the Nasdaq Capital Market. If the offered securities

are traded after their initial issuance, they may trade at a discount from their initial offering price, depending upon prevailing interest

rates, the market for similar securities and other factors. While it is possible that an underwriter could inform us that it intends to

make a market in the offered securities, such underwriter would not be obligated to do so, and any such market-making could be discontinued

at any time without notice. Therefore, no assurance can be given as to whether an active trading market will develop for the offered securities.